Here we are providing Business Studies Class 11 Important Extra Questions and Answers Chapter 7 Formation of a Company. Business Studies Class 11 Important Questions with Answers are the best resource for students which helps in class 11 board exams.

Class 11 Business Studies Chapter 7 Important Extra Questions Formation of a Company

Formation of a Company Important Extra Questions Short Answer Type

Question 1.

Explain briefly the meaning of promotion of a Company9.

Answer:

Meaning of Promotion: The term promotion is used as the sum total of activities by which a business enterprise is brought into existence. It is a term of business, not of law. Promotion consists of the. business operations by which a company is established.

It is the process of planning and organising the finances and other resources of a business enterprise in the corporate form. According to C.W. Gerstenberg, “Promotion is the discovery of business opportunities and the subsequent organisation of funds, property and management ability into business concern for the purpose of making profit therefrom.”

Promotion is the process of the discovery of a business idea, its investigation and assembling of necessary resources to set-up a business as a profitable concern. The person or group of persons who perform the work of promotion and form a company as a going concern are known as a promoter. A promoter is an entrepreneur or businessman who gives birth to a business concern. A promoter may be an individual, a firm or a company.

According to S. Francis Palmer, “Promoter means a person who originates the scheme of promotion of the company, has the Memorandum and Articles prepared, executed and registered and finds the first directors, settles the terms of preliminary contracts and prospectus (if any) and makes arrangements for advertising and circulating the prospectus and the capital.”

Thus a promoter is a person or a group of persons who conceive the idea of the formation of a company, and takes necessary steps for its incorporation, raising of capital and making it a going concern. In order to perform the task of promotion successfully, a promoter must have several essential qualities. Fertile imagination, sound judgement, initiative, resourcefulness and organising ability are the main qualities of a successful promoter.

Promotion may be done for several objectives, e.g. to start a new business, to expand an existing business or to take over an existing business. Out of this starting, an altogether new business is the most difficult task.

Question 2.

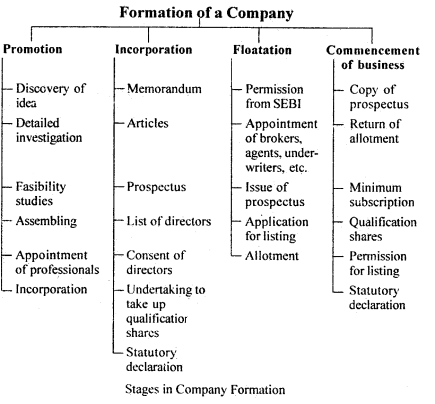

Draw up the various stages of formation of the company.

Answer:

Question 3.

Explain briefly the various types of promoters.

Answer:

Types of Promoters: Promoters can be of the following kinds:

1. Entrepreneur Promoters: An entrepreneur conceives the idea of a new business and performs all the work for establishing it as a going concern. He continues to manage and control the business promoted by him. Small-scale enterprises, such as sole proprietorships and partnerships are promoted by entrepreneurs. He undertakes risk and takes initiative in promoting the company.

2. Professional Promoters: These promoters are specialists in promoting new business ventures. Large-scale enterprises are generally promoted by experts. These experts possess the necessary skills and knowledge in the promotion. They promote a business as a going concern and then sell the proposition or hand-over its management and control others.

These promoters are interested only in looking out tor business reality. He needs to be action-oriented. He will assemble resources, prepare necessary document give a name to the company opportunities and converting them into business units in return for handsome remuneration. There are very few professional promoters in India. They initiate new enterprises and find out the persons who can supply capital.

3. Occasional Promoters: This type of promoters promote a business once a while rather than on a regular basis. Promotion is not their main job and after promoting a company they go back to their original occupation. For example, an engineer or a technical expert may promote a business to commercially exploit a patent or invention discovered by him. They manage the company’s affairs even after incorporation of the company.

4. Financial Promoters: These promoters float new companies during favourable conditions in the securities market. Banks and other financial institutions also perform the work of promotion owing to their experience in the financial sector. Investment bankers become active in the field of promotion when the securities market is able to absorb new issues of equity shares. In India, the Industrial Development Bank of India and other financial institutions carry out the work of promoting industrial concerns.

5. Government: Nowadays, the government has become the biggest promoter. For example, the Government of India has established several basic, strategic and defence industries to speed up the process of economic development in the country. It has promoted large-scale enterprises in iron and steel, coal, shipping, fertilisers, electronics, engineering, insurance, tourism, hotels, etc.

Question 4.

A promoter has various qualities. Explain in brief.

Answer:

Qualities of a Promoter: A promoter should possess the following qualities.

- Vision: A promoter requires a sound imagination and a clear but realistic view of the future. He analysis the prospects of a company and brings together the men, materials and machinery.

- Alert mind: The promoter should be alert enough to notice business opportunities that can be used to advantage. An invention, a patent, a natural resource, an unsatisfied or poorly satisfied need are examples of such opportunities.

- Resourcefulness: A promoter should be able to mobilise financial, human and physical resources so a

- Risk-taking ability: The promoter should be able to bear the calculated risks of the business. Sometimes, an idea may be good but technically not possible to execute.

- Tact: A promoter needs to be tactful so as to persuade people to invest money in the new venture.

- Patience: Considerable patience is necessary to wait till the business idea takes a practical shape. Sometimes, it so happens that a project is technically feasible and viable, but chances of it being profitable are very little, the idea may have to be adopted later by investigating into details which require patience.

- Analytical ability- The promoter should be able to carefully examine each idea and opportunity in terms of costs and benefits.

Question 5.

Define ‘Memorandum of Association’ and ‘Articles of Association’ as these are public documents.

Answer:

Memorandum of Association: The Memorandum of Association is the principal or most important document of a company. According to Lord Macmillan, “The Memorandum of Association sets out the constitution of the company. It is, so to speak, the charter of the company and provides the foundation on which the structure of the company is built. It enables persons, who deal with the company, to know its permitted range of activities.” In the words of Lord Cains, “the Memorandum of Association of a company is its charter and defines the limitations of the power of the company established under the Act.

The Memorandum contains the fundamental conditions upon which alone the company is allowed to be incorporated.” It also lays down the scope of operations of the company beyond which it cannot operate. The purpose of the Memorandum of Association is to enable the shareholders, creditors and others who deal with the company to know its permitted range of activities. In fact, it can be considered as the .foundation on which the structure of a company is based. Its primary importance lies in the fact that a company cannot undertake such operations which are not mentioned in its memorandum.

Great care should be taken in preparing the Memorandum of Association because a company cannot go beyond the limits laid down in the Memorandum.

The Memorandum of Association must be

(a) printed,

(b) divided into suitable paragraphs numbered in sequence, and

(c) signed by the required number of persons in the presence of at least one witness.

The Memorandum must be published in sufficient numbers because it is a public document and a copy has to be given on demand and at a nominal charge. The facsimile and common seal of the company should be filed on the Memorandum. The Companies Act contains different forms of Memorandum (in Schedule 1), one each for companies limited by shares, companies limited by guarantee without shares capital, and unlimited company.

In brief Lord Justice Browen, “a Memorandum of Association is a fundamental document of a company which is also known as the charter of the company. It lays down the object and scope of activities and limitations on the power of a company beyond which the company cannot go. It is a document which contains all conditions upon which a company is allowed to be incorporated.

Articles of Association: Articles of Association are the bylaws of a company. They contain rules and regulations for the management of the internal affairs of a company. They define the mode and manner in which the company’s business is to be carried on. Articles of Association are public document. Outsiders dealing with the company are supposed to have read the Memorandum and Articles of the company. They are entitled to believe that the company conduct its business according to the rules and regulations. This is known as the Doctrine of Indoor Management.

A private company, a company limited by guarantee and an unlimited company, must prepare and file their own Articles of Association. But a public company limited by shares may adopt Table A in the First Schedule of the Companies Act, in case it does not want to prepare and file its own Articles of Association. While preparing the Articles great care should be exercised.

Anything contained in the Articles which is against the Memorandum of Association or against The Companies Act shall be null and void. The Articles of Association should be printed, properly divided into paragraphs, consecutively numbered and signed by the signatories to the Memorandum in the presence of at least one witness. The Articles of Association are subordinate to the Memorandum of Association.

Question 6.

What is ‘Statement in lieu of Prospectus*?

Answer:

Statement in lieu of Prospectus: A public company having a share capital may sometimes decide not to approach the public for securing the necessary capital because it may be confident of obtaining the required capital privately. In such a case, it will have to file a ‘Statement in lieu of Prospectus’ with the Registrar. A ‘Statement in lieu of Prospectus’ is drafted in accordance with the particulars set out in “Schedule III” of the Companies Act. It .contains information very much similar to a prospectus:

It must be duly signed by all the directors and a copy thereof must be filed with the Registrar at least three days before the allotment of the shares. However, a private company is a riot required to either file “Prospectus” or a “Statement in the lie of Prospectus” with the Registrar. ‘Statement in lieu of Prospectus’ must be dated and signed by each director. It should not contain any untrue or misleading statement. Provisions regarding the penalty for issuing a misleading prospectus are also applicable to untrue details given in a statement in lieu of prospectus. A private company is not required to file either a prospectus or a statement in lieu of prospectus as it is not permitted to raise funds.

Formation of a Company Important Extra Questions Long Answer Type

Question 1.

What is the procedure adopted for the alteration of various clauses of Memorandum of Association?

Answer:

Alternation of the Memorandum: The Memorandum of Association can be altered in accordance with the procedure laid down in the Companies Act.

The provisions of the Act are as follows:

1. Alteration of Name Clause: A company can change its name in the following manner.

(a) If the name registered is identical with or similar to the name of an existing company, bypassing an ordinary resolution and obtain ing written approval of the Central Government;

(b) Bypassing a special resolution and obtaining the written consent of the Central Government in other cases.

It may be pointed out and delete that the word ‘private’ to the name of the company does not require the approval of Central Government. But where the addition of the word ‘private’ becomes essential due to the conversion of a public company into a private company, such conversion | is effective only with the approval of the Central Government.

2. Alternation of Registered Office Clause: This clause can be altered in the following ways.

(a) If the registered office is to be shifted from one state to another, bypassing a special resolution and obtaining the sanction of the Registrars of both the states;

(b) If the office is to be shifted from one town to another in the same state, bypassing a special resolution;

(c) If the office is to be shifted from one locality to another in the same town, bypassing an ordinary resolution.

The Registrar of Companies shall register the confirmation of the change of registered office and the alteration made in the memorandum of association within 30 days from the date of filing the documents of change.

3. Alteration of Object Clause: In order to alter its object clause, a company must pass a special resolution and obtain the permission of the Company Law Board.

The Company Law Board must satisfy the following conditions before granting permission:

(a) The objections, if any, of the Registrar of Companies have been obtained.

(b) Sufficient notice has been given to every creditor and other persons whose interest may be affected by the proposed alteration; and

(c) With respect to every creditor either his consent has been obtained or his debt has been discharged.

An alteration in the object clause is permissible if it is necessary to enable the company

(a) To carry on its business more economically or efficiently;

(b) To enlarge the area of its operations;

(c) To carry on some other business which can be profitably combined with the existing business;

(d) To amalgamate with any other company or association;

(e) To attain its main purpose by new or improved means;

(f) To restrict or abandon any of the objects specified in the Memorandum; and.

(g) To sell or dispose of the whole or part of the company’s property.

A special resolution must be passed at a general meeting of the company for alteration of the object clause. The resolution must state reasons or purposes for doing so.

4. Alteration of Liability Clause: If a company wants to make an alteration which imposes any additional liability on its members, it must pass a unanimous resolution in a meeting of its members. The liability of the members automatically becomes unlimited if their number is reduced below seven in case of a public company and below two in a private company. The liability of members may be increased if the members agree in writing consent may be given either before or after the alteration.

5. Alteration of Capital Clause: A company must pass a special resolution and obtain the approval of the Company Law Board. In case the capital is to be reduced, the permission offline court is also required. The court may direct that the company must write the words ‘reduced’ after its name and all the official documents of the company will bear this word. Where the alteration involves the return of capital or reduction in uncalled capital, the consent of creditors must be obtained.

A company may reduce its capital in the following ways:

(a) By extinguishing or reducing the liability of members for uncalled capital;

(b) By paying off some part of capital;

(c) By writing off or cancelling any paid-up capital which is lost; and

(d) By any other method approved by the court.

A company may alter its capital to:

(a) Increase the amount of share capital;

(b) Consolidate the divide its capital into shares of higher denominations;

(c) Subdivide the shares into those of smaller denominations;

(d) Cancel the unissued capital;

(e) Convert fully paid shares into stock or vice versa; and

(f) Reduce the amount of share capital.

6. Alteration of Subscription Clause: In this clause, the subscribers declare that they desire to be bound to assist information of a company and no subscriber can withdraw his name on any ground after registration of the company.

Question 2.

Explain the various contents of Article of Association and its alteration.

Answer:

Articles of Association: The Articles of Association of a company contain the rules relating to the management of its internal affairs. The articles define the duties, the rights and the powers of the Board of Directors as between themselves and the company at large, and the mode and form in which the business of the company is to be carried on, and the mode and form in which changes in the internal regulations of the company may be made.

Articles of association contain the rules angulations for regulating the internal affairs of the company. The subscribers df the memorandum may include in it all such regulations as they deem fit. But everything included in it must be subject to the Companies Act and Memorandum of Company.

A public company limited by shares may opt for the adoption of Table A (i.e. the model set of 99 articles given in Schedule I of Companies Act). The other types of companies are required to file their articles of association along with the Memorandum at the time of registration. The Articles of Association should be printed, divided into paragraphs and numbered consecutively, and signed by each signatory to the memorandum in the presence of at least one attesting witness.

Contents of Articles of Association: The Articles of Association usually contain the provisions relating to the following matters:

- The amount of share capital and different types of shares.

- Rights of each class of shareholders.

- Lien on shares, forfeiture of shares for non-payment of calls and transfer and transmission of shares.

- Procedures tor conduct of meetings, voting, quorum, poll and proxy.

- Appointment, removal and remuneration of directors and their powers and duties.

- Procedure regarding alteration of share capital.

- Matters relating to the distribution of dividend.

- Matters relating to the keeping of statutory books.

- Procedure regarding the winding up of the company.

- Adoption of preliminary contracts.

- Redemption of preference shares.

- Rights of members.

- Borrowing powers.

- Reserves and capitalization of reserves.

Alteration of Articles: A company may change its Articles of Association by passing a special resolution subject to the following conditions.

- The alteration must not be contrary to the Memorandum and the Companies Act. The alteration should not allow the company to do something which is forbidden by the Memorandum.

- It must be bona fide and in the interest of the company as a whole.

- It must not result in a breach of contract with outsiders.

- The alteration must not purport sanction anything illegal or against public policy.

- It must not have the effect of increasing the liability of members.

- It should not amount of fraud by the majority on the monetary. Any alteration which constitutes the discrimination of interest of minority is a fraud on them.

- If the alteration involves converting a public company into a private company, the approval of the Central Government must be obtained.

Question 3.

What is Prospectus? Mention its importance and various important contents.

Answer:

Prospectus: The purpose of issuing a prospectus is to acquaint the investors with the proposed company and induce them to invest in its shares. The law with a view to protecting the interest of investors regulates the issue and the contents of the prospectus.

A prospectus means “any prospectus, notice, circular, advertisement or other document inviting deposits from the public or inviting offers from the public for the subscription or purchase of any shares or debentures of a company.” The term “Prospectus”, therefore, includes any document which invites deposits from the public or invites offers from the public to purchase shares or debentures of a company.

The essential elements of a prospectus are as follows:

- There must be an invitation to the public.

- The invitation must be made “by or on behalf of the company”.

- The invitation must be “to subscribe or purchase its shares or debentures or such other instruments”.

- Every prospectus issued must contain the matters specified by the provisions of the Companies Act.

Importance of Prospectus: Investors make up their minds about investment in a company primarily on the basis of the information contained in the prospectus. Therefore, there must not be a misstatement in the prospectus and all significant information must be duly disclosed.

The prospectus of a company serves the following purposes:

- It reflects the future policies and programmes of the company.

- It serves as an invitation to the public to subscribe to the shares and debentures of the company.

- It provides a legal document of the terms and conditions on which shares and debentures have been issued.

- It identifies the persons who can be held responsible for any untrue statements made in it.

Contents of a Prospectus: Prospectus is the only document through which the prospective investors can evaluate the soundness of the company.

It must contain at least the following broad particulars:

- Company’s name and address of its registered office, nature of business of the company.

- The main objects of the company and other objects.

- The number and classes of shares, if any, and the nature and extent of the interest of the holders in the property and profits of the company. Rights attached to the shareholders are also mentioned.

- The details about the redeemable preference shares intended to be issued, if any, i.e., the date and mode of redemption etc, details regarding debentures also if any.

- Qualification shares of directors, if any.

- Any provision in the articles as to the remuneration of the directors, managing director or otherwise.

- The names, addresses, and occupations of the directors, managing director or manager.

- The “minimum subscription” that is, the minimum amount which, in the opinion of directors must be raised by the issue of shares.

- The time of the opening and closing of the subscription list.

- To amount payable on application and allotment of each class of share.

- Rights, privileges and restrictions attached to each class of shares.

- A reasonable time and place at which copies of audited balance sheets and profit and loss accounts of the company may be inspected.

- Names and addresses of auditors, bankers, brokers and solicitors.

- Names and addresses of underwriters and commission payable to underwriters.

Question 4.

What is a misleading statement in a prospectus and give its consequences?

Answer:

Mis-statement or untrue statement in the prospectus: If a prospectus contains misstatements or omits material facts, it will give rise to many consequences. A misstatement or an untrue statement is one which is misleading in the form and context in which it has been included in the prospectus. A prospectus shall also be deemed to have an untrue statement if the omission of any matter from it is calculated to mislead those who act on the faith of the prospectus.

Consequences of Misleading Prospectus: If a prospectus contains misstatements, the aggrieved party will have remedies against the company, directors, promoters and legal experts. A prospectus must be prepared very carefully. In an effort to influence the investors, a company may make exaggerated statements about its operations and future prospects. But a prospectus must contain full and honest disclosure of all material facts. To avoid preparing a misleading prospectus, it should be ensured that material facts are not concealed and no false details are given.

The persons responsible for issuing a misleading prospectus face civil and criminal liability.

1. Civil Liability: If the prospectus contains false information or incomplete details due to the negligence of the directors, it amounts to misrepresentation. The persons who invest money in the company on the basis of such misrepresentation have the right to avoid the contract and claim refund of their money. They can also claim damages from the company and from those who have authorised the issue of a misleading prospectus. An aggrieved subscriber of shares or debentures may sue directors, promoters etc. for payment of loss or damages caused to him by the misrepresentation in the prospectus issued. Subscriber must prove that he has suffered loss by reason of the omission of a matter from the prospectus.

A person accused of misrepresentation in a prospectus can avoid liability if he proves that:

(a) He had withdrawn his consent before the issue of the prospectus and that it was issued without his consent or authority;

(b) The prospectus was issued without his knowledge or consent and he had given reasonable notice to this effect after he came to know about it;

(c) After the issue of the prospectus but before allotment, on becoming aware of the misrepresentation, he had withdrawn his consent and given public notice to that effect;

(d) The statement was based on the statement of an expert who had given his consent to it;

(e) He genuinely believed the statement to be true; or

(f) The statement was based on an official document.

The directors etc., however, will not be liable for the compensation of loss, if it is proved that they honestly believed the statement to be true.

2. Criminal Liability: If the directors of a company deliberately, conceal information, they are punishable with a fine extending to Rs. 5,000 or imprisonment up to two years or both. If the public is fraudulently induced to invest money, the penalty may extend to a fine of Rs. 10,000 or imprisonment of five years or both.

A person accused of deliberate or fraudulent misrepresentation may avoid his ability by proving that:

(a) The statement was immaterial; or

(b) He had reasonable grounds to believe and did believe that the statement was true.

An expert who has given his consent to issue the prospectus containing an untrue statement made by him shall be liable to every subscriber who takes shares on the faith of his statement. The aggrieved shareholder is entitled to claim damages under the general law i.e. Contract Act. An expert shall not be liable if he proves that he was competent to make the statement and that he had reasonable ground to believe that statement was true at the time of allotment of securities. Expert includes an engineer, a valuer, an accountant and any other person whose profession gives authority to a statement made by him.