Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 8 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 8 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

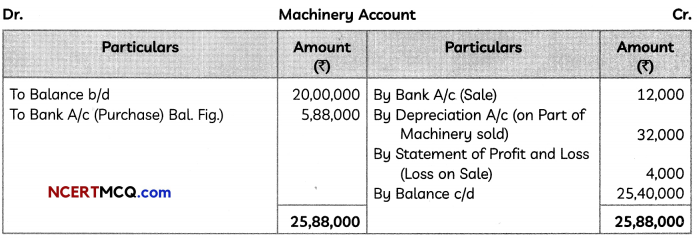

From the following information, calculate the amount of subscriptions received by Happy Sports Club during the year ended 31st March, 2020.

| Particulars | 2018-19 (₹) | 2019-20 (₹) |

| Advance subscription | 6,000 | 9,000 |

| Outstanding subscription | 9,000 | 12,000 |

The Club has 2,000 members each paying an annual subscription of ₹ 1,000. (2)

Answer:

Question 2.

State the difference between ‘Firm’s Debts’ and ‘Private Debts’ on the basis of:

(A) Liability

(B) Application of firm’s property (2)

Answer:

Difference between Dissolution of Partnership and Dissolution of Partnership Firm

| Basis of Difference | Firm’s Debts | Private Debts |

| (A) Liability | All the partners are jointly or individually liable for repayment of liability. | The liability of repayment lies with the partner from his personal assets. |

| (B) Application of firm’s property | The firm’s property is first applied for settling the firm’s debts. | Concerned partner’s share in the distributable profit is used for private debts. |

![]()

Question 3.

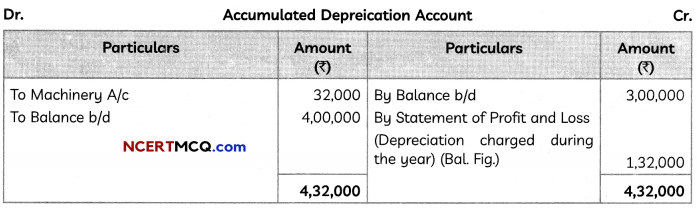

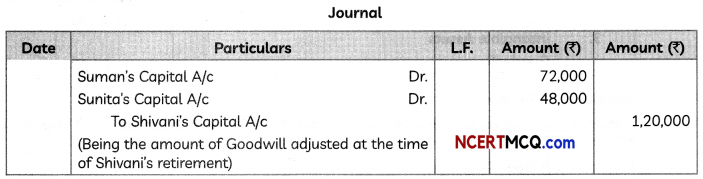

In a partnership firm Sushi Limited, Suman, Sunita and Shivani were partners sharing profits and losses in the ratio of 3 : 2 : 1. Shivani retires from the firm and her capital after making the necessary adjustments was ₹ 10,00,000. It was decided that Shivani be paid ₹ 11,20,000 in full settlement of her claim.

Record the necessary journal entry in the books of Sushi Limited and also show your workings clearly. (2)

Answer:

Working Notes:

(1) Calculation of Profit Sharing Ratio:

Old Profit Sharing Ratio of Suman, Sunita and Shivani = 3 : 2 : 1

New Profit Sharing Ratio and Gaining Ratio of Suman and Sunita will be 3 : 2, as no information provided of future profit sharing ratio between Suman and Sunita.

(2) Calculation of Shivani’s Share of Goodwill:

Shivani’s Share of Goodwill = Amount Paid – Shivani’s Capital after Adjustments

= ₹ 11,20,000 – ₹ 10,00,000

= ₹ 1,20,000

which will be compensated by Suman and Sunita in their Gaining Ratio, i.e., 3 : 2.

Suman will compensate = ₹ 1,20,000 × \(\frac{3}{5}\) = ₹ 72,000

Sunita will compensate = ₹ 1,20,000 × \(\frac{2}{5}\) = ₹ 48,000

Question 4.

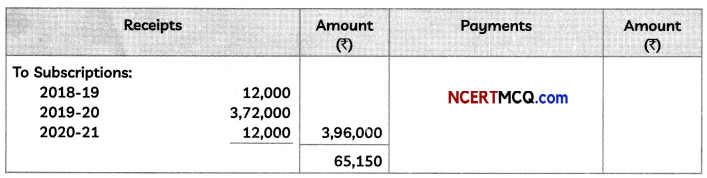

Extract of Receipts and Payments Account for the year ended 31st March, 2020 of Rajdhani Club are given below:

Additional Information:

(i) The Club has 500 members each paying ₹ 800 as annual subscription.

(ii) Subscription outstanding as on 31st March, 2019 were ₹ 32,000.

Calculate the amount of subscriptions to be shown as income in the Income and Expenditure Account for the year ended 31st March, 2020 and show the relevant data in the Balance Sheet of the Club as at 31st March, 2020.

OR

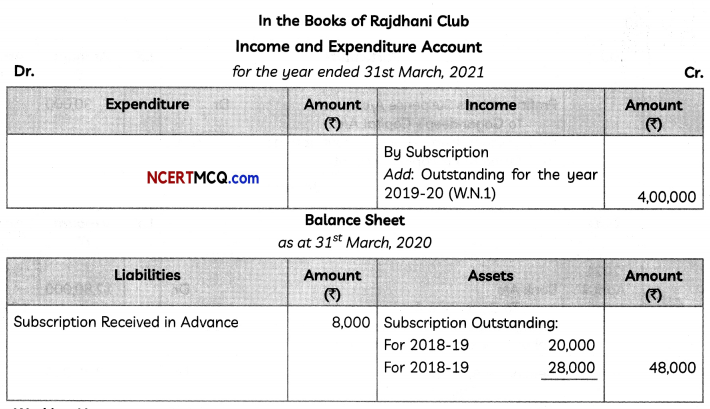

How the following items for the year ended 31st March, 2021 will be presented in the financial statements of Feather Club:

| Receipts | Debit Amount (₹) | Credit Amount (₹) |

| Tournament Fund | – | 3,00,000 |

| Tournament Fund Investments | 3,00,000 | – |

| Income from Tournament Fund Investments | – | 36,000 |

| Tournament Expenses | 24,000 | – |

Additional Information:

Interest Accrued on Tournament Fund Investments ₹ 12,000. (3)

Answer:

Working Notes:

(1) Total members are 500, each paying an annual subscription of ₹ 800

Hence, total subscription receivable during the year 2019-20 (500 × ₹ 800) ₹ 4,00,000

Less: Amount of subscription received during the year for 2019-20 ₹ 3,72,000

Outstanding subscription for the year 2019-20 ₹ 28,000

(2) The outstanding subscription for 2018-19 is ₹ 32,000 out of which ₹ 12,000 has been received. Hence the balance of ₹ 20,000 (₹ 32,000 – ₹ 12,000) is still in arrear for 2018-19. It will be shown in the Balance Sheet on 31st March, 2020 on assets side.

OR

![]()

Question 5.

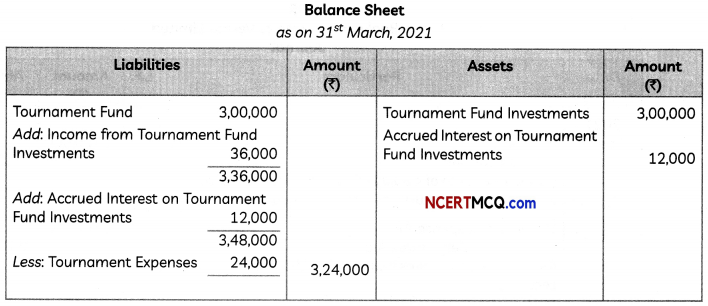

In a partnership firm ‘Lakshya Limited’, Lalit, Krishna and Gagandeep were partners with capitals of ₹ 12,00,000, ₹ 8,00,000 and ₹ 4,00,000 respectively. They shared profits and losses of the firm in the ratio of their capitals.

On 31st May, 2021 Gagandeep died, and the firm closes its books of accounts on 31st March every year. According to their partnership deed, Gagandeep’s representatives would be entitled to get share in the interim profits of the firm on the basis of sales. Sales and profit for the year 2020-21 amounted to ₹ 32,00,000 and ₹ 9,60,000 respectively and sales from 1st April, 2021 to 31st May 2021 amounted to ₹ 6,00,000. The rate of profit to sales remained constant during these two years. You are required to:

(A) Calculate Gagandeep’s share in profit.

(B) Pass journal entry to record Gagandeep’s share in profit. (3)

Answer:

(A) Sales for the year 2020-21 = ₹ 32,00,000

Profit for the year 2020-21 = ₹ 9,60,000

Sales from 1st April, 2021 to 31st May 2021 = ₹ 6,00,000

Ratio of Profit to Sales = \(\frac{9,60,000}{32,00,000}\) × 100 = 30%

Profit upto Gagandeep’s date of death = ₹ 6,00,000 × 30% = ₹ 1,80,000

Gagandeep’s Share of Profit upto his date of death = ₹ 1,80,000 × \(\frac{1}{6}\) = ₹ 30,000

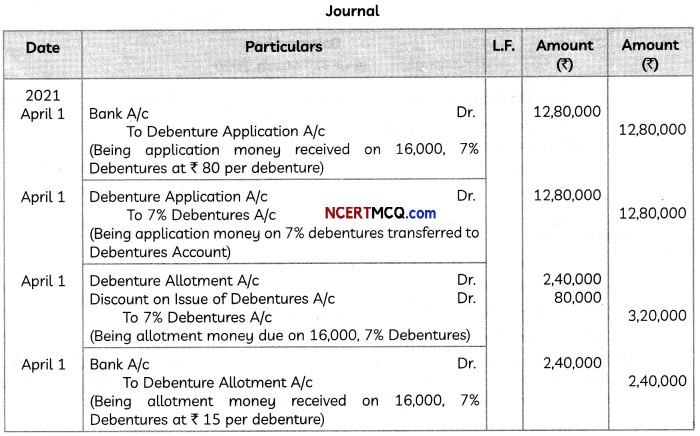

Question 6.

On 1st April, 2021, Karishma Limited issued 16,000, 7% Debentures of ₹ 100 each at a discount of 5%, redeemable after six years.

The amount per debenture was payable as follows:

On Application – ₹ 80 per debenture

On Allotment – Balance amount

The debentures were fully subscribed and all money was duly received.

Pass necessary journal entries for the issue of debentures.

OR

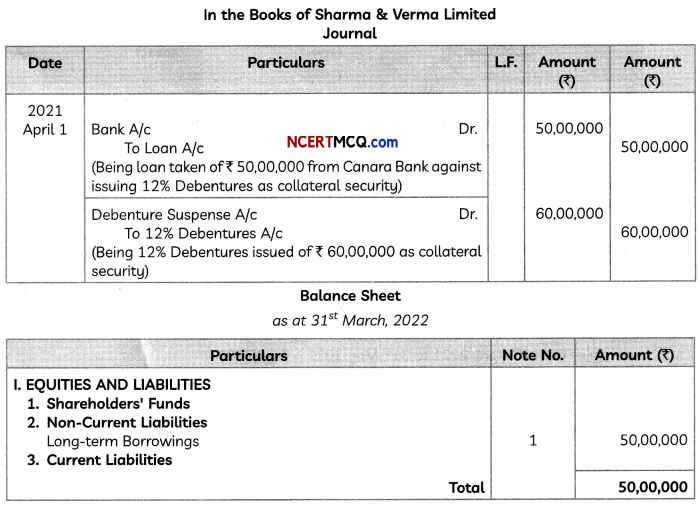

On 1st April, 2021, Sharma & Verma Limited took a loan of ₹ 50,00,000 from Canara Bank giving ₹ 60,00,000; 12% Debentures as collateral security.

Pass journal entries in the books of the company regarding issue of debentures, if any, and show this loan in the Balance Sheet of the company as at 31st March, 2022. (3)

Answer:

OR

Notes to Accounts:

![]()

Question 7.

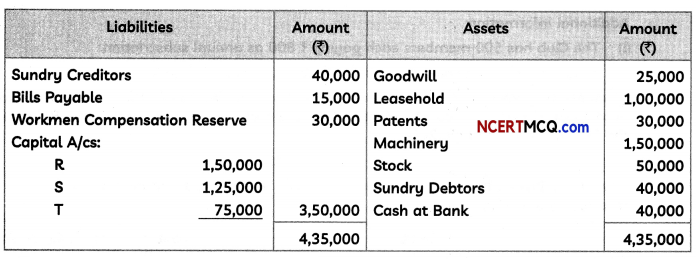

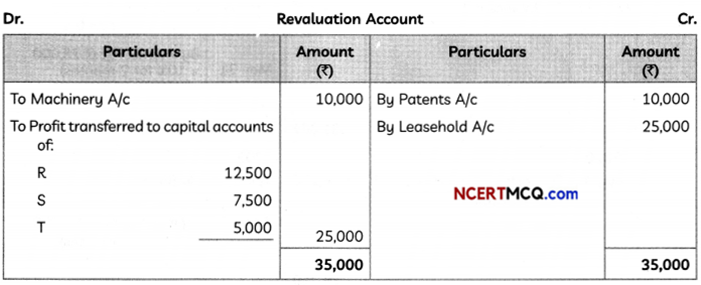

R, S and T were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On 31st March, 2018, their Balance Sheet stood as:

T died on 1st August, 2018. It was agreed that:

(i) Goodwill be valued at two and a half years’ purchase of average of last four years’ profits which were:

2014-15 : ₹ 65,000; 2015-16 : ₹ 60,000; 2016-17 : ₹ 80,000 and 2017-18 : ₹ 75,000.

(ii) Machinery be valued at ₹ 1,40,000; Patents be valued at ₹ 40,000; Leasehold be valued at ₹ 1,25,000 on 1st August, 2018.

(iii) For the purpose of calculating T’s share in the profits of 2018-19, the profits in 2018-19 should be taken to have accrued on the same scale as in 2017-18.

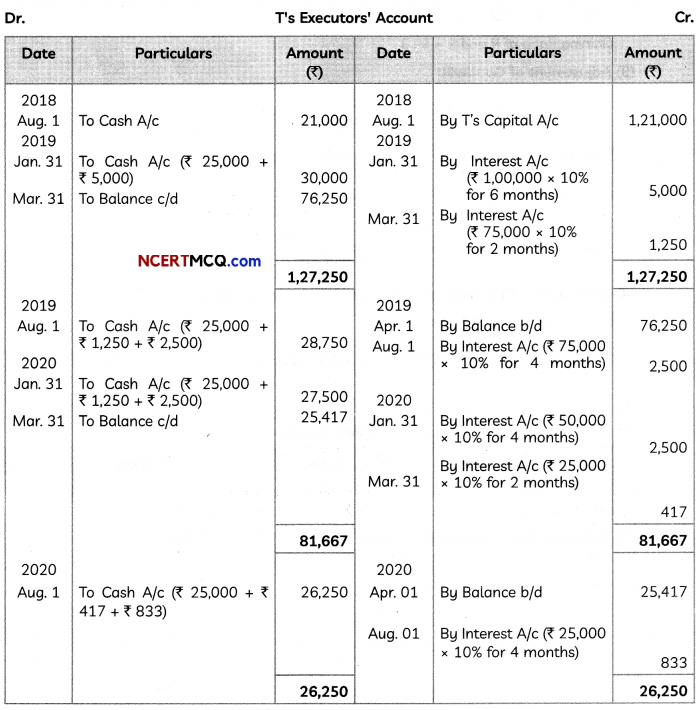

(iv) A sum of ₹ 21,000 to be paid immediately to the Executors of T and the balance to be paid in four equal half-yearly instalments together with interest @ 10% p.a.

Prepare T’s Executors’ Account.

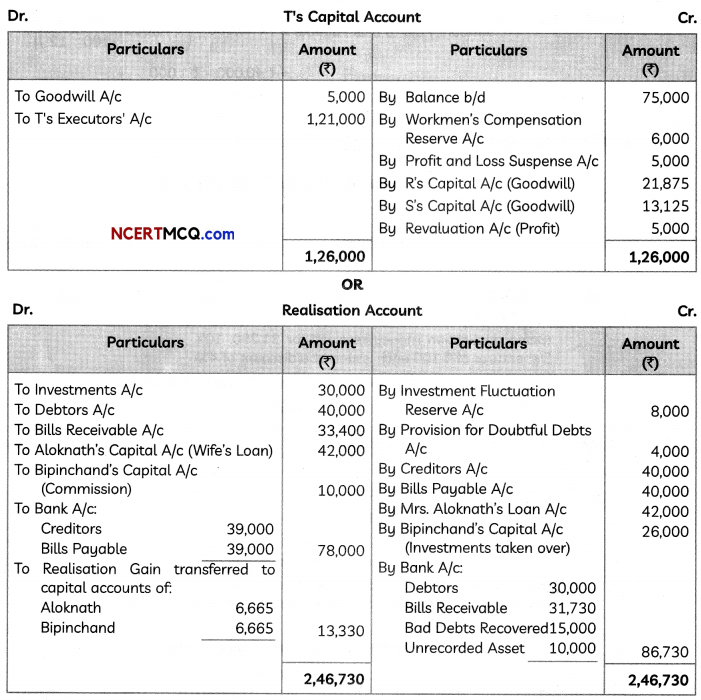

OR

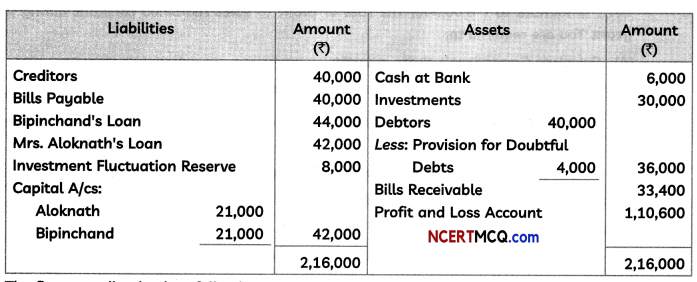

Aloknath and Bipinchand were partners in AB Traders Limited sharing profits equally. They dissolved the firm on 1st April, 2021. Bipinchand was assigned the responsibility to realise the assets and pay the liabilities at a remuneration of ₹ 10,000 including expenses. Balance Sheet of the firm as on that date was as follows:

The firm was dissolved on following terms:

(i) Aloknath was to pay his wife’s loan.

(ii) Debtors realised ₹ 30,000.

(iii) Bipinchand was to take investments at an agreed value of ₹ 26,000.

(iv) Creditors and Bills Payable were payable after two months but were paid immediately at a discount of 15% p.a.

(v) Bills Receivable were received allowing 5% rebate.

(vi) A Debtor previously written off as Bad Debt paid ₹ 15,000.

(vii) An unrecorded asset realised ₹ 10,000.

Prepare Realisation Account and Partners’ Capital Account at the time of dissolution of AB Traders Limited. (5)

Answer:

Working Notes:

(1) Calculation of goodwill:

Goodwill = Average Profit × Number of Year’s Purchase

Average Profit = \(\frac{65,000+60,000+80,000+75,000}{4}\)

= \(\frac{2,80,000}{4}\) = ₹ 70,000

Goodwill of Firm = Average Profit × Number of Year’s Purchase

= ₹ 70,000 × 2.5

= ₹ 1,75,000

(2) Calculation of Profit Sharing Ratio:

Old Profit Sharing Ratio of R, S and T = 5 : 3 : 2

T died.

> New Profit Sharing Ratio of R and S = 5 : 3 and

Gaining Ratio of R and S = 5 : 3

(3) Adjustment of Goodwill:

T’s Share in Goodwill = ₹ 1,75,000 × \(\frac{2}{10}\) = ₹ 35,000

This share of goodwill will be compensated by R and S in their gaining ratio, i.e., 5 : 3.

R will compensate = 35,000 × \(\frac{5}{8}\) = ₹ 21,875

S will compensate = 35,000 × \(\frac{3}{8}\) = ₹ 13,125

(4) Calculation of T’s Share of Profit upto his date of his death:

Profit of Firm for 2017-18 = ₹ 75,000

T’s Share of Profit upto his date of his death = ₹ 75,000 × \(\frac{2}{10} \times \frac{4}{12}\) = ₹ 5,000

![]()

(5)

(6)

Working Notes:

(1) Calculation of Amount Paid to Creditors:

Amount Paid to Creditors = [₹ 40,000 – (₹ 40,000 × \(\frac{15}{100} \times \frac{2}{12}\))]

= ₹ 40,000 – ₹ 1,000 = ₹ 39,000

(2) Calculation of Amount Paid to Bills Payable:

Amount Paid to Bills Payable = [₹40,000 – (₹ 40,000 × \(\frac{15}{100} \times \frac{2}{12}\))]

= ₹ 40,000 – ₹ 1,000

= ₹ 39,000

![]()

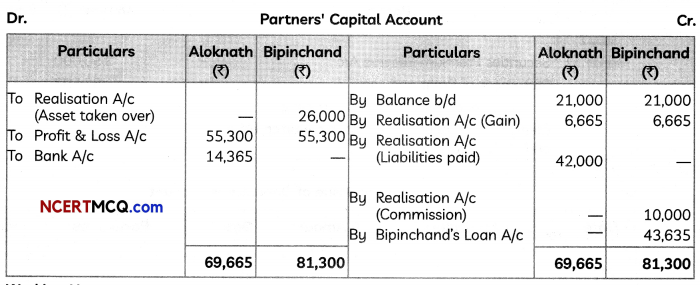

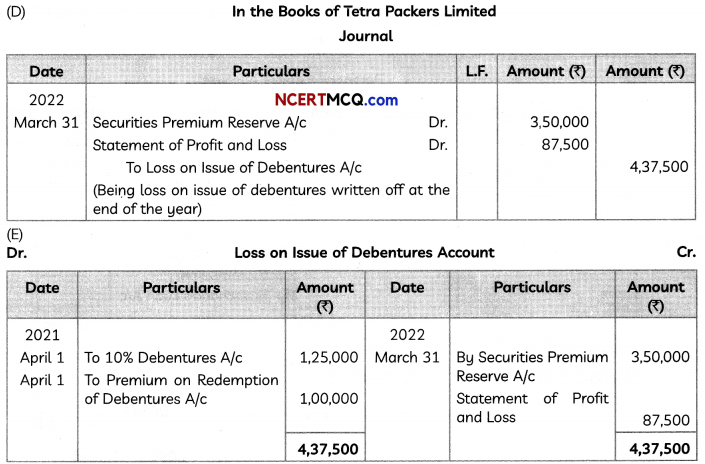

Question 8.

Tetra Packers Limited, a packers and movers company has an equity share capital of ₹ 60,00,000. The company needed funds for diversification. The finance manager of the company had the following two options:

Option 1: Issue ₹ 30,00,000,10% Debentures of ₹ 100 each to the public at 5% discount, redeemable at a premium of 10% after six years.

Option 2: Borrow ₹ 30,00,000 @ 15% p.a. from the bank payable in four equal quarterly instalments starting from the end of the fourth year.

After all the discussions, on 1st April, 2021, the board of directors of the company opted for Option 1, to increase the return to the shareholders. The Balance Sheet of the company on 1st April, 2021 shows a balance of ₹ 3,50,000 in Securities Premium Reserve which the company decided to use for writing off the loss on issue of debentures.

You are required to answer the following questions:

(A) Calculate the number of debentures issued to the public.

(B) Pass journal entry for receipt of application money of debentures.

(C) Pass journal entry to be passed at the time of allotment of debentures.

(D) Pass journal entry to write off loss on issue of debentures.

(E) Prepare Loss on Issue of Debentures Account. (5)

Answer:

(A) Number of Debentures Issued = \(\frac{₹ 30,00,000}{₹(100-4)}\) = 31,250

![]()

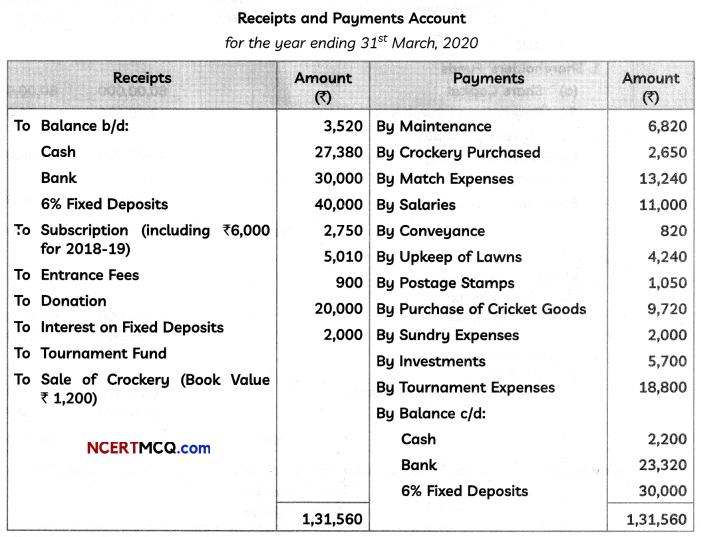

Question 9.

From the following Receipts and Payments Accounts of Samay Cricket Club and the additional information given, prepare the Income and Expenditure Account for the year ending 31st March, 2020:

Additional Information:

(i) Salary outstanding is ₹ 1,000.

(ii) Opening Balance of Stock of Postage and Stationery and Cricket goods is ₹ 750 and ₹ 3,210 respectively. Closing stock of the same is ₹ 900 and ₹ 2,800 respectively.

(iii) Outstanding subscription for the year 2018-19 is ₹ 6,600 and for the year 2019-20 is

₹ 8,000. (5)

Answer:

![]()

PART-B

Option-1

(Analysis of Financial Statements)

Question 10.

Identify the following transactions as belonging to Operating Activities, Investing Activities, Financing Activities or Cash and Cash Equivalents:

(A) Income tax paid

(B) Interest on Debentures (2)

Answer:

(A) Income tax paid – Operating Activities

(B) Interest on Debentures – Financing Activities

Question 11.

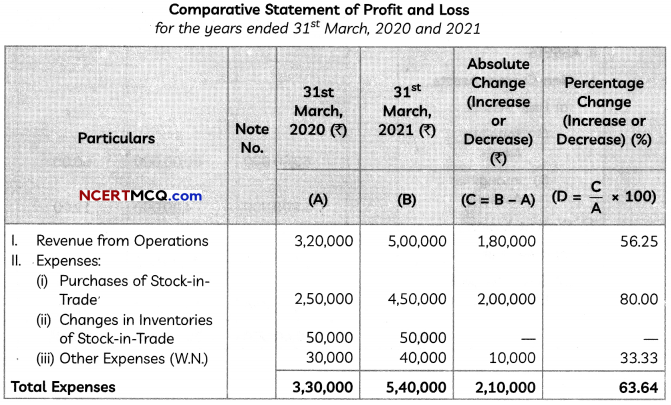

Prepare Comparative Statement of Profit and Loss from the following information:

| Particulars | 31st March, 2021 | 31st March, 2020 |

| Revenue from Operations | ₹ 5,00,000 | ₹ 3,20,000 |

| Purchases of Stock-in-Trade | ₹ 4,50,000 | ₹ 2,50,000 |

| Changes in Inventories of Stock-in-Trade | ₹ 50,000 | ₹ 50,000 |

| Other Expenses (% of Cost of Revenue from Operations) | 8% | 10% |

| Tax | 30% | 30% |

OR

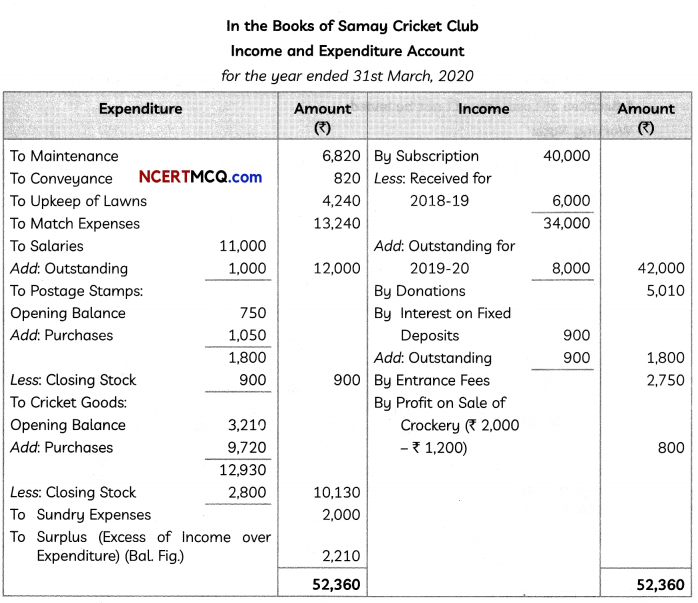

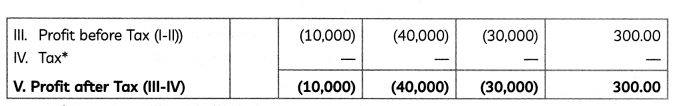

From the following Balance Sheet of Surga Trading Limited as at 31st March, 2021, prepare Common Size Balance Sheet:

Answer:

* Because of Loss Tax Will not be levied

Working Notes:

![]()

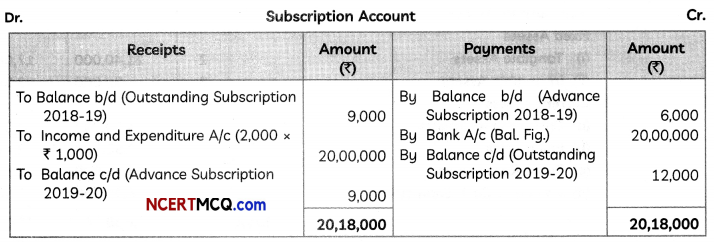

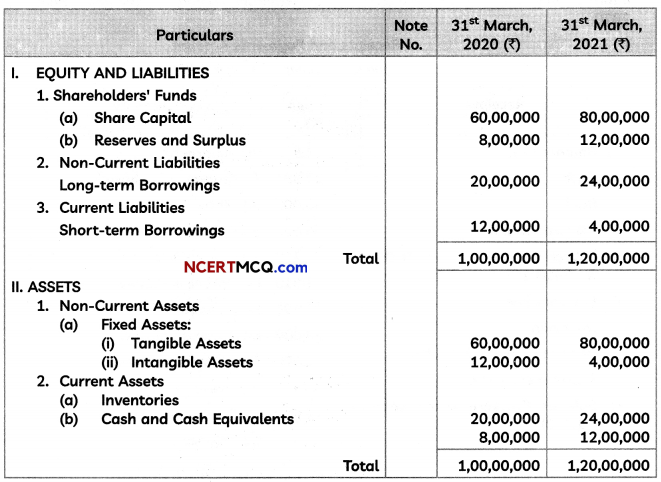

Question 12.

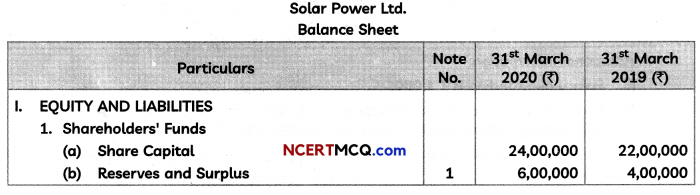

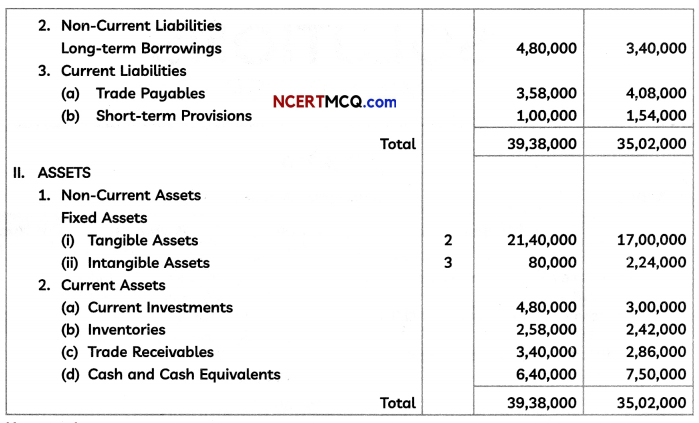

Following are the Balance Sheets of Solar Power Ltd. as at 31st March, 2020 and 2019:

Notes to Accounts:

Additional Information:

During the year, a piece of machinery costing ₹ 48,000 on which accumulated depreciation was ₹ 32,000 was sold for ₹ 12,000.

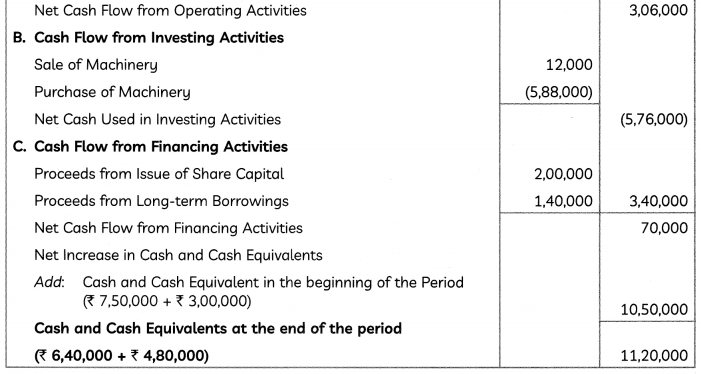

Prepare Cash Flow Statement. (5)

Answer:

![]()

Working Notes: