Here we are providing Online Education Class 12 Accountancy Important Extra Questions and Answers Chapter 11 Cash Flow Statement. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Online Education for Class 12 Accountancy Chapter 11 Important Extra Questions Cash Flow Statement

Cash Flow Statement Important Extra Questions Very Short Answer Type

Question 1.

Mevo Ltd., a financial enterprise had advanced a loan of ₹ 3,00,000, invested ₹ 6,00,000 in shares of the other companies and purchased machinery for ₹ 9,00,000. It received dividend of ₹ 70,000 on investment in shares. The company sold an old machine of the book value of ₹ 79,000 at a loss of ₹ 10,000.

Compute Cash flows from Investing Activities. (CBSE Delhi 2019)

Answer:

Note: As it is clearly mentioned that shares are purchased for investment. They have been treated as investing activities.

Question 2.

Give the meaning of ‘Cash Equivalents’ for the purpose of preparing Cash Flow Statement.(CBSE Delhi 2019)

Answer:

“Cast equivalents” means short term highly liquid investments that are readily convertible into known amount of cash & which are subject to an in significant risk of changes in value.

For Ex-short term marketable securities.

The primary purpose of the statement of cash flows is to provide information about cash receipt, cash payments, and the net change in cash resulting from the operating, investing and financing activities of a company during the period.

Question 3.

What is meant by ‘Cash Flows? (CBSE Delhi 2019)

Answer:

Cash Flows imply movement of cash in and out due to some non-cash items.

Question 4.

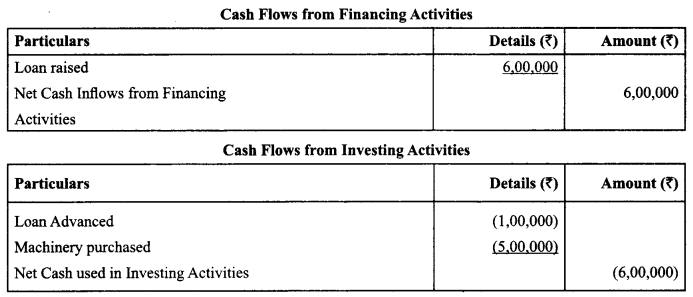

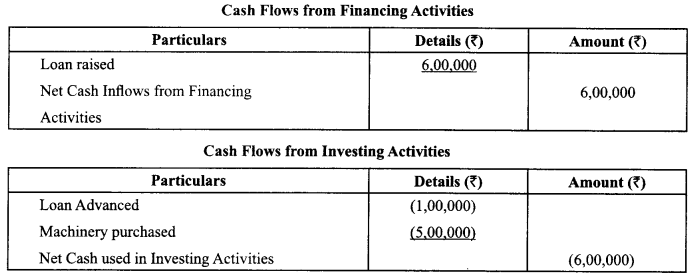

K Ltd., a manufacturing company obtained a loan of ₹ 6,00,000, advanced a loan of ₹ 1,00,000 and purchased machinery for ₹ 5,00,000. Calculate the amount of Cash Flow from financing and investing activities.

Answer:

Question 5.

How will ‘commission received’ be treated while preparing cash-flow-statement ? (CBSE Delhi 2019)

Answer:

It will be treated as Cash flows from operating activities.

Question 6.

How is ‘dividend paid’ treated by a financial enterprise for the purpose of preparing cash flow statement?

Answer:

Dividend paid is treated as a financing activity.

Question 7.

When can ‘Receipt of Dividend’ be classified as an operating activity ₹ State. Also give reason in support of your answer. (CBSE Delhi 2019)

Answer:

Receipt of dividend can be an operating activity for a financial company as it is a principal revenue generating activity.

Question 8.

What is meant by ‘Cash Flow Statement’ ? (CBSE Outside Delhi 2019)

Answer:

A Cash Flow Statement is a statement that provides information about the historical changes in Cash & Cash Equivalents of an enterprise by classifying cash flows into Operating, Investing and Financing Activities.

Question 9.

What is meant by ‘Cash Flows’? (CBSE Outside Delhi 2019)

Answer:

Cash Flows imply movement of cash in and out due to some non-cash items.

Question 10.

K Ltd., a manufacturing company obtained a loan of ₹6,00,000, advanced a loan of ₹1,00,000 and purchased machinery for ₹5,00,000. Calculate the amount of Cash Flow from financing and investing activities.

Answer:

Question 11.

How will ‘commission received’ be treated while preparing cash-flow-statement ? (CBSE Outside Delhi 2019)

Answer:

It will be treated as Cash flows from operating activities.

Question 12.

How is ‘dividend paid’ treated by a financial enterprise for the purpose of preparing cash flow statement?(CBSE Outside Delhi 2019)

Answer:

Dividend paid is treated as a financing activity.

Question 13.

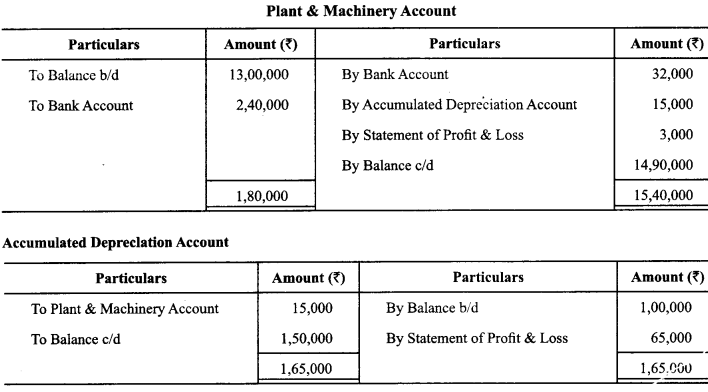

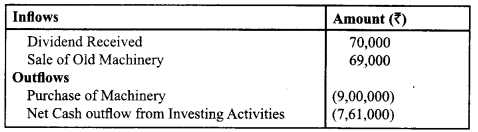

M/s Mevo and Sons.; a bamboo pens producing company, purchased a machinery for ₹ 9,00,000.

It received dividend of ₹ 70,000 on investment in shares. The company also sold an old machine of the book value of ₹ 79,000 at a loss of ₹ 10,000. Compute Cash flow from Investing Activities

(CBSE SP 2019-20)

Answer:

Cash flow from Investing Activities

Question 14.

Give any two examples of cash flows from operating activities.

Answer:

(i) Cash Sales

(ii) Cash Purchases

Question 15.

What is meant by ‘Financing Activities’ for preparing Cash Flow Statement? (CBSE 2019 Compt.)

Answer:

Financing activities are the activities that result in change in capital or borrowings of the enterprise.

Question 16.

What is mean by investing activities for preparing Cash Flow Statement? (CBSE 2019 Compt.)

Answer:

Investing activities (as per AS-3) are the acquisition and disposal of long term assets and other investments not included in cash equivalents.

Question 17.

State the primary objective of preparing Cash Flow Statement. (CBSE 2019 Compt.)

Answer:

The primary objective of preparing Cash Flow Statement is to provide useful information about cash inflows and outflows of an enterprise during a particular period.

Question 18.

What is meant by‘Cash Flow Statement’? (CBSE 2019 Compt.)

Answer:

Cash Flow Statement is a statement showing inflows and outflows of cash and cash equivalents during a particular period.

Question 19.

Cashier of Y Ltd. withdrew ₹ 2,00,000 from bank. Will this transaction result into inflow, outflow or no flow of cash? Give reason in support of your answer. (CBSE 2019 Compt.)

Answer:

No flow of cash as there is no change in cash and cash equivalents.

Question 20.

Interest received and paid is considered as which type of activity by a finance company while preparing the cash flow statement. (CBSE 2018)

Answer:

Operating Activity for both.

Question 21.

Under which type of activity will you classify ‘Rent received’ while preparing cash flow statement? (CBSE Sample Paper 2018-19)

Answer:

Rent received is inflow of cash from Investing Activities.

Question 22.

Give any one example of cash inflows from operating activities other than cash receipts from sale of goods and rendering of services.

Answer:

Royalties

Question 23.

P P Limited is Share Broker Company. G G Limited is engaged in manufacturing of packaged food. P P Limited purchased 5,000 equity shares of₹ 100 each of Savita Limited. G G Limited also purchased 10,000 equity shares of₹ 100 each of Savita Limited.

For the purpose of preparing their respective Cash Flow Statements, under which category of activities the purchase of shares will be classified by P P Limited and G G Limited? (CBSE Sample Paper 2017-18)

Answer:

(a) For P P Limited: Operating Activity

(b) For G G Limited: Investing Activity

Question 24.

Cash Flow Statement shows inflows and outflows of ‘Cash’ and ‘Cash Equivalents’ from various activities of an enterprise during a particular period. State one component of cash. (Compt. Delhi 2017)

Answer:

Demand deposits with bank.

Question 25.

Give an example of an activity, which is a financing activity for every type of enterprise. (Compt. Delhi 2017)

Answer:

Issue of shares.

Question 26.

Net increase in working capital other than cash and cash equivalents will increase, decrease or not change cash flow from operating activities. Give reason in support ofyour answer. [Delhi 2017]

Answer:

Decrease.

Question 27.

‘Payment and Receipt of interest and dividend’ is classified as which type of activity while preparing cash flow statement? [Delhi 2017]

Answer:

Payment of Interest and Dividend: Financing Activity Receipt of Interest and Dividend: Investing Activity

Question 28.

‘Cheques and drafts in hand’ are not considered while preparing cash flow statement. Why? [Delhi 2017]

Answer:

Cheques and Drafts in hand are not considered while preparing cash flow statements as they are part of cash and cash equivalents only.

Question 29.

State any one advantage of preparing cash flow statement. [Delhi 2017]

Answer:

It helps in short term financial planning.

Question 30.

Normally, what should be the maturity period for a short-term investment from the date of its acquisition

to be qualified as cash equivalents? (Outside Delhi 2017)

Answer:

90 days/ 3 months.

Question 31.

State whether the following will increase, decrease or have no effect on cash flow from operating activities while preparing ‘Cash Flow Statement’ :

(i) Decrease in outstanding employees benefits expenses by ₹ 3,000

(ii) Increase in prepaid insurance by ₹ 2,000. (Compt. Delhi 2017)

Answer:

(i) Decrease

(ii) Decrease

Question 32.

Will ‘acquisition of machinery by issue of equity shares’ be considered while preparing ‘Cash Flow Statement’ ?

Answer:

No.

Question 33.

The Goodwill of X Ltd. increased from ₹ 2,00,000 in 2013-14 to ₹ 3,50,000 in 2014-15. Where will you show the treatment while preparing Cash Flow Statement for the year ended 31st March 2015? (CBSE Sample Paper 2016, 2017)

Answer:

Investing Activities.

Question 34.

Does movement between items that constitute cash or cash equivalents result into cash flow?

Answer:

No flow of cash and cash equivalents.

Question 35.

‘An enterprise may hold securities and loans for dealing or trading purposes in which case they are similar to inventory acquired specifically for resale.’ Is the statement correct?

Answer:

Yes

Question 36.

‘G Ltd.’ is carrying on a paper manufacturing business. In the current year, it purchased machinery for 7 30,00,000, it paid salaries of ₹ 60,000 to its employees; it required funds for expansion and therefore, issued shares of ₹ 20,00,000. It earned a profit of₹ 9,00,000 for the current year. Find out cash flows from operating activities. (Delhi Compartment 2015)

Answer:

₹ 9,00,000 (as per indirect method and other information is not relevant)

Question 37.

Finserve Ltd. Is carrying on a mutual fund business. It invested ₹ 30,00,000 in shares and ₹ 15,00,000 in

debentures of various companies during the year. It received ₹ 3,00,000 as dividend and interest. Find out cash flows from investing activities. (CBSE Sample Paper 2015)

Answer:

Nil.

Question 38.

State with reason whether the issue of 9 % debentures to a vendor for the purchaser of machinery of ₹ 50,000 will result in inflow, outflow or no flow of cash while preparing cash flow statement. (CBSE Compartment Delhi 2014)

Answer:

No flow of cash.

Question 39.

Interest received by a finance company is classified under which kind of activity while preparing a cash flow statement. (CBSE Sample Paper 2014)

Answer:

Operating Activity.

Question 40.

While preparing cash flow statement of Sharda Ltd. Depreciation provided on fixed asset was added to the net profit to calculate cash flow from operating activities. Was the accountant correct in doing so Give reason.(CBSE Delhi 2014)

Answer:

Yes.

Question 41.

While preparing the cash flow statement of Alka Ltd. Dividend paid was shown as an operating activity by the accountant of the company. Was he correct in doing so?

Answer:

No.

Question 42.

Asia Ltd. declared payment of dividend of ₹ 50,000 on its equity shares. Mention with reason whether it is cash inflow, cash outflow or no cash flow.

Answer:

No cash flow.

Question 43.

A company has issued bonus equity shares of ₹ 2,00,000. Mention with reason whether it is cash inflow, cash outflow or no cash.

Answer:

No cash flow.

Question 44.

Mention the case in which interest received (other than interest on calls in arrears) is treated as cash inflow from operating activities.

Answer:

Cash inflow company.

Question 45.

State with reason whether deposit of cash into bank will result into inflow, outflow or no flow cash. (CBSE 2011 Delhi)

Answer:

No cash flow equivalents.

Cash Flow Statement Important Extra Questions Short Answer Type

Question 1.

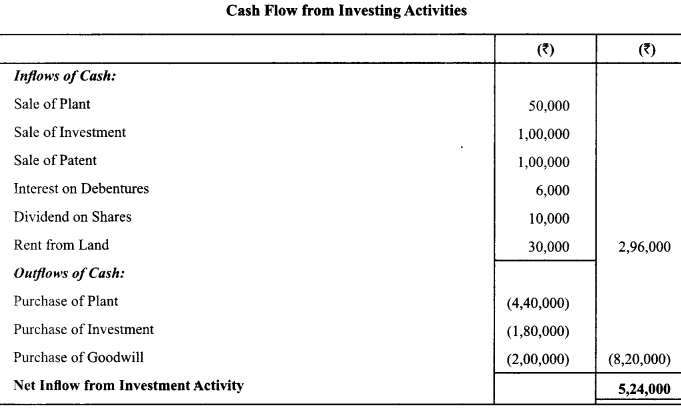

From the following particulars, calculate cash flows from investing activities:

Interest received on debentures held as investment ₹ 60,000.

Dividend received on shares held as investment ₹ 10,000.

A plot of land had been purchased for investment purposes and was let out for commercial use and rent received ₹ 30,000.

Answer:

Question 2.

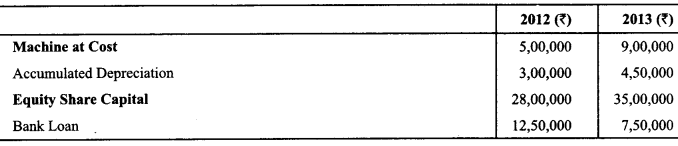

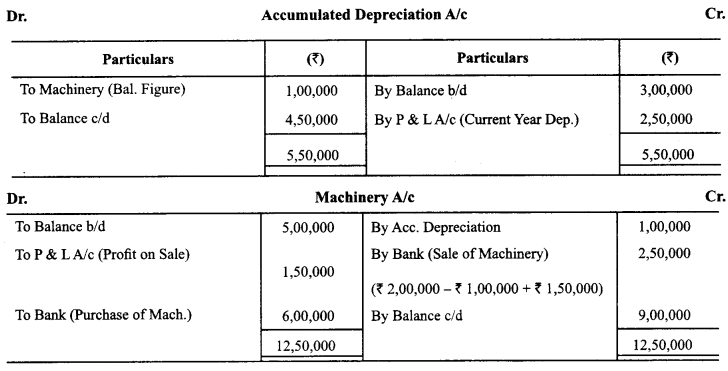

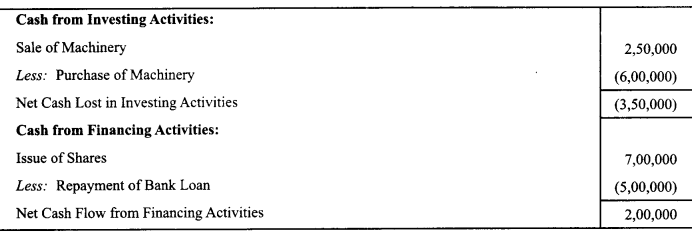

From the following information, calculate Cash Flow from Investing and Financing Activities

In year 2013, machine costing ₹ 2,00,000 was sold at a profit of₹ 1,50,000. Depreciation charged on machine during the year 2013 amounted to ₹ 2,50,000.

Answer:

Question 3.

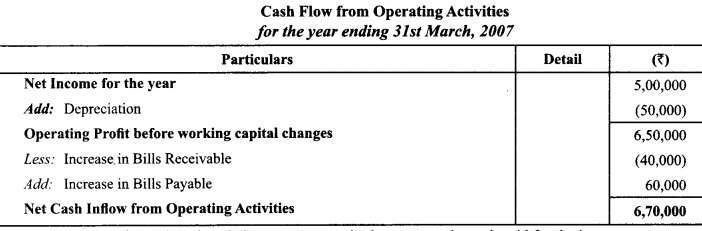

Anand Ltd. arrived at a net income of ₹ 5,00,000 for the year ended March 31,2007. Depreciation for the year was ₹ 2,00,000. There was a gain of₹ 50,000 on assets sold which was credited to profit and loss account. Bills Receivables increased during the year ₹ 40,000 and Bills Payables also increased by ₹ 60,000. Compute the cash flow from operating activities by the indirect approach.

Answer:

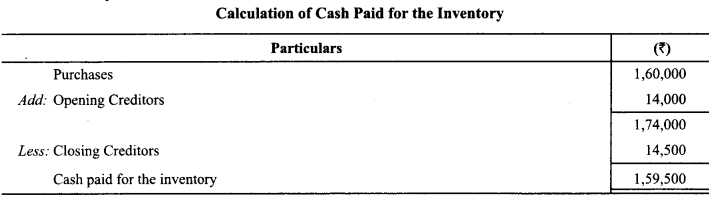

Question 4.

From the information given below you are required to prepare the cash paid for the inventory:

Answer:

Question 5.

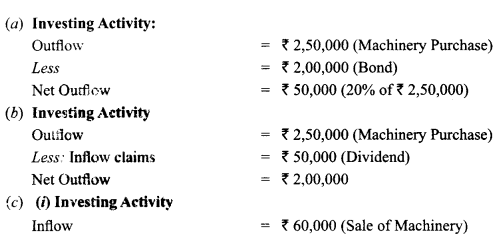

For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow viz., operating, investing and financing.

(a) Acquired machinery for ₹ 2,50,000 paying 20% drawn and executing a bond for the balance payable.

(b) Paid ₹ 2,50,000 to acquire shares in Informa Tech, and received a dividend of ₹ 50,000 after acquisition.

(c) Sold machinery of original cost ₹ 2,00,000 with an accumulated depreciation of ₹ 1,60,000 for ₹ 60,000.

Answer:

(ii) Operating Activity.

₹ 20,000 will be deducted (profit sale of machinery), while calculating cash from operating activities due to non-operating profit.

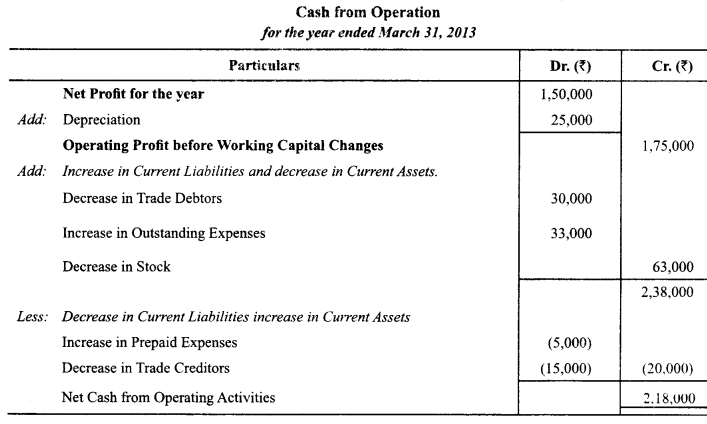

Question 6.

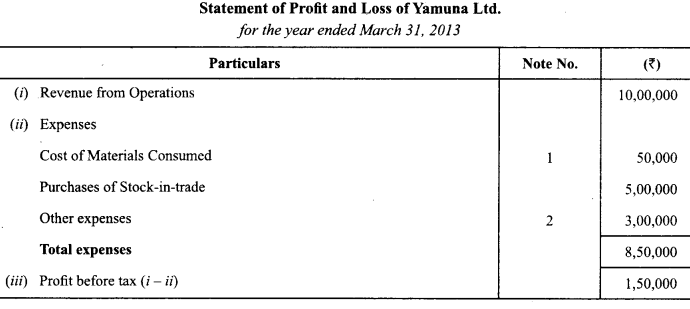

The following is the Profit and Loss Account of Yamuna Limited:

Additional Informations:

(i) Trade receivables decrease by ₹ 30,000 during the year.

(ii) Prepaid expenses increase by ₹ 5,000 during the year.

(iii) Trade payables decrease by ₹ 15,000 during the year.

(iv) Outstanding expenses payable increased by ₹ 33.000 during the year.

(v) Other expenses included depreciation off 25,000.

Compute net cash provided by operations for the year ended March 31, 2014 by the indirect method.

Answer:

Question 7.

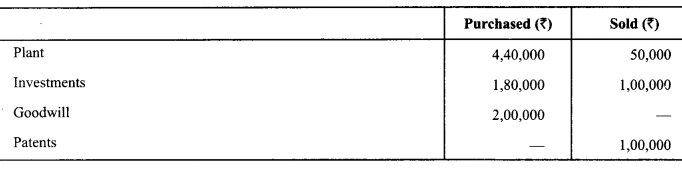

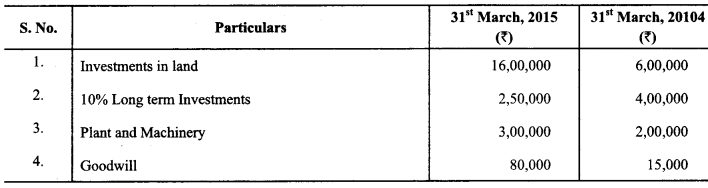

Calculate Cash Flows from Investing Activities from the following information:

Additional Information:

A machine costing ₹ 40,000 (depreciation provided thereon ₹ 12,000) was sold for X 35,000. Depreciation charged during the year was ₹ 60,000. (Compt. Delhi 2017)

Answer:

Cash Flow Statement Important Extra Questions Long Short Answer Type

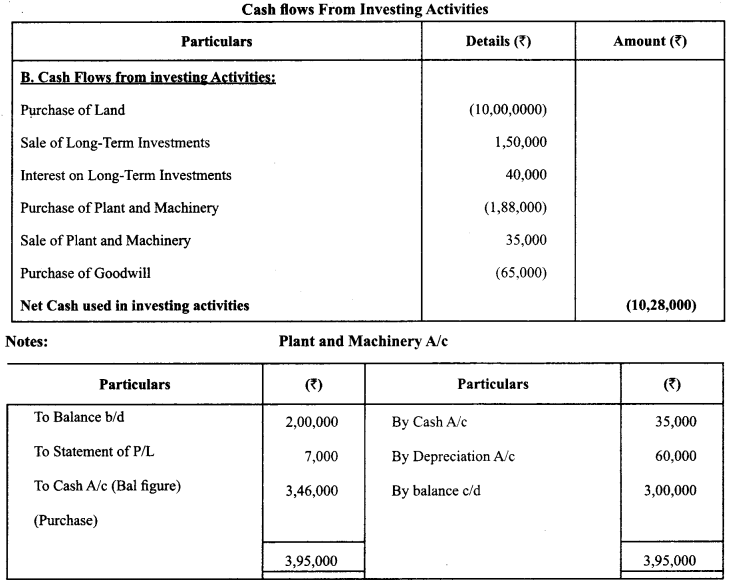

Question 1.

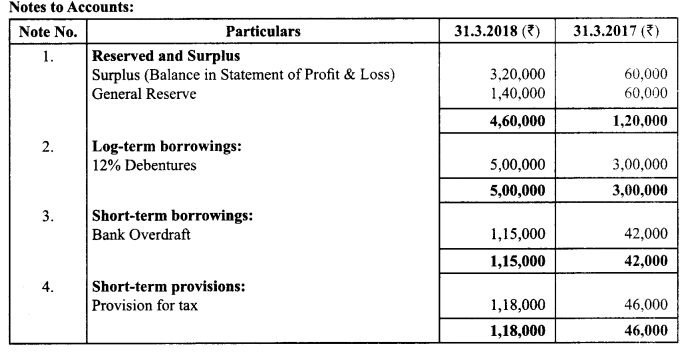

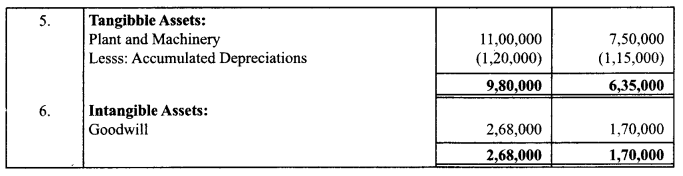

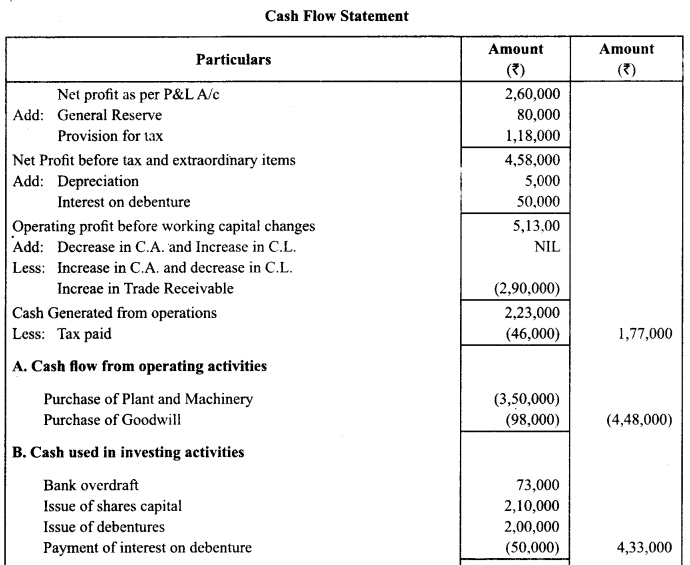

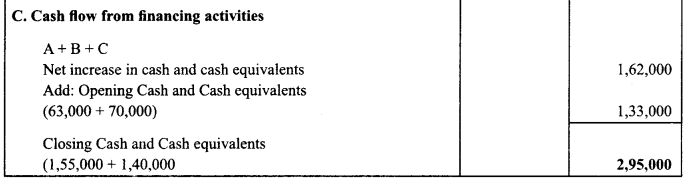

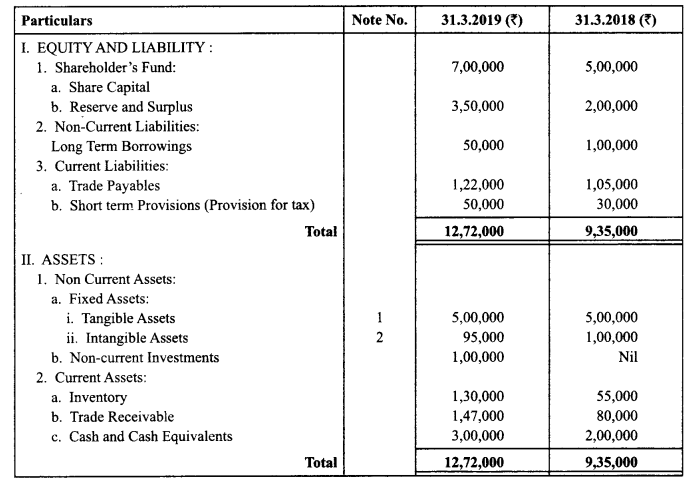

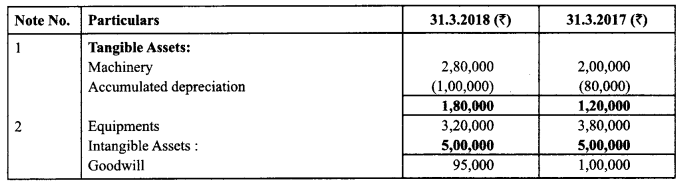

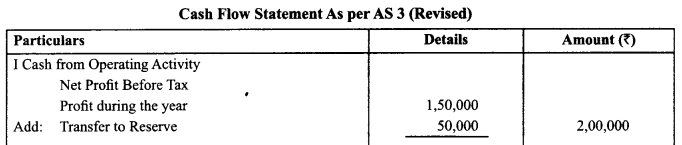

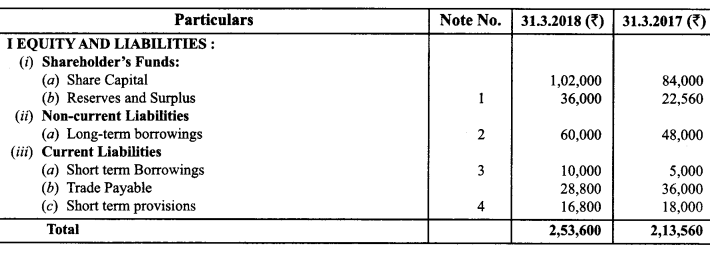

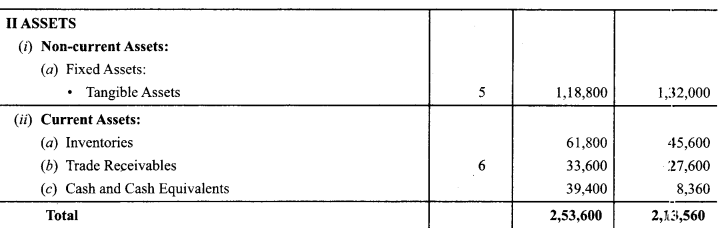

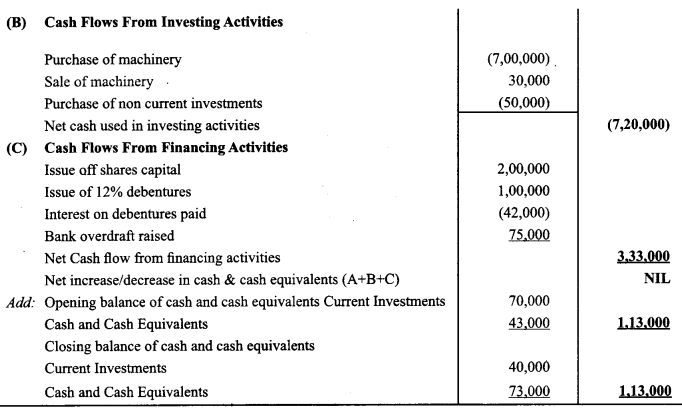

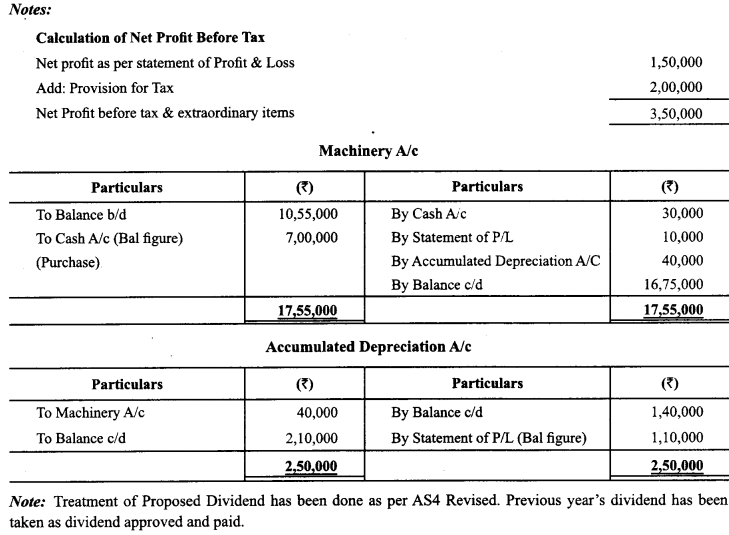

From the following Balance Sheet of Kiero Ltd. and the additional information as on 31-3-2018, prepare a Cash Flow Statement: (CBSE Delhi 2019)

Additional Information:

12% debentures were issued on 1st September, 2017.

Question 2.

From the following Balance Sheet of Dreams Converge Ltd as at 31.3.2018 and 31.3.2017; Calculate Cash from operating activities. Showing your workings clearly. (CBSE SP 2019-20)

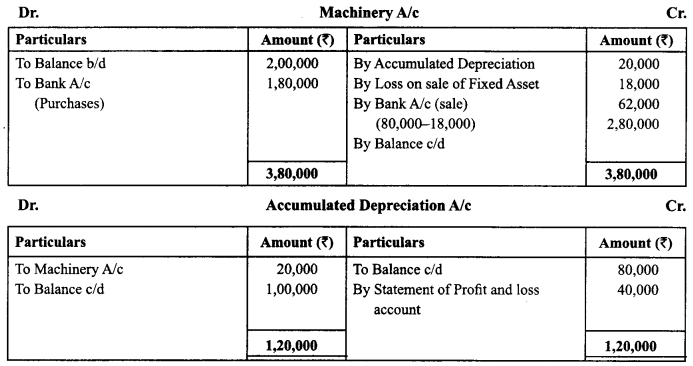

Additional Information:

L Machinery of the book value of 80,000 (accumulated depreciation ₹ 20,000) was sold at a loss of ₹ 18,000.

Question 3.

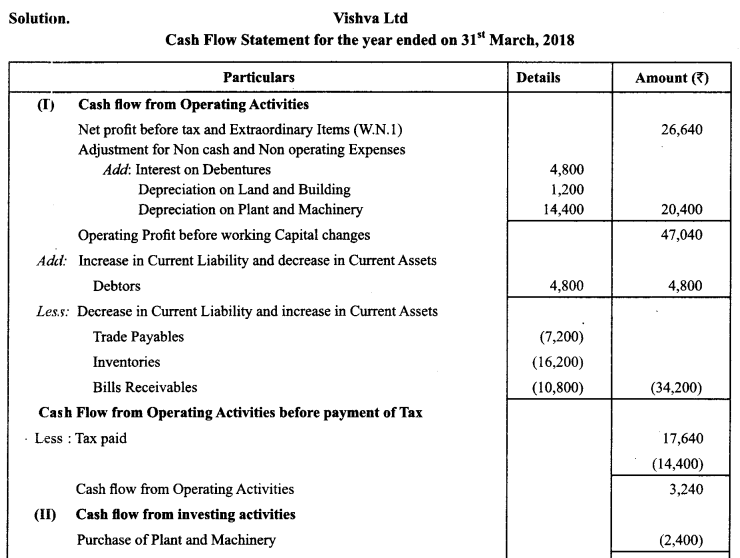

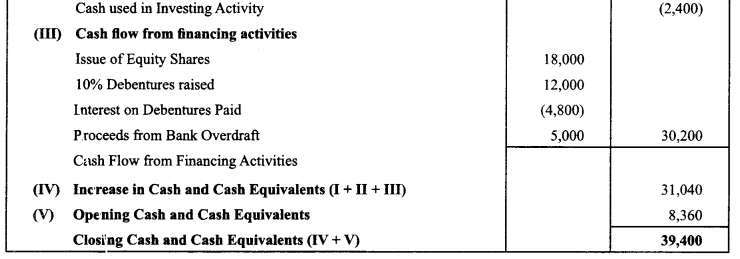

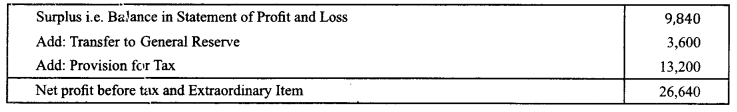

From the following Balance Sheets of Vishva Ltd., prepare Cash Flow Statement as per AS – 3 (revised) for the year ending 31st March, 2018

Additional Information:

(a) Tax paid during the year 2017-18 ₹ 4,400

(b) Depreciation on plant charged during the year 2017-18 was ₹ 14,400

(c) Additional debentures were issued on March 31,2018 (CBSE Sample Paper 2018-19)

Answer:

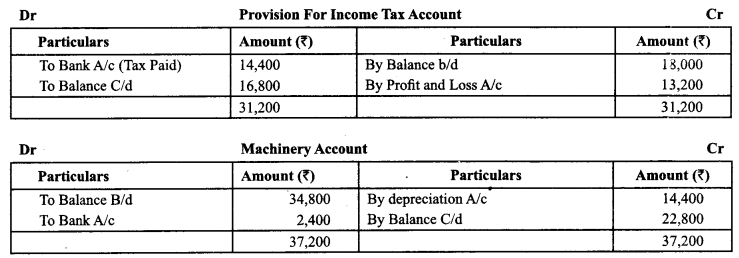

Working Notes:

Calculation of Net Profit before Tax and Extraordinary items

Question 4.

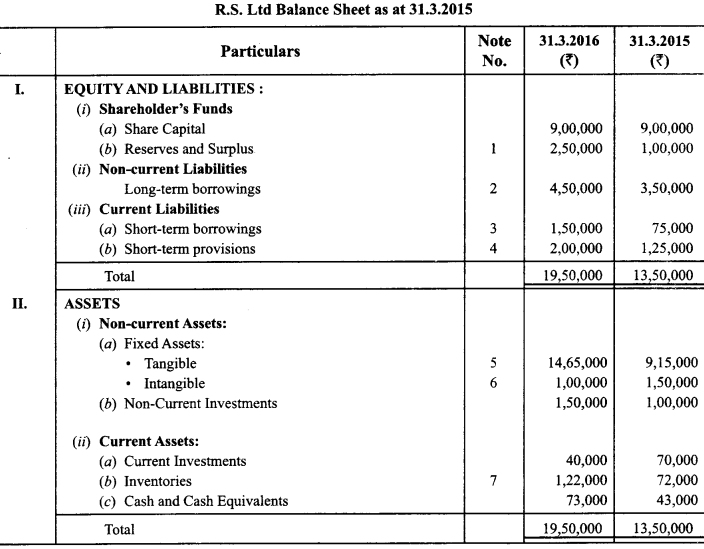

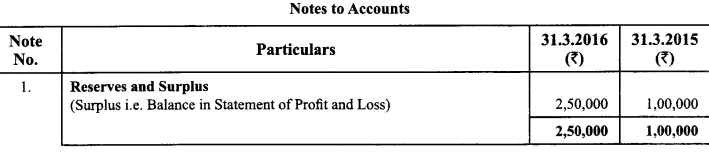

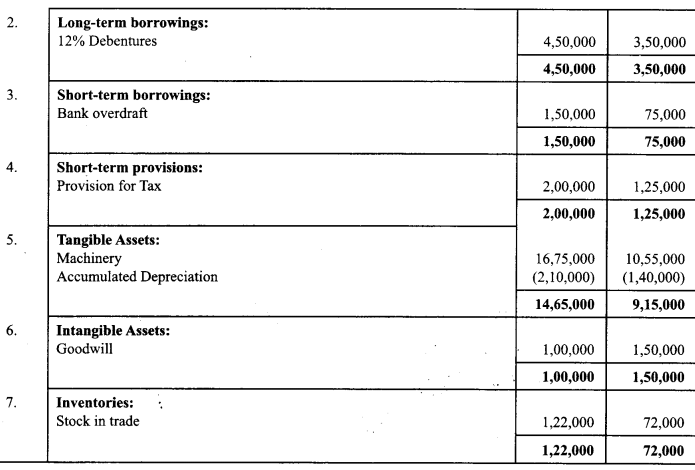

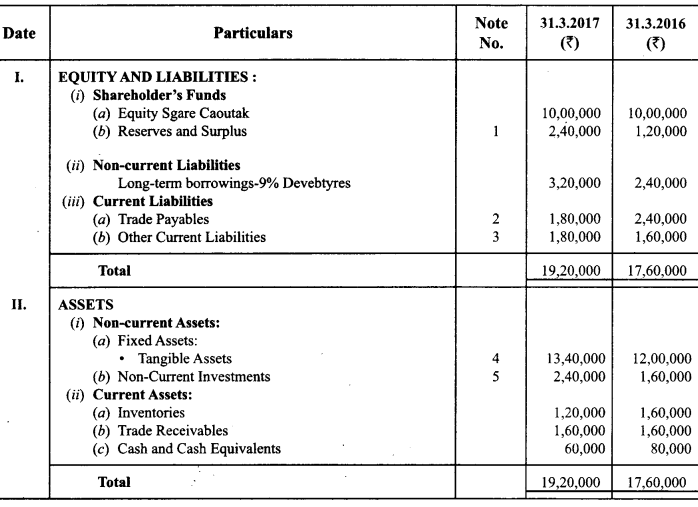

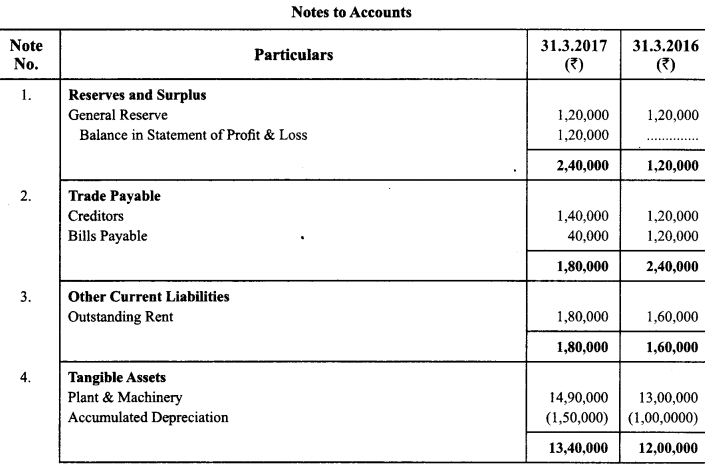

Following is the Balance Sheet of R.S. Ltd as at 31st March. 2016:

Additonal Information:

(i) ₹ 1,00,000,12% Debenures were issued on 31.3.2016.

(ii) During the year a piece of machinery costing ₹ 80,000, on which accumulated depreciation was ₹40,000, was sold at a loss of ₹ 10,000.

Prepare a Cash Flow Statement. (Delhi 2017, Modified)

Answer:

Question 5.

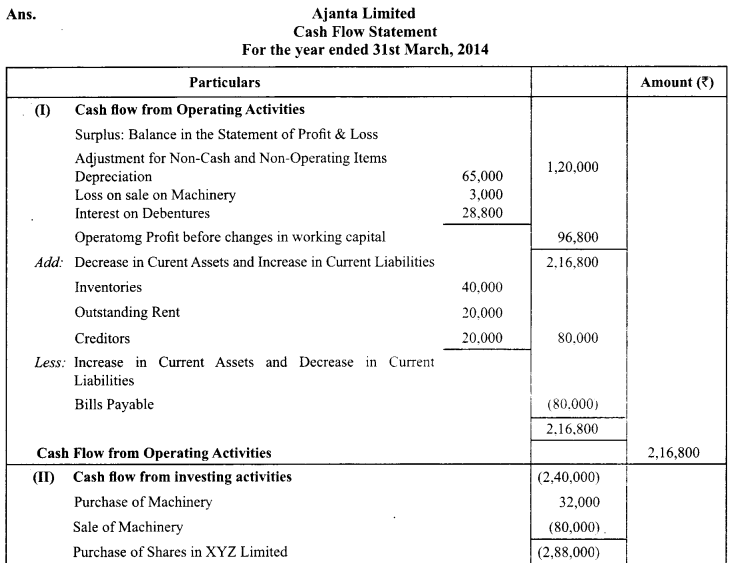

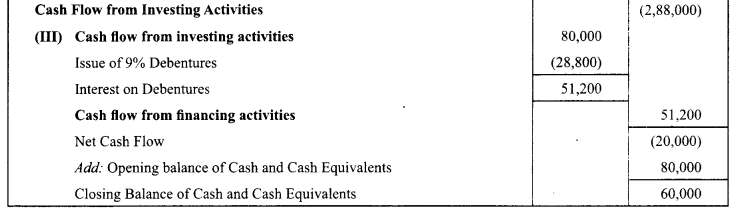

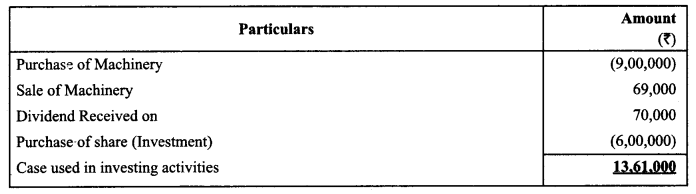

From the following Balance Sheet of Ajanta Limited as on March 31,2017, prepare a Cash Flow Statement:

Additional Information:

(a) During the year 2016-17, a machinery costing ₹ 50,000 and accumulated depreciation thereon ₹ 15,000 was sold for ₹ 32,000.

(b) 9 % Debentures ₹ 80,000 were issued on April 1, 2016. (CBSE Sample Paper 2017-18)

Answer: