Here we are providing Business Studies Class 11 Important Extra Questions and Answers Chapter 4 Business Services. Business Studies Class 11 Important Questions with Answers are the best resource for students which helps in class 11 board exams.

Class 11 Business Studies Chapter 4 Important Extra Questions Business Services

Business Services Important Extra Questions Short Answer Type

Question 1.

Explain the need and benefits of services.

Answer:

The need for Service Sector: Modern trade is the symbol of modem civilization. It has crossed every barrier and reached even the distant and remote parts of the world. It has touched every man. The economic welfare of mankind has been made possible by trade. The physical distribution of goods requires series of interrelated activities, which help in the flow of goods from the producer to the final consumer.

Serv ice sector ensures the smooth supply of goods and services. The service sector consists of a series of interrelated activities concerned with producers to consumers. Service facilities help ensure the supply of the right quantity of the right products to the right place at file right time.

Benefits of Services:

1. Quick and economical services to customers: Efficient service to customers is the only way to have an edge over the competitors. Customer satisfaction can be gained by providing quick, economical, and efficient services to consumers.

2. Minimisation of cost: The distribution costs are part of the price of goods. The costs of transportation, insurance, warehousing, and financing increase the price of the commodities. The efficient and cheap supply of these services minimizes the cost, which is beneficial to consumers.

3. Additional sales volume: The service sector through its efficient transportation, communication, warehousing, and advertising facilities helps increase demand and supply of sales. These services provide knowledge about the commodity and also help in their distribution. Services improve the faith and loyalty of customers.

4. Stabilisation of prices: Transportation helps in the transfer of goods from areas of abundant supply to the areas of scarcity, so the price remains almost the same everywhere. Warehousing adjusts the supply according to demand to avoid violent fluctuations in prices.

5. Removal of time and place barrier- There is a time gap between the production and consumption of the commodities. The warehousing services keep the commodity in their safe custody for the period between production or purchases and sale. This service protects goods from damage and destruction. Modem transport facilities have enabled the movement of commodities from one place to other places.

Question 2.

What are the various types of financial services? Explain in brief.

Answer:

Types of Financial Services: In addition to the traditional financial services of Banking and Insurance the following new financial services have emerged.

1. Merchant Banking: Services of intermediary regarding the issue, management, underwriting corporate restructuring are referred to as merchant banking. They provide growth of the capital market and help in developing an investment climate in the country.

2. Loan Syndication: The approach of borrowers to several banks willing to syndicate a loan, specify ing the amount, and the tenure of the loan is termed as loan syndication.

3. Venture Capital: Subscribing the equity shares of borrowers in return for part of ownership.

4. Factoring: The practice of selling accounts receivable to other companies or agencies for raising funds is termed factoring.

5. Leasing: The legal agreement by which the user of an asset may make payment of lease rent to the owner of the asset in return of use. At the end of the agreement, the lessee takes possession of the assets.

6. Mutual Funds: A company that pools funds from individuals to invest in shares or debentures and in short-term securities.

Question 3.

What are the various types of life insurance policies undertaken by the policyholders?

Answer:

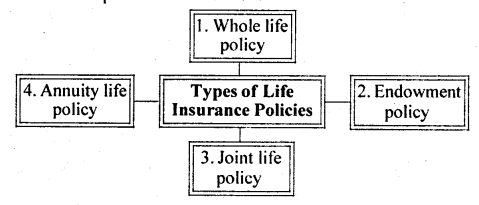

Types of Life Insurance Policies: The life insurance corporation has got different policies suiting to the needs of different persons. These policies are as Under:

1. Whole life policy: This policy reins throughout the whole life of the assured. The sum assured becomes payable to the beneficiary only after the death of the insured. The amount of premium is comparatively lesser in this policy. The period of the policy is indefinite. Its payment is made to the dependents of the insured only.

2. Endowment policy: This policy is for a fixed amount and specified period. If the policyholder survives for the period of the policy he is paid the specified amount of the policy with a bonus. An endowment policy provides both protection as well as savings for old age.

3. Joint life policy: This life policy is taken by two or more persons jointly. These persons may be partners of the firm, employees of an organization, members of the family, etc. According to the terms of the policy, the premium is paid jointly. On the death of anyone member of the group, the entire amount of the policy or the amount as per agreement is paid.

4. Annuity life policy. In this policy, the amount of the policy is paid before the maturity of the policy after one year or the year or the expiry of the fixed period. The entire amount of the policy is paid on the death of the policyholder or after the expiry of the period of the policy, whichever is earlier.

Question 4.

Differentiate Life Insurance and Fire Insurance.

Answer:

Difference between Life Insurance and Fire Insurance:

| Points of difference | Life Insurance | Fire Insurance |

| I. Element of safety/investment | It has got both the

the element of safety and investment. |

It has got an element of safety only. |

| 2. Surrender value | The assured can surrender the policy before its maturity. | The insured cannot surrender the policy. |

| 3. Contract of indemnity | It is not a contract of indemnity. | It is a contract of indemnity. |

| 4. Number of years | The life insurance policy is taken for many years. | Fire insurance policy is taken for one year. It has to be renewed after one year if it has to be continued. |

| 5. Insurable interest | It must be present at the time of the contract | It must be present both at the time taking policy and at the time of loss. |

Question 5.

Explain the term Double Insurance and Re-Insurance and differentiate the two.

Answer:

Double Insurance: Any person is free to take more than one insurance policy for the same property or goods. But he cannot recover more than the amount of loss actually suffered because a contract of insurance is a contract of indemnity.

Reinsurance: When an insurer risks that are beyond his control, he may get the whole or a part of his risk reinsured with other insurers. This is known as reinsurance.

| Points of difference | Double Insurance | Reinsurance |

| 1. Meaning | Ensuring the same risk with two or more companies is Double Insurance. | It is a contract of sub-insurance between the insurer and the reinsurer. |

| 2. FilingClaim | A claim can be filed with all insurers but restricted to an actual loss in case of fire and marine policies. | The insured will claim compensation from the original insurer, who will claim compensation from reinsurers. |

| 3. Contribution | The contribution will be made by each insurer in proportion to the sum insured. | Reinsurers are not directly required to contribute to losses. |

Question 6.

What is the role or advantages of insurance in business?

Answer:

Role/Advantages Of Insurance In The Business: The future is always uncertain. Uncertainties in the business make plans futile and investments valueless. In order to minimize risk different types of insurance policies are taken. Insurance policies are advantageous in the following respects:

Role/Advantages of Insurance in the Business:

| 1. | Protection |

| 2. | Indemnity |

| 3. | Diffusion of Risk |

| 4. | Social utility |

| 5. | Industrial Development |

1. Protection: Insurance provides protection against the risk of loss. Incaseoflife insurance the loss of an individual cannot be compensated but the receipt of the insured amount from Life Insurance Corporation helps him in standing. Insurance enables the businessman to carry on business with confidence and peace of mind.

2. Indemnity: The loss caused by fire and other mishappenings is compensated by the insurance company. Insurance, as such is the protection against losses and businessman feels secured and free from anxiety.

3. Diffusion of Risk: The burden of loss is distributed among a large number of persons through insurance. The impact of loss on one industry is not unduly heavy, that can be transferred by the insurance company to others.

4. Social utility: Insurance provides safety to the common man. It is a means of social security. It also generates employment opportunities.

5. Industrial Development: The insurance companies collect a huge amount as a premium. These funds are invested in industrial ventures and cause industrial development.

Question 7.

What do you understand by the term Merchant Bankers? Mention in brief the services provided by Merchant Bankers.

Answer:

Merchant Bankers: Merchant bankers or lead managers undertake the management of new capital issues of companies. A merchant banker helps the company intending to raise fresh capital in drafting the prospectus (or statement in lieu of prospectus), the arrangement of underwriters, selection of brokers, publicity, the appointment of the registrar to the issue, etc. In India, several banks have specialized divisions or subsidiaries for offering merchant banking services.

Merchant bankers provide a wide variety of financial services to the corporate sector. They look into various legal and procedural aspects involved in the issue of securities and the raising of loans. They also provide consultancy in matters of investment, capital restructuring, valuation, merger, acquisition, etc.

Question 8.

Define Reserve Bank of India and its important functions:

Answer:

Reserve Bank of India: It was incorporated on April l, 1935 as a shareholders’ bank. The majority of shares were held by the central government. After independence, the Reserve Bank of India was nationalized on April l, 1949. Reserve bank of India performs the following important functions:

Functions Of Reserve Bank Of India:

A. Primary functions:

- Issuingcurrencynotes(except one rupee note, which is issued by the ministry of finance)

- Bank of the government

- Working as the banker of banks

- Controlling bank rate or rate of interest

- Controlling exchange rate.

B. Subsidiary functions:

- Dealing in foreign exchange

- Discounting bills of different banks

- Dealing in government securities

- Accepting deposits without interest

- Managing clearing houses

- Managing agricultural credit

- Extending short-term loans to banks and financial institutions

- Regulating developmental, industrial, and commercial activities in India.

Question 9.

Explain the term E-banking and the services of E-banking in today’s economic world.

Answer:

E-Banking (Electronic Banking): Many banks have introduced electronic banking services for their customers. Like IDBI Bank, UTI Bank, Global Trust Bank, Citibank, State Bank of India, etc. They make use of computers and satellites for the transfer of funds and communication. E-banking includes the following services:

1. EFT (Electronic Fund Transfer System): It is a cost-saving scheme for the convenience of customers. Under the schemes accompany may transfer wages and salaries from its bank account to the personal accounts of its employees. Similarly, a company can distribute dividends to its shareholders electronically. This is a very safe method of transfer of money as compared to banker’s draft, traveler’s cheque, etc.

2. ATMs (Automated Teller Machines): Many banks have installed ATMs in big cities. An ATM renders a teller’s job 24 hours a day. It is a self-service terminal that renders the facility of withdrawal and deposit of money to the bank customers. Each customer is given a separate plastic card to avail of the services at the ATM.

The customer has to insert the plastic card into the terminal and enter his identification code. The machine would then respond to the customer’s instruction of giving cash, taking a deposit, and handling other banking transactions.

3. Credit Card: The card issued to selected customers to enable them to make payment of credit bills of the credit limit. It is also called plastic money as it allows the credit cardholder to withdraw money without making any deposit into the bank. It allows an overdraft facility to the customer up to a specified limit. The cardholder can use the card for making payments for goods and services to the suppliers having Internet service is provided in India by many companies like VSNL, Bharti Telecom, and MTNL known as Internet Providers.

Any individual or organization can open an account with any Internet Service Provider who will give an account number for a monthly or yearly charge. Then the user may have access to the internet and the e-mail through it.

4. Debit Card: This is the card issued to the holder of a bank account against the balance amount in the account to facilitate and simplify the payment, withdrawal, and transfer of money any time, anywhere through the computer is known as a debit card.

Question 10.

Banking is the lifeblood of the economy. Mention the role or importance of Banking in the economy.

Answer:

Role/Importance Of Banking In National Economy:

As capital is the lifeblood of trade, commerce, and industry, so banking, in the same way, is the lifeblood of the economy. The importance of banking can be justified on the following grounds:

The modem economy is helpless without banking services. Banking as the lifeblood of the economy has assumed the following significance.

1. Credit creation: Banks accept deposits, retain a nominal percentage of the deposit as a cash reserve, and the best major part is lent to trade, industry and commerce at a higher rate of interest. It is known as credit creation.

2. Mobilisation of savings: Banking accept surplus savings and return together with interest, whenever required. It inculcates the habit of savings among people. It is responsible for capital formation.

3. Safe custody of valuables: The banks provide locker services and keep our valuables like ornaments, notes, documents, etc. safe, we can take them from banks whenever required.

4. Promotion of foreign trade: Finance is the lifeblood of all trading activities, even foreign trade. Banks are the source of funds, help in the payment and transfer of money, provide foreign exchange, issue letter of credit, and provide assistance to foreign trade in many ways.

5. Social and national welfare: Surplus funds of the people are accepted as deposits by banks and lent to trade, commerce, and industry for productive purposes. It promotes the welfare of the people.

Question 11.

Define the term internet and its various benefits and uses in the modern world.

Answer:

Internet is a worldwide or global network of computers, connected through telephone lines and other high-speed links. It is a facility of communicating and sharing information with mi 11 ions of people all over the World Internet Service is provided in India by many companies like VSNL, Bharti Telecom, and MTNL, known as internet service providers.

Any individual or organization can open an account with any internet service provider who will give an account number for a monthly or yearly charge. Then the user may have access to the internet and the e-mail through its information in a variety of forms.

Benefits/Uses of the Internet: Nowadays the internet is being used in every place and every sphere of life, whether it is a share market, shopping complex, companies, organization, departments, or Government understandings. There are a lot of buyers and sellers who use the internet as their buying and selling market. A newspaper or magazine can be read out through it. Seminars, conference, workshop, meeting, the conversation is also possible on the internet.

Thus, the benefits/uses of the internet can be classified as follows:

1. Sharing information: The first and foremost use of the internet is to share information. Company employees and many other people can share research and business data among colleagues and like-minded individuals

2. Communication- Internet facility is also used for communication Through the internet individuals can make communicate directly in various “chat-sessions” and E-mail facilities. With the help of modern technology people can talk face-to-face with the help of a Digital Camera which is possible only with the internet.

3. Marketing of products: Various Multinational Companies (MNC’s), departmental stores, shopping complexes, manufacturers, organizations, etc. used the internet for selling their products. Buyers also used interest to buy different kinds of goods from different corners of the world.

4. Entertainment: The Internet is a good source of entertainment. It offers a lot of entertainment programs as you can play any game by downloading it on your computers. You can come to know the latest Hollywood and Bollywood information about your favorite stars and films. You can hear songs and see films on the internet.

5. Making of queries: The Internet provides the facility to make queries regarding various places, products, films, books, personalities, institutions, etc. That’s why. a high and suitable institute, college, or school with its features and co-curricular activities can be approached.

6. Feedback and suggestions: Through the internet, many institutions and governments can take feedback and suggestions about their decisions and orders (e.g. Daily voting regarding decisions in Hindustan Times and Aaj Ki Baat).

7. Other uses: The Internet facility is also used to find out vacancies and provide opportunities. It can also be used for matrimonial and many more things.

Question 12.

Discuss the various characteristics of an Ideal warehouse.

Answer:

Characteristics Of An Ideal Warehouse: Efficient storage facilities are essential for the smooth flow of trade and commerce.

The essential features of good storage facilities are as follows:

1. Economy: An ideal warehouse must not be very expensive. The benefits provided by it should be much greater than the cost involved in its establishment and maintenance. Its hire charges should be reasonably low.

2. Safety: A good warehouse must provide adequate protection to the goods stored in it. It should be properly constructed to safeguard the goods from heat, moisture, rats, fire, theft, etc.

3. Proximity: The warehouse should be easy Iy accessible. It should be centrally located so that goods can be loaded, unloaded, and transported quickly at the minimum possible cost. It should provide easy or convenient entry and exit of goods.

4. Security: A good warehouse should facilitate pledging or hypothecation of the goods kept therein. It should provide for the supervision and control of the pledged goods. It should be capable of being insured at low rates of premium.

5. Control-There must be proper arrangements for the inspection, measurement, identification, etc. of goods. Proper care should be taken of the stored goods. There should be trained and experienced staff to manage the warehouse.

Question 13.

Differentiate between Private Warehouses and Public Warehouses.

Answer:

Difference between Private Warehouses and Public Warehouses:

| Points of Difference | Private Warehouse | Public Warehouse |

| 1. Capital | Large investment in equipment. trained personnel and other facilities. | There is no need for capital investment in public warehouses. |

| 2. Risk | More risk of obsolescence due to change in demand and technology. | Minimum risk is involved investment in public warehouses. |

| 3. Tax benefit | Advantages of depreciation allowance white calculating taxable income. | No property advantage due to free-port State real estate is taxless. |

| 4. Operating cost | Operating costs are lower. if sufficient volume is stored. | Higher due to inclusion of profit factor. selling and advertising costs. |

| 5. Economies of scale. | Depends on company volume. | Possible due to serving a large number of customers. |

| 6. Storage and handling Cost | Only estimated costs of storage and handling are made. | Storage and handling costs depend on decision making. |

Question 14.

What are Bonded Warehouse and its significance in business?

Answer:

Bonded warehouses are those licensed by the government to accept imported goods for storage before the payment of customs duty by the importers of such goods. Such warehouses work under the supervision and control of customs authorities. Bonded warehouses are located near ports. The goods stored in a bonded warehouse cannot be withdrawn without payment of necessary duty charges. These warehouses are very useful in foreign trade.

Significance Or Objectives Of Bonded Warehouse:

1. Facility in the payment of customs duty: The importer after depositing goods with the bonded warehouse gets sufficient time to arrange funds for the customs duties. There is also an opportunity to pay customs in parts and get the required quantity of goods cleared from the bonded warehouse.

2. Possibility of sales even without clearance of goods: Warehouse receipt is a negotiable instrument, so goods can be sold by endorsing warehouse receipt to the purchaser, who will have to pay customs duty for clearing goods.

3. Exemption from customs duty in case of the report: If goods are imported for exporting abroad, the importer can get it cleared from the bonded warehouse without the payment of customs duty’.

4. Encouragement to foreign trade: Bonded warehouse facilitates foreign trade by its location at the ports and deferred payment of custom duty.

5. Borrowing facility: Warehouse receipt issued by bonded warehouses can be deposited with the bank as security for obtaining loans.

Question 15.

Differentiate between service and goods.

Answer:

Difference between service and goods:

| Points of Difference | Services | Goods |

| 1.Nature | An activity or Process | A Physical Product |

| 2. Type | Heterogeneous | Homogenous |

| 3. Tangibility | Intangible | Tangible |

| 4. Ownership | Not transferable | Transferable |

| 5. Inventory | Cannot be kept as stock | Can be kept as stock |

| 6. Involvement | Participation of customers at the time of service delivery | Transferable at the time of delivery not possible |

| 7. Inseparability | Simultaneous production and consumption | Separation of production and consumption |

| 8. Production | Services are performed not produced | Goods are produced |

Question 16.

Write a short note on types of services?

Answer:

Services can be classified into:

- Business Services

- Personal Services

- Social Services

1. Business Services: Business services are those services which are used by business to conduct its day to day work. Like Warehousing, Transport, Banking, Insurance, Communication, etc. There are gaps of distance, time, knowledge, and risk between the production and consumption of goods. Business services bridges these gaps. The need for services arises because production is concentrated whereas customers are scattered widely.

2. Personal Services: Those services which are experienced differently by different customers are called personal services. These services are not consistent in nature. They will differ depending upon the service provider. They will also depend upon the customer’s preferences and demands, for example, tourism, restaurants, etc.

3. Social Services: Social services are those services that are performed for the benefit of society. They provide voluntarily in pursuit of certain goals. These goals may improve the standard of living of the weaker sections of the society or may educate them or provide health care and hygienic conditions in slum areas. For example health care and education services provided by certain NGOs and government agencies.

Question 17.

Explain the various types of Banks?

Answer:

Banks can be classified into the following:

- Commercial Banks

- Cooperative Banks

- Specialized Banks

- Central Banks

1. Commercial Banks: These banks perform all kinds of banking business. They accept deposits from the public and provide short term loans and advances to customers. They act as financial intermediaries or dealers in debt. Commercial banks are regular banks.

In India, there are three types of commercial banks:

- Public Sector Commercial Banks

- Private sector commercial banks

- Foreign Banks

2. Cooperative Banks: These banks are formed and set up the principles of cooperations. They are registered under Cooperative Societies Act. They provide credit and other facilities to their members. The members may be farmers, small scale traders, etc. They accept deposits from the members and grant loans to them at low rates of interest.

3. Specialised Banks: Specialised banks are foreign exchange banks, industrial banks, development banks, export-import banks catering to specific needs of these unique activities. They provide financial aid to industries, heavy turnkey projects, and foreign trade.

4. Central Bank: Central bank is the apex institution that supervises and controls the entire banking system of the country. Every country has a central bank. The Reserve Bank of India is the central bank of our country. A central bank does not deal directly with the public and its aim is not to earn profits. It also acts as a government banker. It controls and coordinates the currency and credit policies of any country. It maintains the exchange rate. It is the custodian of foreign currency reserves of the country.

Question 18.

What do you understand by insurance? How is it facilitates business?

Answer:

Insurance is a means of spreading risks. It involves the pooling of risks. A group of people who are subject to an insurable risk contributes regularly and the fund so created is utilized to compensate those unfortunate few members of the group who actually suffer a loss due to some unexpected density:

In other words, Insurance is a social device for pooling arid dividing risks among a large number of persons.

Importance of Insurance: Insurance plays a very important role in business. It provides the following advantages of businessman:

1. Protection against risks: It provides protection against risks of loss. By providing security against heavy risks and losses, insurance stimulates the expansion of trade and industry.

2. Division of labor- It facilitates the division of labor. A businessman can concentrate fully on his own business because his risks are taken over by an insurance company that is a specialist in risk-bearing.

3. Ability to face competition- It helps in improving the efficiency of business because an insured businessman feels more safe and active. Insurance contributes to the survival and continuity of business.

4. Better utilization of capital: In absence of insurance facilities businessmen will have to maintain large reserves to face risks due to loss. Insurance avoids the need for such reserves and the fund so released can be invested to generate additional wealth.

5. Facility for loan: Insurance companies provide loans and underwriting facilities to businessmen and also invest in industrial securities. After insuring his goods, the creditworthiness of the businessman increases.

Business Services Important Extra Questions Long Answer Type

Question 1.

What is Business Finance? Explain the various types of business finance and their uses ¡n business.

Answer:

Business Finance:

Ours is a developing economy. Agriculture is the dominant source of income. The 11m citations of agriculture here and the exploding population results in mass unemployment and non-Litilisation of resources. The remedy lies in the rapid growth of the business. consisting of trade, industry, and commerce. The establish is out. nursing and growth of the trade, industry, and commerce owe to the finance. It is rightly said that finance is the lifeblood of business.

The ancient business was very small in size, so own funds and loans from friends and relatives were sufficient to carry on business activities. Modem business has assumed a large size. It has become complicated and complex. Mechanization, specialization, and tough competition are their common features. Own funds are incapable of meeting present financial requirements. This is why, we have developed new sources of finance such as shares, debentures, public deposits, and institutional finance.

Types of Business Finance: Finance is required at every stage of the business. We need different types of finance for different purposes. On the basis of purpose the finance can be classified as under:

Manufacturers require long term finance more than the traders, who purchase and sell goods for-profit motive. More long-term finance will be required if the size of the business is larger.

Special features of long term finance:

- Finance required for a period of more than 5 years is known n as long-term finance. According to certain authorities, finance for a period exceeding ten years is known as long term finance.

- Long-term finance is required for making investments in fixed assets, such as land, building, plant, machinery, vehicles, equipment, furniture, etc.

- Long term finance meets the long term financial needs of the business. These needs are the permanent needs of the business.

- Fixed assets purchased out of long term finance are revenue-generating.

- Long term finance once invested in the business cannot be taken without dissolving the business or scaling down the business.

- Long-term finance is acquired through the issue of shares, debentures, or loans from specialized financial institutions.

(2) Medium Term Finance:

Medium-term finance, also known as medium-term capital is required for a period ranging between 2 to 5 or 2-10 years (The period of finance depends upon the nature and purpose of the business).

Medium-term finance is required for the following business activities:

- Introduction of a new product.

- Expenses on the modernization of business.

- Advertising campaign.

- Investment in permanent working capital.

- Adopting new methods and techniques of production.

Medium-term finance is raised through debentures, banks, public deposits, and financial institutions. Medium-term finance is required by manufacturing industries more than trading industries. Medium-term expenditures are also treated as capital expenditure because it is supposed to be revenue-generating.

3. Short Term Finance: Short term finance, also known as, short term capital or working capital is required for a period not exceeding one year. It is required to meet the day-to-day needs of the business. Short term finance is used again and again in the business, so it is also known as circulating capital.

Uses of Short Term Finance:

The short term finance is required for the following business activities:

- Meeting short-term financial needs of the business.

- Purchase of raw material.

- Payment of direct expenses i.e. expenses on acquiring and manufacturing goods i.e. carriage, freight, wages, power and manufacturing expenses, etc.

- Payment of selling, distribution, and administrative expenses. Trading concerns require more short term finances than manufacturing concerns. Lesser short term finance will be required if the gap between production and sale is lesser. Small factories need lesser short term finance than a large manufacturing enterprise.

Question 2.

Explain the various types of banks and their important functions:

Answer:

1. Commercial Banks: These banks perforin all types of the banking business. They accept deposits from the public and provide short-term loans and advances to customers. They act as financial intermediaries. State bank of India is the largest commercial bank in India. These banks have been established to assist trade commerce and industry.

2. Agricultural Banks: Agriculture needs both short-term and long-term loans. Short-term loans are required for purchasing seeds, manure, tractor, cattle, and tube wells, etc. These short-term needs are met by cooperative banks. Long-term financial needs are regarding the purchase of a land, tractor, other equipment and for installation of tube wells., Long-term financial needs are met by land mortgage banks also known as an agricultural bank. These banks are very helpful for the fanning community.

3. Industrial Banks: These banks provide long-term funds, so their requirement cannot be effectively met by commercial banks. They assist in the promotion of new industrial units. Unfortunately in India, we do not have a sufficient number of industrial banks. In place of industrial banks, we have the industrial development bank of India and various financial corporations to meet the financial needs of industrial enterprises. In western countries like the UK and the USA, there is a large number of industrial banks.

4. Exchange Banks: These banks provide finance for foreign trade. Many Indian commercial banks provide exchange services also. Most foreign banks work as exchange banks in India. These banks are City banks, Bank of Tokyo, Grindlays Bank, Chartered Bank, etc. These banks deal in foreign exchange and assist importers and exporters.

5. Indigenous Banks: Before independence financial needs of fanners and small business units were met by indigenous banks in rural areas. These are money lenders who accept deposits and grant loans. The working of these banks is so simple that farmers and borrowers may approach them at any time. Borrowers have to pledge their ornaments, land, and valuables for borrowing funds.

These banks are virtually exploiter of poor rural people. In spite of our development in financial fields by establishing big banks and financial corporations, indigenous banks are still serving the needs of the poor masses.

Special features of Indigenous banks:

- Loans can be granted for any purpose.

- Loans are granted at a higher rate of interest.

- Loans may be granted without security and a pledge.

- (They are easily accessible.

- Their method of work is simple.

- They may not observe business rules and regulations.

6. Central Bank: Reserve Bank of India: Every country has a central bank responsible for the overall control of cash and credit money in the economy. In India, the Reserve Bank of India works as the Central Bank of the country.

Question 3.

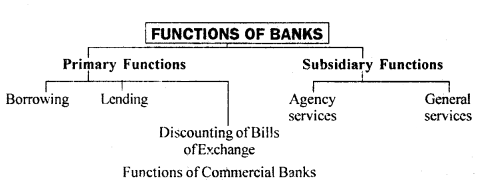

What are the various functions of a bank to be performed for the benefit of customers?

Answer:

1. Accepting Deposits: The basic function of a bank is to accept deposits from the general public and business community. People deposit their money in banks for sake of safety. The deposits can be collected in the following forms:

(a) Current Accounts/Demand Deposits

(b) Saving Deposits,)

(c) Fixed Deposits,

(d) MiscellaneousdepositslikeRecunringDeposits, Cumulative Deposits, Cash Certificates, Old Age Pension Plan, etc.

2. Granting of Loans: The second important function of a bank is lending. Commercial banks lend finance to businessmen, farmers, artisans, and others. It generally makes advances to those who can pay back the principal with interest.

A bank makes advances to businessmen in various ways:

(a) cash credits;

(b) overdrafts;

(c) loans.

3. Discounting of Bills of Exchange: To meet the credit needs of businessmen, a bank can extend financial assistance through discounting bills of exchange. When a businessman needs funds, he may get his bills of exchange discounted with the bank. The bank will deduct the discounting charges (i.e. interest on credit) from the amount of the bill and credit the account of the customer with the balance amount.

4. Agency functions: A commercial bank acts as an agent of its customers in the following ways:

(a) Collecting bills of exchange, promissory notes, and cheques.

(b) It collects dividend and interest warrants of its customers.

(c) It collects the salaries and pensions of its customers.

(d) Itpurchasesand sells securities the instructions its customers.

(e) It executes standing instructions like payment of rent, electricity bill, telephone bill, insurance premium, etc.

5. Miscellaneous Services: A commercial bank performs the following general utility services:

(a) Safecustodyofvaluableslikegoldjewelleryandimportantdocuments.

(b) Providing lockers for the safe custody of Jewellery, valuable documents, and other valuables.

(c) Remittance of money through drafts, mail transfer, and telegraphic transfer.

(d) Purchase and sale in foreign currencies.

(e) Giving references about the financial position of customers.

(f) Underwriting issue of shares and debentures.

(g) Advising customers on financial and investment matters.

Question 4.

What are the major contributions of the Life Insurance business for the development of safety and security of the public?

Answer:

Importance of Life Insurance: Life insurance renders a variety of services to individuals, to groups, to business houses, and to society in general.

The important contributions made by life insurance are as follows:

1. Protection against Premature Death-Life Insurance provides protection to the dependents of the assured in case of his untimely death. The dependents get a large sum in case of death of the person insured. If he has taken a whole life policy, there will be a considerable relief to the dependants.

2. Provision for Old Age: Life Insurance also marked good provision for old age. After retirement. The earning capacity of a person is substantially reduced. He cannot maintain his standard of living. Endowment insurance affords comfortable support in old age and the money is available just when it is most urgently required.

3. Promote on of Thrift or Savings: Life insurance is one of the most important agencies for the promotion of savings. It fosters compulsory savings as the premium assumes the character of a debt or an obligation to be met. If any premium is not paid on the due date, the policy may lapse. Only surrender value can be obtained.

4. Sense of Security: The policyholder and his dependants have a sense of security as their future is financially secured. If the policyholder survives, he will get the stipulated money from the insurance company during his old age and if he dies, his dependants will get money from the insurance company.

5. Commercial Value-Life insurance policy can be used as collateral security to raise loans. It serves as a basis for credit. When a life policy after remaining in force for a good time acquires a cash value, it can be furnished as collateral security to acquire a ready loan in times of stringency.

6. Social Utility: If the earning member of a family undertakes a suitable life insurance policy, it will make the family self-reliant in case the earning member dies. This will relieve the society of a great problem of supporting such families. Life insurance serves as a measure of social security.

7. Funds for Investment-The life insurance companies accumulate vast sums in the form of a premium. This fund has rightly been called “a vast economic reservoir” which furnishes a good means of investment for the economic development of the country.

Question 5.

Explain in detail the comparative study of life, fire, and marine insurance businesses.

Answer:

Comparative Study Of Life, Fire And Marine Insurance:

| Basis | Life Insurance | Fire Insurance | Marine Insurance |

| 1. Indemnity or Compensation | It is not a contract of iri1emnity. The assured. if he survives. or his dependants have entitled to the sum assured. It is a contract of guarantee. | It is a contract of indemnity. The insured can claim the actual market value of the property destroyed by fire. | It is a contract of indemnity. The insured can claim the market value of the ship and the cost of goods destroyed by perils of the sea plus a reasonable margin for anticipated profits. |

| 2. Insurable Interest | Insurable ¡ntcrest must be present at the time of taking the policy. | Insurable interest must be present at the time of taking the policy and at the time of actual loss. | Insurable interest must be present at the time of loss only. |

| 3. Assignment | A life assurance policy can be assigned without the permission of the insurance company. | A fire insurance policy can’t be assigned without the permission of the insurance company. | Marine insurance policy can be assigned without the permission of the insurance company. |

| 4. Period | Life assurance is for a long period ranging from 5 to 30 years. whole life policy may also be taken. | A fire insurance policy is generally for one year. | Marine insurance policy is either for a voyage or for one year. h may also be a mixed policy. |

| 5. investment | It contains both the element of investment & safety. | The element of protection only. | it contains elements of protection only. |

| 6. Double Insurance | The benefit of double or multi-insurance is allowed. | The benefit of double insurance is not allowed. | The benefit of doubt insurance is not allowed |

| 7. Surrender or Paid-up ‘value | Provides both surrender value and paid-up value. | Does not provide surrender or paid-up-value. | Does not provide surrender or paid-up-value. |

| 8. Contingency of Risk | Risk is inevitable. Every policy becomes a claim sooner or later. | Risk is contingent and uncertain. Every policy does not become a claim. | Risk is contingent and uncertain. Every policy does not become a claim. |

Question 6.

Discuss in detail the various clauses in a Life Insurance Policy.

Answer:

Clauses In A Life Policy (Terms and conditions)

A life policy is a legal document in writing containing the contract between the insurer and insured. It determines the terms and conditions under which a life has been insured. It is issued after the proposal form, duly filled in and signed by the proposer, is accepted by the insurer and the first installment of the premium is paid.

The main clauses or conditions in a contract of life insurance are as follows:

1. Premium-Premium is the payment or price of insurance payable by the insured. The amount of premium depends upon the sum assured age of the insured, and period of policy taken.

2. Days of Grace: Days of grace are the days after the due date of the premium. The premium can be paid within the days of grace. In the case of the monthly payment, 15 days of grace are allowed to pay the premium from the due date. In other cases, 3 0 days of grace are allowed. In case the assured dies within the days of grace without paying the installment of premium, the premium due shall be deducted from the full amount of the policy, insured.

3. Proof of Age: Proof of age is necessary because the rate of premium charged is decided on the basis of the age at taken the policy. If the date of birth is not admitted at the time of the policy, it will have to be proved to the satisfaction of the insurance company at the time of the claim. Proof of age may be given in the form of a school certificate, horoscope, birth certificate from the municipal authority, certificate of baptism, the service book, or a declaration by a court of law.

4. Nomination and Assignment: The insured can nominate anyone at any time during the period of the policy. The nominee is the person who will get the amount of the policy in the event of the death of the assured. The nomination is made by an endorsement of the policy.

Assignment of a policy implies the transfer of the policy to a third person. A life insurance policy can be assigned freely to any person with or without consideration. The assignment can be made at any time but it must be in writing, witnessed, and registered with the insurer.

The assignment can be made by an endorsement on the policy or on a separate signed instrument. The person making the assignment is known as the assignment, and the person to whom the policy is assigned is called the assignee, upon a valid assignment, all rights in the policy vest in the assignee who can sue on the policy in his own name. By registering an assignment or nomination the insurer does not accept responsibility as to its validity or legal effect.

5. Surrender Value: If a person is unable or unwilling to pay the premium, he may surrender the policy and ask for the surrender value which is the cash value of the policy. Surrender value depends upon the types of policy and the amount of premium paid. Usually, it is one-third of the total premium paid. A policy acquires surrender value only when the premium has been paid for at least three years.

6. Paid-up Value: When a policyholder wants to terminate the policy, he may convert his policy into a paid-up policy. The Paid-up value is equal to the premium paid and, therefore, it is higher than the surrender value. But the amount of paid-up value is payable to the insured only at the time of maturity of the policy. A policy can be made paid-up only after it has remained in force for at least two years.

7. Incontestable Clause: Under the Insurance Act 1950, no life policy can be contested after it has run for two years except in case of fraud or proof of age.

8. Forfeiture: This clause states that the occurrence of any fault or fraudulent event will result in the forfeiture of the right in the policy. Non-payment of premium, concealment of material facts, furnishing wrong information, etc. are some examples of these faults and fraudulent actions.

9. Revival of Lapsed Policies: When the premium is not paid within the days of grace, the policy lapses. But the policy may be revived within a period of five years from the due date of the first unpaid premium and before the date of maturity.

10. Claims: This clause states the office of the insurance company at which the amount of the policy is payable.

Question 7.

Explain the various clauses mentioned in Marine Insurance Policy.

Answer:

Clauses In Marine Policy: A policy of marine insurance may contain several clauses. Some of the clauses are common to all marine policies while others are included to meet the special requirements of the insured.

Some of the important clauses in a marine policy are described below:

1. Valuation Clause: This clause states the value of the subject matter insured as agreed upon between both parties.

2. Sue and Labour Clause: This clause authorizes the insured to take all possible steps to avoid or minimize the loss or to protect the subject-matter insured in case of danger. The insurer is liable to pay the expenses, if any, incurred by the insured for this purpose. It is also called S.L.T. (Sue, Labour, and Travel clause).

3. Waiver Clause: This clause is an extension of the sue and labor clause and it covers both the insurer and the insured. The clause states that any act of the insured or the insurer to protect, recover or preserve the subject matter of insurance shall not be taken to mean that the insured wants to forget the compensation, nor. will it mean that the insurer accepts the act as an abandonment of the policy?

4. Reach and Stay Clause: This clause requires the ship to reach and stay at such ports and in such order as specified in the policy. If nothing is mentioned, the ship must reach and stay at such ports which are usually called at in that particular trade route. Any departure from the route mentioned in the policy or the ordinary trade route followed will be considered as deviation unless such departure is essential to save the ship or the lives on board in an emergency.

5. Warehouse-to-Warehouse Clause: This clause is inserted to cover the risks to goods from the time they are despatched from the consignor’s warehouse until their delivery at the consignee’s warehouse at the port of destination.

6. Inchmaree Clause: This clause covers the loss or damage caused to the ship or machinery by the negligence of the master of the ship as well as by explosives or latent defect in the machinery or the hull.

7. F.P.A. and F.A.A. Clause: The F.P.A. (Free of Particular Average) clause relieves the insurer from particular average liability. The F.A.A. (Free of all Average) clause relieves the insurer from liability arising from both particular average and general average.

8. Lost or Not Lost Clause: Under this clause, the insurer is liable even if the ship insured is found to be lost prior to the contract of insurance, provided the insured had no knowledge of such loss and he did not commit any fraud. This clause covers the risks between the issue of the policy and the shipment of the goods.

9. Running down Clause (RDC): This clause covers the risk arising out of a collision between two ships. The insurer is liable to pay compensation to the owner of the damaged ship. This clause is used in hull insurance.

10. Free of Capture and Seizure Clause: This clause relieves the insurer from the liability of making compensation for the capture and seizure of the vessel by enemy countries. The insured can insure such abnormal risks by taking an extra ‘war risks’ policy.

11. Continuation Clause: This clause authorizes the vessel to continue and complete her voyage even if the time of the policy has expired. This clause is used in time policy. The insured has to give prior notice for this and deposit a monthly prorate premium.

12. Barratry Clause: This clause covers losses sustained by the shipowner or the cargo-owner due to the willful conduct of the master the crew of the ship.

13. Jettison Clause: Jettison means throwing overboard a pan of the ship’s cargo so as to reduce her weight or to save other goods. The cargo is thrown deliberately to save the ship from sinking. The jettison clause covers the loss arising out of such throwing of goods. The owner of jettisoned goods is compensated by all interested parties.

14. At and From Clause: This clause covers the subject matter while it is lying at the port of departure and until it reaches the port of destination. It is used in voyage policies. If the policy contains only the words ‘from’ instead of and from’, the risk is covered only from the time of departure of the ship.

Question 8.

Discuss in detail the various types of fire insurance policies

Answer:

Types of Fire Policies: Different types of fire insurance policies are issued to meet the varying needs of the public.

The important fire insurance policies are discussed below:

1. Valued Policy: Valued policies are the exception in fire insurance Undervalued policy, the value declared in the policy is the amount the insurer will have to pay to the insured in the event of a total loss irrespective of the actual value of the loss. This policy is usually issued for artistic wort antiques, work of art, and similar rare articles whose value cannot lx determined easily.

2. Specific Policy: Under this policy, the insurer undertakes to make good the loss to the insured up to the amount specified in the policy. Suppose a building worth Rs.40,000 is insured against fire for Rs.20,000. If tin- damage to the property is Rs. 15,000, the insured will get the full compensation Even if the loss is Rs.20,000, the insured will get the full amount. But if the tin loss is more than Rs. 20,000 (/.e. the amount insured), the insured will Rs. 20,000 on !y. Hence, the value of the property is not relevant in determining the amount of indemnity in the case of a specific policy.

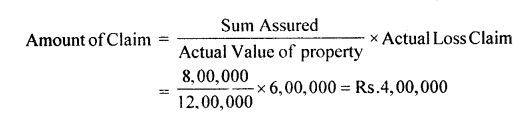

3. Average Policy: The policy contains an ‘average clause’, the insured is penalized for under-insurance of the property. The insured liable for such proportion of the loss as the value of the uncovered property bears to the value of the whole property. The amount of elm is arrived at by dividing the insured sum by the actual value of the property and then multiplying it by the amount of loss.

Thus, if a person gets his house insured for Rs.8,00,000 though its actual value is Rs. 12,00,000, if a part of the house is damaged in a fire and the insured suffers a loss of Rs.6,00,000, the amount of compensation to be paid by the insurer comes out to Rs.4,00,000 arrived as follows:

4. Floating Policy: A floating policy is taken for covering fluctuating stocks of goods held in different lots and several places under one sum and for one premium. It is taken by big businessmen whose goods 1 ie in different stations, ports, and warehouses. With every transaction of sale or purchase, the quantities of goods kept at different places fluctuate. It is difficult for the owner to take a policy for a specific amount. The best way open to him is to take out a floating policy for all the goods lying at different places.

5. Reinstatement Policy: In such a policy, the insurer has the right to reinstate or replenish the property destroyed instead of paying compensation to the insured in cash.

6. Consequential Loss Policy: The insured has to suffer a greater financial loss on account of the dislocation of the business caused by fire. When a fire breaks out in a factory, it disrupts production because the factory has to be closed down for repairs. The production suffers and so also profits of the insured. He has also to meet the fixed expenses such as rent, rates, taxes, salaries, and other expenses as usual. Such considerable loss to the insured is not covered by the ordinary fire policy. In order to cover such loss by fire, the “ConsequentiaJ Loss Policy” has been introduced. The loss so suffered is separately calculated from the loss actually suffered.

Question 9.

Explain the various Marine Policies undertaken by the Insurer under Marine Insurance Contract.

Answer:

Types of Marine Policies: The important types of marine insurance policies are discussed below:

1. Voyage Policy: It is a policy under which the subject matter is insured for a particular voyage irrespective of the time involved to cover transit from one part to another e.g., Mumbai to New York or New York to London. The risk starts from the departure of a ship from the port and it ends on its arrival at the port of destination.

2. Time Policy: It is one under which the insurance is affected for a specified period of time, usually not exceeding twelve months. Tin*e poles are generally used in connection with the insurance of the ship.

3. Mixed Policy: It is a mixture of voyage and time policies. Under it, the subject matter is insured for a certain voyage and time, e.g, Kolkata to New York, for a period of one year. Mixed policies are generally issued to ships operating on particular routes.

4. Valued Policy-It is one under which the value of the subject-matter insured is specified on the face of the policy itself. The value which is agreed upon is called the insured value. It forms the measure of indemnity in the event of a loss. Insured value is not necessarily the actual value.

It includes:

(a) the invoice price of goods;

(b) freight, insurance, and other charges;

(c) ten to fifteen percent margin to cover expected profits.

5. Open or Unvalued Policy: When the value of the subject-matter insured is not specified and agreed upon. It is known as an open policy. In such a policy the value is ascertained as the time of damage.

6. Floating Policy: A merchant who is a regular shipper of goods can take out a ‘floating policy’ to avoid the botheration and waste of time involved in taking a new policy for every shipment. This policy stands for the contract of insurance in general terms and leaves the details to be declared subsequently.

Thus, the insured takes a policy for a huge amount and he informs the underwriter as and when he makes shipment of goods. The underwriter goes on recording the entries in the policy. When the sum assured is exhausted, the policy is said to be “fully declared” or “run-off’.

7. BlockPolicy-Thispolicycoversotherrisks also in addition to marine risks. When goods are to be transported by ship to the place of destination, a single policy is known as block policy may be taken to cover all risks.

Question 10.

Explain the term E-Mail used in communication. Also, give its working and significance.

Answer:

E-Mail-the great new way to send messages: E-mail or electronic mail is the recent electronic media to send messages. It is an addictive way to communicate with people all over the world throughout the day and night without waiting for the recipient to wake up and making himself present. The messages may consist of short notes and greetings, text files plus graphics, images, video clips, or sound.

Working of E-mail:

Step I: We compose the message first. After that, the messages are input by a keyboard and sent off to a machine at ISP (known as a mail server) which handles all the mail from its members.

Step II: The mail server locates the mail server which accepts the recipient’s incoming email.

Step III: After this our mail server send our message to the recipient’s mail server at his E-mail address. ,

Step IV: The message waits at the recipient’s mail server.

Step V: The recipient checks for new mail and picks up the message.

Communicating messages through E-mail is a very short process. Most/of the E-mail is delivered in a matter of minutes.

Significance of E-Mail:

- Easy to communicate: Sending messages through E-mail is easy. It is simple to operate E-mail equipment.

- Fast communication: Messages are sent within minutes to distant places.

- Economical Taking into consideration the distance and the contents of the message, sending messages through E-mail is economical. If you have got your own computer with an Internet facility e-mail is virtually free.

- Secrecy of the message: Messages sent through E-mail remain a secret between the communicator and communicatee.

Electronic mail or e-mail is joining popularity in modern business organizations. Companies around the world are now using e-mail to enhance their effectiveness.

E-mail is fast replacing the telephone and the fax communication mode. Its cost is lower and has a very high speed of travel. It takes only a second to reach the receiver at any distance of the world. It ensures a higher degree of secrecy of the message.

Question 11.

What factors to be considered while selecting public warehouses and Private warehouses.

Answer:

Choice Between Public Warehouses And Private Warehouse: While making a choice between the public warehouse and private warehouses the following factors should be considered:

1. Capital investment: No investment is required in the case of public warehouses. On the other hand, a considerable initial investment is required for the construction of a private warehouse. In addition to the building, start-up equipment and trained personnel are required.

2. Operating costs: A user of a public warehouse has to pay high rent because the owner of a public warehouse seeks profits. Operating costs of private warehouses are lower provided full space is used.

3. Economies of scale: A public warehouse can enjoy economies of scale because it serves a large number of customers. The owner of a private warehouse can achieve economies of scale only when sufficient volume is stored.

4. Control over cost: A public warehouse has to perform well on short-term contracts and, therefore, it is motivated to exercise effective cost control. The owner of a private warehouse has direct responsibility for staff and procedures which permit control over cost.

5. Risk: The use of public warehouses involves nominal risk. Private warehouses involve the risk of obsolescence due to changes in demand and technology.

6. Consolidation of shipments: A public warehouse can consolidate various shipments to and from the warehouse. But no such consolidation is possible under a private warehouse.

7. Storage and handling costs: In a public warehouse these costs are accurately known to the user. But these costs can only be estimated in the case of a private warehouse.

8. Tax benefit: A user of a public warehouse does not get a tax benefit. But the owner of a private warehouse can claim depreciation allowance while calculating his taxable income.