Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 3 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 3 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms, and Companies)

Question 1.

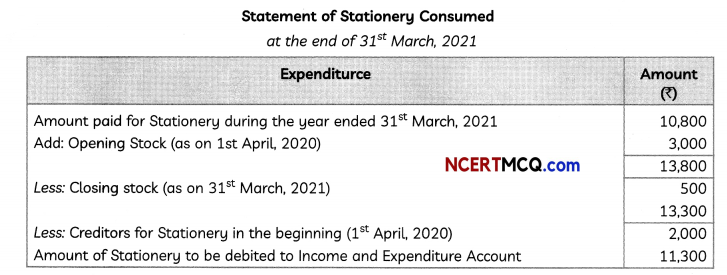

Calculate the amount to be posted to the Income and Expenditure Account for the year ended 31st March 2021 from the information given:

Stock of Stationery on 1st April 2020 – ₹ 3,000

Creditors for Stationery on 1st April 2020 – ₹ 2,000

Amount paid for Stationery during the year – ₹ 10,800

Stock of Stationery on 31st March 2021 – ₹ 500. (2)

Answer:

Question 2.

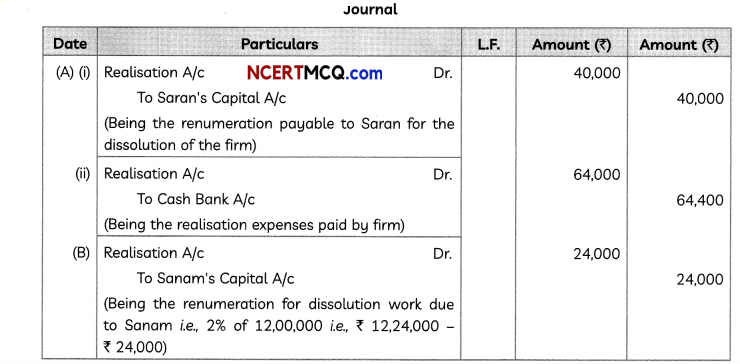

Pass the necessary journal entries for the following transactions on the dissolution of a partnership firm:

(A) Saran, a partner is paid remuneration of ₹ 40,000 for the dissolution of the firm. Realization expenses of ₹ 64,000 are borne by the firm.

(B) Sanam one of the partners was to receive 2% of the value of assets realized as remuneration for completing the dissolution work and was to bear realization expenses. Realization expenses were ₹ 8,000 paid by Sanam. The assets including cash at Bank ₹ 24,000, realized ₹ 12, 24,000. (2)

Answer:

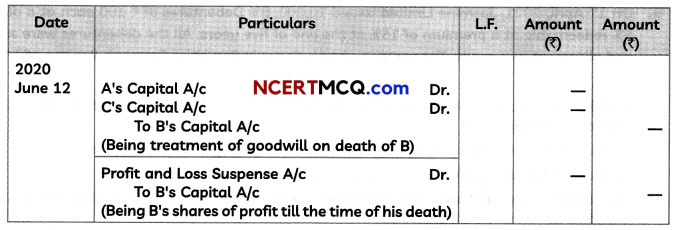

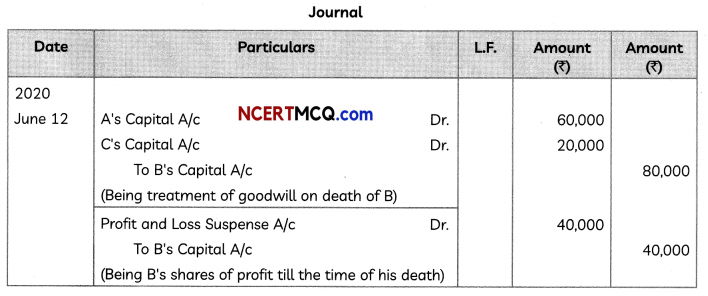

Question 3.

A, B and C are partners in a firm sharing profit in 3: 2 :1. The firm closes its book on 31st March every year. B died on 12th June 2020. On B’s death, the goodwill of the firm was valued at ₹ 2,40,000. B’s share in the profits of the firm till the date of death from the last Balance Sheet was to be calculated on the basis of previous year’s profit which was ₹ 6,00,000.

Fill in the missing figures in the following journal entries.

(2)

(2)

Answer:

Working Notes:

B’s share of profit will his date of death

= ₹ 6,00,000 x \(\frac{73}{365} \times \frac{2}{6}\)

= 40,000

![]()

Question 4.

Distinguish between Receipts and Payments Account and Income and Expenditure Account on the basis of:

(A) Nature

(B) Period

(C) Nature of Items

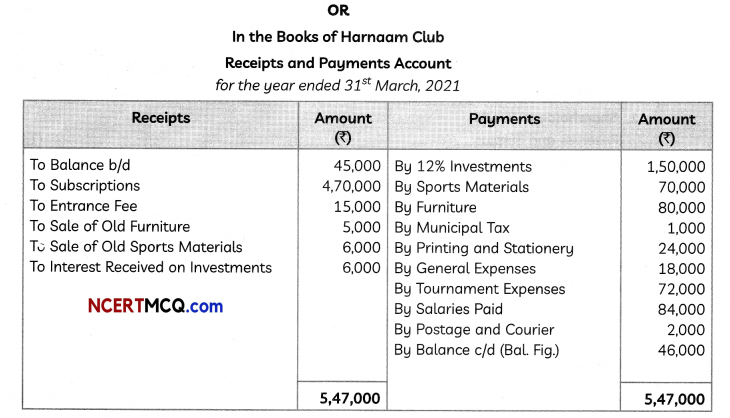

OR

From the information given below, prepare Receipts and Payments Account of Harnaam Club for the year ending on 31st March 2021:

| Particulars | Amount (₹) |

| Cash & Bank as on 1st April, 2020 | 45,000 |

| Subscriptions (including ₹ 8,000 for 2019-20 and ₹ 12,000 for 2021-22) | 4,70,000 |

| 12% Investments purchased on 1st April, 2020 | 1,50,000 |

| Entrance Fee Received | 15,000 |

| Sports Materials Purchased | 70,000 |

| Furniture purchased | 80,000 |

| Sale of Old Furniture (Cost ₹20,000) | 5,000 |

| Municipal Taxes | 1,000 |

| Printing and Stationery | 24,000 |

| Sale of Old Sports Materials | 6,000 |

| General Expenses (out of which ₹ 2,000 is yet to be paid) | 20,000 |

| Interest Received on Investments | 6,000 |

| Tournament Expenses | 72,000 |

| Salary paid | 84,000 |

| Postage and Courier | 2,000 |

(3)

Answer:

Difference between Receipts and Payments Account and Income and Expenditure Account:

| Basis of Difference | Receipts and Payments Account | Income and Expenditure Account |

| (A) Nature | It is classified summary of cash transactions showing receipts and payments under different heads for the period. | It is Like a Profit and Loss Account |

| (B) Period | It shows receipts and payments during the year whether they relate to past, current or succeeding year. | It shows incomes and expenditures of the current year only. |

| (C) Nature of Items | Debit side of this account records receipts and credit side records payments. | Debit side of this account records expenses and Losses and credit side records incomes and gains. |

Question 5.

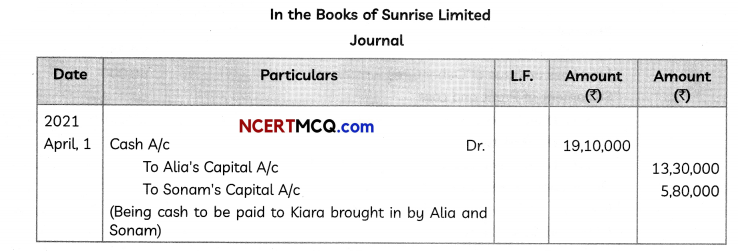

Alia, Kiara, and Sonam are partners is Sunrise Limited sharing profit and losses is the ratio of \(\frac{4}{9}: \frac{1}{3}: \frac{2}{9} \) On 1st April 2021 Kiara gave a notice to retire from the firm. Alia and Sonam decided to share the future profits equally.

The capital accounts of Alia and Sonam after all adjustment showed a balance of ₹ 86,000 and ₹ 1,61,000 respectively. The total amount to be paid to Kiara was ₹ 19,10,000. This amount was to be paid by Alia and Sonam is such a way that their capitals become proportionate to their new profit sharing ratio. Pass the necessary journal entries in the books of Sunrise Limited for the above transactions. Show your working clearly. (3)

Answer:

Working Note:

(1) CalcuLation of total capitaL of new firm:

₹

Adjusted Capital of Alia 8,60,000

Act Adjusted Capital of Sonam 16,10,000

Amount to be paid to Kiaro 19,10,000

Total Capital of New Firm 43,80,000

(2) Calculation of Cash to be brought in or Withdrawn by Alio and Sonam:

| Particulars | Alla (₹) | Sonam (₹) |

| New capital of ALio and Sonam ( ₹ 43.80,000 in new ratio, i.e., 1: 1) | 21,90.000 | 21,90,000 |

| Less Existing capital of Alia and Sonam | 8,60,000 | 16,10,000 |

| Cash to be brought in | 13,30,000 | 5,80,000 |

![]()

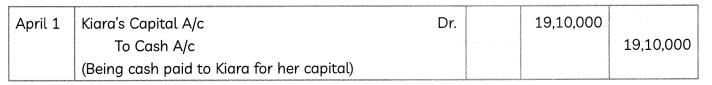

Question 6.

On 1st April 2021, Jasmine Limited issued 10,000, 8% Debentures of ₹ 100 each at a discount of 5% redeemable at a premium of 15% at the end of five years. All the debentures were subscribed and allotment was made. The company had balance in Securities Premium Reserve of ₹ 80,000.

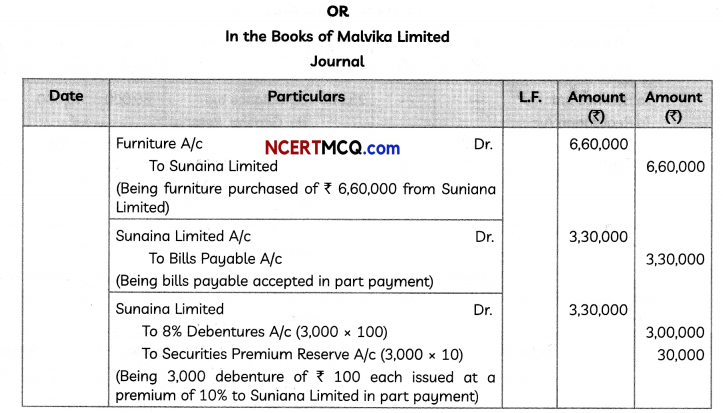

OR

Malvika Limited purchased furniture worth ₹ 6,60,000 from Sunaina Limited and paid to Suniana Limited as follows:

(i) 50% of the amount by accepting a bill of exchange payable after one month.

(ii) Balance by issuing 8% debentures of ₹ 100 each at a premium of 10%.

Pass necessary journal entries in the books of Malvika Limited for the purchase of furniture and making payment to Sunaina Limited. (3)

Answer:

Working Note:

Purchase consideration = ₹ 6,60,000

Amount paid by Bilis Payable = 50% of ₹ 6,60,000

= ₹ 3,30,000

Amount paid by issuing debentures = ₹ 6,60,000 – ₹ 3,30,000

= ₹ 3,30,000

Number of debenture issued = \(\frac{\text { Amount paid by Issuing Debentures }}{\text { Issue Price per Debenture }} \)

= \(\frac{₹ 3,30000}{(₹ 100+₹ 10)} \)

= \(\frac{₹ 3,30000}{₹ 110}\)

= 3,000

Question 7.

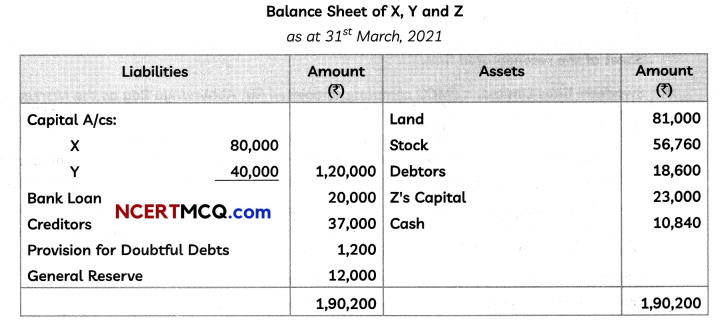

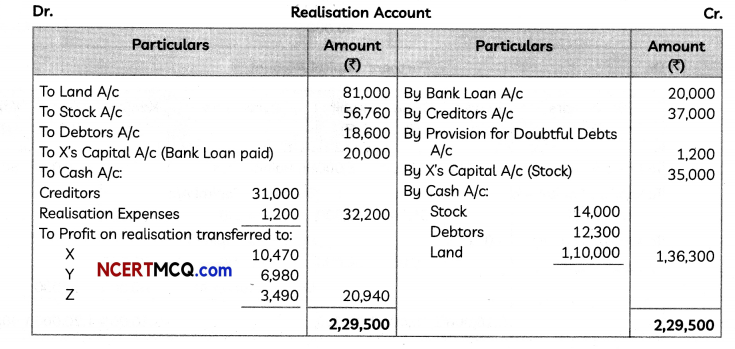

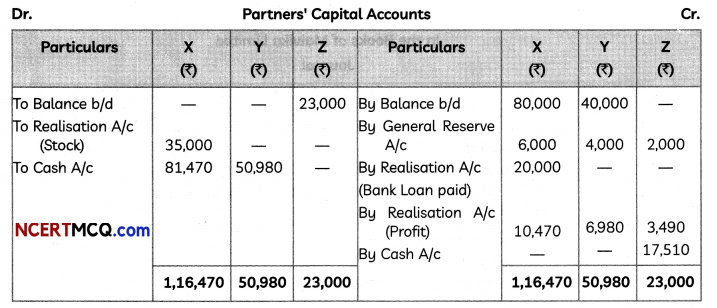

X, Y, and Z decided to dissolve their partnership firm on 31st March 2021. Their profit sharing ratio was 3:2:1 and their Balance Sheet was as under:

It is agreed as follows:

(i) The stock of value of ₹ 41,660 are taken over by X for ₹ 35,000 and he agreed to discharge bank loan.

(ii) The remaining stock was sold at ₹ 14,000.

(iii) Debtors amounting to ₹ 10,000 realised ₹ 8,000. The remaining debtors realized 50% at their book value.

(iv) Land is sold for ₹ 1,10,000.

(v) The cost of realization amounted to ₹ 1,200.

(vi) There was a typewriter not recorded in the book’s worth of ₹ 6,000 which was taken over by one of the Creditors at this value.

Prepare Realisation Account, Partners’ Capital Accounts, and Cash Account to close the books of the firm.

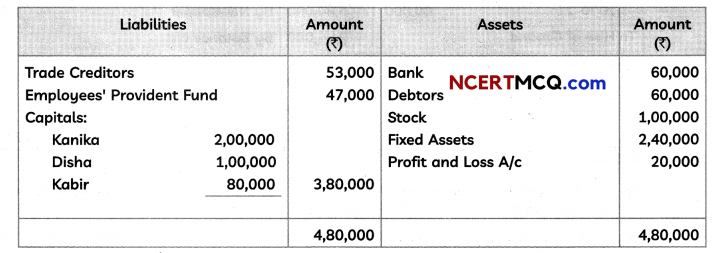

OR

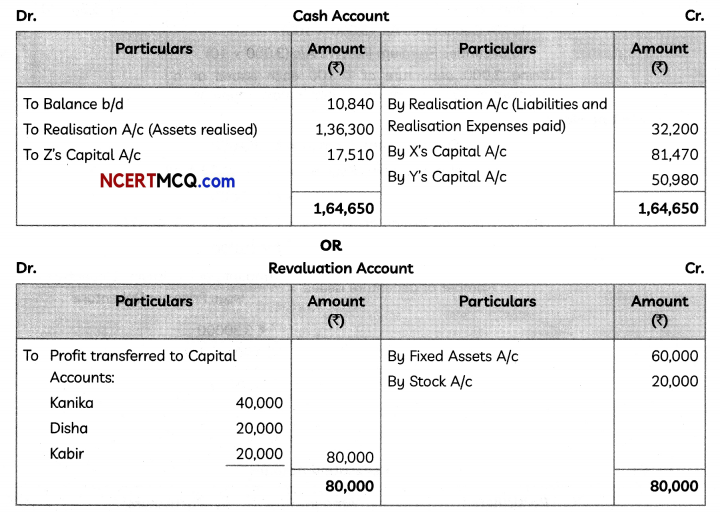

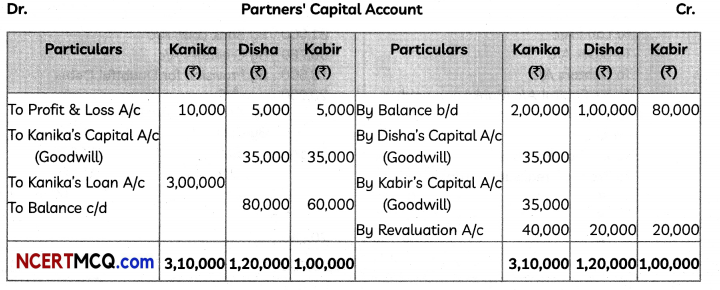

Kanika, Disha, and Kabir were partners in a partnership firm sharing profits and losses in the ratio

of 2 :1: 1. On 31st March 2019, their Balance Sheet was as under:

Balance Sheet

as at 31st March 2019

Kanika retired on 1st April 2019. For this purpose, the following adjustments were agreed upon:

(i) Goodwill of the firm was valued at 2 years’ purchase of average profits of three completed years preceding the date of retirement. The profits for the year were:

2016- 17 ₹ 1,00,000

2017- 18 ₹ 1,30,000

(ii) Fixed Assets were to be increased to ₹ 3,00,000.

(iii) Stock was to be valued at 120%.

(iv) The amount payable to Kanika was transferred to her Loan Account.

You are required to prepare a Revaluation Account, Capital Accounts of the partners, and the Balance Sheet of the reconstituted firm. (5)

Answer:

Working Note:

Calculation of Goodwill:

Goodwill = Average Profits x Number of Years’ Purchase

Average Profits = \(\frac{\text { Total Profits }}{\text { Number of Years }}\)

= \(\frac{₹ 1,00,000+₹ 1,30,000- ₹ 20,000}{3}\)

= \(\frac{₹ 2,10,000}{3}\)

= ₹ 70,000

Goodwill of the Firm = 70,000 x 2 = 1,40,000

Kanika’s share of Goodwill = 1,40,000 x \(\frac{2}{4}\) = ₹ 70,000

which will be borne by gaining partners in their gaining ratio

Disho will compensate = 70,000 x \(\frac{1}{2}\) = ₹ 35,000

Kabir wilt compensate = 70,000 x \(\frac{1}{2}\) = ₹ 35,000

Note: Since no information is given about the share of the gain, it is assumed that the old partners are gaining in their old profit sharing ratio.

![]()

Question 8.

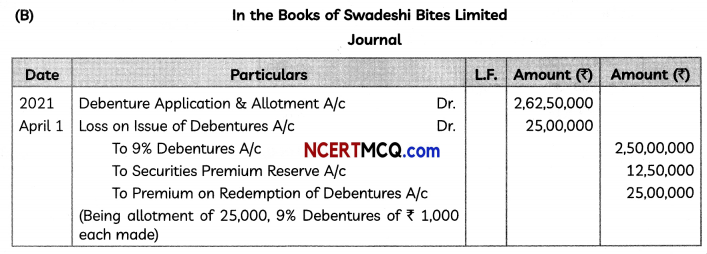

Swadeshi Bites Limited, a FMCG company appointed Mr. Abhimanyu Roy as the Marketing IHead of the company, with a target to enter the international market. Mr. Abhimanyu Roy discussed the ways and means to achieve target of the company with his marketing team.

After reviewing the suggestions given by all the marketing team members and consultation with Finance Head an additional fund of ₹ 2,62,50,000 is required to penetrate their roots in the international market.

After all discussions, on 1st April 2021, the board of directors of Swadeshi Bites Limited decided to issue 9% Debentures of ₹ 1,000 each to the public at a premium of 5%, redeemable after 5 years at a premium of 10% to raise the additional fund.

You are required to answer the following question:

(A) Calculate the number of debentures to be issued to raise additional funds.

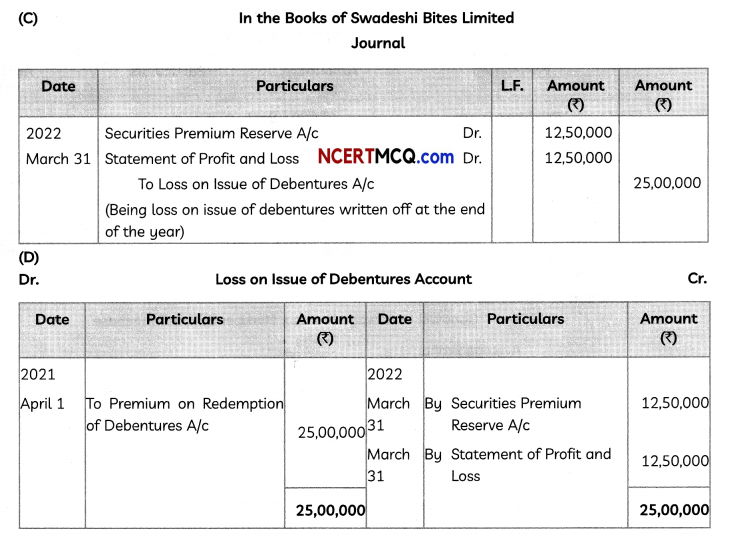

(B) Pass journal entry to be passed at the time of allotment of debentures.

(C) Pass journal entry to write off loss on issue of debentures.

(D) Prepare Loss on Issue of Debentures Account.

(E) Calculate the amount of annual fixed obligation associated with debentures. (5)

Answer:

(A) Additional. Funds Raised = 2,62,50,000

Number of Debentures Issued to raise Additional Funds = \(\frac{\text { Additional Funds Raised }}{\text { Issue Price }} \)

= \(\frac{₹ 2,62,50,000}{₹(1,000+50)}\)

= 25,000.

(E) Interest on 9% Debentures = ₹ 2,50,00,000 x\(\frac{9}{100}\) =₹ 22,50,000

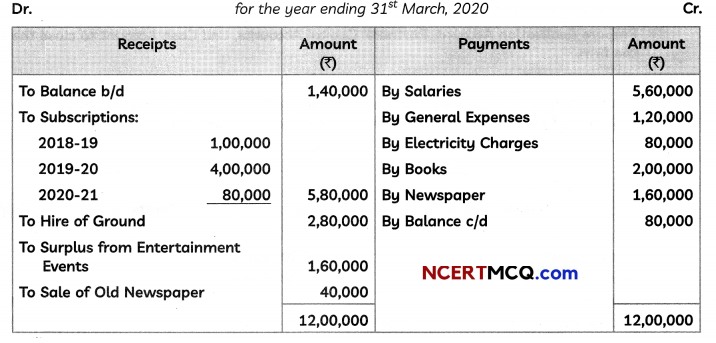

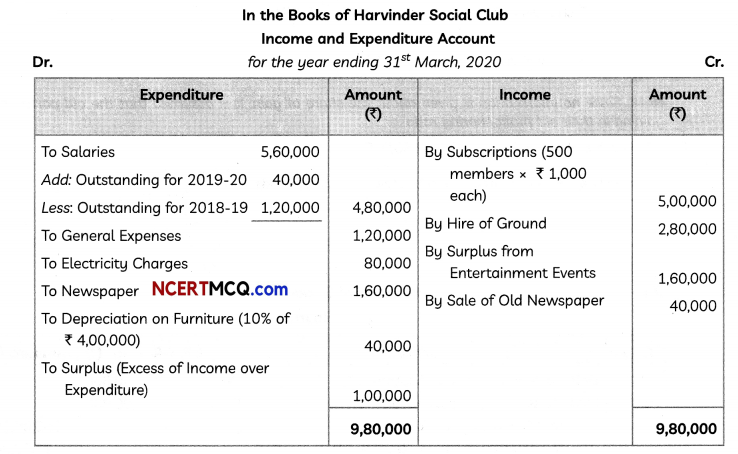

Question 9.

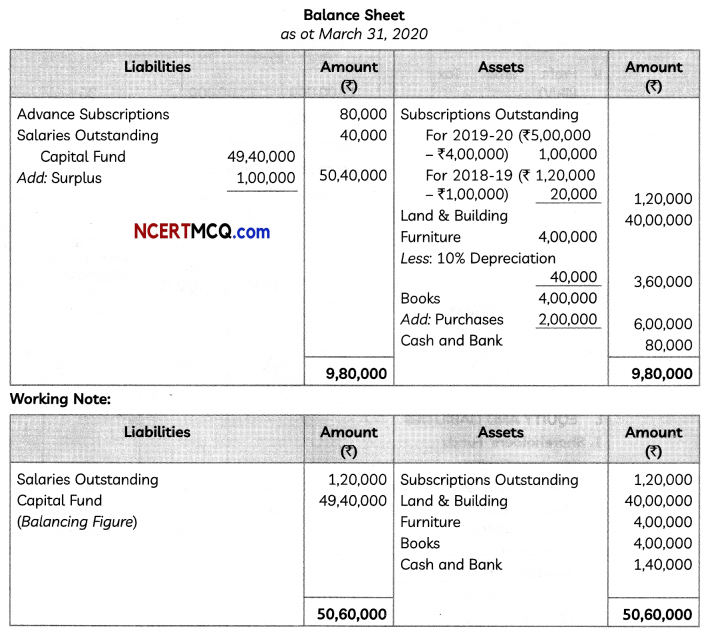

From the following Receipts and Payments Account of Harvinder Social Club and the information supplied, prepare Income and Expenditure Account for the year ended 31st March 2020 and Balance Sheet as at that date:

Receipts and Payments Account

Additional Information:

(i) The club has 500 members each paying an annual subscription of ₹ 1,000. Subscriptions Outstanding on 31st March 2019 were ₹ 1,20,000.

(ii) On 31st March 2020, Salaries Outstanding amounted to ₹ 40,000. Salaries paid in the year ended 31st March 2020 included ₹ 1,20,000 for the year ended 31st March 2019.

(iii) On 1st April, 2019, the club owned Land & Building valued at ₹ 40,00,000; Furniture ₹ 4,00,000 and Books ₹ 4,00,000.

(iv) Provide depreciation on Furniture at 10%. (5)

Answer:

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State which of the following transactions will result in inflow, outflow or no flow of Cash and Cash Equivalents:

(A) Sale of Marketable Securities for cash at par.

(B) Declaration of Final Dividend ₹ 50,000. (3)

Answer:

(A) Sale of Marketable Securities for cash at par will result in no flow of Cash and Cash Equivalents.

(B) Declaration of Final Dividend ₹ 50,000 wilt result in no flow of Cash and Cash Equivalents.

![]()

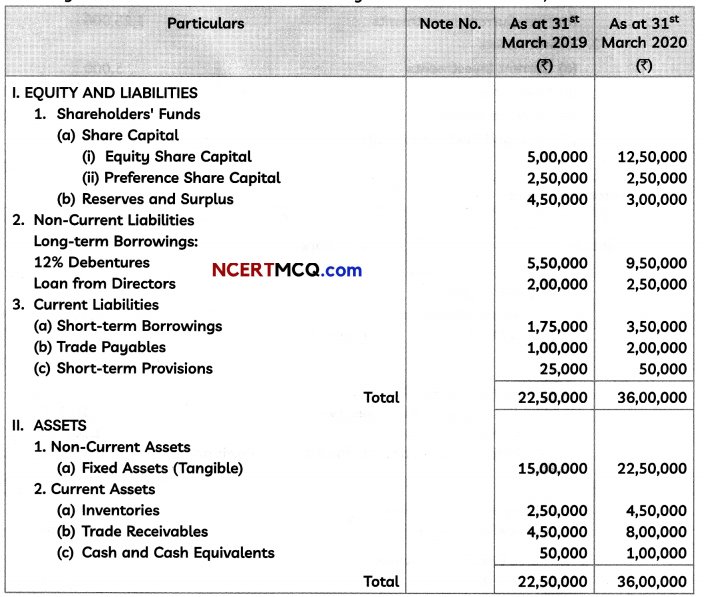

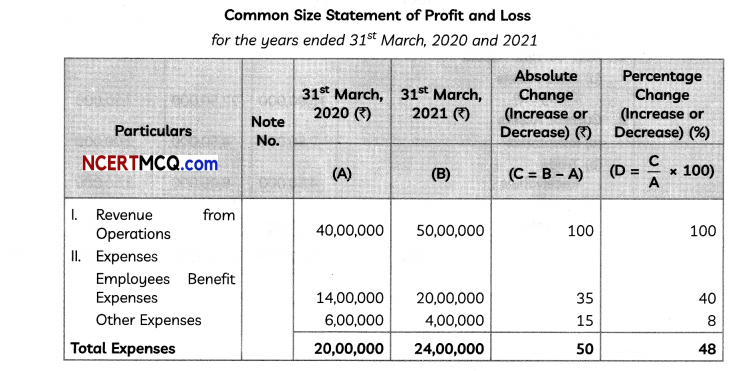

Question 11.

From the following information provided of Star Ltd., for the year ended 31st March 2020 and

Following is the Balance Sheet of Sumona Trading Limited as at 31st March 2019 and 2020:

| Particulars | 2020-21 | 2019-20 |

| Revenue from Operations | ₹ 50,00,000 | ₹ 40,00,000 |

| Employee Benefit Expenses | ₹ 20,00,000 | ₹ 14,00,000 |

| Other Expenses | ₹ 4,00,000 | ₹ 6,00,000 |

| Tax Rate | 40% | 40% |

OR

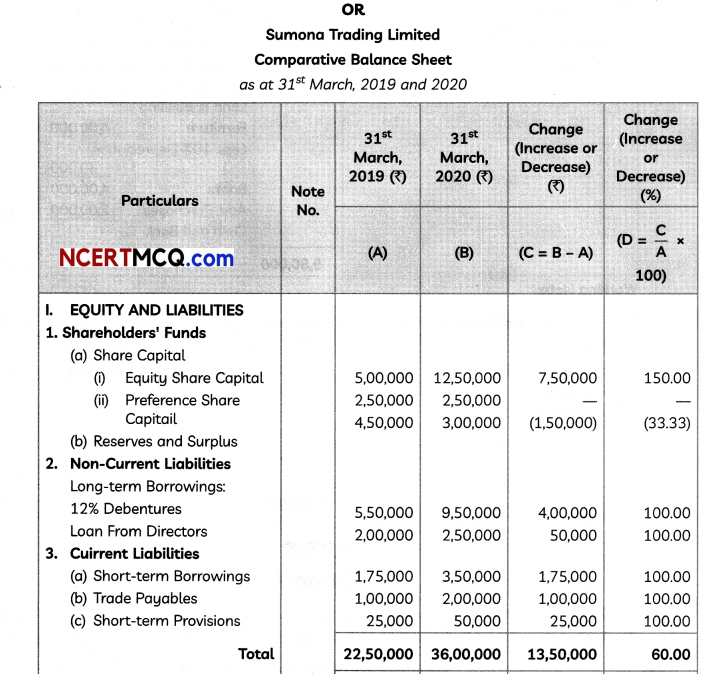

Following is the Balance Sheet of Surnona Trading Limited os oct 31 March 2019 and 2020:

You are required to prepare Comparative Balance Sheet of Sumona Trading Limited as at 31st March 2019 and 2020. (3)

Answer:

Question 12.

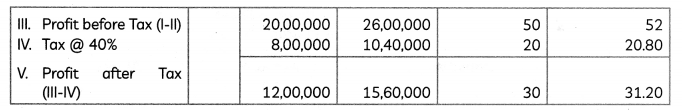

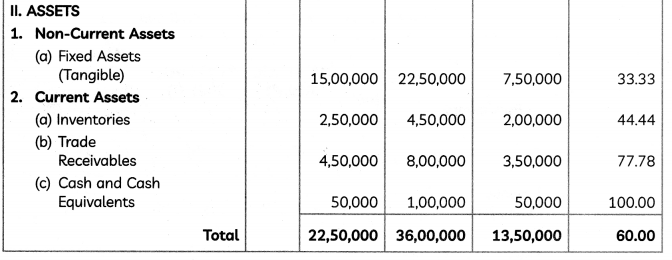

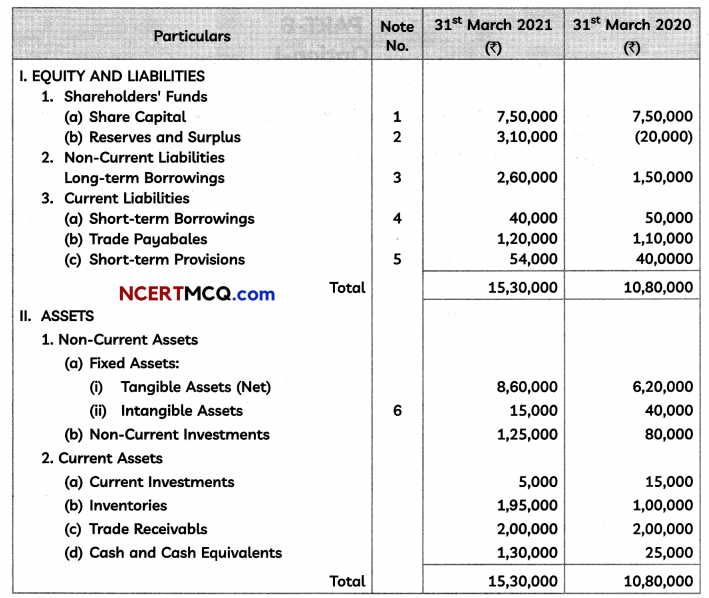

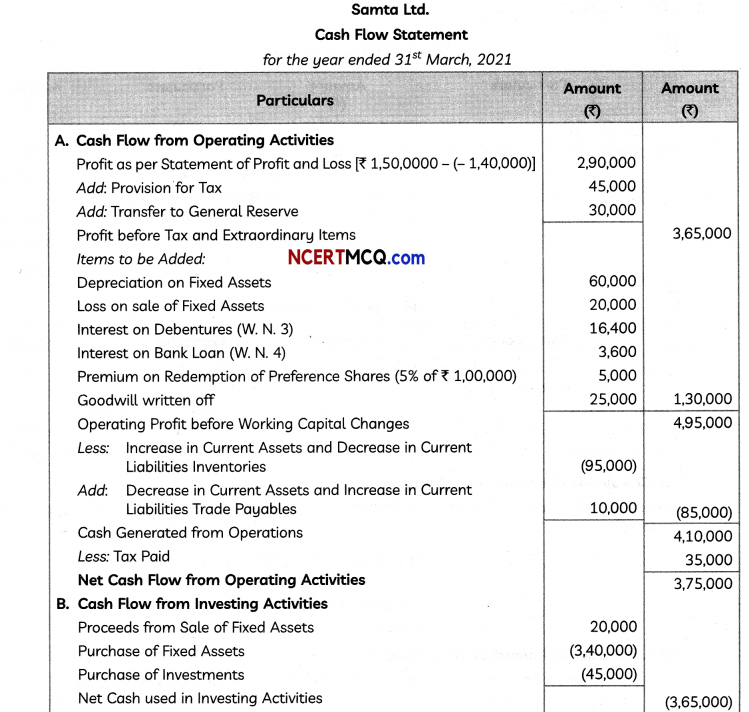

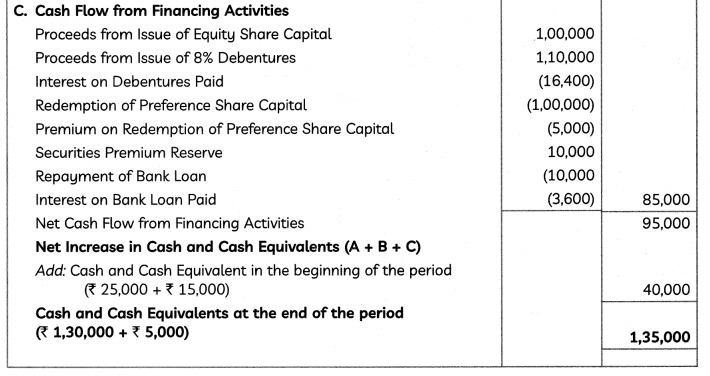

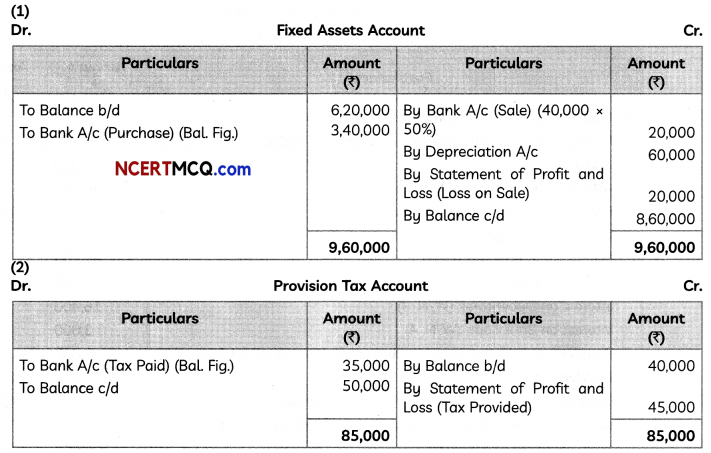

From the following Balance Sheet of Samta Ltd., as at 31st March 2021, prepare Cash Flow Statement for the year ended 31st March 2021:

Additional Information:

(i) During the year a piece of machinery costing ₹ 60,000 on which depreciation charged was ₹ 20,000 was sold at 50% of its book value.

Depreciation provided on tangible assets ₹ 60,000.

(ii) Income tax of ₹ 45,000 was provided.

(iii) Additional Debentures were issued at par on 1st October 2020 and Bank Loan was repaid on the same date.

(iv) At the end of the year, Preference Shares were redeemed at a premium of 5%. (5)

Answer:

(3) CaLcuLation of Interest on Debentures

Interest on Debentures = On ₹ 1,50000 @ 8% for 12 months + On ₹ (2.60,000 – 1,50,000) @ 8% for 6 months

= \(\left(₹ 1,50,000 \times \frac{8}{100}\right)+\left(₹ 1,10,000 \times \frac{8}{100} \times \frac{6}{12}\right)\)

= ₹ 12.000 + ₹ 4,400

= ₹ 16,400.

(4) Calculation of Interest on Bank Loan:

Interest on Bank Loan = On ₹ 50,000 @ 8% for 6 months + On ₹ 40,000 @ 8% for 6 months

= \(\left(₹ 50,000 \times \frac{8}{100} \times \frac{6}{12}\right)+\left(₹ 40,000 \times \frac{8}{100} \times \frac{6}{12}\right)\)

= ₹ 2,000 + ₹ 1,600

= ₹ 3,600