Check the below Online Education NCERT MCQ Questions for Class 10 Economics Chapter 3 Extra Questions and Answers Money and Credit Pdf free download. https://ncertmcq.com/extra-questions-for-class-10-social-science/

Online Education for Money and Credit Class 10 Extra Questions Economics Chapter 3

Money And Credit Class 10 Extra Questions Question 1.

Who issues currency in India?

Answer:

The Reserve Bank of India issues currency in India.

Money And Credit Extra Questions Question 2.

Mention the form of modem currency

Answer:

Usually, there are two forms of modem currency. Those are (a) paper currency, (b) coins.

Class 10 Economics Chapter 3 Extra Questions Question 3.

What is Money Supply?

Answer:

Money supply refers to total money in circulation in any country at a given point of time.

Money And Credit Class 10 Important Questions Question 4.

What is paper money? What is its use?

Answer:

Money made of paper is called paper money. It is easy to carry

Money And Credit Class 10 Questions And Answers Question 5.

What do you know about Muhammad Yunns?

Answer:

Muhammad Yunus founded the Grameen Bank in Bangladesh. He got Nobel Peace prize in 2006.

![]()

Extra Questions For Class 10 Economics Chapter 3 Question 6.

What do you mean by a bank?

Answer:

A bank is an institution which deals with the transaction of money and credit.

Extra Questions Of Money And Credit Class 10 Question 7.

What is a commercial bank?

Answer:

A commercial bank is a financial institution which deals with money and credit with a view to earn profit.

Class 10 Economics Chapter 3 Extra Questions And Answers Question 8.

What is credit control?

Answer:

Credit control is the regulation of credit by the RBI for achieving certain objectives like price stability, growth and exchange rate stab ill ty.

Extra Questions Of Chapter Money And Credit Class 10 Question 9.

Define moral suasion?

Answer:

Moral suasion means persuasion, request and appeal by the RBI to the member-banks so to expand and control credit.

Class 10 Eco Ch 3 Extra Questions Question 10.

What eliminates the need for double coincidence wants?

Answer:

Money eliminates the double coincidence of wants.

Chapter 3 Economics Class 10 Extra Questions Question 11.

What is called the medium of exchange?

Answer:

Money as an intermediate in the exchange process is rightly called the medium of exchange.

Ch 3 Economics Class 10 Extra Questions Question 12.

How do we deposit money in the bank?

Answer:

We deposit money in the bank by opening an account. the money so deposited in the bank is credited to our account.

Class 10 Economics Ch 3 Extra Questions Question 13.

What will happen if all the depositors ask for their money from the bank?

Answer:

The bank will have to seek deposits from other sources or will have to ask its borrowers to give back the money.

Ncert Class 10 Economics Chapter 3 Extra Questions Question 14.

Explain the meaning of the collateral?

Answer:

Collateral is an asset the borrower owns (such as to land, livestock, building etc.) and uses this as a guarantee a lender until the loan is paid.

Economics Chapter 3 Class 10 Extra Questions Question 15.

What do you mean by terms of credit?

Answer:

Interest rate, collateral and documentation requirements, and the mode of repayment etc. comprise what is called th.e terms of Credit.

Question 16.

Explain how money acts as a medium of exchange?

Answer:

Money has a significant role in helping exchange or commodities. We sell our products in return to get money. We buy products by giving money for the products we want. Money acts as the intermediate, and thus eliminates the need of the double coincidence of wants.

Question 17.

Why rupee is used, in India, as a medium of exchange?

Answer:

As per law, it is only the Reserve Bank of India which issues paper notes. We find rupee as a paper note. No individual has been authorised to issue rupees in the form of paper currency Law recognises the use of rupees as a medium of making payment. It is used in settling transactions in India. No individual in India can legally refuse a payment made in rupees.

Question 18.

Why do the cheques constitute money- in the modem currency?

Answer:

We buy products by making payment through cash.

Question 19.

Give briefly the functions of money.

Answer:

Money, in the form of cash or cheques, is a medium of exchange. Its functions, briefly, are:

- it acts as a medium of exchange,

- it acts as a measure of value;

- it is source of store of value;

- it helps us transfer value;

- it acts as a standard for deferred payments.

Question 20.

Differentiate between demand deposits and fixed deposits

Answer:

Demand deposits can be written down from the bank without any notice; fixed deposits are withdrawn only at the time of maturity. Demand deposits are chequable; fixed deposits are not chequable. Demand deposit constitute a part of money supply while the fixed deposits come under the category of near money.

Question 21.

Why are demand deposits considered as money?

Answer:

M.Salim will write a cheque in the name of a person from whom he buys on a products. Then he will write the specific amount both in words and figures. On the right top of the cheque, he will specify the date, and down below in the right, he will sign the cheque.

Salim’s balance in his bank account decreases and Prem’s balance increases.

As the deposits in the bank can be withdrawn on demand, they act as money. One can issue a cheque and ask for money against one’s deposits in the bank. If you do not have deposits in the bank, you can not withdraw money. Supposing, Salim continues to get orders from traders. What would be his position after 6 years.

![]()

Question 22.

What are the reasons that make Swapna’s situation so risky? Discuss the following factors pesticides role of moneylenders; climate.

Answer:

- Salim is a small trader. He wants to buy stock so to sell it at the time of festival in the following month.

- The risk is that if he does not get credit, he would not able to buy stock and shall not earn profit.

- Salim was able to obtain credit from the bank against some security. He got the loan, had bought the stocks and earning profit when he sold the stock.

Salim would be able to make profit year after year his business will expand.

Swapna took loan from the moneylender and paid a higher rate of interest. But what she bought for her farming expenses, she did not obtain the desired result. Unfortunately, her crop failed. She was caught up in debit. She had to pay to the moneylender a high amount in the form of interesct.

Question 23.

Why should the people deposit money with bank

Answer:

People hold money as deposit with the bank. At a point of time, people need only some currency for their day-to-day needs. For instance, workers who receive their salaries at the end of each month have extra cash at the beginning of the month.

They deposit it with the banks by opening a bank account in their name. Banks accept the deposits and also pay an interest rate on the deposits. In this way people’s money is safe with the banks and it earns an interest. People also have the provision to withdraw the money as and when they require. Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits.

Demand deposits offer another interesting facility. It is this facility which lends it the essential characteristics of money (that of a medium of exchange). One would like to make payments by cheques instead of cash. For payment through cheque, the payer who has an account with the bank makes out a cheque for a specific amount. A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been made.

![]()

Question 24.

What does the bank do with the deposits it has?

Answer:

Banks has the deposits from the people. It keeps only a small proportion of their deposits as cash with themselves. For example, banks in India these days hold about 15 per cent of their deposits as cash. This is kept as provision to pay the depositors who might come to withdraw money from the bank on any day. Since, on any particular day, only some of its many depositors come to withdraw cash, the bank is able to manage with this cash.

Banks use the major portion of the deposits to extend loans. There is a huge demand for loans for various economic activities banks make use of the deposits to meet the loan requirement of the people. In this way, banks mediate between those who a surplus funds (the depositors) and those who are in need these funds (the borrowers). Banks charge a higher interest rate on loans than what they offer on deposits. The difference between what is charge from borrowers and what is paid to depositors is their main source of income.

Question 25.

What do you mean by terms of credit? Why do the lender aks for collateral against loan?

Answer:

Interest rate, collateral and documentation requirements, and the mode of repayment together comprise what is called the terms of credit. The terms of credit vary substantially from one another. Every loan agreement specific an interest which the borrower must pay me lender along with the repayment of the principal.

In addition, lenders may demand collateral (i.e. security against loan). Collateral is an asset that the borrower own, such as land, building, vehicle, livestock, deposits with the bank and uses this as guarantee to a lender until the loan is refunded. If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain repayment payment such as land titles, deposits with banks livestock are some common examples of collateral used for borrowing.

Question 26.

What are formal and informal sector loans? Who supervises the functioning of formal sources of loans and how?

Answer:

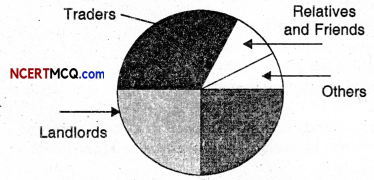

Various types of loans can be grouped as formal sector loans and informal sector loans. Banks and cooperatives are examples of formal sector loans whereas informal sector loans include loans from money lenders, traders, employers, relatives and friends. The chart here refers to sources of credit for Rural Households in India in 2003.

Sources of Credit for Rural Households in India in 2003.

The Reserve Bank of India supervises the functioning of formal sources of loans. For instance, the banks maintain a minimum cash balance out of the deposits they receive. The RBI monitor that the banks actually maintain the cash balance. Similarly, the RBI sees that the banks give loans not just to profit-make into business and traders but also to small cultivators, small scale industries, to small borrowers etc. Periodically, banks have to submit information to the RBI on how much they are lending to whom, at what interest rate, etc.

Question 27.

Write a note on ‘Self Help Group’.

Answer:

In recent years, people have tried out some newer ways of providing loans to the poor. The idea is to organise rural poor, in particular women, into small Self Help Groups (SHGs) and pool (collect) their savings. A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save Regularly. Saving per member varies from ₹ 25 to ₹ 100 or more, depending on the ability of the people to save.

Members can take small loans from the group itself to meet their needs. The group charges interest on these loans but this is still less than what the moneylender charges. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

The SHGs help borrowers overcome the problem of lack of collateral. They can get timely loans for a variety of purposes and at a reasonable interest rate. Moreover, SHGs are the building blocks of organisation of the rural poor. Not only does it help women to become financially self-reliant, but the regular meetings of the group also provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

![]()

Objectives Type Questions

1. Fil in the blanks with appropriate words

Question 1.

The Reserve Bank of India issue ………………….. currency.

Answer:

paper.

Question 2.

Banks are the ………………….. sources of credit.

Answer:

formal.

Question 3.

Money is an ………………….. of exchange.

Answer:

instrument.

Question 4.

………………….. are important in giving loans to the poorer.

Answer:

SHGs.

2. Choose the most appropriate answer:

Question 1.

The following eliminates the need for double coincidence of wants:

(a) barter

(b) money

(c) bank

(d) none of these

Answer:

(b) money

![]()

Question 2.

Money provides a medium of the following :

(a) Production

(b) consumption

(c) exchange

(d) Distribution.

Answer:

(c) exchange

Question 3.

Cheque is an instruction to the following

(a) Borrower

(b) Lender

(c) Bank

(d) None of these.

Answer:

(c) Bank.