Students can access the CBSE Sample Papers for Class 12 Economics with Solutions and marking scheme Term 2 Set 1 will help students in understanding the difficulty level of the exam.

CBSE Sample Papers for Class 12 Economics Term 2 Set 1 with Solutions

Time allowed: 2 Hours

Maximum Marks: 40

General Instructions:

- This is a Subjective Question Paper containing 13 questions.

- This paper contains 5 questions of 2 marks each, 5 questions of 3 marks each and 3 questions of 5 marks each.

- 2 marks questions are Short Answer Type Questions and are to be answered in 30-50 words.

- 3 marks questions are Short Answer Type Questions and are to be answered in 50-80 words.

- 5 marks questions are Long Answer Type Questions and are to be answered in 80-120 words.

- This question paper contains Case/Source Based Questions.

![]()

Question 1.

Distinguish between Rnal Goods and Intermediate Goods.

OR

Distinguish between positive externalities and negative externalities. (2)

Answer:

Final goods refer to those goods which are used either for final consumption or for investment purposes. Whereas Intermediate goods refer to those goods which are used either for resale or for further production purposes.

Explanation:

| Final Goods | Intermediate Goods |

| Goods which are used for either consumption or investment is known as final goods. | Goods which are used for further production as raw material or purchased for resale is known as intermediate goods. |

| Final goods included in estimation national income. | Intermediate goods the are not included in of the estimation of national income. |

OR

Positive externalities refer to benefits caused by one entity to another, without being paid for it. Whereas Negative externalities refer to the harms caused by one entity to another without being penalized for it.

Explanation:

| Positive Externalities | Negative Externalities |

| Positive externalities refer to the benefits of an economy activity to the others without involving any price paid for that. | Negative externalities refer to the negative impact of an economy activity on the others without involving any penalty. |

| Employment generated due to establishment of a factory is an example of positive externality. | Smoke omitted by factories causes air pollution is an example of negative externality. |

![]()

Question 2.

Calculate equilibrium level of income for a hypothetical economy, for which it is given that:

(1) Autonomous Investments = ₹500 crores, and

(2) Consumption function, C = 100 + 0.80 Y

OR

Calculate Change in Income (ΔY) for a hypothetical economy. Given that

(1) Marginal Prospensity to Consume (MPC) = 0.8, and

(2) Change in Investment (Δl) = ₹1,000 crores (2)

Answer:

Given Consumption function is,

C = 100 + 0.8 Y

Autonomous investments = ₹500 crores We know, at equilibrium level

Y = C + l

Y = 100 + 0.8 Y + 500

Y – 0.8Y = 600 0.2 Y = 600

Y = ₹3,000 crores

Explanation:

Given,

Consumption function (C) = 100 + 0.8Y

Autonomous investments (I) = 500 crores

Y = C + l

Y = 100 + 0.8Y + 500

Y – 0.8Y = 600

0.2Y = 600

Y = ₹ 3,000 crores

OR

P Given ΔI = ₹1,000 crores

MPC = 0.8

As we know,

Multiplier (K) = \(\frac{1}{1-M P C}=\frac{1}{1-0.8}=\frac{1}{0.2}\)

= 5 times

We know K = \(\frac{\Delta Y}{\Delta l}\)

5 = \(\frac{\Delta Y}{1000}\)

ΔY = ₹ 5,000 crores

Explanation: Given,

Change in Investment

(Δl) = ₹ 1,000 crores

Marginal Propensity to Consume (MPC) = 0.8

Multiplier (K) = 1/1 – MPC

= 1/1 – 0.8

= 1/0.2 = 5

Multiplier (K) = Change in Income (ΔY)/

Change in Investment (Δl) =

5 = ΔY/1,000 ΔY = ₹ 5,000 crores

![]()

Question 3.

‘As the income increases, people tend to save more’. Justify the given statement. (2)

Answer:

At a lower level of income, a consumer spends a larger proportion of his/her income on consumption expenditure (basic survival requirements). As the income increases, owing to the psychological behavior of a consumer (rational), people tend to consume less and save more for future uncertainty.

Explanation:

It is true that as the income increases, people tend to save more. At a lower Level of income, a person spends most of his income on the basic survival requirements. People on very low income cannot afford the Luxury of saving. But as the income increases, households tend to have a higher marginal propensity to save as they save more for future uncertainty.

Question 4.

State and discuss any two indicators that help in measuring the health status of a country.

OR

Compare and analyze the ‘Women Worker Population Ratio’ in Rural and Urban areas based on following information: Worker-Population Ratio in India, 2017-2018. (2)

| Sex | Worker-Population Ratio | ||

| Total | Rural | Urban | |

| Men | 52.1 | 51.7 | 53.0 |

| Women | 16.5 | 17.5 | 14.2 |

| Total | 34.7 | 35.0 | 33.9 |

Answer:

Two indicators that help to measure the health status of a country are:

- Infant Mortality Rate – Infant Mortality Rate (or IMR) indicates the number of children that survive first year of their life.

- Literacy Rate – Literacy rate measures the proportion of literate population in the age group of seven years or above.

Explanation:

Two indicators that help to measure the health status of a country are:

- Life expectancy: It refers to the number of years a person is expected to live based on the statistical average.

- Infant Mortality Rate: The infant mortality rate is the number of infant deaths for every 1,000 live births.

OR

The data in the given table reveals that:

(1) Women constitute 16.5% of the total worker population in the economy.

(2) The number of women workers in rural areas (17.5%) are relatively higher than the women workers in urban areas (14.2%). Due to the abject poverty in rural areas, rural women are compelled to work more than their urban counterparts.

Explanation:

Women constitute 16.5% of the total worker population in the economy. The difference in participation rates is large as in urban areas, for every 100 urban females, only about 14 are engaged in some economic activities. In rural areas, for every 100 rural women about 18 participate in the employment market. As poverty in the rural areas is more widespread than in the urban areas, so, the rural women engage themselves in low productive jobs just to support the livelihood of their families.

![]()

Question 5.

‘Investment in infrastructure contributes to the economic development of a country’. Justify the given statement with a valid argument. (2)

Answer:

The given statement is true; infrastructural development in an economy increases productivity, induces higher investment, facilitates employment, and generates more income. With the rise in income the quality of life of the people improves. Thus, conclusively we may say that infrastructure contributes to the economic development of a country.

Explanation:

Infrastructure contributes to economic development of a country both by increasing the productivity of the factors of production and improving the quality of life of its people.

Question 6.

Giving valid reasons explain which of the following will not be included in estimation of National Income of India?

(A) Purchase of shares of X. Ltd. by an investor in the National Stock Exchange.

(B) Salaries paid by the French Embassy, New Delhi to the local workers of the housekeeping department.

(C) Compensation paid by the Government of India to the victims of floods.

OR

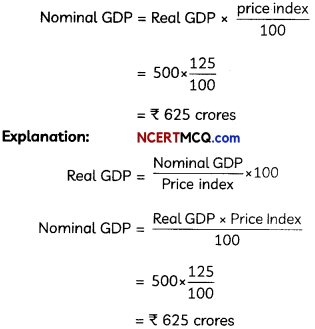

Estimate the value of Nominal Gross Domestic Product for a hypothetical economy, the value of Real Gross Domestic Product and Price Index are given as ₹500 crores and 125 respectively. (2)

Answer:

Following will not be included in estimation of National Income of India:

(A) As such transactions are mere paper claims and do not lead to any value addition.

(B) Compensation paid by the Government of India is mere transfer payment and does not lead to any flow of goods and services in an economy.

![]()

Explanation:

(A) Purchase of shares of X. Ltd. by an investor in the National Stock Exchange will not be included in the estimation of national income because it is just a financial transaction, leading to change of ownership of financial asset. There is no flow of goods or services in the economy.

(B) This will be included in estimation of the National Income of India.

(C) Compensation paid by the Government of India to the victims of floods will not be included in the estimation of national income because it is a transfer payment. There is no flow of goods or services in the economy.

OR

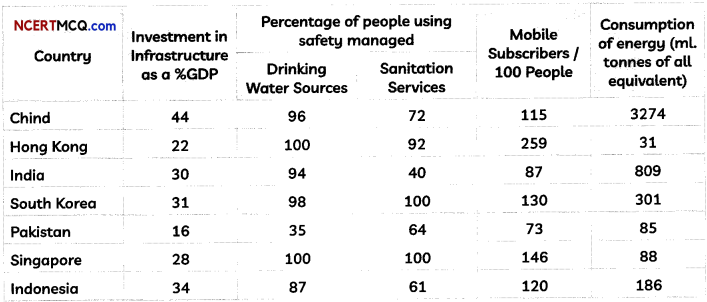

Question 7.

Study the following information and compare the Economies of India and Singapore on the grounds of investment in Infrastructure as a percentage of GDP’. (2)

Some Infrastructure in India and Other Countries, 2018

Sources: World Development Indicators 2019, World Bank website: www.worldbank.org.:

BP Statistical Review of World Energy 2019, 69th Edition Note: (*) refers to Gross Capital Formation.

Answer:

“Investment in infrastructure as a percentage of GDP’ is that proportion of Gross Domestic Product which is invested for the development of infrastructural facilities in a country. According to the given data it is evident that India is contributing 30% of its total GDP on infrastructural progress, which is just a notch above the corresponding figure of 28% for Singapore.

Considering the vast geography of India this is a relatively lower proportion in this direction. If India wants to grow at a faster rate, she must concentrate on higher judicious investment on development of infrastructure.

![]()

Explanation:

The data given in the table reveals that India is contributing 30% of its GDP on infrastructure, whereas Singapore is contributing 28% of its GDP. So it can be concluded that India is investing in infrastructural facilities more than Singapore but this gap is not that large. Some economists have projected that India will become the third biggest economy in the world a few decades from now. Considering this fact, this is a relatively lower proportion in this direction. For that to happen, India will have to boost its infrastructure investment.

Read the following text carefully and answer questions number 8 and 9 given below:

SINO-PAK FRIENDSHIP CORRIDOR

The China-Pakistan Economic Corridor (CPEC) relationship between the two nations. But it has also sparked criticism for burdening Pakistan with mountains of debt and allowing China to use its debt strategic assets of Pakistan.

The foundations of CPEC, part of China’s Belt and Road Initiative, were laid in May 2013. At the time, Pakistan was reeling under weak economic growth. China committed to play an integral role in supporting Pakistan’s economy.

Pakistan and China have a strategic relationship that goes back decades. Pakistan turned to China at a time when it needed a rapid increase in external financing to meet critical investments in hard infrastructure, particularly power plants and highways. CPEC’s early harvest projects met this need, leading to a dramatic increase in Pakistan’s power generation capacity, bringing an end to supply-side constraints that had made rolling blackouts a regular occurrence across the country.

Pakistan leaned into CPEC, leveraging Chinese financing and technical assistance in an attempt to end power shortages that had paralyzed its country’s economy. Years later, China’s influence in Pakistan has increased at an unimaginable pace.

China As Pakistan’s Largest Bilateral Creditor: China’s ability to exert influence on Pakistan’s economy has grown substantially in recent years, mainly due to the fact that Beijing is now Islamabad’s largest creditor. According to documents released by Pakistan’s finance ministry, Pakistan’s total public and publicly guaranteed external debt stood at $44.35 billion in June 2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had ballooned to $90.12 billion, with Pakistan owning 27.4 percent -$24.7 billion – of its total external debt to China, according to the International Monetary Fund (IMF). Additionally, China provided financial and technical expertise to help Pakistan build its road infrastructure, expanding north-south connectivity to improve the efficiency of moving goods from Karachi all the way to Gilgit-Baltistan (POK). These investments were critical in better integrating the country’s ports, especially Karachi, with urban centers in Punjab and Khyber- Pakhtunkhwa provinces.

![]()

Despite power asymmetries between China and Pakistan, the latter still has tremendous agency in determining its own policies, even if such policies come at the expense of the longterm socioeconomic welfare of Pakistani citizens.

(https://www.usip.org/publications /2021/ 05/ pakistans-growing-problem-its-china-economic-corridor – Modified)

Question 8.

Outline and discuss any two economic advantages of China Pakistan Economic Corridor (CPEC) accruing to the economy of Pakistan. (3)

Answer:

Economic advantages of China Pakistan Economic Corridor (CPEC) to the economy of Pakistan are:

- China provided financial and technical expertise to help Pakistan build its road infrastructure, supporting employment and income in the economy

- CPCE has led to a massive increase in power generation capacity of Pakistan. It has brought an end to supply-side constraints in the nation, which had made blackouts a regular phenomenon across the country.

Explanation: Economic advantages of China Pakistan Economic Corridor (CPEC) accruing to the economy of Pakistan:

- CPEC’s early harvest projects met investment needs of Pakistan in power plants, leading to a dramatic increase in Pakistan’s power generation capacity, bringing an end to supply-side constraints that had made rolling blackouts a regular occurrence across the country.

- China provided financial and technical expertise to help Pakistan build its road infrastructure, expanding north-south connectivity to improve the efficiency of moving goods.

Question 9.

Analyse the implication of bilateral ‘debt-trap’ situation of Pakistan vis-a-vis the Chinese Economy. (3)

Answer:

China has become famous for its ‘Debt Trap Diplomacy’ in recent times. Under this China provides financial and technical expertise/ assistance to help various nations to bring them under its direct or indirect influence.

The first and the foremost implication of the diplomacy is that Beijing has now become Islamabad’s largest creditor. According to documents released by Pakistan’s finance

ministry, its total public external debt stood at $44.35 billion in June 2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had ballooned to $90.12 billion, with Pakistan owing 27.4 percent -$24.7 billion – of its total external debt to China, according to the IMF.

![]()

Explanation:

China’s ability to exert influence on Pakistan’s economy has grown substantially in recent years, mainly due to the fact that Beijing is now Islamabad’s largest creditor. It is the first and foremost implication of this ‘Debt=trap’ diplomacy. According to documents released by Pakistan’s finance ministry, Pakistan’s total public and publicly guaranteed external debt stood at $44.35 billion in June 2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had ballooned to $90.12 billion, with Pakistan owing 27.4 percent -$24.7 billion – of its total external debt to China, according to the International Monetary Fund (IMF).

Question 10.

Explain how ‘Non-Monetary Exchanges’ impact the use of Gross Domestic Product as an index of economic welfare. (3)

Answer:

Non-monetary exchange transactions are not included in the estimation of Gross Domestic Product on account of practical difficulties like non-availability of reliable data. Although these activities enhance public welfare which may lead to underestimation of GDP.

For example: kitchen gardening, services of homemaker etc.

Explanation:

Such exchanges which don’t involve the use of money as a medium of exchange are known as non-monetary exchanges. In non-monetary exchanges, goods are exchanged for goods.

As these transactions are outside the monetary system of exchange, thus, are not included in gross domestic product of the economy. Due to this, GDP remains underestimated. Thus, non-monetary exchanges make GDP an inappropriate index of welfare.

Question 11.

‘Monetary measures offer a valid solution to the problem of Inflationary gap in an economy’. State and discuss any two monetary measures to justify the given statement. (5)

Answer:

Two measures which may be used to solve the problem of inflation are:

(i) An increase in Cash Reserve Ratio (CRR) may reduce the credit creation capacity of the commercial banks in the economy. This may lead to a fall in the borrowings from

banks causing a fall in Aggregate Demand in the economy, and helps to correct the inflationary gap in the economy.

(ii) Sale of Government Securities in the open market by the Central Bank will adversely affect the ability of the Commercial Banks to create credit in the economy. As a result Aggregate Demand in the economy may fall and correct the inflationary gap in the economy.

![]()

Explanation:

Two measures which may be used to solve the problem of inflation are:

(i) Repo Rate: The rate at which central bank lends money to the commercial banks is known as repo rate. To correct the situation of inflationary gap, repo rate should be increased. A rise in repo rate is expected to cause a rise in market rate of interest, leading to a fall in demand for funds in the money market. Implying a fall in expenditure or AD, correcting inflationary gap.

(ii) Open Market Operations: In the situation of inflationary gap, cash balances need to be reduced. In this situation, Central bank starts selling securities. It reduces purchasing power from the money market. Consequently, aggregate demand is decreased and inflationary gap is corrected.

Question 12.

(A) From the following data calculate the value of Domestic Income:

| Items | Amount (in crores) |

| Compensation Employees of | 2,000 |

| Rent and Interest | 800 |

| Indirect Taxes | 120 |

| Corporate Tax | 460 |

| Consumption Fixed Capital of | 100 |

| Subsidies | 20 |

| Dividend | 940 |

| Undistributed Profits | 300 |

| Net Factor Income from Abroad | 150 |

| Mixed-Income of Self Employed | 200 |

(B) Distinguish between ‘Value of Output’ and ‘Value Added’.

OR

(A) Given the following data, find Net Value Added at Factor Cost by Sambhav (a farmer) producing Wheat:

| Items | Amount (in crores) |

| Sale of wheat by the farmer in the local market | 6,800 |

| Purchase of Tractor | 5,000 |

| Procurement of wheat by the Government from the farmer | 200 |

| Consumption of wheat by the farming family during the Year | 50 |

| Expenditure on the maintenance of existing capital stock | 100 |

| Subsidies | 20 |

(B) State any two components of‘Net Factor Income from Abroad’. (5)

Answer:

(A) Domestic Income (NDP@fc)

= (i) + (ii) + (iv) + (vii) + (viii) + (x)

= ₹ 2000 + ₹ 800 + ₹ 460 + ₹ 940 + ₹ 300 + ₹ 200

= ₹4,700 crore

![]()

Explanation:

Domestic Income (NDPFC) = Compensation of Employees + Rent and Interest + Corporate Tax + Dividend + Undistributed Profits + Mixed Income of Self Employed

= ₹ 2000 + ₹ 800 + ₹ 460 + ₹ 940 + ₹ 300 + ₹ 200

= ₹ 4,700 crores

(B) Value of output is the estimated money value of all the goods and services, inclusive of change in stock and production for self-consumption. Whereas, Value added is the excess of value of output over the value of intermediate consumption.

Explanation:

Monetary value of all the goods and services produced in a given period of time is known as value of output, whereas, value-added is the excess of value of output over the value of intermediate consumption.

OR

(A) Net Value Added at Factor Cost (NVA @ FC)

= (i) + (iii) + (iv) + (vi) – (v)

= ₹ 6800 + ₹200 + ₹ 50 + ₹20 – ₹100

= R6,970crore

Explanation:

Net Value Added at Factor Cost (NVAFC) = Sale of wheat by the farmer in the local market+ Procurement of wheat by the Government from the farmer+ Consumption of wheat by the farming family during the Year + Subsidy – Expenditure on the maintenance of existing capital stock

= ₹ 6800 + ₹ 200 + ₹ 50 + ₹ 20 – ₹ 100

= ₹ 6,970 crores

(B) Component of net factor income from abroad are:

- Net compensation of employees

- Net income from property and entrepreneurship

- Net retained earnings of resident companies abroad (any two)

Explanation:

Components of Net Factor Income from Abroad are:

- Net compensation of employees

- Net income from property and entrepreneurship

- Net retained earnings of resident companies abroad.

![]()

Question 13.

(A) ‘Pesticides are chemical compounds designed to kill pests. Many pesticides can also pose health risks to people even if exposed to nominal quantities. ‘

In the light of the above statement, suggest any two traditional methods for replacement of the chemical pesticides.

(B) ‘In recent times the Indian Economy has experienced the problem of Casualisation of the workforce. This problem has only been aggravated by the outbreak of COVID-19.’

Do you agree with the given statement? Discuss any two disadvantages of casualisation of the workforce in the light of the above statement. (5)

Answer:

(A) The traditional practices can help in controlling contamination without the use of chemical fertilizers, as follows:

- Neem trees and its by products are a natural pest-controller, which has been used since ages in India. Recently, the government promoted the sale Neem coated urea as a measure of natural pest control.

- Large variety of birds should be allowed to dwell around the agricultural areas, they can clear large varieties of pests including insects

Explanation: Traditional methods for replacement of the chemical pesticides are:

(i) Neem: Neem is a naturally occurring pesticide that comes from the seeds of the neem tree. Neem seeds and leaves contain many compounds which are useful for pest control. Neem repels or reduces the feeding of many species of pest insects as well as some nematodes.

(ii) Animals and Birds: Animals and birds are also one of the traditional methods of pest control. For example, snakes are one of the prime group of animals which prey upon rats, mice and various other pests. Similarly, large varieties of birds, for example, owls and peacocks, prey upon vermin and pests. If these are allowed to dwell around the agricultural areas, they can clear large varieties of pests including insects. Lizards are also important in this regard.

(B) The given statement is quite appropriate with reference to the ‘casualisation of labour’ in India.

(i) For casual workers, the rights of the labour are not properly protected by labour laws. Particularly, during pandemic times, as demand for goods and services fell the casual workers were left jobless, without any compensation or support.

(ii) During the COVID-19 lockdown millions of casual workers lost their jobs, raising the question of their survival. Also, additional health expenditure added to their troubles. Had such workers been working under the formal sector, it would have given them some respite in their difficult times.

![]()

Explanation:

It is true that in recent times the Indian Economy has experienced the problem of Casualisation of the workforce. This problem has only been aggravated by the outbreak of COVID-19. India lacks of opportunities in the organised sector, thus people start working as casual workers. The coronavirus pandemic comes as huge shock to the labour market in India.

Disadvantages to casual workers during Covid-19:

- The Indian labor market is largely informal, lacks a social security net, which increases labor vulnerability and distress during lockdowns.

- Thousands of casual workers and self-employed in cities like Mumbai and Pune have left for their native places in the last few months after the Covid-19 outbreak.