Here we are providing Class 12 Economics Important Extra Questions and Answers Chapter 6 Open Economy Macroeconomics. Economics Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Class 12 Economics Chapter 6 Important Extra Questions Open Economy Macroeconomics

Open Economy Macroeconomics Important Extra Questions Very Short Answer Type

Question 1.

When will there be a surplus in balance of trade?

Answer:

The balance of trade is in surplus when the imports of goods are less than the exports.

Question 2.

Which two transactions determine balance of trade?

Answer:

Export and import of visible items determine the balance of trade.

Question 3.

When is there a deficit in the balance of trade?

Answer:

The balance of trade is in deficit when the imports of goods are more than the exports.

Question 4.

What does Balance of Payments account of a country record?

Answer:

The Balance of Payments (BoP) account of a country records the payments and receipts of a country with the rest of the world, during one year. ,

Question 5.

List two items of the capital account of Balance of Payment account

Answer:

Items of the capital account of Balance of Payment account are:

(i) Private foreign loan flow

(ii) Movement in banking capital

Question 6.

What is the difference between the values of exports of goods and imports of goods called?

Answer:

The difference between the values of exports of goods and imports of goods is called balance of trade.

Question 7.

What is balance of trade? (C.B.S.E 2014)

Answer:

Balance of trade refers to the relationship between the value of imports and exports of the goods of a country. It includes only visible items.

Question 8.

Define Balance of Payment. (C.B.S.E 2017)

Answer:

Balance of Payments (BoP) records the transactions in goods, services and assets of the residents of a country with the rest of the world. It also records the country’s demand for and supply of foreign exchange.

Question 9.

What do you mean by Balance of Payment on current account?

Answer:

The Balance of Payments on current account is the sum of balance of merchandise trade, services and net transfers received from rest of the world.

Question 10.

What do you mean by Balance of Payment on capital account?

Answer:

The Balance of Payments on capital account includes capital transactions relating to borrowing and lending of capital, sale and purchase of assets, interest payment, etc.

Question 11.

What is current account deficit in the Balance of Payments? (C.B.S.E. 2014)

Answer:

Current account is said to be in deficit when the export of goods and services and unilateral transfers falls’ short of the import of goods and services and unilateral transfers.

Question 12.

What is meant by “current account surplus”? (C.B.S.E Outside Delhi 2019)

Answer:

Current account surplus refers to excess of receipts from value of exports of visible items and invisible items; and unilateral transfers over payment for value of imports of visible items and invisible items; and unilateral transfer.

Question 13.

What is foreign exchange rate? (C.B.S.E 2011)

Answer:

Foreign exchange is the price of one unit of the foreign currency in terms of the domestic currency.

Question 14.

What is fixed exchange rate system? (C.B.S.E. Outside Delhi 2012) :

Answer:

Fixed exchange rate is the system in which the exchange rate is set and maintained by the government as official exchange rate. Flexible exchange rate is the system in which the exchange rate is determined by the demand and supply forces in the foreign exchange market.

Question 15.

Define foreign exchange market.

Answer:

Foreign exchange market is the market where the national currencies are traded for one another.

Question 16.

What is ‘hybrid’ system?

Answer:

Hybrid system is the combination of fixed and flexible exchange rates system.

Question 17.

How can increase in Foreign Direct Investment affect the price of foreign exchange ? (C.B.S.E 2013)

Answer:

Increase in Foreign Direct Investment increases the supply of foreign exchange and hence decreases the price of foreign exchange.

Question 18.

How can Reserve Bank of India help in bringing down the foreign exchange rate which is very high? (C.8.S.E Outside Delhi 2013)

Answer:

The Reserve Bank of India can sell foreign currency in exchange of domestic currency to bring down the foreign exchange rate.

Question 19.

What is devaluation? (C.B.S.E 2014)

Answer:

Devaluation of a currency means lowering of the value of the domestic currency by the monetary authority in terms of the currencies of the other countries.

Question 20.

What is managed floating exchange rate? (C.B.S.E. Outside Delhi 2014)

Answer:

Managed floating exchange rate is a system that allows adjustment in exchange rate according to a set of rules and regulations which are officially declared in the foreign exchange market.

Question 22.

Define floating exchange rate. (C.B.S.E Outside Delhi 2014)

Answer:

A floating exchange rate is the rate determined by the free play of market without any intervention by; the centra bank.

Question 23.

What is meant by depreciation of domestic currency? (C.B.S.E. Outside Delhi 2017)

Answer:

Currency depreciation implies that domestic currency has become less expensive in terms of foreign currency.

Open Economy Macroeconomics Important Extra Questions Short Answer Type

Question 1.

Distinguish between current account and capital account of Balance of Payments account. Mention ; any two transactions of capital account.

Answer:

The Balance of Payments on capital account includes capital transactions relating to borrowing and ; lending of capital, sale and purchase of assets, interest payment, etc.

The Balance of Payments on current account is the sum of balance of merchandise trade, services ; and net transfers received from rest of the world.

The two transactions of capital account are:

- Direct investment

- Private transactions

Question 2.

State any four items each of current account and capital account of the Balance of Payments account. (C.B.S.E Outside Delhi 2011), (C.B.S.E. 2011)

Answer:

Items of Current Account

(i) Export and Import of Goods: Current account shows exports and imports of visible items i.e., goods like machinery, wheat, steel, etc.

(ii) Export and Import of Services: Current account shows exports and imports of invisible items i.e., services like banking, tourism, insurance, etc.

(iii) Unilateral Transfers: These are those receipts which residents of a country receive or payments that the residents of a country make without getting anything in return. Receipts from abroad are entered as positive items and payments abroad are entered as negative items.

(iv) Private Transfers: These are gifts that domestic residents receive from or make to foreign residents.

Items of Capital Account

- Private Transactions: These are transactions that affect the assets or liabilities of individuals, business, etc. and other non-government entities.

- Official Transactions: These are the transactions that affect the assets and liabilities by the government and its agencies.

- Direct Investment: Direct investment means the act of purchasing an asset and at the same time acquiring control of it.

- Portfolio Investment: It is the acquisition of an asset that does not give the purchase control over the asset.

Question 3.

What is meant by visible and invisible items in the Balance of Payment account? Give two examples of invisible items.

Answer:

All types of physical goods exported and imported are called visible items in the Balance of Payment account. On the other hand, all those services whose export and import are not visible are known as invisible items in the Balance of Payment account.

Two examples of invisible items are:

- Shipping

- Insurance and banking

Question 4.

Name the board categores of transactions recorded in the ‘current account’ of the balance of payments account. (C.B.S.E 2015)

Answer:

The main components of the current account of the Balance of Payments accounts include:

- Import and export of goods

- Import and export of services

- Unilateral transfers

The deficit in current account indicates that the current imports of goods and services and unilateral transfers to rest of the world are greater than the exports of goods and services and unilateral transfers from rest of the world.

Question 5.

Name the broad categories of transactions recorded in the‘capital account’ of the Balance of Payments Accounts. (C.B.S.E. 2015)

Answer:

The broad categories of transactions recorded in the ‘capital account’ of the Balance of Payments Accounts are:

(i) External assistance

(ii) Commercial borrowings

(iii) NR deposits

(iv) Foreign investment:

- Foreign Direct Investment

- Portfolio Investment

(v) Other flows

Question 6.

Define “Trade surplus”. How is it different from “Current account surplus”? (C.B.S.E 2019)

Answer:

Trade surplus refers to excess of value of export of visible items over value of import of visible items in the balance of payment account of a country. In other words it only includes trade of goods. Current account surplus refers to excess of receipts from value of exports of visible items and invisible items; and unilateral transfers over payment for value of imports of visible items and invisible items; and unilateral transfer. It is a relatively broader concept as compared to trade surplus.

Question 7.

Explain the meaning of deficit in Balance of Payment. (C.B.S.E. 2010,2014)

Or

Explain the concept of‘deficit’ in balance of payments. (C.B.S.E. 2018)

Answer:

When net balance of all the receipts and payment is negative, it is known as deficit in Balance of Payment (BoP). Deficit in BoP indicates that all receipts are less than all the payments. These receipts and payments include both visible and invisible items.

Question 8.

Distinguish between autonomous and accommodating transactions of Balance of Payment account (C.B.S.E 2010,12), (C.B.S.E Outside Delhi 2014,2017)

Answer:

Following are the points of difference between autonomous and accommodating transactions:

| Autonomous Transactions | Accommodating Transactions |

| 1. Autonomous items refer to the international economic transactions, which occur for achievement of economic motive such as profit maximisation.

2. Autonomous transactions are independent of the country’s Balance of Payments status. 3. Autonomous transactions are also known as ‘above the line items’. |

Accommodating items refer to the transactions, which occur because of government financing.

Accommodating transactions are not independent of the country’s Balance of Payments status. Accommodating transactions are also known as ‘below the line items’. |

Question 9.

Which transactions determine the balance of trade? When is balance of trade in surplus? (C.B.S.E. Outside Delhi 2011)

Answer:

Export and import of visible items determine the balance of trade. The balance of trade in surplus when imports are less than exports.

Question 10.

Distinguish between Trade Deficit’ and ‘Current Account Deficit’. (C.B.S.E. Outside Delhi 2019)

Answer:

Trade deficit refers to excess of value of imports of visible items over value of exports of visible items in the balance of payment account of a country. In other words.it only includes trade of goods.

Current account deficit refers to excess of payment for value of imports of visible items and invisible items; and unilateral transfer over receipts from value of exports of visible items and invisible items; and unilateral transfers. It is a relatively broader concept as compared to trade deficit.

Question 11.

State whether the following statements are true or false. Give reasons for your answer: (C.B.S.E. 2011 Comp.)

(i) Difference between value of exports and imports of goods and services is called trade balance.

(ii) External assistance is not recorded in Balance of Payments account.

Answer:

(i) False. Balance of trade refers to the relationship between the value of imports and exports of the goods of a country. It does not include invisible items such as services.

(ii) False. External assistance is a component of Balance of Payments account.

Question 12.

Giving reasons, state whether the following statements are true or false:

(i) Excess of foreign exchange receipts over foreign exchange payments on account of accommodating transactions equals deficit in the Balance of Payments.

(ii) Export and import of machines are recorded in capital account of the Balance of Payments

account (C.B.S.E. 2011 Comp.)

Answer:

(i) False. Excess of foreign exchange receipts over foreign exchange payments on account of autonomous transactions equals deficit in the Balance of Payments.

(ii) False. Export and import of machines are not recorded in capital account as capita! account transactions do not involve movement of goods. Export and import of machines is a part of Current Account.

Question 13.

Giving reasons state whether the following statements are true or false.

(i) Current account of Balance of Payments account records only exports and imports of goods and services.

(ii) Foreign investments are recorded in the capital account of Balance of Payments.

(C.B.S.E. Outside Delhi 2011 Comp.)

Answer:

(i) False. Current account of Balance of Payments account also records unilateral transfers along with exports and imports of goods and services.

(ii) True. Foreign investments are recorded in the capital account of Balance of Payments as It involves change in ownership of assets.

Question 14.

Where will sale of machinery to abroad be recorded in the Balance of Payments Accounts? Give reasons.

(C.B.S.E 2015)

Answer:

Machinery is a visible item and its sale to abroad will be an export. This will result in inflow of foreign exchange in the country. Thus, sale of machinery to abroad will be recorded as a credit item under visible items in the current account.

Question 15.

Where is ‘borrowings from abroad’ recorded in the Balance of Payments Accounts? Give reasons.

(C.B.S.E Outside Delhi 2015)

Answer:

Borrowings from abroad would lead to an inflow of foreign exchange into the country. Thus, borrowings from abroad will be recorded as positive items in the capital account of Balance of Payments.

Question 16.

Giving reasons explain why charity to foreign countries is recorded in the Balance of Payments Accounts.

(C.B.S.E. Foreign 2015)

Answer:

Charity to foreign countries is unilateral transfers, which are a part of BoP’s current account. These transfers are one-sided and cause an outflow of foreign currency. Thus, charity to foreign countries will be recorded as negative item in the current account of Balance of Payments.

Question 17.

State four sources each of demand and supply of foreign exchange. (C.B.S.E 2010)

Answer:

Following are the four sources each of demand for and supply of the foreign exchange:

Sources of Demand for Foreign Exchange

- Purchase of goods and services from other countries

- Send gift abroad

- Purchase of financial assets in a particular country

- Speculative trading on the value of the foreign currencies

Sources of Supply of Foreign Exchange

- Foreigners purchasing home country’s goods and services through exports

- Foreign investment in home country through joint ventures

- Foreign investment in heme country through the financial market operations

- Foreign currencies flow into the economy through the currency dealers and speculators

Question 18.

How is foreign exchange rate determined? Use diagram. (C.B.S.E. Outside Delhi 2013)

Or

Discuss briefly the concept of flexible exchange rate system of foreign exchange rate determination. (C.B.S.E. Outside Delhi 2019)

Answer:

The exchange: rate in the foreign market is determined:by the intersection; of supply and demand, curves of the foreign exchange .The foreign exchange market, like any other normal market, comprises of a downward sloping demand curve and an upward sloping supply curve.

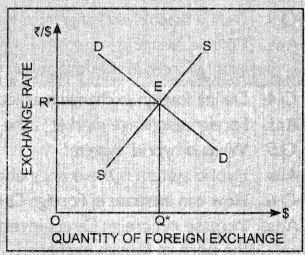

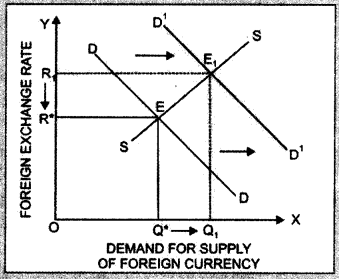

In the following diagram, the vertical shows

He states in terms of the domestic currency, Cruf is,” amount of rupee for one US dollar, The horizontal axis measures the quantity demanded or supped. At point E, the intersection of demand and supply curves determines the equilibrium exchange rate in the foreign market (R*) and equilibrium quantity (Q*) of the foreign currency, that is, US dollar ($).

An increase in the demand for US dollars in India will cause the demand curve to shift to D’$ and the exchange rate rises to R’. Similarly, an increase in the supply of US dollars will cause the supply curve shift to S’$ and the exchange rate falls to RT In this: case, the domestic currency is more valuable.

Question 19.

Explain the impact of rise in exchange rate on national income. (C.8.S.E 2018)

Answer:

A rise in the foreign exchange rate implies that the price of foreign currency, in terms of domestic currency, has increased. Since domestic goods and services have become cheaper, the foreign country can now buy higher quantity from one unit of its currency.

This will result in increased demand for Indian exports. Moreover, depreciation of domestic currency will make the imports from foreign countries more expensive. Thus, there will be increase in exports and fall in imports, causing the net exports to rise. Consequently, the net aggregate demand for domestically produced goods will increase and so will the national income.

Question 20.

When exchange rate of foreign currency rises, its supply rises. How? Explain. (C.B.S.E 2011)

Answer:

The foreign exchange rate is the price of one currency in terms of another currency. A rise in the foreign exchange rate implies that the price of foreign currency, in terms of domestic currency, has increased. Since domestic goods and services have become cheaper, the foreign country can now buy higher quantity from one unit of its currency. This increases the supply of foreign currency in the domestic country.

For instance, suppose the foreign exchange rate between India and UK has increased. The price of one pound has increased from ₹ 60 to ₹ 70. It implies that UK citizens can buy ₹ 70 worth of goods by parting one pound compared to only ₹ 60 worth of goods prior to rise in exchange rate. Since Indian goods have become cheaper for UK, they will buy more of them. This increases the supply of UK pounds to India. Thus, a rise in foreign exchange rate causes a rise in its supply.

Question 21.

When exchange rate of foreign currency fells its demand rises. Explain how? (CBS.E. Outside Delhi 2011)

Answer:

The foreign exchange rate is the price of one currency in terms of another currency. A fall in the foreign exchange rate implies that the price of foreign currency, in terms of domestic currency, has l decreased. Since foreign goods and services have become cheaper, the domestic country can now buy higher quantity.

This increases the demand for foreign currency in the domestic country. : For instance, suppose the foreign exchange rate between India and UK has decreased. The price of one pound has fallen from ₹ 70 to ₹ 60. It implies that Indians have to pay only ₹ 60 to buy one pound worth: of goods compared to ₹ 70 prior to fell in exchange rate. Since goods in UK have become cheaper for; India, Indians will buy more of them. This increases the demand for UK pounds in India Thus, a fall in foreign exchange rate causes a rise in its demand :

Question 21.

Give two reasons for a rise in demand for a foreign currency when its price fells.

Answer:

Following are the two reasons for the rise in the demand for a foreign currency when its price falls:

(i) When the price of a foreign currency falls, the imports from that country become cheaper. As a result, imports increase, and hence, the demand for the foreign currency also rises.

(ii) When a foreign currency becomes cheaper in terms of domestic currency, people plan investment in foreign country. As a result, demand for that foreign currency rises.

Question 22.

State any two merits and demerits of flexible exchange rate system:

Answer:

Merits of Flexible Exchange Rate System

(i) Flexible exchange rate system automatically corrects the deficit or surplus in the Balance of Payments account.

(ii) The government is not required to hold any foreign exchange reserves.

Demerits of Flexible Exchange Rate System

(i) It encourages speculation in the foreign exchange market.

(ii) There can be wide fluctuations in exchange rate, which may cause instability in the foreign trade.

Question 23.

Explain two merits each of fixed foreign exchange rate.

Answer:

Merits of Fixed Exchange Rate System

(i) Fixed exchange rate system ensures stability in foreign exchange market.

(ii) It prevents speculative activities in foreign exchange market.

Question 24.

There is an inverse relation between foreign exchange rate and demand for foreign exchange.Why? Explain.

Answer:

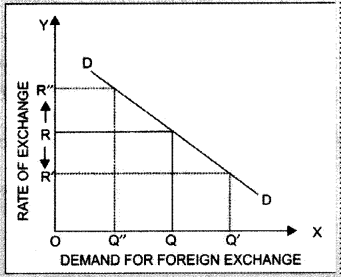

There is an inverse relationship between demand for foreign exchange and rate of exchange.

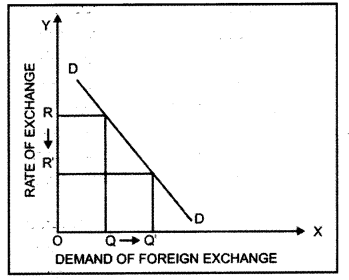

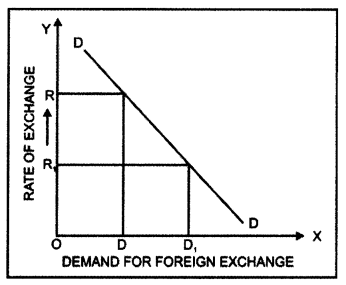

The curve showing demand for the foreign exchange (DD) slopes downward from left to right. This implies that higher the exchange rate, lower would be the demand for foreign exchange, and vice-versa. The diagram shows that when the exchange rate is OR then the demand for foreign exchange is OQ. However, when the exchange rate declines to OR’, then the demand for foreign exchange increases to OQ’.

Question 25.

Explain the meaning of managed flexible exchange rate.

Or

Discuss briefly the concept of managed floating system of foreign exchange rate determination. (C.B.S.E Outside Delhi 2019)

Answer:

Managed flexible foreign exchange rate is a system, which allows adjustments in exchange rate according to a set of rules and regulations officially declared in the foreign exchange market. There is no pre-defined range and time for the adjustment. Adjustment is allowed entirely on the merits of a care. It is for the managing authority to allow or reject the appeal for adjustment.

Question 26.

When price of a foreign currency rises, its demand falls. Explain why? (C.B.S.E Comp. 2011,2012)

Answer:

The foreign exchange rate is the price of one currency in terms of another currency. A rise in the foreign exchange rate implies that the price of foreign currency, in terms of domestic currency, has increased. Since foreign goods and services have become expensive, the domestic country can now buy less of them.

This decreases the demand for foreign currency in the domestic country. For instance, suppose the foreign exchange rate between India and UK has increased. The price of one pound has increased from ₹ 70 to ₹ 80. It implies that Indians have to pay ₹ 80 to buy one pound worth of goods compared to ₹ 70 prior to rise in exchange rate.

Since goods in UK have become expensive for India, Indians will buy less of them. This decreases the demand for UK pounds in India. Thus, a rise in foreign exchange rate causes a fall in its demand.

Question 27.

When price of a foreign currency falls, the supply of that foreign currency also falls. Explain why? (C.B.S.E Outside Delhi 2011)

Answer:

The foreign exchange rate is the price of one currency in terms of another currency. A fall in the foreign exchange rate implies that the price of foreign currency, in terms of domestic currency, has decreased. Since domestic goods and services have become expensive, the foreign country can now buy lesser quantity from one unit of its currency. This decreases the supply of foreign currency in the domestic country.

For instance, suppose the foreign exchange rate between India and UK has decreased. The price of one pound has decreased from ₹ 60 to ₹ 50. It implies that UK citizens can buy only ₹ 50 worth of goods by parting one pound compared to only ₹ 60 worth of goods prior to fall in exchange rate. Since Indian goods have become expensive for UK citizens, they will buy less of them. This decreases the supply of UK pounds to India. Thus, a fall in foreign exchange rate causes a fall in its supply.

Question 28.

Explain the effect of appreciation of domestic currency on imports. (C.B.S.E 2013)

Answer:

Appreciation of a currency means an increase in the value of the domestic currency in terms of the foreign currency. The price of the domestic currency, in terms of a foreign currency, increases and the foreign exchange rate decreases. For instance, suppose rupee has appreciated in terms of pound.

That is, the foreign exchange rate between India and UK has decreased. The price of one pound has decreased from ₹ 70 to ₹ 60. It implies that Indian citizens can buy one pound worth of goods by parting only ₹ 60 compared to ₹ 70 priorto fall in exchange rate. Since UK goods have become cheaper for Indians, they will buy more of them. Consequently, Indian imports from UK will increase.

Question 29.

Explain the effect of depreciation of domestic currency on exports. (C.B.S.E Outside Delhi 2013)

Answer:

Depreciation of a currency means a decrease in the value of the domestic currency in terms of the foreign currency. The price of the domestic currency, in terms of a foreign currency, decreases and the foreign exchange rate increases. For instance, suppose rupee has depreciated in terms of pound.

That is, the foreign exchange rate between India and UK has increased. The price of one pound has increased from ₹ 60 to ₹ 70. It implies that UK citizens can buy ₹ 70 worth of goods by parting one pound compared to only ₹ 60 worth of goods prior to rise in exchange rate. Since Indian goods have become cheaper for UK, they will buy more of them. Consequently, Indian exports to UK will increase.

Question 30.

“Indian Rupee (₹) plunged to all time low of ₹ 74.48 against the US Dollar ($)”.

In the light of the above report, discuss the impact of the situation on Indian Imports. (C.B.S.E 2019)

Answer:

Indian rupee plunged to all time low of rupees ₹ 74.4 8 against US Dollar. This is called as depreciation in the value of Indian rupee. It might lead to fall in imports as foreign goods will become more expensive for domestic consumers.

Question 31.

Recently Government of India has doubled the import duty on gold.What impact is it likely to have on foreign exchange rate and how? (C.B.S.E 2014)

Answer:

When the import duty on gold rises, the import of gold would become costlier. This would reduce

the demand for foreign currency. Since the supply of foreign currency remains the same, the foreign exchange rate would fall. This implies appreciation of rupees.

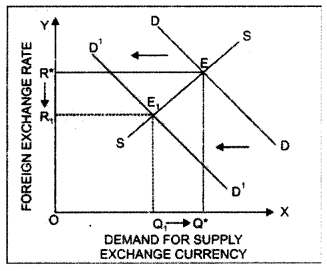

In the diagram, point E determines the equilibrium exchange rate in the foreign market (R*) and equilibrium quantity (Q*) of the foreign currency, where demand (DD) and supply (SS) curves intersect. A fall in the demand for foreign currency will cause the demand curve to shift-to the left from DD to D1D1, and the exchange rate falls to R1 New equilibrium is established at E1.

Question 32.

Distinguish between appreciation of home currency and depreciation of home currency. (C.B.S.E Outside Delhi 2019)

Answer:

Appreciation of home currency means increase in the value of the domestic currency in terms of the currencies of the other countries. On the other hand, depreciation of home currency means lowering of the value of the domestic currency in terms of the currencies of the other countries.

Question 33.

Explain the effect of appreciation of domestic currency on exports. (C.B.S.E Outside Delhi 2014)

Answer:

Appreciation of a currency means an increase in the value of the domestic currency in terms of the foreign currency. The price of the domestic currency, in terms of a foreign currency, increases and the foreign exchange rate decreases. For instance, suppose rupee has appreciated in terms of pound.

That is, the foreign exchange rate between India and UK has decreased. The price of one pound has decreased from ₹ 70 to ₹ 60. UK citizens can buy only 60 worth of goods by parting one pound compared to X 70 worth of goods prior to fall in exchange rate. Since Indian goods have become expensive for UK citizens, they will buy less of them. Consequently, Indian exports to UK will decrease.

Question 34.

How does giving incentives for exports influence foreign exchange rate? Explain. (C.B.S.E 2014)

Answer:

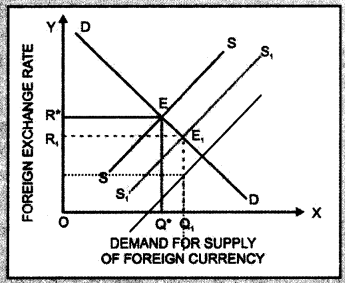

The incentives for exports boost exports of the country. An increase in exports causes the supply of foreign currency to increase in the domestic country while the demand remains unchanged. Consequently, the exchange rate falls and the domestic currency appreciates. in the diagram, point E determines the equilibrium exchange rate in the foreign market (R*) and equilibrium quantity (0*) of the foreign currency, where demand (DD) and supply (SS) curves intersect. A rise in the supply for foreign currency will cause the supply curve to shift to the right from SS to S1 S1 and the exchange rate falls to R1.

Question 35.

Vista to foreign countries for sight seeing etc by the people of India in the rise. What will be its impact on foreign exchange rate? How?

Answer:

Increase in the foreign visits of Indian residents would increase the demand for foreign currency increases. Since the supply of foreign currency remains the same, the foreign exchange rate would rise implying depreciation of rupee.

In the diagram, point E determines the equilibrium exchange rate in the foreign market (R*) and equilibrium quantity (Q*) of the foreign currency, where demand (DD) and supply (SS) curves intersect. A rise in the demand for foreign currency will cause the demand curve to shift to the right from DD to D1D1 and the exchange rate rises to R1.

Open Economy Macroeconomics Important Extra Questions Long Answer Type

Question 1.

Explain the causes of disequilibrium in the Balance of Payments.

Answer:

Following are the causes of disequilibrium in Balance of Payments:

1. Natural Causes

Natural calamities like famine, flood, etc. may cause disequilibrium in the Balance of Payments of an economy as these calamities result in reduction in production and exports and increase in imports.

2. Economic Causes

(i) Economic Development: In order to accelerate the pace of development, underdeveloped countries have to depend on foreign assistance. These countries import advanced machinery, capital goods and raw material, etc, which results in the excess of imports over exports. Flence, there arises the problem of disequilibrium in Balance of Payments.

(ii) Cyclical Fluctuations: Cyclical fluctuations like inflation and depression also cause the problem of disequilibrium of Balance of Payments. If there is depression in the world market then exports of a country are affected adversely. Similarly, if prices start rising within the economy, the rate of increase in imports exceeds that of exports, which results in disequilibrium.

(iii) Capital Outflow: If a country invests its capital in other countries in order to earn more dividend then it may result in unfavourable Balance of Payments of the country investing the capital and favourable Balance of Payments of the country where the capital is invested. Hence, the problem of disequilibrium arises.

3. Political Factors

Government expenditure in foreign countries, political instability, political relations with other countries partition or unification of a country etc. may cause disequilibnum in Balance of Payments of a country.

Question 2.

What do you mean by Balance of Payment? Explain the items constituting the Balance of Payments of country.

Answer:

Balance of Payments (BoP) records the transactions in goods, services and assets of the residents of a country with the rest of the world. It also records the country’s demand for and supply of foreign ex-change.

Items of Current Account

(i) Export and Import of Goods: Current account shows exports and imports of visible items i.e., goods like machinery, wheat, steel, etc.

(ii) Export and Import of Services: Current account shows exports and imports of invisible items i.e., services like banking, tourism, insurance, etc.

(iii) Unilateral Transfers: These are those receipts, which residents of a country receive or payments that the residents of a country make without getting anything in return. Receipts from abroad are entered as positive items and payments abroad are entered as negative items.

(iv) Private Transfers: These are gifts that domestic residents receive from or make to foreign residents.

Items of Capital Account

- Private Transactions: These are transactions that affect the assets or liabilities of individuals, business, etc. and other non-government entities.

- Official Transactions: These are the transactions that affect the assets and liabilities by the government and its agencies.

- Direct Investment: Direct investment means the act of purchasing an asset and at the same time acquiring control of it.

- Portfolio Investment: It is the acquisition of an asset that does not give the purchase control over the asset.

Question 3.

What is foreign exchange rate? Explain how it is determined.

Answer:

Foreign exchange rate is the price of one unit of the foreign currency in terms of the domestic currency.

Determination of Foreign Exchange Rate: Foreign Exchange Rate is determined in the exchange

market at the point of intersection of foreign exchange demand and supply curves.

1. Demand Curve of Foreign Exchange: A country is dependent upon other countries for its requirements of imports and foreign capital. Demand for foreign exchange arises to make payments for these imports. There is an inverse relationship between the demand for foreign exchange and the rate of exchange. If the exchange rate increases, the demand for foreign exchange would fall and the vice-versa.

In the diagram, demand for foreign exchange is OD when exchange rate is OR. When the rate of exchange falls to OR, then demand for foreign exchange increases to OD,. Demand curve for foreign exchange (DD) curve slopes downwards from left to right.

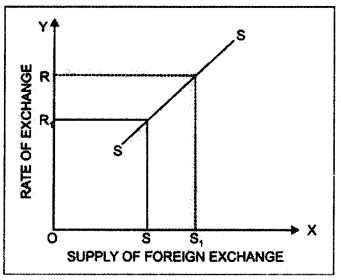

2. Supply Curve of Foreign Exchange: Supply of foreign exchange depends on a number of factors like the value of exports of a country, import of capital, extent of foreign investment, etc. There is direct relation between exchange rate and the supply of foreign exchange. An increase in the exchange rate results in an increase in the supply of foreign exchange and vice-versa.

In the diagram, the supply of foreign exchange is OS when exchange rate is equal to OR. If the exchange rate is increased to OR,, supply of capital also increases to OS,. SS is the positively sloped supply curve of foreign exchange.

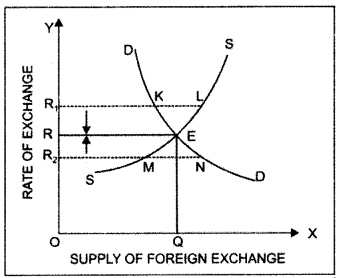

3. Equilibrium Foreign Exchange Rate: Equilibrium exchange rate is determined at a level where demand for foreign exchange is equal to supply of foreign exchange. The determination of equilibrium foreign exchange rate can be explained with the help of given diagram:

The demand for foreign exchange is equal to supply of foreign exchange at point E. the equilibrium foreign exchange rate is OR and equilibrium quantity of foreign exchange is OQ. MN represents excess demand for foreign exchange at OR,. Similarly, KL represents excess supply of foreign exchange at OR2.

Question 4.

Give arguments in favour and against the fixed and flexible

Answer:

Arguments in Favour of Fixed Exchange Rate

1. Encouragement to Foreign Trade: The system of fixed exchange rate provides suitable environment for foreign trade. The exporters and the importers have no fear of changes in the prices of goods and it helps to promote the foreign trade.

2. End to Speculations: There is no uncertainty in the foreign exchange market under the system of fixed exchange rate. It helps to bring an end to the activities of speculation as a result of uncertainty.

3. Internal Stability: Fixed exchange rate results in internal economic stability of a country. The fluctuations in the price level are reduced to the minimum on account of stability of exchange rate and the prices of imports and exports.

4. Useful for Small Countries: For the small countries like Denmark, Belgium, etc. this system of exchange rate has turned out to be very useful. For the countries dependent on foreign trade for their economic development, stability of exchange rate is essential. Flexibility in rate of exchange may adversely affect the process of economic development of these countries.

Arguments against Fixed Rate of Exchange

1. Monetary Dependence: If the exchange rate is fixed then the unfavourable Balance of Payments of a country has an adverse effect on the level of domestic output and income. Under such a situation, the government of a country will have to adopt such a monetary policy, which does not influence its exchange rate. Thus, the government is not free to formulate an independent monetary policy.

2. Cost-price Relationship: The fixed exchange rate is not determined in accordance with the value theory of price determination. Since economic policies of different countries are not alike, their cost-price relationships do not remain stable. Thus, fixed exchange rate does not enable us to analyse the changes in cost-price relations and their effect on exchange rate.

3. Increase in Demand for Foreign Exchange: The demand forforeign exchange in a country increases under the system of fixed exchange rate. Therefore, the government will have to accumulate the stock of foreign exchange and consequently, will have to bear the opportunity cost of foreign exchange.

4. Slow Rate of Growth: There is lack of co-ordination among the economic policies of different countries under the system of fixed exchange rate. As a result a country fails to achieve the desired rate of growth in the absence of co-ordination and co-operation of other countries.

Arguments in Favour of Flexible Exchange Rate

1. Solves the Problem of BoP Deficit: The flexible exchange rate helps to solve the problem of BoP deficit of a country. For example, if demand for foreign exchange exceeds its supply, the rate of exchange will increase to attain equilibrium. On the other hand, if supply of foreign exchange exceeds its demand, the rate of exchange will decrease to attain equilibrium.

2. Effective Monetary Policy: According to Prof. Friedman, monetary policy of a country can be effectively implemented if its exchange rate is flexible. If the objective of monetary policy is to increase the level of production then rate of interest will be reduced to provide incentive for investment. It will also result in an increase in the level of output and hence the exports.

3. Regulations of Import and Export: The level of production, income and employment keep on changing in an economy. These changes influence the demand for and supply of goods. Keeping in view the demand and supply of goods, the government of a country may introduce changes in its imports and exports, which are possible only under the system of flexible exchange rate.

Arguments against Flexible Exchange Rate

1. Effect on Economic Structure: The economic activities of international market have a direct impact on the structure of an economy if the exchange rate is flexible. The fluctuations in international market influence the price level, level of output and employment of an economy.

2. Uncertainty: Flexible exchange rate creates an environment of uncertainty in the international market, which in turn adversely affects the flow of capital among the countries. Moreover, it hinders the process of borrowing and lending of loans in the international market.

3. Internal Instability: The system of flexible exchange rate, sometimes, results in the problem of internal instability in a country if the assumptions of full employment, perfect competition and perfect mobility of factors of production are not fulfilled.

4. Unnecessary Capital Movements: Under the system of flexible exchange rate, capital movements among the countries may increase unnecessarily. Such capital movements may prove to be harmful for the structure of an economy.

Question 5.

Give the meaning of‘foreign exchange and foreign exchange rate’. Giving reason explain the relation between foreign exchange rate and demand for foreign exchange.

Answer:

Foreign Exchange: Foreign exchange is the conversion of one currency into another currency.

Foreign Exchange Rate: Foreign exchange rate is the price of one currency in terms of another currency.

Relation between Foreign Exchange Rate and Demand for Foreign Exchange There is an inverse relation between foreign exchange rate and demand for foreign exchange. The relationship can be explained with the help of a diagram.

In the diagram, X axis shows the quantity of foreign exchange demanded and Y axis shows the price of foreign exchange. The curve showing demand for the foreign exchange (DD) slopes downward from left to right. This implies that higher the exchange rate, lower would be the demand for foreign exchange, and vice-versa. The diagram shows that when the exchange rate is OR then the demand for foreign exchange is OQ.

When the exchange rate declines to OR’, foreign goods become cheaper than the domestic goods. Thus, the demand for foreign exchange increases to OQ’. On the contrary, when the exchange rate increases to OR’, foreign goods become expensive than the domestic goods. Thus, the demand for foreign exchange decreases to OQ’.

Question 6.

Why does the demand for foreign currency fall and supply rises when its price rises ? Explain. (C.B.S.E. 2017)

Answer:

When the price of the foreign currency increases, the value of domestic currency increases in terms of the foreign currency. In other words, we can say that the domestic currency depreciates.

Now in such a case, there are two implications.

(a) Since the domestic currency has depreciated the imports become expensive. The domestic traders will have to pay more to buy the same units of foreign good. This leads to a decline in the demand for the foreign currency.

(b) At the same time, with a depreciation in the domestic currency, the exports become cheaper. This will bring in more foreign currency hence, leading to an increase in the foreign exchange supply.

Open Economy Macroeconomics Important Extra Questions HOTS

Question 1.

The balance of trade shows a deficit of ₹ 5,000 crores and the value of imports are ₹ 9,000 crores. What is the value of exports?

Answer:

The balance of trade is the difference between the value of exports (X) and the value of imports (M).

That is, Balance of Trade – Value of Exports – Value of Imports

Given: Balance of Trade = (-) ₹ 5,000 crores

Value of Imports = ₹ 9,000 crores

Thus, 5000 = Value of Exports – 9000

Value of Exports = – 5000 + 9000 = 4000

The value of exports is ₹ 4,000 crores.

Question 2.

The balance of trade shows a deficit of ₹ 300 crores.The value of exports are ₹ 500 crores. What is the value of imports?

Answer:

The balance of trade is the difference between the value of exports (X) and the value of imports (M).

That is, Balance of Trade = Value of Exports – Value of Imports

Given: Balance of Trade = (-) ₹ 300 crores

Value of Exports = ₹ 500 crores

Thus,

– 300 = 500 – Value of Imports Value of Imports = 500 + 300 = 800

The value of imports is ? 800 crores.

Question 3.

Name three such items which are not included in the balance of trade.

Answer:

Items which are not included in the balance of trade are:

- Exports and imports of services such as of shipping and banking, etc.

- Interest and dividend payments between the countries.

- Expenditure by the tourists.

Question 4.

Why is flexible rate of exchange called free rate of exchange?

Answer:

Flexible rate of exchange is called free rate of exchange as it is freely determined by the forces of supply and demand in the international money market.