By going through these CBSE Class 11 Accountancy Notes Chapter 7 Depreciation, Provisions and Reserves, students can recall all the concepts quickly.

Depreciation, Provisions and Reserves Notes Class 11 Accountancy Chapter 7

SECTION-1 (Depreciation)

The term ‘Depreciation’ means a decline in the value of fixed assets due to use, the passage of time, or obsolescence. an accounting item, depreciation is that part of the cost of a fixed asset that has expired on account of its usage and/or lapse of time. The amount of depreciation, being a charge against profit, is debited to the profit and loss account.

Meaning of Depreciation

Depreciation may be described as a permanent, continuing, and gradual shrinkage in the book value of fixed assets. It is based on the cost of assets consumed in a business and not on its market value,

“The depreciation is the diminution in the intrinsic value of the assets due to use and/or lapse of time.”

– Institute of Cost and Management Accounting, London (ICMA)

Accounting Standard-6 issued by The Institute of Chartered Accountants of India (ICAI) defines depreciation as “a measure of the wearing out, consumption or other loss of value of depreciable assets arising from use, effluxion of time or obsolescence through technology and market change.

Depreciation is allocated so as to change the fair proportion of depreciable amount in each accounting period during the expected useful life of the assets. Depreciation includes amortization of assets whose useful life is predetermined.”

Features of Depreciation:

- It is a decline in the book value of fixed assets.

- It includes loss of value due to effluxion of time, usage, or obsolescence.

- It is a continuing process.

- It is an expired cost and hence must be deducted before calculating taxable profits.

- It is a non-cash expense.

Depreciation and, Other Similar Terms:

- Depletion: It is used in the context of extraction of natural resources like mines, quarries, etc. that reduces the availability of the quantity of the material or assets.

- Amortization: It refers to writing off the cost of intangible assets like patents, copyright, trademarks, franchises, leasehold mines which have entitlements to use for a specified period of time.

Causes of Depreciation:

- Wear and tear due to use or passage of time.

- Expiration of legal rights.

- Obsolescence due to technological changes etc.

- Abnormal factors such as accidents due to fire, earthquake, floods, etc.

Need for Depreciation:

- Matching of Costs and Revenue.

- Consideration of Tax.

- True and Fair Financial Position.

- Compliance with Law.

Factors affecting the Amount of Depreciation

- Cost of Assets.

- Estimated Net Residual Value.

- Depreciable Cost.

- Estimated Useful Life.

Methods of Calculating Depreciation Amount

The selection of an appropriate method depends upon the following:

- Type of the asset.

- Nature of the use of such assets.

- Circumstances prevailing in the business.

1. Straight Line Method:

This method is based on the assumption of equal usage of the assets over its entire useful life. It is also called the fixed installment method because the amount of depreciation remains constant from year to year over the useful life of the assets. Accordingly to this method, a fixed and equal amount is charged on depreciation in every accounting period during the lifetime of an asset. This method is also known as a fixed percentage on the original cost method.

Formula:

Depreciation = \(\frac{\text { Cost of assets-Estimated residual value }}{\text { Estimated usefullife of the asset }}\)

Rate of Depreciation = \(\frac{\text { Annualdepreciation amount }}{\text { Acquisition cost }}\) × 100

2. Written Down Value Method:

Under this method, depreciation is charged on the book value of the asset. It is also known as the reducing balance method. The amount of depreciation reduces year after year.

Under this method, the rate of depreciation is computed by using following formula:

R = \(\left[1-\sqrt[n]{\frac{s}{c}}\right]\) × 100

Where . R = rate of deprecition

n = expected useful life

s = scrap value

c = cost of an asset

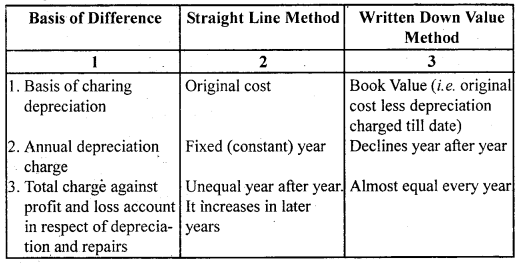

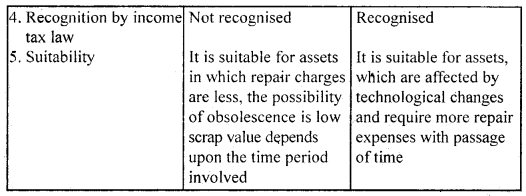

Straight Line Method and Written Down Method: A Comparative Analysis

Methods of Recording Depreciation:

In the books of account, there are two types of arrangements for recording depreciation of fixed assets.

- Charging depreciation to assets account.

- Creating provision for depreciation/accumulated depreciation account.

1. Charging depreciation to assets account: Under this, depreciation is deducted from the depreciable cost of the asset (credited to the asset account) and charged (or debited) to the profit and loss account.

Journal Entries:

1. For recording purchase of asset: (Only in the year of purchase)

Asset A/c Dr. [With the cost of assets including installation etc.]

To Bank/Vendor A/c

2. Following two entries are recorded at the end of every year

(a) For deducting depreciation amount from the cost of the asset.

Depreciation A/c Dr. [[With the amount of depreciation]

To Asset A/c

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. [With the amount of depreication]

To Depreciation A/c

The fixed asset appears at its net book value i.e. cost less depreciation charged till date on the asset side of the balance sheet,

2. Creating Provision for Depreciation Account/ Accumulated Depreciation Account: Under this method of recording depreciation, the asset account continues to appear at its original cost year after year over its entire life, and depreciation is accumulated on a separate account instead of being adjusted into the assets account at the end of each accounting period.

Journal Entries:

l. For recording purchase of asset: (Only in the year of purchase)

Asset A/c Dr. [With the cost of assets including installation etc.]

To Bank/Vendor A/c [Cash/Credit purchase]

2. Following two journal entries are recorded at the end of each year

(a) For crediting depreciation amount to provide for depreciation account

Depreciation A/c Dr. [[With the amount 0f depreication]

To Provision for depreciation A/c.

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. [With the amount of depreication]

To Depreciation A/c

Balance Sheet Method: In the balance sheet, the fixed assets continue to appear at their original cost on the assets side. The depreciation charged till that date appears, in the provision for depreciation account which is shown either on the liabilities side of the balance sheet or by way of deduction from the original cost of the assets concerned on the asset side of the balance sheet.

Disposal of Asset:

Disposal of an asset can take place either at the end of its useful life or during its useful life due to obsolescence or any other abnormal factor.

Journal Entries:

1. For the sale of asset as scrap

Bank A/c Dr.

To Assets A/c

2, For transfer of balance in assets account

(a) In case of profit

Asset A/c Dr.

To Profit & Loss A/c

(b) In case of loss

Profit & Loss A/c Dr.

To Assets A/c

In case, however, the provision for depreciation account has been in use for recording the depreciation, then before passing the above entries transfer the balance of the provision for depreciation account to the asset account by recording the following journal entry:

Provision for Depreciation A/c Dr.

To Asset A/c

Asset Disposal Account:

This method is generally used when a part of the asset is sold and a provision for a depreciation account exists.

Journal Entries:

1. Assets Disposal A/c Dr. [With the original cost of the asset, being sold]

To Assets A/c

2. Provision for Depreciation A/c Dr. [With the accumulated balance in provision for depreciation account]

To Assets Disposal A/c

3. BankA/c Dr. [With the net sale proceeds]

To Assets Disposal A/c

4. In case of loss

Profit & Loss A/c Dr. [With the amount of loss on sale]

To Assets Disposal A/c

5. In case of profit

Assets Disposal A/c Dr. [With the amount of profit on sale]

‘ To Profit & Loss A/c

SECTION-II (Provisions and Reserves)

Provisions:

Provisions mean, “any amount written off or retained by way of providing for depreciation, renewals or diminution in the value of assets, or retained by way of providing for any known liability .of which the amount cannot be determined with substantial accuracy’’. Provision is a charge Against profit.

Reasons/Purposes of creating Provisions

- To provide for doubtful debts.

- To provide for taxation.

- To provide for depreciation, etc.

Reserves:

Reserve means the profit retained in the th&business not having any attributes of a provision. A provision in excess of the amount considered necessary for the purpose for which it was created is to be treated as a reserve. Thus it is an appropriation of profit.

Difference between Reserve and Provision:

1. Basic nature: A provision is a charge against profit whereas a reserve is an appropriation of profit.

2. Purpose: A provision is made to meet a specific liability or contingency whereas reserves are created to strengthen the financial position of the business.

3. Presentation in Balance Sheet: Provision is shown either

- by way of deduction from the item on the asset side for which it is created or

- on the liabilities side along with the current liabilities. On the other hand, the reserve is shown on the liabilities sides of the capital.

4. Effect on taxable profits: Provision reduces taxable profits whereas reserve has no effect on the taxable profits.

5. Element of compulsion: Creation of provision is necessary to ascertain true and fair profit or loss whereas the creation of a Reserve is at the discretion of the management however in certain cases law has stipulated for creation of specific reserves such as Debenture Redemption Reserve. ,

6. Use for the payment of dividend: Provision cannot be used for dividend distribution whereas Reserves can be used for dividend distribution.

Types of Reserves:

- General Reserves: When the purpose for which reserve is created is not specified, it is called General Reserve.

- Specific Reserves: Specific reserve is a reserve, which is created for some specific purpose and can be utilized only for that purpose.

Examples are:

- Dividend Equalisation Reserve

- Workmen Compensation Fund

- Investment Fluctuation Fund

- Debenture Redemption Reserve

Reserve is also classified as revenue and capital reserve according to the nature of profit out of which they are created.

Revenue Reserves:

They are created from revenue profits which arise out of the normal operating activities of the business and are otherwise freely available for distribution as dividend Examples are:

- General Reserve

- Workmen Compensation Fund

- Investment Fluctuation Fund

- Dividend Equalisation Reserve

- Debenture Redemption Reserve etc.

Capital Reserves:

They are created out of capital profits that do not arise from the normal operating activities. Such reserves are not available for distribution as dividends. These reserves can be used for writing off capital losses or issue of bonus shares in the case of a company.

Examples are:

- Premium on issue of shares or debentures

- Profit on sale of fixed assets

- Profit on redemption of debentures

- Profit on revaluation of fixed assets and liabilities.

- Profit prior to incorporation

- Profit on the reissue of forfeited shares.

Importance of Reserves:

A business firm may consider it proper to set up some mechanism to protect itself from the consequences of unknown expenses and losses.

The amount so set aside may be meant for the purpose of:

- To meet the unforeseen liability or loss

- To strengthen the financial position of the business

- To provide funds for meeting a specific liability

- To provide funds for the payment of dividends at the time of inadequacy of profits.

Secret Reserves:

It is a reserve that does not appear in the balance sheet. It may also help to reduce the disclosed profits and also tax liability. When total depreciation charged is higher than the total depreciable cost, a secret reserve is created.