Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 10 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 10 for Practice

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt 1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

How are the following dealt with in the accounts of a Not-for-Profit Organisation?

| Particulars | Debit Amount (₹) | Credit Amount (₹) |

| Match Fund | – | 1,00,000 |

| Match Expenses | 35,000 | – |

| Investments of Match Fund | 60,000 | – |

| Interest on Match Fund Investments | – | 3,000 |

| Prizes paid | 19,000 | – |

![]()

Question 2.

Distinguish between Sacrificing Ratio and Gaining Ratio in terms of:

(A) Objective of calculation

(B) Effect (2)

Question 3.

Pawan, Kumar and Dharam were partners in a firm sharing profits and losses in the ratio of 1 : 4 : 5. On 31st March, 2021 the firm was dissolved and on that date the Balance Sheet of the firm showed a loan of ₹ 9,00,000 given by Kumar’s sister Karishma. Kumar agreed to pay his sister’s loan. On that date provision for bad debts also showed a balance of ₹ 4,500.

Pass necessary journal entry for the above on the firm’s dissolution. (2)

Question 4.

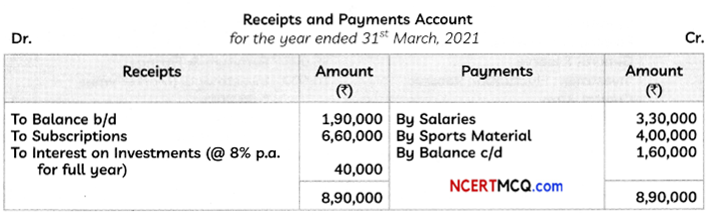

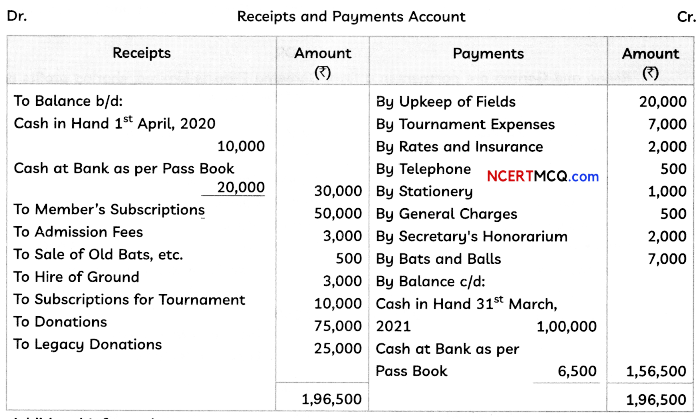

From the following Receipts and Payments Account of Surya Kumar Sports Club and from the given additional information, prepare Income and Expenditure Account for the year ending 31st March, 2021:

Additional Information:

(i) The dub had received ₹ 20,000 for subscription in 2019-20 for 2020-21.

(ii) Salaries had been paid only for 11 months.

(iii) Stock of sports material on 31st March, 2020 was ₹ 3,00,000 and on 31st March, 2021 was ? 6,50,000.

OR

From the following information calculate the amount of‘Sports Material’ to be debited to Income and Expenditure Account of Young Cricket Club for the year ended 31st March, 2020.

| Receipts | Amount (₹) |

| Opening Stock of Sports Material | 42,000 |

| Closing Stock of Sports Material | 48,000 |

| Opening Creditors of Sports Material | 47,000 |

| Closing Creditors of Sports Material | 54,000 |

| Amount paid to Creditors of Sports Material during the year | 2,20,000 |

(3)

![]()

Question 5.

Pass journal entries for the following transaction on the dissolution of the firm of M and N after various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(A) Bank loan ₹ 1,02,000 was paid.

(B) Furniture worth ₹ 2,10,000 was taken by M at ₹ 1,29,000.

(C) Partner N agreed to pay a creditor ₹ 22,500.

(D) A computer previously written off fully realised ₹ 11,700.

(E) Expenses of realisation ₹ 9,600 were paid by partner M.

(F) Profit on realisation ₹ 14,400 was distributed between N and N in 5 : 3 ratio. (3)

Question 6.

Future Limited took over the assets of ₹ 6,60,000 and liabilities of ₹ 80,000 of Beyond Limited for an agreed purchase consideration of ₹ 6,00,000 payable 10% in cash and the balance by the issue of 12% Debentures of ₹ 100 each. Give necessary Journal entries in the books of Future Limited, assuming that:

Case (I): The debentures are issued at 20% premium.

Case (II): The debentures are issued at 10% discount.

OR

Kapoor Limited took a loan of? 27,00,000 from Central Bank of India. The company issued 36,000; 12% Debentures of ? 100 each as a collateral security for the same. Show how these items will be presented in the Balance Sheet of the company. (3)

![]()

Question 7.

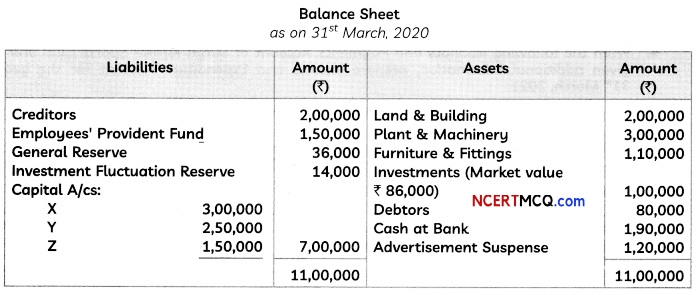

X, Y and Z were partners in a firm sharing profits and losses in the 5 : 4 : 3. The Balance Sheet of the firm on 31st March, 2020 was as follows:

X died on 1st October, 2020 and Y and Z decide to share future profits in the ratio of 7 : 5. It was agreed between his executors and the remaining partners that:

(i) Goodwill of the firm be valued at 21/2 gears’ purchase of average of four completed gears’ profit which were:

(ii) X’s share of profit from the closure of last accounting gear till date of death be calculated on the basis of last gears’ profit.

(iii) Land & Building undervalued bg ₹ 2,00,000; Plant & Machinerg overvalued bg ₹ 1,50,000 and Furniture & Fittings overvalued bg ₹ 46,000.

(iv) A provision of 5% be created on Debtors for Doubtful Debts.

(v) Interest on Capital to be provided at 10% p.a.

(vi) Half of the net amount pagable to X’s executor was paid immediatelg and the balance was transferred to his loan account which was to be paid later.

You are required to prepare Revaluation Account, X’s Capital Account and X’s Executor’s Account as on 1st October, 2020.

OR

Reena and Garima are partners in a firm, Gareema Exports Limited, sharing profits and losses equallg. On 1st April, 2021, the Balance Sheet of the firm was:

The firm was dissolved on the date given above. The following transactions took place:

(i) Reena took 25% of the Stock at a discount of 20% in settlement of her loan.

(ii) Book Debts realised ₹ 54,000 and the balance of the Stock was sold at a profit of 30% on cost.

(iii) Sundrg Creditors were paid out at a discount of 10%.

(iv) Bills Pagable were paid in full.

(v) Plant and Machinerg realised ? 75,000.

(vi) ₹ 1,20,000 was realised from Land and Building.

(vii) Reena took the goodwill of the firm at a value of ₹ 30,000.

(viii) An unrecorded asset of ₹ 6,900 was handed over to an unrecorded liabilitg of ₹ 6,000 in full settlement.

(ix) Realisation expenses were ₹ 5,250.

Show Realisation Account and Partners’ Capital Account in the books of ‘Gareema Exports Limited’. (5)

![]()

Question 8.

Goodluck Woollens Ltd. based in Ludhiana, are the manufacturers and exporters of woollen garments and blankets. Blankets of the compang are exported to mang countries. The compang decided to distribute garments free of cost to four villages of Punjab destroged bg the floods. It also decided to emplog 100 goung persons from these villages in their newlg established factorg at Solan in Himachal Pradesh.

To meet the requirements of funds for starting its new factory, on 1st April, 2020 the company issued 50,000 equity shares of t 100 each and 20,000, 12% Debentures of ₹ 100 each to the vendors of machinery purchased for ₹ 70,00,000.

According to the terms of issue, interest on the debentures is payable half-yearly on 30th September and 31st March and the tax deducted at source is 10%.

You are required to answer the following questions:

(A) Pass journal entry for the purchase of machinery.

(B) Give journal entry to be passed at the time of payment to the vendor of the machinery.

(C) Calculate the amount of annual fixed obligation associated with debentures.

(D) Calculate the amount of annual tax obligation associated with debentures.

(E) Pass journal entry for the transfer of interest on debentures of the year to the Statement of

Profit and Loss (5)

Question 9.

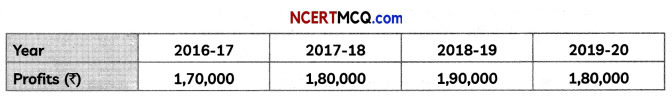

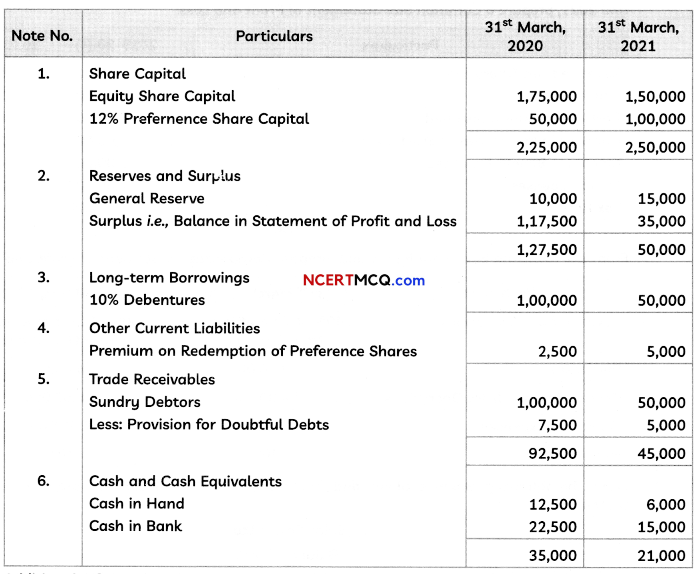

From the following Receipts and Payments Account and additional information relating to the Shandaar Cricket Club, prepare Income and Expenditure Account for the year ended 31st March, 2021 and Balance Sheet as at that date:

Additional Information:

(i) Assets on 1st April, 2020:

Stock of Bats and Balls ₹ 15,000

Stationery ₹ 2,000

Subscriptions Due ₹ 5,000

(ii) Subscriptions due on 31st March, 2021 amounted to ₹ 7,500.

(iii) Write off 50% of Bats and Balls (not considering sale) and 25% of Stationery. (5)

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

Identify the following transactions as belonging to Operating Activities, Investing Activities, Financing Activities or Cash and Cash Equivalents:

(A) Income Tax paid on Gain of Sale of Asset

(B) Commission received (2)

Question 11.

From the following information provided of Deluxe Limited, for the year ended 31st March, 2020 and 2021, prepare a Common Size Statement of Profit and Loss:

| Particulars | 2019-20 (₹) | 2020-21 (₹) |

| Revenue from Operations | 20,00,000 | 25,00,000 |

| Other Income | 1,00,000 | 2,50,000 |

| Cost of Material Consumed | 6,00,000 | 8,00,000 |

| Changes in Inventories of Stock-in-Trade | 1,00,000 | 2,00,000 |

| Employee Benefit Expenses | 3,00,000 | 4,50,000 |

| Other Expenses | 2,00,000 | 2,25,000 |

| Tax Rate | 40% | 40% |

OR

From the following information provided, prepare Comparative Statement of Profit and Loss:

| Particulars | 31st March, 2020 | 31st March, 2021 |

| Revenue from Operations | 140% of Cost of Revenue from Operations | 150% of Cost of Revenue from Operations |

| Purchases | ₹ 3,00,000 | ₹ 5,00,000 |

| Cost of Revenue from Operations | ₹ 4,00,000 | ₹ 6,00,000 |

| Operating Expenses | ₹ 20,000 | ₹ 30,000 |

| Income Tax | 40% | 40% |

(3)

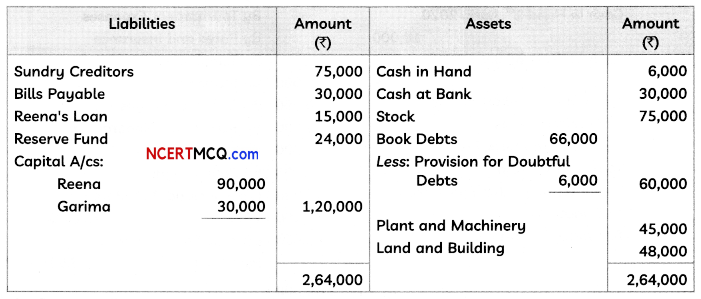

![]()

Question 12.

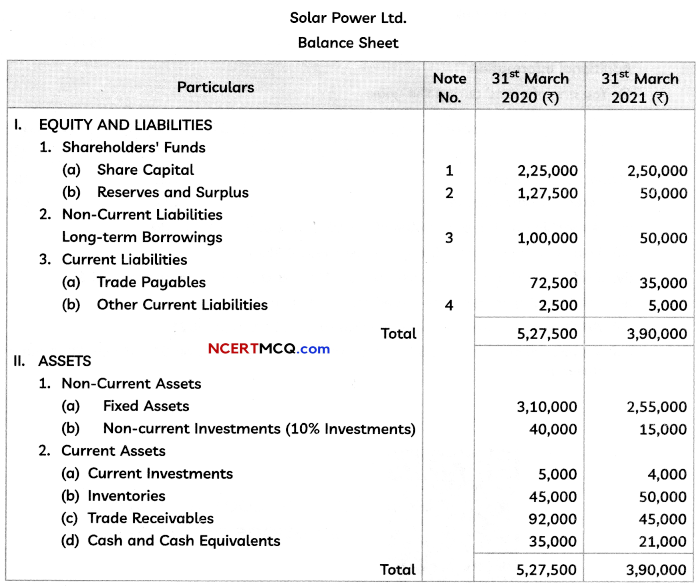

From the following Balance Sheet and information of Sunrise Limited, prepare Cash Flow Statement:

Notes to Accounts:

Additional Information:

(i) You are informed during the year:

| Proposed Dividend | 31st March, 2021 (₹) | 31st March, 2020 (₹) |

| Equity Share Capital | NIL | NIL |

| Preference Share Capital | 12% | 12% |

(ii) A machine with a book value of ₹ 20,000 was sold for ₹ 12,500.

(iii) Depreciation charged during the year was ₹ 35,000.

(iv) Preference shares were redeemed on 31st March, 2020 at a premium of 5%.

(v) Fresh equity shares were issued on 31st March, 2021.

(vi) Additional Investments were purchased on 31st March, 2021.

(vii) An Interim dividend of ₹ 5,000 was paid on equity shares on 31st March, 2021 out of General