Students can access the CBSE Sample Papers for Class 11 Accountancy with Solutions and marking scheme Term 2 Set 1 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Accountancy Term 2 Set 1 with Solutions

Time : 2 Hours

Maximum Marks: 40

General Instructions:

- The Question Paper consists of two Parts – A and B. There are total 12 questions. All questions are compulsory.

- Part – A consists of Accounting Process.

- Part – B consists of Financial Accounting and Computers in Accounts.

- Question Nos. 1 to 2 and 5 to 6 are short answer type questions – I carrying 2 Marks each.

- Question Nos. 3 and 7 to 9 are short answer type questions – II carrying 3 Marks each.

- Questions Nos. 4 and 10 to 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part-A (12 marks)

Accounting Process

Question 1.

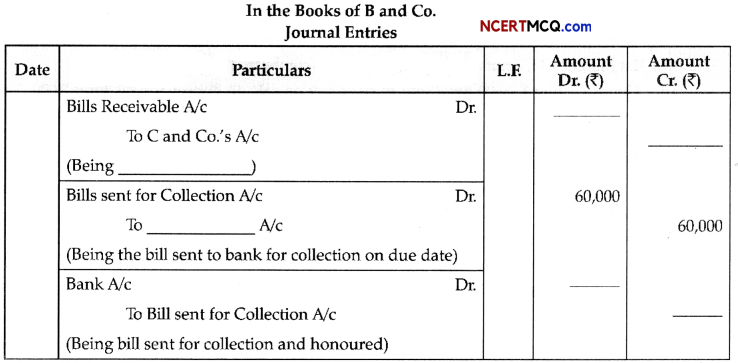

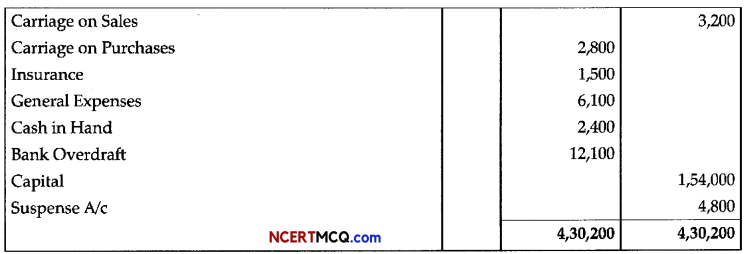

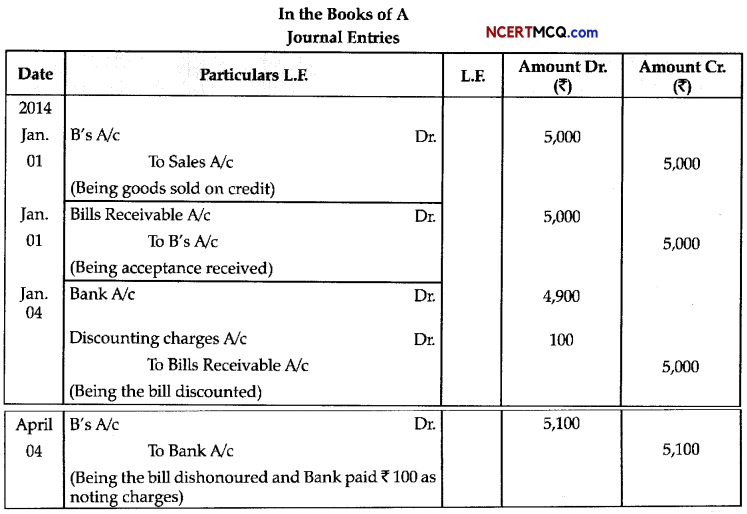

With the help of the information given, complete the Journal entries in the books of B and Co. A two-month Bill for ₹ 60,000 is drawn by B and Co. and accepted by C and Co., payable at the Bank of India. B and Co. gave the bill to their banker for collection. On due date, bill is honoured. Show the entries that will be passed in the books of B and Co. [2]

Answer:

![]()

Question 2.

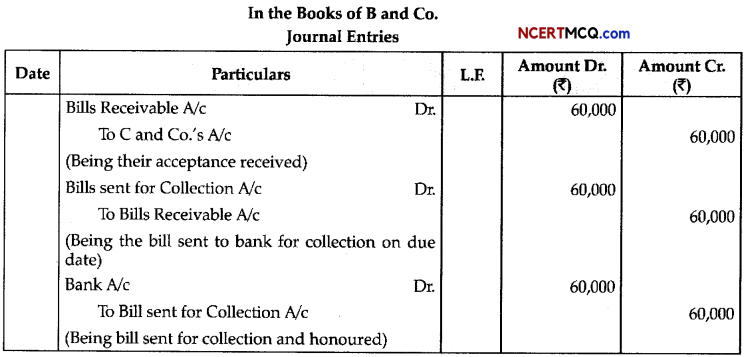

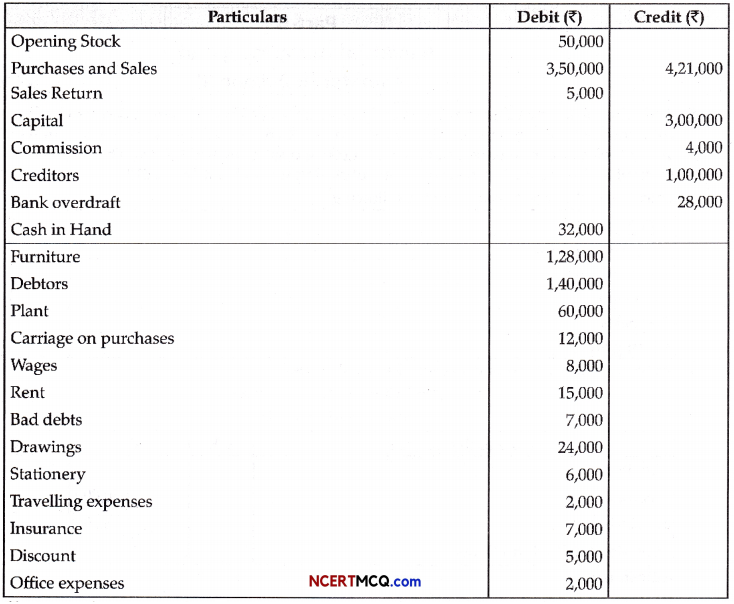

The following Trial Balance has been prepared by an inexperienced accountant. Redraft it in a correct form: [2]

Answer:

![]()

Question 3.

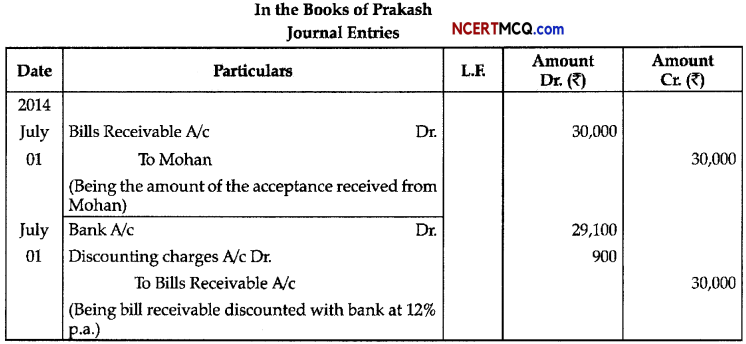

Prakash received from Mohan an acceptance for ₹ 30,000 on 1st July, 2014 at 3 months. Prakash got this acceptance discounted at 12% per annum at his bank. On the due date, Mohan paid the required amount. Give Journal entries in the books of Prakash and Mohan. [3]

OR

On 1st January, 2014, A sold goods to B for ₹ 5,000 and on the same day drew upon him a bill at three months for the amount. B accepted the bill and returned it to A. On 4th January, 2014, A discounted the bill with his bank at ₹ 4,900. On the due date, the bill was dishonoured and bank paid ₹ 100 as noting charges. Record these transactions in the Journals of A and B. [3]

Answer:

Working Note:

Discount for whole year = ₹ 3,600

Discount for 3 months = ₹ 900

Cash received = ₹ 30,000 – ₹ 900 = ₹ 29,100

Amount of Discount = 30,000 – 30,000 × \(\frac{12}{100}\) × \(\frac{3}{12}\) = ₹ 900

Note: On payment of the bill, no entry will be made.

Commonly Made Errors:

- Students pass the entry for making of payment on due date in the book of Prakash.

- Some students wrongly pass the entry for discounting of bill through bank in the books of Mohan.

Answering Tip:

- Since Prakash has got the bill discounted with the bank, due date entries will not be passed through his Books of Account.

- Since bill has been discounted by Prakash, the entry will be shown only in his books and not in the books of Mohan.

OR

Commonly Made Errors: Students do not pass the entry dishonour in the books of A.

Answering Tip: Though bill is discounted with bank, then a dishonour entry will be made in the books of A along with the amount of noting charges. This is so because now A is liable to pay the amount of bill to the bank along with noting charges and the same becomes renewable from B.

![]()

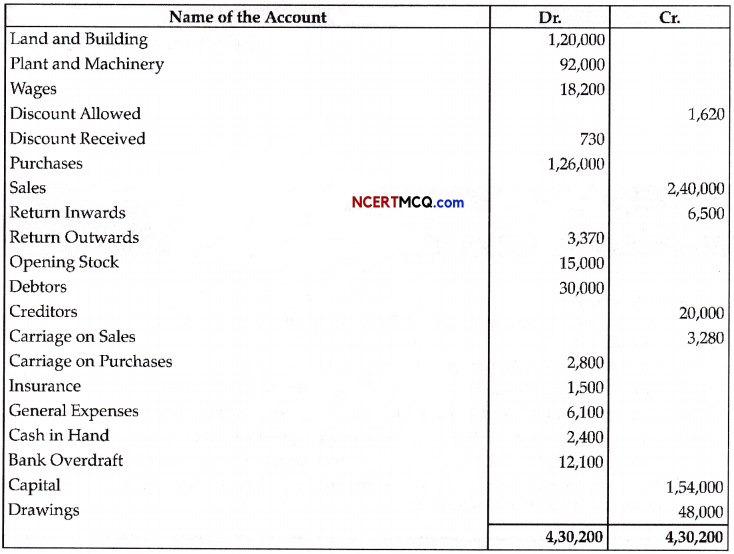

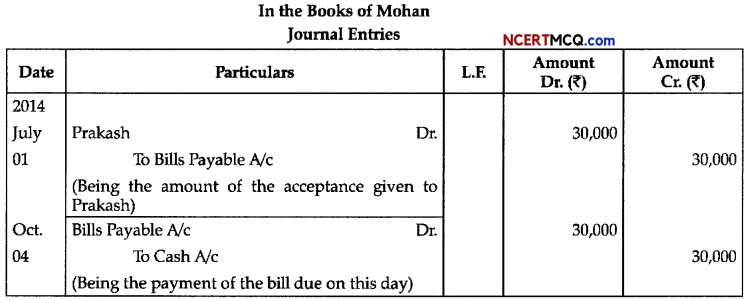

Question 4.

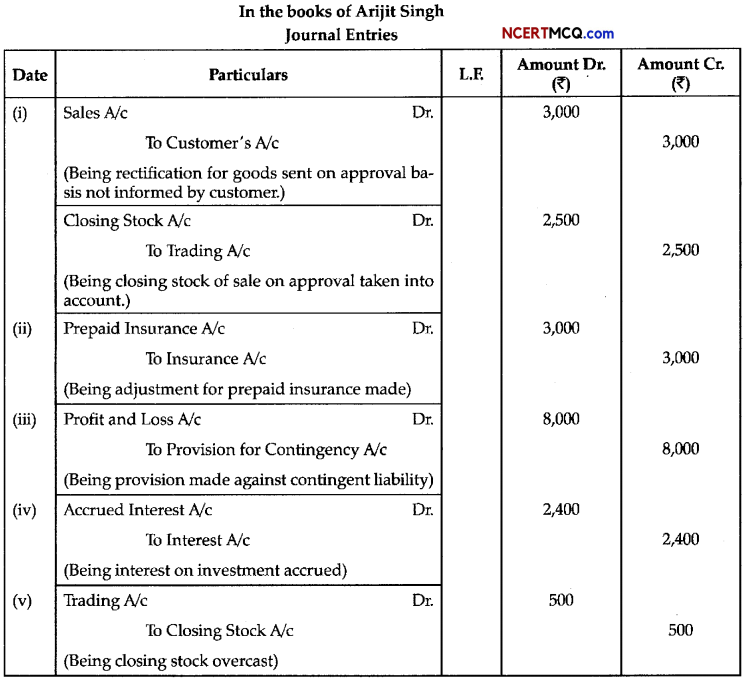

On 31st March 2018, Arijit Singh finds that he has committed following errors:

(i) Goods costing ₹ 2,500 were sent to customer on sale on approval basis for ₹ 3,000. The entry was made in Sales Book, but the customer has not informed regarding their acceptance by 31st March 2018.

(ii) Unexpired insurance of ₹ 3,000 has not been considered while preparing Profit & Loss A/c.

(iii) An amount of ₹ 17,000 on account of claim against the customer was in dispute and it was estimated that ₹ 8,000 would probably have to be paid on this account.

(iv) Interest accrued on Investment was ₹ 2,400.

(v) Closing Stock was overcast by ₹ 500.

Give necessary journal entries. [5]

Answer:

Commonly Made Errors: Students tend to pass the amount of overcast of Closing Stock to Suspense A/c.

Answering Tip: When Closing Stock is overcast, the Trading Account will show increased gross profit by that amount. Hence, Trading A/c needs to be debited to rectify the error.

![]()

Part-B (28 marks)

(Financial Accounting and Computer in Accounts)

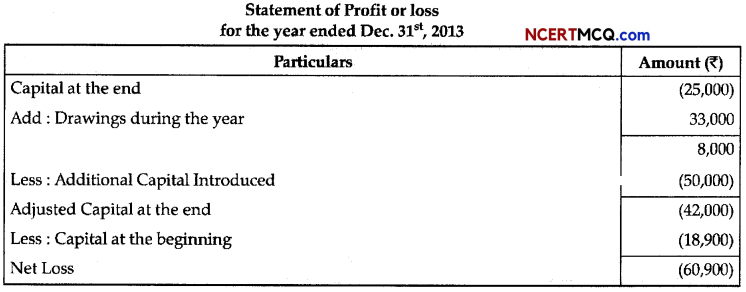

Question 5.

S. Sharma closes their financial books on 31 December, 2013. Stock taking takes about two weeks. In 2014, the value of closing stock thus arrived at was ₹ 25,000. During the two weeks in which stock taking took place, purchases made were ₹ 1,000 and sales totalled ₹ 4,000. The firm makes a Gross Profit of 30% on sales. Ascertain the value of closing stock of 31st Dec., 2013. [2]

Answer:

Cost of goods sold during stock taking period = 70% of ₹ 4,000 = ₹ 2,800

Closing stock = Value as on 16th Jan. 2007 + Cost of goods sold during 1-16 Jan. – Cost of goods purchased during 1-16 Jan.

= ₹ 25,000 + ₹ 2,800 – ₹ 1,000 = ₹ 26,800

Commonly Made Errors: Students get confused while solving this question.

Answering Tip: Carefully read the question, understand what information is given in it and then solve the question.

Question 6.

Calculate cost of goods sold from the following:

| Opening Stock | ₹ 40,000 |

| Wages and Salaries | ₹ 10,000 |

| Net Purchases | ₹ 50,000 |

| Rent Paid | ₹ 15,000 |

| Net Sales | ₹ 1,19,000 |

| Closing Stock | ₹ 15,000 |

Answer:

Cost of Goods Sold = Opening stock + Purchases + Direct expenses – Closing stock

= ₹ 40,000 + ₹ 50,000 + ₹ 10,000 – ₹ 15,000

= ₹ 85,000

Commonly Made Errors: Some students wrongly deduct rent paid while calculating cost of goods sold.

Answering Tip: It should be kept in mind that only direct expenses are considered while calculating cost of goods sold.

Question 7.

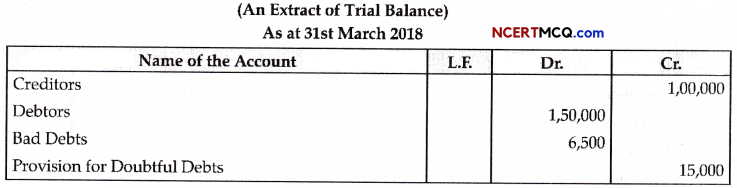

From the following pass the necessary journal entries:

Adjustments:

(1) Write off further Bad debts of ₹ 5,000.

(2) Provision for Doubtful Debts is to be kept at 5% of Debtors.

(3) Provision for discount on Creditors is to be maintained at 10%. [3]

Answer:

![]()

Question 8.

Briefly explain the various components of a Computer Hardware. [3]

OR

Explain the importance or application of computers in accounting. [3]

Answer:

- Mother-Board: Mother-Board is a main board of a computer. It is also called logic board. It allows communication between many crucial electronic components of a system.

- Keyboard: Keyboard is an input device. It is used to input text into the computer. All the keys in keyboard are arranged in specific order

- Speaker: Speaker produces electrical signal produced with the help of amplifier and turn these into sound waves.

- Monitor: It is a computer screen. The Operator can see the result. Now-a-days, LCD Monitors

are used instead of CRT monitors which were used in old days. ]

Commonly Made Errors:

- While writing the answer students confuse between components of computer hardware and elements of a computer system.

- Carefully read the question and understand what is asked in the question.

OR

The importance of computers in accounting can be understood by the following:

- Accuracy: Accounting through computers is more accurate as there is less possibility of errors.

In built controls in the computer reduce the possibility of making errors. - Time Saving: Accounting in computers saves time. A journal entry is required to be passed in accounts whereas the ledgers, trial balance, profit and loss account are automatically prepared.

- Analysis: Accounting data in computers make analysis of the performance easier. Programs can be written-to generate important performance indicators such as ratios, graphs, etc.

- Audit Trail: The information in computers have audit trails therefore, the entry flow of transaction can be easily determined at one click.

- Prevention of Fraud: Information in computers can be prevented from deletion. Moreover, the person who passes the entry is also recorded. Hence, it provides a better control against fraud.

- Data Storage: Accounting through books and registers are cumbersome and also prone to damage. Computer information can be easily stored as well as backup can also be taken.

![]()

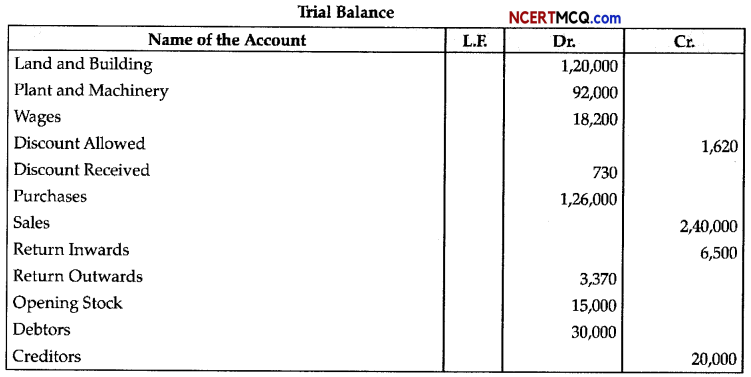

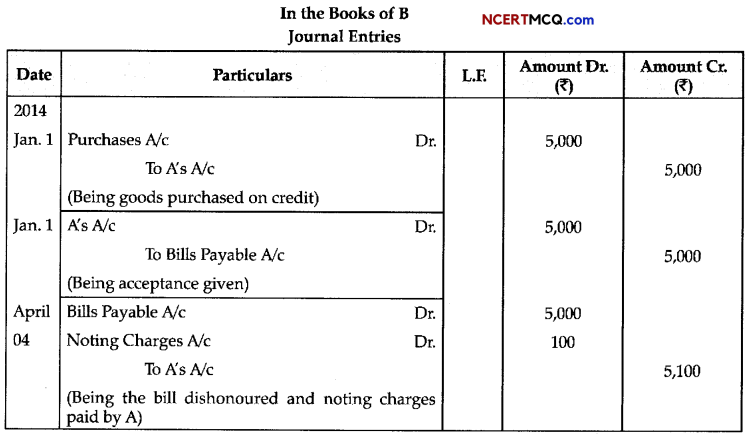

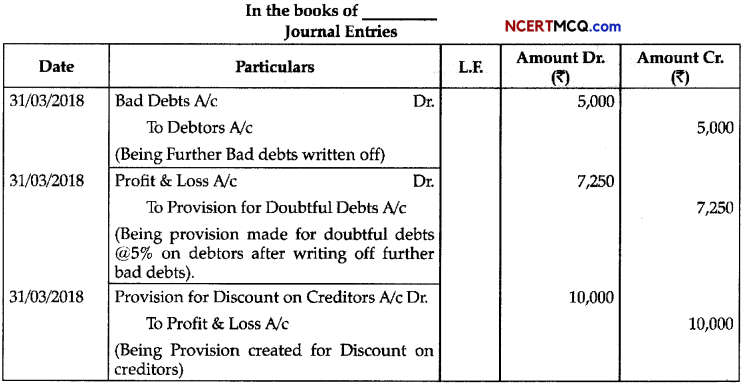

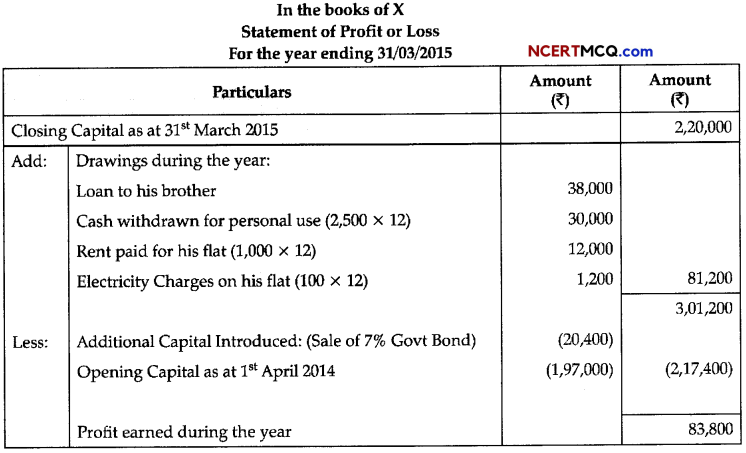

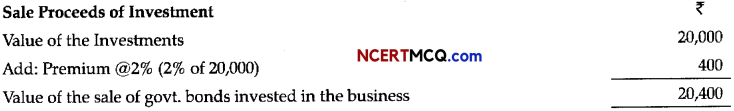

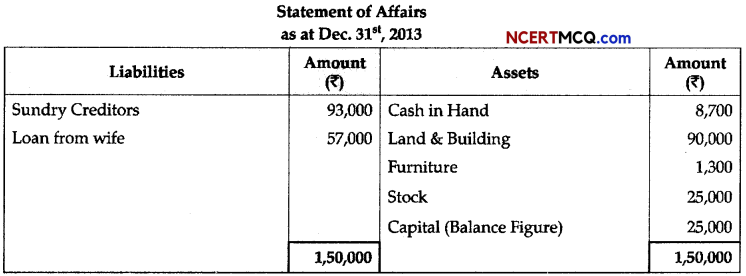

Question 9.

The Capital of X on 31st March, 2015 is ₹ 2,20,000 and his capital on 31st March, 2014 was ₹ 1,97,000. During the year, he gave a loan of ₹ 38,000 to his brother on private account and withdraw ₹ 2,500 p.m. for personal purpose. He also used a flat for his personal purpose, the rent of which at the rate of <f 1,000 p.m. and electricity charges at an average rate of ₹ 100 p.m. were paid from business account. During the year, he sold his 7% Government Bonds of ₹ 20,000 at 2% premium and bought that money into his business. Besides this, there is no other information. You are required to prepare a Statement of Profit.

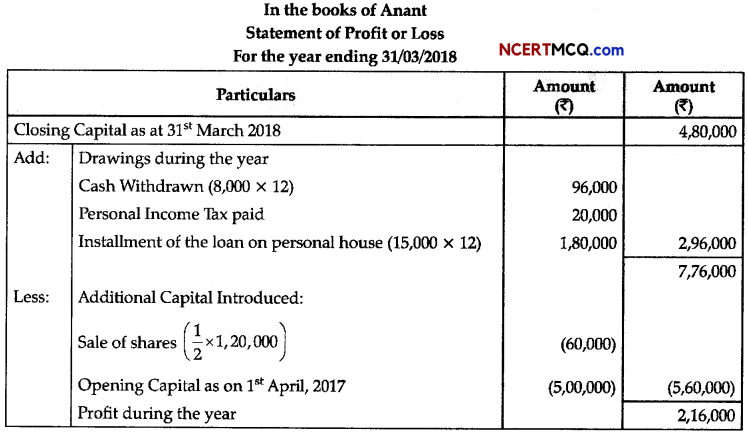

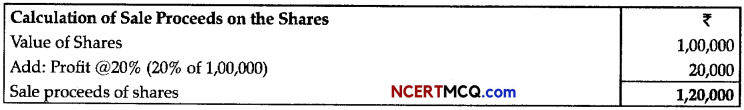

OR

The Capital of Anant on 1st April, 2017 was ₹ 5,00,000 and on 31st March, 2018 was ₹ 4,80,000. He informed that he will withdraw from the business ₹ 8,000 per month for private use. He paid ₹ 20,000 for his personal income-tax and the instalment of the loan of his personal house at the rate of ₹ 15,000 per month from the business. He also sold his shares of Tata Finance costing ₹ 1,00,000 at a profit of 20% and invested half of this amount in the business. Calculate the profit or loss of the business.

Answer:

Working Note:

OR

Working Note:

![]()

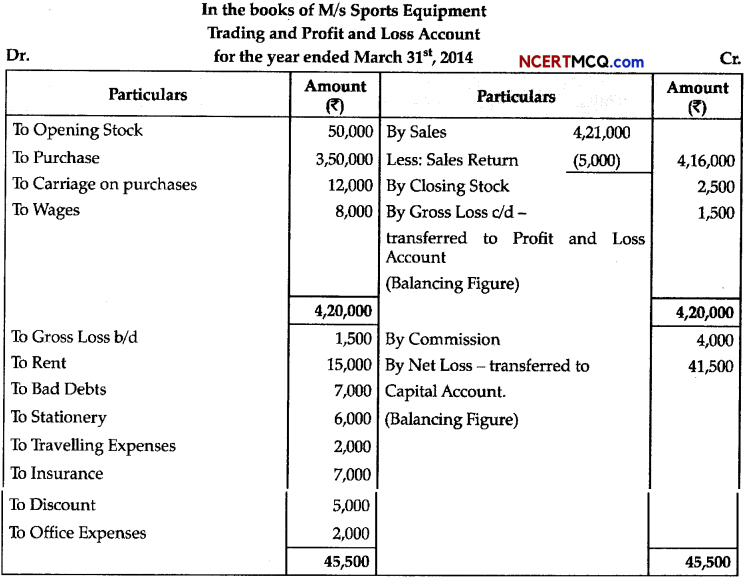

Question 10.

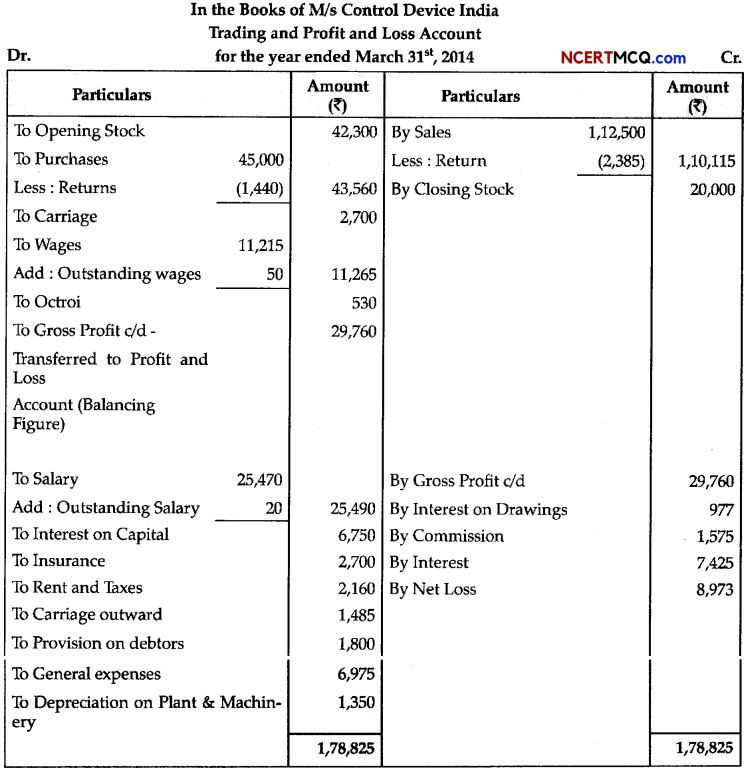

Prepare trading and Profit and Loss account of M/s Sports Equipment for the year ended March 31, 2014 and Balance sheet as on that date:

Closing stock as on March 31st, 2014 ₹ 2,500, [5]

OR

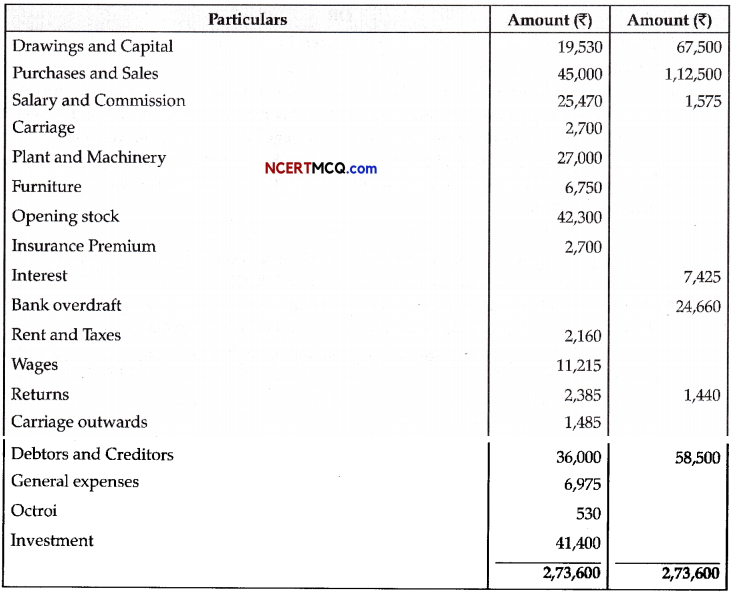

Prepare the trading and profit and loss account and balance sheet of M/s Control Device India on March 31,2014 from the following balances as on that date:

Adjustments:

(i) Closing stock was valued 20,000.

(ii) Interest or capital @ 10%.

(iii) Interest on drawings @ 5%.

(iv) Wages outstanding ₹50.

(v) Outstanding salary ₹20.

(vi) Provide depreciation @ 5% on plant and machinery.

(vii) Make a 5% provision on debtors. [5]

Answer:

OR

![]()

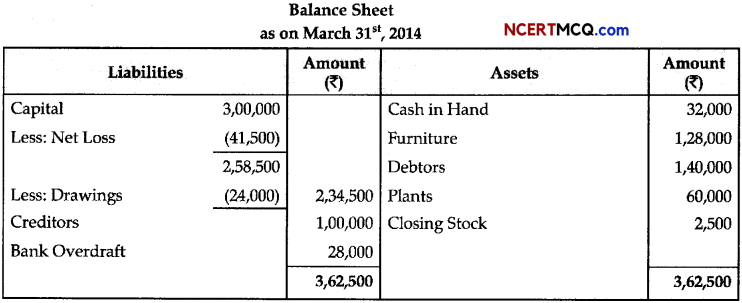

Question 11.

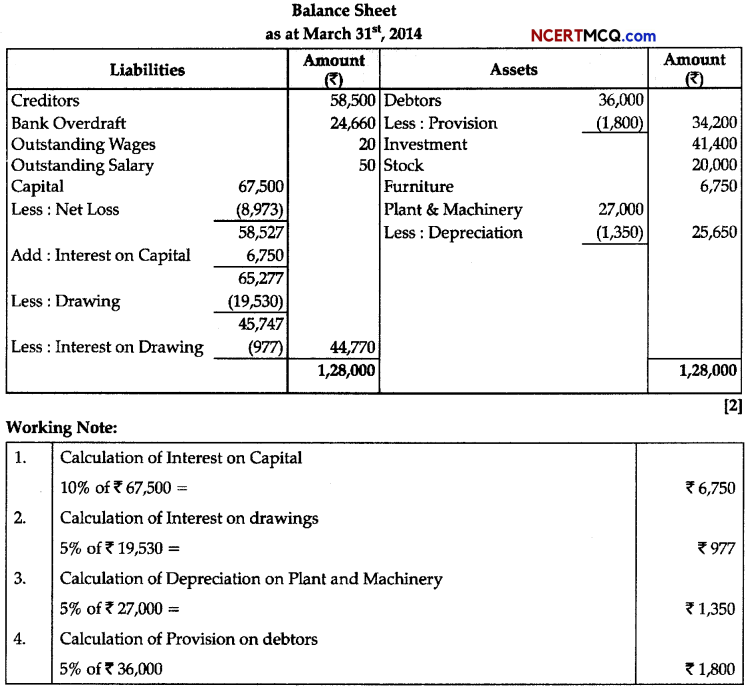

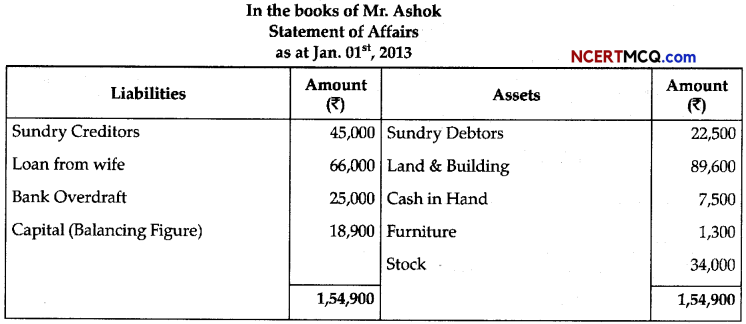

Mr. Ashok does not keep his books properly. Following information is available from his books:

| Particulars | Jan. 01,2013 (₹) | Dec. 31,2013 (₹) |

| Sundry creditors | 45,000 | 93,000 |

| Loan from wife | 66,000 | 57,000 |

| Sundry debtors | 22,500 | — |

| Land and Building | 89,600 | 90,000 |

| Cash in hand | 7,500 | 8,700 |

| Bank overdraft | 25,000 | — |

| Furniture | 1,300 | 1,300 |

| Stock | 34,000 | 25,000 |

During the year Mr. Ashok sold his private car for ₹ 50,000 and invested this amount into the business. He withdraw from the business ₹ 1,500 per month upto July 31,2013 and thereafter ₹ 4,500 per month as drawings. You are required to prepare the statement of profit or loss and statement of affairs as on December 31st, 2013. [5]

Answer:

Working Notes:

Drawing during the year

![]()

Question 12.

(a) Define Accounting Information System. [2]

Answer:

An Accounting Information System is a system of collecting, processing, summarizing and reporting information about a business organization in monetary terms.

(b) State any three purpose of Accounting Information System. [3]

Answer:

The purpose of Accounting Information System is as follows:

- Sales order Processing: The customer’s orders are processed, and invoices are made. This also facilitates the inventory control and sales analysis.

- Inventory Control: Inventory at various levels of manufacturing process can be easily controlled and monitored with the frequent changes happening in the stock.

- Accounts Receivable: The track of all the debtor of the company and the amount owed by them can be easily traced and calculated.

- Accounts Payable: The record of the amount paid and owed to the creditors can be easily tracked.

- Payroll: The computerised recording of the employee time card and the payment to be made accordingly can be easily calculated. It also enables in producing pay checks and efficiency analysis report of individual employee.

- General Ledger: The consolidation of all the accounting information is done easily from the data received.