Students can access the CBSE Sample Papers for Class 11 Applied Mathematics with Solutions and marking scheme Term 2 Set 4 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 11 Applied Mathematics Term 2 Set 4 for Practice

Time : 2 Hours

Maximum Marks : 40

General Instructions:

- The question paper is divided into 3 sections -A, B and C.

- Section A comprises of 6 questions of 2 marks each. Internal choice has been provided in two questions.

- Section B comprises of 4 questions of 3 marks each. Internal choice has been provided in one question.

- Section C comprises of 4 questions. It contains one case study-based question. Internal choice has been provided in one question.

Section – A [2 Marks each]

Question 1.

The radius r of a right circular cone is decreasing at the rate of 3 cm/min and the height h is increasing at the rate of 2 cm/min. When r = 9 cm and h = 6 cm, find the rate of change of its volume.

OR

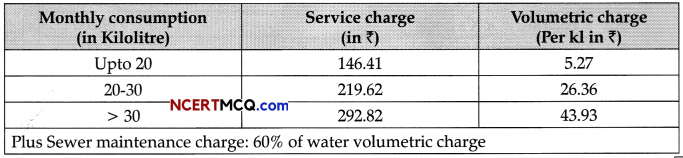

Find the value of k for which the function.

Question 2.

A dealer is in Jhansi buys some articles worth ? 8,000. If the rate of GST is 18%, find how much will the dealer pay for the articles bought.

![]()

Question 3.

₹ 1000 is invested every 3-months at 4.8% p.a. compounded quarterly. How much will the annuity be worth in 2 years ? [Given that (1.012)8 = 1.1001]

OR

What is the monthly equivalent interest rate to a quarterly interest 2.5% ? [Given that (1.025)1/3 = 1.008265]

Question 4.

If P(E) = \(\frac{7}{13}\) P(F) = \(\frac{9}{13}\) and P(E ∩ f)= \(\frac{4}{13}\) then evaluate : (i) P\(\left(\frac{\bar{E}}{F}\right)\) and (ii)P\(\left(\frac{\bar{E}}{\bar{F}}\right)\)

Question 5.

Determine ∠B of the triangle with vertices A(-2, 1), B(2, 3) and C(-2, -4).

Question 6.

Determine the number of 5 cards combinations out of a deck of 52 cards if there is exactly one ace in each combination.

Section – B (3 marks each)

Question 7.

An unbiased die is thrown twice, let the event A be ‘odd number on first throw’ and B the event ‘odd number on the second throw’. Check independence of the events.

Question 8.

Find the equation of the circle drawn on a diagonal of the rectangle as its diameter whose sides are the lines x = 4, x = – 5, y = 5 and y = – 1.

OR

An equilateral triangle is inscribed in the parabola y2 = 4ax, where one vertex is at the vertex of the parabola, Find the side of the triangle.

Question 9.

Two dice are thrown together. What is the probability that sum of the numbers on the two faces is neither divisible by 3 nor 4 ?

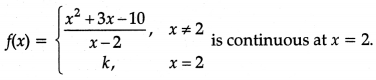

Question 10.

(a) In what time will ₹85000 amount to ₹157675 at 4.5% p.a. ?

(b) A sum of ₹46875 was lent out at simple interest and at the end of 1 year 8 months the total amount was ₹50,000. Find the rate of interest percent per annum.

![]()

Section – c [4 Marks each]

Question 11.

In how many ways three girls and nine boys can be seated in two vans, each having numbered seats, 3 in the front and 4 at the back ? How many seating arrangements are possible if 3 girls should sit together in a back row on adjacent seats ?

Question 12.

Compute the taxable value of the perquisite in respect of medical facilities availed of by X from his employer in the following situations:

(a) The employer reimburses the following medical expenses:

(i) Treatment of X by his family physician ₹ 8,400

(ii) Treatment of Mrs. X in a private nursing home ₹ 7,200

(iii) Treatment of X’s mother (dependent upon him) ₹ 2,400 by a private doctor

(iv) Treatment of X’s brother (not dependent upon him) ₹ 800

(v) Treatment of X’s grandfather (dependent upon him) ₹ 3,000

(b) The employer reimburses an insurance premium of ₹ 6,000 paid by X under a health insurance scheme on the life of X and his wife.

(c) The employer maintains a hospital for the employees where they and their family members are provided free treatment. The expenses on treatment of X and his family members during the previous year 2019-20 were as under:

| Particulars | Amount (₹) |

| (i) Treatment of X’s major son (dependent upon him) | 4,400 |

| (ii) Treatment of X | 10,400 |

| (iii) Treatment of X’s uncle | 9,200 |

| (iv) Treatment of Mrs. X | 16,000 |

| (v) Treatment of X’s widowed sister (dependent upon him) | 8,200 |

| (vi) Treatment of X’s handicapped nephew | 5,000 |

(d) Expenses on cancer treatment of married daughter of X at Tata Memorial Hospital, Mumbai paid by the employer ₹ 1,00,000 and reimbursement of expenses for medical treatment of himself amounting to ₹ 40,000.

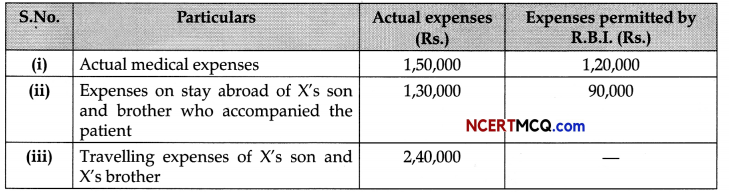

(e) The following expenses on treatment of X’s major son outside India were paid by the employer:

Assume that the other income of X is (a) ₹ 1,20,000 (b) ₹ 1,80,000. (including income under the head salary excluding the above taxable perquisite)

OR

A manufacturer in a firm manufactures a machine and marks it at ₹ 80,000. He sells the machine to a wholesaler (in Gorakhpur) at a discount of 20%. The wholesaler sells the machine to a dealer (in Mathura) at a discount of 15% on the marked price. If the rate of GST 28%, find tax paid by the whole seller to Central Government.

![]()

Question 13.

Question 14.

Read the following text and answer the following questions on the basis of the same:

Water Bill: The amount one must pay to use water and sewage services each month. Normally, water and sewage is provided by a municipality, but this is not always the case. Water bills are usually based upon one’s usage, such that those who use more water are charged more.

The water bill invoice: is provided by a company that supplies water on a residential and/or commercial basis. A customer that receives their water supply from such a company will receive a water bill invoice complete with the charges for the company’s services and the amount owed for said services. From time to time, people forget to pay their utility bills, so the customer might see a summary of past due charges that must be paid on the next billing period. Payments not received on time could result in interest charges or additional fees. The water bill invoice will show the total amount due and the date upon which payment must be received.

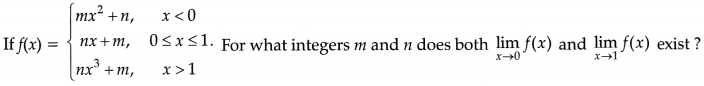

There will be generally following three components of water / sewerage bill:

Fixed Water Charge: With a fixed water charge, the consumer pays a monthly water bill, which is the same independently of the volume consumed. In absence of a water metering system, a fixed water charge is the only possible tariff structure.

Sewerage maintenance charge: This charge is levied for the maintenance of sewerage system and is charged according to volumetric consumption of water.

Service charge: Service charge under the domestic category which is presently linked with the built up area of the property, that is, whether the covered area is more than or less than 200 sq. meters and this has been now delinked from the area concept. Instead, under the new tariff it will be linked with the consumption slab for all categories of consumers including the domestic category.

Based on the information given above, solve the following questions:

(a) What do you understand by is water tariff and fixed water charge? (2)

(b) For an industrial connection monthly consumption of water is 40 ki, calculate the Water bill. (2)

Tarrif rates can be considered as the table given below: