Students can access the CBSE Sample Papers for Class 11 Accountancy with Solutions and marking scheme Term 2 Set 5 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Accountancy Term 2 Set 5 for Practice

Time : 2 Hours

Maximum Marks: 40

General Instructions:

- The Question Paper consists of two Parts – A and B. There are total 12 questions. All questions are compulsory.

- Part – A consists of Accounting Process.

- Part – B consists of Financial Accounting and Computers in Accounts.

- Question Nos. 1 to 2 and 5 to 6 are short answer type questions – I carrying 2 Marks each.

- Question Nos. 3 and 7 to 9 are short answer type questions – II carrying 3 Marks each.

- Questions Nos. 4 and 10 to 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part-A (12 marks)

Accounting Process

Question 1.

Anisha sold goods worth ₹ 19,000 to Naina on March 2,2018. ₹ 4,000 were paid by Naina immediately and for the balance she accepted a bill of exchange drawn up on her by Anisha payable after three months. Anisha discounted the bill immediately with her bank @10% p.a. On the due date, Naina dishonoured the bill and the bank paid ₹ 30 as noting charges.

Calculate the following:

(i) Amount of discount charged.

(ii) Amount due from Naina [2]

Question 2.

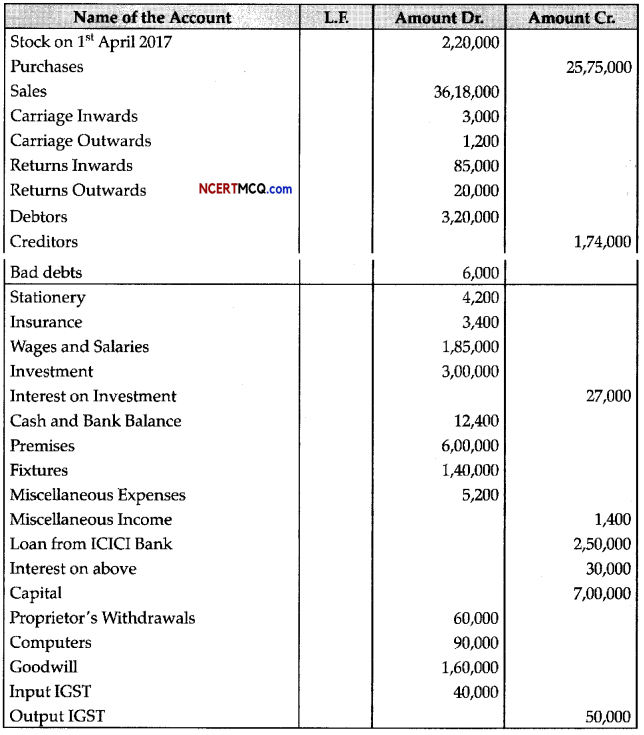

The accountant of Sri Balaji Trader’s have made some errors in drafting the Trial Balance. Redraft the trial Balance.

![]()

Question 3.

Prepare a Trial Balance for Shyam Sundar and Sons from the following ledger accounts: (3)

| Particulars | Amount (₹) |

| Cash A/c | 64,750 |

| Capital A/c | 80,000 |

| Purchases A/c | 88,000 |

| Machinery A/c | 4,000 |

| Dilip’s A/c | 15,000 |

| Purchases Return A/c | 4,000 |

| Discount Received | 650 |

| Sales A/c | 73,400 |

| Mahesh Chand & Sons A/c | 10,400 |

| Discount Allowed A/c | 200 |

| Rent | 1,500 |

| Commission Received | 2,000 |

| Drawings | 6,200 |

OR

Give the rectifying Journal Entries in the books of Mehra & Company :

(i) Sale of old furniture worth ₹ 1,500 treated as sales of goods.

(ii) Sales Book added ₹ 2,500 short.

(iii) Total of Bills Receivable Book ₹ 2,700 left unposted.

(iv) Rent of Proprietor’s residence, ₹ 3,250 debited to Rent A/c.

(v) Payment of ₹ 800 to Rishabh posted to his credit as ₹ 8,000.

(vi) Goods worth ₹ 5,985 returned by Mishra posted to his debit as ₹ 5,895.

Question 4.

A is in need of funds to the extent of ₹ 1,000. He requests his friend B to help him. B is also in the need of funds. As per the arrangement between them, B accepts 30 days bill on Sept. 1, 2014, for ₹ 2,000. It is agreed that the proceeds of the bill will be shared between A and B equally. A discounts the bill for ₹ 1,980 and hands over half the proceeds to B. On the due date, A sends the remaining amount to B, who meets the bill. Pass the necessary journal entries in the books of A and B. [5]

Part-B (28 marks)

(Financial Accounting and Computer in Accounts)

Question 5.

Give the Journal entries for the following adjustments: [2]

(i) Outstanding salary ₹ 3,500.

(ii) Rent unpaid for one month at ₹ 6,000 per annum.

Question 6.

Opening Capital ₹ 70,000, Profit for the year ₹ 20,000, Drawings ₹ 7,000. During the year, proprietor sold ornaments of his wife for ₹ 20,000 and invested that amount in the business. Calculate the Closing Capital. [2]

Question 7.

Define the following terms: [3 × 1]

(a) Computer

(b) Accounting Information System

(c) Computerised Accounting System

OR

“Accounting Information System suffers from a lot of limitations even though it is categorised to be very efficient in accuracy, time saving, audit trails and prevention of fraud.” Comment. [3]

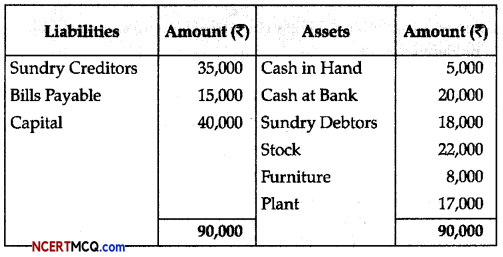

![]()

Question 8.

Manish Chand started a business with a capital of ₹ 80,000 and maintains his account on Single Entry System. Calculate his profit on 31st March, 2016 from the following information:

| Liabilities and Assets | 31st March, 2016 (₹) |

| Debtors | 40,000 |

| Creditors | 30,000 |

| Stock | 30,000 |

| Furniture | 20,000 |

| Bank Balance | 35,000 |

| Cash-in-hand | 5,000 |

During the year, his drawings were ₹ 10,000 and additional capital invested ₹ 20,000.

OR

Mr. Kapil does not keep proper records of his business, he provided following information. You are required to prepare a statement showing the profit or loss for the year 2013-14.

| ₹ | |

| Opening Capital (01-04-2013) | 50,000 |

| Closing Capital (31-03-2014) | 1,00,000 |

| Additional capital introduced (2013-14) | 20,000 |

| Drawings made during the year (2013-14) | 40,000 |

Question 9.

Identify whether following receipts are capital or revenue. How will they be treated in final accounts:

(i) Sale proceeds of goods ₹20,000

(ii) Commencement of business with ₹ 60,000

(iii) Rent received from premises sublet ₹ 4,000

(iv) Profit on sale of land and building ₹ 5,000

(v) Amount received from sale of assets ₹ 80,000

(vi) Amount received from sale of scraps, i.e., newspapers, boxes, grass, bottles, etc ₹ 300

Question 10.

Mr. Girdhari Lai does not keep the double entry records. His balance as on January 01, 2013 is as follows:

His Balance on 31st Dec., 2013 is as follows:

| Particulars | ₹ |

| Cash in hand | 7,000 |

| Stock | 8,600 |

| Debtors | 23,800 |

| Furniture | 15,000 |

| Plant | 20,350 |

| Bills Payable | 20,200 |

| Creditors | 15,000 |

He withdrew ₹ 500 per month, out of which he spent ₹ 1,500 for business purpose. Prepare the statement of profit or loss. [5]

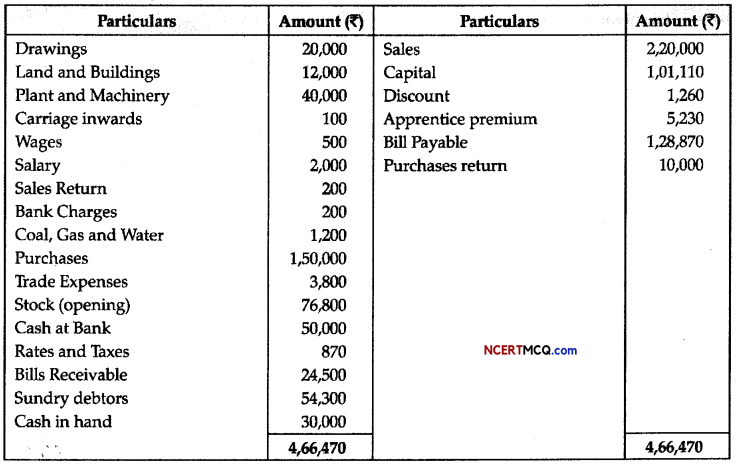

Question 11.

From the following balances extracted from the books of Raga Ltd. Prepare a trading and profit and loss account for the year ended March 31,2014 and a balance sheet as on that date.

The additional information is as under:

(i) Oosing stock was valued at the end of the year 20,000.

(ii) Depredation on plant and machinery charged at 5% and land and building at 10%.

(iii) Discount on debtors at 3%.

(iv) Make a provision at 5% on debtors for bad debts.

(v) Salary outstanding was ? 100 and wages prepaid was f 40.

(vi) The manager is entitled a commission of 5% on net profit after charging such commission. [5]

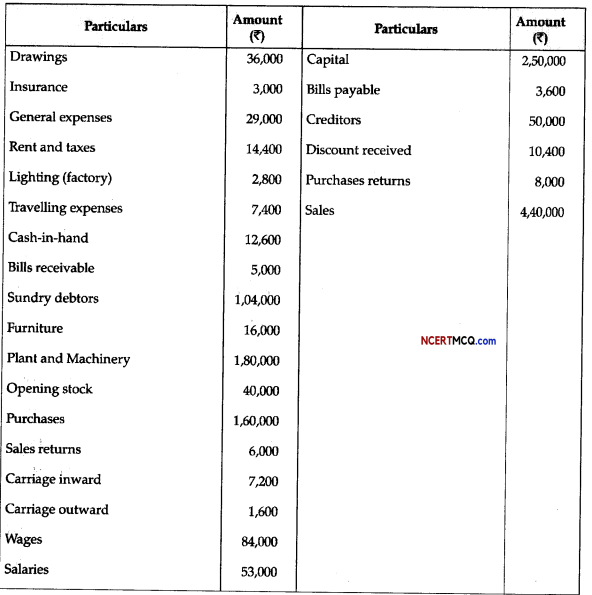

OR

Following is the trial balance of Mr. Deepak as on March 31,2014. You are required to prepare Trading Account, Profit and Loss Account and a Balance Sheet as on date : [5]

Closing Stock ₹ 35,000

![]()

Question 12.

State whether the following statements are true or false by giving reasons for the following: [5]

(a) Computer makes the work fast.

(b) Computer Accounting System enables the reports to be generated at ease.

(c) The computer cannot do multiple tasks at one time.

(d) Keyboard is an input device.

(e) The Memory unit is the part of the CPU,