Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 3 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 4 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms, and Companies)

Question 1.

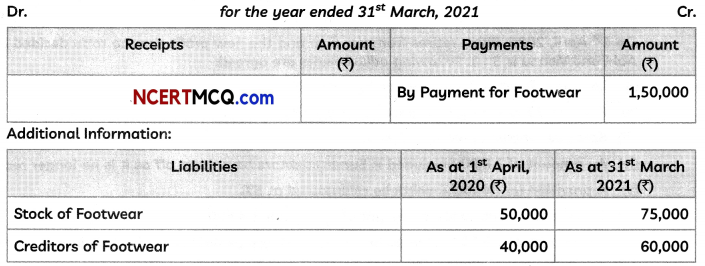

How are the following dealt with while preparing Income and Expenditure Account for the year ended 31st March 2021? (2)

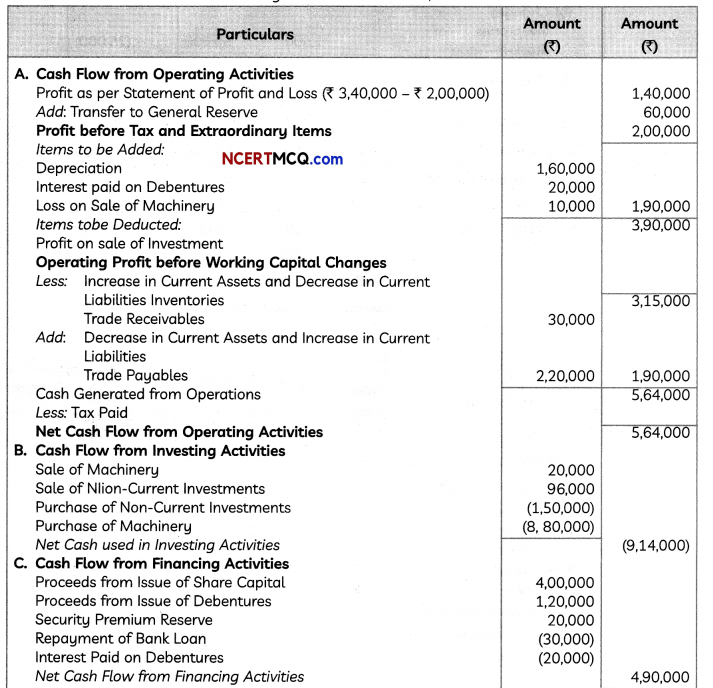

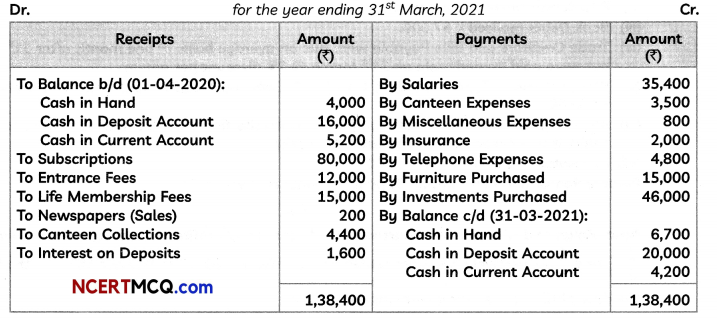

Receipts and Payments Account (An Extract)

Answer:

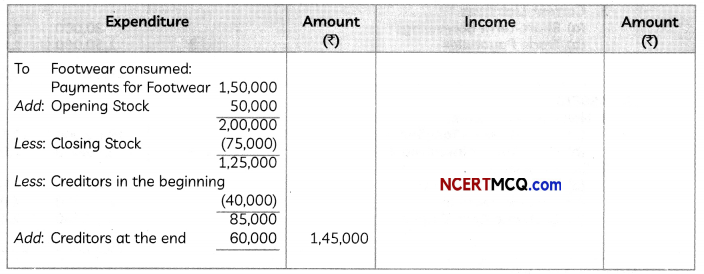

Income and Expenditure Account (An Extract) For the year ended 31st March, 2021

Question 2.

Differentiate between ‘Dissolution of Partnership’ and ‘Dissolution of Partnership Firm’ on the basis of:

(A) Court’s intervention

(B) Closure of Books (2)

Answer:

Difference between Dissolution of Partnership and Dissolution of Partnership Firm

| Basis of Difference | Dissolution of Partnership | Dissolution of Partnership Firm |

| (A) Court’s Intervention | There is no intervention by the court. | Dissolution of partnership firm may be done with the given permission of court. |

| (B) Closure of Books | Books of accounts are not closed. It is continued by the remaining partners. | Books of accounts are dosed, as the business is discontinued. |

Question 3.

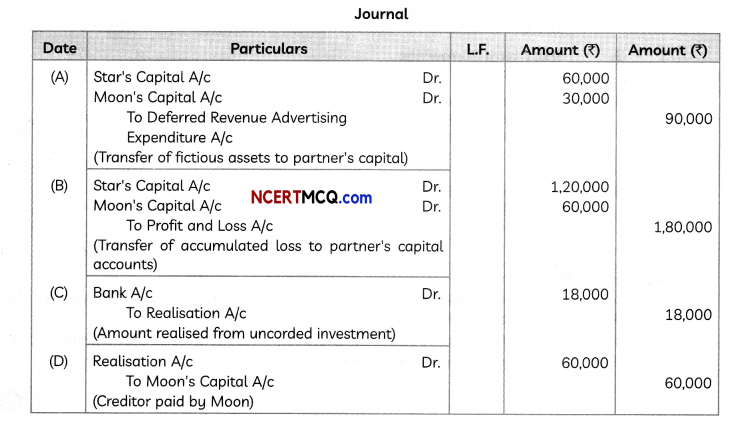

Star and Moon are two partners sharing profits in the ratio of 2 :1. Give the journal entry at the time of dissolution in the following cases.

(A) Deferred revenue advertising expenditure appered at ₹ 90,000

(B) Profit and Loss A/c was appearing on the assets side of balance sheet at ₹ 1,80,000.

(C) An unrecorded investment realized at ₹ 18,000.

(D) Partner moon paid to a creditor ₹ 60,000 (2)

Answer:

![]()

Question 4.

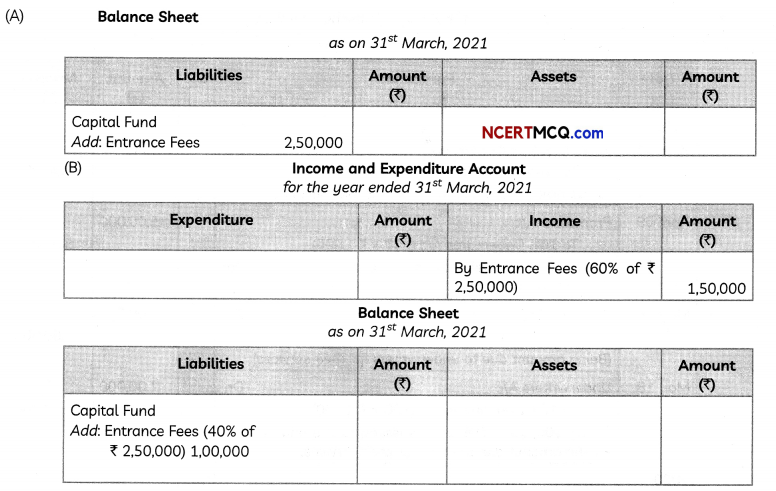

How will you deal with the Entrance Fees while preparing the final accounts for the year ended 31st March, 2021, in each of the following cases:

(A) During the year 2020-21, Entrance Fees received ₹ 2,50,000. It is the policy of the club to treat the Entrance Fees as capital receipts.

(B) During the year 2020-21, Entrance Fees received ₹ 2,50,000. According to the policy of the club, 40% of the Entrance Fees is to be capitalized.

OR

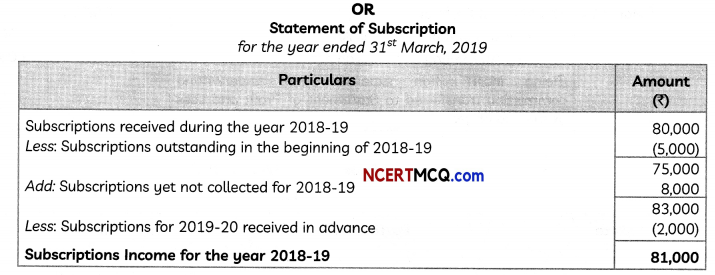

From the following information provided by Moonlight Club, calculate the amount of subscriptions which will be treated as income for the year ended 31st March 2019:

(i) Subscriptions received during the year ended 31st March, 2019 amounted to ₹ 80,000.

(ii) Subscriptions outstanding in the beginning of the year ended 31st March 2019 amounted to ₹ 5,000.

(iii) Subscriptions not yet collected for the year ended 31st March 2019 amounted to ₹ 8,000.

(iv) Subscriptions received in advance for the year ended 31st March, 2020 amounted to ₹ 2,000. (3)

Answer:

Question 5.

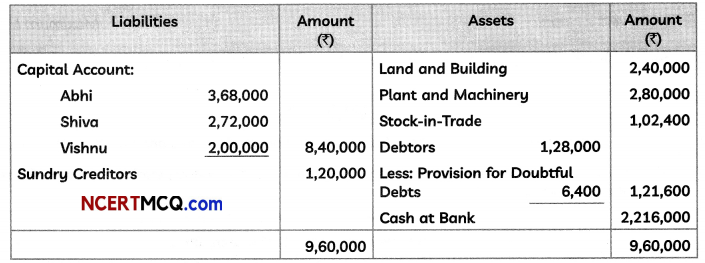

In a partnership firm, Abhi, Shiva, and Vishnu were partners sharing profits and losses is the ratio of 5 :3: 2. The balance sheet of the firm as at 31st March 2020 is as under:

On 1st April 2020, Shiva retires from the firm and the new profit sharing ratio decided between Abhi and Vishnu is 3 :1. Following adjustments are agreed:

(i) Land and Building be written up by ₹ 88,000.

(ii) Plant and Machinery be reduced by ₹ 88,000.

(iii) Stock be written down by ₹ 8,440.

(iv) An amount of ₹ 8,800 included is Sundry debtors be written off as it is no longer receivable.

(v) A provision for doubtful debts be maintained at 5%.

(vi) There was an outstanding amount of Repairs of ₹ 4,800.

(vii) An amount of ₹ 5,600 included in sundry creditors be written back as no longer payable,

(viii) An old furniture written-afF previously was sold for ₹ 16,000 as scrap.

You are required to prepare the Revaluation Account of the firm, to give effect to the above adjustment. (3)

Answer:

Question 6.

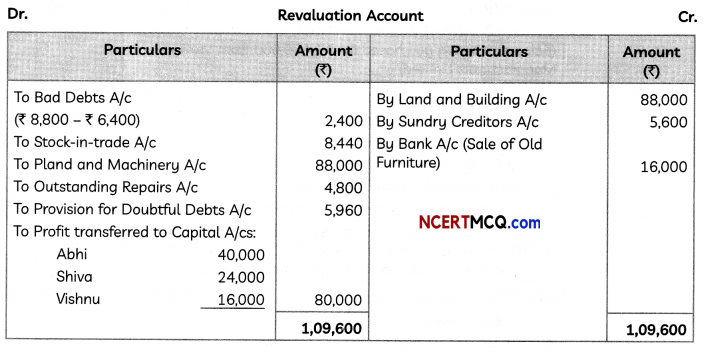

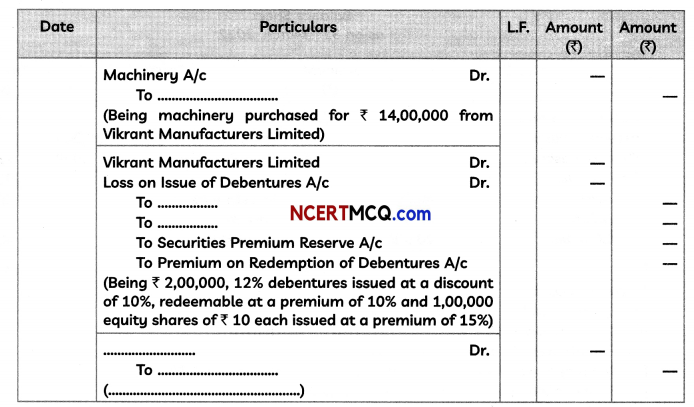

On 9th April, 2021, Sunshine Ltd. issued 500, 10% Debentures of ₹ 1,000 each credited as fully paid-up to the promoters for their services to incorporate the company. On 18th May, 2021, the company issued 100, 10% Debentures of ₹ 1,000 each credited as fully paid-up to the underwriters towards their commission.

Pass necessary journal entries in the books of the company.

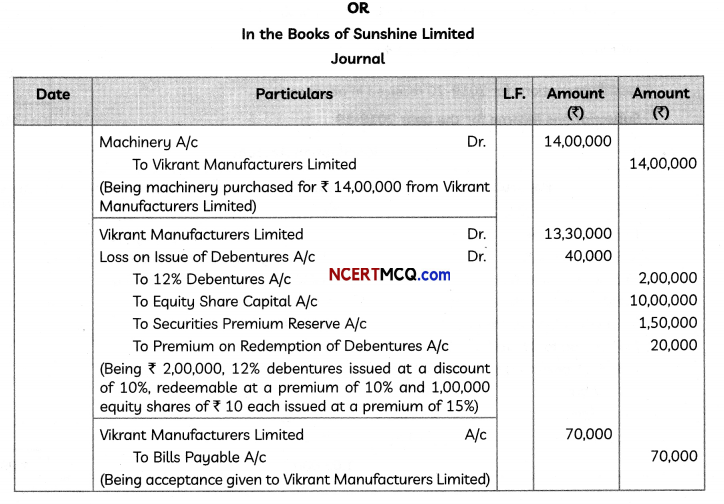

OR

Suhana Limited purchased machinery from Vikrant Manufacturers Limited. The company paid the vendors by issue of some equity shares and debentures and the balance through Bill payable on acceptance in their favour payable after three months. The accountant of the company, while journalizing the above-mentioned transactions left some items blank. You are required to fill in the blanks. (3)

Answer:

![]()

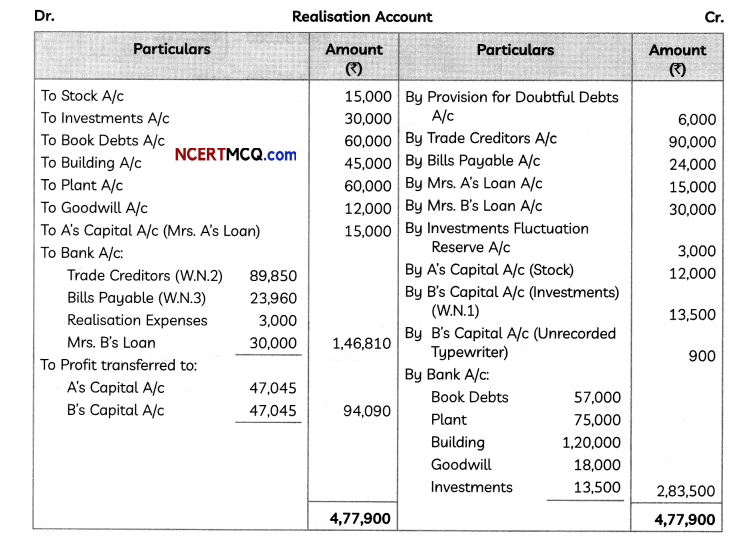

Question 7.

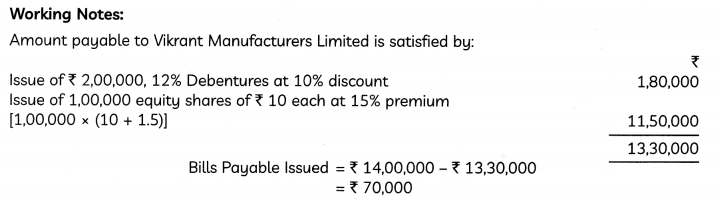

Following is the Balance Sheet of A and B as at 31st March, 2021:

The firm was dissolved on the above date under the following arrangement:

(i) A promised to pay off Mrs. A’s Loan and took Stock at ₹ 12,000.

(ii) B took half the Investments @ 10% discount.

(iii) Book Debts realised ₹ 57,000.

(iv) Trade Creditors and Bills Payable were due on average basis of one month after 31st March, but were paid immediately on 31st March @ 2% discount per annum.

(v) Plant realised ₹ 75,000; Building ₹ 1,20,000; Goodwill ₹ 18,000 and remaining Investments ₹ 13,500.

(vi) An old typewriter, written off completely from the firm’s books, now estimated to realise f 900. It was taken by B at this estimated price.

(vii) Realisation expenses were ₹ 3,000.

Prepare Realisation Account and Capital Accounts of Partners.

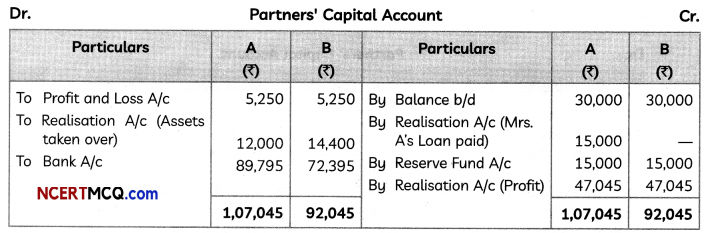

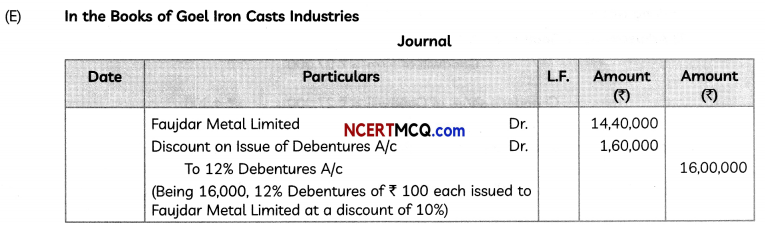

OR

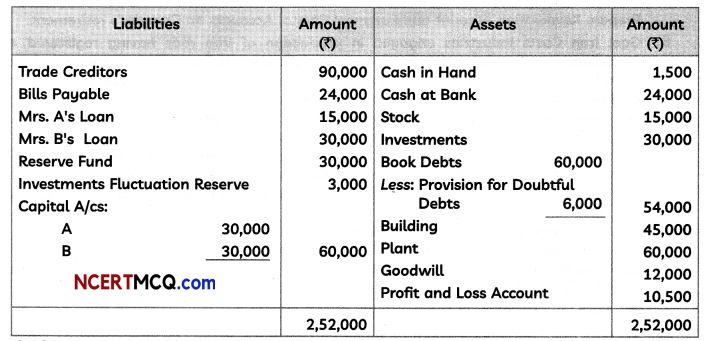

Amit, Balan and Chander were partners in a firm sharing profits and losses in the proportion of \(\frac{1}{2}, \frac{1}{3} \text { and } \frac{1}{6}\) respectively. Chander retired on 31st March 2022. The Balance Sheet of the firm on the date of Chander’s retirement was as follows:

Balance Sheet

as on 31st March 2022

It was agreed that:

(i) Goodwill will be valued at ₹ 27,000.

(ii) Depreciation of 10% was to be provided on Machinery.

(iii) Patents were to be reduced by 20%.

(iv) Liability on account of Provident Fund was estimated at ₹ 2,400.

(v) Chander took over Investments for ₹ 15,800.

(vi) Amit and Balan decided to adjust their capitals in proportion of their profit sharing ratio by opening Current Accounts.

Prepare Revaluation Account and Partners’ Capital Accounts on Chander’s retirement. (5)

Answer:

Working Notes:

(1) Value of Investments taken over by B:

Book Value of Investments taken over by B = 50% of Total Investments

= \(\frac{50}{100} \times ₹ 30,000\)

= ₹ 15,000

Value of Investments taken over by B = Book Value of Investments taken over x \(\frac{90}{100}\)

=15,000x \(\frac{90}{100}\)

= ₹ 13,500

[Since Investment is taken over by B at a discount of 10%]

(2) Calculation of Amount paid to Creditors:

Amount paid to Creditors = Amount to be paid to Credftors – 2% Discount for 1 month

= ₹ 90,000- \(\left(₹ 90,000 \times \frac{2}{100} \times \frac{1}{12}\right)\)

= ₹ 90.000 – ₹ 150

= ₹ 89,850

(3) Calculation of Amount paid to BillS Payable:

Amount paid to Bills Pagable = Amount to be paid to Bills Payable – 2% Discount for 1 month

= ₹ 24,000 – \(\left(₹ 24,000 \times \frac{2}{100} \times \frac{1}{12}\right)\)

= ₹ 24,000 – ₹ 4O

= ₹ 23,960

Working Notes:

(1) Adjustment of Goodwill:

Goodwill of Firm = ₹ 27,000

Chander’s share of Goodwill = ₹ 27,000 x \(\frac{1}{6}\) = ₹ 4,500

which will be compensated by Amit and Balan in their Gaining Ratio. i.e, 3 : 2

Amit will compensate = ₹ 4,500 x \(\frac{3}{5}\) = ₹ 2,700

Balan wilL compensate = ₹ 4,500 x \(\frac{2}{5} \) = ₹ 1,800

(2) Adjustment of CapitoL:

Adjusted Old Capitol of Amit = ₹ 40,000 + ₹ 300 + ₹ 4, 500 – ₹ 2,700

= ₹ 42,100

Adjusted Old Capital of Batan = ₹ 36,500 + ₹ 200 + ₹ 3,000 — ₹ 1,800

= ₹ 37,900

Total Adjusted Capital of Amit and Batan = ₹ 42,100 + ₹ 37,900 = ₹ 80,000

New Profit Shoring Ratio of Amit and Batan = 3: 2

Amit’s New Capital = ₹ 80,000 x \(\frac{3}{5}\) = ₹ 48,000

BaLan’s New Capital = ₹ 80,000 x \(\frac{2}{5}\) = ₹ 32,000

Note: Since, here no information is given regarding the share acquired by Amit and Batan, therefore, their gaining ratio is same as their new profit sharing ratio, i.e 3: 2

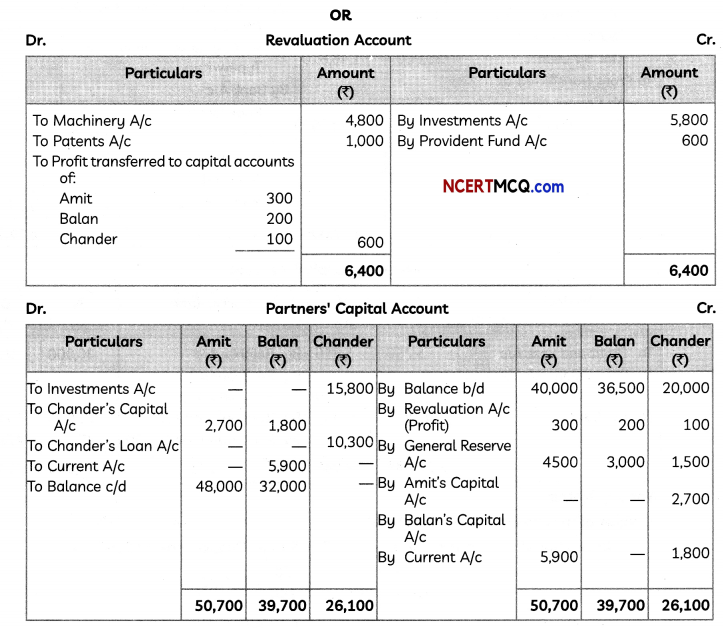

Question 8.

Goel Iron Casts Industries engaged in production of Iron rods having registered office in Chandigarh was incorporated on 1st April 2016. To expand their business, company purchased a Plant from Faujdar Metal Limited to increase the production of iron rods. Goel Iron Casts Industries paid the amount to Faujdar Metal Limited as follows:

(i) By issuing 16,000,12% Debentures of ₹ 100 each at a discount of 10%.

(ii) By issuing 80,000, Equity Shares of ₹ 100 each at a premium of 10%.

(iii) Balance by accepting a bill of exchange of ₹ 4,00,000 payable after two months.

You are required to answer the following questions:

(A) Calculate the amount Goel Iron Casts Industries paid to Faujdar Metal Limited by issuing 12% Debentures.

(B) Calculate the purchase price of Plant.

(C) Calculate the amount of annual fixed obligation associated with debentures.

(D) Pass journal entry which will be passed at the time of purchase of Plant in the books of Goel Iron Casts Industries.

(E) Pass journal entry for the allotment of debentures. (5)

Answer:

(A) Amount Paid to Faujdar Metal limited by Issue of 12% Debentures

= 16,000 x [₹ 100 – (10% of ₹ 100)]

= 16,000 x ₹ 90 = ₹ 14,40,000

(B) Purchase Price of Plant = Amount Paid by Issue of Debentures + Amount Paid by Issue of Equity

Shares + Amount Paid by Bill of Exchange

= {16.000 x [₹ 100 – (10% of ₹ 100)J} + { 80,000 x [₹ 100 + (10% of ₹ 100)1} + ₹ 4,00,000

= (16.000 x ₹ 90) + (80,000 x ₹ 110) +₹ 4,00,000

= ₹ 14,40,000 +₹ 88,00.000 + ₹ 4,00,000

= ₹ 1,06,40,000

(C) Interest on 12% Debentures = ₹ 16,00,000 x \(\frac{12}{100}\) =₹ 1,92,000

(D) In the Books of Goel Iron Casts Industries Journal

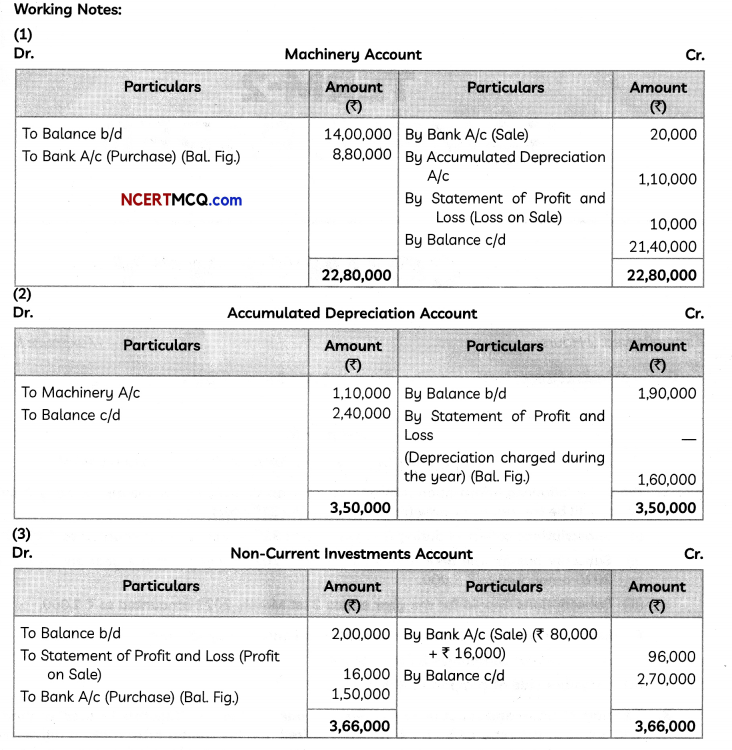

Question 9.

Receipts and Payments Account of Sunderban Society Club for the year ended 31st March 2021 is as follows:

Receipts and Payments Account

Additional Information:

| Particulars | 31st March 2020 (₹ ) | 31st March 2021 (₹ ) |

| Outstanding Subscriptions | 7,000 | 5,600 |

| Subscriptions Received in Advance | 2,000 | 2,500 |

| Salaries Outstanding | 1,200 | 1,800 |

| Furniture | 10,000 | – |

| Sports Equipment | 20,000 | – |

Depreciate furniture by 20% and Sports Equipment by 30%.

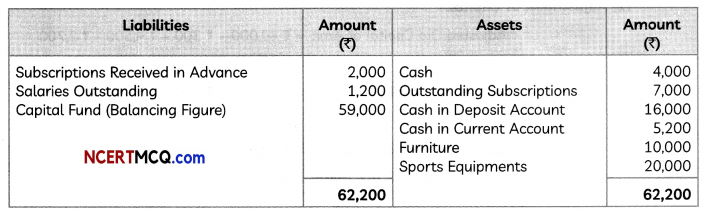

You are required to prepare an Income and Expenditure Account for the year ended 31st March, 2021 and ascertain the Capital Fund on 31st March, 2020. (5)

Answer:

In the Books of Sunderban Society Club

Balance Sheet

as on 31st March. 2020

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State which of the following transactions would result in inflow, outflow or no flow of Cash and Cash Equivalents:

(A) Decrease in Cash Credit.

(B) Sale of Current Investments. (2)

Answer:

(A) Decrease in Cash Credit wilt results in outflow of Cash and Cash Equivalents.

(B) Sale of Current Investments wilt result in no fLow of Cash and Cash Equivalents.

Question 11.

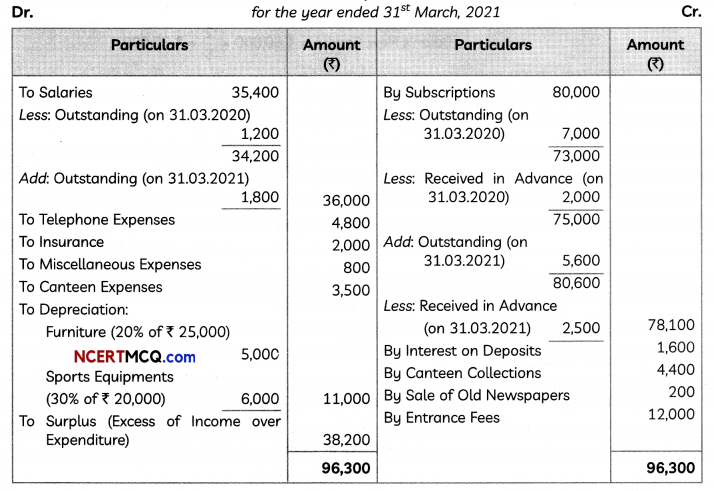

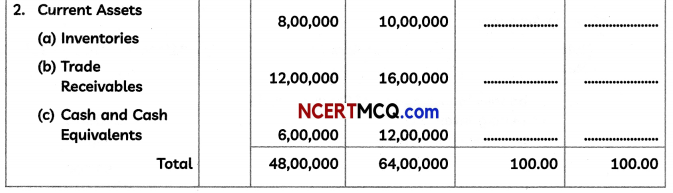

From the following Statement of Profit and Loss of Gokulnath Traders Limited as at 31st March 2020 and 2021, you are required to prepare Comparative Statement of Profit and Loss as at 31st March 2020 and 2021:

OR

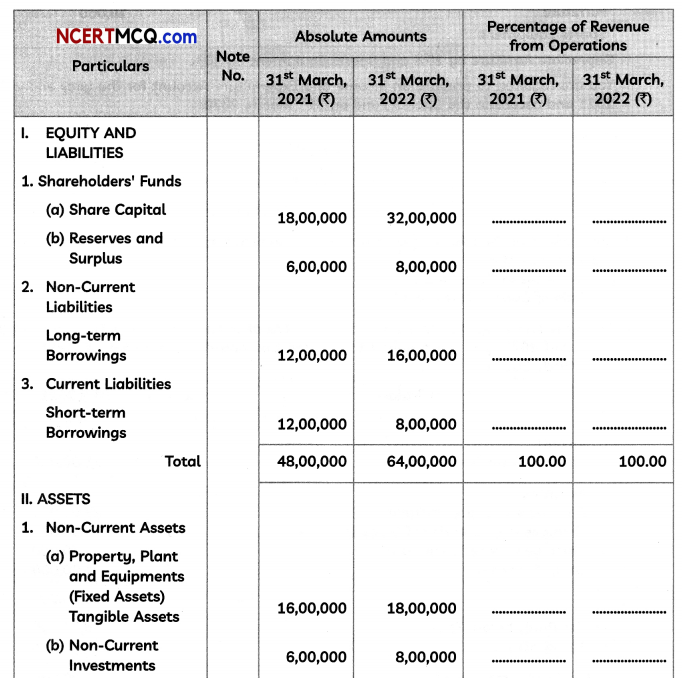

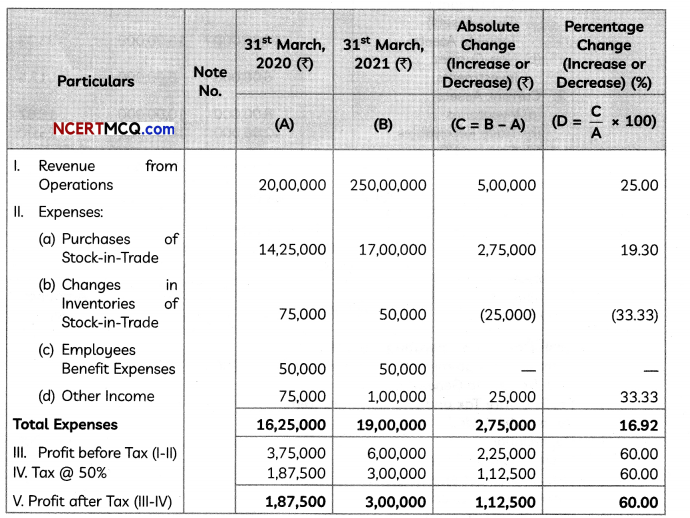

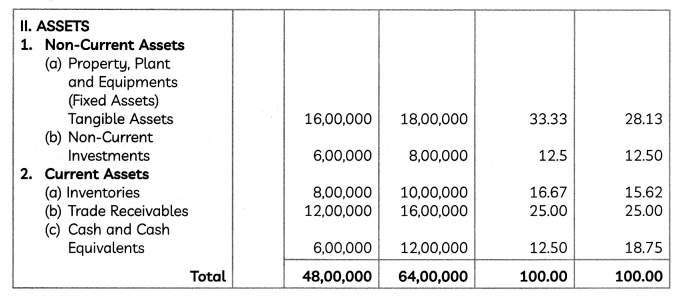

You are provided with the Common Size Balance Sheet of Sushiksha Limited as at 31st March, 2022 with missing information. You are required to fill in the blanks:

In the Books of Sushiksha Limited

Common Size Balance Sheet

as at 31st March 2022 (3)

Answer:

Gotuknath Traders limited

Comparative Statement of Profit and Loss

for the years ended 31 March 2020 and 2021

OR

In the Books of Sushikshci Limited

Common Size BaLance Sheet

as at 31 March 2022

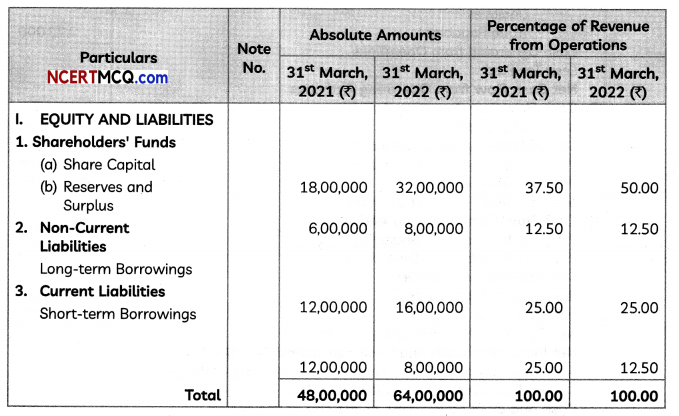

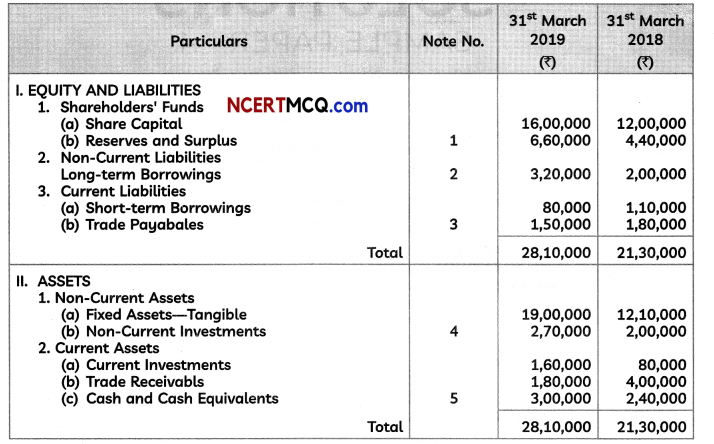

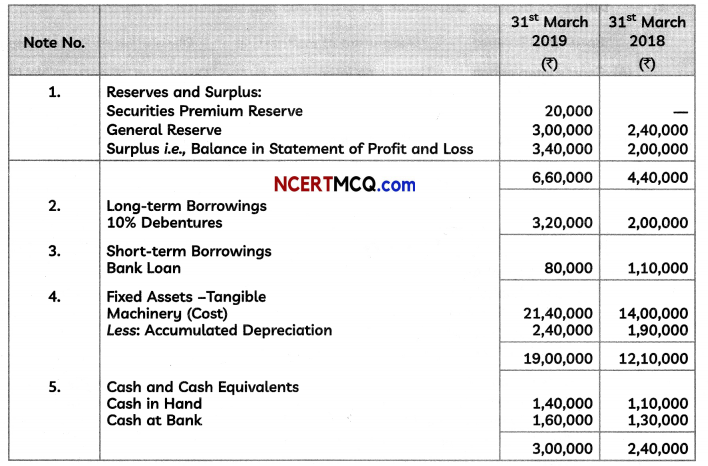

Question 12.

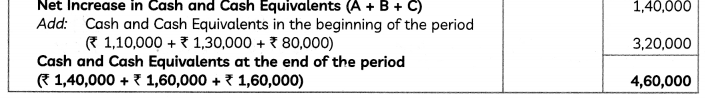

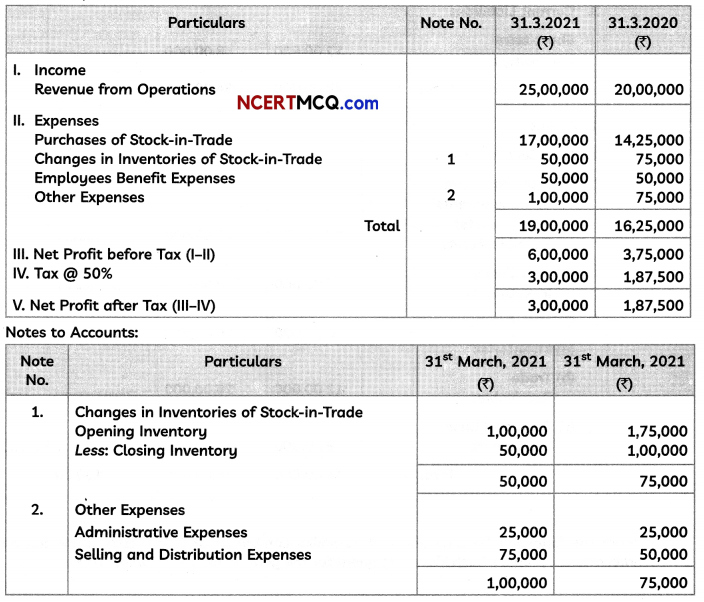

From the following Balance Sheet of Tamalika Limited as at 31st March 2019 and additional information, prepare Cash Flow Statement for the year ended 31st March 2019:

Statement of Profit and Loss

for the year ended 31st March 2019

Notes to Accounts:

Additional Information:

(i) During the year, Machinery costing ₹ 1,40,000 (accumulated depreciation provided thereon ₹ 1,10,000) was sold for ₹ 20,000.

(ii) During the year, Non-Current Investments costing ₹ 80,000 were sold at a profit of ₹ 16,000.

(iii) Additional debentures were issued on 31st March, 2019. (5)

![]()

Answer:

Tamatikci Limited Cash Flow Statement

for the year ended 31s March, 2021