By going through these CBSE Class 11 Accountancy Notes Chapter 1 Introduction to Accounting, students can recall all the concepts quickly.

Introduction to Accounting Notes Class 11 Accountancy Chapter 1

In the period when ownership and management were treated, the prime objective of accounting was to ascertain profit and loss and the financial position of the enterprise. In the modern world, the growth of business required large investments and this brought in the period when ownership and management got separated, taking the place of professional management.

Accounting became an important tool In helping decision-making by the management as it makes available the required information. Accounting, therefore, means an information system that provides the accounting information to users thereof to arrive at the correct decision.

Meaning of Accounting

“Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are in part at least, of financial character and interpreting the result thereof.”.

– The American Institute of Certified Public Accountants

“Accounting is the art of recording and classifying business transactions and events, basically of a financial nature and the art of making significant summaries, analysis and interpretation of those transactions and events and communicating the results to persons who must make decisions or firm judgment.” – Smith and Ashburne.

Accounting can therefore be defined as the process of identifying, measuring, recording, and communicating the required information relating to the economic events of an organization to the interesting uses of such information.

Relevant aspects of the definition of accounting

- Economic events

- Identification, measurement, recording, and communication

- Organization

- The interested user of information

1. Economic Events: An economic event is known as a happening of consequence to a business organization which consists of transactions and which are measurable in monetary terms.

2. Identification, measurement, recording, and communication:

1. Identification: It means determining what transactions to record i.e. to identify events that are to be recorded.

2. Measurement: It means quantification (including estimates) of business transactions into financial terms by using monetary units.

3. Recording: Once the economic event is identified and measured in financial terms, these are recorded in books of accounts in monetary terms and in chronological order.

4. Communication: The economic events are identified, measured, and recorded in order that the pertinent information is generated and communicated in a certain form to

management and other internal and external users.

3. Organisation: It refers to a business enterprise, whether for profit or not-for-profit motive.

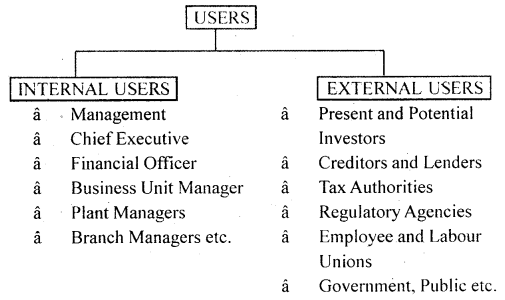

4. Interested user of information: Accounting is a means by which necessary financial information about business enterprise is communicated and is also called the language of business. Many users need financial information in order to make important decisions.

Accounting as a source of information: Accounting is a service activity. Its function is to provide qualitative information primarily financial in nature, about economic entities that are intended to be useful in making economic decisions.

It is universally accepted that making available qualitative accounting information is an important objective because it is the basis to make decisions by its users. The accounting information expected by its users is provided through financial statements. Financial statements are Profit and Loss Account and the Position statement or Balance sheet made available the Information relating to profit and loss, and information relating to financial position.

Similarly, investors, lenders, creditors, employees, and the Government agencies by analyzing the financial statements can make decisions about investments pattern, lending and making credit available, information relating to providing funds & other dues, and natural accounts of government agencies respectively.

Branches of Accounting

1. Financial Accounting: It assists in keeping a systematic record of financial transactions, the preparation, and presentation of financial reports in order to arrive at a measure of organizational success and financial soundness.

2. Cost Accounting: It assists in analyzing the expenditure for ascertaining the cost of various products manufactured or services provided by the firm and fixation of prices thereof.

3. Management Accounting: It deals with the provisions of necessary accounting information to people within the organization to enable them in decision-making, planning, and controlling business operations.

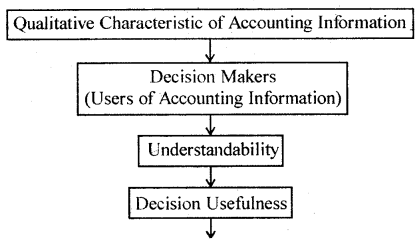

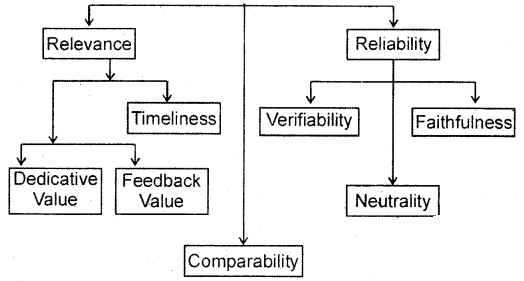

Qualitative Characteristics of Accounting Information:

1. Reliability: An accounting information should be objective and reliable. To be reliable, it should be free from errors and bias and should represent what it should represent.

2. Relevance: An accounting information should be relevant for decision making. To be relevant, information must be made available in time and help in prediction and feedback.

3. Understandability: An accounting information should be readily understandable by its user. It should be presented in simple terms and form.

4. Comparability: An accounting information will be useful and • beneficial to the different users only when it is comparable over time and with other enterprises. For this, there should be consistency, i.e. use of the common unit of measurement, common format of reporting, and common accounting policies.

Objectives of Accounting

- To keep systematic records of the business.

- To ascertain the financial results, i.e. profit or loss of the firm during a particular period.

- To show the financial position of the firm by preparing a position statement on a particular date.

- To communicate the accounting information to its users.

Role of Accounting: An accountant with his education training, analytical mind, and experience are best qualified to provide multiple need-based services to the end growing society. The accountants of today can do full justice not only to matters relating to taxation, costing, management accounting, financial layout, company legislation, and procedures but they can act in the fields relating to financial policies, budgetary policies, and even economic principles.

The service recorded by accountants to the society include the following:

(a) To maintain the Books of Account in a systematic manner.

(b) To act as a Statutory Auditor.

(c) To act as an Internal Auditor.

(d) To act as a Taxation Advisor.

(e) To act as a Financial Advisor. ,

(f) To act as a Management information system consultant.

Basic Terms in Accounting

1. Entity: It means a thing that has a definite individual existence.

2. Transaction: A event involving some value between two or more entities.

3. Assets: Anything which is in the possession or is the property of business enterprises including the amount due to it from others is called assets. Assets may be classified as Fixed Assets and Current Assets.

4. Liabilities: It refers to the amount which the business enterprise owes to outsiders excepting the amount owned to proprietors.

Liabilities may be classified as follows:

- Long-term Liabilities

- Current Liabilities

5. Capital: Amount invested in an enterprise in form of money or assets by its owner is known as capital.

6. Sales: Sales are total revenues from goods or services sold or provided to customers. It may be cash sales or credit sales.

7. Revenues: Amounts which business earned or received. Revenue in accounting means the income of a recurring nature from any source.

8. Expenses: Costs incurred by a business in the process of earning revenue are known as expenses.

9. Expenditure: Spending money or incurring liability for some benefits, service, or property received is called expenditure. It is of two types: Revenue expenditure and Capital expenditure.

10. Profit: The excess of revenue of a period over its related expenses during the accounting year is profit.

11. Gain: It is a monetary benefit, profits, or advantages resulting from events or transactions which are incidental to the business.

12. Loss: In accounting, this term conveys two different meanings:

- The result of the business for a period when total expenses exceed the total revenue.

- Some facts or activities against which the firm receives no benefit.

13. Discount: Discount is the deduction in the price of the goods sold. It is of two types:

- Trade discount and

- Cash discount.

14. Voucher: The documentary evidence in support of a transaction is known as a voucher.

15. Goods: It refers to the products in which the business unit is dealing, i.e. in terms of which it is buying and selling or producing and selling.

16. Drawings: Withdrawal of money and/or goods by the owner from J the business for personal use is known as drawings.

17. Purchases: Purchases are the total amount of goods procured by a business on credit and on cash, for use or sale.

18. Stock: Stock is a measure of something on hand – goods, spares, and other items in a business.

19. Debtors: They are persons and/or other entities who owe to an enterprise an amount for buying goods and services on credit.

20. Creditors: They are persons and/or other entities who have to be paid by an enterprise an amount for providing the enterprise goods and services on credit.