Here we are providing Online Education for Business Studies Class 11 Important Extra Questions and Answers Chapter 8 Sources of Business Finance. Business Studies Class 11 Important Questions with Answers are the best resource for students which helps in class 11 board exams.

Online Education for Class 11 Business Studies Chapter 8 Important Extra Questions Sources of Business Finance

Sources of Business Finance Important Extra Questions Short Answer Type

Question 1.

Explain the meaning of finance and its importance in business.

Answer:

Significance of Business Finance: Business is concerned with the production and distribution of goods and services for the satisfaction of the needs of society. For carrying out various activities, business requires money. Finance is the lifeblood of business.

No business firm can carry on its operations smoothly and successfully without the availability of the right amount of funds at the right cost and at the right time. In the absence of finance, the production and selling of goods and services are not possible.

The success of a business enterprise depends, to a great extent. On the manner in which it raises, employs, and disburses its funds. In business, finance is required

(a) for establishing an enterprise

(b) for purchase of fixed assets and current assets, i.e. for carrying on present operations

(c) for expansion, growth, and modernization of business.

In modern business, the significance of business finance has increased due to an increase in the scale of business, use of capital-intensive techniques, shortage of finance, and increase in competition.

Adequate finance provides the following benefits to a business concern:

- The firm can meet its liabilities in time. Prompt payment of debts helps in raising its credit-standing. As a result, the firm can easily borrow funds as and when necessary.

- The firm can take advantage of business opportunities For example, it can buy materials in bulk at a low price.

- The firm can carry on its business smoothly and without any interruptions.

- The firm can replace its plant and machinery in time, thereby improving the efficiency of its operations.

- The firm can face recession, trade cycles, and other crises more easily and confidently.

- The requirement for fixed and working capital increases with the growth and expansion of the business. At times, additional funds are required for upgrading the technology employed so that the cost of production or operations can be reduced.

Question 2.

Explain in brief the various types of business finance and their uses.

Answer:

Types of Business Finance and their uses:

On the basis of nature and purpose served finance used in a business is of the follow ing kinds –

1. Long-term Finance:

Long-term sources fulfill the financial requirement of an enterprise fora period exceeding 5 years. Long-term finance refers to the fundraised for a long period of time. Such finance is used for investment in fixed assets such as land, building, plants, machinery, furniture, fixtures, etc. Fixed assets are those assets that are required for permanent use and are not meant for sale. Long-term finance is used for meeting the permanent needs of businesses. It is used again and again to generate revenue.

Such finance cannot be taken out of the business without closing down the firm or without reducing the scale of operations. Long-term finance is raised from shareholders, debenture holders, financial institutions, and retained earnings. The amount of long-term funds required depends upon the nature and size of the business. For example, a factory requires more long-term funds than a shop.

Similarly, a large factory needs greater long term funds than a small factory. Long-term sources of finance include shares and debentures, long-term borrowings, and loans from financial institutions.

2. Medium-term Finance:

This type of finance is required for investment in permanent working capital and for repayment of assets. It is also used for modernization and expansion. It is raised for a period of more than one year but less than five years. Medium-term finance is raised from debenture holders, financial institutions, public deposits, and commercial banks.

3. Short-term Finance:

Short-term funds are those which are required for a period of not exceeding one year. It is used for meeting the short-term needs of the business. It is also known as working capital. Working capital is the capital required for meeting the day-to-day needs of the business, e.g. purchase of materials and payment of wages, salaries, rent, taxes, freight charges, etc. short-term finance is raised from public deposits, commercial banks, trade credit, factoring, customer advances, etc.

Short-term funds can be used over and over again from year to year. Seasonal businesses that must build inventories in anticipation of selling requirements often need short-term financing for the interim period between seasons. Wholesalers and manufacturers with a major portion of their assets tied up in inventories or receivables also require a large number of funds for a short period.

Question 3.

What is the term Trading on Equity? Explain with the help of an example.

Answer:

Trading on Equity:

Trading on equity is an arrangement under which the management raises funds by issuing securities that carry a fixed rate of interest or dividend which is less than the average earnings of the company to increase the return on equity shares. If a company can earn more than the rate of fixed dividend or interest, excess earnings will goto equity shareholders; and they would thereby earn higher earnings per share than they would have without the use of gearing of capital structure.

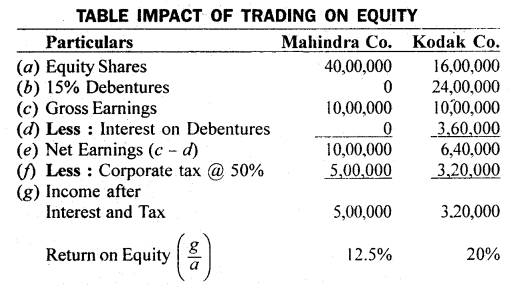

For instance, Mahindra company has an equity capital of Rs.40,00,000, and Kodak company has an equity capital of Rs. 16,00,000 and 15% debentures of Rs.24,00,000. Both have earnings of Rs. 10,00,000 which is 25% on the total capitalisation of Rs.40,00,000. Assuming the tax rate of 50% on corporate income, the shareholders of Kodak company will have the benefit of trading on equity. Their return is 20% compared to 12.5% in the case of Mahindra Company as shown in Table.

Question 4.

Differentiate between Equity Share and Preference Share

Answer:

Difference between Equity Share and Preference Share:

| Basis | Equity Share | Preference Share |

| 1. Preferential Right | Payment of equity dividend is made after the payment of preference dividend. | Payment of preference dividend is made before the payment of equity dividend. They have priority over equity shares. |

| 2. Repayment of Capital at Winding-up | Repayment of equity share capital is made after the repayment of prtf&n share capital. | Repayment of preference share capital is made before the repayment of equity share capital. They have priority over the refund of capital. |

| 3. Rate of Dividend | The rate of equity dividend may vary from year to year depending upon the profits of the company. | The rate of preference dividend is fixed by the terms of the issue. |

| 4. Arrears of Dividend | In the case of equity shares, arrears of dividend cannot accumulate. It fluctuates with profit. | In the case of preference shares. arrears of dividend may accumulate if such shares are cumulative. |

| 5. Convertibility | Equity shares cannot be convertible. | Preference shares may be convertible into equity shares. |

| 6. Redeemability | Equity shares are not redeemable during the lifetime of the company | Preference shares are redeemable during the lifetime of the company or at a specific time mentioned. |

| 7. Premium on Redemption | They cannot carry a right to receive a premium on redemption. | They may carry a right to receive a premium on redemption. |

| 8. Voting Rights | Equity shareholders enjoy voting rights ¡n the general meetings of shareholders. These shareholders have full voting rights. | Preference shareholders do not have any voting rights except all the meetings of preference shareholders. Voting rights of preference shareholders are restricted. |

| 9. Degree of Risk | Sink and swim with the company. | Relatively less risk. |

| 10. Appeal to investors | Attractive to bold and adventurous investors. | Appeal to conservative and orthodox investors. |

Question 5.

Differentiate between Shares .and Debentures.

Answer:

Difference between Share and Debentures:

| Point of Distinction | Shares | Debentures |

| 1. Nature | Part of capital. owned funds of the company. | Debt or loan, borrowed funds and is an acknowledgment of debt. |

| 2. Status of Holders | Owners of the company. | Creditors of the company. |

| 3. Right to return | Dividends cannot be claimed as a matter of rights. | Interest can be claimed as a matter of right. |

| 4. Security | No charge on assets or mortgage as security. | Generally a charge on assets as security to mortgage. |

| 5. Voting rights | Full voting rights | No voting rights and say in the management. |

| 6. Redemption | Not repayable during the lifetime of a company (except redeemable preference shares) | Generally repayable after a specified period. |

| 7. Order of repayment | After all claims of creditors are settled | Prior to all types of shareholders. |

| 8. Frequency of return | Uncertain and fluctuating depending on profits. | Absolutely certain or fixed irrespective of profits. |

| 9. Risk to holders | The complete risk is borne by holders. | Minimum risk in case of secured debentures. |

| 10. Charge in accounts | Dividend on shares ¡s a charge against profit and loss appropriation account | Interest on debentures is a charge against profit and loss account. |

Question 6.

Explain the term Lease-financing. Give in brief its merits and limitations.

Answer:

Lease-financing:

A lease is a contractual agreement in which one party i.e. the owner of an asset grants the other party the right to use the assist in return for a specific period for payment. The owner of the assets is called the lessor while the other party that uses the assets is known as the lessee.

Lease financing provides an important means of modernization and diversification to the firm. Such type of financing is more prevalent in the acquisition of assets like computers and electronic equipment which becomes obsolete quicker because of fast-changing technological developments.

Following are the merits of lease-financing:

(a) It enables the lessee to acquire the asset with a lower investment.

(b) It provides finance without diluting the ownership or control of the business.

(c) The lease agreement does not affect the debt raising capacity of an enterprise.

(d) The risk of obsolescence is born by the lesser. This allows greater flexibility to the lessee to replace the asset.

Limitations:

The limitations of lease-financing are as under –

- A lease arrangement may impose restrictions to allow the lessee to make any alteration or modification in the asset.

- It may result in higher payout obligation in case the equipment is not found useful and the lessee opts for premature termination of the lease agreement.

- The lessee never becomes the owner of the assets. It depriver him of the residual value of the assets.

Question 7.

Classify the sources of funds on the basis of ownership.

Answer:

On the basis of ownership the sources of fund are divided into two types:

- Owner’s capital,

- Borrowed capital.

Owner’s capital or Owner’s fund: The capital of the owner of the business falls under this category.

It is got from three resources:

- Equity shares,

- Preference shares and

- Retained earnings.

Features:

- Owner funds are treated as risk capital i.e., provision of loss, low profits, etc.

- Owned funds are the permanent source of capital.

- Owners fund different front management.

- There is no need for security for the owner’s fund.

Advantages:

- Owner’s capital forms the basis for raising loans.

- It is the permanent source of capital.

- This management is separate from ownership. Therefore professional managers can be employed to work efficiently.

- Capital forms the basis on which owner acquire their rights to control the activities of the company.

- In this type of capital, no security is required, the assets of the company are free to be used for raising loans.

Borrowed funds: Funds obtained from the parties, separate from the owner of an enterprise are known as borrowed funds:

- Borrowed funds can be raised for a specific period.

- There must be security for raising funds through debentures.

- A fixed charge is made on assets due to borrowing funds.

- Borrowed funds are payable after the specific period.

- There is much control on the company due to the non-interference of creditors.

Advantages:

- It does not affect the owner’s control over management.

- Interest is treated as an expense. Therefore the amount of tax liability is reduced.

- It provides flexibility to the capital structure. Finance may be raised when it is required and repaid when it is not required.

Limitations:

- Payment of interest and repayment of the loan cannot be avoided even if there is no profit.

- It requires securities to be offered against the loans.

Question 8.

What is Trade Credit? State its merits and limitations?

Answer:

Trade credit is the credit extended by one trader to another for the purchase of goods and services. It is used as short term financing. It is granted to those parties which have a sound financing position and goodwill. The volume and period of the credit depending upon various factors such as goodwill of the purchasing firm, the financial position of the seller, volume of purchases, past record of payment, and degree of competition in the market.

Merits:

The following are the merits of trade credit:

- It is a convenient and regular source of funds.

- It may be readily available in case the creditworthiness of the customers is known to the seller.

- It does not create any charge on the assets of the firm.

- It promotes the sales of an organization.

- It helps in increasing the stock in order to meet expected demand in the sales volume in near future.

Limitations:

- Easy availability may induce a firm to “indulge in overtrading.

- Only a limited amount of funds can be generated.

- It is a costly source of funds as compared to others.

Question 9.

Explain Commercial Banks and Financial Institutions as a source of business finance.

Answer:

Commercial Banks:

Commercial Banks are a very important source of finance. They provide funds for different purposes and for different periods. They provide loans to all firms and finance them by the way of cash credits, overdraft, purchase/selling, and the issue of letters of credit. The Interest rate depends upon the type of loan and the interest rate of an economy. The loan is repaid either in a lump sum or in installments. The borrower is required to provide some security or create a change on the assets of the firm before a loan is sanctioned by a commercial bank.

Merits:

- They provide timely finance as and when needed by the business.

- Information supplied to the bank by the firm is kept confidential, so the secrecy of the firm can be maintained.

- Not many formalities required like an issue of prospectus and underwriting for raising loans from banks.

- The loan from a bank is a flexible source of finance, a loan is taken as and when required and repaid in advance when funds are not needed.

Limitations:

- Funds available from the bank generally for a short and medium period.

- The procedure of obtaining funds from banks is slightly difficult because the bank makes a detailed investigation of the company affairs and may ask for the security of assets and personal securities.

- In some cases, difficult terms and conditions are imposed by the bank for the grant of loan which affects the smooth running of the business.

Financial institutions: For the development of industry’s’ and business center and state governments established various financial institutions to provide finance and assistance, They provide both owned capital and loan capital for the long and medium-term. In addition to providing financial assistance, these institutions also conduct market surveys and provide technical assistance and managerial services to people who run the enterprises.

This source of financing is considered suitable when large funds for a larger duration are required for the expansion, reorganization, and modernization of an enterprise.

Merits:

- They provide long-term finance.

- They also provide financial, managerial, and technical advice and consultancy to business enterprises.

- Raising a loan from this institution increases the goodwill of the borrowing company in the capital market.

- As repayment of the loan can be made in easy installments, it does not prove to be much of a burden on the business.

- The funds are made available even during periods of depressions.

Limitations:

- Raising loans from a financial institution is time-consuming and expensive because they follow too many formalities.

- Certain restrictions are imposed on the power of the borrowing company.

They may have their nominees in the Board of Directors of the borrowing company thereby restricting the powers of the company.

Question 10.

“Finance is the lifeblood of business.” Is this statement true? Explain.

Answer:

Yes, it is true that ‘Finance is the lifeblood of the business. No business firm can carry on its operation smoothly and successfully without the availability of the right amount of funds at the right cost and at the right time. In the absence of finance, the production and selling of goods and services are not possible.

In business, finance is required for:

- establishing an enterprise

- purchase of fixed and current assets

- expansion, growth, and modernization of business.

In modem business, the significance of business finance has increased due to an increase in the scale of business, use of capital-intensive techniques, shortage of finance, and increase in competition.

Sources of Business Finance Important Extra Questions Long Answer Type

Question 1.

What is equity share? Mention its merits and demerits as it is the source of raising permanent capital in the company.

Answer:

Equity (Ordinary) Shares: Equity shares is the most important source of raising long term capital by a company. Equity shares represent the ownership of a company and thus the capital raised by the issue of such shares is known as ownership capital or owner’s funds. Equity shares are those shares which do not carry any special or preferential rights in the payment of annual dividend or repayment of capital.

The rate of dividend on such shares is not fixed. Dividend on equity shares is paid out of the residual profits left after paying interest on debentures and dividend on preference shares.

Similarly, equity shareholders are paid at the time of winding up of the company after all debts and preference shareholders have been paid in full. They are entitled to receive what is left after all prior claims have been satisfied. Therefore, equity shareholders are the real risk-bearers. But they share in the increasing profits of the company. They enjoy full voting rights in the management and control of the company.

Thus, the distinctive characteristics of equity shares are as follows:

- The holders of equity shares are the main risk bearers. They provide risk capital because when the company fails and is, closed, equity shareholders may lose their entire investment.

- Equity shareholders are likely to enjoy higher returns and considerable increases in the value of their shares.

- Equity shareholders have a residual claim in the company. The income left after payment of interest to creditors and dividend to preference shareholders belongs to equity shareholders.

- Equity share capital improves the creditworthiness of the company and the confidence of the creditors. It is the basis on which loans can be raised.

- The voting rights of these shareholders provide them a right to participate in the management of the company.

- Equity shareholders have the right to elect directors. They can collectively ensure that the company is managed in their best interests.

Advantages:

As a source of finance, equity shares offer the following benefits –

1. Permanent Capital: Equity shareholders provide the permanent funds of a company. There is no obligation to return the money except at the time of winding up the company. As it stands last of claims, it provides a cushion for creditors in the event of winding up of a company.

2. No Obligation as to Dividend: Equity shares do not impose an obligation to pay a fixed dividend. Dividends are payable only if the

company has adequate profits. Equity shareholders stand by the company through thick and thin.

3. No Charge on Assets: Funds can be raised through equity shares without creating any charge on the assets of the company. For issuing equity shares, the company is not required to mortgage or pledge its assets. The assets remain free of charge for borrowing money in the future.

4. Source of Prestige: A company with substantial equity capital has a high credit-standing. Creditors readily lend money to it because they regard equity capital as a safety shield. It provides confidence to prospective loan providers.

5. Small Denomination The nominal or face value of an equity share is generally quite low, such as Rs. 10. Therefore, equity shares have a wide appeal. The company can mobilize huge funds from investors belonging to different income groups.

6. Suitable for adventurous investors: Equity shares are suitable for investors who are willing to assume the risk for higher returns. Equity shares are the ideal investment for bold and enterprising investors. They get handsome dividends and the value of their holdings appreciates during boon periods. In addition, they enjoy full voting power in the management of the company. They also have the pre-emptive right to buy new shares. The company has to first offer its new shares to the existing shareholders in proportion to their existing holdings.

Disadvantages/Limitations:

Equity shares suffer from the following limitations –

1. No Trading on Equity: If a company issues only equity shares, it cannot obtain the benefits of trading on equity.

2. Danger of Overcapitalisation: Equity share capital is not refundable during the lifetime of a company. A mistake in estimating financial requirements may, therefore, result in overcapitalization, particularly when the company’s earning capacity declines. Equity capital may remain idle and underutilized. The cost of equity shares is generally more as compared to the cost of raising funds through other sources.

3. Perpetuation of Control: Any new issue of equity shares must be offered first to the existing shareholders. As a result, there is a concentration of control in a few hands.

4. Takeover Bids: Equity shares have proportionate voting rights. Persons who seek to gain control over a company may indulge in undesirable practices, such as cornering of votes, the formation of groups, and abuse of proxy rights. Issue of additional equity shares dilutes the voting rights and earnings of existing shareholders.

5. Speculation: During boom periods, profits of a company and dividends on equity shares tend to increase. This leads to excessive speculation in the prices of equity shares. Investors who want steady income may not prefer equity shares as equity shares get fluctuating returns.

6. Unsound Dividend Policy: During boom periods proiltsTend to increase. The directors may decide to distribute higher dividends to win the cooperation of equity shareholders. They may overlook reserves for contingencies, replacements, etc.

7. Dividends Controlled by Directors: The rate of dividend is decided by the Board of Directors. Shareholders cannot demand higher dividends than those recommended by the Board. Therefore* investors may consider the equity shares unsafe and non-remunerative.

8. High Risk: Equity shareholders sink and swim with the company. During the depression, they get no dividend and the market value of their holdings falls drastically. The collateral arid resale value also declines. Equity shareholders lose heavily if the company fails and goes into liquidation. Therefore, equity shares do not appeal to the investors who want the safety of their investment and a regular and fixed return. More formalities and procedural delays are involved while raising funds through the issue of equity shares.

Question 2.

What are preference shares that mention their types, merits, and demerits?

Answer:

Preference shares: The preference shares are those which carry preferential rights at to the payment of dividend at a fixed rate and as to the repayment of capital.

Thus, preference shareholders enjoy the following two preferential rights over the equity shareholders:

1.They are entitled to receive a fixed rate of dividend out of the net profits of the company prior to the declaration of dividend on equity shares.

2. They get priority over the equity shareholders regarding the return of capital in case of winding up of the company. Preference shares resemble debentures as they bear a fixed rate of return.

Features of Preference Shares:

Besides the above two preferential rights (features), the preference shares may carry the following additional features –

- They don’t carry the voting rights as are enjoyed by the equity shareholders.

- If preference shares are cumulative and the dividend is not paid in a particular year, then the dividend will be carried forward to the next year.

- If preference shares are redeemable, they will be retired at the end of their term. Preference shares may be classified as follows:

- Cumulative and Non-cumulative Preference Shares: When dividends go on accumulating if they are not paid, preference shares are said to be cumulative. If in a particular year, they are not paid the dividend, they will be paid such arrears in the next year before any dividend can be distributed among the equity shareholders. But the dividend on non-cumulative shares does not accumulate if the dividend is not paid in any year. If the company is unable to pay dividends in a particular year, the shareholder’s right to the dividend in respect of that year is lost forever.

- Convertible and Non-convertible Preference Shares: If the preference shareholders are given a right to convert their shares into equity shares within a given period of time, such shares will be known as convertible preference shares. The preference shares which cannot be converted into equity shares are known as non-convertible preference shares.

3. Redeemable and Irredeemable Preference Shares: Redeemable preference shares are those which in accordance with the terms of their issue, will be repaid on or after a certain date. The preference shares which cannot be redeemed during the lifetime of the company are known as irredeemable preference shares. Such shares are refunded only at the time of winding up of the company.

4. Participating and Non-participating Shares:

In addition to the two basic preferential rights, the participating shares may carry either or both the following rights –

(a) a right to participate in the surplus profits left after paying a dividend to the equity shareholders; and

(b) a right to participate in the surplus assets left after the repayment of capital to the equity shareholders on the winding up of the company.

But non-participating shares don’t have these additional rights.

Merits of Preference Shares:

The issue of preference shares has the following benefits –

- The preference shares attract funds from those investors who prefer the safety of their investments and a fixed rate of return on their investments. They provide a reasonable steady income in the form of fixed-rate return and safety of the investment.

- The management can retain control over the company by issuing preference shares to outsiders because the preference shareholders have only restricted voting rights.

- Preference shareholders are entitled to a fixed rate of dividend which enables the equity shareholders to get the higher dividend. These are useful for those investors who want fixed rate a return with comparatively low risk.

- Preference shares do not impose a heavy burden on the company because they carry a fixed rate of dividend.

- By issuing preference shares, a company can raise finance for the long-term without creating any charge over its assets.

Demerits of Preference Shares:

There are certain limitations of raising funds by issuing preference shares. These include –

- The investors may not like preference shares as they have restricted voting rights only. Preference shares are not suitable for those investors who are willing to take risks and interested in higher returns.

- Because of the issue of the preference shares, the rights of equity shareholders over the assets of the company are diluted.

- The issue of these shares restricts the flexibility of the company in certain cases.

- The existence of preference shares may affect the creditworthiness of the company.

- As the dividend on these shares is to be paid only when the company earns a profit. There is no assured return for the investors. Thus, these shares may not be very attractive to investors.

- The dividend paid is not deductible from profits as an expense. Thus, there are no tax savings as in the case of interest on loans.

Question 3.

Define debenture as a source of borrowed capital, its important features, and types of debentures issued by a company.

Answer:

Debentures/Bonds:

Debentures are an important instrument for raising long term debt capital. A company can raise funds through the issue of debentures, which bear a fixed rate of interest. Debentures constitute the borrowed funds of a company. They are known as creditorship securities because debenture holders are the creditors of a company. Debenture capital may, therefore, be called debt capital.

A debenture is a document or certificate issued by a company under its seal as an acknowledgment of its debt. It is also an undertaking to repay the specified sum with interest to its holder. Holders of debentures are called debenture holders. A company can issue different types of debentures. Issue of zero interest debenture (LID) which does not carry an expected rate of interest has also become popular in recent years.

Characteristics:

The main features of debentures are as follows –

- Debentures represent borrowed funds.

- Interest on debentures is paid at d fixed-rate at specified intervals,

- Interest is payable every year irrespective of whether there are profits or not. ,

- Debentures generally carry no voting rights financing through debentures do not dilute the control of equity’ shareholders.

- Debentures may involve a charge on the assets of the company.

- If interest and the borrowed sum is not paid to debenture holders in time, they can take legal action (including winding-up) against the company.

- Debentures are generally repayable after a specified period of time.

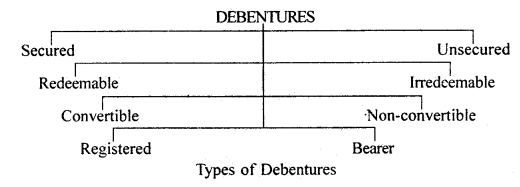

Types Of Debentures:

Debentures can be of the following kinds –

1. Naked or Unsecured Debentures: Such debentures are unsecured and do not carry a charge on the assets of the company. They are mere promises to pay without any security. No property is mortgaged or pledged with the holders of such debentures. In case of default in payment by the company, they can only file a suit for recovery of money. Holders of these debentures are treated as ordinary creditors.

2. Secured or Mortgage Debentures: Such debentures carry a fixed or floating charge on the assets of the company. A mortgage deed is executed by the company describing the terms and conditions of the issue. In case of default by the company, the debenture holders can recover money from the mortgaged property. A fixed charge is created on some definite and existing assets of the company.

The company cannot use these assets without the consent of the debenture holders. On the other hand, a floating charge can be created on both existing and future assets. The company can deal in such assets in the usual course of business. The charge goes on shifting from asset to asset and becomes fixed when the company goes into liquidation

or stops business or makes default in repayment. Any charge created by a company in favor of debenture holders must be registered with the Registrar of Companies within thirty days of its creation.

3. Redeemable Debentures: These debentures are repayable after a predetermined period during the lifetime of the company. These can be repaid on the specified date on demand by the debenture holders or on a notice of redemption by the company. In case of such debentures, the company reserves the right of paying off the principal on or after a particular date. These are also known as perpetual debentures.

4. Convertible Debentures: Such debentures carry an option to their holders to convert their holdings into equity shares after a specified period. The debenture holders can become shareholders. These debentures are more attractive for investors.

5. Non-convertible Debentures: The holders of such debentures have no right to get them converted into shares. They always remain creditors of the company. In recent years, the practice of issuing debentures that are partially convertible into equity shares have gained momentum.

6. Registered Debentures: The names of the holders of such debentures are recorded in the company’s books. Interest and the principal sum are paid only to the registered holders. Such debentures can be transferred only by a transfer deed and not by delivery alone.

7. Bearer Debentures: Bearer debentures are such which can be transferred by mere delivery’ from the bearer of the debenture without any formal notice by the company. The company keeps no record of such debentures.

Question 4.

Foreign Currency convertible bonds (FCCBS) and Foreign Direct Investment (FDI) is the investment instruments in international financing. Explain in brief the merits and demerits of these instruments of investments.

Answer:

Foreign Currency Convertible Bonds (FCCBs):

Foreign currency convertible bonds are equity-linked debt securities that are to be converted into equity shares or depository receipts after a specified period. Thus, a holder of FCCB has the option of either converting them into equity shares at a predetermined price or exchange rate or retaining the bonds. The FCCB’s are issued in a foreign currency and carry a fixed interest rate which is lower than the rate of any other similar non-convertible debt instrument.

FCCBs have the following advantages and disadvantages –

Advantages:

- The convertible bond gives the investor the option to convert the bond into equity shares at a price or redeem the bond at the end of a specified period, usually three years.

- The investor is assured a minimum fixed interest-earning which is lower than the rate of any other similar instrument.

- FCCBs are easily convertible and, therefore, offer liquidity.

- Companies prefer FCCBs as a dilution of equity is delayed. It allows the company to avoid any current dilution in earnings per pure that a further issue of equity shares would cause.

- FCCB can be freely traded and the issuing company has no control Over the transfer mechanism and is not aware of the ultimate beneficiary.

Disadvantages:

- Interest on bonds is payable in foreign currency which involves an exchange risk. Companies with low debt-equity ratios and large forex earnings potential only opt for FCCBs.

- FCCBs involve the creation of more debt and forex outgo in the form of interests.

- If the investors do not convert the bonds into equity shares there is a burden of repayment.

Foreign Direct Investment (FDI): Foreign direct investment (FDI) denotes direct investment in the equity shares, debentures, or bonds of Indian companies by foreign investors. FDI is channelized in the form of direct foreign contribution to the equity capital of the company and is all into domestic equity invested by the Indian shareholders of the companies.

Foreign Direct Investment refers to the investment made by a company in manufacturing and/or marketing facilities in a foreign country. The investment made by Enron in a power plant in India is an example of foreign direct investment. The investing foreign company is called the ‘Parent Company’ and the investment made is known as an affiliate’.

FDI includes:

- investment in setting up a new subsidiary or branch in a foreign country,

- expansion of overseas subsidiary or branch and

- acquisition of an overseas enterprise. The flow of foreign direct investment in India has been increasing steadily since 1991 due to the policy of economic liberalization and globalization. Several MNCs have made a substantial investment in their operations in India.

Foreign direct investment has costs and benefits to the home country (the country of origin of the investor company, e.g. USA in the case of Enron) as well as the host country (the foreign country in which FDI is made, e.g. India). FDI can be routed through GDRs and ADR’s. It is regulated by Government policy as regards FDI.

Benefits to Home Country:

- Trade barriers like tariffs and quotas can be overcome through FDI.

- The company can export its competitive strengths such as organization and management through FDI.

- FDI increases business activity in the home country through exports of technology, machinery, and equipment.

- The increased industrial activity in the home country enhances employment opportunities.

- The inflow of foreign currency in the form of dividends, interest, etc. improves the balance of payment position of the home country. For example, Nissan Motor Company repatriated profits to Japan from its FDA in the UK.

- The firms can learn skills from their exposure to foreign countries. These skills can be transferred to the industry in the home country.

Costs to the Home Country:

- Industry and employment position in the home country may suffer when the firms enter foreign markets. For example, the entry of US Textiles in Central America caused retrenchment in LISA.

- The current account position of the home country suffers because FDI is a substitute for direct exports.

Benefits to the Host Country:

- FDI enlarges business activity in the host country through the establishment of new industries and the development of ancillary industries.

- Employment opportunities in the host country are enhanced.

- The host country receives scarce resources such as foreign capital, technology, machinery, equipment, organization, and management. Transfer of these resources facilitates economic and social development in the host country. The government of India has been encouraging FDI to develop the Indian industry, infrastructure, and service sectors.

- FDI improves the foreign exchange resources and balance of payments position of the host country. It provides for the production of goods and services domestically. This in turn reduces the imports of the host country. Further, the foreign companies export.

Question 5.

What are the main factors affecting the choice of the source of funds?

Answer:

Every business enterprise has different needs for finance. Some need long-term finance or some need for a short time. Some want a large sum of money and some want a small sum of money. Short term borrowing offers the benefit of reduced cost due to reduction of idle capital, but long term borrowings are considered a necessity on many grounds. Every source of finance has its own limitation, therefore it is advisable to use a combination of sources, instead of relying only on a single source.

The following factors affect the choice of this combination, making it a very complex decision for the business –

1. Cost: Cost of procurement of funds and cost of utilizing the funds, both costs should be taken into account while deciding about the source of fund.

2. Risk profile: Businesses should evaluate each of the sources of finance in terms of the risk involved.

3. Purpose and Time Period: Business should plan according to the time period for which the funds are required. Short-term finance can be arranged through borrowing funds at a low rate of interest through trade credit, commercial paper, etc. for long-term finance, issue of share and debentures are more suitable. The purpose for which funds are required needs to be considered so that the source is matched with the use.

4. Financial strength and stability of operations: The financial strength of a business is very important in deciding the source of funds. The business should be in a sound financial position and has a stability of return, so as to be able to repay the loan.

5. Control: A particular source of funds may affect the control and power of the owner on the management of a firm. A business firm should choose a source keeping in mind the extent to which they are willing to share their control over the business.

6. Form of organization and legal status: The form of organization and its legal status influences the choice of a source for raising money. For example, sole tradership cannot borrow funds by issuing shares to the public. Only joint-stock companies raise funds like this.

7. Tax benefits: Various sources of funds may also weigh in terms of their benefits. For example, while the dividend on preference share is not tax-deductible, interest paid on debenture and loan is tax-deductible.

8. Effects on creditworthiness: The dependence of a business on certain sources may affect its creditworthiness in the market. For example, the issue of secured debentures may affect: the interest of unsecured creditors, it may adversely affect their willingness to extend further loans to the firm.

9. Flexibility and ease: Restrictive provisions, detailed investigation, and documentation in case of borrowings from banks and financial institutions, for example, maybe reasons that a business organization may not opt for it if other options are readily available.