Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 6 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 6 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

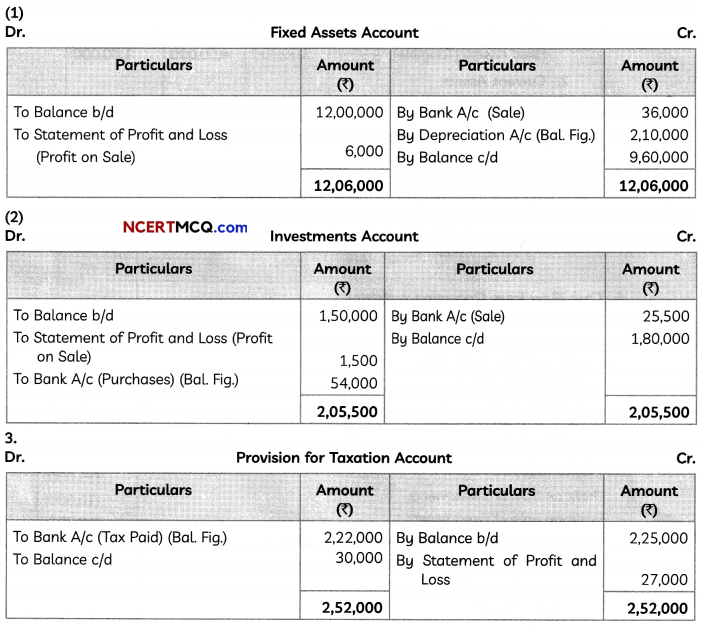

From the following information provided by Reunion Club, calculate the amount of subscriptions which will be treated as income for the year ended 31st March, 2019:

(i) Subscriptions received during the year ended 31st March, 2019 amounted to ₹ 25,000.

(ii) Subscriptions outstanding in the beginning of the year ended 31st March, 2019 amounted to ₹ 3,000.

(iii) Subscriptions outstanding for the year ended 31st March, 2019 amounted to ₹ 5,500.

(iv) Subscriptions not yet collected for the year ended 31st March, 2019 amounted to ₹ 5,000. (2)

Answer:

Question 2.

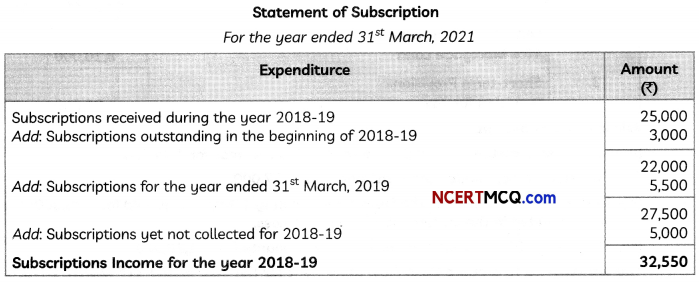

Babita, Chetan and Dhanush were partners in a firm sharing profits and losses in the ratio of 1 : 4 : 5. On 31st March, 2020 the firm was dissolved and on that date the Balance Sheet of the firm showed a loan of ₹ 10,000 given by Chetan’s brother Rohan. Chetan agreed to pay his brother’s loan.

Pass necessary journal entry for the above on the firm’s dissolution. (2)

Answer:

![]()

Question 3.

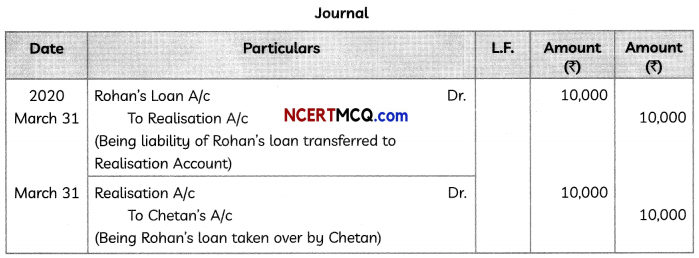

Preeti, Kareena and Rani were partners sharing profits in the ratio of their Capital contribution which were ₹ 6,00,000; ₹ 4,00,000 and ₹ 5,00,000 respectively. Their books are closed on 31st March every year. Preeti dies on 24th August, 2020.

Under the partnership deed, deceased partner is entitled to her share of profit/loss to the date of death based on the average profits of preceding four years.

Profits were:

2016-17 – ₹ 50,000

2017-18 – ₹ 20,000 (Loss)

2018-19 – ₹ 30,000

2019-20 – ₹ 60,000

Pass necessary journal entry for the treatment of profit and also show your workings clearly. (2)

Answer:

Working Notes:

Average Profit/(Loss) = \(\frac{₹ 50,000-₹ 20,000+₹ 30,000+₹ 60,000}{4}\)

= ₹ 30,000

Number of Days from 01.04.20 to 24.08.20 = 30 + 31 + 30 + 31 + 24 = 146

Preeti’s share of Profit upto the date of her death = ₹ 30,000 × \(\frac{6}{15} \times \frac{146}{365}\)

= ₹ 4,800

Question 4.

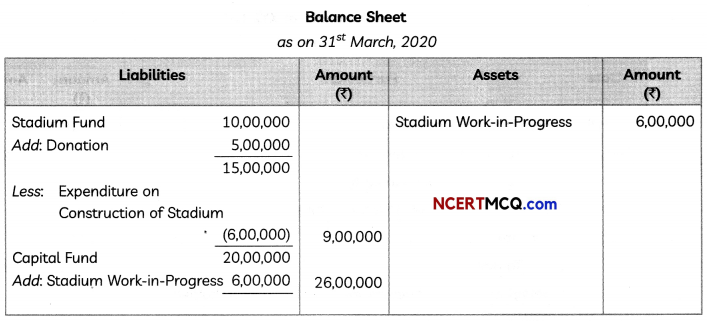

Show how are the following items dealt with while preparing the final accounts of Fitness Sports Club for the year ended 31st March, 2020:

(i) Expenditure on construction of Stadium is ₹ 6,00,000. The construction work is in progress and has not yet completed.

(ii) Stadium Fund as at 31st March, 2019 is ₹ 10,00,000, and Capital Fund as at 31stMarch, 2019 is ₹ 20,00,000.

(iii) Donation Received for Stadium on 1st January, 2020 is ₹ 5,00,000.

OR

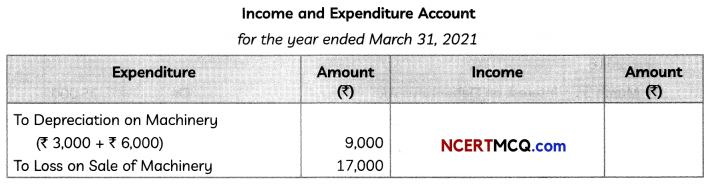

The book value of Machinery on 1st April, 2020 is ₹ 1,20,000. Half of this Machinery is sold for ₹ 40,000 on 30th September, 2020. Depreciation is to be charged on Machinery @ 10% p.a.

Calculate loss on sale of Machinery. Show how the loss on sale and depreciation on Machinery will be shown in the Income and Expenditure Account for the year ended 31st March, 2021. (3)

Answer:

OR

Working Note:

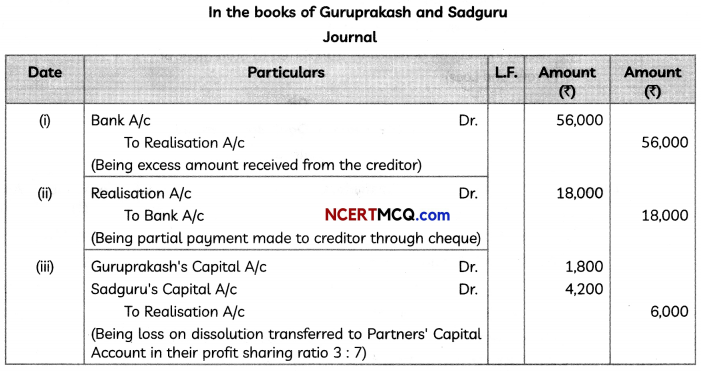

Calculation of Profit or Loss on Sale of Machinery

![]()

Question 5.

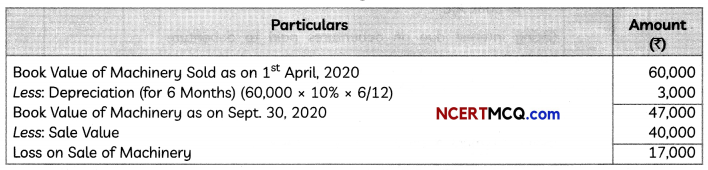

In a partnership firm, Guruprakash and Sadguru were partners sharing profits and losses is the ratio of 3 : 1. On 1st April, 2019 partners decided to dissolve the firm.

After transferring the assets (other than cash) and outsider’s liabilities of the firm to Realisation Account, you are given the following information:

(i) A creditor of ₹ 1,44,000 accepted furniture valued at ₹ 2,00,000 and paid to the firm ₹ 56,000.

(ii) A second creditor for ? 20,000 accepted stock at ₹ 18,000 in full settlement of his claim.

(iii) A third creditor amounting to ₹ 36,000 accepted ₹ 18,000 is cash and investment worth ₹ 17,200 is full settlement of his claim.

(iv) Loss on dissolution of the firm was ₹ 6,000.

Pass the necessary journal entries for the above transaction in the books of the partnership firm assuming that all payments were made by cheque. (3)

Answer:

![]()

Question 6.

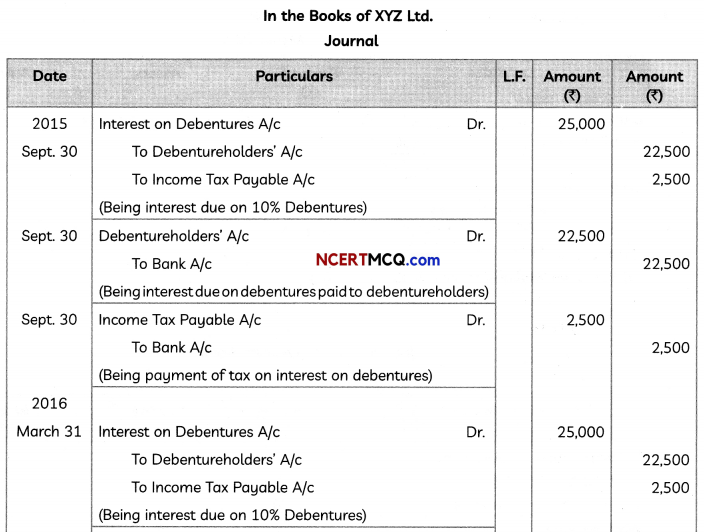

XYZ Ltd. issued 5,000, 10% Debentures of ₹ 100 each on 1st April, 2015 at a discount of 10%, redeemable at a premium of 10% after four years.

Pass necessary journal entries in the books of XYZ Ltd. for debenture interest for the year ended 31st March, 2016, assuming that the interest on debentures was payable half-yearly on 30th September and 31st March. The rate of tax is 10%.

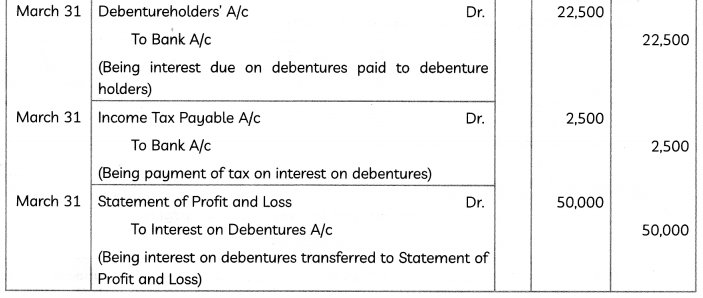

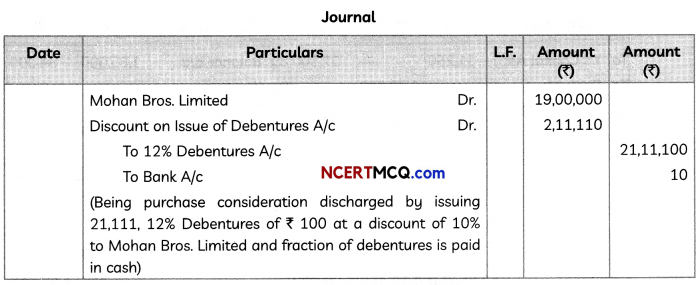

OR

Dauji Bros. Limited purchased the business of Mohan Bros. Limited consisting assets of the book value ₹ 20,00,000 and the liabilities of ₹ 2,50,000. It was agreed that the purchase consideration, settled at ? 19,00,000 be paid by issuing 12% Debentures of ₹ 100 each.

Pass journal entries in the books of the firm, if the debentures are issued:

(A) at a discount of 10%; and

(B) at a premium of 10%.

It was agreed that any fraction of debentures be paid in cash. (3)

Answer:

OR

(A) When Debentures are issued at 10% Discount:

Working Note:

= \(\frac{₹ 19,00,000}{₹(100-10)}\)

= \(\frac{₹ 19,00,000}{₹(100-10)}\)

= 21,111.11 or 21,111

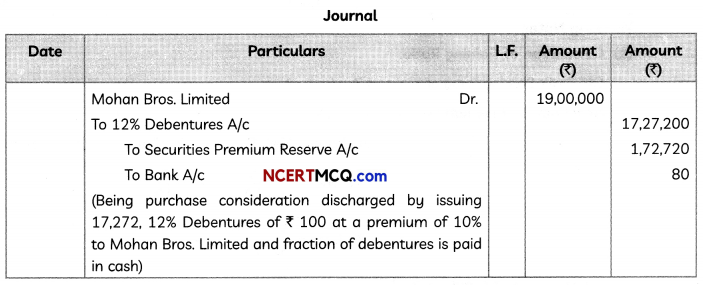

(B) When Debentures are issued at 10% Premium:

![]()

Working Note:

= \(\frac{₹ 19,00,000}{₹(100+10)}\)

= \(\frac{₹ 19,00,000}{₹ 110}\)

= 17,272.72 or 17,272

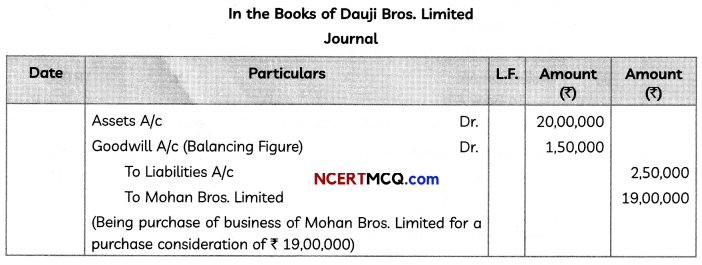

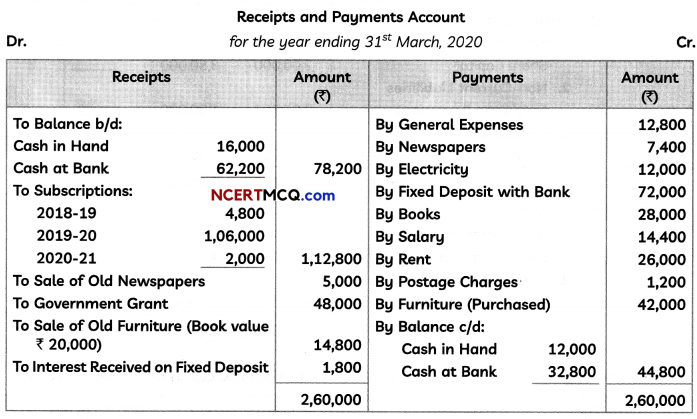

Question 7.

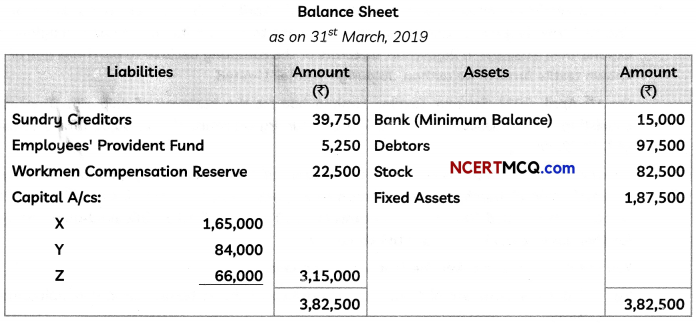

Balance Sheet of X, Y and Z who shared profits in the ratio of 5 : 3 : 2, as on 31st March, 2019 was as follows:

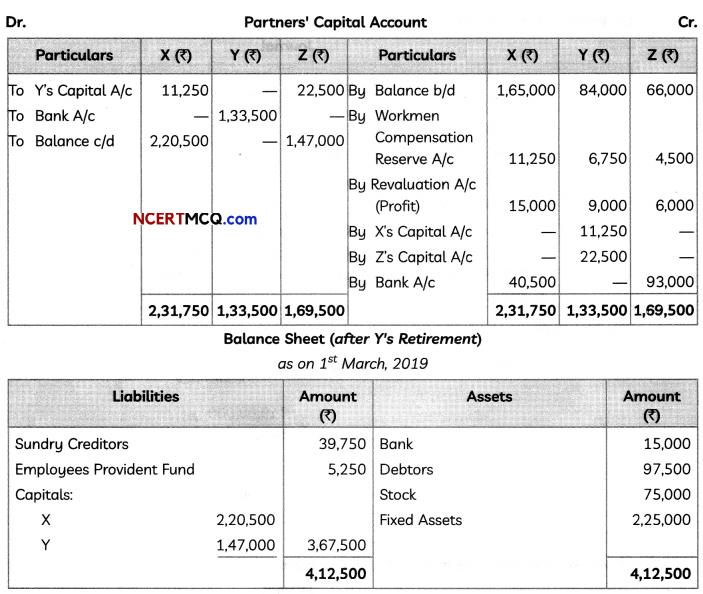

Y retired on 1st April, 2019 and it was agreed between the partners that:

(i) Goodwill of the firm is valued at ₹ 1,12,500 and Y’s share of it be adjusted into the accounts of X and Z who are going to share future profits in the ratio of 3 : 2.

(ii) Fixed Assets be appreciated by 20%.

(iii) Stock of the firm be reduced to ₹ 75,000.

(iv) Y be paid amount brought in by X and Z so as to make their capitals proportionate to their new profit sharing ratio.

Prepare Capital Account of Partners at the time of Y’s retirement and the Balance Sheet of the New Firm.

OR

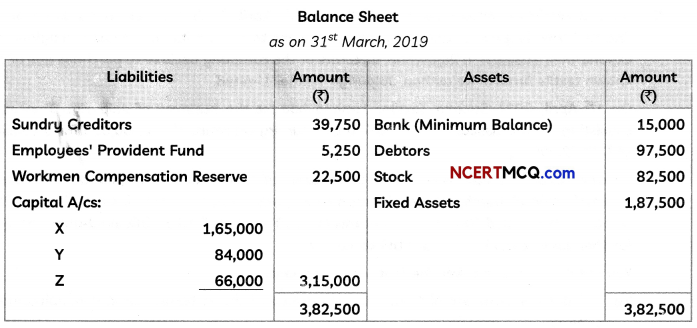

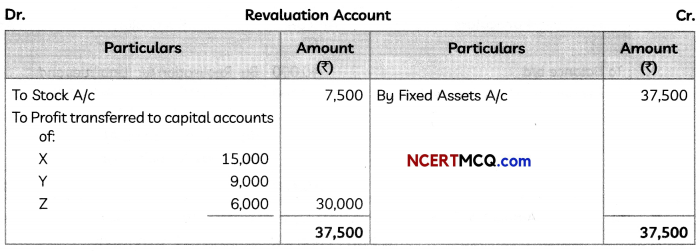

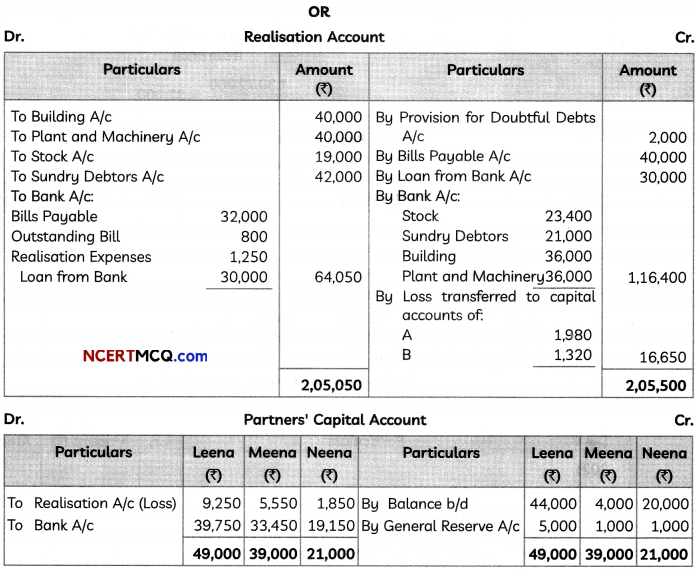

Balance Sheet of Leena, Meena and Neena as at 31st March, 2021, who were sharing profits in the ratio of 5 : 3 :1, was:

The partners decided to dissolve the business on 31st March, 2021.

The Assets of the business were realised as follows:

(i) Stock realised ₹ 23,400.

(ii) Debtors realised 50% amount.

(iii) Other Fixed Assets were realised at 10% less than their book value.

Bills Payable were settled for ₹ 32,000. There was an Outstanding Bill of Electricity of ₹ 800 which was paid off. Realisation expenses ₹ 1,250 were also paid.

You are required to prepare Realisation Account, Partner’s Capital Accounts and Bank Account of the firm. (5)

Answer:

Working Notes:

(1) Calculation of Gaining Ratio:

Old Profit Sharing Ratio of X, Y and Z = 5 : 3 : 2

New Profit Sharing Ratio of X and Z = 3 : 2

Gaining Ratio = New Profit Sharing Ratio – Old Profit Sharing Ratio

X’s Gain = \(\frac{3}{5}-\frac{5}{10}\) = \(\frac{6-5}{10}-\frac{1}{10}\)

Z’s Gain = \(\frac{2}{5}-\frac{2}{10}=\frac{4-2}{10}=\frac{2}{10}\)

Gaining Ratio of X and Z = 1 : 2

(2) Adjustment of Goodwill:

Goodwill of Firm = ₹ 1,12,500

Y’s share of Goodwill = ₹ 1,12,500 × \(\frac{3}{10}\) = ₹ 33,750

which will be compensated by X and Z in their gaining ratio, i.e., 1 : 2

X will compensate = ₹ 33,750 × \(\frac{1}{3}\) = ₹ 11,250

Z will compensate = ₹ 33,750 × \(\frac{2}{3}\) = ₹ 22,500

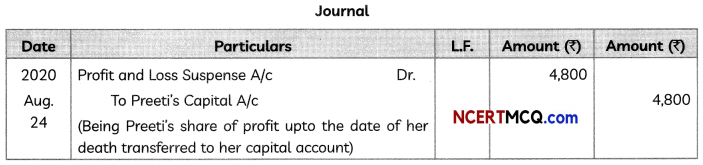

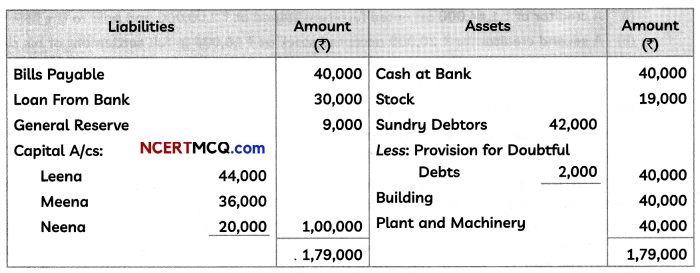

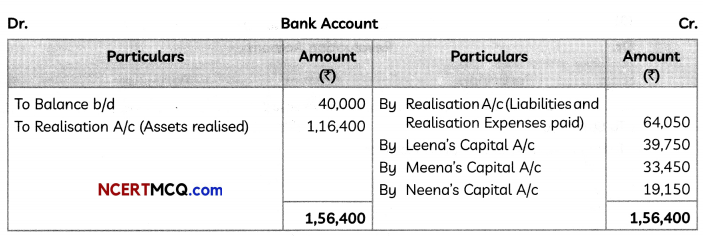

(3)

![]()

(4) Adjustment of Capital:

Adjusted Capital of X = ₹ 1,65,000 + ₹ 11,250 + ₹ 15,000 – ₹ 11,250 = ₹ 1,80,000

Adjusted Capital of Y = ₹ 84,000 + ₹ 6,750 + ₹ 9,000 + ₹ 11,250 + ₹ 22,500 = ₹ 1,33,500

Adjusted Capital of Z = ₹ 66,000 + ₹ 4,500 + T 6,000 – ₹ 22,500 = ₹ 54,000

New Capital of Firm = ₹ 1,80,000 + ₹ 1,33,500 + ₹ 54,000 = ₹ 3,67,500

X’s New Capital = ₹ 3,67,500 x \(\frac{3}{5}\) = ₹ 2,20,500

Z’s New Capital = X 3,67,500 x \(\frac{2}{5}\) = ₹ 1,47,000

X brings \n = ₹ 2,20,500 – ₹ 1,80,000 = ₹ 40,500

Z brings in = ₹ 1,47,000 – ₹ 54,000 = ₹ 93,000

OR

Question 8.

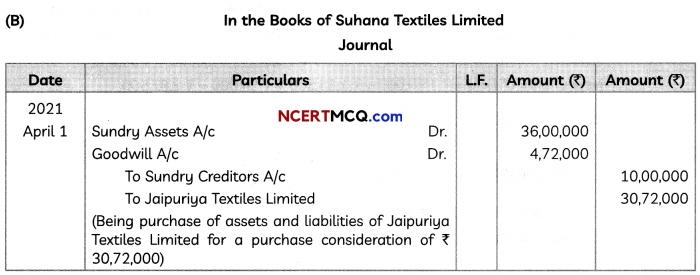

Suhana Textiles Limited was incorporated on 1st April, 2015 with registered office in Gujarat. The company is growing year by year, and begins to expand its operations throughout India. To expand their business in Rajasthan, directors of the company decided to purchase one of the well- known textile firms of Rajasthan, Jaipuriya Textiles Limited,

On 1st April, 2021 Suhana Textiles Limited bought the business of Jaipuriya Textiles Limited consisting sundry assets of ₹ 36,00,000 and sundry creditors of ₹ 10,00,000 for a consideration of ₹ 30,72,000.

Suhana Textiles Limited issued 12% Debentures of ₹ 100 each fully paid, at a discount of 4% in satisfaction of purchase consideration to Jaipuriya Textiles Limited. On 10th June, 2021, the company also issued 500,10% Debentures of ₹ 100 each credited as fully paid-up to the promoters for their services to incorporate the company.

You are required to answer the following questions:

(A) Calculate the amount of Goodwill purchased by Suhana Textiles Limited of Jaipuriya Textiles Limited.

(B) Pass journal entry for the purchase of business of Jaipuriya Textiles Limited.

(C) Calculate the number of debentures issued to Jaipuriya Textiles Limited.

(D) Pass journal entry for the allotment of debentures to Jaipuriya Textiles Limited.

(E) Pass journal entry for the allotment of debentures to the underwriters. (5)

Answer:

(A) Amount of Goodwill = Purchase Consideration – (Value of Assets – VaLue of Liabilities)

= ₹ 30,72,000 – (₹ 36,00,000 – ₹ 10,00,000)

= ₹ 4,72,000

![]()

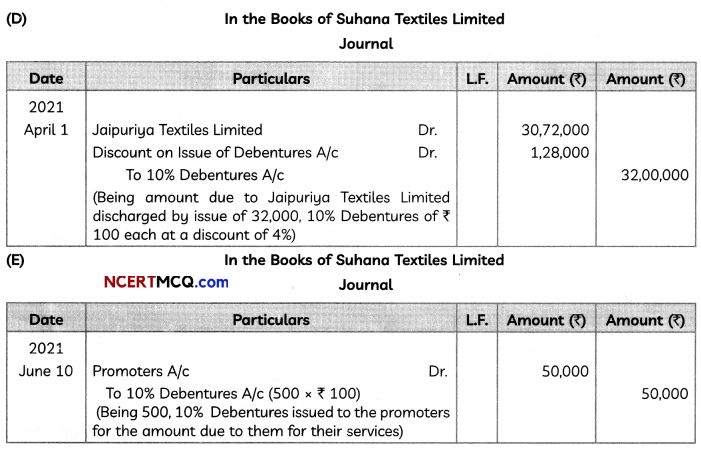

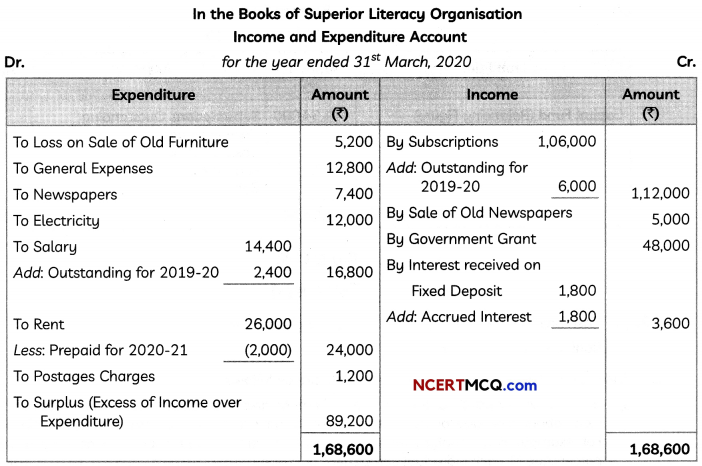

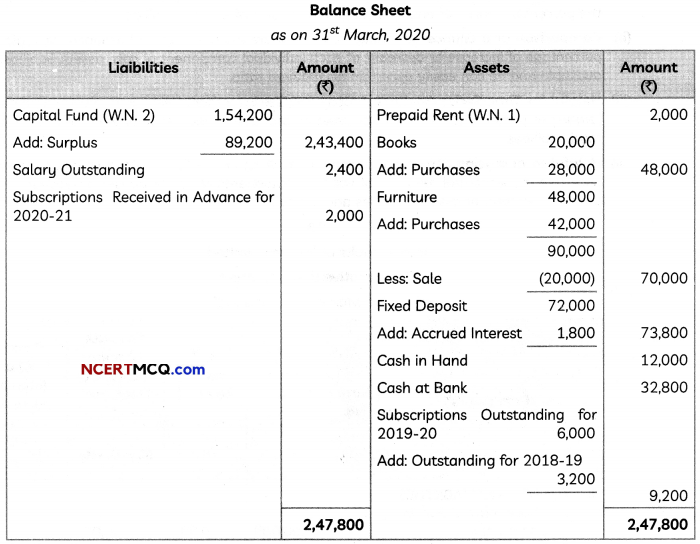

Question 9.

From the following Receipts and Payments Account and information given below, prepare Income and Expenditure Account and Balance Sheet of Superior Literacy Organisation as on 31st March, 2020.

Additional Information:

(i) Subscriptions outstanding as on 31st March, 2019 was ₹ 8,000 and on 31st March, 2020 was ₹ 6,000.

(ii) Fixed Deposit with Bank was made on 30th September, 2019 @10% p.a.

(iii) On 31st March, 2020 Salary outstanding ? 2,400, and one month Rent paid in advance.

(iv) On 1st April, 2019, Superior Literacy Organisation owned Furniture of ₹ 48,000, Books of ₹

20,000. (5)

Answer:

Working Note:

(1) Calculation of Prepaid Rent:

Prepaid Rent (for Year 2020-21) = ₹ 26,000 x \(\frac{1}{13}\) = ₹ 2,000

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

Identify the following transactions as belonging to Operating Activities, Investing Activities, Financing Activities or Cash and Cash Equivalents:

(A) Cash paid against Services taken.

(B) Bank Overdraft (2)

Answer:

(A) Cash paid against Services taken – Operating Activities

(B) Bank Overdraft – Financing Activities

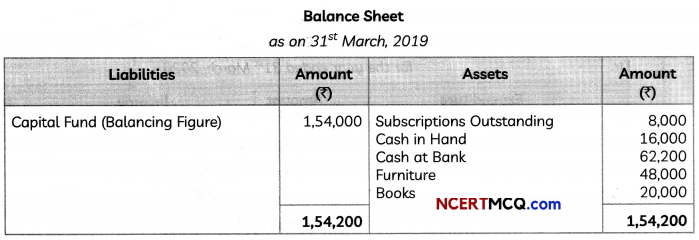

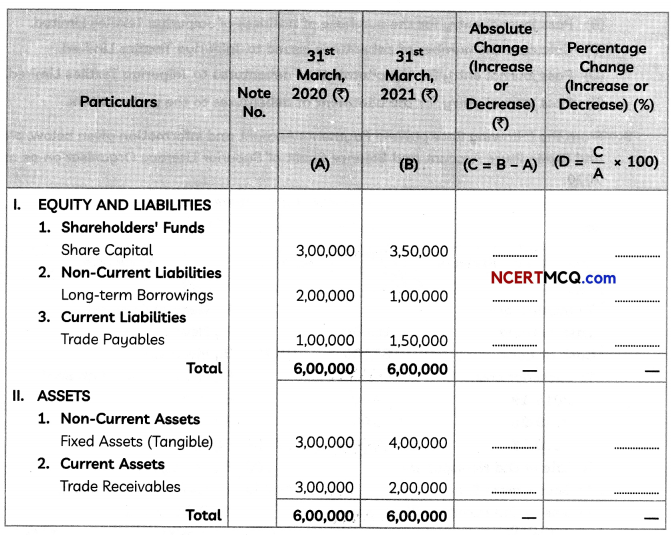

Question 11.

Explain some advantages of Common Size Statements.

OR

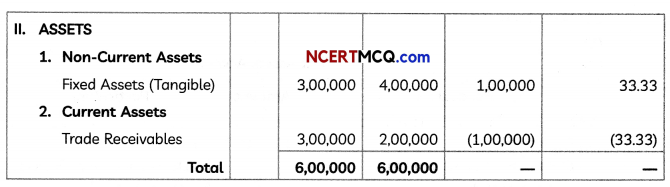

You are provided with the Comparative Balance Sheet of Picasso Limited with missing information. You are required to fill in the blanks:

(3)

Answer:

The advantages of Common Size Statements are as follows:

(i) Easy to Understand: Common Size Statement helps the users of financial statement to make clear about the ratio or percentage of each individual item to total assets/liabilities of a firm. For example, if an analyst wants to know the working capital position he may ascertain the percentage of each individual component of current assets against total assets of a firm and also the percentage share of each individual component of current liabilities.

(ii) Comparison at a Glance: An analyst can compare the financial performances at a glance since percentage of increase or decrease of each individual component of cost, assets, liabilities etc. are available and he can easily ascertain his required ratio.

(iii) Helpful for Time Series Analysis: A Common Size Statement helps an analyst to find out a trend relating to percentage share of each asset in total assets and percentage share of each liability in total liabilities.

(iv) Helpful in analysing Structural Composition: A Common Size Statement helps the analyst to ascertain the structural relations of various components of cost/expenses/assets/liabilities etc. to the required total of assets/liabilities and capital.

OR

![]()

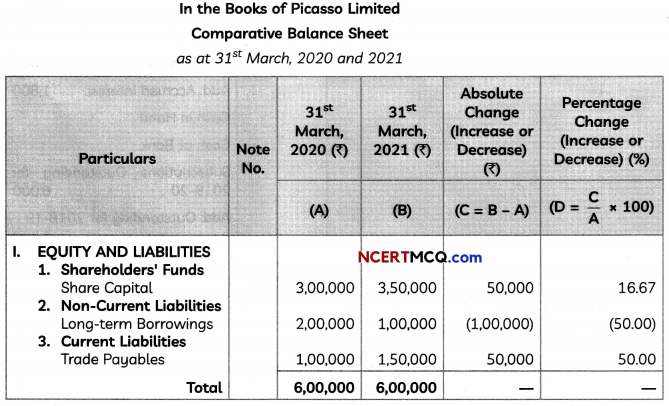

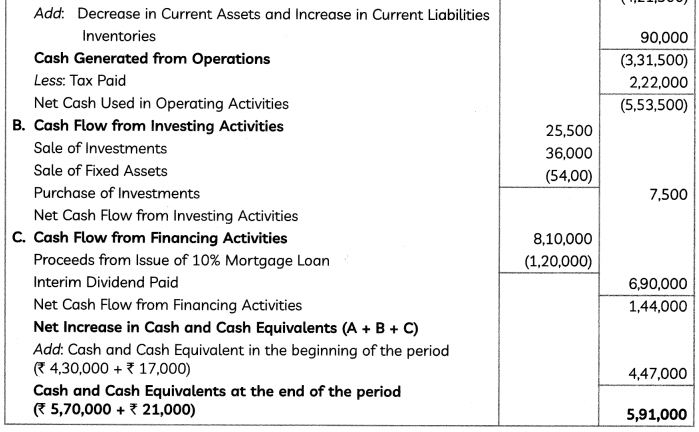

Question 12.

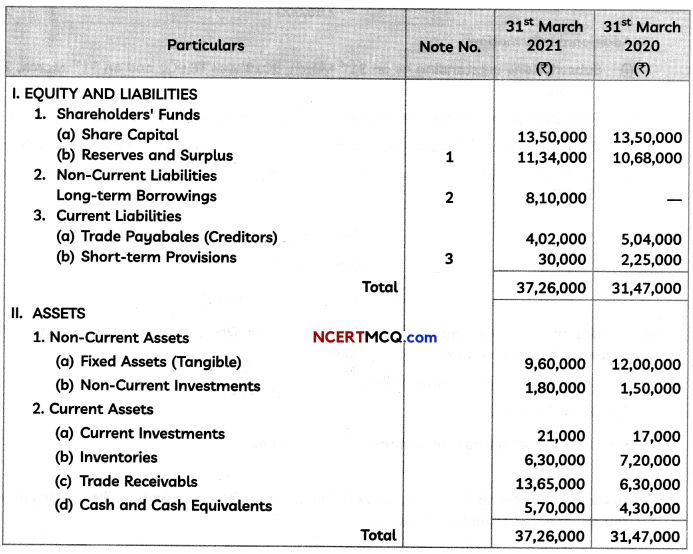

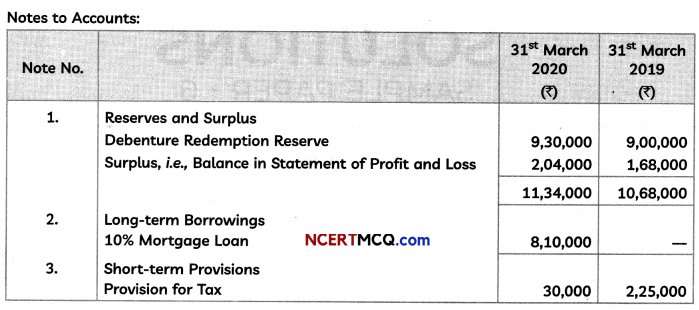

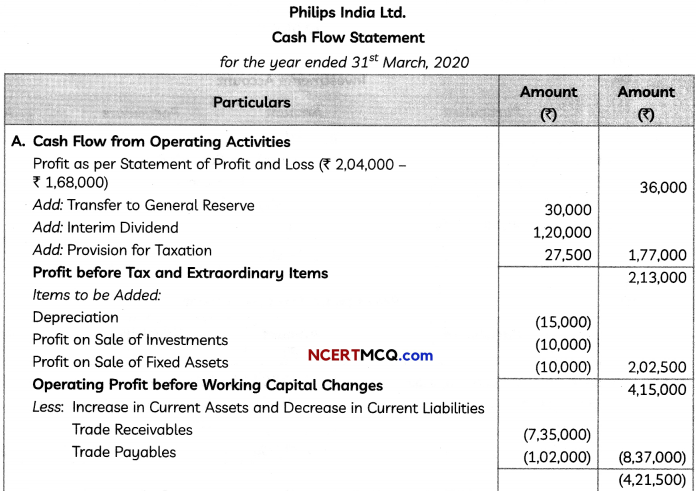

Following is the summarised Balance Sheet of Philips India Ltd. as at 31st March 2020:

Additional Information:

(i) Investments costing ? 24,000 were sold during the year for ₹ 25,500.

(ii) Provision for Tax made during the year was ₹ 27,000.

(iii) During the year, a part of the Fixed Assets costing ₹ 30,000 was sold for ₹ 36,000. The profits were included in the Statement of Profit and Loss.

(iv) The Interim Dividend paid during the year amounted to ₹ 1,20,000.

You are required to prepare Cash Flow Statement for the year ended 31st March, 2020. (5)

Answer:

![]()