Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 12 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 12 for Practice

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt 1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

Distinguish between Receipts and Payments Account and Income and Expenditure Account on the basis of:

(A) Posting of Items

(B) Period (2)

Question 2.

Khushi, Garima and Agrim were partners in a firm sharing profits in the ratio 4 : 3 : 3. The firm was dissolved on 31st March, 2021. Pass the necessary Journal entries for the following transactions after various assets (other than cash and bank) and third party liabilities had been transferred to Realisation Account:

(A) The firm had stock of ₹ 1,60,000. Khushi took over 50% of the stock at a discount of 20% while the remaining stock was sold off at a profit of 30% on cost.

(B) Agrim’s Loan of ₹ 24,000 was settled at ₹ 25,000. (2)

![]()

Question 3.

Firoz, Shah and Qureshi were partners in a firm sharing profits in the ratio of 2 : 1 : 2. On 15th February, 2021, Firoz died and the new profit sharing ratio between Shah and Qureshi was 4 : 11. On Firoz’s death the goodwill of the firm was valued at ₹ 1,80,000. Calculate gaining ratio and pass necessary journal entry for the treatment of goodwill on Firoz’s death without opening goodwill account. (2)

Question 4.

How are the following dealt with while preparing the final accounts of Kawaljeet Club for the year ended 31st March, 2021:

| Particulars | Amount ₹ |

| Stock of stationery on 1st April, 2020 | 7,000 |

| Stock of stationery on 31stMarch, 2021 | 3,000 |

| Creditors for stationery on 1st April, 2020 | 4,000 |

| Creditors for stationery on 31st March, 2021 | 8,000 |

| Advance paid for stationery carried forward on 1st April, 2020 | 6,000 |

| Advance paid for stationery on 31st March, 2021 | 1,500 |

| Amount paid for stationery during the year 2020-21 | 42,000 |

OR

Show how are the following items dealt with while preparing the final accounts of Shaheer Cricket Club for the year ended 31st March, 2021:

(i) Stadium Fund as at 31stMarch, 2020 is ₹ 40,00,000, and Capital Fund as at 31st March, 2020 is ₹ 80,00,000.

(ii) Expenditure on construction of Stadium is ₹ 24,00,000. The construction work of stadium is in progress and has not yet completed.

(iii) Donation Received for Stadium on 1st January, 2021 is ₹ 20,00,000. (3)

Question 5.

Alpha, Beta, Gamma and Delta are partners in a firm sharing profits in the ratio of 3 : 3 : 2 : 2 respectively. On 31st March, 2022 Delta retires from the firm and Alpha, Beta and Gamma decided to share the future profits in the ratio of 3 : 2 : 1. Goodwill of the firm is valued at ₹ 3,00,000. Goodwill already appears in the books of the firm at ₹ 2,25,000. The profits for the first year after Delta’s retirement amount to ₹ 6,00,000.

Give the necessary journal entries to record Goodwill and to distribute the profits. Show your calculations clearly. (3)

![]()

Question 6.

Kapoor Co. Limited issued 8,000,12% Debentures of ₹ 100 each on 1st April, 2020 at a discount of 10% redeemable at a premium of 10% after five years.

Pass journal entries in the books of Kapoor Co. Limited for interest on debenture for the year ended 31st March, 2021, assuming that the interest was payable half-yearly on 30th September and 31st March. Tax is to be deducted @ 10%.

OR

Govinda Co. Limited obtained a loan of ₹ 10,00,000 from United Bank of India @ 12% p.a. interest. The company issued ₹ 15,00,000,12% Debentures of ₹ 100 each in favour of United Bank of India as Collateral Security. Pass necessary Journal entries for the above transactions:

(i) When company decided not to record the issue of 12% Debentures as Collateral Security.

(ii) When company decided to record the issue of 12% Debentures as Collateral Security. (3)

Question 7.

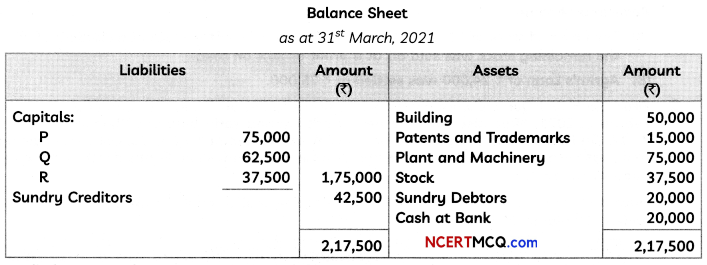

P, Q and R were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 31st March, 2021 their Balance Sheet was as follows:

R died on 31st July, 2021. It was agreed that:

(i) Goodwill be valued at two and a half years’ purchase of the average profits of the last four years, which were as follows:

Years – Profit (₹)

2017 – 18 – 32,500

2018 – 19 – 30,000

2019 – 20 – 40,000

2020 – 21 – 37,500

(ii) Plant and Machinery be valued at ₹ 70,000; Patents and Trademarks at ₹ 20,000 and Building at ₹ 62,500.

(iii) For the purpose of calculation R’s share of profits in the year of his death, the profits in 2021-22 should be taken to have been accrued on the same scale as in 2020-21.

(iv) A sum of ₹ 17,500 was paid immediately to the executors of R and the balance was paid in four half yearly instalments together with interest at 12% p.a. starting from 31st January, 2022.

Pass necessary journal entries to record the above transactions and prepare R’s Executors’ Account till the payment of instalments due on 31st January, 2022.

OR

Pass necessary journal entries on the dissolution of a partnership firm in the following cases:

(A) Dissolution expenses ₹ 2,200 were paid by Sudha, a partner.

(B) Nakul, a partner agreed to do the work of dissolution for a commission of ₹ 4,000. He also agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 4,200 were paid by Nakul.

(C) Taranjeet, a partner was appointed to look after the dissolution work for a remuneration of ₹ 20,000. He also agreed to bear the dissolution expenses. Actual dissolution expenses ₹? 19,600 were paid from the firm’s bank account.

(D) Sugandha, a partner was appointed to look after the dissolution work for a remuneration of ₹ 30,000. She also agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 26,000 were paid by partner ‘Subhash’ on behalf of Sugandha.

(E) Malvika, a partner was appointed to look after the process of dissolution for a remuneration of ₹ 18,000. She also agreed to pay the dissolution expenses. Malvika took away Motor Car of ₹ 18,000 as her remuneration. Motor Car had already been transferred to the Realisation Account. (5)

![]()

Question 8.

Ajmeria Limited was incorporated on 1st April, 2014 with registered office in Rajasthan. The company is growing year by year, and begins to expand its operations throughout India. To expand their business in Madhya Pradesh, directors of the company decided to take over one of the well-known firm of Madhya Pradesh, Pandaya Limited,

On 1st April, 2021 Ajmeria Limited bought the business of Pandaya Limited consisting sundry assets of ₹ 72,00,000 and sundry liabilities of ₹ 20,00,000 for a consideration of ₹ 61,44,000.

Ajmeria Limited issued 12% Debentures of ₹ 100 each fully paid, at a discount of 4% in satisfaction of purchase consideration to Pandaya Limited. On 10th June, 2021, the company also issued 1,000, 12% Debentures of ₹ 100 each credited as fully paid-up to the promoters for their services to incorporate the company.

You are required to answer the following questions:

(A) Calculate the amount of Goodwill purchased by Ajmeria Limited of Pandaya Limited.

(B) Pass journal entry for the purchase of business of Pandaya Limited.

(C) Pass journal entry for the allotment of debentures to Pandaya Limited.

(D) Pass journal entry for the allotment of debentures to the promoters.

(E) Calculate the amount of annual fixed obligation associated with debentures. (5)

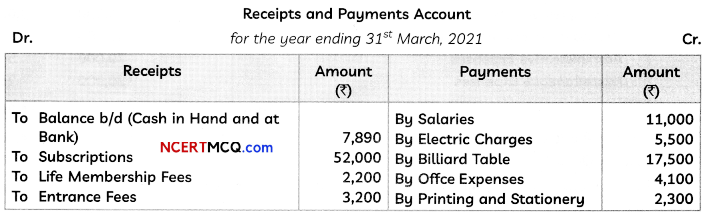

Question 9.

Receipts and Payments Account of Rawalpindi Sports Club for the year ending 31st March, 2021 is as follows:

Additional Information:

(i) Subscriptions outstanding was ₹ 1,200 on March 31, 2020 and ₹ 3,200 on March 31, 2021.

(ii) Locker rent outstanding on March 31, 2021 was ₹ 250.

(iii) Salary outstanding on March 31, 2021 was ₹ 1,000.

(iv) Fixed Deposit was made on 1st January, 2021 @10% p.a.

(v) On April 1, 2020, club has following assets: Building ? 36,000, Furniture ^ 12,000, and Sports Equipments ₹ 17,500. Depreciation on these items is to be charged at 10% (including purchase).

(vi) Income and Expenditure Account for the year ending 31st March, 2021 shows a surplus of ₹ 26,300.

From the Receipts and Payments Account and additional information provided, you are required to prepare Balance Sheet of Rawalpindi Sports Club as on 31st March, 2021. (5)

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State whether the following transactions will result in inflow, outflow or no flow of cash while preparing Cash Flow Statement:

(A) Interest received on debentures ₹ 12,000.

(B) Increase in Inventories by ₹ 45,000. (2)

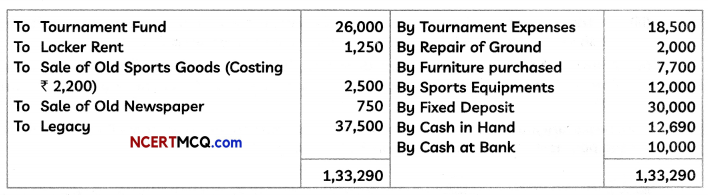

Question 11.

From the following Statement of Profit and Loss of Romita Limited as at 31 March, 2021, prepare Comparative Statement of Profit and Loss:

OR

From the following information provided of Vineeta Limited, for the year ended 31st March, 2020 and 2021, prepare a Common Size Statement of Profit and Loss:

| Particulars | 2020-21 | 2019-20 |

| Revenue from Operations | ₹ 50,00,000 | ₹ 40,00,000 |

| Other Income | ₹ 15,00,000 | ₹ 7,50,000 |

| Employee Benefit Expenses | ₹ 20,00,000 | ₹ 14,00,000 |

| Depreciation and Amortisation Expenses | ₹ 60,000 | ₹ 30,000 |

| Administrative and General Expenses | ₹ 50,000 | ₹ 45,000 |

| Other Expenses | ₹ 4,00,000 | ₹ 6,00,000 |

| Tax Rate | 40% | 40% |

![]()

Question 12.

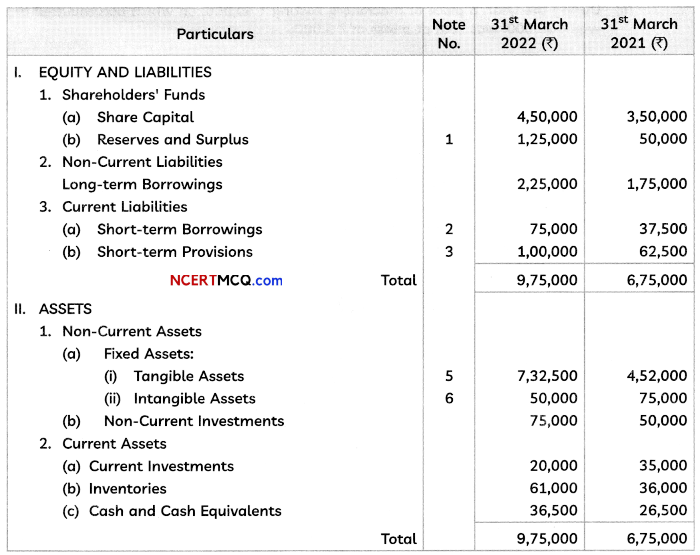

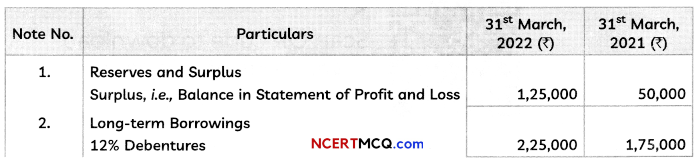

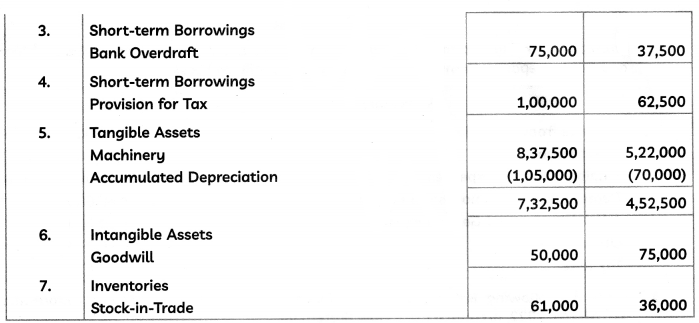

From the following Balance Sheet of Jionee Limited and the additional information as on 31st March, 2022, prepare a Cash Flow Statement:

Notes to Accounts:

Additional Information:

(i) ₹ 50,000, 12% Debentures were issued on 31st March, 2022.

(ii) During the year, a piece of machinery costing ₹ 40,000, on which accumulated depreciation

was ₹ 20,000, was sold at a loss of ₹ 5,000. (5)