By going through these CBSE Class 11 Accountancy Notes Chapter 8 Bills of Exchange, students can recall all the concepts quickly.

Bills of Exchange Notes Class 11 Accountancy Chapter 8

When goods are sold or bought for cash, payment is received immediately whereas when goods are sold or bought on credit the payment is deferred to a future date. In such a case, the seller would like to get a written undertaking from the buyer to get the payment after a fixed period. Nowadays these written undertaking is called bills of exchange or promissory notes. The bill of exchange contains an unconditional order to pay a certain amount on an agreed date while the promissory note contains an unconditional promise to pay a certain sum of money on a certain date.

Meaning of Bill of Exchange:

“A bill of exchange is defined as an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.” – Negotiable Instrument Act, 1881

Features of Bill of Exchange:

- It must be in writing.

- It is an order to make payment.

- The order to make payment is unconditional’.

- The maker of the bill of exchange must sign it.

- The payment to be made must be certain.

- The date on which payment is made must also be certain.

- It must be payable to a certain person.

- The amount mentioned in the bill of exchange is payable either on-demand or on the expiry of a fixed period of time.

- It must be stamped as per the requirement of law.

Parties to a Bill of Exchange:

1. Drawer: The drawer is the maker of the bill of exchange. A seller/ creditor who is entitled to receive money from the debtor can draw a bill of exchange upon the buyer/debtor. The drawer of the writing the bill of exchange has to sign it as a maker of the bill of exchange.

2. Drawee: Drawee is the person upon whom the bill of exchange is drawn. Drawee is the purchaser or debtor of the goods upon whom the bill of exchange is drawn.

3. Payee: Payee is the person to whom the payment is to be made.

The drawer of the bill himself will be the payee if he keeps the bill with him till the date of its payment. The payee may change in the following situations:

(a) In case the drawer has got the bill discounted, the person who has discounted the bill will become the payee;

(b) In case the bill is endorsed in favour of a creditor of the drawer, the creditor will become the payee.

Promissory Note:

“A promissory note is defined as an instrument in writing (not being a banknote or currency note), containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person.” -Negotiable Instrument Act, 1881

Features of Promissory Note:

- It must be in writing;

- It must contain an unconditional promise to pay;

- The sum payable must be certain;

- It must be signed by the maker;

- The maker must sign it;

- It must be payable to a certain person;

- It should be properly stamped.

Parties to a Promissory Note:

1. Maker or Drawer: The maker or drawer is the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

2. Drawee or Payee: Drawee or payee is the person in whose favour the promissory note is drawn. He is called the promisee.

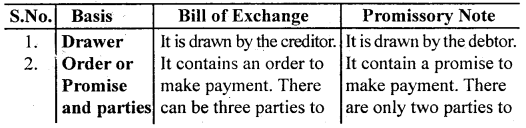

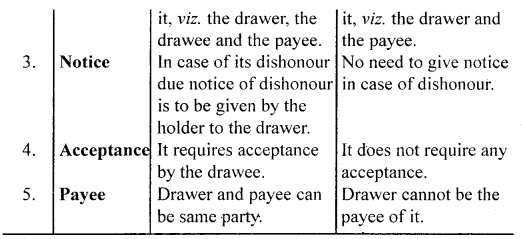

The distinction between a Bill of Exchange and Promissory Note

Advantages of Bill of Exchange:

- Goods can be sold and purchased easily on credit with the use of Bill of Exchange.

- The drawer can discount the bill of exchange with the bank if the money is needed immediately.

- When the bill is accepted by the drawee, it is proof of debt.

- A bill of exchange can be endorsed to any third party for the settlement of the debt.

- It is a legal document and a suit can be fed against the drawee if he refuses to pay it.

- Bill of exchange payable on the due date and needs no remainder for payment.

- In foreign, Trade Bills are generally used and facilitate payments.

Maturity of Bill:

The term Maturity refers to the date on which a bill of exchange or a promissory note becomes due for payment. In arriving at the maturity date three days know as days of grace must be added to the date on which the period of credit expires instrument is payable.

Discounting of Bill:

Sometimes the holder of the bill may need cash before the maturity of the bill. For this, he needs to hand over the bill to his bank. The bank charges a normal discount for its services. This process of encashing a bill any time before maturity is known as discounting a bill. In this case, the bank gets the amount from the drawee on the due date.

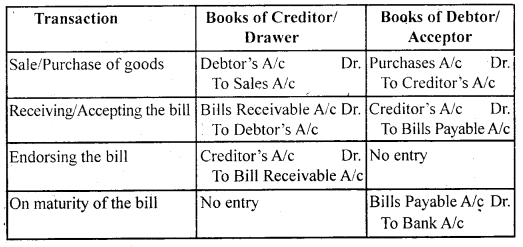

Endorsement of Bill:

The transfer of a bill by the holder by putting his signature on its back is called Endorsing a Bill. In this way, the transferee becomes the holder of the bill of exchange. Now the bill of exchange would be payable to the endorsee instead of the transferer.

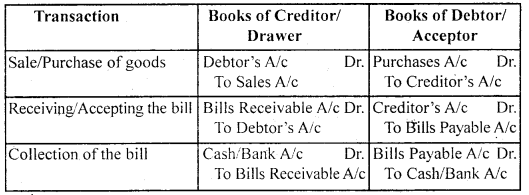

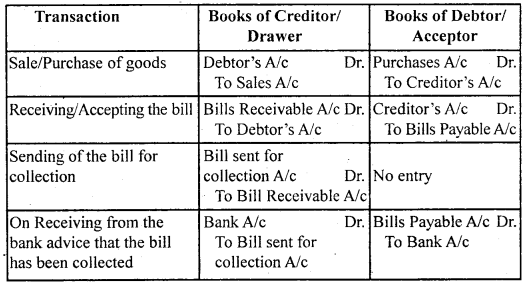

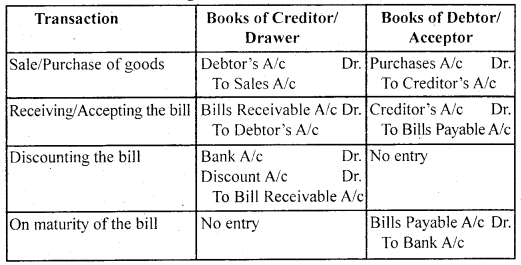

Accounting Treatment:

1. When the drawer retains the bill with him till the date of its maturity and gets, the same collected directly.

2. When the bill is retained by the drawer with him and sent to the bank for collection a few days before maturity.

3. When the drawer gets the bill discounted from the bank.

4. When the bill is endorsed by the drawer in favour of his creditor.

Dishonour of a Bill:

When the drawee refuses to pay the amount of the bill on the date of maturity or becomes insolvent, a bill is said to have been dishonoured. In case of dishonour, the holder of the bill can recover the amount of the bill from any of the endorsers or the drawer. For this purpose, the holder of the bill must serve a notice of dishonour to the drawer and each prior endorser whom he seeks to make liable for payment immediately of the dishonour or with a reasonable time.

Noting Charges:

A bill of exchange should be duly presented for payment on the date of its maturity. The drawee is absolved of his liability if the bill is not duly presented. Proper presentation of the bill means that it should be presented on the date of maturity to the acceptor during business working hours. To establish, beyond doubt that the bill was dishonoured, despite its due presentation, it may prefer to be got noted by Notary Public. Noting authenticates the fact of dishonour. For providing this service, a fee is charged by the Notary Public which is called ‘Noting Charge’.

Renewal of the Bill:

Sometimes, the acceptor of the bill foresees that it may be difficult to meet the obligation of the bill on maturity and may, therefore, approach the drawer, with the request for an extension of time for payment.

If it is so, the old bill is cancelled and the fresh bill with the new term of payment is drawn and duly accepted and delivered. This is called renewal of the bill. Here noting charges are not required. The drawee may have to pay interest to the drawer for the extended period of credit.

Retiring of the Bill:

Sometimes the drawee of the bill has funds at his disposal and makes a request to the drawer or holder to accept the payment of the bill before its maturity. If the holders agree to do so, the bill is said to have been retired. To encourage the retirement of the bill, the holder allows some discount called Rebate on bills for the period between the date of retirement and maturity.

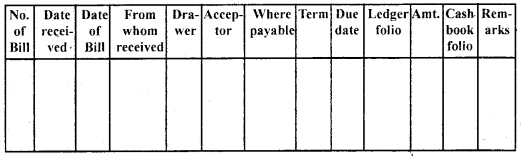

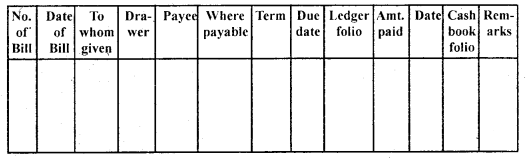

Bills Receivable and Bills Payable Books:

When a large number of bills are drawn and accepted, their recording by means of journal entry for every transaction relating to the bills become a very cumbersome and time-consuming exercise. It is then advisable to record them separately in special subsidiary books, the bills receivables in the Bills Receivable Book and the Bills Payable in the Bills Payable Book. The reason for the use of subsidiary books for recording bill transactions is the same as that in the case of other subsidiary books for cash, purchases etc.

An important point in connection with these books is that they only record the transactions relating to drawings and acceptance of bills, all other transactions do not record the entire range of transactions relating to the bills, e.g. relating to bills discounted, endorsement, retirement, renewal etc. simply have a passing reference in these books and the entries relating thereto are recorded as usual in the journal. It may be noted that the entry relating to honouring bills appear in the cash book.

Format of Bills Receivable Book

Bills Receivable Book

Format of Bills Payable Book

Bills Payable Book

Accommodation Bills

Apart from financing transaction in goods, bills of exchange, promissory notes may also be used for raising funds temporarily. Such a bill is called an ‘accommodation bill’ as it is accepted by the drawee to accommodate the drawer. Hence, the drawee is called the ‘accommodating party’ and the drawer is called the ‘accommodation party’.

Sometimes, the accommodation parties agree to raise the funds through an accommodation bill for mutual benefits. It can be done in any of the following two ways:

(a) The drawer and the drawee share the proceeds in an agreed ratio.

(b) Each draws a bill and each accepts a bill.