Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 2 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 2 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms, and Companies)

Fibonacci calculator is a simple and useful tool that can help you to calculate Fibonacci extension.

Question 1.

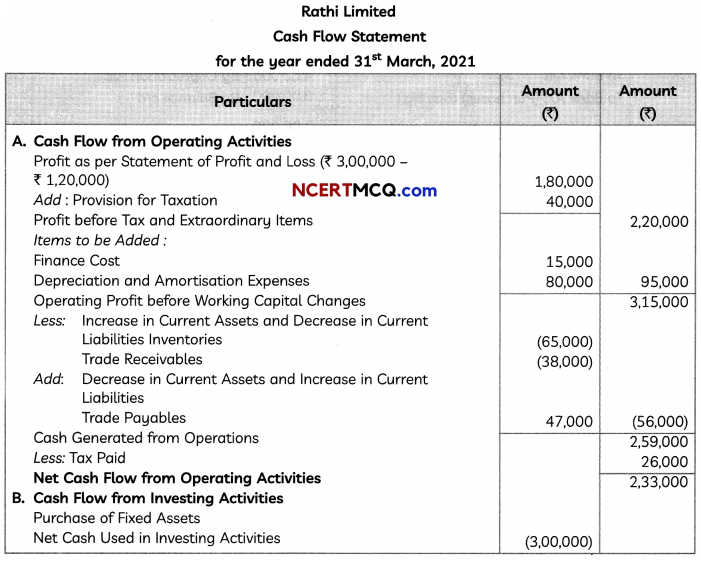

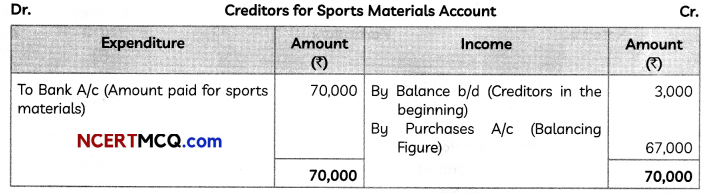

Following information has been provided by Fitbit Sports Academy. You are required to calculate the sports materials consumed during the year 2020-21:

Receipts and Payments Account (An Extract)

Additional Information:

Sports Materials in Hand on 31st March 2020 – ₹ 11,000. (2)

Answer:

Alternatively, Sports Material consumed can also be calculated as

Sports Materials Consumed = Opening Stock + Purchases — Closing Stock

= ₹ 4,000 + ₹ 67,000 – ₹ 11,000

= ₹ 60,000.

![]()

The Recursive Sequences Formula Calculator finds the equation of the sequence and also allows you to view the next terms in the sequence.

Question 2.

Differentiate between Revaluation Account and Realisation Account based on:

(A) Time of preparation

(B) Effect on accounts (2)

Answer:

Difference between Revaluation Account and Realisation Account

| Basis of Difference | Revaluation Account | Realization Account |

| (A) Time of preparation | A revaluation Account is prepared when there is any change in the partnership deed like admission of a partner, retirement of a partner, or death of a partner. | The realization Account is prepared at the time of dissolution of a partnership firm. |

| (B) Effect on accounts | In Revaluation Account, the assets and Liabilities accounts are revaluated not closed. | In Realisation, accounts are the assets and closed. |

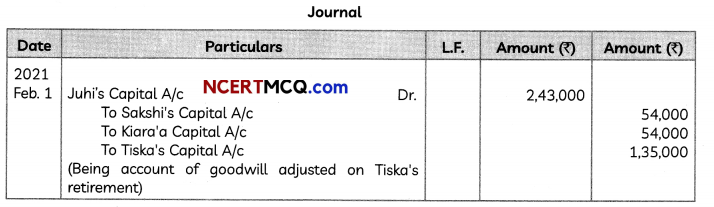

Question 3.

In a partnership firm, Juhi, Sakhi, Kiara, and Tiska were partners sharing profits and losses is the ratio of 3:2: 2:1. On February 1, 2021, Tiska retired from the firm and the new profit sharing ratio decided between Juhi, Sakhi and Kiara was 3/5, 1/5, and 1/5 respectively.

At the time of Tiska’s retirement, the goodwill of the firm was valued at ₹ 10,80,000. Paas the necessary journal entry in the books of the firm for the treatment of goodwill on Tiska’s retirement. Also, show working notes clearly. (2)

Answer:

Working Notes:

(1) Calculation of Gaining Rutio:

Old Profit sharing ratio of Juhi, Sakshi, Kiara and Tiska = 3: 2 : 2: 1

New profit sharing ratio of Juhi, Sokshi and Kiara = 3: 1: 1

Gaining Ratio = New Profit Shoring Ratio — Old Profit Shoring Ratio

Juhi Gain/Sacnfice = \(\frac{3}{5}-\frac{3}{8}=\frac{24-15}{40}=\frac{9}{40}\) (Gain)

Sakshi’s Gain/Sacrifice = \(\frac{1}{5}-\frac{2}{8}=\frac{8-10}{40}=\left(\frac{2}{40}\right)\) (Sacrifice)

Kiara s Gain/Sacrifice = \(\frac{1}{5}-\frac{2}{8}=\frac{8-10}{40}=\left(\frac{2}{40}\right)\) (Sacrifice)

(ii) CalcuLation of Share of Goodwill

Tiska’s Share of Goodwill = ₹ 10,80.000 x \(\frac{1}{8}\) = ₹ 1.35,000

As Sakshi and Kiara are also sacrificing partners, both of them wilt be compensated along with Tiska by Juhi in their sacrificing ratio.

Juhi’ Gain = ₹ 10,80.000 x \(\frac{9}{40}\) = ₹ 2,43,000

Sakshi’s Sacrifice = ₹ 10,80.000 x \(\frac{2}{40}\) = ₹ 54,000

Kiara’s Sacrifice = ₹ 10,80,000 x \(\frac{2}{40}\) = ₹ 54,000

RSD Calculator is free online tool.

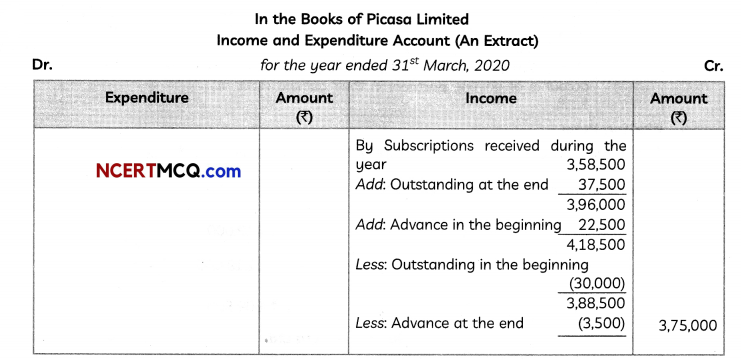

Question 4.

How are the following items of subscriptions shown in the Income and Expenditure Account of Picasa Club for the year ended 31st March 2020 and Balance Sheet as at 31st March 2020?

| Particulars | Amount (₹) |

| Subscriptions received during the year ended 31 March 2020 | 3,58,500 |

| Subscriptions outstanding on 31 March 2019 | 30,000 |

| Subscriptions received in advance on 31 March 2019 | 22,500 |

| Subscriptions received in advance on 31 March 2020 | 13,500 |

| Subscriptions outstanding on 3l March 2020 | 37,500 |

OR

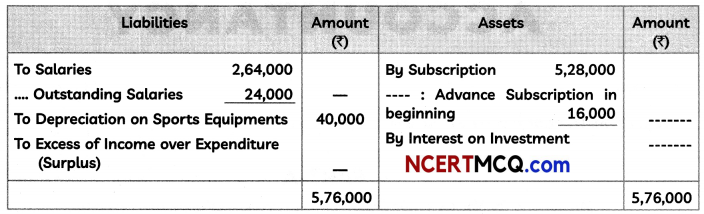

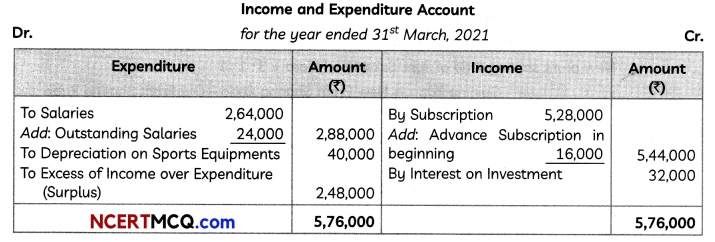

In the foLLowing Income and Expenditure Account for the year ended 31 March 2021, determine

the missing information:

(3)

(3)

Answer:

In the Books of Picasa Limited Income and Expenditure Account (An Extract)

Balance Sheet (An Extract)

as at 31St March 2020

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| Subscriptions Received in Advance | 13,500 | Subscriptions Outstanding | 37,500 |

OR

![]()

Question 5.

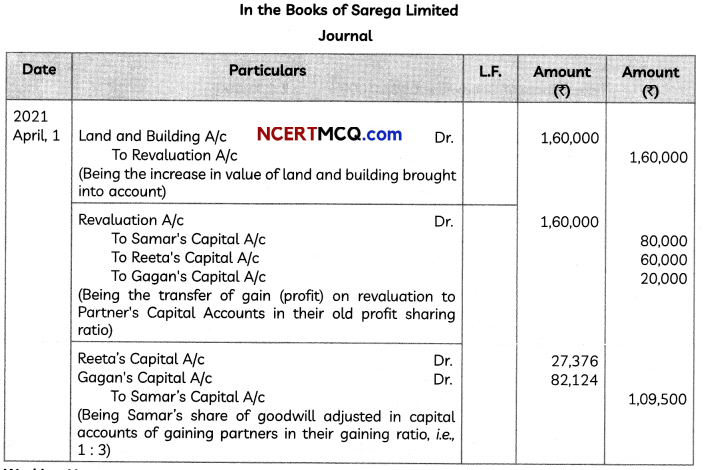

In a partnership firm ‘Sarega Limited’, Samar, Reeta, and Gagan are partners sharing profits and losses in the ratio 4:3:1. As per the terms of the Partnership Deed of the firm, on the death of any partner, goodwill was to be valued at 50% of the net profits credited to that Partner’s Capital Account during the last three completed years before his/her death.

The profits and losses for the last five years were:

2016-17 ₹ 1,20,000

2017-18 ₹ 1,94,00

2018-19 ₹ 2,10,000

2019-20 ₹ 60,000

2020-2 1 ₹ 1,68O00

On 1st April, 2021, Samar dies. On that date, land and building was found undervalued by ₹ 1,60,000, which was to be considered.

Calculate the amount of Samar’s share of goodwill in the firm and pass the necessary adjusting journal entries of goodwill and revaluation of assets. (3)

Answer:

Working Notes:

Total Profit of last three year’s = ₹ 2,10,000 + ₹ 60,000 +₹ 1,68,000 = ₹ 4,38,000

Sama’s share in prcMt already credited ta his account = ₹ 4, 38, 000 x \(\frac{4}{8}\) = ₹2,19,000

∴ Sarnar’s share of goodwill = Rs. 2.19.000 x \(\frac{50}{100}\) = ₹ 1,09,500.

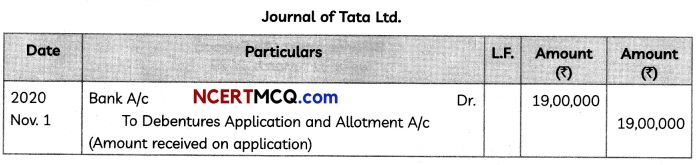

Question 6.

On 1st Nov. 2020, Tata Ltd. issued 20,000, 10% debenture of ₹ 100 each at a discount of 5%, redeemable at par after four years. The debentures were fully subscribed. It has a balance of ₹ 40,000 in capital reserve and ₹ 75,000 in Securities Premium Reserve which the company decided to use for writing off the discount on issue of debentures. Pass the journal entries for issue of debentures and writing off the discount. Also, prepare discount on issue of Debentures Account.

OR

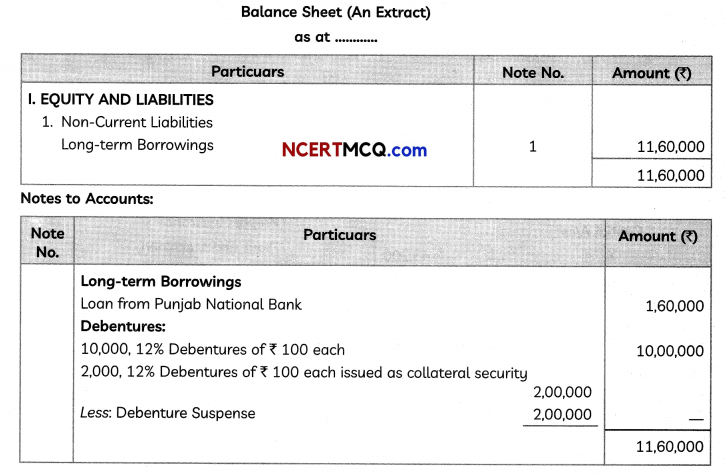

Wisdom Fireworks Limited issued 10,000, 12% debentures of ₹ 100 each at par for cash. It also raised a loan of ₹ 1,60,000 from Punjab National Bank, for which the company placed with the bark ₹ 2,00,000,12% debentures as collateral security.

As per the terms, Punjab National Bank is obliged and bound to immediately release the debentures as soon as the loan is repaid. How will you show the debentures in the Balance Sheet of Wisdom Fireworks Limited assuming that the company has recorded the issue of debentures as collateral in the book. (3)

Answer:

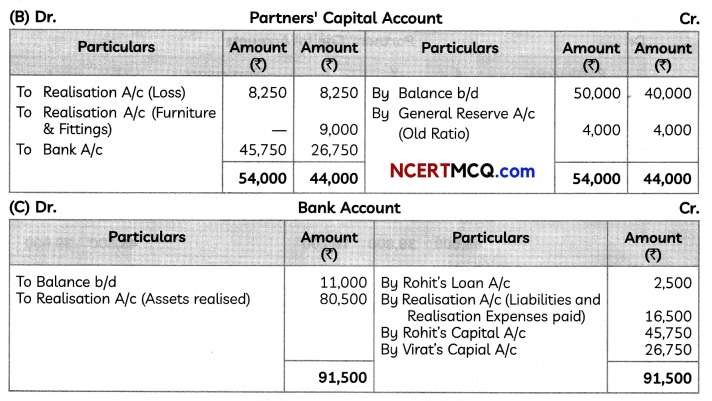

Question 7.

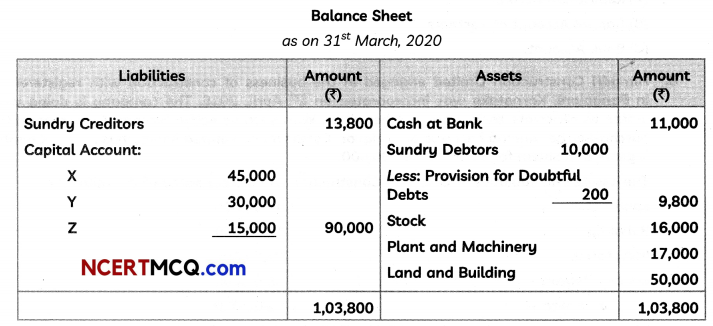

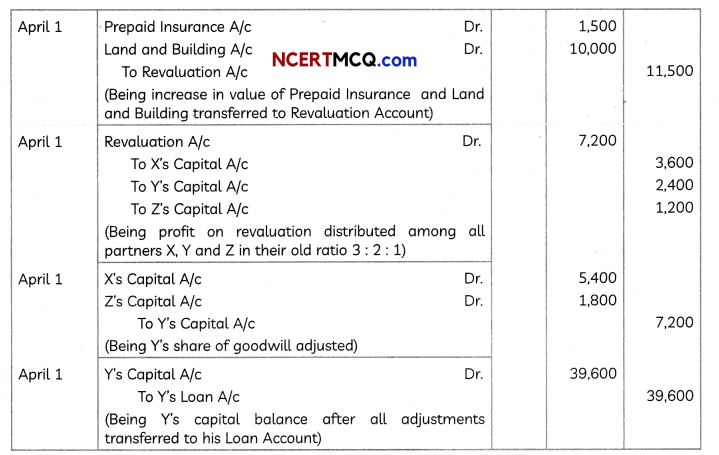

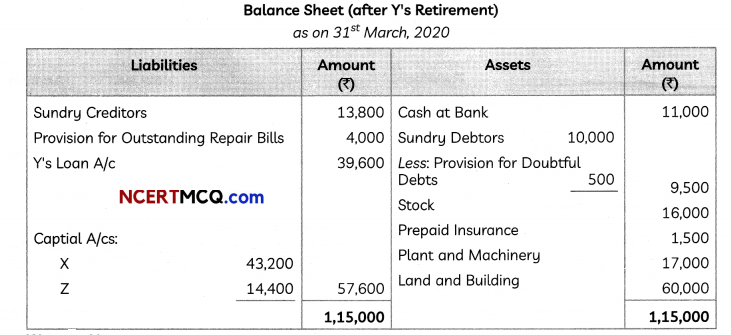

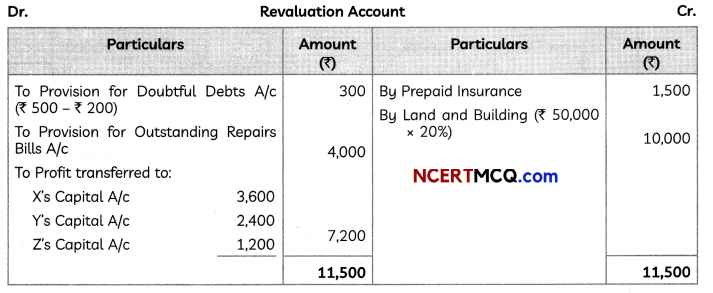

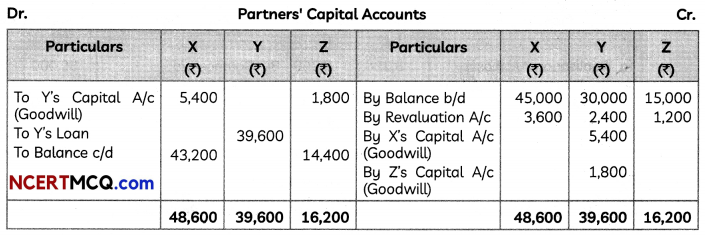

The Balance Sheet of X, Y, and Z who were sharing profits and losses in ratio of their capitals stood as follows:

Balance Sheet

as on 31st March 2020

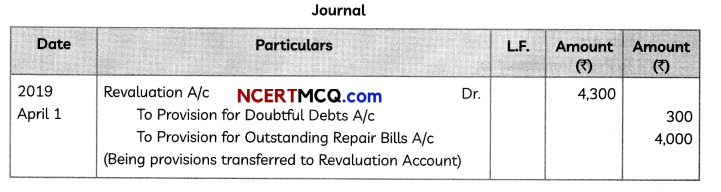

Y retired on 1st April, 2020 and the following adjustments were agreed upon:

(i) Out of the insurance premium debited to Profit and Loss Account, ₹ 1,500 to be carried forward as Prepaid Insurance.

(ii) Provision for Doubtful Debts to be brought up to 5% of Sundry Debtors.

(iii) Land and Building to be appreciated by 20%.

(iv) A provision of ₹ 4,000 be made in respect of outstanding bills for repairs.

(v) Goodwill of the firm was determined at ₹ 21,600.

(vi) Y’s share of goodwill be adjusted to that of X and Z who will share profits in future in the ratio of 3 :1.

Pass necessary Journal entries and prepare the Balance Sheet after Y’s retirement.

OR

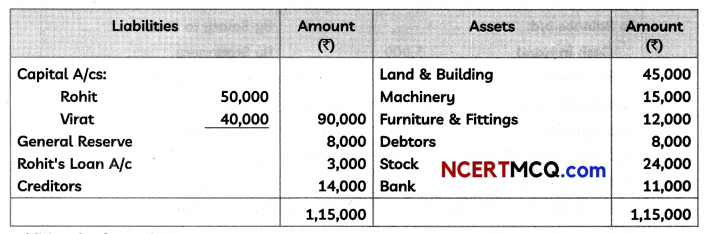

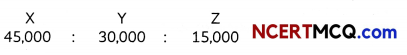

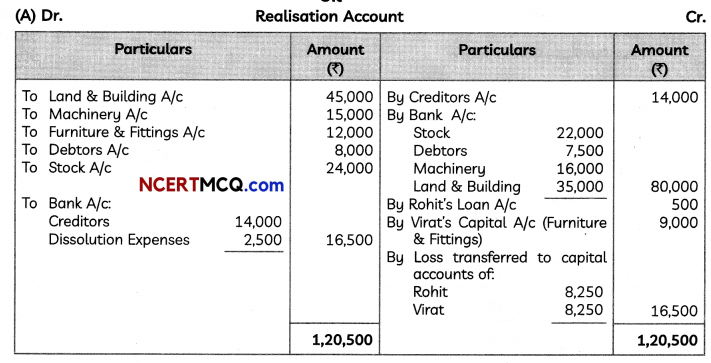

Rohit and Virat are equal partners of a partnership firm ‘RV Limited’. They decided to dissolve their partnership firm on 31st March 2020, at which date the Balance Sheet of the firm stood as:

Additional Information:

(i) The assets realized were:

Stock ₹ 22,000; Debtors ₹ 7,500; Machinery ₹ 16,000; Land & Building ₹ 35,000.

(ii) Virat took over the Furniture & Fittings at ₹ 9,000.

(iii) Rohit agreed to accept ₹ 2,500 in full settlement of his Loan Account.

(iv) Dissolution Expenses amounted to ₹ 2,500.

You are required to prepare:

(A) Realisation Account

(B) Capital Account of Partners

(C) Bank Account. (5)

Answer:

Working notes:

(1)

(2)

(3) Calculation of Old Ratio:

Capitol Ratio =

∴ Old Ratio of X, Y and Z= 3:2: 1

(4) CalcuLation of Gaining Ratio:

Old Ratio of X,Y and Z = 3:2:1

New Ratio of X and Z =3:1

Gaining Ratio = New Ratio – Old Ratio

X’s Gain = \(\frac{3}{4}-\frac{3}{6}=\frac{9-6}{12}=\frac{3}{12}\)

Z’ s Gain = \(\frac{1}{4}-\frac{1}{6}=\frac{3-2}{12}=\frac{1}{12}\)

Gaining Ratio of X and Z = 3: 1

(5) Adjustment of Good will:

Goodwiti of the Firm = ₹ 21,600

Y’s Share of GoodwilL = ₹ 21,600 x \(\frac{2}{6}\) = ₹ 7,200

Y’s share of goodwill will be compensated b X and Z in their Gaining Ratio i.e., 3: 1

X will compensate = 7.200 x \(\frac{3}{4}\) = ₹ 5,400

Y will compensate = 7,200 x \(\frac{1}{4}\) = ₹ 1,800

![]()

Question 8.

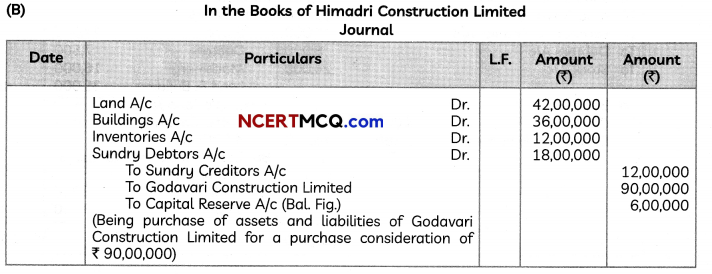

Himadri Construction Limited engaged in the business of construction with a registered office in Bangalore, Karnataka was incorporated on 1st April 2016. The company is doing well and wants to penetrate their roots in other cities. With such objective Himadri Construction Limited purchased the running business of Godavari Construction Limited having business in Coimbatore, Mysore and Salem for a sum of ₹ 90,00,000. The assets and liabilities of Godavari Construction Limited consisted of the following:

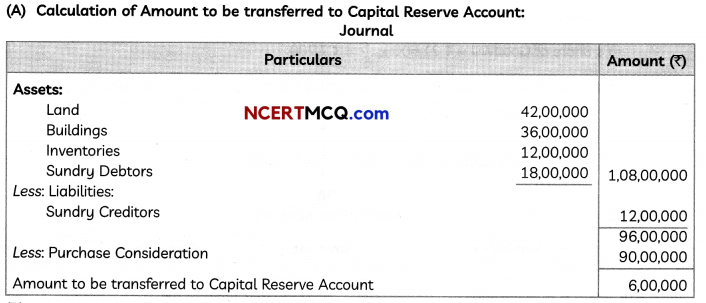

Land ₹ 42,00,000

BuiLdings ₹ 36,00,000

Inventories ₹ 12,00,000

Sundry Debtors ₹ 18,00,000

Sundry Creditors ₹ 12,00,000

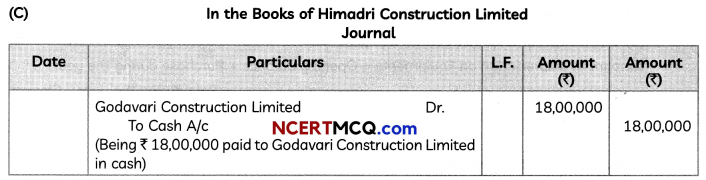

Himadri Construction Limited paid ₹ 18,00,000 in cash and for the balance amount issued 10% Debentures of? 100 each at par, redeemable after 6 years at par for the sum due to Godavari Construction Limited.

You are required to answer the following questions:

(A) Calculate the amount to be transferred to Capital Reserve Account.

(B) Pass journal entry to be passed at the time of purchase of business of Godavari Construction Limited.

(C) Pass journal entry for payment made in cash to Godavari Construction Limited.

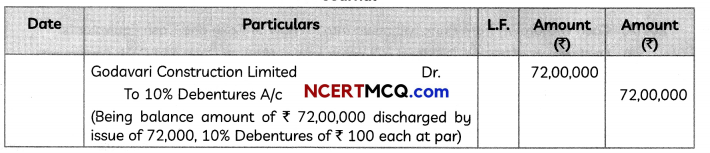

(D) Calculate the number of debentures issued to Godavari Construction Limited.

(E) Pass journal entry for the allotment of debentures to Godavari Construction Limited. (5)

Answer:

(D) Amount paid in Cash = ₹ 18,00,000

Amount paid through Debentures = ₹ 90,00,000 – ₹ 18,00.000 = ₹ 72,00,000

Number of Debentures Issued to Godavari Construction Limited

= \(\)\frac{\text { Amount Due }}{\text { Issue Price }}=\frac{₹ 72,00,000}{₹ 100}[/lattex] = 72,000

(E) In the Books of Himadri Construction Limited

Journal

Question 9.

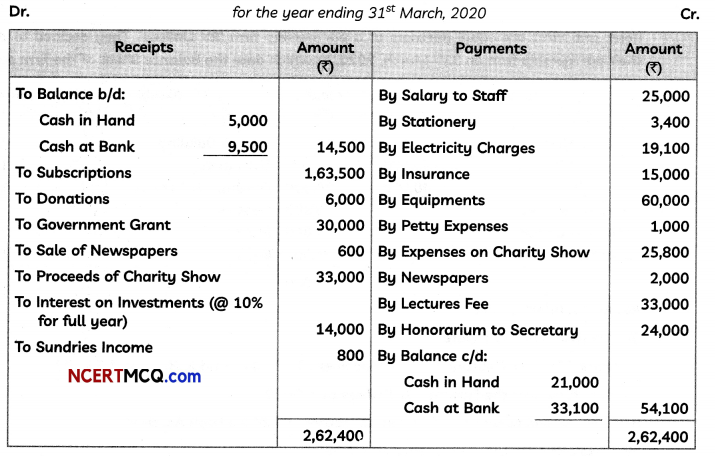

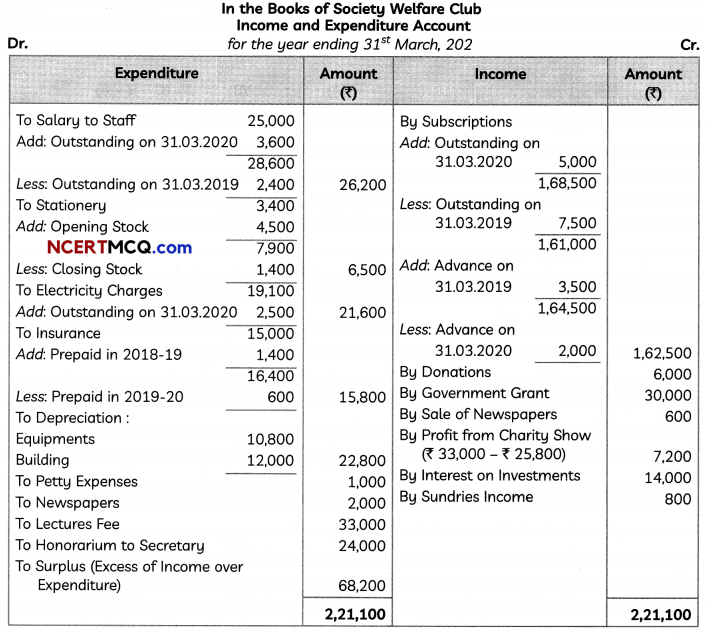

Following is the Receipts and Payments Account of Society Welfare Club for the year ended 31st March, 2020:

Receipts and Payments Account

Additional Information:

| Particulars | 31st March 2019 (₹ ) | 31st March 2020 (₹ ) |

| Outstanding Salary to Staff | 2,400 | 3,600 |

| Prepaid Insurance | 1,400 | 600 |

| Outstanding Subscriptions | 7,500 | 5,000 |

| Subscriptions Received in Advance | 3,500 | 2,000 |

| Outstanding Electricity Charges | – | 2,500 |

| Stock of Stationery | 4,500 | 1,400 |

| Equipments | 51,200 | 1,00,400 |

| Building | 4,80,000 | 2,28,000 |

| Investments | 2,80,000 | 1,40,000 |

From the information provided, you are required to prepare Income and Expenditure Account of Society Welfare Club for the year ended 31st March 2020. (5)

Answer:

Working Note:

(1) CalcuLation of Depreciation on Equipments:

Amount of Depreciation on Equipments = Opening Balance + Purchase during the year – Sale during the year- Closing Balance

= ₹ 51,200 + ₹ 60,000 – 0 – ₹ 1,00,400

= ₹ 10,800

(2) CaLculation of Depreciation on Building:

Amount of Depreciation on Building = Opening Balance + Purchase during the year – Sale during the year – Closing Balance

= ₹ 2,40,000 + 0- 0 – ₹ 2,28,000

= ₹ 12,000

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State which of the following transactions will result in inflow, outflow, or no flow of Cash and Cash Equivalents:

(A) Cash is withdrawn from Bank.

(B) Declaration of Interim Dividend. (2)

Answer:

(A) Cash withdrawn from Bank will, resuLt into no flow of Cash and Cash Equivalents.

(B) Declaration of Interim Dividend will resuLt into the outflow of Cash and Cash Equivalents.

![]()

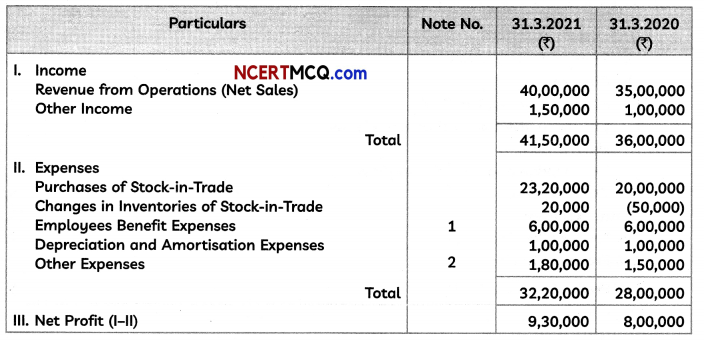

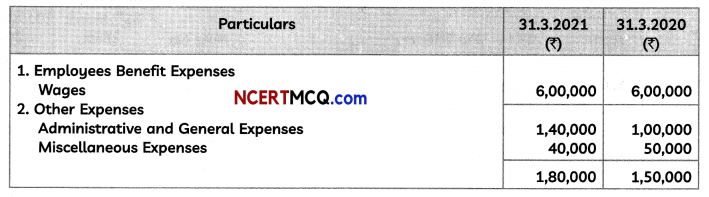

Question 11.

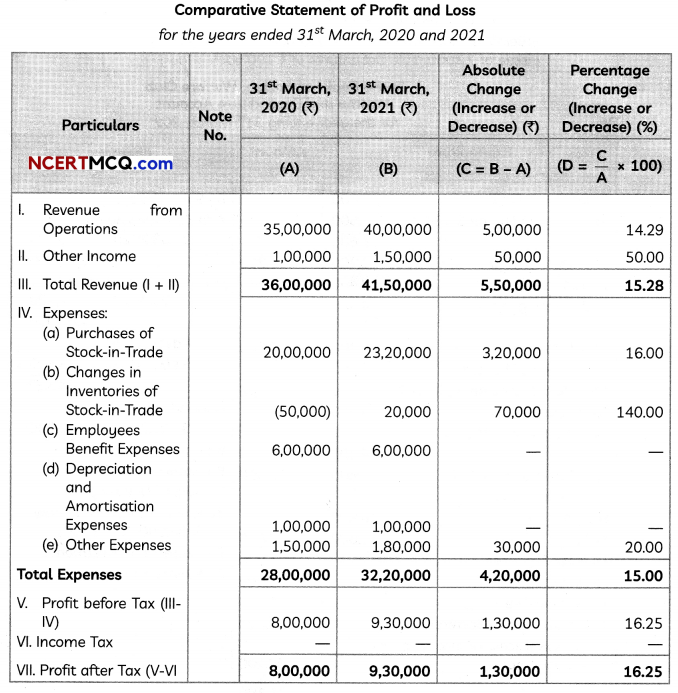

From the following Statement of Profit and Loss, prepare Comparative Statement of Profit and Loss:

Notes to Accounts:

OR

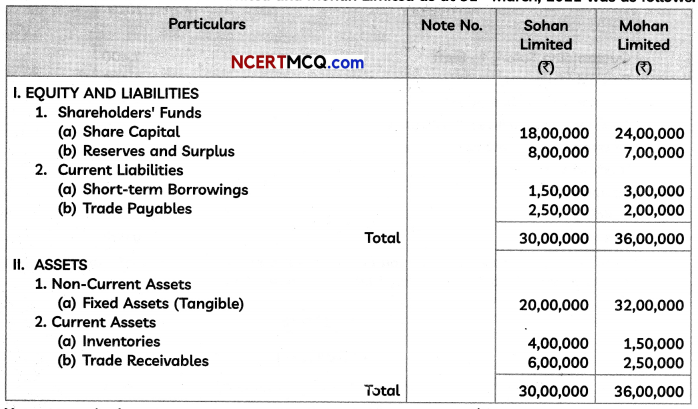

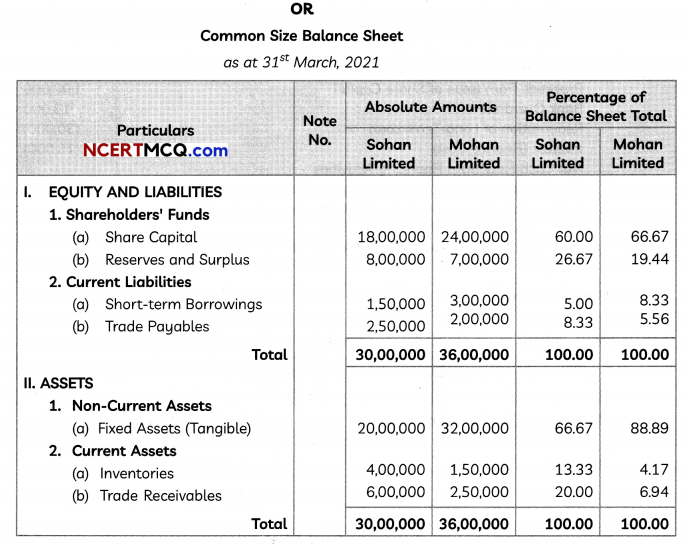

The Balance Sheets of Sohan Limited and Mohan Limited as at 31st March 2021 was as follows:

You are required to prepare Common Size Balance Sheet as at 31st March 2021. (3)

Answer:

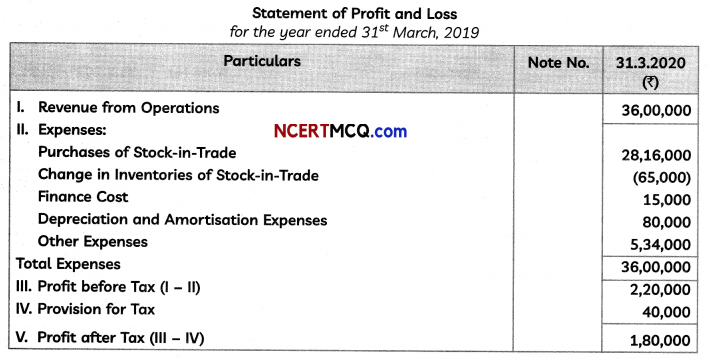

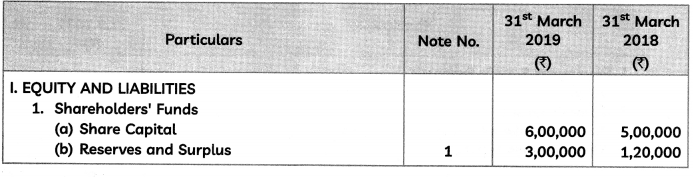

Question 12.

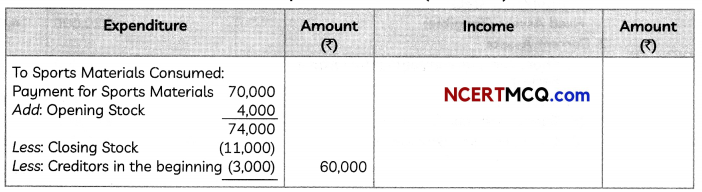

From the following Statement of Profit and Loss for the year ended 31st March 2019, Balance Sheet as at 31st March 2019 and Notes to Accounts of Rathi Limited, prepare its Cash Flow Statement:

Balance Sheet as at 31st March, 2019

(5)

(5)

Answer: