Here we are providing 1 Mark Questions for Accountancy Class 12 Chapter 10 Accounting Ratios are the best resource for students which helps in class 12 board exams.

One Mark Questions for Class 12 Accountancy Chapter 10 Accounting Ratios

Question 1.

What will be the effect on current ratio if a bills payable is discharged on maturity? (CBSE SP 2019-20)

Answer:

The current ratio will increase

Question 2.

Debt Equity Ratio of a company is 1:2. Purchase of a Fixed asset for ₹ 5,00,000 on long term deferred payment basis will increase, decrease or not change the ratio?

Answer:

Increased

Question 3.

It is a simple arithmetical expression of relationship between two figures. Name the term.

Answer:

Ratio

Question 4.

The liquidity of a business firm is measured by its ability to satisfy its long-term obligations as they become due. Name a ratio used for this purpose.

Answer:

Current Ratio.

Question 5.

X Ltd. has a Debt-Equity Ratio at 3 : 1. According to the management it should be maintained at 1 : 1. What is the choice to do so?

Answer:

To increase the equity or reduce the debt.

Question 6.

How the solvency of a business is assessed by Financial Statement Analysis? (CBSE Delhi 2012)

Answer:

With the help of solvency ratios.

Question 7.

Assuming that the debt to equity ratio is 1 : 2, state giving reason, whether the ratio will improve, decline or will have no change in case equity shares are issued for cash. (CBSE Foreign 2006)

Answer:

Decrease.

Question 8.

Debt to equity ratio of a company is 08 : 1. State whether long term loan obtained by the company will increase, decrease or not change the ratio. (CBSE Outside Delhi 2008)

Answer:

Increase.

Question 9.

Inventory Turnover ratio of a company is 3 times. State, giving reason, whether the ratio improve, decline or do not change because of increase in the value of closing stock by ₹ 5,000. (CBSE Outside Delhi 2008)

Answer:

Decrease.

Question 10.

Trade Receivables Turnover Ratio of a company is 6 times. State with reason whether the ratio will improve, decrease or not change due to increase in the value of closing inventory by ₹ 50,000. (CBSE Foreign 2008)

Answer:

No change. .

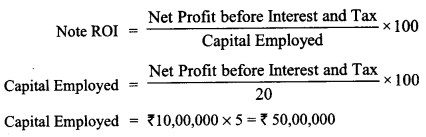

Question 11.

If a company has earned ₹ 10,00,000 as profit before interest and tax, ROI is 20%. State the capital employed in the company.

Answer:

₹ 5,00,000

Question 12.

What will be operating profit if operating ratio is 88.94? (CBSE Delhi 2009)

Answer:

Operating Profit = 100 – 88.94 = 11.06

Question 13.

State with reason whether repayment of long-term loan will result in increase, decrease or no change of debt- equity ratio. (CBSE Outside Delhi 2010 Compt.)

Answer:

Decrease.

Question 14.

A company has Share Capital of ₹ 5,00,000, Reserves and Surplus of ₹ 2,00,000 and Debt Equity Ratio of 1.8 : 1. It has issued additional Share Capital of ₹ 2,00,000 for cash and bonus shares of₹ 1,00,000. What will be new Debt Equity Ratio?

Answer:

1.4 : 1