Students can access the CBSE Sample Papers for Class 12 Accountancy with Solutions and marking scheme Term 2 Set 9 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Accountancy Standard Term 2 Set 9 with Solutions

Time Allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. Alt1 questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e., (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one. of the given options.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

PART-A

(Accounting for Not-for-Profit Organisations, Partnership Firms and Companies)

Question 1.

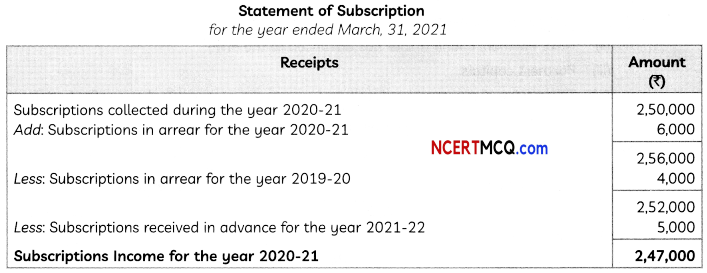

Calculate the amount of subscriptions which will be treated as income for the year ended 31st March, 2021 for each of the following cases:

(i) Subscriptions collected during the year ended 31st March, 2021 amounted to ₹ 2,50,000.

(ii) Subscriptions in arrear for the year ended 31st March, 2021 amounted to ₹ 6,000.

(iii) Subscriptions in arrear for the year ended 31st March, 2020 amounted to ₹ 4,000.

(iv) Subscriptions received in advance for the year ended 31st March, 2022 amounted to ₹ 5,000. (2)

Answer:

![]()

Question 2.

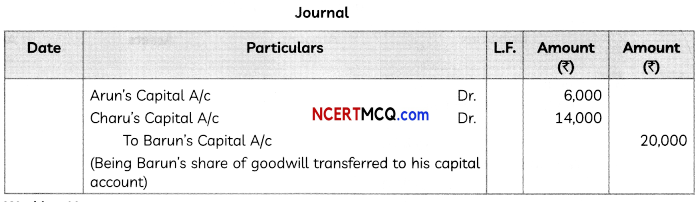

Arun, Barun and Charu are sharing profits in the ratio of 3 : 2 :1. Barun retires and on the day of

Barun’s retirement Goodwill of the firm is valued at ₹ 60,000. Arun and Charu decided to share future profits in the ratio of 3 : 2. Pass necessary journal entry for the treatment of goodwill. Also show workings clearly. (2)

Answer:

Working Notes:

(1) Calculation of Gaining Ratio:

Old Profit Sharing Ratio of Arun, Barun and Charu = 3 : 2 : 1

New Profit Sharing Ratio of Arun and Charu = 3 : 2

Gaining Ratio = New Profit Sharing Ratio – Old Profit Sharing Ratio

Arun’s Gain = \(\frac{3}{5}-\frac{3}{6}\) = \(\frac{18-15}{30}\) = \(\frac{3}{30}\)

Charu’s Gain = \(\frac{2}{5}-\frac{1}{6}\) = \(\frac{12-5}{30}\) = \(\frac{7}{30}\)

Gaining Ratio of Arun and Charu = 3 : 7

(2) Calculation of Barun’s Share of Profit:

Goodwill of Firm = ₹ 60,000

Barun’s share of Goodwill = ₹ 60,000 × \(\frac{2}{6}\) = ₹ 20,000

which will be compensated by Arun and Charu in their gaining ratio.

Arun will compensate = ₹ 20,000 × \(\frac{3}{10}\) = ₹ 6,000

Charu will compensate = ₹ 20,000 × \(\frac{7}{10}\) = ₹ 14,000

Question 3.

State the provisions of Section 48 of the Partnership Act, 1932 regarding settlement of Accounts

during the Dissolution of a Partnership Firm. (2)

Answer:

According to Section 48 of the Partnership Act, 1932:

(1) Losses including the deficiencies of Capitals are to be paid:

- First out of profits

- Next out of Capitals of the partners

- Lastly if required, by the partners individually in their profit sharing ratio (as their liability is unlimited)

(2) The Assets of the firm and the amount contributed by the partners to make up the deficiency of capital shall be applied for:

- First to pay the debts of the firm to the third parties.

- Next, Partners Loan(Partner has advanced to the firm)

- Partners capitals

- The residue, if any shall be distributed among the partners in their profit sharing ratio.

![]()

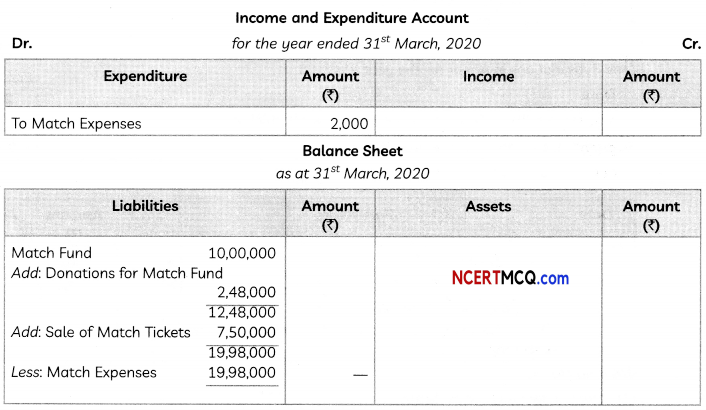

Question 4.

Present the following information for the year ended 31st March, 2020 in the financial statements of a Not-for-Profit Organisation:

| Particulars | Amount (₹) |

| Opening balance of Match Fund | 10,00,000 |

| Sale of Match Tickets | 7,50,000 |

| Donations for Match Fund received during the year | 2,48,000 |

| Match Expenses | 20,00,000 |

OR

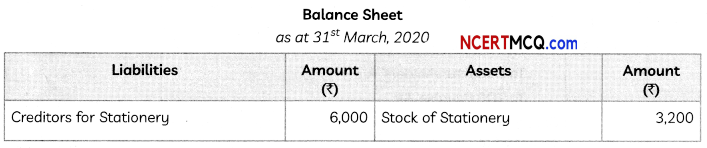

Present the following information for the year ended 31st March, 2020 in the financial statements of a Not-for-Profit Organisation:

| Receipts | 01.04.2019 (₹) | 31.03.2020 (₹) |

| Creditors for Stationery | 8,000 | 6,000 |

| Stock of Stationery | 3,000 | 3,200 |

During 2019-20 payment made for Stationery was ₹ 60,000.

Answer:

OR

![]()

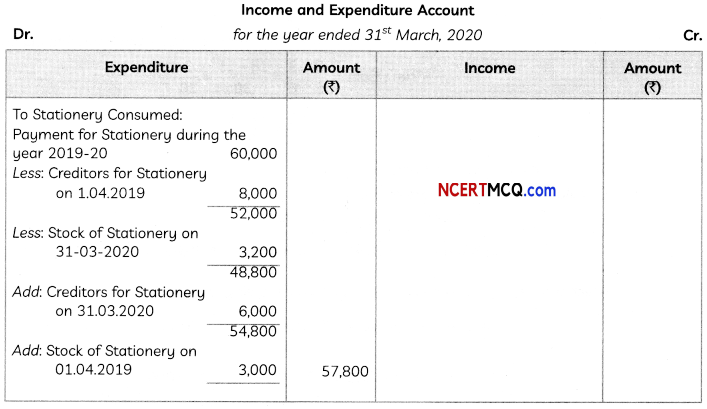

Question 5.

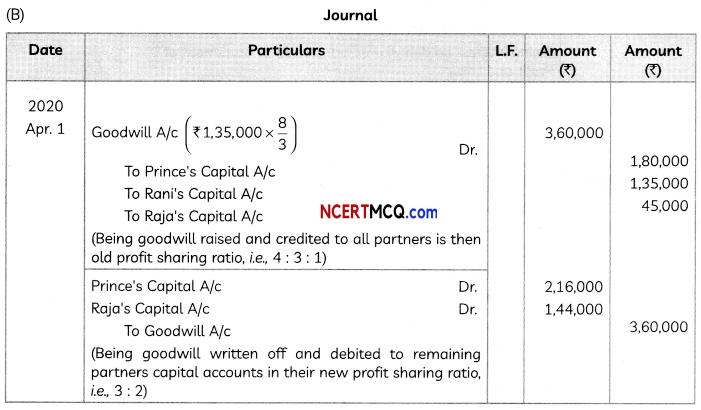

In a partnership firm, prince, Rani and Raja are partners hsaring profits and loses of the firm in the ratio of 4 : 3 : 1. On 1st April, 2020, Rani died.

It is provided in the partnership deedof the firm that on the death of any partner, deceased partner’s show of goodwill will be valued at half of the profits credit to his/her account during previous four completed years.

The profits or lossesof the firm of lart four years are as:

2016-17 – ₹ 3,60,000 (Profit)

2017-18 – ₹ 1,80,000 (Profit)

2018-19 – ₹ 60,000 (Loss)

2019-20 – ₹ 2,40,000 (Profit

You are required to:

(A) Determine the amount that should be credited to Rani’s Capital Account as her share of goodwill.

(B) Pass journal entry for adjustment of goodwill assuming that Prince and Raja will share future

profits and losses is the ratio of 3 : 3, when Goodwill Account is opened. (3)

Answer:

(A) Total profit of 4 years = ₹ 3,60,000 + ₹ 1,80,000 – ₹ 60,000 + ₹ 2,40,000 = ₹ 7,20,000

Rani’s Share in profit already credited to her account = ₹ 7,20,000 x \(\frac{5}{8}\)

= ₹ 2,70,000

∴ Rani’s Share of Goodwill = ₹ 2,70,000 x \(\frac{1}{2}\)

= ₹ 1,35,000

![]()

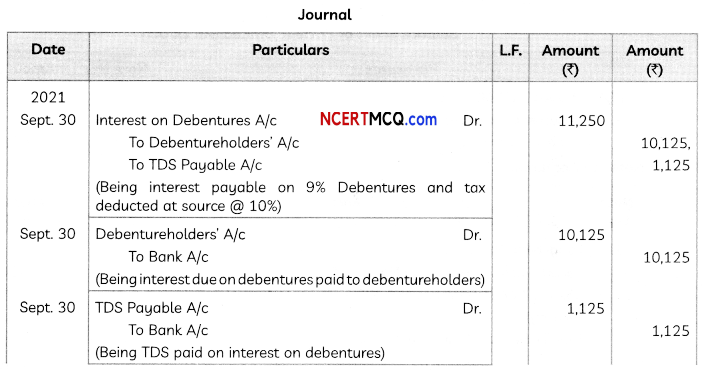

Question 6.

On 1st April, 2020, Yashika Ltd. issued 500, 9% Debentures of ₹ 500 each at a discount of 4% and redeemable at a premium of 5% after three years.

Pass necessary journal entries in the books of the company for interest on debentures for the year ended 31st March, 2021 assuming that interest is payable on 30th September and 31st March and the rate of tax deducted at source is 10%. The company closes its books on 31 March every year.

OR

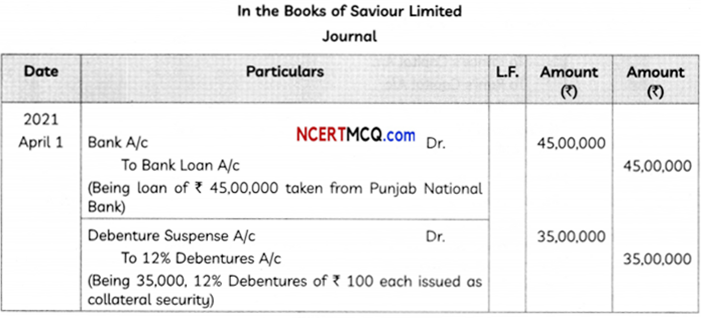

Saviour Limited took a loan of ₹ 45,00,000 from Punjab National Bank against the security of tangible assets. In addition to principal security, it issued 35,000 12% Debentures of ₹ 100 each as collateral security.

Pass necessary journal entries for the above transactions, if the company decided to record the issue of 12% Debentures as collateral security and show the presentation in the Balance Sheet of Saviour Limited. (3)

Answer:

OR

![]()

Question 7.

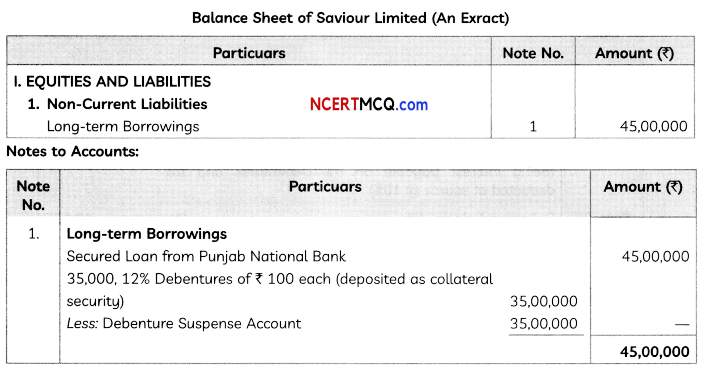

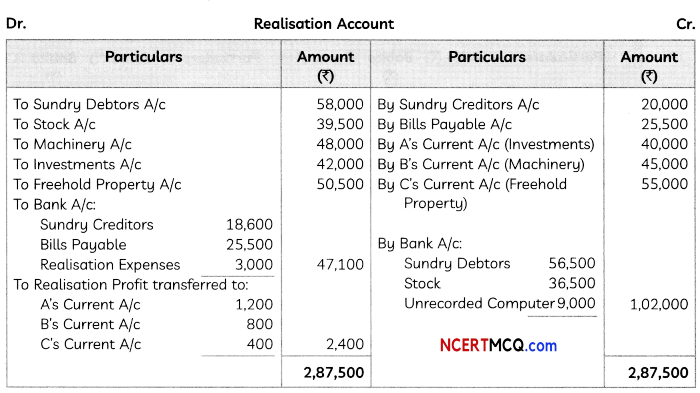

A, B and C are partners in a partnership firm sharing profits and losses in the proportion of 1/2, 1/3, 1/6 respectively. They dissolve the partnership firm on 31st March, 2020 when the Balance Sheet of the firm stood as under:

The Machinery was taken over by B for ₹ 45,000, A took over the Investments for ₹ 40,000 and Freehold property took over by ‘C’ at ₹ 55,000. The remaining Assets realised as follows: Sundry Debtors ₹ 56,500 and Stock ₹ 36,500.

Sundry Creditors were settled at discount of 7%. A office computer, not shown in the books of accounts realised ₹9,000. Realisation expenses amounted to ₹ 3,000.

Prepare Realisation Account and Capital Account of Partners.

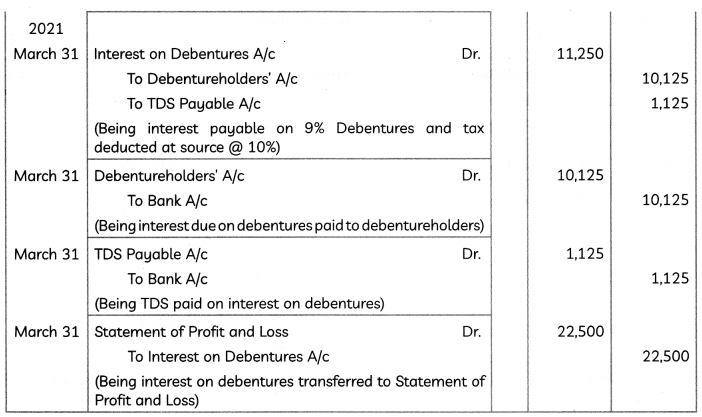

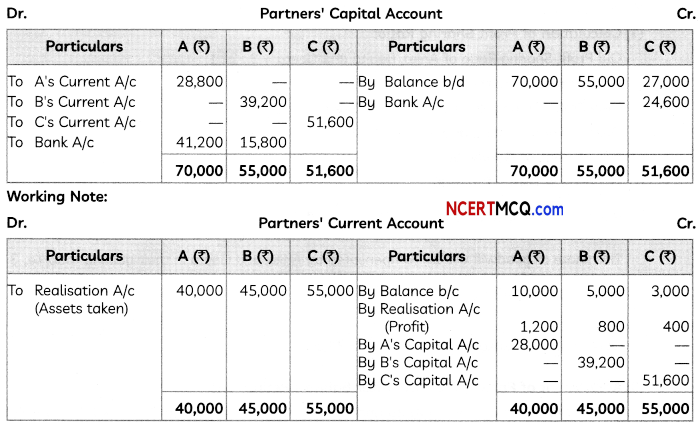

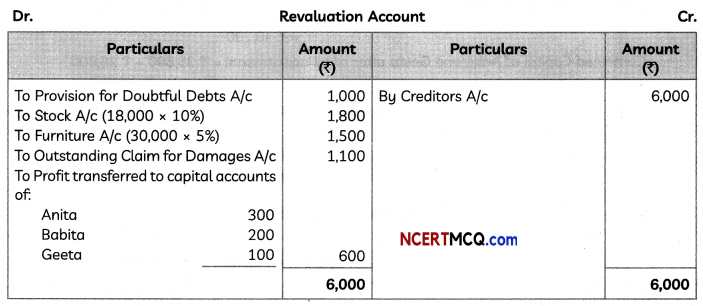

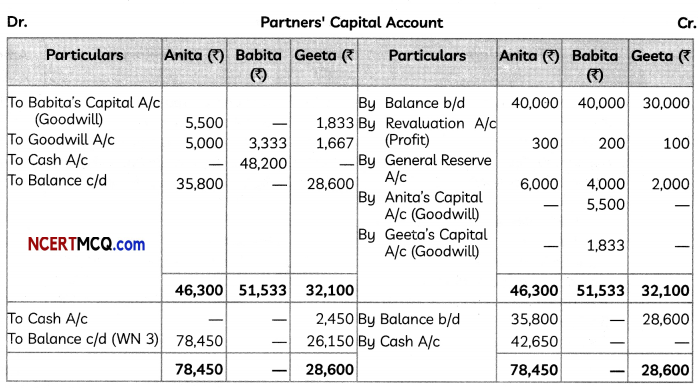

OR

Anita, Babita and Geeta are partners in ‘Pleasant Limited’ sharing profits and losses in the ratio of 3 : 2 :1. The Balance Sheet of the firm as at 31st March, 2021 was:

Babita retires from the partnership firm on 1st April, 2021 on the following terms:

(i) Provision for Doubtful Debts be raised by ₹ 1,000.

(ii) Stock to be reduced by 10% and Furniture by 5%.

(iii) There is an outstanding claim of damages of ₹ 1,100 and it is to be provided for.

(iv) Creditors will be written back by ₹ 6,000.

(v) Goodwill of the firm is valued at ₹ 22,000.

(vi) Babita is paid in full with the cash brought in by Anita and Geeta in such a manner that their capitals are in proportion to their profit sharing ratio and Cash in Hand in the firm remains at ₹ 10,000.

You are required to prepare Revaluation Account and Partners’ Capital Accounts at the time of Babita’s retirement. (5)

Answer:

OR

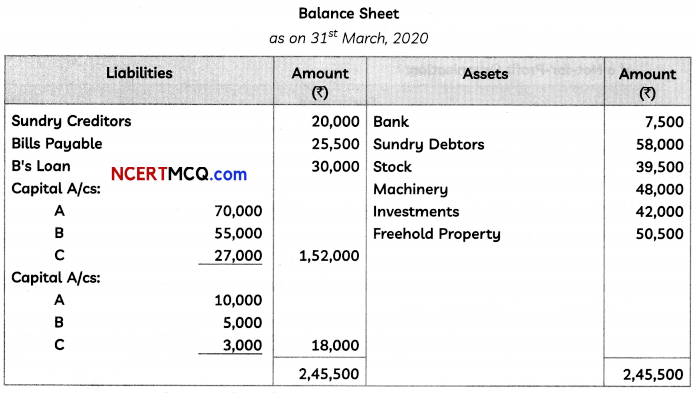

Working Notes:

(1) Calculation of Profit Sharing Ratio:

Old Profit Sharing Ratio of Anita, Babita and Geeta = 3 : 2 : 1

Babita retires from the firm.

New Profit Sharing Ratio of Anita and Geeta = 3 : 1 and

Gaining Ratio of Anita and Geeta = 3 : 1

(2) Adjustment of Goodwill:

Goodwill of Firm = ₹ 22,000

Babita’s Share of Goodwill = ₹ 22,000 × \(\frac{2}{6}\) = ₹ 7,333

This share of goodwill will be compensated by Anita and Geeta in their gaining ratio, i.e., 3 : 1

Anita will compensate = ₹ 7,333 × \(\frac{3}{4}\) = ₹ 5,500

Geeta will compensate = ₹ 7,333 × \(\frac{1}{4}\) = ₹ 1,833

(3) Adjustment of Partners’ Capital after Babita’s Retirement:

Amount to be brought in by Anita and Geeta = Cash to be paid to Babita + Minimum Balance of

Cash – Existing Balance of Cash

= ₹ 48,200 + ₹ 10,000 – ₹ 18,000

= ₹ 40,200

Combined Capital of Anita and Geeta after of all adjustments = ₹ 35,800 + ₹ 28,600

= ₹ 64,400

Total Capital of the New Firm = Amount to be brought in by Anita and Geeta +

Combined Capital of Anita and Geeta

= ₹ 40,200 + ₹ 64,400

= ₹ 1,04,600

Anitas New Capital = ₹ 1,04,600 × \(\frac{3}{4}\) = ₹ 78,450

Geeta’s New Capital = ₹ 1,04,600 × \(\frac{3}{4}\) = ₹ 26,150

![]()

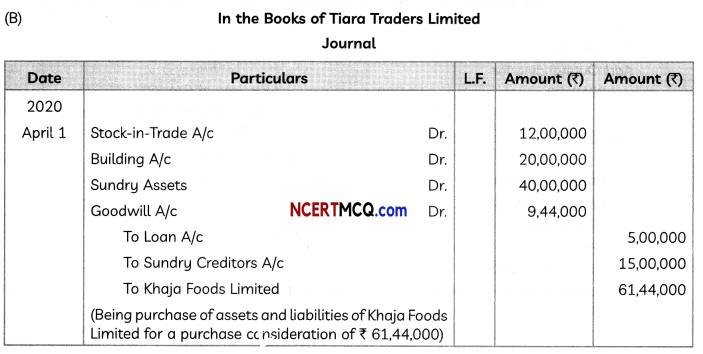

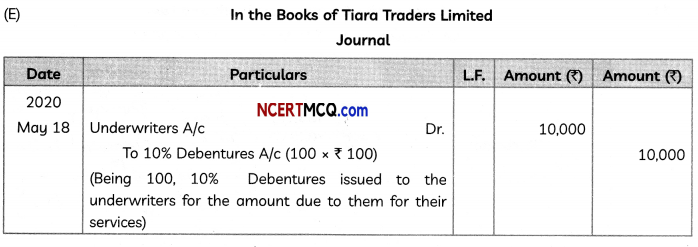

Question 8.

Tiara Traders Limited was incorporated on 1st April, 2016 with registered office in Pune. The company’s profit grows year after year, and it begins to expand its operations throughout India. To expand their business in Madhya Pradesh, CEO of the company decided to purchase the business of Khaja Foods Limited, a well-known firm of FMCG in Madhya Pradesh.

On 1st April, 2020 Tiara Traders Limited bought the business of Khaja Foods Limited consisting Stock-in-Trade of ₹ 12,00,000, building of ₹ 20,00,000 and other sundry assets of ₹ 40,00,000 and loan of ₹ 5,00,000 and sundry creditors of ₹ 15,00,000 for a consideration of ₹ 61,44,000.

Tiara Traders Limited issued 12% Debentures of ₹ 100 each fully paid, at a discount of 4% in satisfaction of purchase consideration to Khaja Foods Limited. On 18th May, 2020, the company also issued 100, 10% Debentures of ₹ 100 each credited as fully paid-up to the underwriters towards their commission.

You are required to answer the following questions:

(A) Calculate the amount of Goodwill purchased by Tiara Traders Limited of Khaja Foods Limited.

(B) Pass journal entry for the purchase of business of Khaja Foods Limited.

(C) Calculate the number of debentures issued to Khaja Foods Limited.

(D) Pass journal entry for the allotment of debentures to Khaja Foods Limited.

(E) Pass journal entry for the allotment of debentures to the underwriters. (5)

Answer:

(A) Amount of Goodwill = Purchase Consideration – (Value of Assets – VaLue of Liabilities)

= ₹ 61,44,000 – (₹ 72,00,000 – ₹ 20,00,000)

= ₹ 9,44,000

![]()

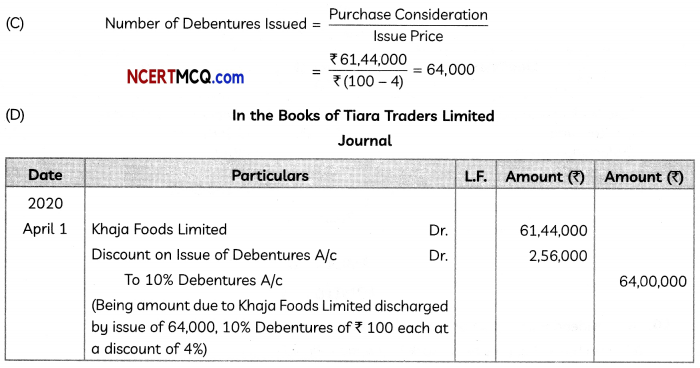

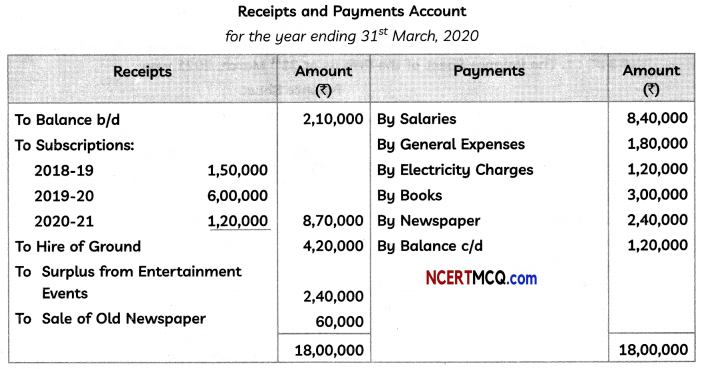

Question 9.

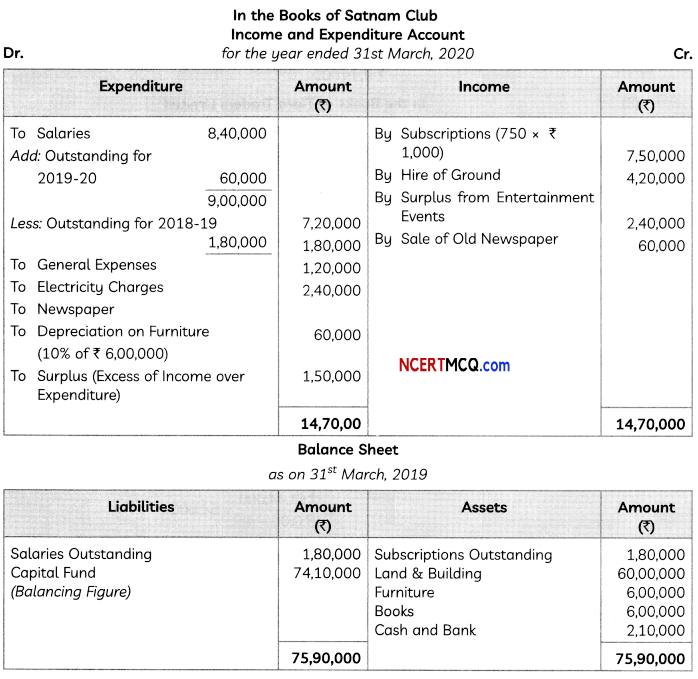

From the following Receipts and Payments Account of Satnam Club and the information supplied, prepare Income and Expenditure Account for the year ended 31st March, 2020 and calculate Capital Fund as on 31st March, 2019:

Additional Information:

(i) The club has 750 members each paying an annual subscription of ₹ 1,000. Subscriptions Outstanding on 31st March, 2019 were ₹ 1,80,000.

(ii) On 31st March, 2020, Salaries Outstanding amounted to ₹ 60,000.

(iii) Salaries paid in the year ended 31st March, 2020 included ₹ 1,80,000 for the year ended 31st March, 2019.

(iv) On 1st April, 2019, the club owned Land & Building valued at ₹ 60,00,000; Furniture ? 6,00,000 and Books ₹ 6,00,000.

(v) Provide depreciation on Furniture at 10%. (5)

Answer:

![]()

PART-B

Option-1

(Anaiysis of Financial Statements)

Question 10.

Classify the following transactions as Operating Activities for a financial company and a non- financial company:

(A) Dividend received on Shares

(B) Purchase of shares on a Stock Exchange

Answer:

(A) Dividend received on Shares – Financial Company

(B) Purchase of shares on a Stock Exchange – Financial Company

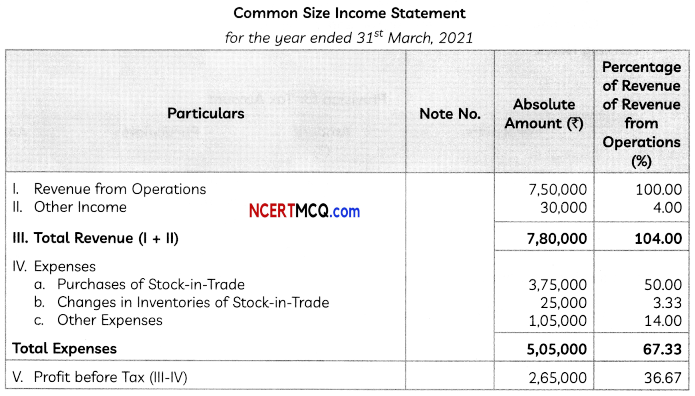

Question 11.

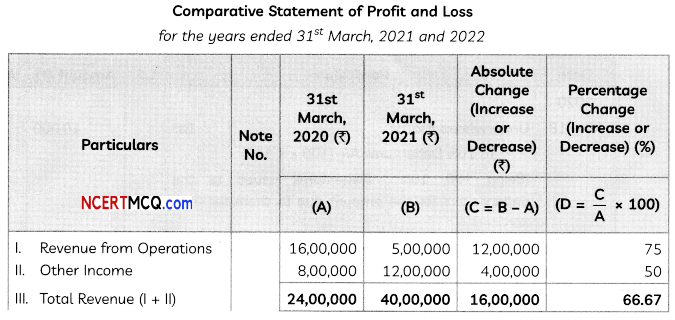

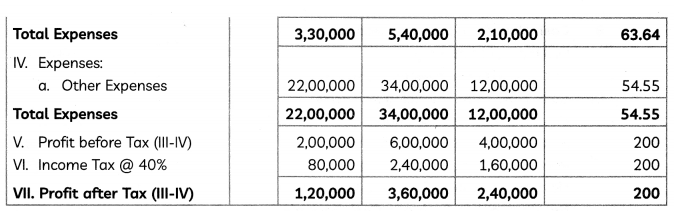

From the following provided from the Statement of Profit and Loss of Lotus Ltd. for the year ended 31st March, 2021 and 2022, prepare Comparative Statement of Profit and Loss:

| Particulars | 31stMarch, 2021 | 31stMarch, 2020 |

| Revenue from Operations | 28,00,000 | 16,00,000 |

| Other Incomes | 12,00,000 | 8,00,000 |

| Other Expenses | 34,00,000 | 22,00,000 |

Rate of Income Tax was 40%

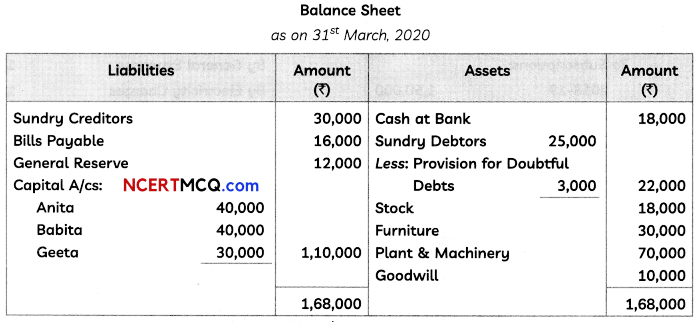

OR

Prepare Common Size Income Statement from the following information provided of Gungun Limited for the year ending 31st March, 2021:

| Particulars | Amount |

| Revenue from Operations | 7,50,000 |

| Other Incomes | 30,000 |

| Purhases of Stock-in-Trade | 3,75,000 |

| Changes in Inventories of Stock-in-Trade | 25,000 |

| Other Expenses | 1,05,000 |

(3)

Answer:

OR

![]()

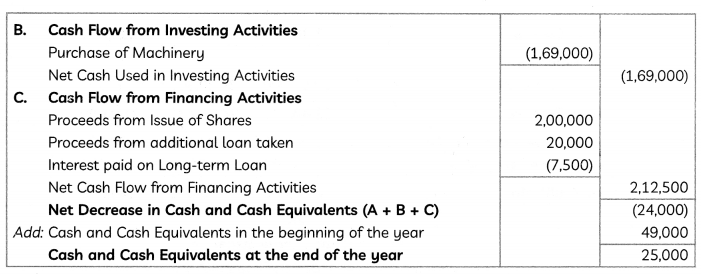

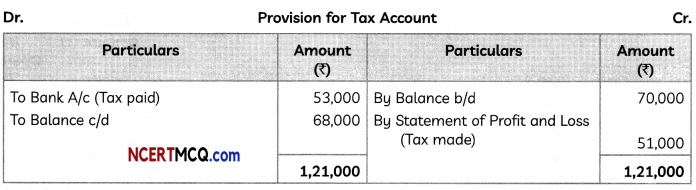

Question 12.

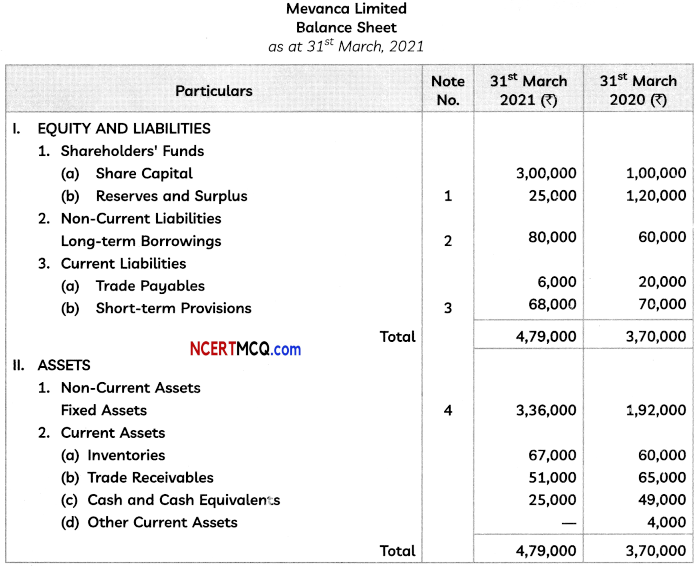

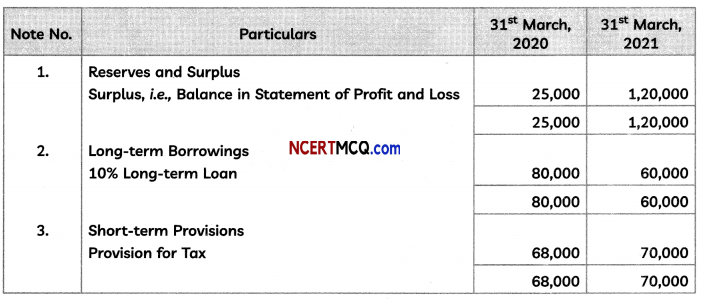

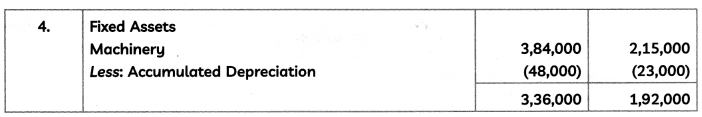

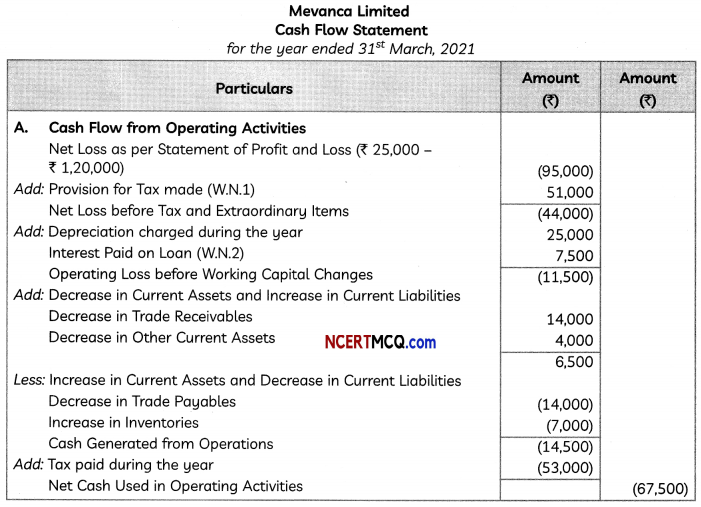

Following is the Balance Sheet of Mevanca Limited as at 31st March, 2021:

Notes to Accounts:

Additional Information:

(i) Additional loan was taken on 1st July, 2020.

(ii) Tax of ₹ 53,000 was paid during the year.

You are required to prepare Cash Flow Statement of Mevanca Limited for the year ended 31st March, 2021.

Answer:

![]()

Working Notes:

(1)

(2) Calculation of Interest on Loan:

Interest on Loan taken on 1st July, 2020 = ₹ 20,000 × \(\frac{10}{100} \times \frac{9}{12}\) = ₹ 1,500

Interest on Loan as on 31st March, 2020 = ₹ 60,000 × \(\frac{10}{100}\) = ₹ 6,000

Total Interest Paid on Loan = ₹ 6,000 + ₹ 1,500 = ₹ 7,500