Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 11 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 11 for Practice

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt 1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

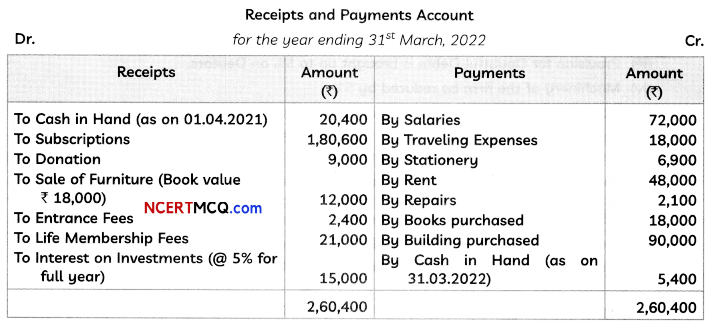

Question 1.

Calculate the amount to be posted to the Income and Expenditure Account for the year ended 31st March, 2021 in the following case:

Stock of Stationery in Hand on 1st April, 2020 – ₹ 3,000

Payment made for Stationery during the year ended 31st March, 2021 – ₹ 10,800

Stock of Stationery in Hand on 31st March, 2021 – ₹ 500 (2)

![]()

Question 2.

Give any two differences between Sacrificing Ratio and Gaining Ratio. (2)

Question 3.

Anupam and Babul who were sharing profits and losses in the ratio of 3 : 1 respectively decided to dissolve the partnership firm on 31st March, 2020 at which date some of the balances were as follows:

Anupam’s Capital – ₹ 2,00,000

Babul’s Capital – ₹ 20,000 (debit balance)

Profit and Loss Account – ₹ 16,000 (debit balance)

Trade Creditors – ₹ 60,000

Loan from Mrs. Anupam – ₹ 20,000

Cash at Bank – ₹ 4,000

Assets (other than cash at bank) realised ₹ 1,10,000 and all creditors were paid off less 5% discount. Realisation expenses amounted to ₹ 1,000.

From the information provided, you are required to prepare Memorandum Balance Sheet. (2)

Question 4.

From the following information given by Sameer Limited, calculate the amount of subscriptions which will be treated as income for the year ended 31st March, 2019:

(i) Subscriptions received during the year ended 31st March, 2019 amounted to ₹ 90,000.

(ii) Subscriptions outstanding at the end of the year ended 31st March, 2018 amounted to ₹ 5,000.

(iii) Subscriptions received in advance on 31st March, 2018 amounted to ₹ 3,000.

(iv) Subscriptions received in advance on 31st March, 2019 amounted to ₹ 4,000.

(v) Subscriptions not yet collected for the year ended 31st March, 2019 amounted to ₹ 6,000.

OR

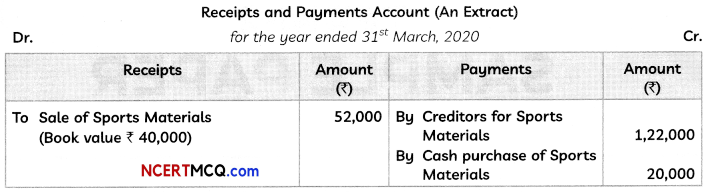

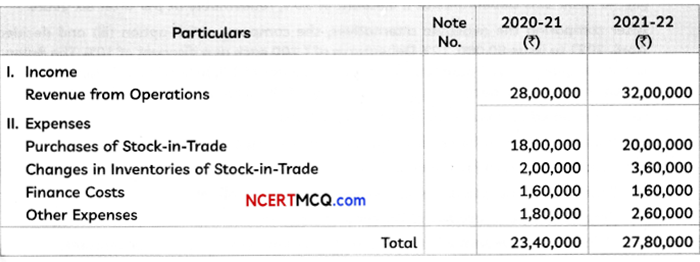

How are the following dealt with while preparing the final accounts of Surjeet Cricket Club for the year ended 31st March, 2020?

Additional Information:

(3)

(3)

![]()

Question 5.

Kavya, Rahul and Shreya were partners in a press sharing profits and losses is the ratio of 2 : 3 : 5. On 31st March 2020 Kavya retired from the firm and on the day of Kavya’s retirement, goodwill is valued at ₹ 90,000. Rahul and Shreya decided to share the future profits equally. Goodwill already appears in the books of the firm at ₹ 1,00,000.

Pass necessary journal entries. Also show working notes clearly. (3)

Question 6.

On 1st April, 2020 Simpony Limited issued 8,000,12% debentures of ₹ 100 each at a premium of 10%. The amount on debentures is payable as follows:

On application: ₹ 50

On Allotment: ₹ 60 (Including premium)

The debentures were fully subscribed and all money was duly received.

Pass the necessary journal entires in the books of Simpony Limited.

OR

Best Barcode Limited took a loan of ₹ 10,00,000 from a bank giving ₹ 12,00,000; 9% Debentures as collateral security.

Pass journal entries in the books of the company regarding issue of debentures, if any, and show this loan in the Balance Sheet of the company. (3)

![]()

Question 7.

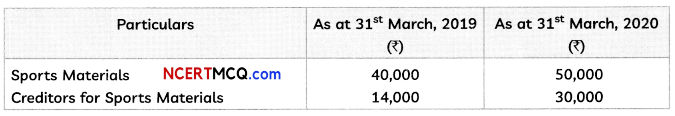

On 31st March, 2019, the Balance Sheet of Alpha, Beta and Gamma who were sharing profits and losses in proportion to their capitals stood as:

Beta retired and following adjustments were agreed to determine the amount payable to Beta:

(i) Out of the amount of insurance premium debited to Profit and Loss Account, ? 1,000 be carried forward as prepaid Insurance.

(ii) Freehold Premises be appreciated by 10%.

(iii) Provision for Doubtful Debts is brought up to 5% on Debtors.

(iv) Machinery of the firm be reduced by 5%.

(v) Liability for Workmen Compensation to the extent of ₹ 1,500 would be created.

(vi) Goodwill of the firm be fixed at ₹ 18,000 and Beta’s share of the same be adjusted into the accounts of Alpha and Gamma who will share future profits in the ratio of 3/4th and 1/4th.

(vii) Total capital of the firm as newly constituted be fixed at ? 60,000 between Alpha and Gamma in the proportion of 3/4th and 1/4th after passing entries in their accounts for adjustments, i.e., actual cash to be paid or to be brought in by continuing partners as the case may be.

(viii) Beta be paid ₹ 5,000 in cash and the balance be transferred to his Loan Account.

Prepare Revaluation Account and Capital Accounts of Partners.

OR

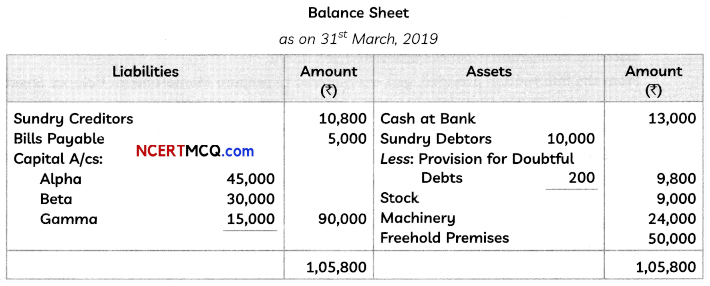

Balance Sheet of Roy Joy Limited as at 31st March, 2021, when it was decided to dissolve the same, was:

₹ 39,000 were realised from all assets except cash at bank. The cost of winding up came to ₹ 880. Roy and Joy shared profits in the ratio of 2 : 1 respectively.

You are required to prepare Realisation Account, Capital Accounts of Partners and Bank Account. (5)

![]()

Question 8.

Tamannah Limited incorporated on 31st April, 2012 had an authorised capital of ₹ 40,00,000 divided into 4,00,000 equity shares of ₹ 100 each. The company issued 2,00,000 shares and the dividend paid per share was ? 2 for the year ended 31st March, 2021. The management of the company decided to export its products to the neighbouring countries Sri Lanka and Nepal. To meet the requirement of additional funds, the Finance Head of the company put up the following three alternatives before its Board of Directors:

(i) Obtain a loan from Export and Import Bank of India. The loan was available at 12% p.a. interest.

(ii) Issue 60,000 equity shares.

(iii) To issue 12% Debentures at a discount of 10%, redeemable at par after six years.

After comparing the available alternatives, the company opted option (iii) and decided on 1st April, 2021 to issue 60,000,12% Debentures of? 100 each at a discount of 10%. The Balance Sheet of the company on 31st March, 2021 shows a balance of ₹ 2,80,000 in Securities Premium Reserve which the company decided to use for writing off the discount on issue of debentures.

You are required to answer the following questions:

(A) Pass journal entry for receipt of application money of debentures.

(B) Pass journal entry for the allotment of debentures.

(C) Pass journal entry to write off discount on issue of debentures.

(D) Prepare Discount on Issue of Debentures Account.

(E) Calculate the amount of annual fixed obligation associated with debentures. (5)

Question 9.

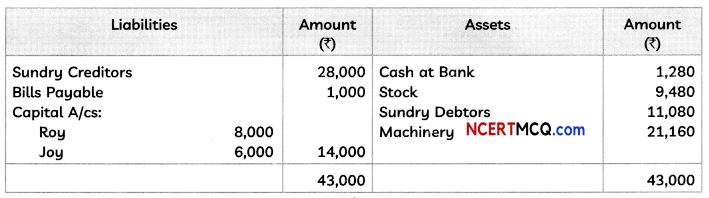

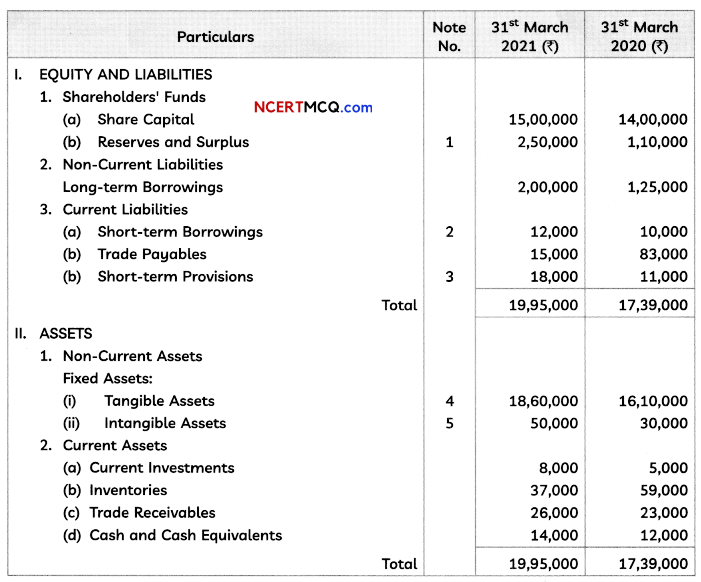

From the following Receipts and Payments Account of Suryam Club, prepare Income and Expenditure Account for the year ending March 31, 2022.

Additional Information:

| Particulars | As at 1st April, 2021 (₹) | As at 31st March, 2022 (₹) |

| (i) Subscription Received in Advance | 3,000 | 9,600 |

| (ii) Outstanding Subscriptions | 6,000 | 11,100 |

| (iii) Stock of Stationery | 3,600 | 2,400 |

| (iv) Books | 40,500 | 49,500 |

| (v) Furniture | 48,000 | 24,000 |

| (Vi) Outstanding Rent | 3,000 | 6,000 |

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State whether the following transactions will result in inflow, outflow or no flow of Cash and Cash Equivalents:

(A) Issue of fully paid Bonus Shares.

(B) Sale of goods against cash. (2)

Question 11.

Prepare Common Size Statement of Profit and Loss from the following Statement of Profit and Loss:

| Particulars | 31st March, 2020 | 31st March, 2021 |

| Cost of Materials Consumed | ₹ 6,72,000 | ₹ 3,00,000 |

| Revenue from Operations (% of Materials Consumed) | 125% | 200% |

| Other Expenses (% of Operating Revenue) | 10% | 10% |

| Tax Rate | 50% | 50% |

![]()

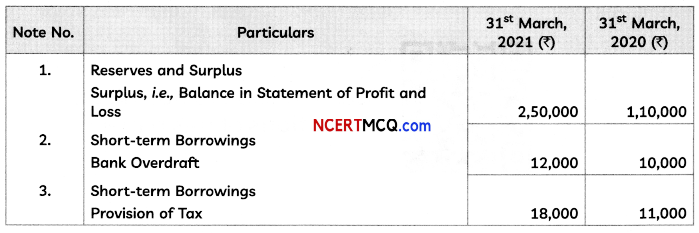

Question 12.

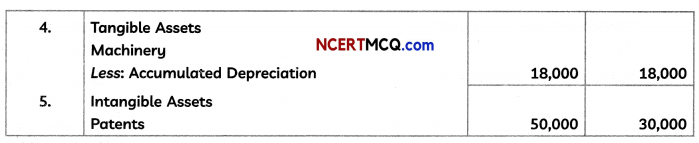

From the following BaLance Sheet of Akash Ltd. as at 31st March 2021:

Notes to Accounts:

Additional Information:

(i) Tax paid during the year amounted to ₹ 16,000.

(ii) Machinery with a net book value of ₹ 10,000 (Accumulated Depreciation ₹ 40,000) was sold for ₹ 2,000.

You are required to prepare Cash Flow Statement of Akash Ltd. for the year ended 31st March, 2021. (5)