Here we are providing 1 Mark Questions for Accountancy Class 12 Chapter 1 Accounting for Not for Profit Organisation are the best resource for students which helps in class 12 board exams.

One Mark Questions for Class 12 Accountancy Chapter 1 Accounting for Not for Profit Organisation

Question 1.

How are specific donations treated while preparing final accounts of a ‘Not-For-Profit Organisation’ (CBSE Delhi 2019)

Answer:

Specific donation is treated as capital receipt & it is shown on liabilities side of Balance Sheet.

Question 2.

State the basis of accounting of preparing ‘Income and Expenditure Account’ of a ‘Not-For-Profit Organisation. (CBSE Delhi 2019)

Answer:

Accrual basis.

Question 3.

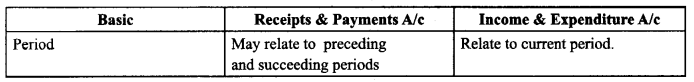

Differentiate between ‘Receipts and Payments Account’ and ‘Income and Expenditure Account’ on the basis of ‘Period’. (CBSE Outside Delhi 2019)

Answer:

Question 4.

What is meant by ‘Life membership fees’ ₹ (Outside Delhi 2019)

Answer:

Membership fee paid in lump stun to become a life member of a not-for-profit organisation.

Question 5.

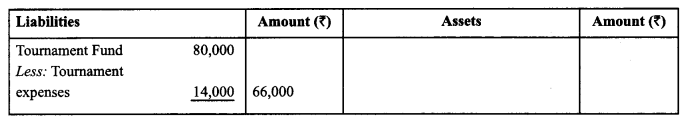

How are the following items presented in financial statements of a Not-for-Profit organisation: (CBSE Delhi 2019)

(a) Tournament Fund 80,000

(b) Tournament expenses 14,000

Answer:

Question 6.

How are general donations treated while preparing financial statements of a not-for-profit organisation (CBSE Compt. 2019)

Answer:

General donations are treated as revenue receipts.

or

How are general donations treated while preparing financial statements of a not-for-profit organisation (CBSE Compt. 2019)

Answer:

Life membership fee is the membership fee paid by some members as a lump sum amount instead of a periodic subscription.

Question 7.

State the basis of accounting on which ‘Receipt and Payment Account’ is prepared in case of Not-for Profit Organisation. (CBSE Sample Paper 2018-19)

Answer:

Cash basis of accounting.

Question 8.

Where will you show the ‘Subscription received in advance’ during the current year in the Balance Sheet of a Not-For-Profit Organisation₹ (CBSE Sample Paper 2018-19)

Answer:

Liability side of current year’s balance sheet.

Question 9.

A not-for-profit organisation sold its old furniture. State whether it will be treated as revenue receipt or capital receipt.

Answer:

Revenue.

Question 10.

Mention a fund who are specific in nature.

Answer:

Sports fund.

Question 11.

Income and Expenditure Account of a not-for-profit organisation has shown credit balance of ₹ 1,20,000 during 2012-13. When will you show it

Answer:

It will be added in the capital fund on the liability side.

Question 12.

Do not for profit organisation maintain proper system of accounts

Answer:

No.

Question 13.

Name any one account prepared by not for profit organisations.

Answer:

Receipts and Payment Account, Income and Expenditure Account and Balance Sheet.

Question 14.

Give one example of not for profit organisations.

Answer:

Charitable dispensaries, schools, educational institutions, trusts, societies etc.

Question 15.

State one source of not for profit organisations.

Answer:

Subscriptions, donations, legacies, government grant etc.

Question 16.

State the receipts relating to non-recurring in nature.

Answer:

Capital receipts.

Question 17.

State the payments relating to non-recurring in nature.

Answer:

The payments can be classified into capital payment and revenue payment.

Question 18.

Give an example of revenue receipt.

Answer:

Subscription.

Question 19.

Give an example of capital receipt.

Answer:

Government grant.

Question 20.

Give an example of capital payments.

Answer:

Purchase of assets.

Question 21.

What name is used for the cash book in case of not for profit organisations?

Answer:

Receipts and Payments Account.

Question 22.

Which side the revenue receipts are transferred in the income and enpenditure account?

Answer:

Credit side.

Question 23.

When the capital receipts are shown?

Answer:

Liabilities side.

Question 24.

Where the capital payments are shown?

Answer:

Assets side.

Question 25.

In which account the funds are transferred in case of not for profit organisation?

Answer:

Capital Fund.

Question 26.

What is the major source of income for not for profit organisations?

Answer:

Subscription.

Question 27.

What name is used for profit in case of not for profit organisations?

Answer:

Surplus.

Question 28.

What name is used for loss in case of not for profit organisations?

Answer:

Deficit.

Question 29.

Is the surplus or deficit in case of not for profit organisations distributed among members?

Answer:

No.

Question 30.

What type of rec eipts are recorded in the income and expenditure account?

Answer:

Revenue Receipts.

Question 31.

What type of payments are recorded in the income and expenditure account?

Answer:

Revenue Payments.

Question 32.

Which system of accountancy is followed to prepare receipts and payments account?

Answer:

Cash system of accounting.

Question 33.

Which system of account is followed to prepare income and expenditure account.

Answer:

Accrual system of accounting.