CA Foundation Business Laws Study Material Chapter 20 The Limited Liability Partnership Act, 2008

INTRODUCTION

A need has been felt for a long time for a new corporate form that would provide an alternative to the traditional partnership with unlimited personal liability on the one hand, and, the compliance based structure of the private or unlisted public company on the other hand. With this objective in view, the Limited Liability Partnership Act, 2008 was enacted by the Parliament on 12th December, 2008, which received the assent of the President on 7th January, 2009 and was notified with effect from 31st March, 2009. Most of the sections of Limited Liability Act, 2008 came into force from 31st March, 2009.

LLP is a hybrid form of business organization structure which combines the advantages of the Partnership firm and the Company Structure. LLP offers the flexibility of a partnership firm and reduces the compliances of a company structure.

Though the enactment regarding Limited Liability Partnership (“LLP”) finally came into operation in 2009 in India, the concept of limited liability partnership is not new; in fact is more than a 100 year old concept. It is one of the most renowned forms of business organizations worldwide.

The Ministry of Corporate Affairs (MCA) and the Registrar of Companies (ROC) are entrusted with the task of administrating the LLP Act, 2008. The Central Government has the authority to frame the Rules with regard to the LLP Act, 2008, and can amend them by notifications in the Official Gazette, from time to time.

This Act deals with the formation and regulation of Limited Liability Partnerships and for matters incidental thereto.

It contains 81 sections and divided into 4 schedules.

- The First Schedule deals with mutual rights and duties of partners, as well as the rights and duties of limited liability partnership and its partners in case of absence of formal agreement with respect to them.

- The Second Schedule deals with conversion of a firm into LLP.

- The Third Schedule deals with conversion of a private company into LLP.

- The Fourth Schedule deals with conversion of unlisted public company into LLP.

Note: The Indian Partnership Act, 1932 is not applicable to LLPs.

WHY LIMITED LIABILITY PARTNERSHIP?

A need has been felt to make a new legislation related to a new corporate form of business organization in India to meet with the contemporary growth of the Indian economy. It provides an alternative to the traditional partnership with unlimited liability on the one hand and the statute- based governance structure of the limited liability company on the other hand, in order to enable professional expertise and entrepreneurial initiative to combine, organize and operate in flexible, innovative and efficient manner.

Limited Liability Partnership (LLP) is a corporate business organization that provides the benefits of limited liability but also allows its members the flexibility of organizing their internal structure just like in case of a partnership, based on a mutually arrived agreement. The LLP form enables entrepreneurs, professionals and enterprises providing services of any kind or engaged in scientific and technical disciplines, to form commercially efficient vehicles suited to their requirements. Owing to flexibility in its structure and operation, the LLP is a suitable vehicle for small enterprises and for investment by venture capital.

LIMITED LIABILITY PARTNERSHIP – MEANING AND CONCEPT

Meaning: A LLP is a new form of legal business entity with limited liability. It is a separate legal entity where LLP itself is liable to the third parties upto the assets it owns but the liability of the partners is limited. It is an alternative corporate business vehicle that not only gives the benefits of limited liability at low compliance cost but allows its partners the flexibility of organising their internal structure as a traditional partnership. It gives the benefits of limited liability of a company and the flexibility of a partnership.

LLP is also called as a hybrid between a company and a partnership as it contains elements of both, a corporate entity as well as a partnership.

Since LLP contains elements of both ‘a corporate structure’ as well as ‘a partnership firm structure’ LLP is called a hybrid between a company and a partnership.

CHARACTERISTIC/SALIENT FEATURES OF LLP

1. A body corporate

A LLP is a body corporate formed and incorporated under LLP Act and is a legal entity separate from the partners constituting it. [Sec. 3]

2. Separate Legal Entity

The LLP is a separate legal entity. It is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP. In other words, creditors of LLP shall be the creditors of LLP alone and not of the partners.

3. Perpetual Succession

Death, insanity, retirement or insolvency of partners has no impact on the existence of LLP. The LLP can continue its existence irrespective of changes in partners. It is can enter into contracts in its own name. It can also hold properties in its own name. It is created by law and law alone can dissolve it.

4. Absence of Mutual Agency

The cardinal principal of mutual agency of partners in a partnership is missing in LLP. In case of LLP, the partners of LLP are agents of LLP alone and not of the other partners. Hence, no partner can be held liable on account of the independent or un-authorized actions of other partners. Thus individual partners cannot be held liable for liability incurred by another partner’s wrongful business decisions or misconduct.

5. LLP Agreement

The partners are free to make rules related to the mutual rights and duties of the partners as per their choice. This is done through an agreement. In the absence of any such agreement, the mutual rights and duties shall be governed by the provisions of the LLP Act, 2008.

6. Artificial Person

A LLP is an Artificial legal person created by law capable of enjoying all the rights of an individual. It can do everything which a natural person can do, except the contracts of very personal nature like, it cannot marry, it cannot go to jail, cannot take an oath, cannot marry or get divorce. Further, it cannot practice a learned profession like CA, Law or Medicine. A LLP is invisible, intangible, immortal but not fictitious because it really exists.

7. Common Seal

Being an artificial person, a LLP work on its own but it has to act through its partners. Hence, it may have a common seal which can be considered as its official signature. [Section 14(c)], It should be noted that it is not mandatory for a LLP to have a common seal. If it decides to have one, then it shall remain under the custody of some responsible official and it shall be a fixed in the presence of at least 2 designated partners of the LLP.

8. Limited Liability

Every partner of a LLP is, for the purpose of the business of LLP, the agent of the LLP, but not of other partners (Section 26). The liability of the partners will be limited to their agreed contribution in the LLP.

9. Management of Business

The partners in the LLP are entitled to manage the business of LLP. However, only the designated partners are responsible for legal compliances.

10. Minimum and Maximum number of Partners

Every LLP shall have least two partners and shall also have at least 2 individuals as designated partners. It is mandatory that at least one of the designated partners shall be resident in India. Further, there is no maximum limit of partners in LLP.

11. Business for profit Only

LLP can be formed only for carrying on any lawful business with a view to earn profit. Thus LLP cannot be formed for charitable or non-for-profit purpose.

12. Investigation

The Central Government shall have powers to investigate the affairs of an LLP by appointment of competence authority.

13. Compromise or Arrangement

Any compromise or arrangement including merger and amalgamation of LLPs shall be in accordance with the provisions of the LLP Act, 2008.

14. Conversion into LLP

A firm, private company or an unlisted public company would be allowed to be converted into LLP in accordance with the provisions of LLP Act, 2008.

15. E-Filling of Documents

Every form or application of document required to be led or delivered under the act and rules made thereunder, shall be led in computer readable electronic form on its website www.mca. gov.in and authenticated by a partner or designated partner of LLP by the use of electronic or digital signature.

16. Foreign LLPs

Section 2(l)(m) defines foreign limited liability partnership “as a limited liability partnership formed, incorporated, or registered outside India which established a place of business within India”. Foreign LLP can become a partner in an Indian LLP.

The following are the advantages of LLP form of business organization:

- It is easier to form a LLP as compared to a company.

- The partners of a LLP enjoy limited liability.

- It operates on the basis of an agreement.

- It is not rigid as far as capital structure is concerned.

- It provides flexibility without imposing detailed legal and procedural requirements.

- It is easy to dissolve an LLP as compared to a Company.

INCORPORATION OF LLP

Essential elements to incorporate LLP

Limited Liability Partnerships are body corporates which must be registered with the Registrar of LLP after following the provisions specified in the LLP Act. The process is quite similar to setting up of a company. Under the LLP Act, 2008, the following elements are very essential to form a LLP in India:

- Persons intending to incorporate a LLP shall decide a name for the LLP.

- A LLP shall execute a limited liability partnership agreement between the partners inter se or between the LLP and its partners. In the absence of any agreement the provisions as set out in First Schedule of LLP Act, 2008 will be applied.

- Then they shall complete and submit the incorporation document in the form prescribed with the Registrar electronically, along with the prescribed fees.

- There must be at least two partners for incorporation of LLP [Individual or body corporate],

- A LLP shall have a registered office in India so as to send and receive communications;

- It should appoint atleast two individuals as designated partners who will be responsible for number of duties including doing of all acts, matters and things as are required to be done by the LLP. At least one of them should be resident in India. Each designated partner shall hold a Designated Partner Identification Number (DPIN) which is allotted by MCA.

- As soon as the process is completed, a certificate of registration shall be issued which shall contain a Limited Liability Partnership Identification Number (LLPIN)

STEPS OR PROCESS FOR INCORPORATING AN LLP

Step I: Reservation of name

- The first step while incorporating a LLP is the reservation of name of LLP.

- The name of a LLP shall not be similar to that of an existing LLP, Company or a Partnership Firm.

- The applicant has to file e-form 1, for ascertaining the availability and reservation of name.

6 names in order of preference can be indicated. - The name should contain the suffix “Limited Liability Partnership” or “LLP”.

Step 2: Incorporation

- In the second step, the applicant has to file e-form 2 for incorporating a new LLP.

- This form contains the details of the proposed LLP and the Partners and Designated Partners along with their consent to act as such.

Step 3: Execute a LLP Agreement

- It is mandatory to execute LLP Agreement. [Sec. 23]

- LLP agreement shall be filed with the registrar in e-form 3 within 30 days of incorporation of LLP.

The contents of the LLP Agreement are enumerated below:

- Name of LLP

- Name and address of partners and designated partners

- Form of contribution & interest on contribution

- Profit sharing ratio

- Remuneration of Partners

- Rights & Duties of Partners

- Proposed Business

- Rules for governing LLP.

DIFFERENCES WITH OTHER FORMS OF ORGANISATION

A. Distinction between LLP and Partnership Firm:

The points of distinction between a limited liability partnership and partnership firm are tabulated as follows:

|

Sr.No: |

Basis | LLP |

Partnership |

|

1 |

Regulating Act |

The Limited Liability Partnership Act, 2008. | The Indian Partnership Act, 1932. |

|

2 |

Body corporate |

It is a body corporate. | It is not a body corporate. |

|

3 |

Separate legal entity |

It is a legal entity separate from its members. | It is a group of persons with no separate legal entity. |

|

4 |

Creation |

It is created by a legal process called registration under the LLP Act, 2008. | It is created by an agreement between the partners. |

|

5 |

Registration |

Registration is mandatory. LLP can sue and be sued in its own name. | Registration is voluntary. Only the registered partnership firm can sue the third parties. |

|

6 |

Perpetual |

The death, insanity, retirement or insolvency of the partner(s) does not affect its existence of LLP. Members may join or leave but its existence continues forever. | The death, insanity retirement or insolvency of the partner(s) may affect its existence. It has no perpetual succession. |

|

7 |

Name |

Name of the LLP to contain the word limited liability partners (LLP) as suffix. | No guidelines. The partners can have any name as per their choice. |

|

8 |

Liability |

Liability of each partner limited to the extent to agreed contribution except in case of wilful fraud. | Liability of each partner is unlimited. It can be extended upto the personal assets of the partners. |

|

9 |

Mutual agency |

Each partner can bind the LLP by his own acts but not the other partners. ‘ | Each partner can bind the firm as well as other partners by his own acts. |

|

10 |

Designated |

At least two designated partners and atleast one of them shall be resident in India. | There is no provision for such partners under the Indian Partnership Act, 1932. |

|

11 |

Common seal |

It may have its common seal as its official signatures. | There is no such concept in partnership |

|

12 |

Legal |

Only designated partners are responsible for all the compliances and penalties under this Act. | All partners are responsible for all the compliances and penalties under the Act. |

|

13 |

Annual filing of documents |

LLP is required to file:

(i) Annual statement of accounts (ii) Statement of solvency (iii) Annual return with the registration of LLP every year. |

Partnership firm is not required to file any annual document with the registrar of firms. |

|

14 |

Foreign |

Foreign nationals can become a partner in a LLP. | Foreign nationals cannot become a partner in a partnership firm. |

|

15 |

Minor as partner |

Minor cannot be admitted to the benefits of LLP. | Minor can be admitted to the benefits of the partnership with the prior consent of the existing partners. |

B. Distinction between LLP and Limited Liability Company (LLC)

|

Sr.No: |

Basis | LLP |

Limited Liability Company |

|

1 |

Regulating Act |

The LLP Act, 2008. | The Companies Act, 2013. |

|

2 |

Members/ |

The persons who contribute to LLP are known as partners of the LLP. | The persons who invest the money in the shares are known as members of the company. |

|

3 |

Internal |

The internal governance structure of a LLP is governed by agreement between the partners. | The internal governance structure of a company is regulated by statute (i.e., Companies Act, 2013). |

|

4 |

Name |

Name of the LLP to contain the word “Limited Liability partnership” or “LLP” as suffix. | Name of the public company to contain the word “limited” and Private company to contain the word “Private limited” as suffix. |

|

5 |

Number of members/ partners |

Minimum – 2 members

Maximum – No such limit on the members in the Act. The members of the LLP can be individuals/ or body corporate through the nominees. |

Private company: Minimum – 2 members Maximum – 200 members

Public company: Minimum – 7 members Maximum – No such limit on the members. Members can be organizations, trusts, another business form or individuals. |

|

6 |

Liability of members/ partners |

Liability of a partners is limited to the extent of agreed contribution except in case of wilful fraud. | Liability of a member is limited to the amount unpaid on the shares held by them. |

|

7 |

Management |

The business of the company managed by the partners including the designated partners authorized in the agreement. | The affairs of the company are managed by board of directors elected by the shareholders. |

|

8 |

Minimum number of directors/ designated partners |

Minimum 2 designated partners. | Private Co. – 2 directors Public Co. – 3 directors |

MULTIPLE CHOICE QUESTIONS:

1. The LLP Act, 2008 came into force from:

(a) 31st March, 2008

(b) 31st March, 2009

(c) 1st April, 2008

(d) 1st April, 2009

2. Maximum number of partners in a LLP can be:

(a) 100

(b) 200

(c) 50

(d) Unlimited

3. In case of a LLP, the partners are agents of

(a) LLP

(b) Other Partners

(c) Both a) and b)

(d) None of the above

4. For reservation of name, e-Form is

required.

(d) E-Form 1

(b) E-Form A

(c) E-Form B

(d) E-Form 2

5. Minimum designated partners required in a LLP are:

(a) 1

(b) 2

(c) 3

(d) 0

6. Common seal is mandatory for

(a) Company

(b) LLP

(c) Both the above

(d) None of the above

7. In case of legal non-compliance and penalties under the LLP Act, are responsible.

(a) Partners

(b) Designated Partners

(c) LLP

(d) All the above

Answers:

![]()

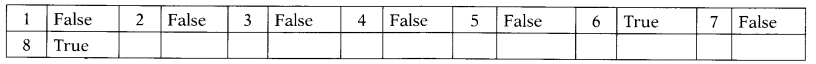

STATE WHETHER THE FOLLOWING ARE TRUE OR FALSE:

1. It is mandatory for a LLP to have a common seal.

2. A LLP is not a body corporate.

3. Executing an LLP Agreement is discretionary.

4. In a LLP, all partners have an unlimited liability.

5. Limited Liability Partnership is governed by Partnership Act, 1932.

6. Every partner in a LLP is the agent for the purpose of the business of LLP but not of the other partners.

7. LLP can be incorporated for charitable purpose as well as for business.

8. Foreign Nationals can become a partner in a LLP.

Answers: