Students can access the CBSE Sample Papers for Class 11 Accountancy with Solutions and marking scheme Term 2 Set 4 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Accountancy Term 2 Set 4 for Practice

Time : 2 Hours

Maximum Marks: 40

General Instructions:

- The Question Paper consists of two Parts – A and B. There are total 12 questions. All questions are compulsory.

- Part – A consists of Accounting Process.

- Part – B consists of Financial Accounting and Computers in Accounts.

- Question Nos. 1 to 2 and 5 to 6 are short answer type questions – I carrying 2 Marks each.

- Question Nos. 3 and 7 to 9 are short answer type questions – II carrying 3 Marks each.

- Questions Nos. 4 and 10 to 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part-A (12 marks)

Accounting Process

Question 1.

Rectify the following errors:

(a) Credit sales to Mohan ₹ 7,000 were recorded as ₹ 700.

(b) Credit purchases from Rohan ₹ 9,000 were recorded as ₹ 900.

(c) Goods returned to Rakesh ₹ 4,000 were recorded as ₹ 400.

(d) Goods returned from Mahesh ₹ 1,000 were recorded as ₹ 100. [2]

Question 2.

Journalise the following transactions in the books of Kamal: Ganesh informs Kamal that Sahani’s promissory note for ₹ 750 has been dishonoured and that noting charges ₹ 10 has been paid. Kamal sends Ganesh’s a cheque and withdraws the Promissory note. [2]

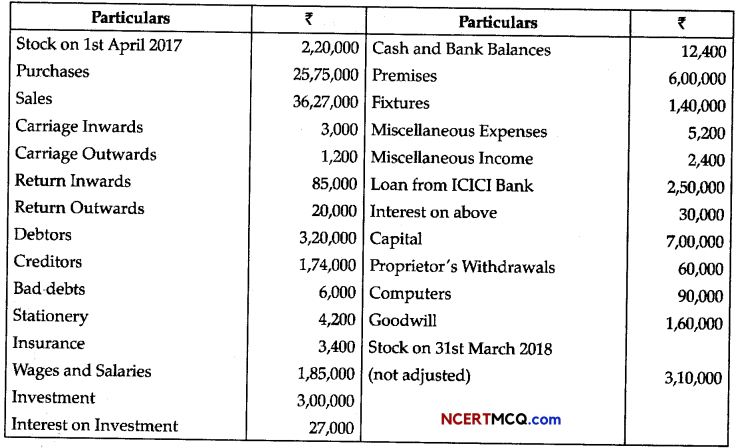

![]()

Question 3.

Calculate the due dates of the bill in the following cases: [3]

| Date of the Bill | Period |

| (a) 31st January 2019 | 3 months |

| (b) 28th December 2015 | 2 months |

| (c) 31st December 2016 | 2 months |

| (d) 31st March 2019 | 1 month |

| (e) 27th November 2015 | 3 months |

| (f) 15th June 2019 | 5 months |

OR

On 1st January, 2017 Ajay sold goods to Bhushan for ₹10,000. Ajay draws a bill of exchange for two months for the amount due which Bhushan accepts and returns it to Ajay. Bhushan met the bill on the due date. Pass the Journal Entries in the books of Ajay. [3]

Question 4.

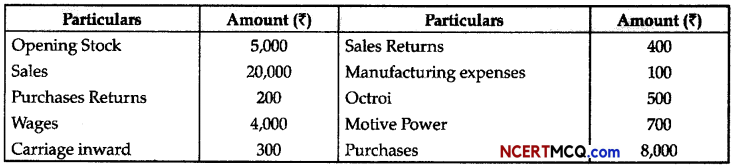

From the following list of balance extracted from the books of Sh. Balaji Traders, prepare a Trial Balance as at 31st March 2018:

![]()

Part-B [28 Marks]

(Financial Accounting and Computer in Accounts)

Question 5.

Insurance Premium of ₹ 6,500 has been paid on July 1, 2017 for one year. Pass the journal entry to adjust the insurance amount and also show how it will be recorded in final accounts assuming that accounts are closed on 31st March, every year. [2]

Question 6.

Calculate Closing Stock from the following details :

Opening stock ₹ 80,000; Cash sales ₹ 2,40,000; Credit sales ₹ 1,60,000; Purchases ₹ 2,80,000. Rate of gross profit on cost 33 1/3%. [2]

Question 7.

Ram keeps his books under Single Entry System. His Assets and Liabilities were as under:

| Particulars | 31.03.2012 (Amount) (₹) | 31.03.2013 (Amount) (₹) |

| Cash | 1,000 | 900 |

| Sundry Debtors | 39,000 | 45,000 |

| Stock | 34,000 | 32,000 |

| Plant and Machinery | 60,000 | 80,000 |

| Sundry Creditors | 15,000 | 14,900 |

| Bills Payable | ……………… | 5,000 |

During 2012 -13, he introduced ₹ 10,000 as additional Capital. He withdrew ₹ 3,000 every month for his household expenses. Ascertain his profit for the year ended 31st March, 2013. [3]

OR

Ajay started business with a capital of ₹ 2,25,000 on 1st April, 2013. During the year, he withdrew ₹ 40,000 for his personal use and introduced ₹ 7,000 as fresh capital. On 31st March, 2014, his position of assets and liabilities stood as follows:

| Particulars | (₹) |

| Cash-in-hand | 18,500 |

| Stock | 20,000 |

| Bills Receivable | 25,000 |

| Debtors | 4,00,000 |

| Creditors | 1,50,000 |

| Bills Payable | 3,000 |

You are required to prepare statement of profit or loss for the year ended 31 March, 2014. [3]

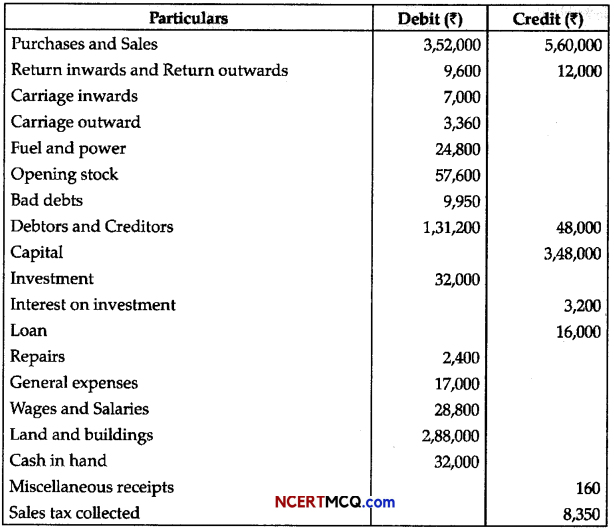

![]()

Question 8.

Explain briefly any six advantages of computerized accounting system over the manual system. [3]

OR

What is Accounting Information System? [3]

Question 9.

Following is the information from the books of ABC Ltd. as on 31st Dec., 2013. Pass closing journal entries: [3]

Closing stock as on 31st Dec., 2014 is ₹ 2,000.

Question 10.

Prepare Trading and Profit and Loss account and Balance Sheet from the following particulars as on March 31,2014.

Closing Stock ₹ 30,000.

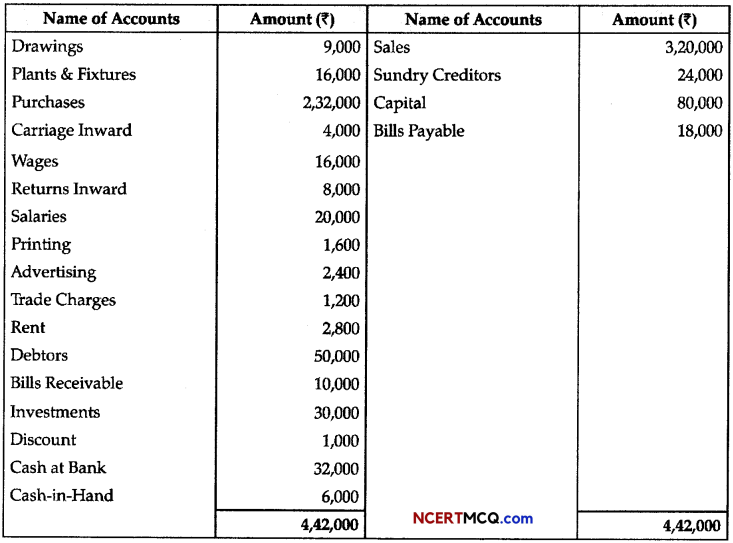

OR

Prepare Trading and Profit & Loss Account for the year ending 31st March, 2015 and a Balance Sheet as on that date from the following Trial Balance :

Adjustments:

(i) Closing Stock was ₹ 52,000.

(ii) ₹ 1 ,000 were as bad debts and Provision for doubtful debts be created on sundry debtors @5%.

(iii) Interest on capital is to be provided @ 6% p.a.

(iv) An additional capital of ₹ 20,000 introduced by proprietor on 1st Oct., 2014.

(v) Plant & Fixtures to be depreciated by 10% p.a.

(vi) Salaries outstanding on 31st March, 2015 amounted to ₹ 1,000.

(vii) Accrued Interest on investment amounted to 1,500. [5]

![]()

Question 11.

Mr. Muneesh maintains his books of accounts from incomplete records. His books provide following information:

| Particulars | Jan. 01,2013 (₹) | Dec. 31,2013 (₹) |

| Cash | 1,200 | 1,600 |

| Bills Receivable | — | 2,400 |

| Debtors | 16,800 | 27,200 |

| Stock | 22,400 | 24,400 |

| Investment | — | 8,000 |

| Furniture | 7,500 | 8,000 |

| Creditors | 14,000 | 15,200 |

He withdrew ₹ 300 per month for personal expenses. He sold his investment of ₹ 16,000 at 2% premium and introduced that amount into the business. [5]

Question 12.

Rajiv is not a person who is very keen on promoting computerised accounting system as he may lose his job, but as a accounting manager he has no points to convince the CEO of Nischal Enterprise that it will not be suitable for their business. Help him by giving him some disadvantages of using a computerised Accounting System. [5]