Here we are providing 1 Mark Questions for Accountancy Class 12 Chapter 6 Accounting for Share Capital are the best resource for students which helps in class 12 board exams.

One Mark Questions for Class 12 Accountancy Chapter 6 Accounting for Share Capital

Question 1.

What is meant by over subscription of shares? (CBSE Compt. 2019)

Answer:

Oversubscription of shares means that the company receives applications for more than the number of shares offered to the public for subscription.

Question 2.

What is meant by ‘par value’ of a share? (CBSE Compt. 2019)

Answer:

Par value is the nominal value or the face value of the share.

Question 3.

Is Reserve Capital a part of Unsubscribed Capital or Uncalled Capital? (CBSE Delhi 2018)

Answer:

Yes.

Question 4.

A company issued 25,000 equity shares of ₹ 10 each but received applications for.30,000 shares. Name the case of subscription.

Answer:

Over subscription

Question 5.

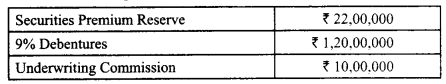

Neelam Limited has the following balances appearing in the balance sheet:

The company decided to redeem its 9% debentures at a premium of 10%. You are required to state how much securities premium amount can be used for redemption of debentures.

Answer:

₹ 12,00,000.

Question 6.

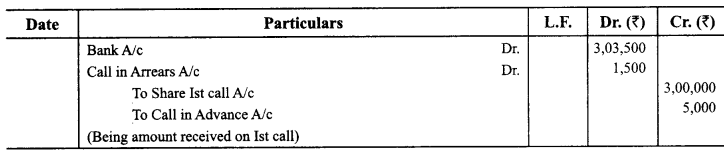

On 1.1.2016 the first call of ₹ 3 per share became due on 1,00,000 equity shares issued by Kamini Ltd. Karan a holder of 500 shares did not pay the first call money. Arjun a shareholder holding 1000 shares paid the second and final call of ₹ 5 per share along with the first call.

Pass the necessary journal entry for the amount received by opening ‘Calls-in-arrears’ and ‘Calls-in- advance’ account in the books of the company. (CBSE Outside Delhi 2016)

Answer:

Question 7.

Where will you show call in arrears in the balance sheet?

Answer:

As deduction from the subscribed but not fully paid share capital.

Question 8.

Where will you show call in advance in the balance sheet?

Answer:

It is shown under other current liabilities.

Question 9.

At what rate of interest, interest on call in arrears, is charged?

Answer:

10%p.a.

Question 10.

At what rate interest on calls-in-advance is paid by the company according to Table F of Companies Act, 2013? ’ (CBSE Delhi Compt.2014)

Answer:

As per Table F, company is required to pay interest on the amount of calls in advance @ 12% p.a.

Question 11.

How would you deal in a situation where the value of purchase considerations is more than the value of net assets while acquiring a business?

Answer:

It would refer to loss.

Question 12.

How will you deal in a situation where the value of net assets is more than the value of purchase consideration while acquiring a business?

Answer:

It would refer to gain.

Question 13.

Which account will you debit while issuing the shares to the promoters of a company against their services?

Answer:

Goodwill Account or Incorporation Expenses Account.

Question 14.

When can shares held by a shareholder be forfeited?. (CBSE Delhi 2017)

Answer:

On the non-payment of call money due.

Question 15.

A Ltd forfeited a share of 100 issued at a premium of 20% for non-payment of first call of 30 per share and’ final call of 10 per share. State the minimum price at which this share can be reissued. (CBSE Sample Paper 2016)

Answer:

₹ 40 per share!

Question 16.

Give the meaning of forfeiture of share.

Answer:

Cancellation of shares.

Question 17.

At the time of forfeiture of shares, what amount is credited to share forfeiture account?

Answer:

The amount already received.

Question 18.

Where will you show the share forfeited account in the balance sheet of a company?

Answer:

As an addition in the subscribed capital.

Question 19.

What amount of share capital is debited when the shares are forfeited?

Answer:

Called up money.

Question 20.

What amount of share capital is credited when the forfeited shares are reissued?

Answer:

Paid up capital of shares at the time of reissue.

Question 21.

Y Ltd. forfeited 100 equity shares of ₹ 10 each for the non-payment of first call of ₹ 2 per share. The final call of ₹ 2 per share was yet to be made.

Calculate the maximum amount of discount at which these shares can be re-issued. (CBSE Delhi 2017)

Answer:

₹ 6 per share or ₹ 600.

Question 22.

If a question is silent on the question of excess money received with application, how would you treat it?

Answer:

In the absence of any information, excess money over the amount due on allotment shall be refunded.