CA Foundation Business Laws Study Material Chapter 19 Reconstitution and Dissolution of Firm

RECONSTITUTION OF A FIRM

Incoming and outgoing Partners: The constitution of a firm may be changed by the introduction of a new partner; death, retirement, insolvency and expulsion of a partner; or by the transfer of a partner’s share to an outsider. All these are included within the term reconstitution of a firm. Upon reconstitution, the rights and liabilities of the incoming and outgoing partners have to be determined. The provisions of the Partnership Act regarding such cases are stated below.

Introduction of a New Partner (Sec. 31)

A new partner can be introduced only with the consent of all the partners. The share of profits which a new partner is entitled to get is fixed at the time he becomes a partner. He is liable for all the debts of the firm after the date of his admission but he is not responsible for any act of the firm done before he became a partner, unless otherwise agreed. These rules do not apply to a minor becoming a partner under Sec. 30.

The incoming partner may, however, assume liability for past debts by novation that is, by tripartite agreement between

- the creditor

- the partners and

- the incoming partner.

Retirement of a Partner (Sec. 32)

A partner may retire

- with the consent of all the other partners,

- in accordance with the terms of the agreement of partnership or

- where the partnership is at will, by giving notice in writing to all the other partners of his intention to retire.

A retiring partner remains liable for the partnership debts contracted while he was a partner. He may however be discharged from any liability to any third party for acts of the firm done before his retirement by novation, if it is so agreed with the third party and the partners of the reconstituted firm. Such agreement may be implied from the course of dealing between the firm and the third party after he had knowledge of the retirement.

The retired partner continues to remain liable to third parties for all acts of the firm until public notice is given of the retirement. Such notice may be given either by the retired partner or by any member of the reconstituted firm. A retired partner is not liable for the debts of the firm incurred after public notice of his retirement. A sleeping partner may retire without giving a public notice of his retirement because he is not known to be a partner to third parties.

Expulsion of a partner (Sec. 33)

A partner can be expelled only when the following conditions are fulfilled:

- When the contract of partnership contains a provision for expulsion under stated circumstances.

- The power to expel is exercised in good faith by the majority of the partners.

- The expelled partner has been given notice of the charges against him and has been given an opportunity to answer the charges.

The liabilities of an expelled partner for the debts of the firm are the same as those of retired partner.

Insolvency of a partner (Sec. 34)

When the partner of a firm is adjudicated an insolvent, he ceases to be a partner from the date on which the order of adjudication was passed by the court. Whether the firm is thereby dissolved or not depends on the terms of the agreement between the partners.

Death of Partners (Sec. 35)

Ordinarily the death of partner has the effect of dissolving the firm. But it is competent for the partners to agree that the firm will continue to exist even after the death of partner.

Transfer of interest (Sec. 29)

What are the Rights of Transferee of Partner’s share?

Transferee’s rights: A share in a partnership is transferable like any other property, but as the 1z partnership relationship is based on mutual confidence, the assignee of a partner’s interest by sale, mortgage or otherwise cannot enjoy the same rights and privileges as the original one (section 29 x of the Partnership Act). The Supreme Court in Narayanappa v. Krishnappa( 1966) has held that the assignee will enjoy only the rights to receive the shares of the profits of the assignor and amount of profits agreed to by other partners.

The rights of such a transferee may be noted as follows:

(a) During the continuance of partnership

During the continuance of partnership, such transferee is entitled to receive the share of the

profits of the transferring partner. However, he is bound to accept the profits as agreed to by the partners i.e. he cannot challenge the accounts.

A transferee of a Partner’s share is not entitled:

- to interfere with the conduct of the business.

- to require accounts or

- to inspect books of the firm.

(b) On the dissolution of the firm

On the dissolution of the firm or on the retirement of the transferring partner, the transferee will be entitled against the remaining partners:

- to receive the share of the assets of the firm to which the transferring partners was entitled and

- for the purpose of ascertaining the share, to an account as from the date of the dissolution.

Rights and liabilities of an outgoing partner

(I) Rights of an outgoing partner

An outgoing partner possesses following rights:

(a) Right to carry on competing business

An outgoing partner has the right to carry on the business competing with that of the firm, and he may advertise such business (Sec. 36). But section 36 imposes some restrictions on his activities in order to prevent unfair competition with the firm. The ‘ restrictions imposed upon outgoing partner are:

- he may not use firm’s name,

- he may not represent himself as carrying on the business on behalf of the firm or

- he may not solicit the customers or the persons who were already dealing with the firm before he left the firm. The above restrictions are subject to a contract to the contrary.

However, the firm may enter into an agreement with the retiring partner not to do competitive business, and then he will not be entitled to carry on competitive business. This agreement will not be void as it will not be treated as an agreement in restraint of trade.

(b) Right to share subsequent profit in certain cases

As per section 37, in case the accounts of the outgoing partners continue to remain unsettled and the remaining partner continues to run the business, such a partner is entitled to receive his share of profit or interest at the rate of 6% p.a. on the amount of his share in the firm.

(II) Liabilities of an outgoing partner

These may be classified into two stages:

(a) Liability for acts done before leaving the firm

A retiring partner is liable for the acts done and debts incurred before his retirement, but he may be exempted from this liability in case on an agreement made by him with the third party and the remaining partners of the reconstituted firm.

(b) Liability for acts done after leaving the firm

In case of retirement of a partner, a public notice is essential to this effect. If it is not given, the retiring partner will continue to be liable to third parties for the acts of the . firm even after his retirement. A public notice is not essential in case of sleeping and deceased partners who is not known to be partner, and so will not be liable for such acts.

DISSOLUTION OF FIRM (SECS. 39 TO 55)

Dissolution of partnership and dissolution of firm

|

Dissolution of firm |

Dissolution of Partnership |

| It involves closing down of the business as the partnership between all the partners comes to an end. | It,involves a change in the relationship amongst the partners due to retirement, expulsion etc., and the business of the firm does not necessary come to an end. It leads to reconstitution of firm. |

Modes of dissolution of firm

A firm may be dissolved on any of the following grounds:

1. By agreement (Sec. 40)

A firm may be dissolved any time with the consent of all the partners of the firm. Partnership is created by contract, it can also be terminated by contract.

2. By Compulsory Dissolution (Sec. 41)

A firm is dissolved-

- by the adjudication of all the partners or of all the partners but one as insolvent, or

- by the happening of any event which makes the business of the firm unlawful.

3. Dissolution on the happening of certain contingencies (Sec. 42)

Subject to contract between the partners, a firm is dissolved-

- if constituted for a fixed term, by the expiry of that term,

- if constituted to carry out one or more adventures of undertakings, by the completion thereof,

- by the death of a partner, and

- by the adjudication of a partner as an insolvent.

The partnership agreement may provide that the firm will not be dissolved in any of the aforementioned cases. Such a provision is valid.

4. Dissolution by notice (Sec. 43)

Where the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all other partners of his intention to dissolve the firm. The firm is dissolved as from the date mentioned in the notice as the date of dissolution, or, if no date is mentioned, as from the date of communication of the notice.

5. Dissolution by the Court (Sec. 44)

At the suit of a partner, the court may dissolve a firm on any one of the following grounds:

A. Insanity

If a partner has become of unsound mind. The suit for dissolution in this case can be filed by the next friend of the insane partner or by any other partner.

B. Permanent incapacity

If a partner becomes permanently incapable of performing his duties as a partner. Permanent incapacity may arise from an incurable illness like paralysis. The suit for dissolution in this case must be brought by a partner other than the person who has become incapable.

C. Guilty conduct

If a partner is guilty of conduct which is likely to affect prejudicially the carrying on of the business, regard being had to the nature of the business. The suit for dissolution on the ground mentioned in this clause must be brought by a partner other than the partner who is guilty of misconduct.

D. Persistent breach of agreement

If a partner wilfully and persistently commits breach of the partnership agreement regarding management or otherwise conducts himself in such a way that it is not rea-sonably practicable for the other partriers to carry on business in partnership with him.

E. Transfer of whole interest

If a Partner has transferred the whole of his interest in the firm to an outsider or as allowed his interest to be sold in execution of a decree. Transfer of partner’s interest does not by itself dissolves the firm. But the other partners may ask the court to dissolve the firm if such a transfer occurs.

F. Loss

If the business of the firm cannot be carried on except at a loss. Since the motive, with which partnerships are formed, is acquisition of gain, the courts have been given discretion to dissolve a firm in cases where it is impossible to make profits.

G. Just and Equitable clause

If the court considers it just and equitable to dissolve the firm. This clause gives a discretionary power to the court to dissolve a firm in cases which do not come within j any of the foregoing clauses but which are considered to be fit and proper cases for dissolution.

Consequences of dissolution:

a. Rights & liabilities of partners on dissolution (Secs. 45 to 55)

When the firm is dissolved, the business of the firm is wound up, the assets are realised to pay the debts and the surplus, if any is distributed amongst the partners. For the purposes of winding up of the firm, the partners possess certain rights and are subject to certain liabilities. These are discussed below.

1. Right to have the business wound up (Sec. 46)

On the dissolution of a firm, a partner has the right

- to have the business of the firm wound up and the debts of the firm settled out of the property of the firm and

- to have the surplus distributed among the partners according to their rights.

2. Continuing authority of partners for purpose of winding up (Sec. 47)

The partners authority to act for the firm and to bind their co-partners continues even after dissolution of the firm for the following two purposes :

- to wind up the affairs of the firm (for example recovering money from debtors)

- to complete transaction begun but unfinished at the time of the dissolution.

3. Right to share in personal profits earned after dissolution (Sec. 50)

Every partner has a right to share in any secret profits derived by any partner under any transaction carried out in the firm name or by use of the property or business connection of the firm, after the dissolution but before winding up.

4. Right to have premium returned on premature dissolution (Sec. 51)

Where a partner has paid a premium (goodwill) on entering into partnership for a fixed term, and the firm is dissolved before the expiration of that term, he shall be entitled ! to repayment of the whole or a reasonable part of the premium. The amount of repayment will depend upon

(a) the terms upon which he became a partner &

(b) length of the time during which he was a partner.

Example: X entered into a partnership, in a firm for a period of 10 years and paid Rs. 5,00,000 as premium. The firm was dissolved after expiration of 3 years because of the insolvency of a partner. Here, X shall be entitled to Rs. 3,50,000 (5,00,000/10 *3= 1,50,000; 5,00,000 -1,50,000 = 3,50,000) as return of premium.

No such premium shall be paid to the partner if such premature dissolution

- is due to death of a partner, or

- is due to his own misconduct or

- is as per agreement which contains no provision for the return of premium.

5. Rights where partnership contract is rescinded for fraud or misrepresentation (Sec. 52)

Where a partner was induced to join the firm by the fraud or misrepresentation of any other partner, the aggrieved partner has the right to rescind the partnership agreement and is entitled:

- to a lien on, or a right of retention of, the surplus or the assets of the firm remaining after the debts of the firm have been paid, for any sum paid by him for the purchase of a share in the firm and for any capital contributed by him;

- to rank as a creditor of the firm in respect of any payment made by him towards the debts of the firm; and

- to be indemnified by the partner or partners guilty of fraud or misrepresentation against all the debts of the firm.

6. Right to restrain the use of firm name or firm property (Sec. 53)

After a firm is dissolved, every partner, may restrain any other partner:

- from carrying on a similar business in the firm name or

- from using any of the property of the firm for his own benefit, until the affairs of the firm have been completely wound up. However, it will not affect the right of any partner or his representative who has bought the goodwill of the firm to use the firm name.

b. Liabilities of partners on dissolution

1. Continuing liability until public notice (Sec. 45)

If a public notice is not given of the dissolution of a firm the partners continue to be liable to third parties for any act done by any of them after dissolution.

2. Liability for continuing authority of Partners for purpose of winding up (Sec. 47)

After the dissolution of the firm, the partners continue to be liable for acts done to wind up the affairs of the firm and to complete transactions begun but unfinished at the time of the dissolution.

Mode of settlement of accounts after dissolution

The partners may lay down their own procedure for the settlement of accounts after dissolution. In the absence of a prior agreement between the partners in this regard, the accounts may be settled in accordance with the provisions provided in sections 48, 49 and 55 of the Indian Partnership Act which are discussed below:

- Goodwill shall be included in the assets and it might be sold separately or along with other property of the firm.

- Losses, including deficiencies of capital, shall be paid first out of profits, next out of capital, and lastly, for the balance, the partners shall individually subscribe in their profit sharing ratio.

- Assets of the firm, including partners’ contributions to make deficiencies of capital, shall be applied firstly, for paying the debts of the firm to third parties, secondly if there remains any surplus, it shall be utilized in paying each partner the amount of advances given to the firm. Such payments are made in the ratio of advances made by the partners. For example, if X gives an advance of Rs. 50,000 and Y of Rs. 60,000, then the ratio of payment shall be 5:6. thirdly, if still there remains any surplus, it shall be utilized for paying each partner rateably on account of capital. For example, the capitals of X, Y and Z have been contributed for Rs. 6,00,000, Rs. 7,00,000 and Rs. 8,00,000 respectively. Here, the proportion of capital shall be 6:7:8. and finally, the residue to be divided amongst partners in their profit sharing ratio.

- In case one of the partners is insolvent and nothing is recoverable from him, then, the deficiency of such a partner is borne by the solvent partners in the ratio of their capitals in accordance with the rule in Garner v. Murray.

- Payment of firm debts and separate debts: According to Section 49 of Partnership Act, where there are debts of the firm as well as individual debts of the partners, then the following rules shall apply:

- The property of the firm shall be first utilized in payment of the debts of the firm; and if there remains any surplus, then the share of each partner in such surplus shall be applied in payment of his individual debts, or if there is no such individual debt then his share shall be paid to him.

- The individual property of any partner shall be applied first in the payment of his individual debts; and if there remains any surplus, it shall be utilized in the payment of the debts of the firm.

PUBLIC NOTICE (SEC. 72)

1. The Partnership Act requires that a public notice must be given in each of the following cases:

- On minor attaining majority

A minor partner on becoming a major must give public notice of his intention to remain or not to remain a partner. [Sec. 30(5)] - Retirement of a partner

When a partner retires from the firm, he must give public notice to terminate further liability. [Sec. 32(3)] - Expulsion of a partner

When a partner is expelled from the partnership business he must give public notice to terminate further liability. [Sec. 33] - Dissolution of the firm

When a partnership firm is dissolved, the partners of the dissolved firm must give public notice to terminate further liability [Section 45(1)]

2. Mode of the Public Notice

According to Sec. 72 the Public Notice becomes effective when the following steps have been taken:

- The notice has been published in the Official Gazette.

- The notice has been published in at least one vernacular newspaper (Le. which is published in Indian language) circulating in the district where the concerned firm has its place or principal place of business.

- If the firm is registered, the notice has been sent to the Registrar of Firms.

3. Consequences of not giving public notice

(a) On minor attaining majority

If a minor is admitted to the benefits of partnership under Section 30 he has to give public notice within 6 months of his attaining majority or of his obtaining knowledge that he has been admitted to the benefits of partnership, whichever date is later. If he fails to give notice, that he has elected to become or not to become a partner in the firm, he shall become a partner in the firm on the expiry of the said 6 months and is liable as a partner of the firm.

(b) Retirement of a partner

If a retiring partner does not give a public notice of the retirement from the firm under section 32, he and the other partners shall continue to be liable as partners to third parties for any act done by any of them which would have been an act of the firm if done before the retirement.

(c) Expulsion of a partner

If in case of expulsion of a partner from the firm a public notice is not given, the expelled partner and the other partners shall continue to be liable to third parties dealing with the firm as in the case of a retired partner. [Section 33],

(d) Dissolution of the firm

If a public notice is not given on dissolution of a registered firm, the partners shall be liable to third persons of any act done by any of them which would have been an act of the firm if done before the dissolution (section 45). When public notice is given of the dissolution of a firm, no partner shall have authority to bind the firm except for certain specific purposes as given in Section 47. According to this section, after the dissolution of a firm, the authority of each partner to bind the firm and their mutual rights and obligations of the partners shall continue :

- so far as may be necessary wind up the affairs of the firm; and

- to complete transactions begun but unfinished at the time of the dissolution.

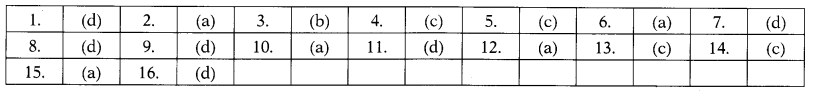

MULTIPLE CHOICE QUESTIONS:

1. A partner may not be expelled from the firm by any majority of partners unless:

(a) The terms of partnership agreement confer the power to expel a partner

(b) The expulsion is made by a majority of the partners of the firm

(c) The decision of expulsion is made by all the partners in good faith

(d) All the above.

2. Agreement in restraint of trade is void. But if an

outgoing partner agrees with the firm that he will not carry on any competing business, such an agreement will be valid if:

(a) Such restraint is in respect of carrying of any business similar to that of the firm

(b) Such agreement is made by the partners beforehand i.e. well in advance

(c) Such agreement is made without any specific reference to time period.

(d) Such agreement is made without reference to local limits.

3. A notice in writing by one partner must be given to all the partners of the firm in case of:

(a) Dissolution on the happening of contingencies

(b) Dissolution of partnership at will

(c) Dissolution by court

(d) Compulsory dissolution

4. A firm is compulsorily dissolved

(a) By adjudication of any partner of the firm as insolvent

(b) By the death of a partner

(c) By adjudication of all the partners or of all the partners but one is insolvent

(d) In any of the above circumstances

5. The partners authority to act for the firm and to bind their co-partners continues even after the dissolution of the firm:

(a) To wind up the affairs of the firm

(b) To complete the unfinished transactions

(c) Both of above

(d) None of the above.

6. Retiring partner continues to remain liable to third parties for acts of the firm :—

(a) Until public notice is given of the retirement.

(b) From the date of retirement

(c) Upto the close of the financial year in which he retires.

(d) So long as the firm uses his name.

7. A partner can be expelled from a firm

(a) If power to expel is conferred by express agreement.

(b) If the power is exercised in good faith.

(c) By majority of partners after giving opportunity of explanation.

(d) All of the above.

8. A retired partner may be liable

(a) For debts incurred before retirement.

(b) For debts incurred after retirement until public notice is given.

(c) Either (a) or (b)

(d) Both (a) and (b)

9. Which of the following conditions is not necessary for expulsion of a partner?

(a) The power of expulsion must be given in the partnership deed.

(b) Such power has been exercised by a majority of the partners.

(c) Such power has been exercised in good faith for the interest of the firm and not used as vengeance against a partner

(d) An FIR has been filed in the Police Station.

10. No public notice is required

(a) On the death of a partner.

( b) On minor attaining majority.

(c) Retirement of partner.

(d) Dissolution of firm.

11. An outgoing partner can carry on a competing business and also advertise such business. For this purpose, in the absence of contract to the contrary —

(a) He can use the firm’s name

(b) He cannot use the firm’s name

(c) He cannot represent himself as carrying on the business of the firm.

(d) Both (b) and (c).

12. If all partners, or all but one partner, of the firm are declared insolvent —

(a) Firm is automatically dissolved

(b) Firm becomes illegal association.

(c) Firm is also declared insolvent.

(d) Firm becomes illegal entity.

13. Dissolution of partnership between all the partners of a firm is called —

(a) Dissolution of partnership.

(.b) Dissolution of partners.

(c) Dissolution of the firm.

(d) Reconstitution of firm.

14. The accounting rule in respect of loss arising due to insolvency of a partner is dealt within

(a) Derry v. Peek

(b) Carlill v. Carbolic Smoke Ball Co.

(c) Garner v. Murray

(d) Chinnaiah v. Ramaiya.

15. While selling goodwill of the firm, the selling partners may agree with the buyer that they will not carry on similar business, within a specified period or within specified local limits. Such agreement in restraint of trade shall be :

(a) Valid, if the restrictions imposed are rea-sonable

(b) Valid (whether restrictions are reasonable or not)

(c) Void

(d) Voidable

16. Public Notice under the Partnership Act, is given in the following manner:

(a) Serving a copy of the Notice to the Registrar of firms

( b) Publishing the Notice in the Official Gazette

(c) Publishing the Notice in one vernacular newspaper circulating in the district where the firm’s principal place of business is situated

(d) All of the above.

Answers:

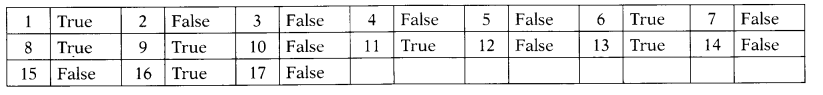

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. A partner who has purchased the goodwill of the firm on dissolution of partnership has a right to make use of the firm’s name for earning profits.

2. All partners are not the joint owners of the property of the firm, unless otherwise provided in the agree-ment.

3. The test of existence of partnership is the element of sharing of profits rather than mutual agency.

4. Legal representatives are required to give public notice so as to avoid the liability of the deceased partner.

5. Permanent incapacity of a partner is not a ground for dissolution of partnership firm.

6. A firm can be held liable for all wrongful acts of a partner done in the ordinary course of partnership business.

7. A firm signifies the abstract legal relation of the partners.

8. Dissolution of firm automatically results in dissolution of partnership.

9. Partnership will get dissolved if all the partnership except one are declared insolvent.

10. Public notice is not necessary on a minor admitted to the benefits of partnership opting to become a partner in the firm.

11. Losses including deficiencies of capital are to be paid by the partners in the portion in which they were entitled to share the profits.

12. Losses including deficiencies of capital shall be first paid out of capital.

13. In settling the accounts of a firm after dissolution, the assets are first utilized in paying the debts of the firm to the third parties.

14. The term dissolution of partnership and dissolution of firm are synonymous.

15. Indian Partnership act imposes penalty for non-registration of the firm.

16. The assignee of a partner’s interest, will enjoy the right to receive the share of the profits of the assignor and receive the accounts of profits agreed to by other partners.

17. When a partner of a firm becomes lunatic, the firm dissolves automatically.

Answers: