Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 7 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 7 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

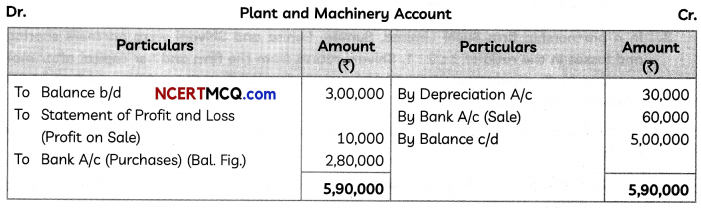

Calculate the amount to be posted to the Income and Expenditure Account of Sangan Sports Academy for the year ended 31st March, 2021 from the information given:

Stock of Sports Materials on 1st April, 2020 – ₹ 60,000

Creditors for Sports Materials on 1st April, 2020 – ₹ 40,000

Amount paid for Sports Materials during the year – ₹ 2,16,000

Stock of Sports Materials on 31st March, 2021 – ₹ 10,000 (2)

Answer:

![]()

Question 2.

Differentiate between ‘Dissolution of Partnership’ and ‘Dissolution of Partnership Firm’ on the basis of:

(A) Economic Relationship

(B) Closure of Books (2)

Answer:

Difference between Dissolution of Partnership and Dissolution of Partnership Firm

| Basis of Difference | Dissolution of Partnership | Dissolution of Partnership Firm |

| (A) Economic Relationship | Economic relationship changes between or among the partners. | Economic relationship between or among the partners comes to an end. |

| (B) Closure of Books | Books of accounts are not closed. It is continued by the remaining partners. | Books of accounts are closed, as the business is discontinued. |

Question 3.

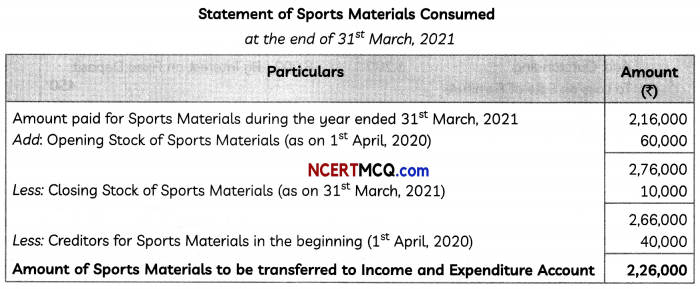

Pass journal entries for following transactions on the dissolution of a firm of partners X and Y, after various assets (other than cash) and outside liabilities have been transferred to Realisation Account?

(A) ‘X’ took 50% of the stock at a discount of 20%. Remaining stock was sold at a profit of 30% on csot (Book value of stock given in the Balance Sheet before dissolution was ₹ 8,00,000).

(B) Debtors ₹ 5,28,000. Provision for Doubtful Debts. ₹ 48,000, ₹ 96,000 of the book debts proved

bad. (2)

Answer:

![]()

Question 4.

From the following information given by Giani Sports Club, calculate the amount of Subscription received during the year 2020-21.

(i) Subscription credited to Income and Expenditure Account for the year ending 31st March, 2021 amounted to ₹ 12,00,000. Each member of the club is required to pay an annual subscription of ₹ 12,000.

(ii) During the year 2019-20,12 members paid the subscription amount for the year 2020-21.

(iii) Subscription in arrears as on 1st April, 2020 amounted to ₹ 64,000.

(iv) During the year 2020-21, 10 members made partial payment of ₹ 1,04,000 towards subscription, 8 members failed to pay the subscription amount and 5 members paid the subscription amount for the year 2021-22.

OR

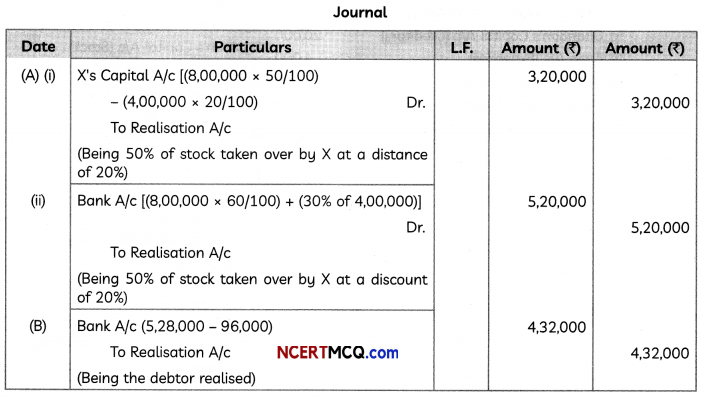

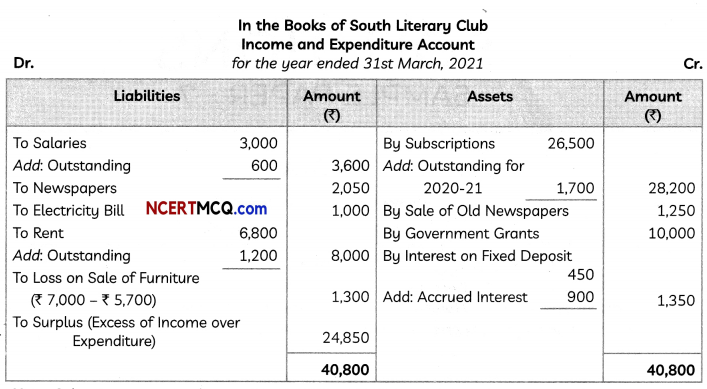

Following is the Receipts and Payments Account of South Literary Club for the year ended 31st March, 2021:

Additional Information:

(i) Subscriptions outstanding as on 31st March, 2020 were ₹ 2,000 and on 31st March, 2021 were ₹ 2,500.

(ii) On 31st March, 2021 salary outstanding was ₹ 600 and rent outstanding was ₹ 1,200.

(iii) On 31st March, 2020 the club owned Furniture of ₹ 15,000 and Books of ₹ 7,000.

You are required to prepare Income and Expenditure Account of South Literary Club for the year ended 31st March, 2021. (3)

Answer:

Note: Subscription outstanding on 31-03-2021 is ₹ 2,500 which includes the subscription outstanding for the year 2019-20 ₹ 800 (i.e., ₹ 2,000 – ₹ 1,200 received during 2020-21). Hence, the subscription outstanding for the year 2020-21 is ₹ 1,700 (i.e. ₹ 2,500 – ₹ 800). it should be noted that there is a difference between subscription outstanding on 31-03-2021 and subscription outstanding for 2020-21 (which indicates that subscription outstanding only for 2020-21).

![]()

Question 5.

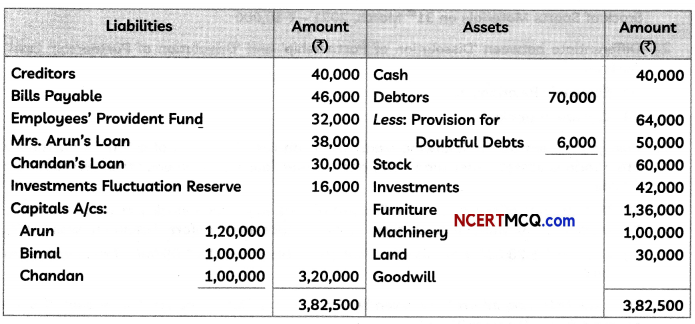

Arun, Bimal and Chandan were partners sharing profits in the ratio of 2 : 2 : 1. They decided to dissolve their firm on 31st March, 2019 when the Balance Sheet was:

Following transactions took place:

(i) Arun took over Stock at ₹ 36,000. He also took over his wife’s loan.

(ii) Bimal took over half of Debtors at ₹ 28,000.

(iii) Chandan took over Investments at ₹ 54,000 and half of Creditors at their book value.

(iv) Remaining Debtors realised 60% of their book value. Furniture sold for ₹ 30,000; Machinery ₹ 82,000 and Land ₹ 1,20,000.

(v) An unrecorded asset was sold for ₹ 22,000.

(vi) Realisation expenses amounted to ₹ 4,000.

Prepare Realisation Account. (3)

Answer:

![]()

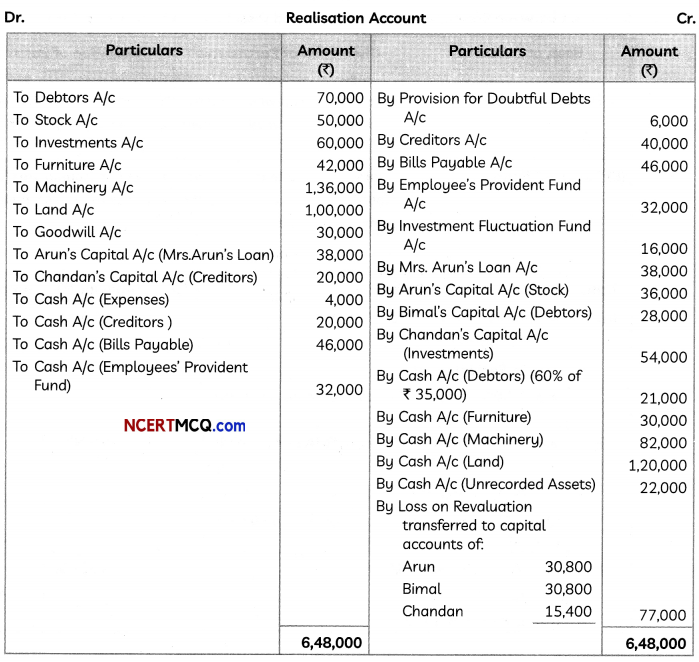

Question 6.

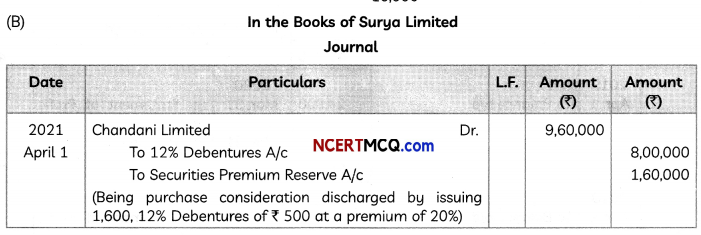

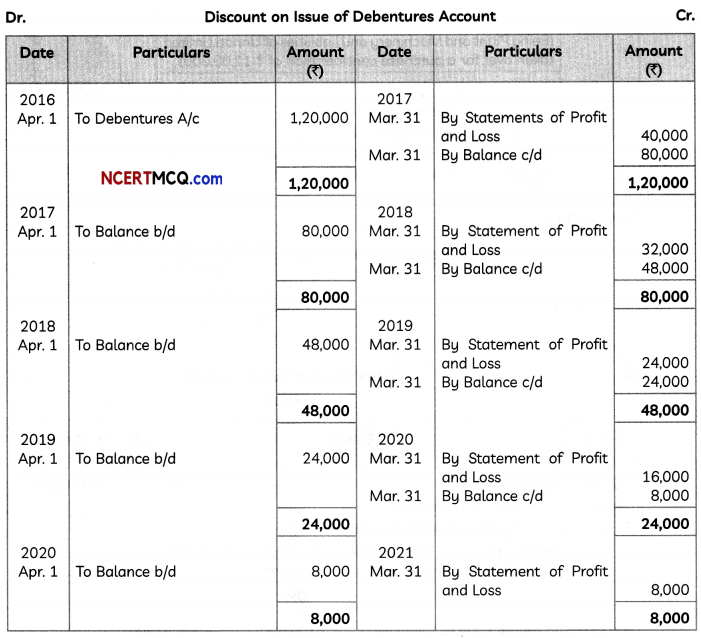

Pass the necessary journal entries for the issue of debentures for the following transactions:

(A) Renuka Traders Limited took over Plant and Machinery of ₹ 16,00,000 and liabilities of ₹ 6,00,000 from Unnati Limited for a purchase consideration of ₹ 12,00,000. The payment was made by issue of 12% Debentures of ₹ 100 each at 20% premium.

(B) On 1st April, 2021, Surya Limited issued 1,600, 12% Debentures of ₹ 500 each at a premium of 20%, to Chandani Limited for Plant purchased from them costing ₹ 9,60,000.

OR

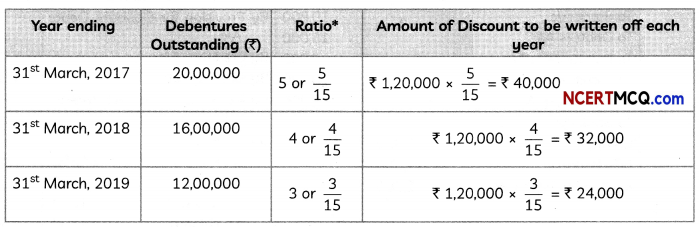

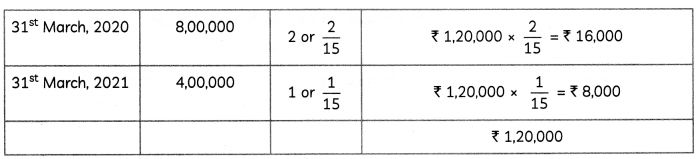

Akanksha Limited issued 8% Debentures of the face value of ₹ 20,00,000 at a discount of 6% on 1st April, 2016. These debentures are redeemable by annual drawings of ₹ 4,00,000 made on 31st March each year. The directors decided to write off discount based on the debentures outstanding each year.

Prepare Discount on Issue of Debentures Account of Akanksha Limited for five years. (3)

Answer:

Working Note:

= \(\frac{₹ 12,00,000}{₹(100+20)}\)

= 10,000

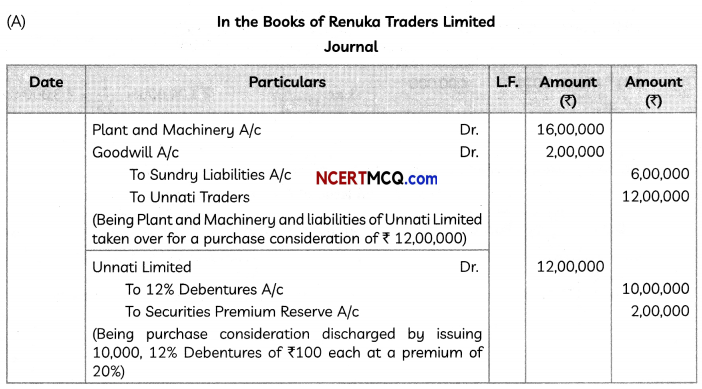

OR

Total Discount on the Issue of Debentures = ₹ 20,00,000 × \(\frac{6}{10}\) = ₹ 1,20,000

Since debentures are redeemable by annual drawings of ₹ 4,00,000, the amount of discount written off from Statement of Profit and Loss is determined as follows:

![]()

*Ratio has been obtained by dividing Debentures Outstanding by ? 4,00,000.

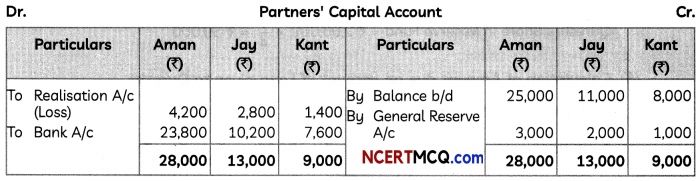

Question 7.

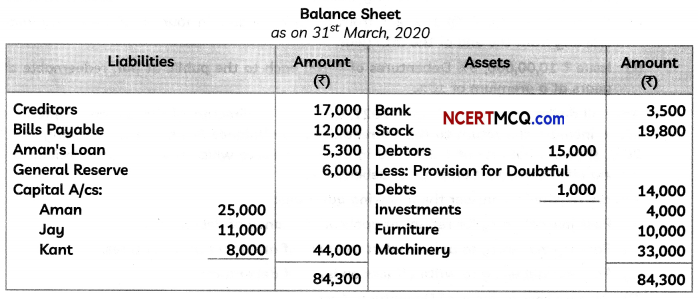

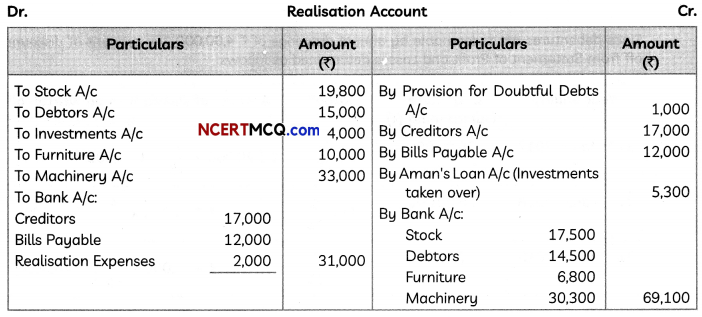

Aman, Jay and Kant are partners in firm ‘Ajaka Limited’ sharing profits and losses in the ratio of 3 : 2 : 1. They decided to dissolve their firm on 31st March, 2020, the date on which their Balance Sheet stood as:

The following additional information is given:

(i) The Investments are taken by Aman for ₹ 5,000 in settlement of his loan.

(ii) Assets were realised as follows:

Stock – ₹ 17,500

Debtors – ₹ 14,500

Furniture – ₹ 6,800

Machinery – ₹ 30,300

(iii) Expenses on realisation amounted to ₹ 2,000.

Prepare Realisation Account and Partners’ Capital Account at the time of dissolution of the partnership firm ‘Ajaka Limited’.

OR

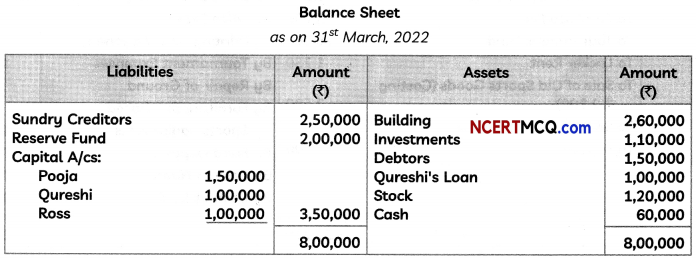

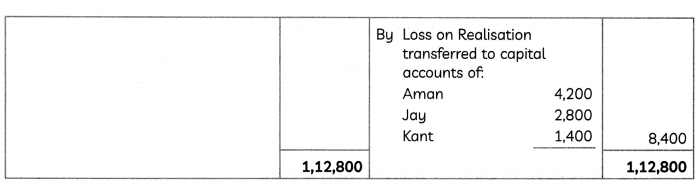

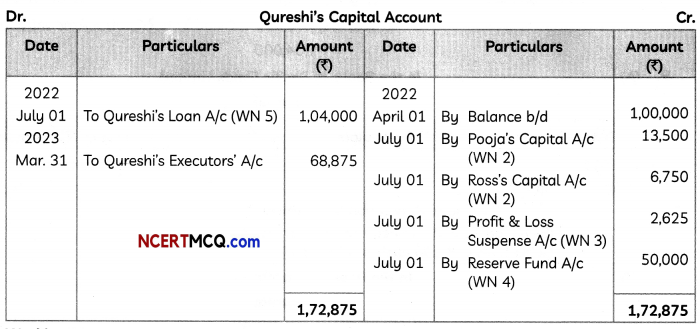

On 31st March, 2022, the Balance Sheet of Pooja, Qureshi and Ross, who were partners in Pukaro Limited was as under:

Qureshi died on 1st July, 2022. The profit sharing ratio of the partners was 2 : 1 : 1. On the death of a partner, the partnership deed provided for the following:

(i) His share in the profits of the firm till the date of his death will be calculated on the basis of average profits of last three completed years.

(ii) Goodwill of the firm will be calculated on the basis of total profit of last two years.

(iii) Interest on loan given by the firm to a partner will be charged at the rate of 6% p.a. or ₹ 4,000, whichever is more.

(iv) Profits for the last three years 2019-20, 2020-21 and 2021-22 were ₹ 45,000, ₹ 48,000 and ? 33,000 respectively.

You are required to prepare Qureshi’s Capital Account to be rendered to his executors. Also show the working notes clearly. (5)

Answer:

![]()

OR

Working Notes:

(1) Calculation of Profit Sharing Ratio:

Old Profit Sharing Ratio of Pooja, Qureshi and Ross = 2 : 1 : 1

New Profit Sharing Ratio of Pooja and Ross = 2 : 1 and

Gaining Ratio of Pooja and Ross = 2 : 1

(2) Calculation of Qureshi’s Share of Goodwill:

Goodwill of Firm = ₹ 48,000 + ₹ 33,000 = ₹ 81,000

Qureshi’s Share of Goodwill = ₹ 81,000 × \(\frac{1}{4}\) = ₹ 20,250

This share of Goodwill will be contributed by Pooja and Ross in their gaining ratio, i.e, 2 : 1.

Pooja will contribute = ₹ 20,250 × \(\frac{2}{3}\) ₹ 13,500

Ross will contribute = ₹ 20,250 × \(\frac{1}{3}\) = ₹ 6,750

(3) Calculation of Qureshi’s Share of Profit till the date of his death:

Average prifit of last three years = \(\frac{45,000+48,000+33,000}{3}\) = ₹ 42,000

Qureshi’s Share of Profit till the date of his death

= Previous year’s Profit × Qureshi’s Share × ![]()

= ₹ 42,000 × \(\frac{1}{4} \times \frac{3}{12}\) = ₹ 2,625

(4) Calculation of Qureshi’s Share in Reserve Fund:

Qureshi’s Share in Reserve Fund = ₹ 2,00,000 × \(\frac{1}{4}\) = ₹ 50,000

(5) Calculation of Amount due on account of Loan given to Qureshi:

Loan given to Qureshi by firm = ₹ 1,00,000

Amount of Interest till 1st July, 2022 = ₹ 1,00,000 × \(\frac{6}{100} \times \frac{3}{12}\) = ₹ 1,500

Total Amount due to firm on 1st July = Loan given to Qureshi by firm + Amount of Interest

= ₹ 1,00,000 + ₹ 4,000 [As ₹ 4,000 > Amount of Interest]

= ₹ 1,04,000

![]()

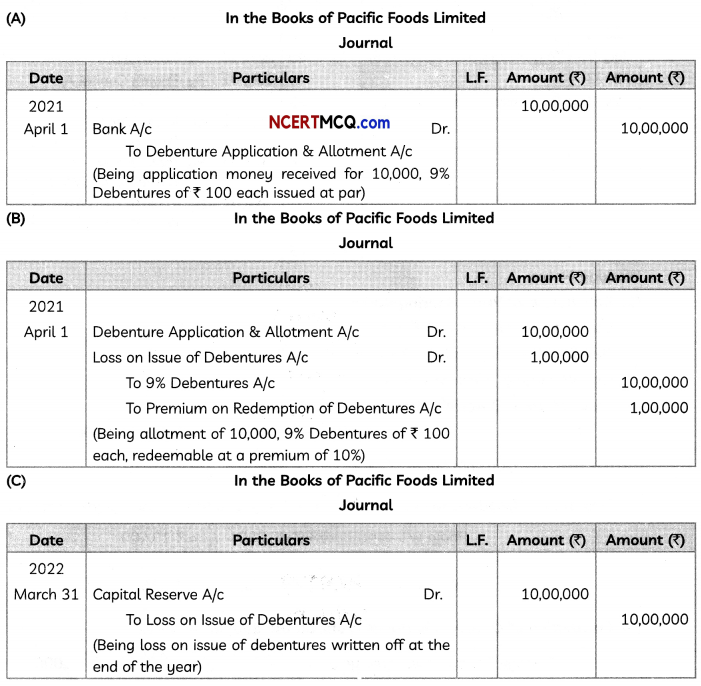

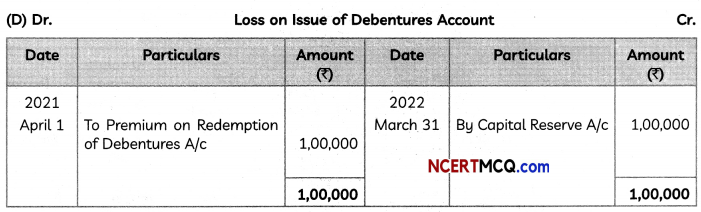

Question 8.

Pacific Foods Limited, a FMCG company has an equity share capital of ₹ 20,00,000. The company earns a return on investment of 15% on its capital. The company needed funds for diversification. The finance manager had the following two options:

(i) Borrow ₹ 10,00,000 @ 15% p.a. from a bank payable in four equal quarterly instalments starting from the end of the fifth year.

(ii) Issue ₹ 10,00,000, 9% Debentures of ? 100 each to the public at par, redeemable after five years at a premium of 10%.

After all deliberations, on 1st April, 2021, the board of directors of the company opted for option (ii), to increase the return to the shareholders. The Balance Sheet of the company on 1st April, 2021 shows a balance of ₹ 3,00,000 in Capital Reserve which the company decided to use for writing off the discount on issue of debentures.

You are required to answer the following questions:

(A) Pass journal entry for receipt of application money of debentures.

(B) Pass journal entry to be passed at the time of allotment of debentures.

(C) Pass journal entry to write ofFloss on issue of debentures.

(D) Prepare Loss on Issue of Debentures Account.

(E) Calculate the amount of annual fixed obligation associated with debentures. (5)

Answer:

(E) Interest on 9% Debentures = ₹ 10,00,000 × \(\frac{9}{100}\) = ₹ 90,000

![]()

Question 9.

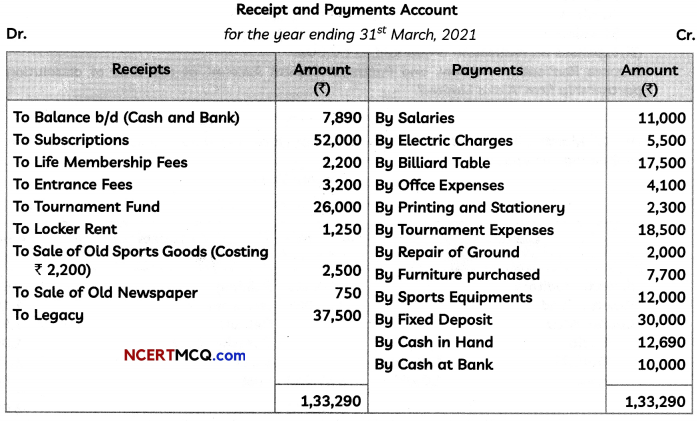

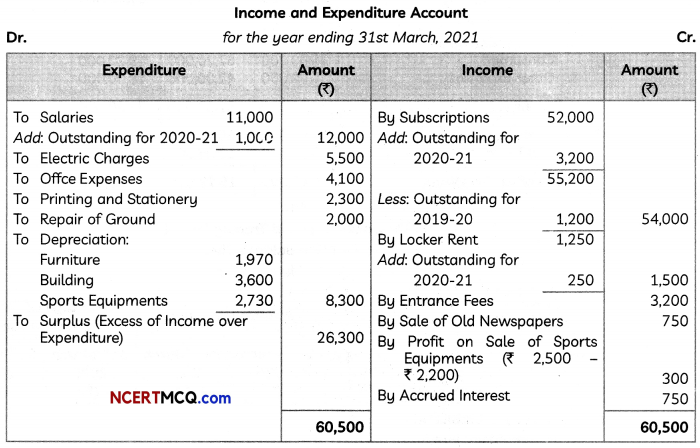

Following is the Receipts and Payments Account of Jalandhar Sports Club for the year ending 31st March, 2021:

Additional Information:

(i) Subscriptions outstanding was ₹ 1,200 on March 31, 2020 and ₹ 3,200 on March 31, 2021.

(ii) Locker rent outstanding on March 31, 2021 was ₹ 250.

(iii) Salary outstanding on March 31, 2021 was ₹1,000.

(iv) Fixed Deposit was made on 1st January, 2021 @10% p.a.

(v) On April 1, 2020, club has following assets: Building ₹ 36,000, Furniture ₹ 12,000, and Sports Equipments ₹ 17,500. Depreciation on these items is to be charged at 10% (including purchase).

You are required to prepare Income and Expenditure Account for the year ending 31st March, 2021 and also ascertain the Capital Fund as on 31st March, 2020. (5)

Answer:

![]()

PART-B

Option-1

(Ana Lysis of Financial Statements)

Question 10.

Classify the following transactions as Operating Activities for a financial company and a Non- Financial Company:

(A) Payment of Interest

(B) Royalty received (2)

Answer:

(A) Payment of Interest – Financial Company

(B) Royalty received – Non-Financial Company

Question 11.

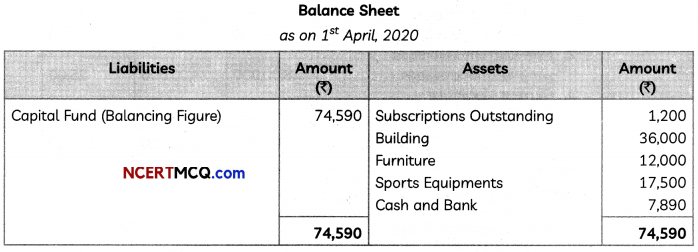

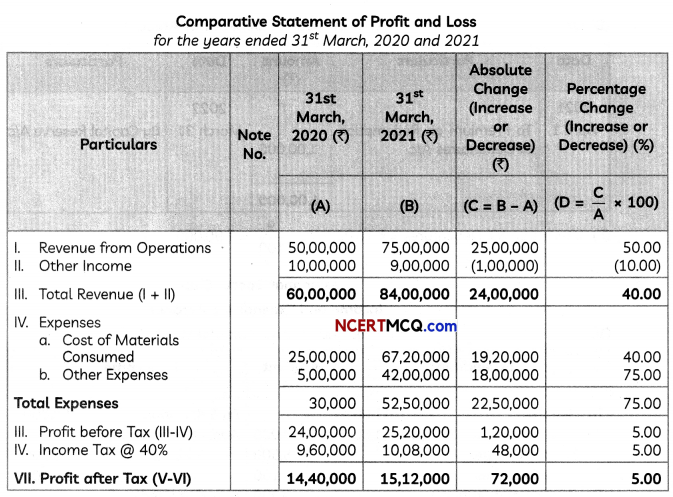

Prepare Comparative Statement of Profit and Loss from the following information:

| Particulars | 31st March, 2021 | 31st March, 2020 |

| Revenue from Operations | ₹ 75,00,000 | ₹ 50,00,000 |

| Other Income | ₹ 9,00,000 | ₹ 10,00,000 |

| Cost of Materials Consumed | ₹ 45,00,000 | ₹ 25,00,000 |

| Other Expenses | ₹ 7,50,000 | ₹ 5,00,000 |

| Tax Rate | 50% | 50% |

OR

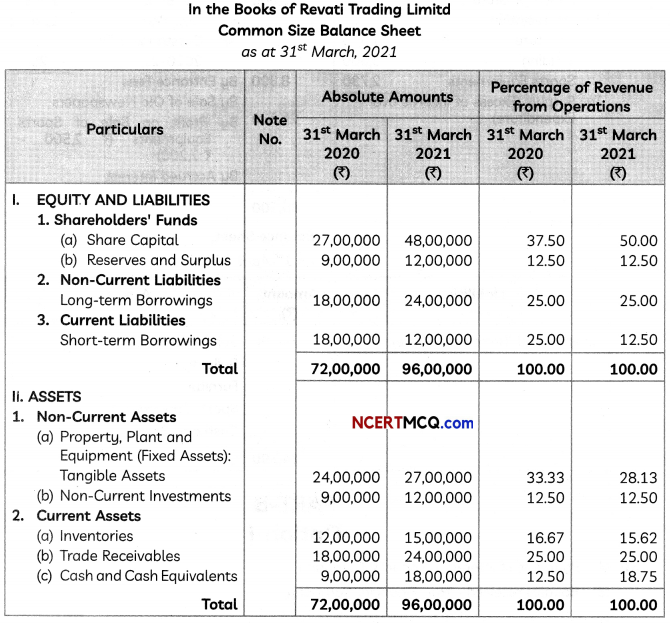

You are required to prepare Common Size Balance Sheet of Revati Trading Limited as at 31st March, 2020 and 2021.

You are required to prepare Common Size Balance Sheet of Revati Trading Limited as at 31st March, 2020 and 2021. (3)

Answer:

![]()

OR

Question 12.

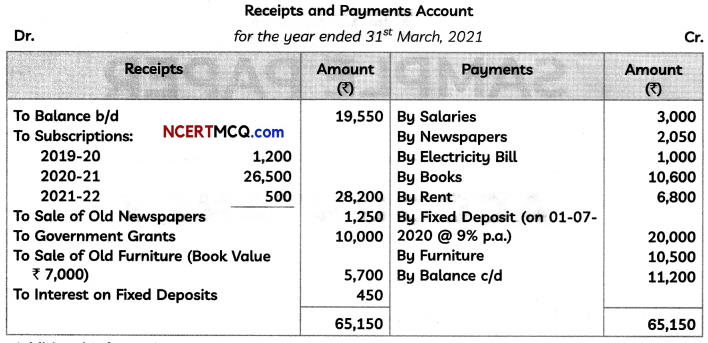

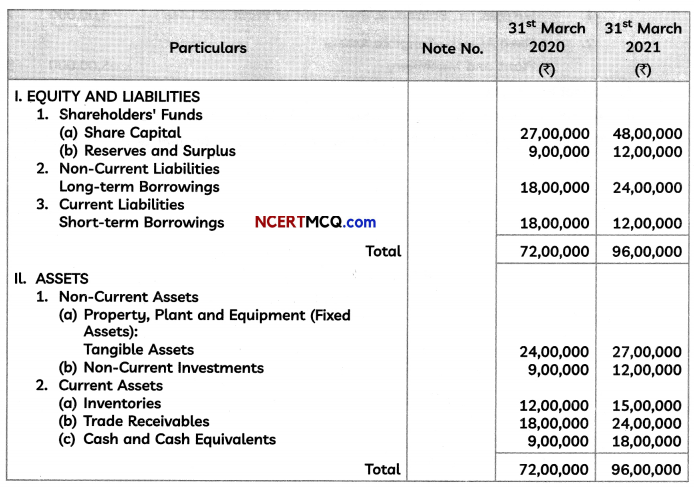

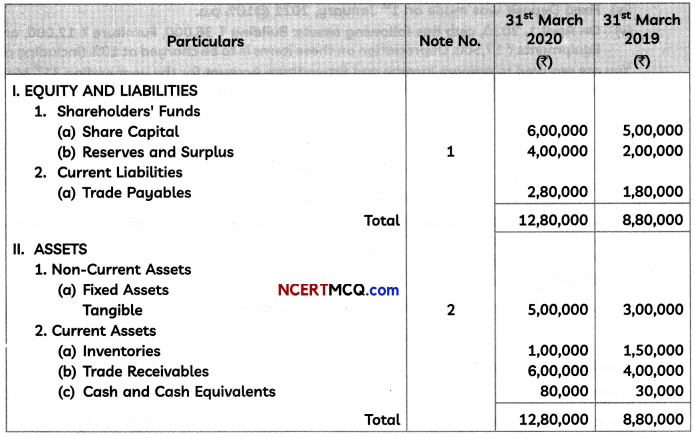

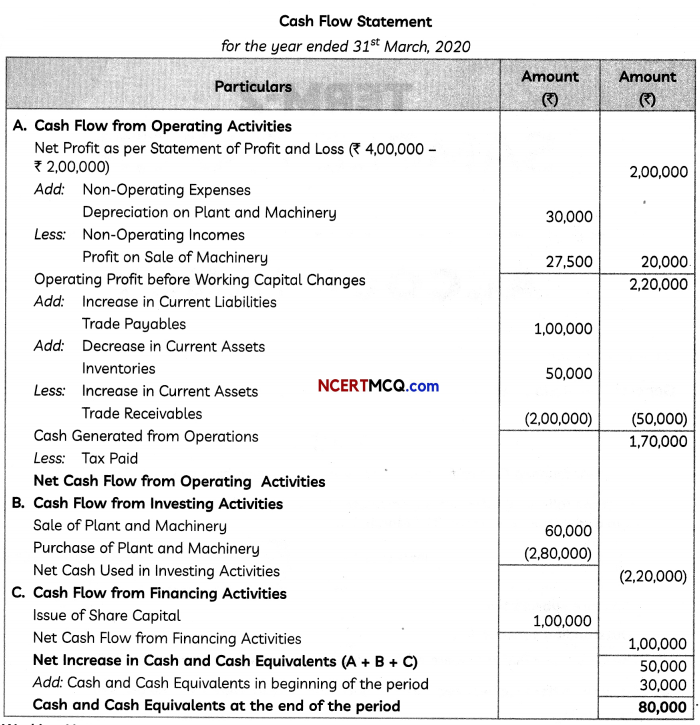

Prepare Cash Flow Statement for the year ended 31st March, 2020 from the following Balance Sheet of Sanskar Limited as at 31st March, 2020 and additional information provided:

Notes to Accounts:

![]()

Additional Information:

(i) An old machinery having book value of? 50,000 was sold for ₹ 60,000.

(ii) Depreciation provided on Plant and Machinery during the year was ₹ 30,000. (5)

Answer:

Working Notes: