Here we are providing Class 12 Accountancy Important Extra Questions and Answers Chapter 1 Accounting for Not for Profit Organisation. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Class 12 Accountancy Chapter 1 Important Extra Questions Accounting for Not for Profit Organisation

Accounting for Not for Profit Organisation Important Extra Questions Very Short Answer Type

Question 1.

How are specific donations treated while preparing final accounts of a ‘Not-For-Profit Organisation’ (CBSE Delhi 2019)

Answer:

Specific donation is treated as capital receipt & it is shown on liabilities side of Balance Sheet.

Question 2.

State the basis of accounting of preparing ‘Income and Expenditure Account’ of a ‘Not-For-Profit Organisation. (CBSE Delhi 2019)

Answer:

Accrual basis.

Question 3.

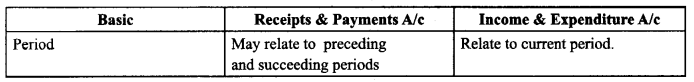

Differentiate between ‘Receipts and Payments Account’ and ‘Income and Expenditure Account’ on the basis of ‘Period’. (CBSE Outside Delhi 2019)

Answer:

Question 4.

What is meant by ‘Life membership fees’ ₹ (Outside Delhi 2019)

Answer:

Membership fee paid in lump stun to become a life member of a not-for-profit organisation.

Question 5.

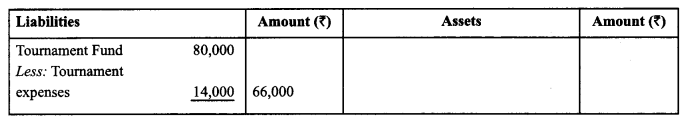

How are the following items presented in financial statements of a Not-for-Profit organisation: (CBSE Delhi 2019)

(a) Tournament Fund 80,000

(b) Tournament expenses 14,000

Answer:

Question 6.

How are general donations treated while preparing financial statements of a not-for-profit organisation (CBSE Compt. 2019)

Answer:

General donations are treated as revenue receipts.

or

How are general donations treated while preparing financial statements of a not-for-profit organisation (CBSE Compt. 2019)

Answer:

Life membership fee is the membership fee paid by some members as a lump sum amount instead of a periodic subscription.

Question 7.

State the basis of accounting on which ‘Receipt and Payment Account’ is prepared in case of Not-for Profit Organisation. (CBSE Sample Paper 2018-19)

Answer:

Cash basis of accounting.

Question 8.

Where will you show the ‘Subscription received in advance’ during the current year in the Balance Sheet of a Not-For-Profit Organisation₹ (CBSE Sample Paper 2018-19)

Answer:

Liability side of current year’s balance sheet.

Question 9.

A not-for-profit organisation sold its old furniture. State whether it will be treated as revenue receipt or capital receipt.

Answer:

Revenue.

Question 10.

Mention a fund who are specific in nature.

Answer:

Sports fund.

Question 11.

Income and Expenditure Account of a not-for-profit organisation has shown credit balance of ₹ 1,20,000 during 2012-13. When will you show it

Answer:

It will be added in the capital fund on the liability side.

Question 12.

Do not for profit organisation maintain proper system of accounts

Answer:

No.

Question 13.

Name any one account prepared by not for profit organisations.

Answer:

Receipts and Payment Account, Income and Expenditure Account and Balance Sheet.

Question 14.

Give one example of not for profit organisations.

Answer:

Charitable dispensaries, schools, educational institutions, trusts, societies etc.

Question 15.

State one source of not for profit organisations.

Answer:

Subscriptions, donations, legacies, government grant etc.

Question 16.

State the receipts relating to non-recurring in nature.

Answer:

Capital receipts.

Question 17.

State the payments relating to non-recurring in nature.

Answer:

The payments can be classified into capital payment and revenue payment.

Question 18.

Give an example of revenue receipt.

Answer:

Subscription.

Question 19.

Give an example of capital receipt.

Answer:

Government grant.

Question 20.

Give an example of capital payments.

Answer:

Purchase of assets.

Question 21.

What name is used for the cash book in case of not for profit organisations?

Answer:

Receipts and Payments Account.

Question 22.

Which side the revenue receipts are transferred in the income and enpenditure account?

Answer:

Credit side.

Question 23.

When the capital receipts are shown?

Answer:

Liabilities side.

Question 24.

Where the capital payments are shown?

Answer:

Assets side.

Question 25.

In which account the funds are transferred in case of not for profit organisation?

Answer:

Capital Fund.

Question 26.

What is the major source of income for not for profit organisations?

Answer:

Subscription.

Question 27.

What name is used for profit in case of not for profit organisations?

Answer:

Surplus.

Question 28.

What name is used for loss in case of not for profit organisations?

Answer:

Deficit.

Question 29.

Is the surplus or deficit in case of not for profit organisations distributed among members?

Answer:

No.

Question 30.

What type of rec eipts are recorded in the income and expenditure account?

Answer:

Revenue Receipts.

Question 31.

What type of payments are recorded in the income and expenditure account?

Answer:

Revenue Payments.

Question 32.

Which system of accountancy is followed to prepare receipts and payments account?

Answer:

Cash system of accounting.

Question 33.

Which system of account is followed to prepare income and expenditure account.

Answer:

Accrual system of accounting.

Accounting for Not for Profit Organisation Important Extra Questions Short Answer Type

Question 1.

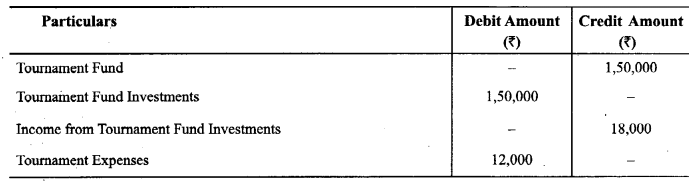

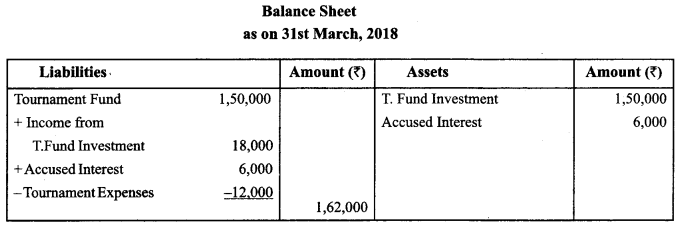

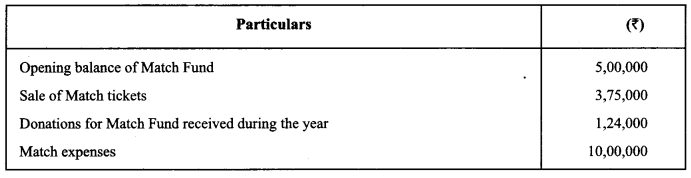

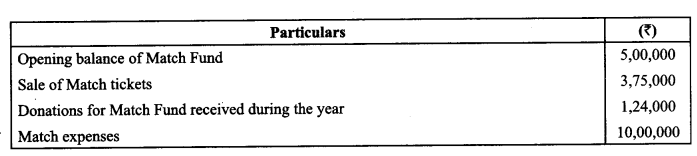

How the following items for the year ended 31st March, 2018 will be presented in the financial statements of Aisko Club: (CBSE Delhi 2019)

Additional information:

Interest Accrued on Tournament Fund Investments ₹ 6,000

Answer:

Question 2.

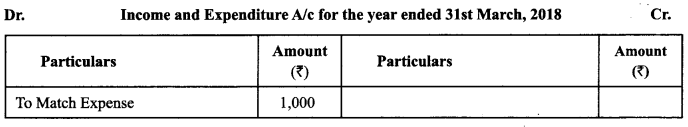

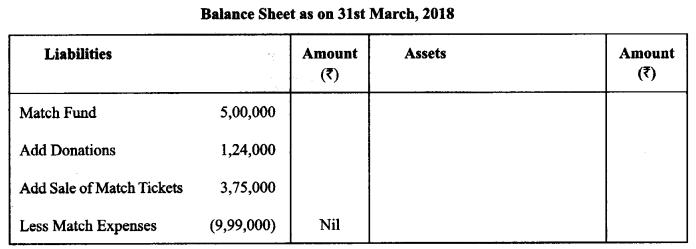

Present the following information for the year ended 31st March, 2018 in the financial statements of a not-for-profit organisation. (CBSE Delhi 2019)

Answer:

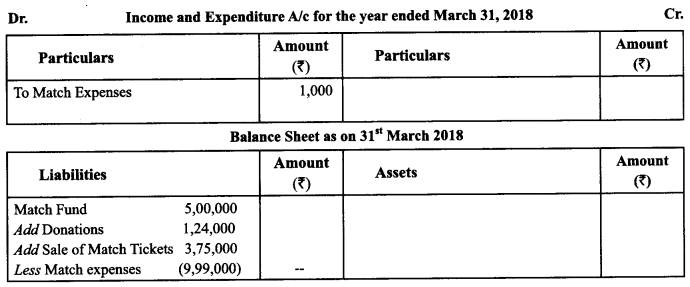

Income and Expenditure A/c for the year ended 31st March, 2018

Question 3.

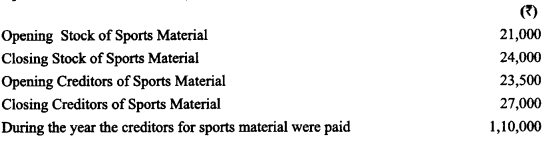

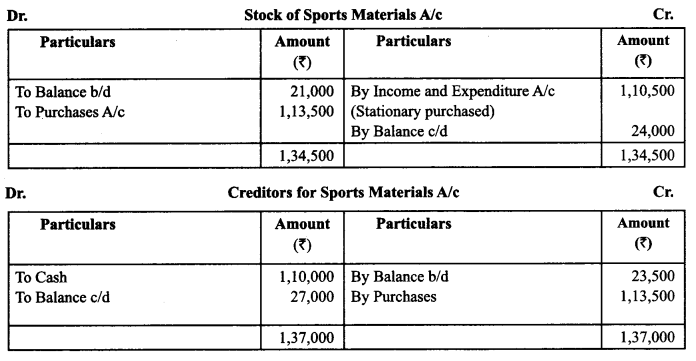

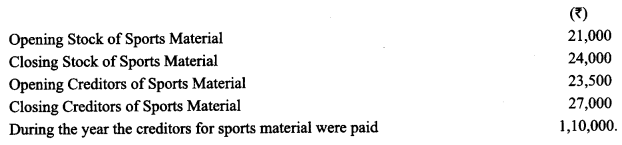

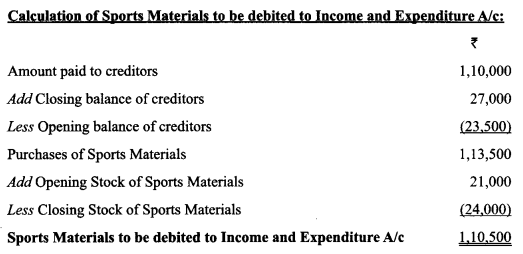

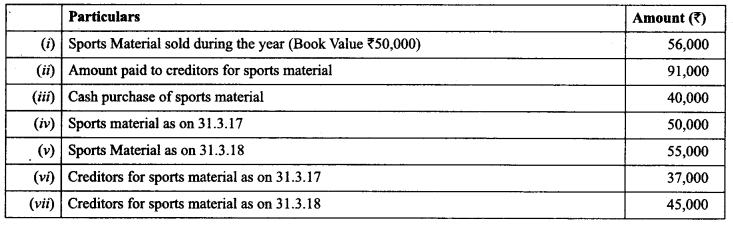

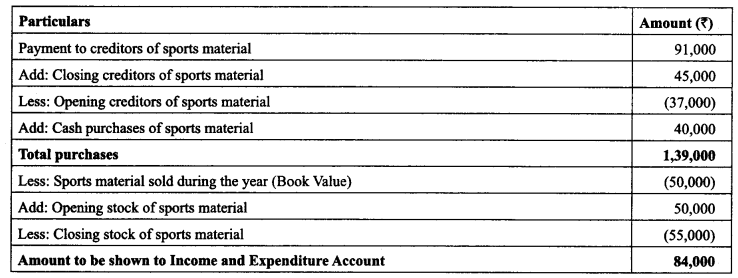

From the following information calculate the amount of ‘Sports Material’ to be debited to Income and Expenditure Account of Young Football Club for the year ended 31st March, 2018. {CBSE Delhi 2019)

Answer:

Question 4.

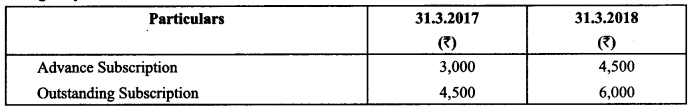

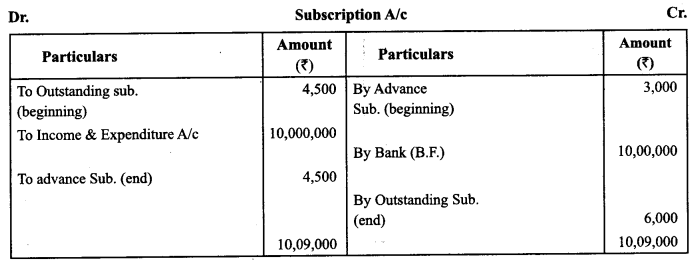

From the following information, calculate the amount of subscriptions received by Happy Sports Club during the year ended 31st March, 2018.

The Club has 2000 members each paying an annual subscription of ₹ 500.

Answer:

Question 5.

Present the following information for the year ended 31st March, 2018 in the financial statements of a not-for-profit organisation.

Answer:

Income and Expenditure A/c for the year ended March 31,2018

Question 6.

From the following information calculate the amount of ‘Sports Material’ to be debited to Income and Expenditure Account of Young Football Club for the year ended 31st March, 2018. (CBSE Outside Delhi 2019)

Answer:

Question 7.

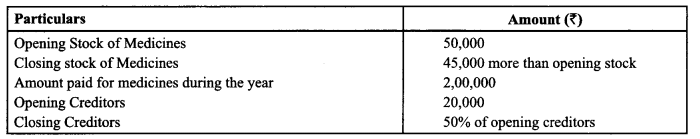

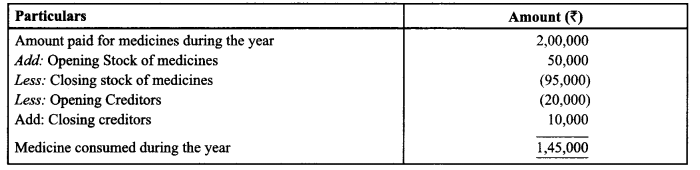

Calculate the amount of medicines consumed during the year ended 31 st March, 2019

Answer:

Question 8.

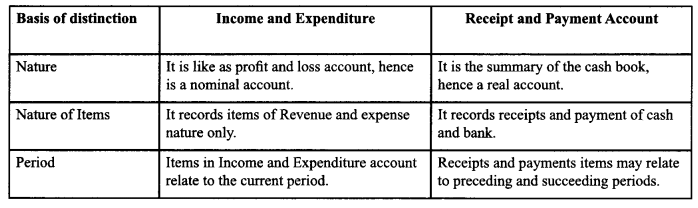

Distinguish between Income and Expenditure Account and Receipt and payment Account on basis of:

(i) Nature

(ii) Nature of items

(iii) Period

Answer:

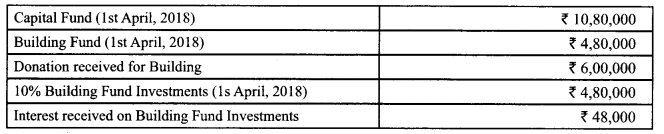

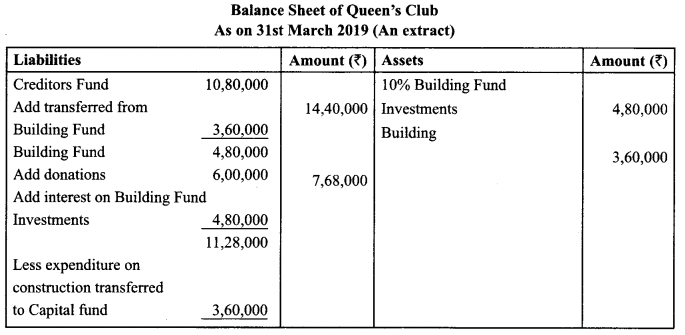

Question 9.

Present the following items in dic Balance Sheet of Queens Club as at 31st March. 2019: (CBSE Comp. 2019-20)

Expenditure on construction of building ₹ 3,60,000. The construction work is in progress and has not yet been completed.

Answer:

Question 10.

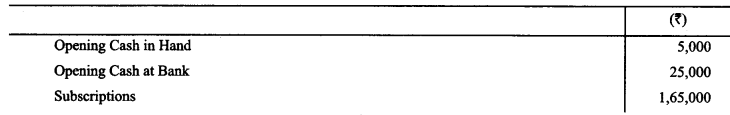

Following is the Receipts and Payments Account of Bharti Club for the year ended 31 st March, 2019.

Receipts and Payments Account of Bharti Club for the year ended 31st March, 2019 (CBSE Comp. 2019-20)

Answer:

Question 11.

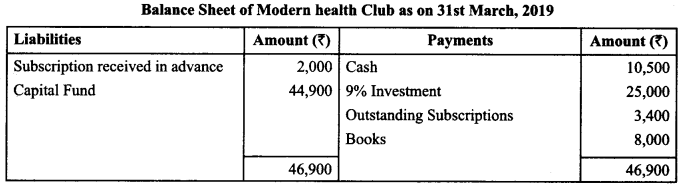

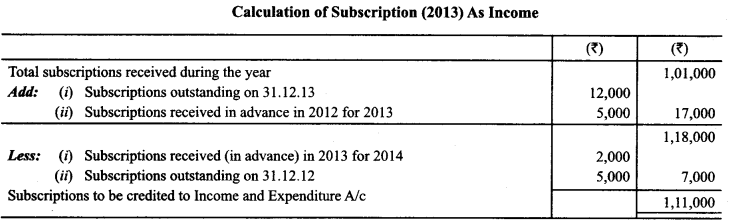

Subscriptions received by the health club during the year 2013 were as under:

Answer:

Question 12.

Calculation of amount of sports material to be transferred to Income and Expenditure Account of Raman Bhalla Sports Club, Ludhiana for the year ended on 31 st March, 2018

Answer:

Calculañon of amount of sports material to bc transferred to Income and Expenditure Account of Raman Bhalla Sports Club. Ludhiana for the year ended on 31st March, 2018

Question 13.

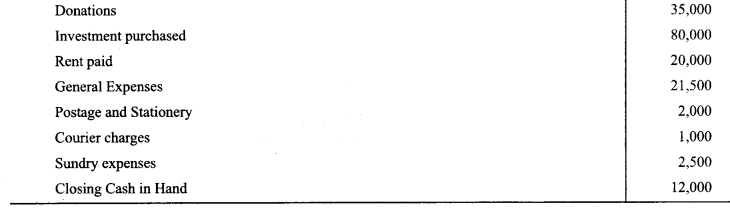

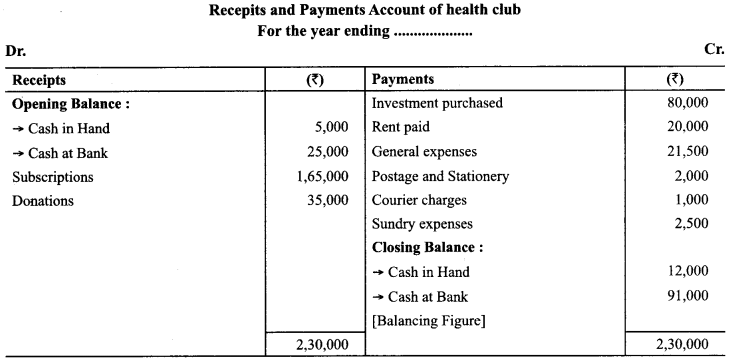

From the following particulars taken from the cash book of a health club, prepare a Receipts and Payments Account.

Answer:

Question 14.

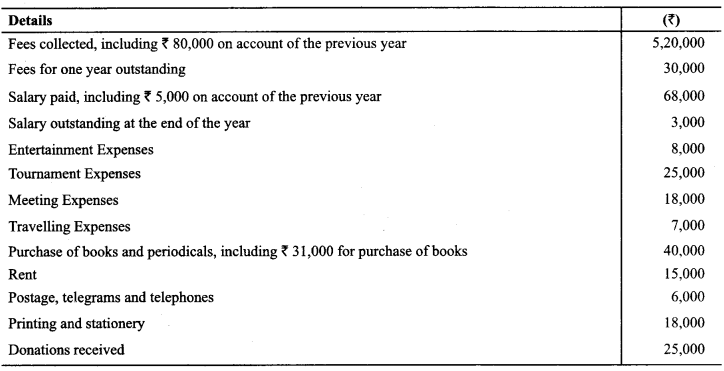

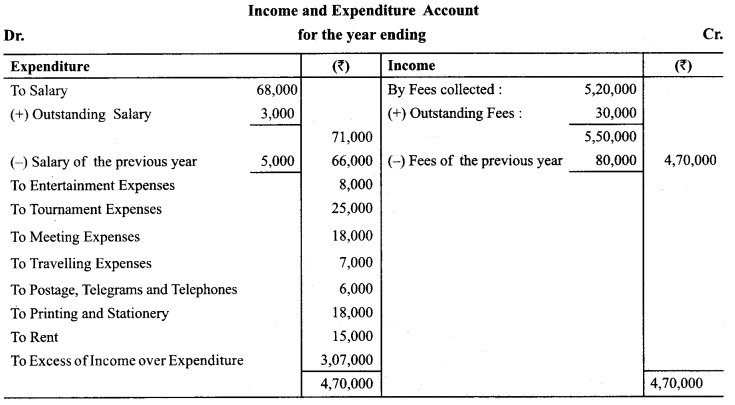

From the following particulars, prepare Income and Expenditure Account:

Answer:

Question 15.

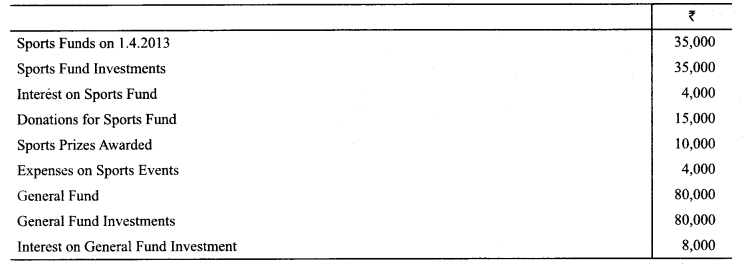

Following is the information given in respect of certain items of a sports club. Show these items in the Income and Expenditure Account and the Balance Sheet of the club:

Answer:

Question 16.

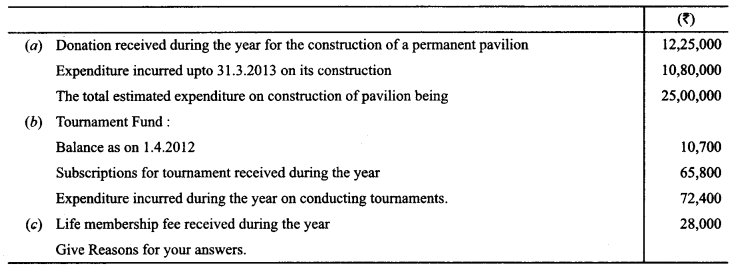

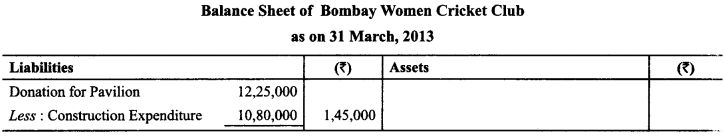

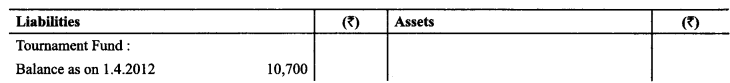

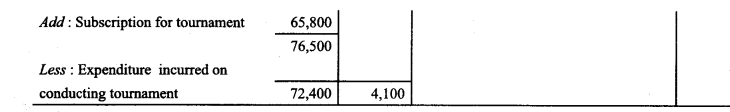

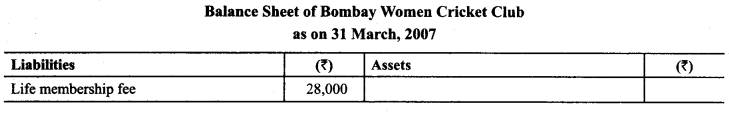

How will you deal with the following items while preparing for the Bombay Women Cricket Club, its Income and Expenditure Account for the year ending 313.2013 and its Balance Sheet as on 31.3.2013

Answer:

(a) Donation received of ₹ 12,25,000 for the construction of a permanent pavilion is a type of specific donation. Therefore, it is to be capitalised and shown on the liability side of Balance Sheet. Expenditure incurred on the construction of pavilion upto 3 13.2013 is ₹ 10,80,000 will be deducted from the donation received during the year. But the estimated expenditure on construction of pavilion will not be shown in Income and Expenditure Account and Balance Sheet of the club. It is also to be noted that when the construction work will be completed, any balance leftover will be transferred to the “Capital Fund.”

(b) Tournament Fund is a type of Special Fund. Therefore, it will be shown on the liability side of the Balance Sheet. Any receipt for tournament i.e., subscription for tournament will be added to the fund and any expenditure on tournament i.e., expenditure incurred on conducting tournaments will be deducted from that specific fund.

(c) Life membership fees is to be capialised unless it is stated otherwise in the Question. Therefore, life membership fees will be shown on liability side of the Balance Sheet at the end of the year on 31st March, 2013.

Question 17.

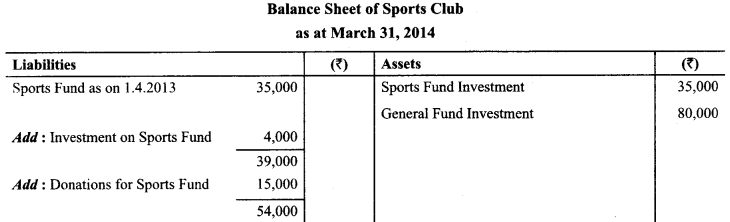

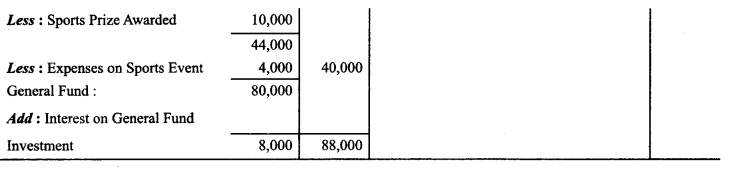

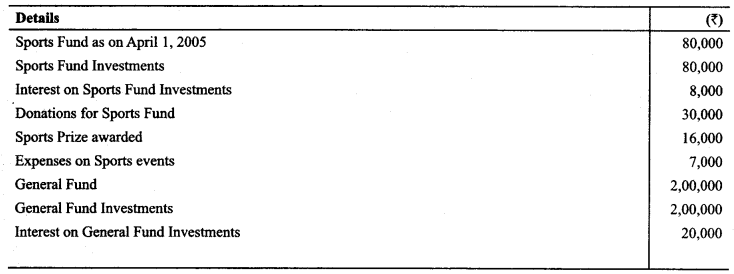

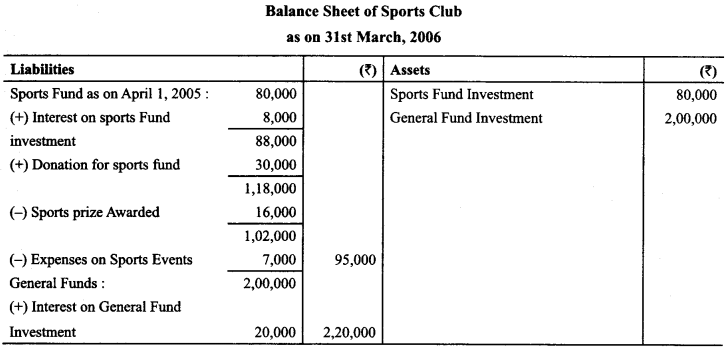

Following is the information in respect of certain items of a Sports Club. You are required to show them in the Balance Sheet.

Answer:

Question 18.

How will you deal with the following items while preparing the income and expenditure account of a club for the year ending 31st December 2017 ?

Answer:

Accounting for Not for Profit Organisation Important Extra Questions Long Answer Type

Question 1.

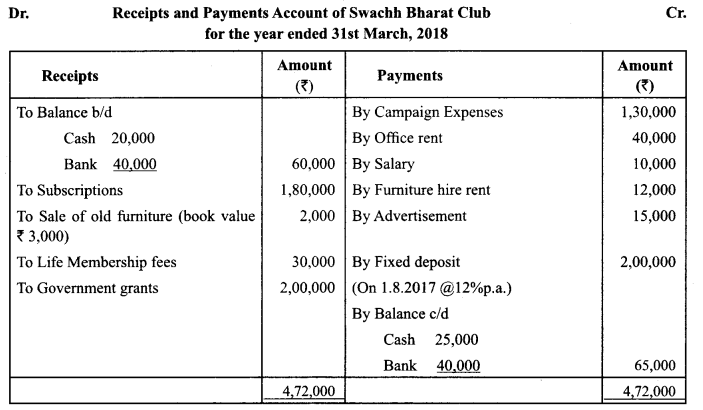

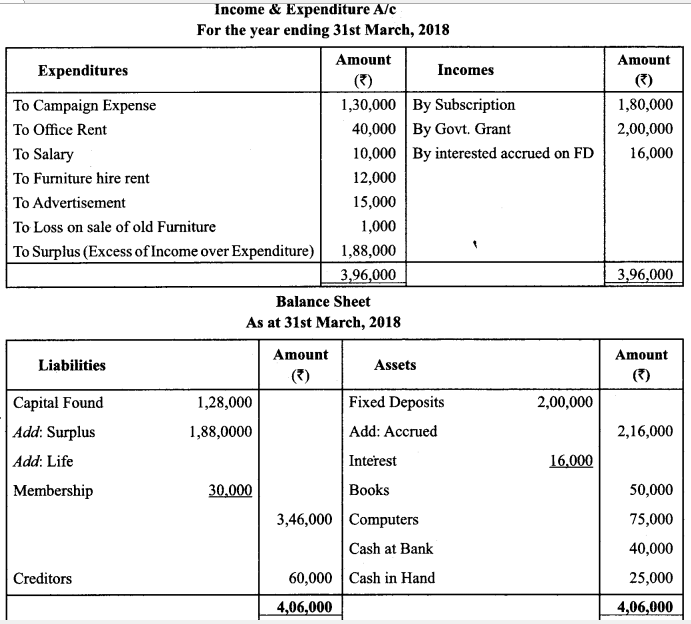

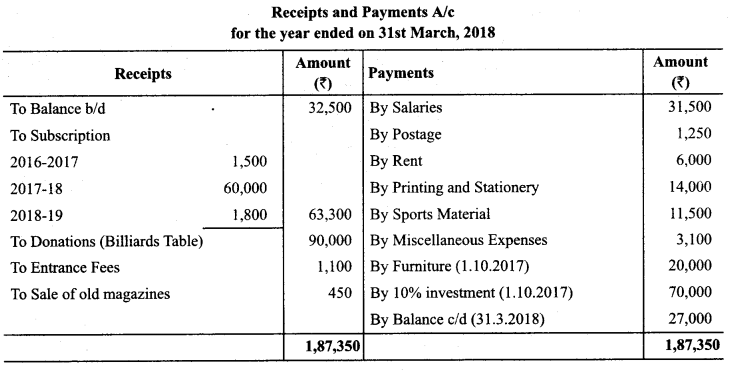

From the following Receipts and Payments Account and additional information of Swachh Bharat Club, New Delhi for the year ended 31st March, 2018, prepare Income and Expenditure Account and Balance Sheet.

Additional Information:

Assets on 1.4.2017 were : Books 50.000; Computers 75.000. Liabilities and Capital fund on 1.4.2017 were : Creditors 60.000; Capital fund 1.28.000.

Answer:

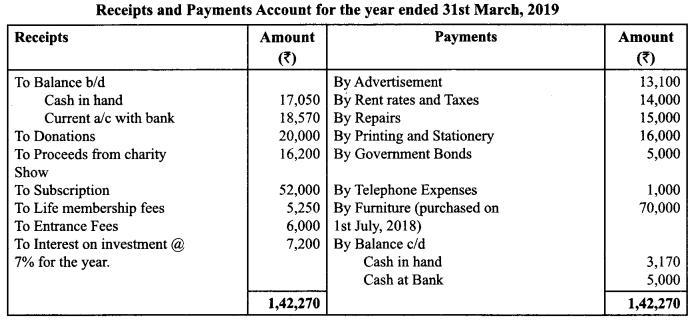

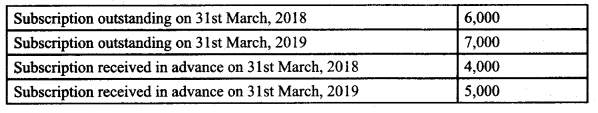

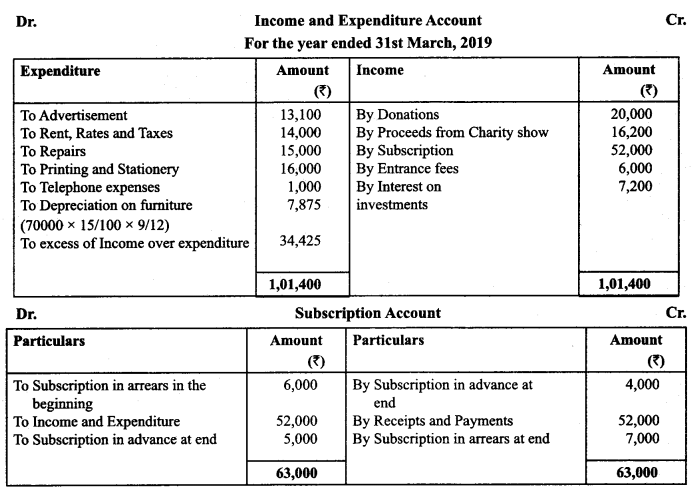

Question 2.

From the following Receipts and Payments Accounts of Rolaxe Club, for the year ended 31st March, 2019. Prepare Income and Expenditure Account for the year ended 31st March, 2019.

AddiLional Information :-

(i) Depreciate furniture by 15% p.a.

(ii) There were 416 Life Members on 31.3.2018 the subscription payable by each member, to be a life time member is ₹ 125

(iii)

Answer:

Question 3.

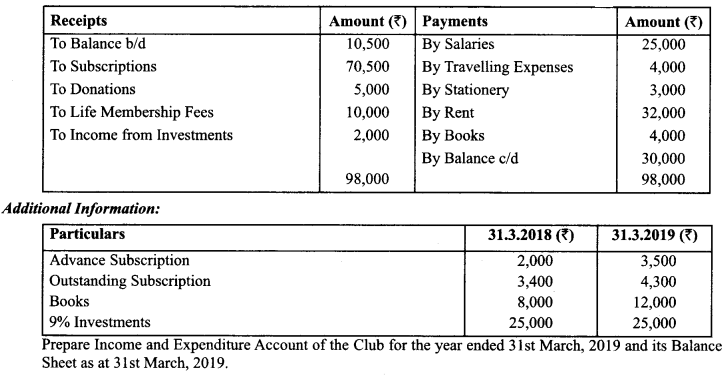

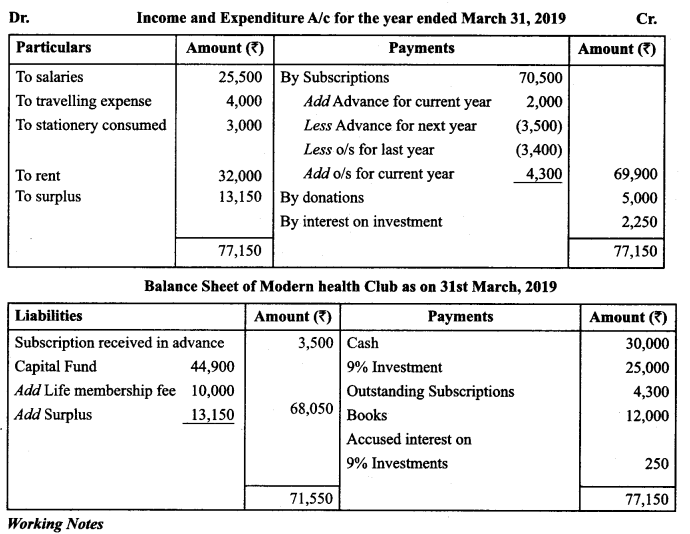

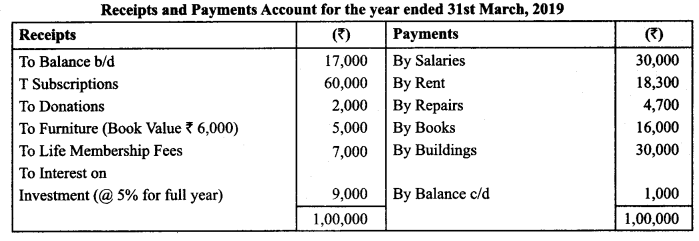

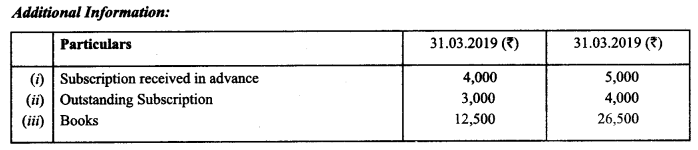

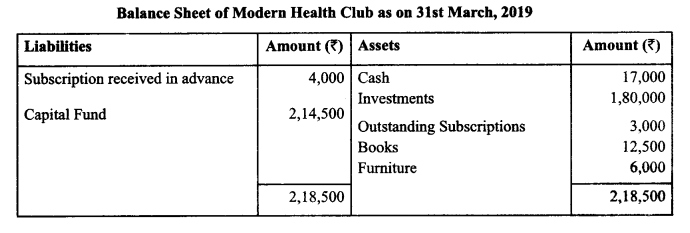

From the following Receipts and Payments Account and additional information of Modem Health Club, prepare Income and Expenditure Account for the year ended 31st March, 2019 and the Balance Sheet as at 31st March, 2019.

Answer:

Question 4.

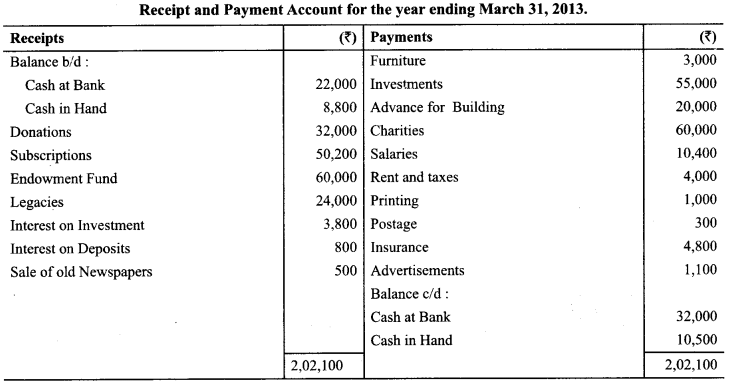

The Receipt and Payment Account of Harimohan Charitable Institution is given:

Prepare the Income and Expenditure Account for the year ended on March 31,2013 after considering thc following:

(i) It was decided to treat fifty pcrccnl of the amount received on account of Legacies and Donations as income,

(ii) Liabilities to be provided for are :

Rent ₹ 800; Salaries ₹ 1200 Advertisement ₹ 200

(iii) ₹2,000 due for interest on investment was not actually received.

Answer:

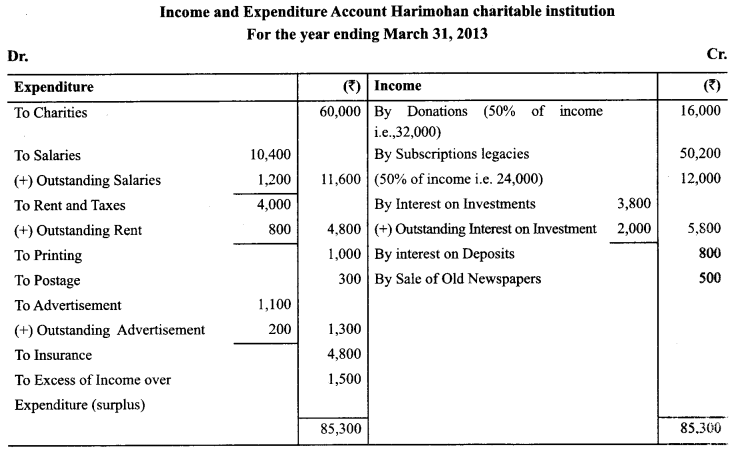

Income and Expenditure Account Harimohan charitable institution For the year ending March 31,2013

Question 5.

The following is the account of cash transactions of the Nan Kalayan Samittee for the year ended December 31. 2013:

You are required to prepare an Income and Expenditure Account after the following adjustments :

(i) Subscription still to be received are ₹ 750, but subscription include ₹ 500 for the year 2013.

(ii) In the beginning of the year the Sangh owned Building ₹ 20,000 and furniture ₹ 3,000 and Books ₹ 2,000.

(iii) Provide depreciation on Furniture @ 5% (including purchase), books @ 10% and building @ 5%.

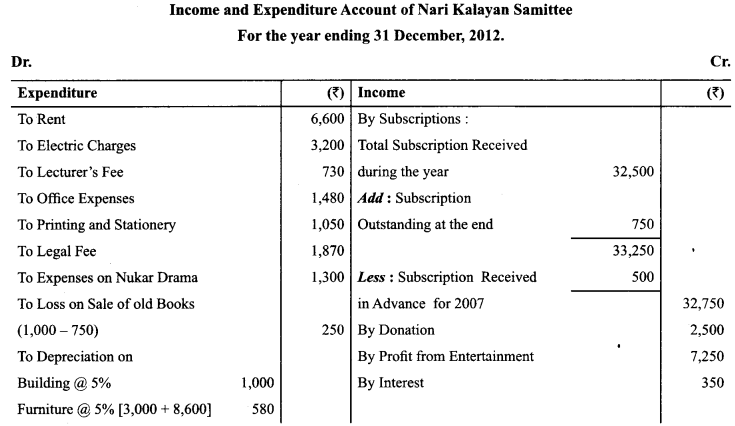

Answer:

Income and Expenditure Account of Nari Kalayan Samittee

For the year ending 31 December, 2012.

Question 6.

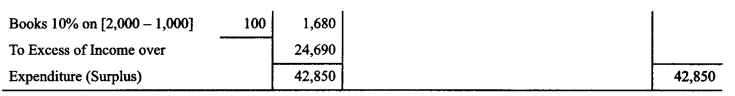

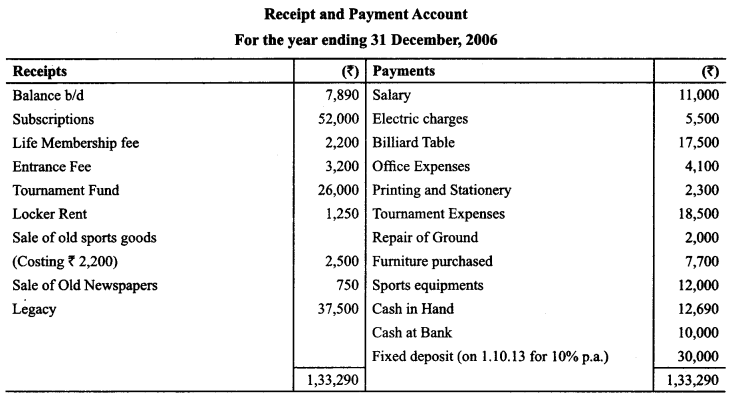

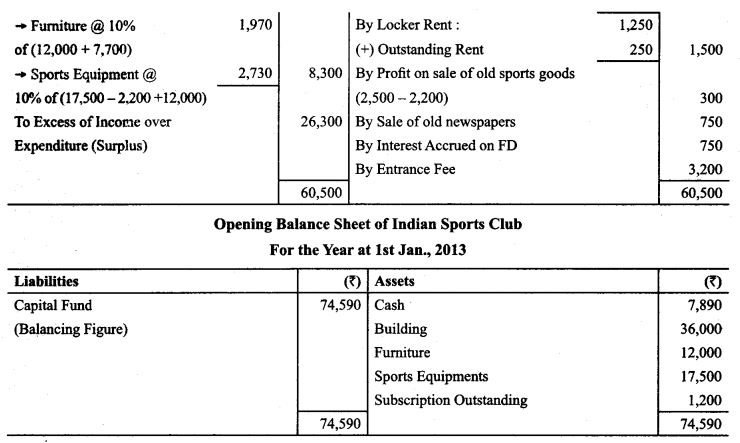

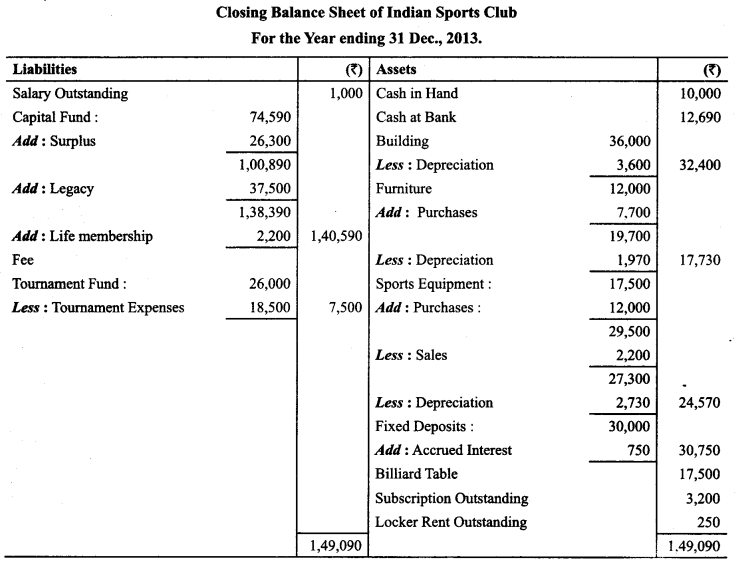

Following is the receipt and payment account of Indian sports club, prepared income and expenditure account, balance sheet as on December 31,2006.

Other informations:

Subscription outstanding was on 31 December 2013, ₹ 1,200 and ₹ 3,200 on 31 December 2013; Locker Rent outstanding on 31 December, 2013 ₹ 250. Salary outstanding on 31 December, 2013 ₹ 1,000.

On January 1, 2013, club has building ₹ 36,000, Furniture ₹ 12,000. Sports Equipments ₹ 17,500. Depreciation charged on these items @ 10% (including purchase).

Answer:

Question 7.

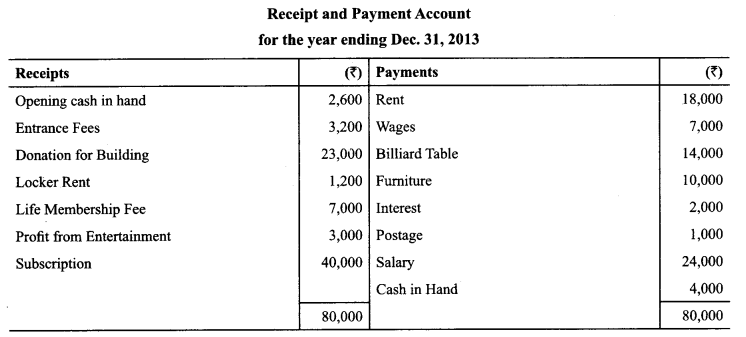

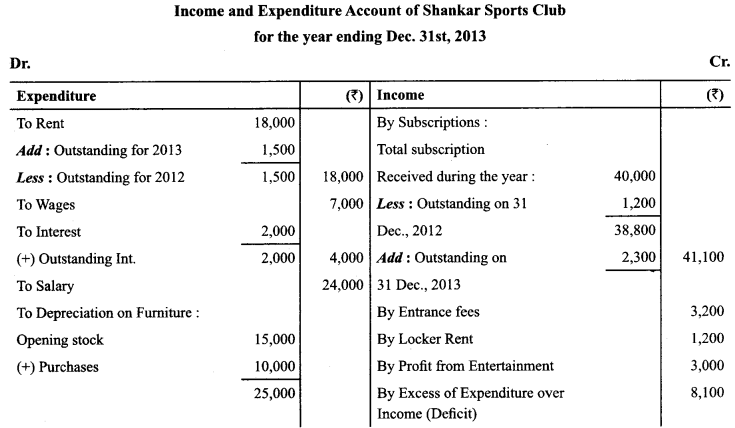

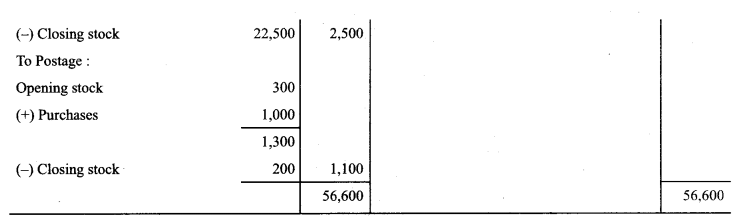

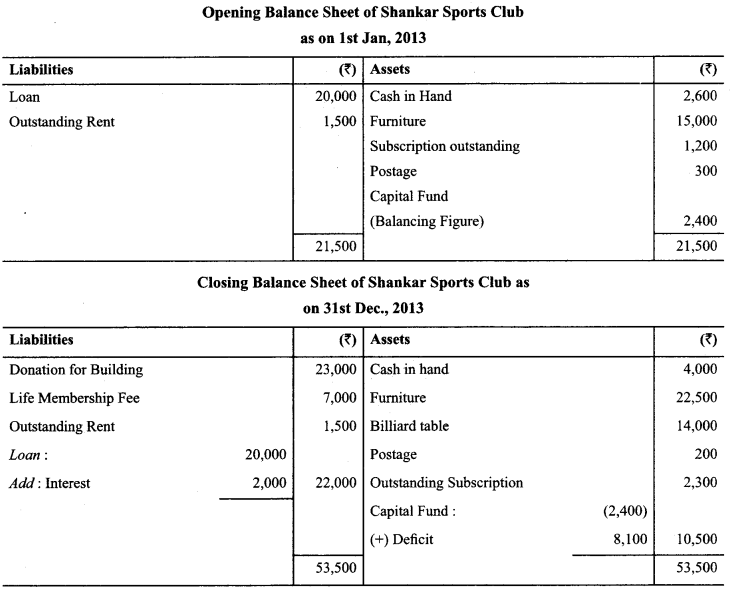

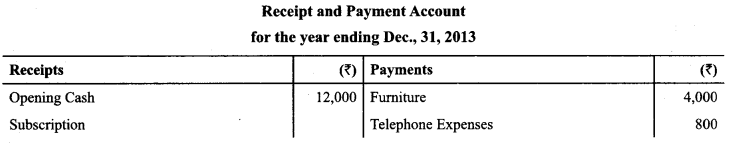

Receipt and Payment Account of Shankar Sports Club is given below, for the year ended December 31, 2013:

Prepare the Income and Expenditure Account and Balance Sheet with the help of the following informations :

Subscription outstanding on 31. Dec., 2012 is ₹ 1,200 and ₹ 2,300 on 31.12.2013, opening stock of postage stamps is ₹ 300 and closing stock is ₹ 200, Rent ₹ 1,500 related to 2012 and ₹ 1,500 is still unpaid.

On January 1, 2006 the club owned furnitures ₹ 15,000, Furniture valued at ₹ 22,500 on 31.12.2013. The club took a loan of ₹ 20,000 @ 10% p.a. in 2012.

Answer:

Question 8.

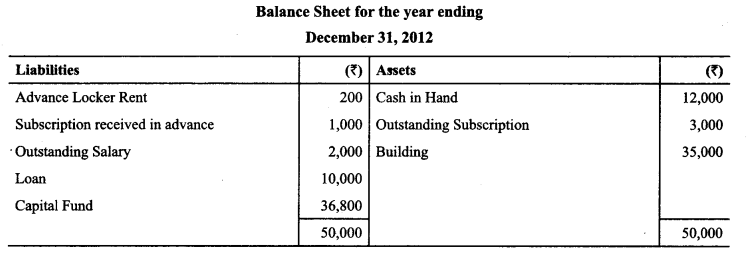

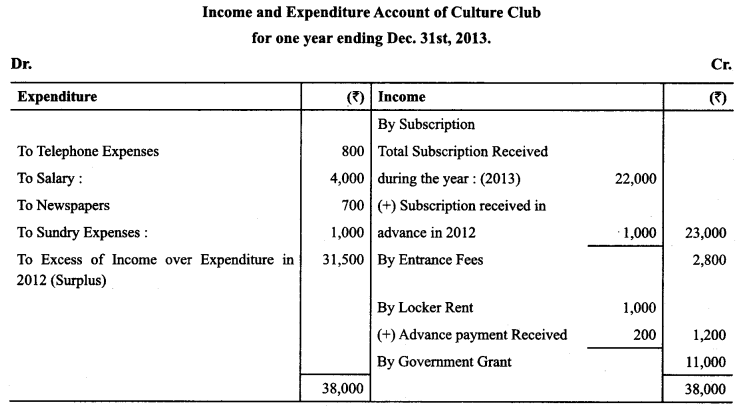

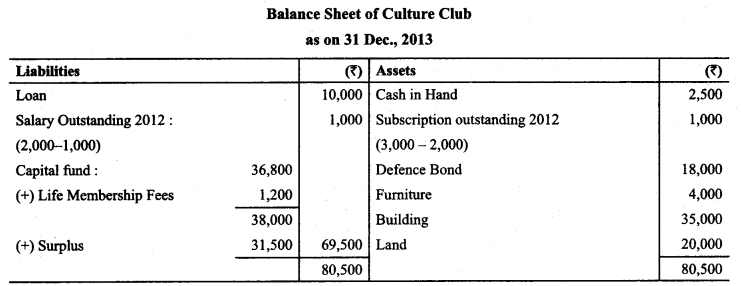

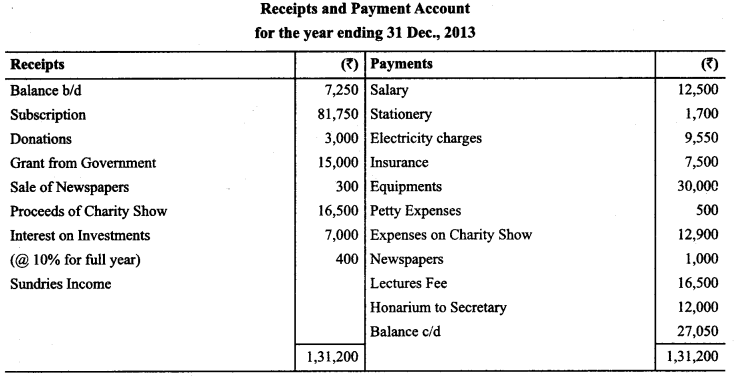

Prepare Income and Expenditure Account and Balance Sheet for the year ended December 31,2013 from the following Receipt and Payment Account and Balance Sheet of Culture Club.

Answer:

Question 9.

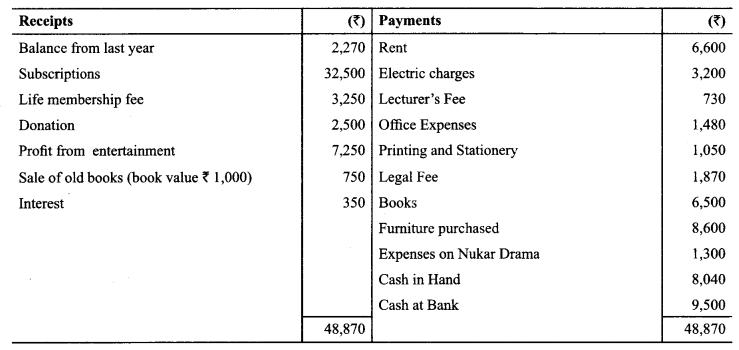

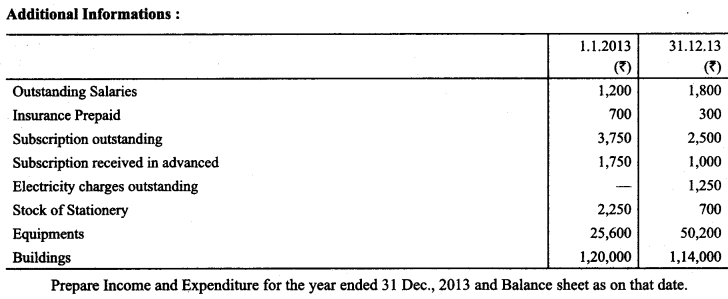

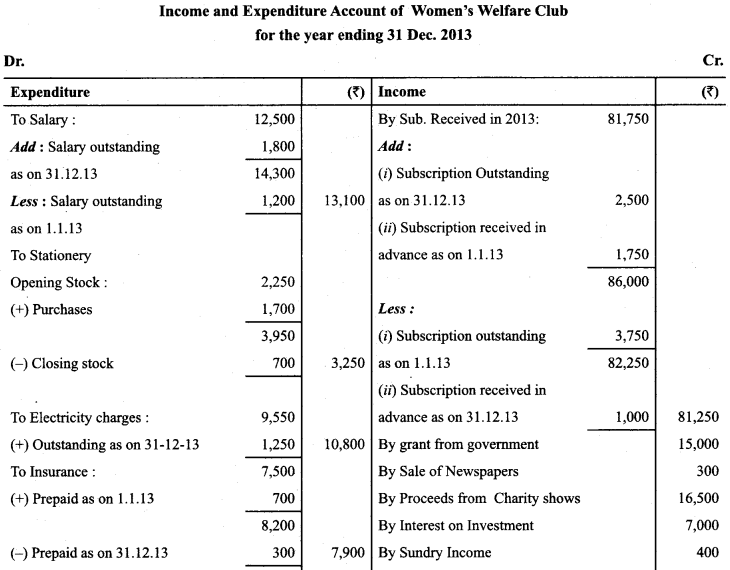

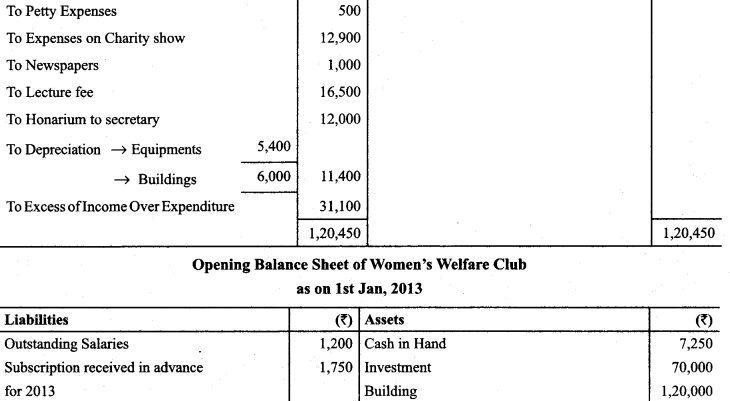

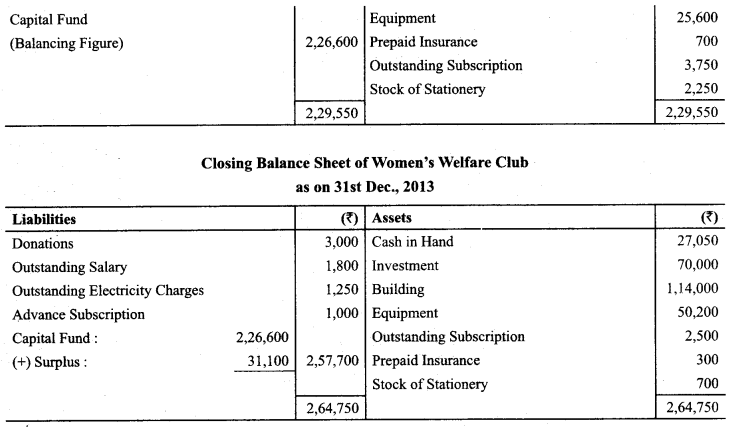

Following is the Receipt and Payment Account of Women’s Welfare Club for the year ended 31 Dec., 2013:

Answer:

Question 10.

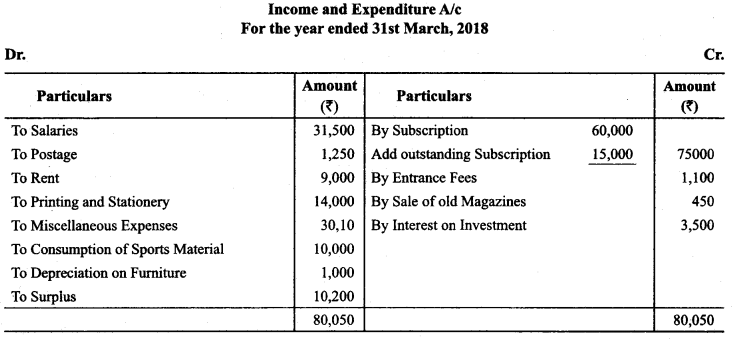

Prepare Income and Expenditure Account from the following particulars of Youth Club, for the year ended on 31st March, 2018:

Additional Information:

(i) Subscription outstanding as at March 31st 2018 ₹ 16,200

(ii) ₹ 1200 is still in arrears for the year 2016-17 for subscription

(iii) Value of sports material at the beginning and at the end of the year was ₹ 3,000 and ₹ 4,500 respectively.

(iv) Depreciation to be provided @ 10% p.a. on furniture.

Answer:

Working Notes:

(i) Consumption of Sports Material Opening stock of sports material + Purchases of sports material during the year – Closing stock of sports material

= ₹ 3,000 + ₹ 11,500 – ₹ 4,500 = ₹ 10,000

(ii) Depreciation of Furniture = ₹ 20,000 x (6/12) x (10/100) = ₹ 1,000

(iii) Interest on Investment = ₹ 70,000 x (10/100) x (6/12) = ₹ 3,500