By going through these CBSE Class 11 Accountancy Notes Chapter 10 Financial Statements 2, students can recall all the concepts quickly.

Financial Statements 2 Notes Class 11 Accountancy Chapter 10

The businessman, first of all, enters his transactions in the books of original entry, then prepares ledger to know its combined effect and, then prepares Trial Balance to test for accuracy of foe ledger posting.

With the help of Trial Balance, he prepares Final Accounts. Jb find out foe net profiteer Iqps of .the business, it is necessary to take all foe adjustments into consideration. For example, if an expense belongs to the current year but part of it has been paid in for next year it should be recorded in the accounts current year otherwise the net profit or net loss at foe current year will not be the effect

Need for Adjustments

The following are foe objects of making adjustments

1. To account for all foe expenses pertaining to the current year. The purpose is to adjust all such expenses that have been incurred but not paid, viz., expenses outstanding and also such expenses which have been paid in advance for the coming year or months, viz., prepaid expenses.

The outstanding expenses are added to the expenses paid in Profit & Loss A/c and shown as liabilities in the Balance Sheet. The prepaid expenses are deducted from the expenses in the Profit & Loss A/c and shown as assets in the Balance Sheet.

2. To account for all the incomes pertaining to the current year. The purpose is to adjust all such incomes which have accrued during this year but have actually not been received or it has been received but are actually for the future period of activity.

3. Providing for depreciation and reserve to arrive at net profit. The purpose is to make provision for the wear and tear of fixed assets and reserves for unforeseen losses which might accrue. Examples are depreciation on assets, interests on capital, reserves for bad debts, and other contingencies.

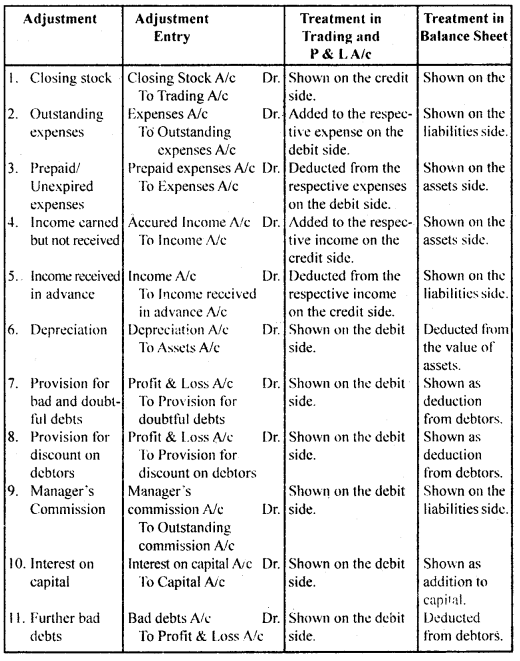

Types of Adjustments:

1. Closing Stock: Stock of those goods which are either not sold, processed, or completed at the end of the year is known as Closing Stock. It is valued on cost or market value whichever is less.

Accounting Treatment:

(a) In case closing stock appearing inside the Trial Balance. No adjustment is required. It will appear only in the Balance Sheet on the Assets side.

(b) In case closing stock appearing outside the Trial Balance:

Journal Entry:

Closing Stock A/c Dr.

To Trading A/c

(Being closing stock transferred to Trading A/c)

Treatment in:

Trading A/c

This appears on the credit side of Trading A/c.

Balance Sheet

This appears on the assets side.

2. Outstanding Expenses: Those expenses which relate to the current year but for which payment is not made. For example, Salary Outstanding, Rent Outstanding, Wages Outstanding, etc.

Journal Entry:

Expenses A/c Dr.

To Outstanding Expenses A/c

Treatment in:

Trading A/c

Add to the respective items on the debit side.

Profit & Loss A/c

Add to the respective items on the debit side

Balance Sheet

Show on the liabilities side.

3. Prepaid Expenses: Expenses that are paid in advance i.e. those expenses which are paid in the current year but relate to the next accounting year. For example, Rent Paid in Advance, Prepaid Taxes, Prepaid Insurance Premium, etc.

Journal Entry:

Prepaid or Unexpired Expenses A/c Dr.

To Expenses A/c

Treatment in:

Trading A/c

Deduct from the concerned item on the debit side.

Profit & Loss A/c

Deduct from the concerned item on the debit side.

Balance Sheet Show on the assets side.

4. Accrued Income: Income earned but not yet received i. e. those incomes which although earned in the current year but are not received in the current year. For example, Interest on Investments, Dividends on Shares, etc.

Journal Entry:

Accrued Income A/c Dr.

To Income A/c

Treatment in:

Profit & Loss A/c

Add to the concerned item on the credit side.

Balance Sheet Show on the assets side.

5. Income Received in Advance or Unearned Income: That income that is received in the current year but which relates to the next year.

Journal Entry:

Income A/c Dr.

To Unearned Income A/c

Treatment in:

Profit & Loss A/c

Deduct from the concerned item on the credit side.

Balance Sheet

Show on the liabilities side.

6. Depreciation: Cost of wear and tear of fixed assets i.e. that expenses by which the value of fixed assets, used for earning revenue, decreases.

Journal Entry:

Depreciation A/c Dr.

To Assets A/c

Treatment in:

Profit & Loss A/c Show on the debit side.

Balance Sheet

Deduct from the concerned asset on the assets side.

7. Bad Debts: Amount which is due from debtors but not receivable. It is a loss of the firm.

Journal Entry:

Bad Debts A/c Dr.

To Debtors A/c

Treatment in:

Profit & Loss A/c

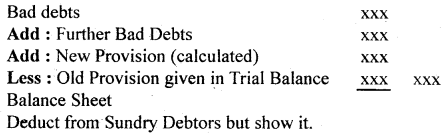

If Bad Debts is already given in trial balance, then Bad Debts given in adjustments is termed as Further Bad Debts and it is added to Bad Debts given in Trial Balance on the debit side of Profit and Loss A/c.

Balance Sheet

Deduct from the debtors but show it.

8. Provision for Bad and Doubtful Debts: It is not possible to accurately know the amount of Bad Debts. Hence, we have to make a reasonable estimate of such loss and provide for the same. Such provision is called provision for bad and doubtful debts.

Journal Entry:

Profit & Loss A/c Dr.

To Provision for Bad and Doubtful Debts A/c

Treatment in:

Profit & Loss A/c

To calculate the amount of Provision for Bad and Doubtful Debts, first, we have to deduct the B^d Debts given as adjustment from the debtors after that calculate the amount of provision on balance.

The amount is shown on the debit side of Profit & Loss A/c as follows:

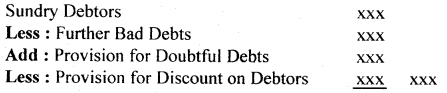

Deduct from Sundry Debtors but show it.

9. Provision for Discount on Debtors: To encourage prompt, payments, a business enterprise allows discounts to its debtors. Discount likely to be allowed to customers in an accounting year can be estimated and provided for by creating a provision for discount on debtors. Provision for discount is made on good debtors which are arrived at by deducting further bad debts and the provision for doubtful debts.

Journal Entry:

Profit & Loss A/c Dr.

To Provision for Discount on Debtors A/c

Treatment in:

Profit & Loss A/c Shown on the debit side.

Balance Sheet

Provision for Discount on Debtors will be shown on the assets side of the Balance Sheet as:

10. Manager’s Commission: The manager of the business is sometimes given the commission on the net profit of the company. The percentage of the commission is applied to the profit either before charging such commission or after charging such commission.

1. Before charging such commission:

= Profit × \(\frac{\text { Rate of Commission }}{100}\)

2. After charging such commission:

= Profit × \(\frac{\text { Rate of Commission }}{100+\text { Rate }}\)

Journal Entry:

Profit & Loss A/c

To Manager’s Commission A/c

Treatment in:

Profit & Loss A/c Shown on the debit side.

Balance Sheet

Shown in liabilities side as Outstanding Manager’s Commission.

11. Interest on Capital: Interest on capital is calculated at a given rate of interest on opening capital. If however, any additional capital is brought during the year, the interest may be computed on such amount from the date on which it was brought into the business.

Journal Entry:

Interest on Capital A/c Dr.

To Capital A/c

Treatment in:

Profit & Loss A/c

Shown on the debit side.

Balance Sheet

Add to the capital on the liabilities side.

Method of Presenting the Financial Statements

The Financial Statements can be presented in two ways:

- Horizontal Form

- Vertical Form

Horizontal Form: Here items are shown side by side in the financial statements. This format is rather technical in nature and is not easily comprehensible for many uses.

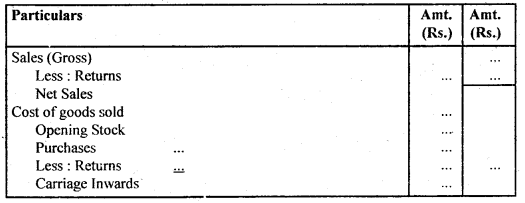

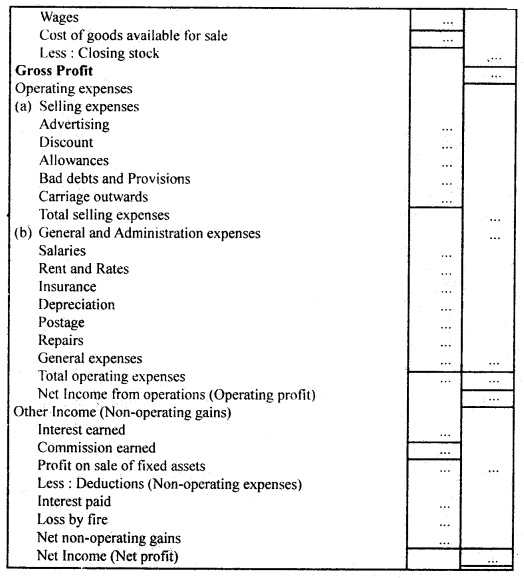

Vertical Form: Here the final accounts are prepared in the form, of statements with different items being shown below the other in a purposeful sequence. Under the vertical form, the format of Trading and Profit & Loss Account and format of Balance Sheet is given below:

Income Statement for the period ended……………..

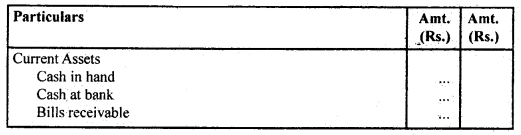

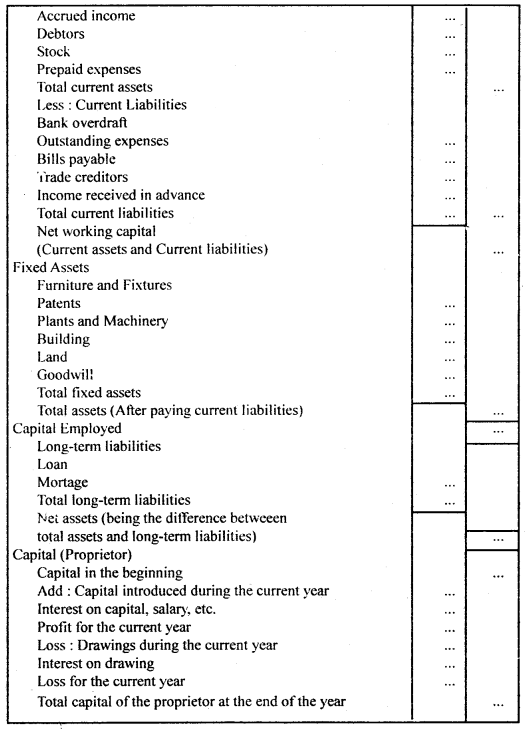

Under the vertical presentation, the Balance Sheet will appear as follows:

Balance Sheet as on

Summary of Treatment of Adjustments