CA Foundation Business Laws Study Material Chapter 18 Relations of Partners 170

RIGHTS & DUTIES OF PARTNERS (SECS. 9 TO 17)

The mutual rights & duties of the partners are usually governed by the agreement between them. Where there is no specific agreement, their relations to one another are governed by Secs. 9 to 17 of the Partnership Act.

a. Rights of partners

Subject to contract between the partners, the Partnership Act confers the following rights upon the partners of a firm:

1. Right to take part in the conduct of the business [Sec.12(a)]

Every partner has a right to take part in the conduct of the business of the firm. The partners among themselves, may agree to entrust the work of management to one or more of them and they may even agree to make payment to such partners by way of an extra remuneration.

2. Right to be consulted[Sec.12(c)]

Every partner has a right to be consulted and heard before any matter is decided. Ordinary matters may be decided by majority opinion but matters of fundamental nature would require unanimity.

The matters which are to be decided by unanimous consent of all the partners are discussed below :

- Nature of business [Sec. 12]:

No change can be made in nature of the business without the consent of all the partners. - Admission of a partner [Sec. 31(1)] :

A person can be admitted as a partner, only with the consent of all the existing partners. - Transfer by a partner of his interest in the firm. (sec. 29):

A partner can transfer his share in the firm to a third person with the consent of all other partners. - Admission of a minor to the benefits of partnership [Sec. 30(1)]:

A minor is incompetent to contract and, therefore a contract of partnership cannot be entered into with a minor. However, he can be admitted to the benefits of an existing partnership firm provided all the partners consent to it.

3. Right to access to books [Sec.12(d)]

Every partner has a right to have access, to inspect and copy any of the records and books of the firm.

4. Right to share the profits [Sec. 13(b)]

Every partner has right to share equally in the profits earned and to contribute equally to the losses sustained by the firm. This provision is irrespective of the amount of capital j contribution made or business expertise offered. However, they may agree to share the profits in some other ratio.

5. Right to interest on Capital [Sec. 13(c)]

Every partner has right to interest on capital, if so agreed, out of profits only.

6. Right to interest on advances [Sec. 13(d)]

A Partner is entitled to receive interest at 6 % p.a. on any advance, in excess of the agreed amount of capital, made for the purposes of the business.

7. Right to indemnity [Sec. 13(e)]

Every partner has a right to claim indemnity from the firm in respect of payments made or liabilities incurred by him

- in the ordinary and proper conduct of the business, and

- in doing such act, in an emergency, for the purpose of protecting the firm from loss, as would be done by a person of ordinary prudence, in his own case, under similar circumstances.

8. Right to prevent the introduction of new partner [Sec. 31(1)]

Every partner is entitled to prevent the admission of a new partner into the firm.

9. Right to retire [Sec.32(1)]

A partner to retire from the firm

- with the consent of all other partners, or

- in accordance with the terms of the deed, or

- by giving a notice to all other partners, of his intention to retire.

10. Right not to be expelled [Sec.33]

Every partner has right to continue in the partnership and not to be expelled from the firm.

11. Right to carry on competing business after retirement [sec.36(1)]

Every outgoing partner has a right to carry on a competitive business under certain conditions.

12. Right to dissolve the firm (sec. 43)

Where the partnership is at will, the firm may dissolve by any partner giving notice in writing to all the other partners of his intention to dissolve the firm.

b. Duties of Partners

1. General Duties of Partners:

Section 9 of Partnership Act lays down that all the partners are bound:

- to carry on the business of the firm to the greatest common advantage,

- to be just and faithful to each other, and

- to render to any partner or his legal representative the true accounts and

- to render full information of all things affecting the firm.

2. Duty to indemnify for loss caused by fraud:

According to Section 10 of Partnership Act, every partner shall indemnify (reimburse or pay back) the firm for any loss caused to it by his fraud in the conduct of the business of the firm.

3. Duty to attend diligently to his duties[Sec. 12 (b)]:

Every partner is bound to attend diligently to his duties in the conduct of the business.

4. Duty to work without remuneration [Sec. 13(a)]:

A partner is normally not entitled to receive any remuneration for taking part in the business of the firm. However if the partnership agreement provides or business custom allows, a partner can be given remuneration.

5. Duty to contribute to the losses [(Sec. 13(b)]:

The partners shall contribute equally to the losses sustained by the firm without regard to the capital contribution made by the firm.

6. Duty to indemnify for wilful neglect [Sec. 13 (f)]:

A partner shall indemnify the firm for any loss caused to it by his wilful neglect in the conduct of the business of the firm.

7. Duty to use firm’s property exclusively by for the firm. (Sec. 15):

Subject to contract between the partners, the property of the firm shall be held exclu¬sively for the purposes of the business of the firm.

8. Duty to account for personal profits derived [Sec. 16(a)]:

If a partner derives any profit for himself from any transaction of the firm, or from the use of the property or business connection of the firm in the firm’s name, he shall account for that profit and pay it to the firm.

9. Duty not to compete with the business of the firm [Sec. 16 (b)]:

No partner can carry on a business which is competing with that of the firm without the consent of the other partners, otherwise the partner carrying on such a business will have to account for and pay to the firm all profits made by him in that business.

10. Not to assign (transfer) his interest in the firm (sec. 29):

It is the duty of a partner not to assign his interest in the firm to a stranger (outsider) without the consent of all other partners.

c. Mutual rights and duties of partners—

- after a change in the constitution of the firm,

- after the expiry of the term of the firm, and

- where additional undertakings or adventures are carried out.

(1) Rights and duties of partners after a change occurs in the constitution of the firm. Subject to contract between the partners, where a change occurs in the constitution of the firm, the mutual rights and duties of the partners in the reconstituted firm remain the same as they were immediately before the change, as far as may be [Sec. 17(a)],

(2) Rights and duties of the partners after the expiry of the term of the firm. Subject

to contract between the partners, where a firm constituted for a fixed term con¬tinues to carry on business after the expiry of that term, the mutual rights and duties of the partners remain the same as they were before the expiry, of the fixed term [Sec. 17(b)]. ’

(3) Rights and duties of partners where additional undertakings or adventures are carried out. Subject to contract between the partners, where a firm constituted to carry out one or more adventures or undertakings carries out other adventures or undertakings, the mutual rights and duties of the partners in respect of the other adventures or undertakings are the same as those in respect of the original adventures or undertakings [Sec. 17(c)].

Relation of Partners with third parties: [Secs. 18 to 30]

PARTNERS AS AGENTS

The law of partnership is an extension of the law of agency. This is evident from the concluding portion of the definition of partnership which says that the business may be carried on “by all or any all of them acting for all.” “This clearly establishes the implied agency, the partner conducting the affairs of the business is considered as agent of the remaining partners. Sec. 18 of the Partnership Act provides, “Subject to the provisions of this Act, a partner is the agent of the firm for the purposes of the business of the firm”.

In carrying on the business of the firm, partners act as agent as well as principals. While the relation between the partners inter se is that of principals, they are agents of one another in relation to third parties for purposes of business of the firm. Every partner has a two-fold character, he is an agent of the other partners (because other partners are bound by his acts) and also he himself is the principal (because he is bound by the acts of other partners). The liability of one partner for the acts of his co-partners is in truth the liability of a principal for the acts of his agent. This concept of mutual agency is, in fact, the true test of the existence of partnership.

The acts of the partner in the usual course of the business, bind the firm unless:

- The partner so acting has no authority to act for the firm in that matter; and

- The person with whom he is dealing knows that he has no authority; or

- Does not know or believe him to be a partner.

IMPLIED AUTHORITY OF PARTNER

a. Meaning of implied authority

Meaning of Implied Authority. The authority of a partner means the capacity of a partner to bind the firm by his act. This authority may be express or implied. Where the authority to a partner to act is expressly conferred by an agreement it is called express authority. It is implied when the law presumes certain powers exercisable by every partner unless negatived by a contract to the contrary. Sections 19(1) and 22 deal with the implied authority of a partner.

According to Sec. 19(1) of the Act, “the act of a partner which is done to carry on, in the usual way business of the kind carried on by the firm. ” is called Implied Authority of partner. It is subject to the following 3 conditions:

- The act done by the partner must relate to the normal business of the firm and must be within the scope of the business of the firm. For example, if the partner of a firm dealing in electronic goods, purchases some wine in the name of the firm, the firm would not be liable.

- The act must be done in the usual way Le., in the normal course. What is usual way of carrying on the business, will depend on the nature of the business, customs and usages in that kind of business and circumstances of each Particular case.

- The act must be done in the name of the firm, or in any other manner expressing or implying an intention to bind the firm (Sec. 22).

Examples of Implied Authority : The implied authority of a Partner shall usually include general powers of partners as agents of the firm. If the partnership is of general nature, the implied authority of a partner shall include the following acts :

- Buy or sell goods on account of firm,

- to borrow money,

- to employ or engage servants,

- settle accounts with third parties,

- receive payments of debts „ present accounts to creditors

- engage lawyer to defend the actions brought against the firm

- to draw negotiable instruments & cheques on name of firm. The implied authority of partners may differ from business to business.

b. Limitation on Implied authority or Statutory Restrictions on Implied Authority [Sec. 19(2)]

Sec. 19(2) contains the list of acts regarding which a partner does not have an implied authority unless there is usage or custom or contract to the contrary. Accordingly, a partner cannot:

- submit a dispute relating to the business of the firm to arbitration;

- open a banking account on behalf of the firm in his own name;

- compromise or relinquish any claim or portion of a claim by the firm;

- withdraw a suit or proceeding filed on behalf of the firm;

- admit any liability in a suit or proceeding against the firm;

- acquire immovable property on behalf of the firm;

- transfer immovable property belonging to the firm; or

- enter into partnership on behalf of the firm.

A partner can do any of the above thing if:

- he has specific or express authority of the partners or

- the usage or custom of trade permits him.

Illustrations

- A being one of a firm of solicitors and attorneys, draws a bill of exchange in the name of the firm without authority. The other partners are not liable on the bill, for it is no part of the ordinary business of a solicitor to draw, accept, or endorse bills of exchange.

- A and B carry on business in partnership as bankers. A sum of money is received by A on behalf of the firm. A does not inform B of such receipt, afterwards A appropriates the money to his own use. The partnership is liable to make good the money.

- A and B are partners. A with the intention of cheating B goes to a shop and purchases articles on behalf of the firm, such as might be used in the ordinary course of the partnership business, and converts them to his own separate use, there being no collusion between him and the seller. The firm is liable for the price of the goods.

EXTENT OF LIABILITY OF PARTNERS

1. Liability of a partner for acts of the firm. (Sec 25)

Every partner is liable jointly with all the other partners and also severally for all acts of the firm done while he is a. partner. A creditor can sue the partners jointly as well as separately and successively. For example when the partnership firm incurred liability to telephone dept., it became the liability of all the partners. The department is competent to disconnect the personal telephone line of the partner to meet the liability of the firm to the dept.

Every partner is liable, to an unlimited extent, for all debts due to third parties from the firm incurred while he was a partner. As between the partners, the liability is adjustable according to the terms of the partnership agreement. Thus if a partner is entitled to receive !4th share of the losses. The accounts between the partners will be adjusted on this basis. But a third party, who is a creditor of the firm, is entitled to realise the whole of his claim from any one of the partners.

An Act of a firm means any act or omission by all the partners or by any partner or agent of the firm which gives rise to right enforceable by or against the firm. Sec. 2(a). Illustration : Suppose R and S are partners. R enters into contract with X. Now if X commits breach of contract, the firm can sue X. Similarly, if the firm commits a breach of contract, X can sue the firm. The contract between R on behalf of the firm and the third party X would be an act of the firm.

2. Liability of firm for wrongful acts of partners (Sec. 26)

Where, by the wrongful act or omission of a partner (a) acting in the ordinary course of the business of a firm, or (b) with authority of his partner, loss or injury is caused to any third party, or any penalty is incurred, the firm is liable therefore to the same extent as the partner.

3. Liability of firm for misapplication by Partners. (Sec. 27)

Where –

- a Partner acting within in his apparent authority receives money or property from a third party and misapplies it or

- a firm in the course of its business receives money or property from a third Party, and the money or property is misapplied by any of the partners while it is in the custody of the firm, the firm is liable to make good the loss.

Example: P, Q and R carry on a partnership business. M, a debtor of the firm, repays his debt of ? 50,000 to P who does not inform Q and R about the repayment and purchases a television for the members of his family. Here, M is discharged from the debt after making payment of ? 50,000 to P. ”

4. The law relating to the liability of the estate of a deceased partner

Section 35 of the Indian Partnership Act provides that “where under a contract between the partners, the estate of the deceased partner is not liable for any act of the firm done after his death.” Thus, a deceased partner’s estate is not liable to third parties for what may be done after his death by the surviving partners.

Proviso to Sec. 45 lays down in identical rule applicable to a case where the death of a partner has caused dissolution of the firm.

No public notice is required in the case of death in order to absolve the estate of the deceased from future obligations of the firm.

Suppose, the surviving partners borrow money to pay for and take delivery of the goods ordered by the firm during the life-time of the deceased partner. In such a case, the latter’s estate is not * liable for the debt. The creditor can have only a personal decree against the surviving partners and a decree against the partnership assets in the hands of those partners. A suit for goods sold and delivered would not lie against the representatives of the deceased partner. This is because there was no debt due in respect of the goods during the life time of the deceased.

MINOR AS A PARTNER

Admission of a minor into the benefits of the firm: According to Sec. 11 of the Indian Contract Act, an agreement by or with a minor is void. As such, he is incapable of entering into a contract of partnership. But with consent of all the partner^ for the time being, a minor may be admitted to the benefits of partnership [Sec. 30(1)]. This provision is based on the rule that a minor cannot be a promiser, but he can be a promisee or a beneficiary. It should, however, be noted that a new partnership cannot be formed with a partner who is a minor. Also, there cannot be partnership of minors among themselves as they are incapable of entering into a contract.

The position of a minor partner may be studied, under two heads:

1. Position before attaining majority

- Rights:

- He has a right to such share of the property and of profits of the firm as may have been agreed upon.

- He has also a right to have access to and inspect and copy any of the accounts, but not books of the firm. [Sec. 30(2)]

- When he is not given his due share of profit, he has a right to file a suit for his share of property of the firm. But he can do so only, if he wants to sever his connection with the firm. [Sec. 30(4)].

- Liabilities: The liability of the minor partner is confined only to the extent of his share in the profits and property of the firm. Over and above this, he is neither personally liable nor is his private estate liable.

2. Position on attaining majority

On attaining majority, the minor partner has to decide within 6 months whether he shall continue in the firm or leave it. Within this period he should give a public notice of his choice:

- to become, or

- not to become, a partner in the firm.

If he fails to give a public notice he is deemed to have become a partner in the firm on the expiry of the said six months [Sec. 30(5)]

Where he elects to become a partner:

- He becomes personally liable to third par ties for all acts of the firm done since he was admitted to the benefits of partnership;

- His share in the property and profits oi the firm is the share to which he was entitled as a minor partner [Sec. 30(7)].

Where he elects not to become a partner:

- His rights & liabilities continue to be those of a minor upto the date of the public notice;

- His share is not liable for any acts of the firm done after the date of the public notice;

- He is entitled to sue the partners for his share of the property and profits in the firm [Sec. 30(8)]

MULTIPLE CHOICE QUESTIONS:

1. As per section 18, a partner in a partnership firm functions :

(a) In a dual capacity of principal and agent.

(b) As a principal.

(c) As an agent.

(d) Neither as a principal nor as an agent.

2. If a partner commits fraud in the conduct of the business of the firm:

(a) He shall indemnify the firm for any loss caused to it by his fraud.

(b) He is not liable to the firm.

(c) He is liable to the partners.

(d) He is liable to the third parties.

3. Partners are bound to carry on the business of the firm —

(a) To the greatest common advantage.

(b) For the welfare to the society.

(c) For the advantage of the family members.

(d) For earning’personal profits.

4. Which are the matters that require unanimous consent of all the partners:

(a) Admission of a partner.

(b) Transfer by a partner of his interest in the firm.

(c) Fundamental change in the nature of the business.

(d) All the above.

5. The liability of a minor partner is limited to the extent of :

(a) His share in the firm

(b) His personal assets

(c) His share in the firm as well as his personal assets

(d) He is not liable

6. Subject to contract between the partners, a partner does not have any one of the following rights :

(a) Right to receive remuneration.

( b) Right to share profits.

(c) Right to take part in the business.

(d) Right to claim interest on capital.

7. A partner can bind a firm by his act if he:

(a) Submits a dispute to arbitration.

( b) Withdraws suit or proceeding filed on behalf of the firm.

(c) Transfer immovable property belonging to the firm.

(d) Buys goods on behalf of the firm.

8. For ordinary business matters the decisions in the firm are taken on the basis of :

(a) Decision of majority of partners.

(b) Unanimous decision of partners.

(c) 2/3 majority.

(d) 1/3 majority.

9. For changing the nature of a business

(a) Consent of all the partners is needed.

(b) Consent of majority of partners is needed.

(c) Consent of court is needed.

(d) Consent of Registrar of firm is needed in reference to conduct of the business.

10. Where a partner has advanced any loan to the firm and the agreement provides for interest, but does not specify any rate, the rate shall be —

(a) 6%

(b) 8%

(c) 10%

(d) Nil

11. Property of the firm does not include:

(a) Trademark owned by the firm.

(b) Property acquired by or for the firm.

(c) Goodwill of the business.

(d) Property belonging to the partners.

12. Notice to a partner operates as notice to the firm. For such purpose, notice may be given to :

(a) All the partners jointly.

( b) A partner who habitually acts in the business of the firm.

(c) Any two partners.

(d) Only the dormant partners.

13. When a partner transfers his share, the transferee of partners share has the following rights:

(a) To take part in the conduct of the business

(b) To require accounts

(c) To inspect books of the firm

(d) To receive the share of the profits of the transferring partner

14. A minor may give public notice of his decision to continue or withdraw from the firm on his attaining majority within:

(a) Three months

(b) Six months

(c) Nine months

(d) One year

15. When a minor on attaining the age of majority, has elected to become a partner, he becomes personally liable to third parties for all the acts of the firm from the date of his:

(a) Decision to become a partner

(b) Attaining the age of majority

(c) Admission to the benefits of the firm

(d) Attaining majority or decision to become a partner, whichever is earlier

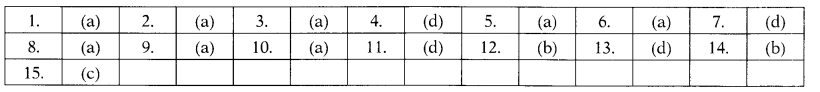

Answers:

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. It is the duty of the partners to work full time in the business of the firm.

2. Partner has a right to receive remuneration.

3. A partner can be admitted to the partnership with the consent of majority of the partners.

4. A partner is not the agent of the other partners.

5. On becoming major, the liability of a minor admitted to the benefits of partnership becomes unlimited from the fate of majority.

6. Where a partner is entitled to interest on the capital he will be paid interest only if there are profits.

7. If a partner advances money to the firm he will be entitled to interest @ 6% p.a. from the firm only in case of profits.

Answers:

![]()