By going through these CBSE Class 11 Accountancy Notes Chapter 9 Financial Statements 1, students can recall all the concepts quickly.

Financial Statements 1 Notes Class 11 Accountancy Chapter 9

Meaning of Financial Statements:

When the business enterprise satisfies itself with the agreement of trial balance, then they proceed to prepare the financial statements for their business. Now they are interested to know whether they have earned profit or incurred losses during the accounting period. They also want to ascertain the business position at the end of the accounting period for this purpose.

They prepare financial statements which are also called Final Accounts. It is the last phase of the accounting process. In our system of accounting, financial statements include a Balance Sheet, Trading Account and Profit and Loss Account, and explanatory schedules and notes. Financial statements are those statements that report the profitability and the financial position of the business at the end of the accounting period. The Statements are presented to users of accounting information for decision making.

According to John N. Myer “The financial statements provide a summary of accounts of the business enterprise, the balance sheet reflecting the assets, liabilities, and capital as on a certain date and the income statement showing the result of operations during a certain period.”

Need of Financial Statements:

The main objective of financial statements is to communicate the financial position and performance of the business entities to the users of accounts. The financial position of the business entity is indicated through the Balance Sheet and performance is indicated through the Trading and Profit and Loss Account.

Users of Financial Statements:

- Management use financial statements for their decision-making.

- Investors use it to assess the financial soundness of the firm.

- Potential investors use to know how safe their investment will be.

- Lenders like debenture holders, suppliers of loans, etc. uses it to know the short-term and long-term financial soundness of the firm.

- Creditors use it for knowing the ability of the enterprise to meet the debts when they fall due.

- Employees use it to demand an increase in bonuses and wages.

- The government uses it to regulate different policies.

- Income Tax and Sales Tax Authorities use them to ascertain the tax liability of the firm.

The distinction between Capital and Revenue:

It is a very important distinction in accounting between capital and revenue items. The revenue items form part of the trading and profit and loss account the capital items help in the preparation of a balance sheet.

The distinction between Capital Expenditure and Revenue Expenditure:

Capital expenditure is the amount spent by an enterprise on the purchase of fixed assets that are used in the business to earn income and are not intended for resale. For example, expenditure incurred in acquiring assets, or erection of fixed assets, an extension of fixed assets, to acquire the right to carry on business, legal charges, etc.

Capital expenditure is debited to a fixed account which appears in the Balance Sheet.

Revenue expenditure is the amount spent on running a business. The benefit of revenue expenditure is exhausted in the accounting period in which it is incurred. For example rent, salaries, wages, power and fuel, carriage, freight, depreciation, cartage, etc.

Revenue expenditure appears in a Trading and-Profit and Foss Account. Capital expenditure increases the earning capacity of the business whereas revenue expenditure incurred for earning profits.

Capital Receipts and Revenue Receipts:

Capital receipts are those receipts that imply an obligation to return the money. The amount received in the form of additional capital introduced, loan received and sale of fixed assets are capital receipts. These are shown in the Balance Sheet only. Revenue Receipts are those receipts that do not imply an obligation to return the money. The amount received in the normal and regular course of business mainly by the sale of goods and services. These are shown in the Profit and Loss Account.

Trading Account:

Trading Account is prepared for calculating the gross profit or gross loss arising or incurred as a result of the trading activities of a business. Its main components are sales, services rendered, and the cost of goods sold.

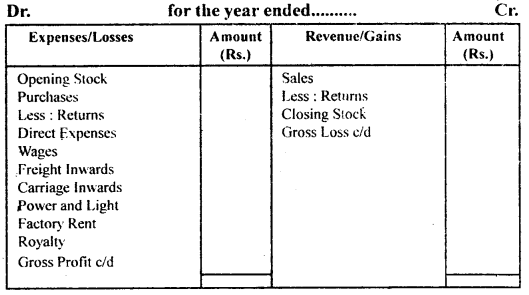

Form of Trading Account

Trading Account

Profit and Loss Account

It is prepared to calculate the net profit or net loss of the business of a given accounting period.

“Profit and Loss Account is an account into which all gains and losses are collected in order to ascertain the excess of gains over the losses or vice-versa.” – Prof Carter

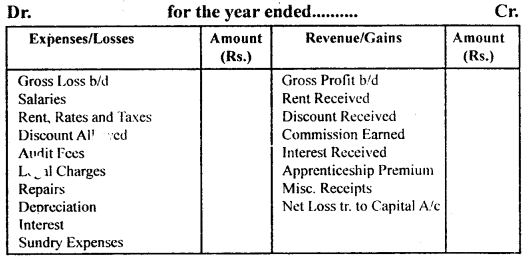

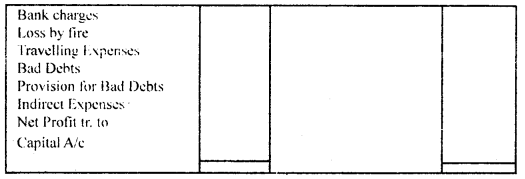

Form of Profit and Loss Account

Profit and Loss Account

Operating Profit and Net Profit

Operating Profit = Net Sales – Operating Cost = Net Sales – (Cost of Goods Sold + Administration and Office and Expenses + Selling and Distribution Expenses)

Or

Operating Profit = Net Profit + Non-Operating Expenses – Non-Operating Incomes

Gross Profit = Net Sales – Cost of Goods Sold.

= Net Sales (Opening stock + Net purchases + Direct expenses – Closing stock)

Net Sales = Total Sales – Sales Return

Net Purchases = Total Purchases – Purchase Returns

Net Profit = Gross Profit + Revenue Receipts-Indirect Expenses

Balance Sheet:

A statement that sets out the assets and liabilities of finner an institution at a certain date.

“Balance Sheet is an a.screen picture of the financial position of a going business at a certain moment.” – Francis R. Stead

It shows the financial position of the business at a certain date.

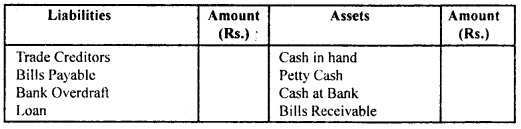

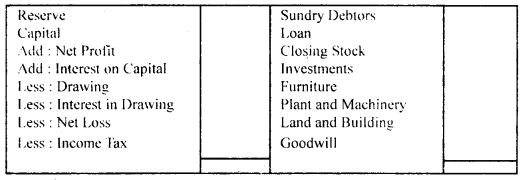

Form of Balance Sheet Balance Sheet as at……………….

Grouping and Marshalling of Balance Sheets

Grouping means putting items of similar nature under a common heading. The arrangement of assets and liabilities in a particular order in the Balance Sheet is called ‘Marshalling’.

Marshaling of Balance Sheet can be made in two ways:

1. In order of Liquidity: According to this method, an asset which is most easily convertible into cash such as cash in hand is written first and then will follow those assets which are comparatively less easily convertible, so that the least liquid assets such as goodwill, is shown last.

In the same way, those liabilities which are to be paid at the earliest will be written first. In other words, current liabilities are written, first of all, then fixed or long-term liabilities, and lastly, the proprietor’s capital. Proforma of a Balance Sheet in the order of liquidity will be the same as shown in the topic Balance Sheet.

2. In order of Permanence: This method is just opposite to the first method. Assets that are most difficult to be converted into cash such as Goodwill are written first and the assets which are most liquid such as cash in hand are written last.

Those liabilities which are to be paid last will be written first. The proprietor’s capital is written, first of all, then fixed or long-term liabilities, and lastly the current liabilities. The Proforma of the Balance Sheet in the order of Permanence will be just opposite to the above.