CA Foundation Business Laws Study Material Chapter 15 Auction Sale

A sale by auction is a public sale where various intending buyers offer bids for the goods and try to outbid each other. Ultimately, the goods are sold to the highest bidder. A bid by the buyer is an offer and it is said to be accepted when the auctioneer announces its completion by the fall of the hammer or in any other customary manner. The words ‘any other customary manner’, takes into account all the manners which may be prevalent to denote acceptance in an auction sale. It may be by shouting one, two, three; or shouting going, going, gone, etc.

A person may himself sell his own goods by auction, or he may appoint an agent, known as auc¬tioneer, to conduct the sale on his behalf.

|

15.1 |

Rules of Auction Sale (Sec. 64) |

Following rules have been laid down to regulate the sales by auction: |

|

1. Sale of goods in lots |

Where goods are put up for sale in lots, each lot is prima facie deemed to be the subject of a separate contract of sale. | |

|

2. Completion of Sale |

An auction sale is complete when the auctioneer announces its completion by the fall of the hammer or in other customary manner, and until then the bidder has the right to revoke or retract his bid. If before the fall of the hammer the bidder withdraws, his security amount cannot be forfeited. But if he does so after the fall of the hammer, it amounts to a breach of the contract and his security amount will be liable to be forfeited. If the conditions of sec. 20, namely, the goods should be specific and in a deliverable state, are satisfied, the property in such goods passes to the buyer at the completion of the contract (by the fall of the hammer) | |

|

3. Seller’s Right to Bid |

Unless the auction is notified to be subject to a right to bid on behalf of the seller, it is not lawful – (i) for the seller to bid himself or to employ any person to bid at such sale on his behalf and (ii) for the auctioneer to, knowingly take any bid from the seller or any such person. Any contravention of this rule renders the sale as fraudulent. |

|

|

4. Pretended biding |

If the seller makes use of pretended bidding to raise the price, the sale is voidable at the option of the buyer. However, the seller may expressly reserve the right to bid at the auction and in such case, the seller or any one person on his behalf may bid at the auction. But there should be only one person on behalf of the seller; if there are more than one person, the intention is to raise the price and is fraudulent. . | |

|

5. Reserve Price |

The seller may notify that the auction will be subject to a reserve or upset price, that is, the price below which the auctioneer will not sell. In such a case the auctioneer is not bound to accept the highest bid unless it reaches the reserve price. Further the property in the goods, even if they are specific, will not pass if the highest bid falls short.of the reserve price. | |

|

6. Knock-out agreement |

Knock-out agreement is a f arm of combination of buyers to prevent competition among themselves at an auction sale. They agree that they will not raise the bid against each other and only one of them will bid of the auction. When the goods have been purchased they will share the profits. Prima facie, a knock-out agreement is not illegal. However, if the intention of the parties to the agreement is to defraud third party, the third party can claim the damages.

The seller may protect his interests against such agreements by reserving his right to bid at the auction, or by fixing a reserved price. |

|

|

15.2 |

Upset price |

“Upset price” is the Scottish equivalent of “reserved price”. |

|

15.3 |

Damping |

It is an unlawful act by which an intending purchaser is prevented from bidding or raising the price at an auction sale. The damping is usually done in any of the following ways :

(i) By pointing out defects in the goods put up in an auction sale. (ii) By taking the intending buyers away from the place of auction by some other device. Damping is illegal and the auctioneer can withdraw the goods from auction sale in case he observes that the damping is being resorted to Puffer-A person who is appointed by the seller to raise the price by fictitious bids. |

|

15.4 |

Incidence of Taxation [Sec. 64A] |

♦ Where after a contract has been made but before it has been performed, tax revision takes place, the parties would become entitled to readjust the price of the goods accordingly. Taxes covered are customs or goods and service tax on the goods and any tax payable on manufacture, sale or purchase of goods.

♦ The buyer would have to be pay the increased price if the tax increases and would be entitled to the benefit of reduction if taxes are curtailed. ♦ Thus, the seller may add the increased taxes in the price. ♦ The effect of the provision can, however, is excluded by an agreement to the contrary. It is open to the parties to stipulate anything about the incidence of taxation. |

MULTIPLE CHOICE QUESTIONS:

1. An auction sale is complete on the –

(a) delivery of goods

(b) payment of price

(c) fall of hammer

(d) None of the above

2. In the case of sale by auction, where goods are put for sale in lots, each lot is prima facie the subject of—

(a) a single contract of sale

(b) a separate contract of sale

(c) either (a) or (b)

(d) both (a) and (b)

3. Where a right to bid at the auction has been expressly reserved by the seller, the seller can depute —

(a) not more than one agent to bid on his behalf

(b) not more than two agents to bid on his behalf

(c) not more than three agents to bid on his behalf

(d) any number of agents to bid on his behalf

4. Where the sale is not notified to be subject to a right to bid on behalf of seller, it shall not be lawful for the seller—

(a) to bid for himself

(b) to employ any person to bid at such sale

(c) either (a) or (b)

(d) neither (a) nor (b)

5. X purchased a VCD at a public auction. Neither Auctioneer nor X knew at that time that the VCD was a stolen property. In such case, the true owner can —

(a) recover the goods from X

(b) sue the Auctioneer for fraud

(c) both (a) and (b)

(d) either (a) or (b)

6. At an auction sale, the bidder can withdraw his bid –

(a) before fall of hammer

(b) at any time during auction

(c) before payment of price

(d) cannot withdraw bid

7. An act by which an intending bidder is discour¬aged or dissuaded from bidding in the auction sale is called

(a) Puffer

(b) Damping

(c) Dumping

(d) knockout

8. is a form of combination of buyers to prevent competition among themselves at an auction sale.

(a) Knock-out agreement

(.b) monopoly agreement

(c) oligopoly agreement

(d) puffing agreement

9. In pretended bidding, sale is

(a) voidable at the option of the seller

(b) valid

(c) voidable at the option of the buyer

(d) illegal

10. Unless excluded by an agreement to the contrary, where after a contract has been made but before it has been performed, excise duty is increased:—

(a) The buyer would have to pay increased price

(b) The seller cannot charge increased price

(c) The seller can charge increased price

(d) Both ‘a’ and ‘c’

11. Any imposition, increase, decrease or remission of (z) Customs or Excise Duty on Goods and (z’z) Tax on the Sale or Purchase of Goods, subsequent to the sale, in case of decrease of tax, shall be deducted from the contract price by the Buyer and he shall not be liable to pay or be sued for such deduction.

(a) True

(b) Depends on the contract

(c) False

(d) Both ‘a’ and ‘b’

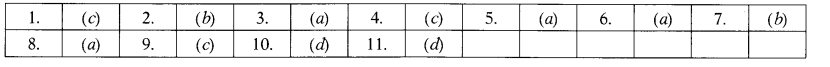

Answers:

IS STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE

1. In case of sale by auction, a bid can be recalled at any time before the fall of hammer.

2. An auctioneer shall be liable for damages if the auctioneer had no authority to sell the goods.

3. If the buyer’s possession is disturbed by the auctioneer or the seller then buyer has a right to claim compensation.

Answers:

![]()