Here we are providing 1 Mark Questions for Accountancy Class 12 Chapter 2 Accounting for Partnership: Basic Concepts are the best resource for students which helps in class 12 board exams.

One Mark Questions for Class 12 Accountancy Chapter 2 Accounting for Partnership: Basic Concepts

Question 1.

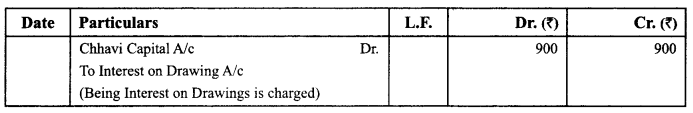

Chhavi and Neha were partners in a firm sharing profits and losses equally. Chhavi withdrew a fixed amount at the beginning of each quarter. Interest on drawings is charged @ 6% p.a. At the end of the year, interest ‘ on Chhavi’s drawings amounted to ₹ 900. Pass necessary journal entry for charging interest on drawings.

Answer:

Question 2.

Dev withdrew ₹ 10,000 on 15th day of every month. Interest on drawings was to be charged @ 12% per

annum. Calculate interest on Dev’s drawings. (CBSE Outside Delhi 2019)

Answer:

Interest On Drawings = 1,20,000 x 12/100 x 6 x 12 = 7,200

Question 3.

Amit, a partner in a partnership firm withdrew ₹ 7,000 in the beginning of each quarter. For how many months would interest on drawings be charged₹ (CBSE SP 2019-20)

Answer:

7 1/2 months.

Question 4.

Raj and Seema started a partnership firm on 1st July, 2018. They agreed that Seema was entitled to a commission of 10% of the net profit after charging Raj’s salary of ₹ 2,500 per quarter and Seema’s commission. The net profit before charging Raj’s salary and Seema’s commission for the year ended 31st March, 2019 was ₹ 2,27,500. Calculate Seema’s commission. (CBSE Compt. 2019)

Answer:

Net profit before salary and commission = ₹ 2,27,500

Net Raj’s salary ₹ 2,500 x 3 = ₹ 7,500

Net profit after Raj’s salary but before Seema’s commission = ₹ 2,20,000

Seema’s commission = 10/110 of ₹ 2,20,000

= ₹ 20,000

Question 5.

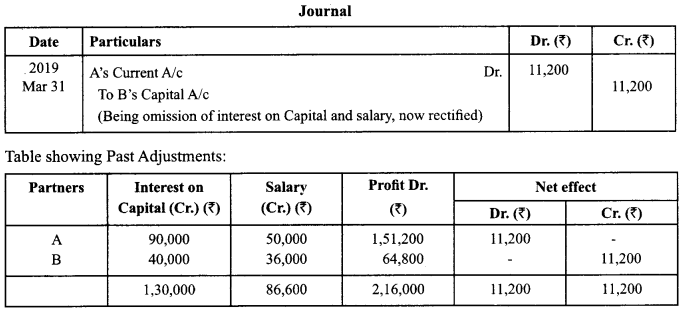

A and B are partners in a firm sharing profits and losses in the ratio of 7 : 3. Their fixed capitals were : A ₹ 9,00,000 and B ₹ 4,00,000. The partnership deed provided the following: (CBSE Compt. 2019)

(i) Interest on capital @ 10% p.a.

(ii) A’s salary ₹ 50,000 per year and B’s salary ₹ 3,000 per month.

Profit for the year ended 31st March 2019 ₹ 2,78,000 was distributed without providing for interest on capital and partner’s salary.

Showing your working clearly, pass the necessary adjustment entry for the above omissions.

Answer:

Question 6.

Partners of ABC Corporation have agreed that D, a minor, should be admitted as a partner in the firm. What will be liability of D?

Answer:

Limited.

Question 7.

X, Y and Z are partners in a firm. The firm had adopted fixed capital method. Mention the account in which the interest on capital will be recorded:

Answer:

Capital Account.

Question 8.

A partnership deed provides for the payment of interest on capital but there was a loss instead of profits during the year 2010-11. Will the interest on capital be allowed?

Answer:

No.

Question 9.

Where is interest on a partner’s loan debited to Profit and Loss Account or Profit and Loss Appropriation Account?

Answer:

Profit and loss Account.

Question 10.

Is interest on a partner’s loan is payable even in case of loss to the firm?

Answer:

Yes.

Question 11.

Net profit of a firm is ₹ 30,000, partners’ salary is ₹ 12,000 and interest on capital is ₹ 20,000. Mention the amount of partners’ salary and interest on capital which should be debited to Profit and Loss Appropriation Account if both items are treated as appropriation.

Answer:

Partners’ salary ₹ 11,250, Interest on capital ₹ 18,750.

Note: In the ratio of salary and interest on capital i.e. 12,000 : 20,000 = 3:5.

Question 12.

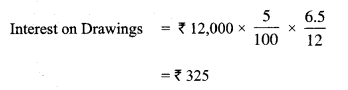

Ram and Shyam are partners sharing profits/losses equally. Ram withdrew ₹ 1,000 p.m. regularly on the first day of every month during the year 2013-14 for personal expenses. If interest on drawings is charged @ 5% p.a. Calculate interest on the drawings of Ram.

Answer:

Question 13.

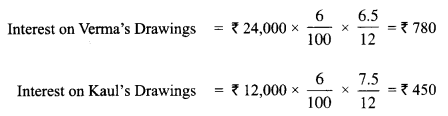

Verma and Kaul are partners in a firm. The partnership agreement provides that interest on drawings should be charged @ 6% p.a. Verma withdraws X 2,000 per month starting from April 01, 2013 to March 31, 2014. Kaul withdraw ₹ 3,000 per quarter, starting from April 01, 2013. Calculate interest on partner’s drawings.

Answer:

Question 14.

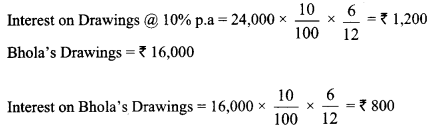

Himanshu withdraws ₹ 2,500 at the end of each month. The partnership deed provides for charging the interest on drawings @ 12% p.a. Calculate interest on Himanshu’s drawings for the year ending 31st December, 2013.

Answer:

![]()

Question 15.

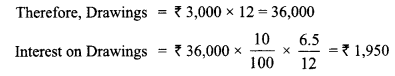

Bharam is a partner in a firm. He withdraws ₹ 3,000 at the starting of each month for 12 months. The books . of the firm closes on March 31 every year. Calculate interest on drawings if the rate of interest is 10% p.a.

Answer:

Bharam withdraws ₹ 3,000 at the starting of each month.

Question 16.

Amit and Bhola are partners in a firm. They share profits in the ratio of 3 : 2. As per their partnership agreement, interest on drawings is to be charged @ 10% p.a. Their drawings during 2013 were ₹ 24,000 and ₹ 16,000, respectively. Calculate interest on drawings based on the assumption that the amounts were withdrawn evenly, throughout the year.

Answer:

Amit’s Drawings = ₹ 24,000

Note: In the absence of date of drawings, it is assumed drawings have been made in the middle of each month/period.

Question 17.

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. B was guaranteed a profit of X 2,00,000. During the year the firm earned a profit of ₹ 84,000. Calculate the net amount of Profit/Loss transferred to the capital accounts of A and C. (CBSE Sample Paper 2017-18)

Answer:

Net Amount of Loss transferred to:

- A’s Capital Account: ₹ 87,000

- C’s Capital Account: ₹ 29,000