CA Foundation Business Laws Study Material Chapter 17 Registration of Firm

The registration of a partnership is not compulsory. Therefore an unregistered firm is not an illegal association. But an unregistered firm suffers from certain disabilities and therefore registration is necessary for carrying on business.

The formalities of registration (Sections 58-59): The following are the formalities that are required to he fulfilled for registration of the firm. The registration of the firm can be classified under the following 3 steps. It should be in a Prescribed Form, there should be Prescribed Documents and it should be deposited along with the Prescribed Fees.

PRESCRIBED FORM

The Registration of a firm may be effected at any time by sending by post or delivering to the Registrar of Firms of the locality, a statement in the prescribed form and accompanied by the prescribed fee.

The application for registration contains the following particulars;

- the firm-name,

- the place or principal place of business of the firm,

- the names of any other places where the firm carries on business,

- the date when each partner joined the firm

- the names in full and permanent addresses of the partners, and

- the duration of the firm.

Undesirable names suggesting the sanction, patronage or approval of the Govt, shall not be allowed unless specially consented to in writing by the Govt.

Signing and verification

The statement shall be signed and verified by all the partners or their agents specially authorised on this behalf.

Registration

When the Registrar is satisfied that the above provisions have been duly complied with, he shall j record an entry of the statement in the Register of Firms and then file the statement (sec. 59). He shall then issue under his hand a certificate of Registration.

Time of registration

There is no provision in the Partnership Act regarding the time of registration of firm. However, [ section 69(2) lays down that before any suit can be filed in Court of Law registration of the firm must have been effected, otherwise the suit will be dismissed.

Registration is effective from the date when the Registrar files the statement and makes entries in j the Register of Firms and not from the date of presentation of the statement to him.

PARTNERSHIP DEED

The partnership agreement may be oral or written. But to avoid any dispute, it is always advisable to have a written agreement, which is commonly known as partnership deed. Under the Income tax Act also, written partnership deed is a pre-requisite for the assessment of the firm.

The partnership deed usually contains provisions relating to the following :

- Name of the firm,

- Duration of partnership,

- Nature of business,

- Place where business is to be carried on,

- Capital brought in by each individual partner,

- Property of the firm,

- Proportions of profits and losses of each partner,

- Rights and duties of partners,

- Provisions for accounts, audit, keeping of account books,

- Drawings by partners and specially by a working partner,

- Dissolution of the firm,

- Retirement of a partner,

- Settlement of accounts, division of assets, profits etc., upon dissolution,

- Arbitration clause in case of dispute.

Under the Income-tax Act it is essential to insert clauses in the partnership for payment of interest to partners and remuneration to working partners so that payment thereof may be allowed as deduction to the firm.

CONSEQUENCES OF NON REGISTRATION (SEC. 69)

An unregistered firm and the partners thereof suffer from certain disabilities, Suit between partners and firm [sec. 69( 1 )]

A partner of an unregistered firm cannot file a suit (against the firm or any partner thereof) for the purpose of enforcing a right arising from contract or a right conferred by the Partnership Act.

Suits between firm & third parties [sec. 69(2)]

No suit can be filed by or on behalf of an unregistered firm against any third party for the purpose of enforcing a right arising from a contract, unless the firm is registered and the persons suing are or have been shown in the Register of Firms as partners in the Firm.

Claims of set-off [sec. 69(3)]

An unregistered firm cannot claim a set-off in a suit, (‘set-off’ means a claim by the defendant which would reduce the amount of money payable by him to the plaintiff).

EXCEPTIONS

There are certain exceptions to the rules stated above.

- A partner of an unregistered firm can file a suit for the dissolution of the firm or for accounts of dissolved firm.

- The Official Assignee or Receiver acting for an insolvent partner of unregistered firm may bring a suit for the realisation of the properties of an insolvent partner or further realisation of the property of dissolved firm.

- There is no bar to suits by firms which have no place of business in the territories to which the Indian Partnership Act extends.

- There is no bar to suits by unregistered firms or by the partners thereof in areas where the provisions relating to the registration of firms do not apply by notification of State Government under Section 56.

- An unregistered firm can file a suit (or claim a set off) for a sum not exceeding Rs. 100 in value, provided the suit is of such a nature that it has to be filed in the small Causes Court.

Proceedings incidental to such suits, e.g., execution of decrees, are also allowed. - Non-registration will not affect the enforcement of rights arising otherwise than out of contract e.g. for an injunction against wrongful infringement of a trademark etc.

An unregistered firm suffers from certain disabilities but is not an illegal association. Therefore registration of a firm is optional.

ALTERATIONS

Any alteration in the name, principal place of business, branches, names and addresses of partners etc. of a firm subsequent to registration, must be intimated in the prescribed form to the Registrar of Partnership Firms. Registrar shall make the necessary amendment relating to such a firm in the Register of firms maintained by it. These matters are:

- Change in the firm name or in location of the principal place of business of the registered firm. Statement to be sent to the Registrar in this case should be accompanied by the prescribed fee. (Sec. 60)

- Closing and opening branches:

When a registered firm discontinues at any place or begins to carry on business at any place other than the principal place of business, an intimation is to be sent to the Registrar by any partner or the agent of the firm. (Sec. 61) - Changes in the names and addresses of partners:

When any partner in a registered firm alters his name or permanent address, an intimation of the alteration is to be sent to the Registrar by any partner or agent of the firm. (Sec. 62) - Changes in the constitution of a firm and its dissolution:

When a change occurs in the constitu-tion of a registered firm, any incoming, continuing or outgoing partner may give notice to the Registrar of such change. Similarly, when a registered firm is dissolved, any person who was a partner immediately before the dissolution, may give notice to the Registrar. [Sec. 63(1)] - Election of minor on attaining the age of the majority as partner:

When a minor who had been admitted to the benefits of partnership attains majority, he has to choose whether he intends to continue as a partner or whether he intends to sever his connection from the firm which is a registered firm. Whatever the election, he or his agent specially authorized on his behalf may give notice to the Registrar that he has or has not become a partner. [Sec. 63(2)]

REGISTER OF FIRMS-A PUBLIC DOCUMENT

The register of firms is a public document shall be open to inspection by any person on payment of the prescribed fee (Sec. 66). Registrar shall also furnish to any person on payment of a prescribed fee a copy, certified under his of any entry or position thereof in the Register of Firms (Sec. 67)

REGISTER OF FIRMS-A CONCLUSIVE EVIDENCE (SEC. 68)

Any statement, intimation notice recorded or noted in the Register of Firms, shall, as against any person by whom whose behalf such statement, intimation or notice was signed, be conclusive of any fact the stated.

A certified copy of an entry relating to a firm in the Register of Firms may be the proof of the fact of the registration of such firm, and of the contents of any statement, intimation or notice recorded or noted therein.

PENALTY FOR FURNISHING FALSE PARTICULARS (SEC. 70)

The Act provides a penal imprisonment which may extend to three months or fine or both to any person liable supplying to the Registrar any information which he knows to be false or does not believe true.

MULTIPLE CHOICE QUESTIONS:

1. Registration of the firm under the Partnership Act is:

(a) Optional

(b) Obligatory

(c) Compulsory

(d) Necessary

2. The Partnership Act by section 69 indirectly renders the registration firm compulsory by providing :

(a) Certain disabilities.

( b) Penalties on partners of unregistered firms.

(c) Penalties on unregistered firms.

(d) Monetary fine on partners.

3. A firm name shall not contain any of the following words :

(a) Crown, Imperial.

(b) Emperor,Empress

(c) King, Queen

(d) All the above.

4. Registration of firm is effective from —

(a) The date when the Registrar files the statement and makes entries in the Register of firms

(b) The date of presentation of the statement to the Registrar of firms

(c) The date published in the Official Gazette

(d) The date intimated to the partners.

5. Non-registration of the firm does not affect the right of the firm to institute a suit or claim of set-off not exceeding —

(a) Rs. 100

(b) Rs. 1,000

(c) Rs. 10,000

(d) Rs. 50,000.

6. After the registration of a firm, if a partner retires, such a change in the constitution of the firm requires :

(a) A notice to be sent to the Registrar.

(b) New registration.

(c) An affidavit of a managing partner about the change.

(d) No intimation.

7. If an unregistered firm intends to file a suit against a third party, it should get itself registered before filing the suit.

(a) False, as such disability can never be removed.

(b) True, as after registration firm’s disability to file such suit is removed.

(c) It should take permission of the court before filing the suit.

(d) Either (b) or (c)

8. In case of an unregistered firm the partners can file a suit for the :

(a) Dissolution of the firm

(b) Accounts of dissolved firm

(c) Realization of property of dissolved firm

(d) All the above

9. Any person who supplies false information to the

Registrar of firms, shall be liable to punishment with imprisonment upto

(n) Three months

(b) Six months

(c) Nine months

(d) Twelve months

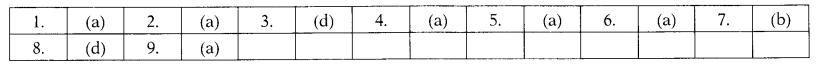

Answers:

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. The registration of a firm is a condition precedent to the right to institute a suit.

2. If a partner refuses to sign the application for registration, then registration can be done only by dropping the name of such a partner from the firm.

3. Application for registration of the firm must be signed by all the partners.

4. A third party cannot file a suit against an unregistered firm.

5. A partner of an unregistered firm cannot sue for the dissolution of the firm.

6. Registration of the firm may be done before filing a suit against the third party.

7. Registration of the firm must be done at the time of formation of the firm.

Answers:

![]()