Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 5 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 5 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

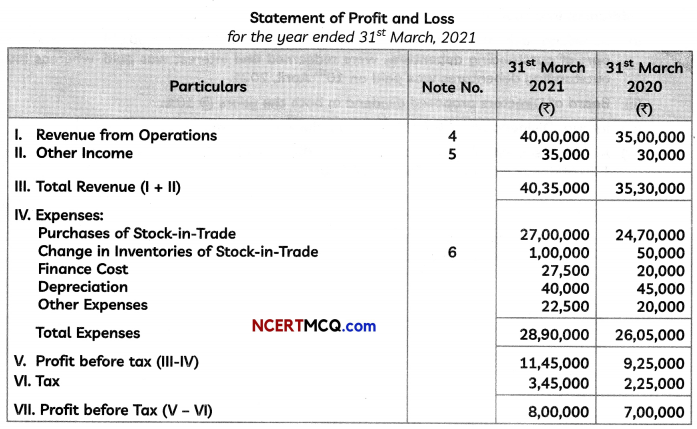

Question 1.

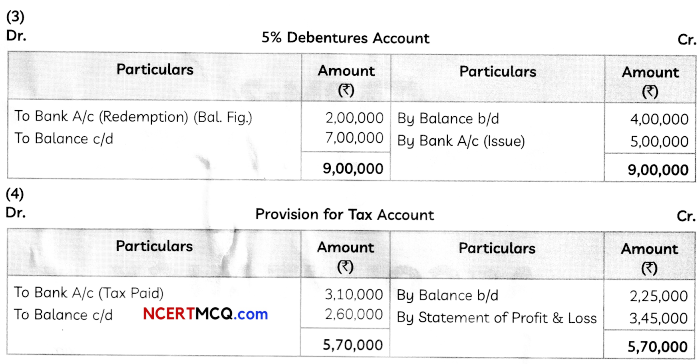

From the following information provided by Reunion Club, calculate the amount of subscriptions which will be treated as income for the year ended 31st March, 2021:

(i) Subscriptions collected during the year ended 31st March, 2021 amounted to ₹ 49,000.

(ii) Subscriptions for the year ended 31st March, 2021 collected in the year ended 31stMarch, 2020 amounted to ₹ 3,000.

(iii) Subscriptions unpaid for the year ended 31st March, 2021 amounted to ₹ 2,000. (2)

Answer:

![]()

Question 2.

On dissolution, how will you deal with Partner’s Loan if it appears on:

(A) Assets side of company’s Balance Sheet

(B) Liabilities side of company’s Balance Sheet (2)

Answer:

(A) If Partner’s Loan appears on the Assets side of the Balance Sheet, it indicates that partner has taken loan from the firm. In that case, at the time of dissolution the amount of loan will be transferred to the concerned Partner’s Capital Account. The following Journal Entry will be passed:

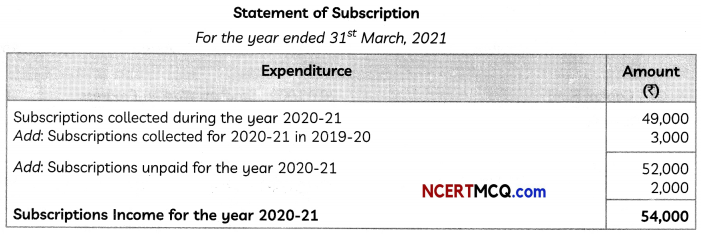

(B) If Partner’s Loan appears on the Liabilities side of the Balance Sheet, it indicates that the respective partner or partners have given loan to the firm. In this case, partner’s loan will be paid off after paying all the external liabilities first. The following accounting entry will be passed:

Question 3.

Tanmay, Gautam and Jagat were partners in a partnership firm ‘Jagatam Limited’ sharing profits and losses in the ratio of 6 : 5 : 4. Gautam retired and his capital after making adjustments on account of reserves, revaluation of assets and reassessment of liabilities stood at ₹ 10,01,600. Tanmay and Jagat agreed to pay him ₹ 11,60,000 in full settlement of his claim.

Pass necessary journal entry for the treatment of goodwill at the time of retirement of Gautam. Also show your workings clearly. (2)

Answer:

Working Notes:

(1) Calculation of Profit Sharing Ratio:

Old Profit Sharing Ratio of Tanmay, Gautam and Jagat = 6 : 5 : 4

New Profit Sharing Ratio and Gaining Ratio of Tanmay and Jagat will be 6 : 4 or 3 : 2, as no information provided of future profit sharing ratio between Tanmay and Jagat.

(2) Calculation of Gautam’s Share of Goodwill:

Gautam’s Share of Goodwill = Amount Paid – Gautam’s Capital after Adjustments

= ₹ 11,60,000 – ₹ 10,01,600

= ₹ 1,58,400

Gautam’s share of goodwill will be compensated by gaining partners, Tanmay and Jagat in their Gaining Ratio, i.e., 3 : 2.

Tanmay Will compansate = ₹ 1,58,400 × \(\frac{3}{5}\) = ₹ 95,040

Jagat Will compansate = ₹ 1,58,400 × \(\frac{2}{5}\) = ₹ 63,360

![]()

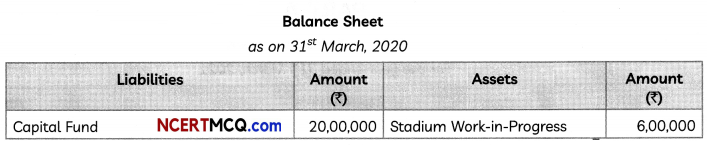

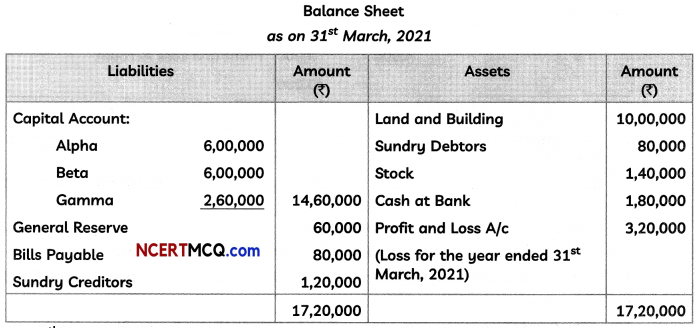

Question 4.

Show how are the following items dealt with while preparing the final accounts of Khadagpur Sports Club for the year ended 31st March, 2020:

Case I:

(i) Expenditure on construction of Stadium is ₹ 6,00,000.

(ii) The construction work is in progress and has not yet completed.

(iii) Capital Fund as at 31st March, 2019 is ₹ 20,00,000.

Case II:

(i) Expenditure on construction of Stadium is ₹ 6,00,000.

(ii) The construction work is in progress and has not yet completed.

(iii) Stadium Fund as at 31st March, 2019 is ₹ 10,00,000.

(iv) Capital Fund as at 31st March, 2019 is ₹ 20,00,000.

OR

How will you treat the following items while preparing Income and Expenditure Account and Balance Sheet of a Not-for-Profit Organisation ?

(A) Donation for Building

(B) Sale of Newspapers

(C) Investment purchased. (3)

Answer:

Case I:

Case II:

OR

(A) Donation for Building: Donation for Building means that the donation received can only be used as a specific donation for building. Specific donation is capitalised and is shown on the Liabilities side of the Balance Sheet of Not-for-Profit Organisation.

(B) Sale of Newspapers: The money paid for newspapers, magazines, periodicals, etc. is a revenue expense and is debited to Income and Expenditure Account. Thus, the amount realised from the sale of newspapers, magazines, periodicals, etc. will be credited to Income and Expenditure Account.

(C) Investment Purchased: Investments purchased are viewed as capital spending and are shown on the Assets side of the Balance Sheet of Not-for-Profit Organisation.

![]()

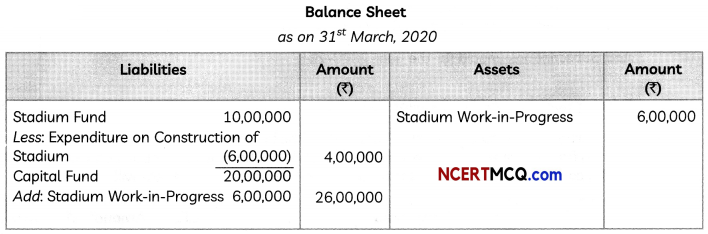

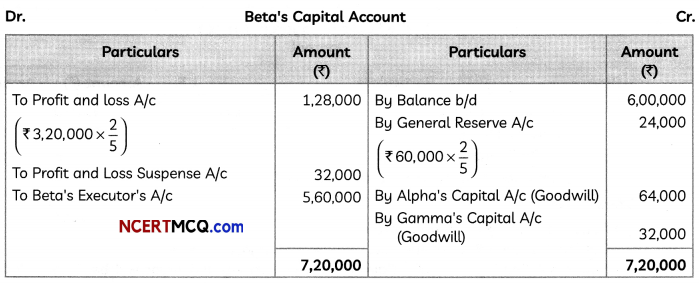

Question 5.

Alpha, Beta and Gamma were partern in a firm sharing profit and losses is the ratio of 2 : 2 : 1. On 31st March, 2021, their Balance Sheet was as follows:

On 30th June, 2021, Beta died. The partnership Deed of the firm provided for the folloiwng on the death of a partner:

(i) Goodwill of the firm was to be calculated on the basis of two times the average profit of he

past five years. The profite for the years ended:

31st March, 2020 – ₹ 1,00,000

31st March, 2019 – ₹ 1,60,000

31st March, 2018 – ₹ 22,20,000

31st March, 2017 – ₹ 2,40,000

(ii) Beta’s share of profit on loss from 1st April, 2021 till he death was to be calculated on the basis of the profit or loss for the year ended 31st March, 2021.

You are required to prepare Beta’s Capital Account at the time of her death to be presented to his executors. (3)

Answer:

Working Notes:

(1) Calculation of Beta’s Share of Goodwill:

Average Profit of 5 years = \(\frac{₹ 1,00,000+₹ 1,60,000+₹ 2,20,000+₹ 4,40,000-₹ 3,20,000}{5}\)

= \(\frac{₹ 6,00,000}{5}\) = ₹ 1,20,000

Goodwill of Firm = Average profit × 2

= ₹ 1,20,000 × 2

= ₹ 2,40,000

Beta’s Share of Goodwill = 22,40,000 × \(\frac{2}{5}\)

= ₹ 96,000

which will be contributed by Alpha and Gamma is their gaining ratio, 2 : 1.

Alpha will contribute = ₹ 96,000 × \(\frac{2}{3}\) = ₹ 64,000

Gamma and contribute = ₹ 96,000 × \(\frac{1}{3}\) = ₹ 32,000

(2) Calculation of Beta’s share of profit or loss upto his date of Death:

Beta’s share of loss upto his Date of Death = 3,20,000 × \(\frac{2}{5} \times \frac{3}{12}\)

= ₹ 32,000

![]()

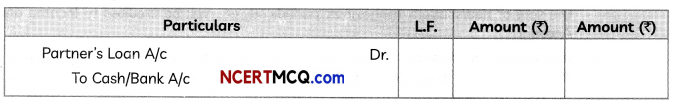

Question 6.

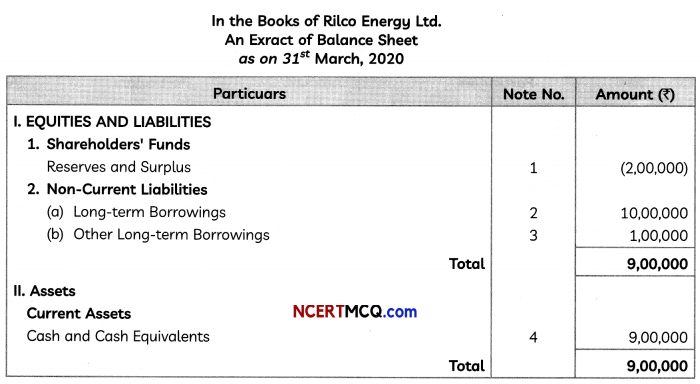

On 1st June, 2019, Rilco Energy Ltd. issued 10,000, 7% Debentures of ₹ 100 each at a discount of 10% redeemable at a premium of 10% at the end of five years. All the debentures were subscribed and allotment was made.

Prepare the Balance Sheet (extract) as at 31st March, 2020.

OR

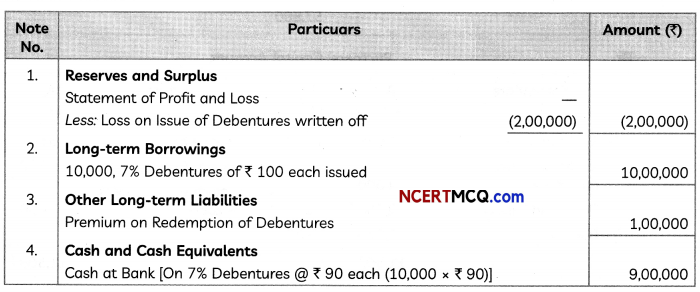

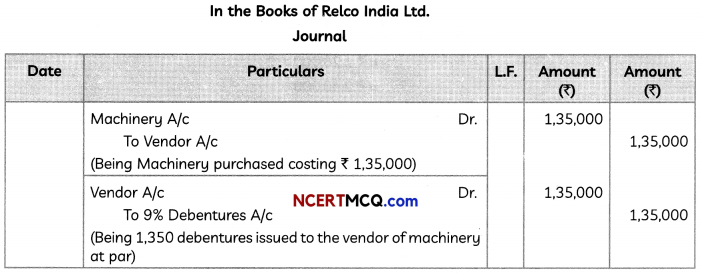

Relco India Ltd. purchased machinery costing ₹ 1,35,000. It was agreed that the purchase consideration be paid by issuing 9% Debentures of ₹ 100 each. Give necessary journal entries if the debentures have been issued:

(A) at par

(B) at a discount of 10%. (3)

Answer:

Notes to Accounts:

OR

Working Note:

= \(\frac{1,35,000}{100-10}\)

= 1,350

![]()

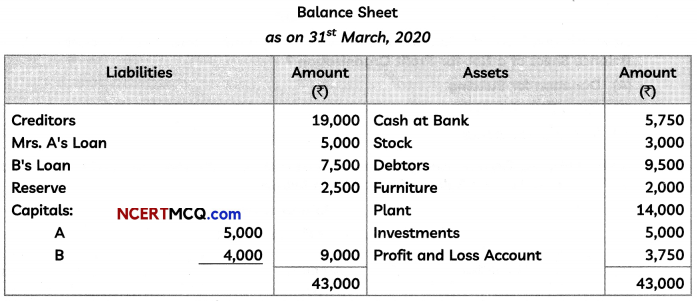

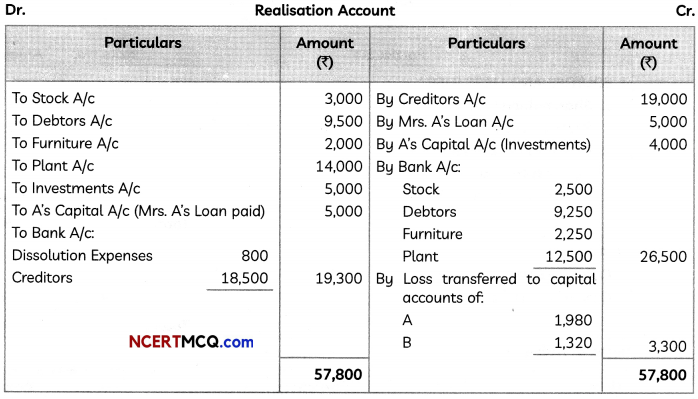

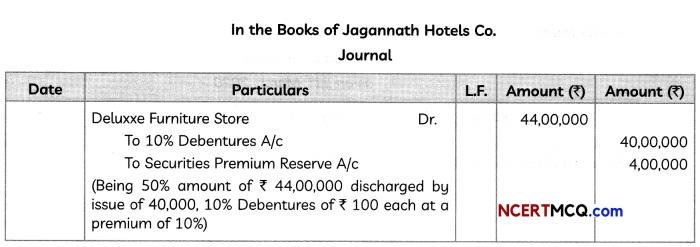

Question 7.

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2020, their Balance Sheet was as follows:

The firm was dissolved on 31st March, 2020 and both the partners agreed to the following:

(i) Investments were taken over by A at an agreed value of ₹ 4,000. He also agreed to settle Mrs. A’s Loan.

(ii) Other assets realised as: Stock – ₹ 2,500; Debtors – ₹ 9,250; Furniture – ₹ 2,250; Plant – ₹ 12,500.

(iii) Expenses of dissolution amounted to ₹ 800.

(iv) Creditors agreed to accept ₹ 18,500 in full settlement of their claim.

You are required to prepare Realisation Account and Partners’ Capital Account of the firm dissolved.

OR

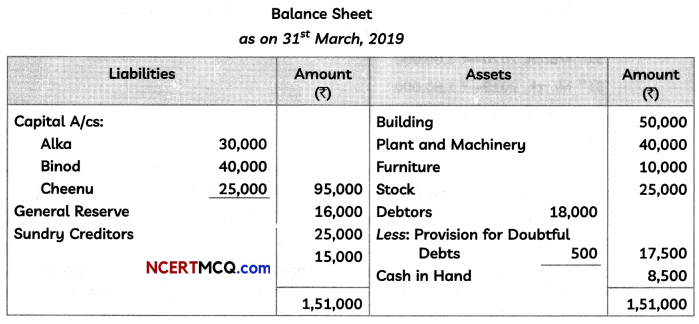

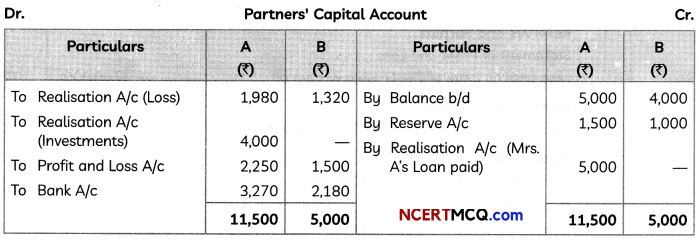

Alka, Binod and Cheenu are partners in a firm ABC Limited, sharing profits and losses as Alka 1/3, Binod 1/2 and Cheenu 1/6 respectively. The Balance Sheet of the firm as on 31st March, 2019 was as follows:

It was agreed that:

(i) Goodwill will be valued at ₹ 27,000.

(ii) Depreciation of 10% was to be provided on Machinery.

(iii) Patents were to be reduced by 20%.

(iv) Liability on account of Provident Fund was estimated at ₹ 2,400.

(v) Chander took over Investments for ₹ 15,800.

(vi) Amit and Balan decided to adjust their capitals in proportion of their profit sharing ratio by opening Current Accounts.

Prepare Revaluation Account and Partners’ Capital Accounts on Chander’s retirement. (5)

Answer:

![]()

OR

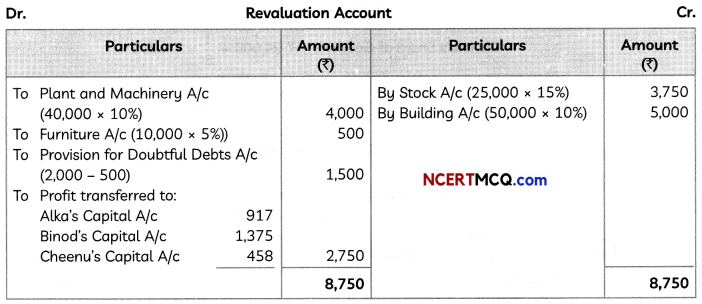

Working Notes:

(1) Calcuation of Gaining Ratio:

Old Radio of Alka,Binod anid Cheenu = \(\frac{1}{3}: \frac{1}{2}: \frac{1}{6}\) or 2 : 3 : 1

Cheenu retires from the firm

New Ratio of Alka and Binod = 3 : 2

Gaining Ratio = New Radio – Old Radio

Alka’s Gain = \(\frac{3}{5}-\frac{2}{6}\) = \(\frac{18-10}{30}\) = \(\frac{8}{30}\) (Gain)

Binod’s Gain = \(\frac{2}{5}-\frac{3}{6}\) = \(\frac{12-15}{30}\) = –\(\frac{3}{30}\) (Sacrifice)

(2) Adjustment of Goodwill:

Goodwill of the Firm = ₹ 24,000

Cheenu’s Share of Goodwill = ₹ 24,000 × \(\frac{1}{6}\) = ₹ 4,000

Alka’s Gain in Goodwill = ₹ 24,000 × \(\frac{8}{30}\) = ₹ 6,400

Binod’s Sacrifice in Goodwill = ₹ 24,000 × \(\frac{3}{30}\) = ₹ 2,400

![]()

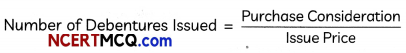

Question 8.

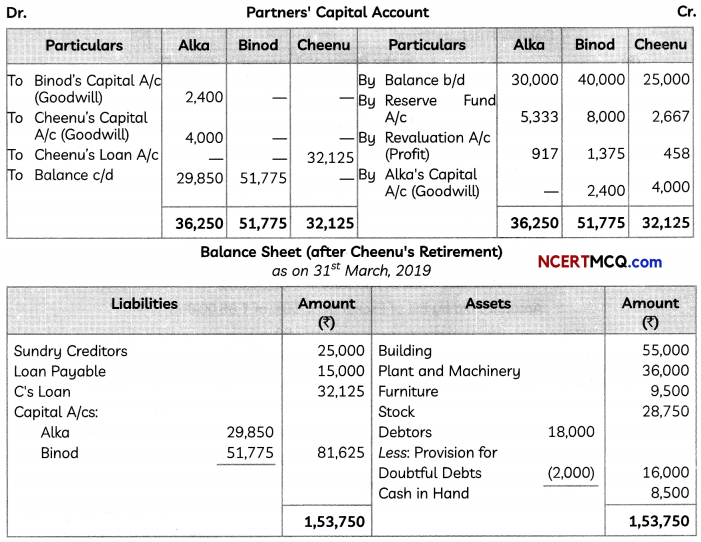

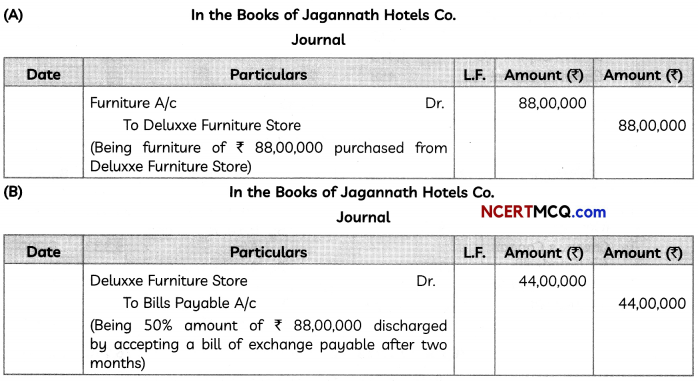

Jagannath Hotels Co. engaged in business of hotels, having chain of hotels in Andhra Pradesh decided to expand their business in other states also. For that the directors of the company decided to start their hotels in nearby states viz. Karnataka, Maharashtra and Goa.

For their underway hotels in Goa, Jagannath Hotels Co. purchased furniture of ₹ 88,00,000 from Deluxxe Furniture Store.

Jagannath Hotels Co. paid 50% of the amount by accepting a bill of exchange in favour of Deluxxe Furniture Store payable after five months. For the balance amount the company issued 10% Debentures of ₹ 100 each at a premium of 10% in favour of Deluxxe Furniture Store.

You are required to answer the following questions:

(A) Pass journal entry which will be passed at the time of purchase of furniture in the books of Jagannath Hotels Co.

(B) Pass journal entry for the payment made through bill of exchange.

(C) Calculate the number of debentures issued to Deluxxe Furniture Store.

(D) Calculate the amount to be transferred to Securities Premium Reserve Account.

(E) Pass journal entry for the allotment of debentures. (5)

Answer:

Working Note:

Purchase Price of Furniture = ₹ 88,00,000

Amount Paid by Bill of Exchange = 50% of ₹ 88,00,000

= \(\frac{50}{100}\) × ₹ 88,00,000 = ₹ 44,00,000

(C) Balance Amount due to Deluxxe Furniture Store = Purchase Price of Furniture – Amount Paid by Bill of Exchange

= ₹ 88,00,000 – (50% of ₹ 88,00,000)

= ₹ 44,00,000

Number of Debentures Issued to Deluxxe Furniture Store

= \(\frac{44,00,000}{₹ 100+(10 \% \text { of } ₹ 100)}\)

= \(\frac{44,00,000}{₹ 110}\) = 40,000

Number of Debentures Issued to Deluxxe Furniture Store = 40,000

Premium per debenture = 10% of ₹ 100 = ₹ 10

(E) Amount transferred to Securities Premium Reserve Account

= Number of Debentures × Premium per debenture = 40,000 × ₹ 10 = ₹ 4,00,000

![]()

(E)

Question 9.

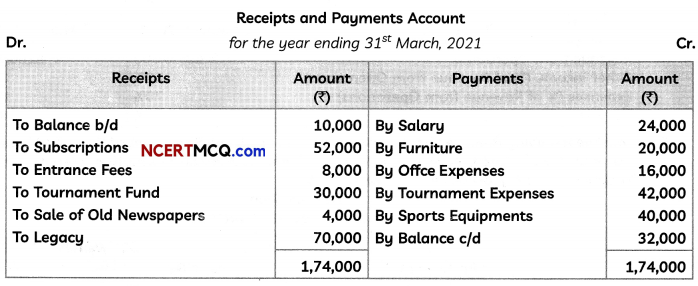

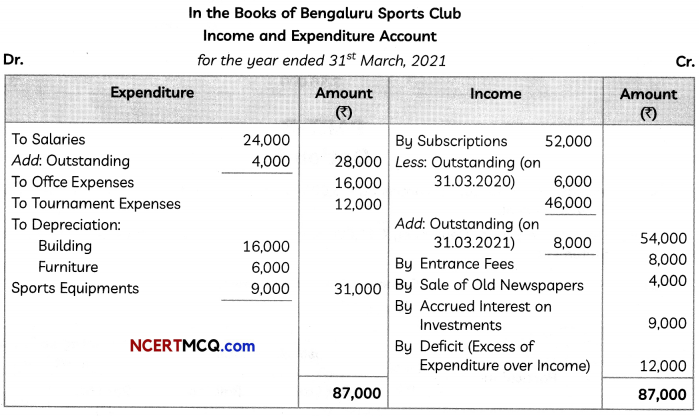

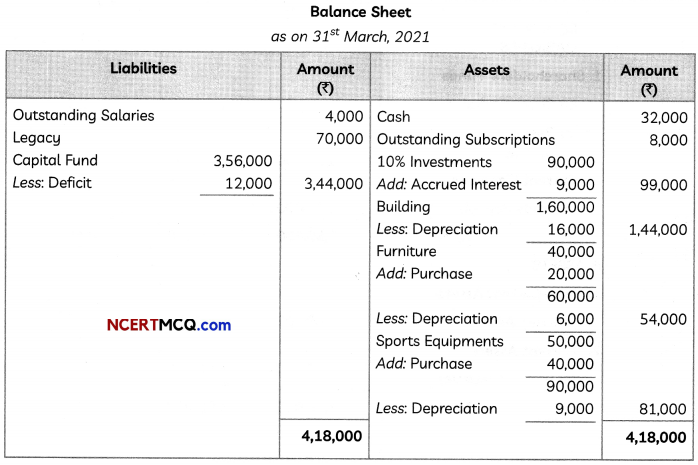

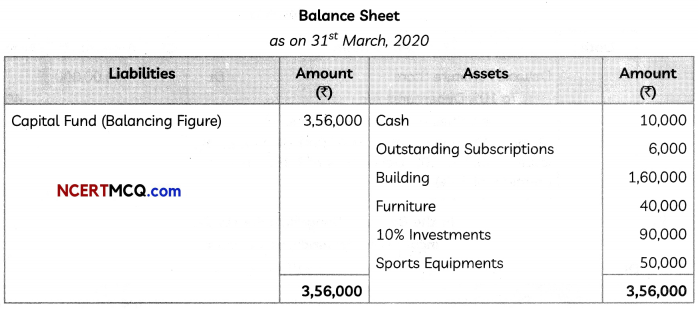

Following is the Receipts and Payments of Bengaluru Sports Club for the year ended 31st March, 2021:

(i) On 31st March, 2020 subscriptions outstanding was ₹ 6,000 and on 31st March, 2021 subscriptions outstanding was ₹ 8,000.

(ii) Salary outstanding on 31st March, 2021 was ₹ 4,000.

(iii) On 1st April, 2020 the club had Building of ₹ 1,60,000, Furniture of ₹ 40,000,10% Investments of ₹ 90,000 and Sports Equipments of ₹ 50,000. Depreciation charged on these items including purchases was 10%.

Prepare Income and Expenditure Account of Bengaluru Sports Club for the year ended 31st March, 2021. Also prepare Balance Sheet of the club as at 31st March, 2021. (5)

Answer:

![]()

Workin Note:

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

State whether the following transactions will result in inflow, outflow or no flow of cash while preparing Cash Flow Statement:

(A) Increase in Marketable Securities by ₹ 5,000.

(B) Decrease in Sundry Debtors by ₹ 15,000. (2)

Answer:

(A) Increase in Marketable Securities by ₹ 5,000 wilL result in no fLow of cash while preparing Cash Flow Statement.

(B) Decrease in Sundry Debtors by ₹ 15,000 will result in inflow of cash while preparing Cash Flow Statement

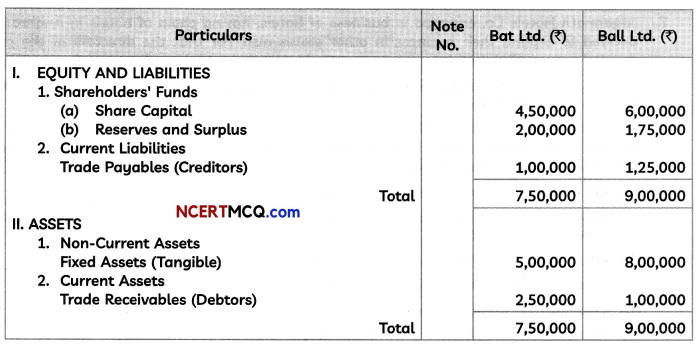

Question 11.

Prepare Common Size Balance Sheet from the Balance Sheets of Bat Ltd. and Ball Ltd. as at 31st March, 2021 are:

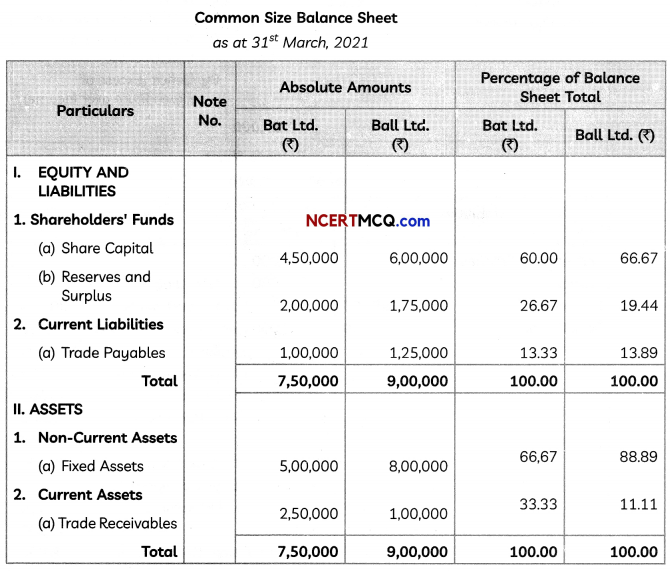

OR

Prepare Comparative Statement of Profit and Loss from the followng figures:

| Particulars | 31st March, 2021 | 31st March, 2020 |

| Revenue from Operations | ₹ 60,00,000 | ₹ 40,00,000 |

| Other Income (% of Revenue from Operations) | 12% | 20% |

| Expenses (% of Revenue from Operations) | 70% | 60% |

| Tax Rate | 40% | 40% |

Answer:

![]()

OR

Working Notes:

(1) Computation of Other Income:

Other Income on 31st March, 2020 = 20% of Revenue from Operations

= 20% of ₹ 40,00,000

= ₹ 8,00,000

Other Income on 31st March, 2021 = 12% of Revenue from Operations

= 12% of ₹ 60,00,000

= ₹ 7,20,000

(2) Computation of Expenses:

Expenses on 31st March, 2020 = 60% of Revenue from Operations

= 60% of ₹ 40,00,000

= ₹ 24,00,000

Expenses on 31st March, 2021 = 70% of Revenue from Operations

= 70% of ₹ 60,00,000

= ₹ 42,00,000

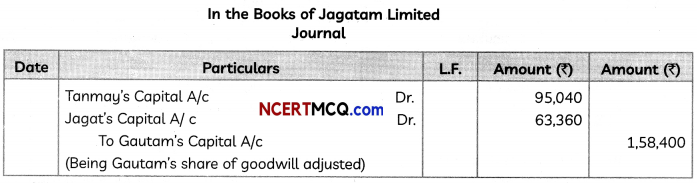

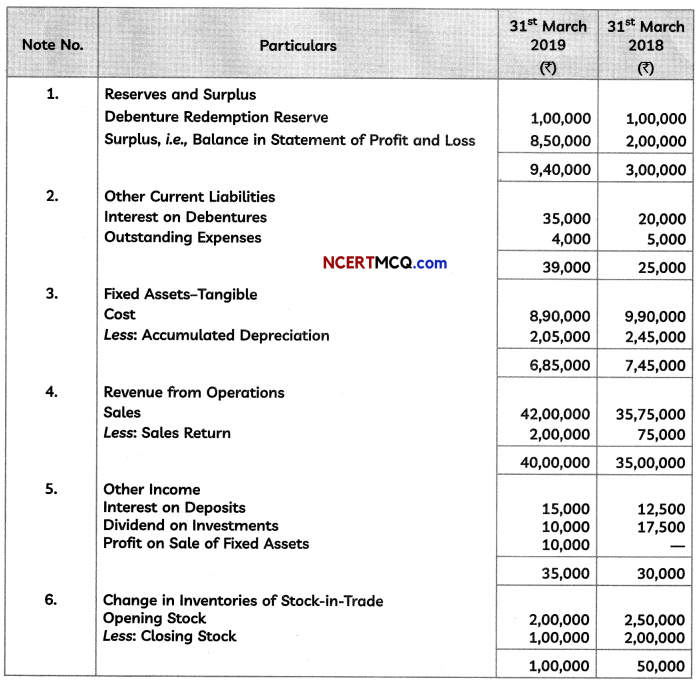

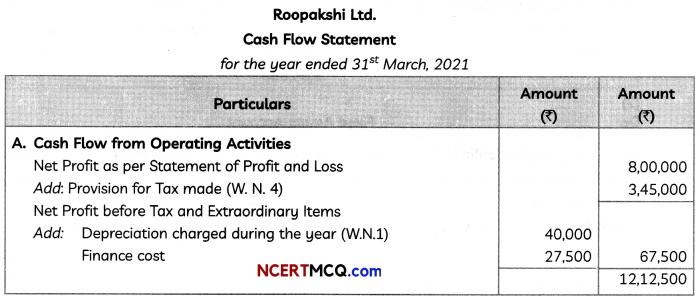

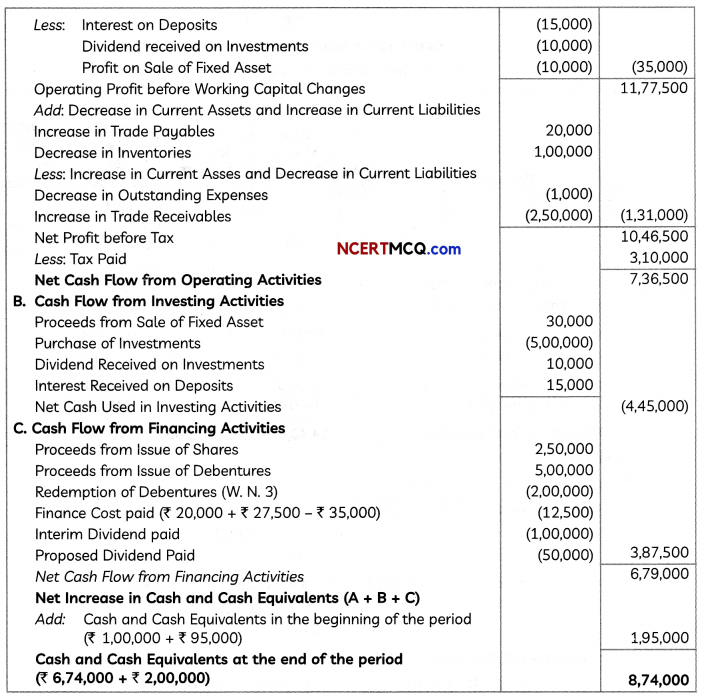

Question 12.

From the following Balance Sheet as at 31st March, 2021 and Statement of Profit and Loss for the year ended 31st March, 2021 of Roopakshi Ltd. and additional information, prepare Cash Flow Statement for the year ended 31st March, 2021:

Notes to Accounts:

![]()

Additional Information:

(i) Additional debentures were issued on 1st October, 2020 of ₹ 5,00,000. On the same date, part of outstanding debentures were redeemed and interest was paid, whereas interest on outstanding debentures was paid on 10th April, 2021.

(ii) Board of Directors proposed dividend in both the years @ 10%.

(iii) Interim Dividend of ₹ 1,00,000 was paid during the year.

(iv) A fixed asset with original cost of ₹ 1,00,000, on which depreciation till date was provided of

₹ 80,000 was sold at a profit of ₹ 10,000. (5)

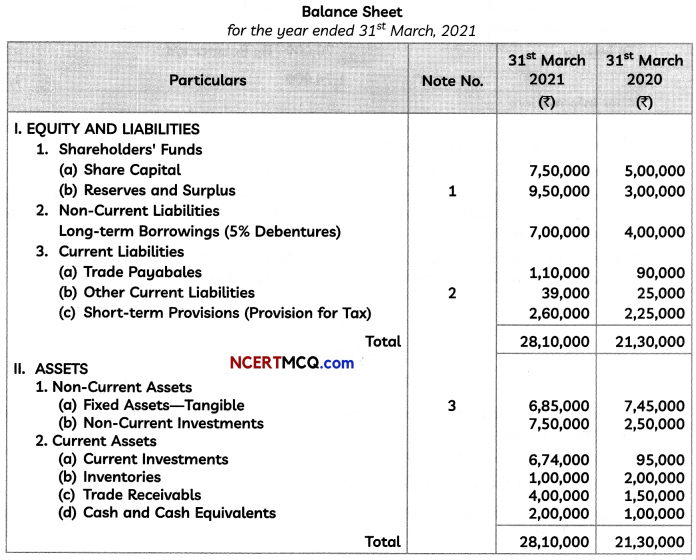

Answer:

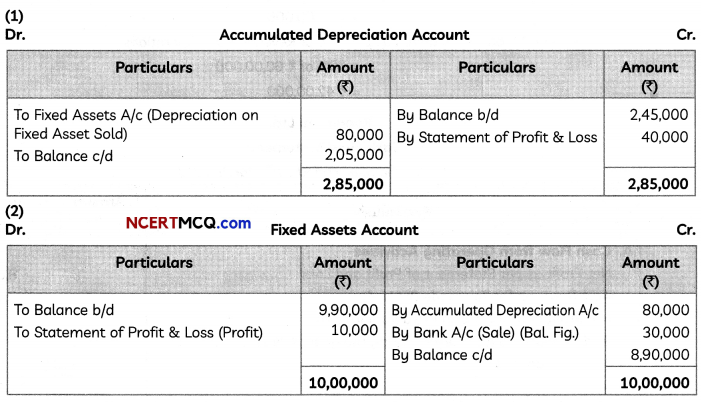

Working Notes:

![]()