Here we are providing Class 12 Accountancy Important Extra Questions and Answers Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Class 12 Accountancy Chapter 3 Important Extra Questions Reconstitution of Partnership Firm: Admission of a Partner

Reconstitution of Partnership Firm: Admission of a Partner Important Extra Questions Very Short Answer Type

Question 1.

What is meant by Issued Capital ? (CBSE Delhi 2019)

Answer:

Issued capital means such capital as the company issues from time to time for subscription-section 2(50) of the companies Act 2013.

Question 2.

What is meant by ‘ Employees Stock Option Plan? (CBSE Delhi 2019)

Answer:

FSOP means an option granted by the company to its employees & employee directors to subscribe the share at a price that lower than the market price i.e., fair value. It is an option granted by the company but it is not an obligation on the employee to subscribe it.

Question 3.

A and B were partners in a firm sharing profits in the ratio of 3 : 2. C and D were admitted as new partners.

A sacrificed ith of his share in favour of C and B sacrificed 50% of his share in favour of D. Calculate the 4 new profit sharing ratio of A, B, C and D.(CBSE Outside Delhi 2019)

Answer:

Old ratio = 3:2

A’s Sacrifice (in favour of C) = 1/4 x 3/5 = 3/20

B’s Sacrifice (in favour of D) = 1/2 x 2/5 = 2/10

A’s New Share = 3/5 – 3/20 = 9/20

B’s New Share = 2/5 – 2/10 = 2/10

Question 4.

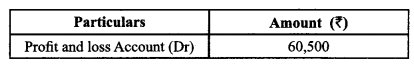

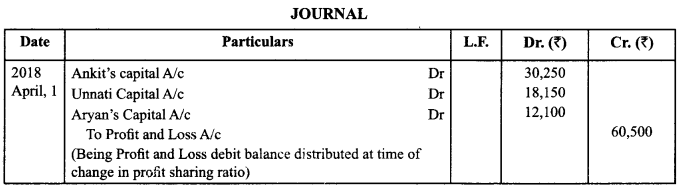

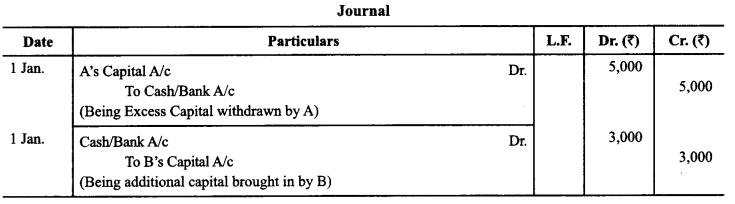

Ankit, Unnati and Aryan are partners sharing profits in the ratio of 5:3:2. They decided to share future profits in the ratio of 2:3:5 with effect from 1st April, 2018. They had the following balance in their balance sheet, passing necessary Journal Entry:

Answer:

Question 5.

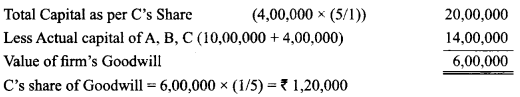

A and B are partners in a firm. They admit C as a partner with l/5th share in the profits of the firm. C brings ₹ 4,00,000 as his share of capital. Calculate the value of C’s share of Goodwill on the basis of his capital, given that the combined capital of A and B after all adjustments is ₹ 10,00,000. (CBSE Sample Paper 2019-20)

Answer:

Question 6.

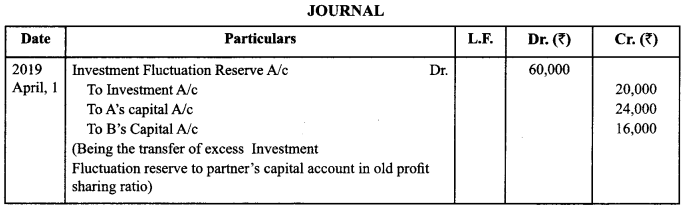

A and B are partners in a firm sharing profits and losses in the ratio of 3:2.On 1st April, 2019 they decided to admit C their new ratio is decided to be equal. Pass the necessary journal entry to distribute Investment Fluctuation Reserve of ₹ 60,000 at the time of C’s admission, when Investment appear in the books at ₹ 2,10,000 and its market value is ₹1,90,000.

Answer:

Question 7.

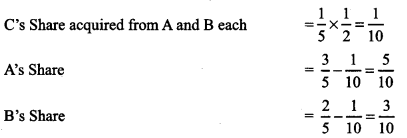

A and B are in partnership sharing profits and losses in the ratio of 3:2. They admit C into partnership with 1/5th share which he acquires equally from A and B. Accountant has calculated new profit sharing ratio as 5:3:2. Is accountant correct:

Answer:

New Profit Sharing ratio of A: B: C ¡s 5:3: 2

Yes, new profit sharing ratio is 5:3:2

Question 8.

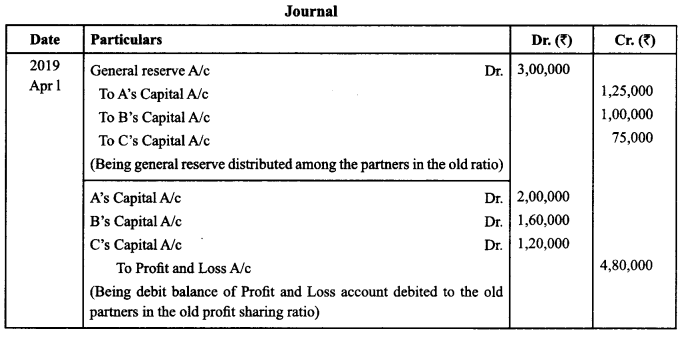

A, B and C were partners sharing profits in the ratio of 5 : 4 : 3. They decided to change their profit sharing ratio to 2:2:1 w.e.f. 1st April, 2019. On that date, there was a balance of ₹ 3,00,000 in General Reserve and a debit balance of ₹ 4,80,000 in the Profit and Loss Account.

Pass necessary journal entries for the above on account of change in the profit sharing ratio.

Answer:

Question 9.

At the time of admission of a partner, who decides the share of profit of the new partner out of the firm’s profit? (CBSE Compartment 2019)

Answer:

It is decided mutually among the old partners and the new partner.

Question 10.

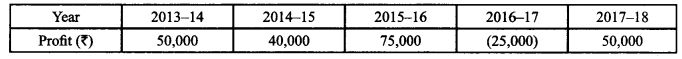

Hari and Krishan were partners sharing profits and losses in the ratio of 2 : 1. They admitted Shyam as a partner for 1/5th share in the profit. For this purpose the Goodwill of the firm was to be value on the basis of three years’s purchase of last five years average profits. The profits for the last five years were:

Calculate Goodwill of the firm after adjusting the following:

The profit of 2014-15 was calculated after charging ₹ 10,000 for abnormal loss of goods by fire.

Answer:

Question 11.

Amit and Beena were partners in a firm sharing profits and losses in the ratio of 3 : 1. Chaman was admitted as a new partner for 1/6th share in the profits. Chaman acquired 2/5th of his share from Amit. How much share did Chaman acquired from Beena? (CBSE 2018-19)

Answer:

Chaman acquired 1/6 – (1/6 x 2/5) = 3/30 from Beena.

Question 12.

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed equal amount and purchased a building for ₹2 crore. After 10 years they sold it for ₹3 crore and shared the profit equally. Are they doing the business in partnership.

Answer:

No.

Question 13.

Pawan and Jayshree are partners. Bindu is admitted for l/4th share. State the ratio in which Pawan and Jayshree will sacrifice their share in favour of Bindu? (CBSE Sample Paper 2014)

Answer:

Old ratio i.e. 1 : 1

Question 14.

X and Y are partners. Y wants to admit his son K into business. Can K become the partner of the firm?

Answer:

Yes, if X agrees to it otherwise not.

Question 15.

Name any one factor responsible which affect the value of goodwill.

Answer:

Location of a business.

Question 16.

Vishal & Co. is involved in developing computer software which is a high value added product and Tiny & Co. is involved in manufacturing sugar which is a low value item. If capital employed of both the firms is same, value of goodwill of which firm will be higher?

Answer:

Vishal & Co.

Question 17.

State a reason for the preparation of ‘Revaluation Account’ at time of admission of a partner.

Answer:

To record the effect of revaluation of assets and liabilities.

Question 18.

In which ratio is the profit or loss due to revaluation of assets and liabilities transferred to capital accounts?

Answer:

Old Ratio of existing partners.

Question 19.

Change in Profit Sharing Ratio amounts to dissolution of partnership or partnership firm?

Answer:

Dissolution of partnership.

Question 20.

State one occasion on which a firm can be reconstituted. (CBSE 2012, Delhi)

Answer:

Change of profit sharing ratio among the existing partners.

Question 21.

What is the formula of calculating sacrificing ratio? (CBSE 2011, Outside Delhi)

Answer:

Sacrificing Ratio = Old Ratio-New Ratio.

Question 22.

By which name the profit sharing ratio in which all partners, including the new partner, will share fixture profits?

Answer:

New profit sharing ratio.

Question 23.

If the new partner acquires his share in profits from all the old partners in their old profit sharing ratio, by which ratio will the old partners sacrifice their profit sharing ratio?

Answer:

Old profit sharing ratio.

Question 24.

Name the accounting standard, issued by the Institute of Chartered Accountants of India, which deals with treatment good will.

Answer:

AS 26.

Question 25.

When the new partner brings amount of premium for goodwill, by which ratio is this amount credited to old partners’ Capital Accounts?

Answer:

Sacrificing ratio.

Question 26.

What is the formula for calculating inferred goodwill?

Answer:

Net worth of business on the basis of new partner’s capital minus net worth of business in new firm.

Reconstitution of Partnership Firm: Admission of a Partner Important Extra Questions Short Answer Type

Question 1.

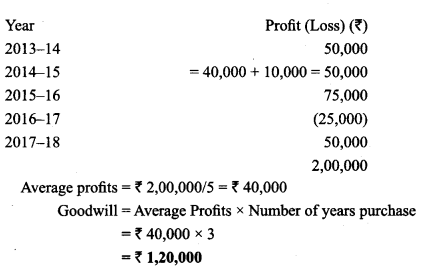

Atul and Neera were partners in a firm sharing profits in the ratio of 3 : 2. They admitted Mitali as a new partner. Goodwill of the firm was valued at ₹ 2,00,000. Mitali brings her share of goodwill premium of ₹ 20,000 in cash, which is entirely credited to Atul’s Capital Accoum. Calculate the new profit sharing ratio.

Answer:

Question 2.

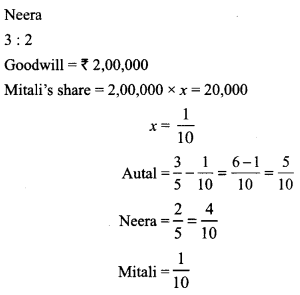

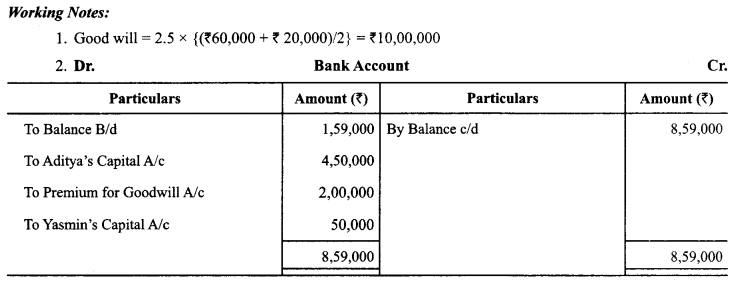

The capital of the firm of Anuj and Benu is ₹ 10,00,000 and the market rate of interest is 15%. Annual salary to the partners is ₹ 60,000 each. The profit for the last three years were ₹ 3,00,000,13,60,000 and ₹ 4,20,000. Goodwill of the firm is to be valued on the basis of two years purchase of last three years average super profits. Calculate the goodwill of the firm.

Answer:

Question 3.

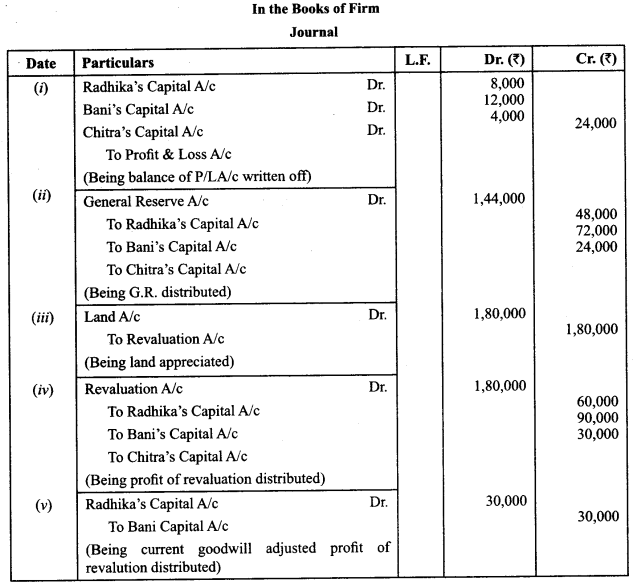

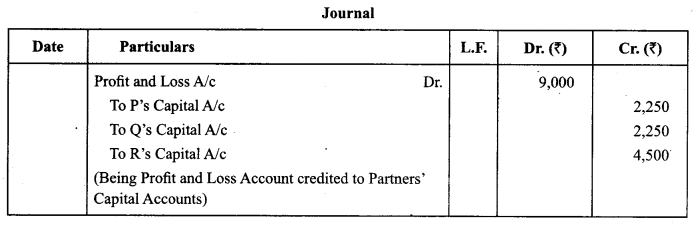

Radhika, Bani and Chitra were partners in a firm sharing profits and losses in the ratio of 2:3 :1. With effect from 1 st April, 2018 they decided to share future profits and losses in the ratio of 3 : 2 : 1. On that date their Balance Sheet showed a debit balance of ₹ 24,000 in Profit and Loss Account and a balance of ₹ 1,44,000 in General Reserve. It was also agreed that:

(a) The goodwill of the firm be valued at ₹ 1,80,000.

(b) The Land (having book value of ₹ 3,00,000) will be valued at ₹ 4,80,000.

Pass the necessary journal entries for the above changes.

Answer:

Question 4.

A firm earned average profit of ₹3,00,000 during the last few years. The normal rate of return of the industry is 15%. The assets of the business were ₹ 17,00,000 and its liabilities were ₹2,00,000. Calculate the goodwill of the firm by capitalisation of average profits. (CBSE Delhi 2019)

Answer:

Actual profits = ₹3,00,000

Net Tangible Assets = Assets – Liabilities

= ₹ 17,00,000 -₹ 2, oo, ooo

= ₹ 15,00,000

Capitalised value of the firm = (Average Profits x 100)/Normal rate of return

= (₹3,00,000 x 100)/15

= ₹20,00,000

Goodwill = Capitalised value of the firm – Net Tangible Assets

= ₹20,00,000-₹15,00,000

= ₹5,00,000

Question 5.

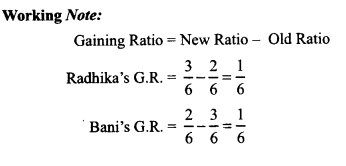

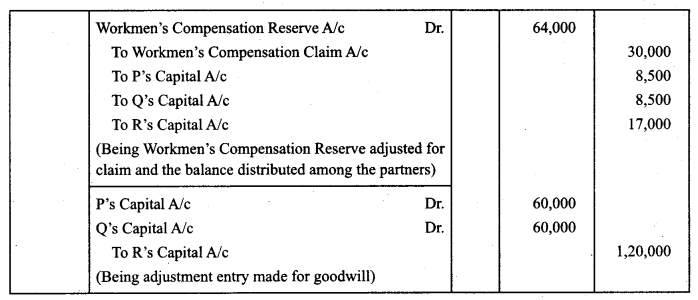

P, Q and R were partners in a firm sharing profits in the ratio of 1 : 1 : 2. On 31st March, 2018, their balance sheet showed a credit balance of ₹9,000 in the profit and loss account and a Workmen Compensation Fund of ₹64,000. From 1st April, 2018 they decided to share profits in the ratio of 2:2: 1. For this purpose it was agreed that:

(a) Goodwill of the firm was valued at ₹4,00,000.

(b) A claim on account of workmen compensation of ₹30,000 was admitted.

Pass necessary journal entries on reconstitution of the firm. (CBSE Delhi 2019)

Answer:

Question 6.

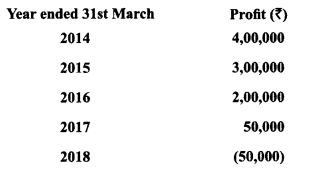

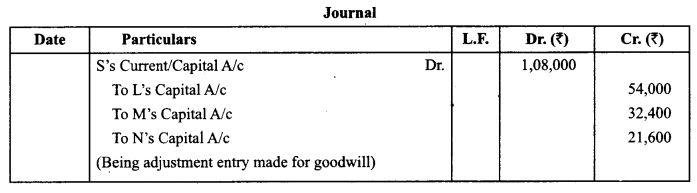

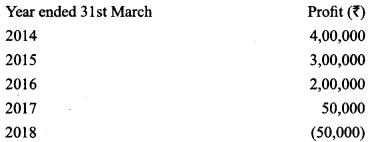

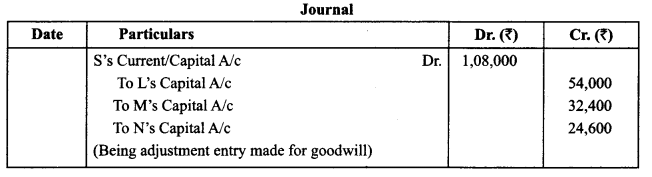

L, M and N were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 1st April, 2018 they admitted S as a new partner in the firm for 1/5th share in the profits. On. S’ admission the goodwill of the firm was valued at 3 years purchase of last five years average profits. The profits during the last five years were:

Calculate the value of the goodwill of the firm. Pass necessary journal entry for the treatment of goodwill on S’s admission.

Answer:

Average profits = ₹ 1 ,80,000

Goodwill = Average profits x Number of years purchase

= 1,80,000 x 3

= ₹ 5,40,000

S’s share of Goodwill = 5,40,000/5

= 1,08,000

Question 7.

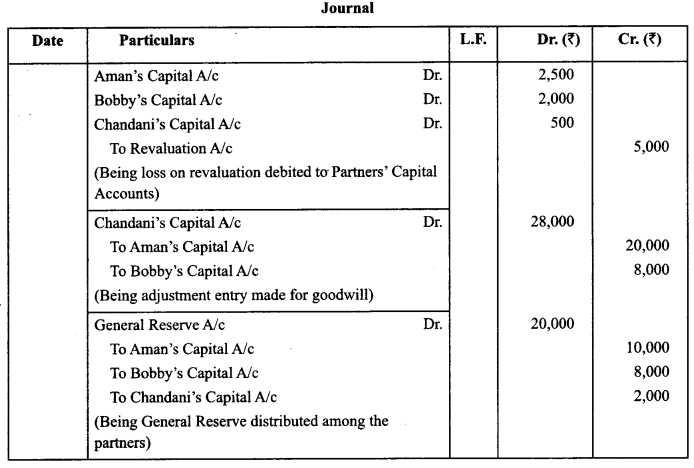

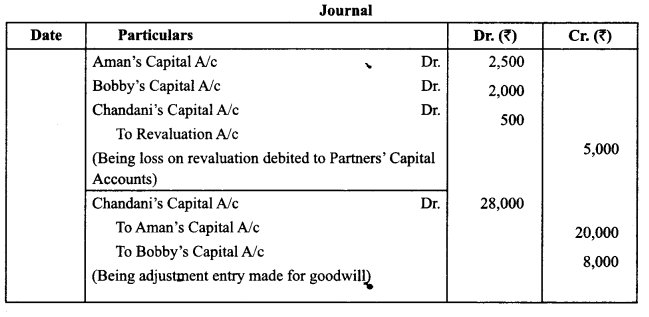

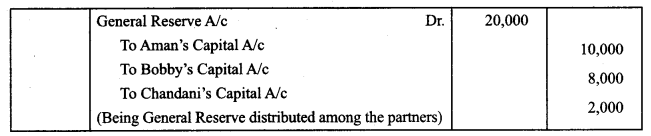

A man, Bobby and Chandani were partners in a firm sharing profits and losses in the ratio of 5 : 4 : 1. From 1st April, 2018 they decided to share profits equally. The revaluation of assets and re-assessment of liabilities resulted in a loss of ₹5,000. The goodwill of the firm on its reconstitution was valued at ₹ 1,20,000. The firm had a balance of ₹ 20,000 in General Reserve. (CBSE Delhi 2019)

Answer:

Showing your workings clearly pass necessary journal entries on the reconstition of the firm.

Question 8.

A firm earned average profit of₹ 3,00,000 during the last few years. The normal rate of return of the industry is 15%. The assets of the business were ₹ 17,00,000 and its liabilities were ₹ 2,00,000. Calculate the goodwill of the firm by capitalisation of average profits. (CBSE Outside Delhi 2019)

Answer:

Actual profits = ₹3,00,000

Net Tangible Assets = Assets – Liabilities

= ₹ 17,00,000 – ₹2,00,000

= ₹ 15,00,000

Capitalised value of the firm = (Average Profits x 100)/ Normal rate of return

= (₹3,00,000 x 100)/15

= ₹20,00,000

Goodwill = Capitalised value of the firm – Net Tangible Assets = ₹20,00,000 – ₹ 15,00,000

= ₹5,00,000

Question 9.

L, M andN were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 1st April, 2018 they admitted S as a new partner in the firm for 1/5th share in the profits. On. S’ admission the goodwill of the firm was valued at 3 years purchase of last five years average profits. The profits during the last five years were :

Calculate the value of the goodwill of the firm. Pass necessary journal entry for the treatment of goodwill on S’s admission. (CBSE Outside Delhi 2019)

Answer:

Average profits = ₹ 1,80,000

Goodwill = Average profits x Number of years purchase

= 1,80,000 x 3

= ₹ 5,40, 000

S’s share of Goodwill = 5,40,000/5 = ₹ 1,08,000

Question 10.

A man, Bobby and Chandani were partners in a firm sharing profits and losses in the ratio of 5 : 4 : 1. From 1 st April, 2018 they decided to share profits equally. The revaluation of assets and re-assessment of liabilities resulted in a loss of ₹5,000. The goodwill of the firm on its reconstitution was valued at ₹1,20,000. The firm had a balance of ₹20,000 in General Reserve.

Showing your workings clearly pass necessary journal entries on the reconstitution of the firm. (CBSE Outside Delhi 2019)

Answer:

Question 11.

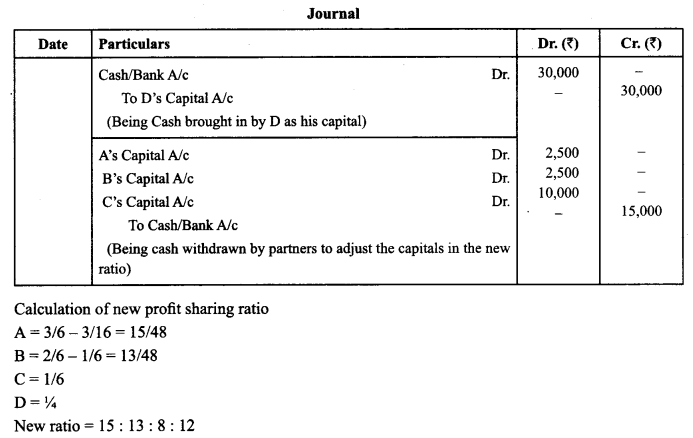

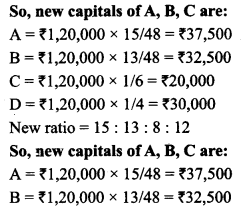

A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. D was admitted into the firm with 1/4th share in profit, which he got 3/16th from A and 1/16th from B. The total capital of the firm as agreed upon was ₹ 1,20,000 and D brought in cash equivalent to 1/4th of this amount as his capital. The capital of other partners also had to be adjusted in the ratio of their respective share in profits by bringing in or paying cash. The capitals of A, B and C after all adjustments related to revaluation of assets and reassessment of liabilities were ₹ 40,000; ₹ 35,000 and ₹ 30,000 respectively.

Calculate the new capitals of A, B and C and record the necessary journal entries for the above transactions.

Answer:

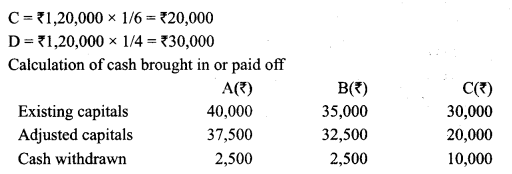

Question 12.

P, Q and R were partners in a firm sharing profits and losses equally. S was admitted as a new partner for 1/4th share in the profits. The total capital of the new firm as agreed between P, Q, R and S was ₹ 2,00,000 and S brought in cash equivalent to 1/4th of this amount as his capital. The capitals of P, Q and R were also to be adjusted in their profit sharing ratio by bringing in or paying off cash as the case may be. The capitals of P, Q and R after doing adjustments related to revolution of assets and reassessment of liabilities were ₹ 40,000; ₹ 50,000 and ₹ 60,000 respectively.

Calculate the new capital of P, Q and R pass necessary journal entries for the above transactions in the books of the firm.

Answer:

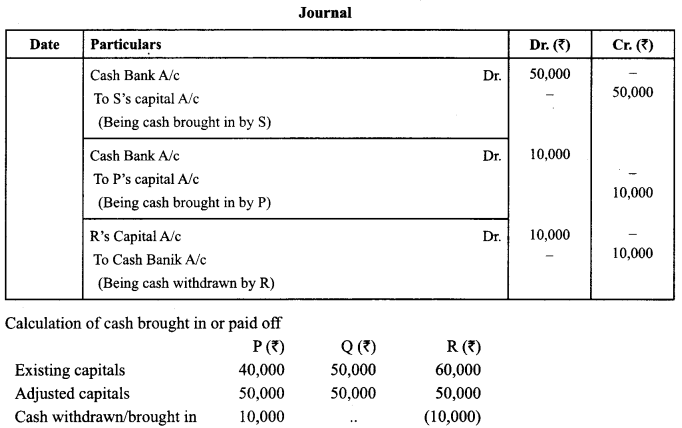

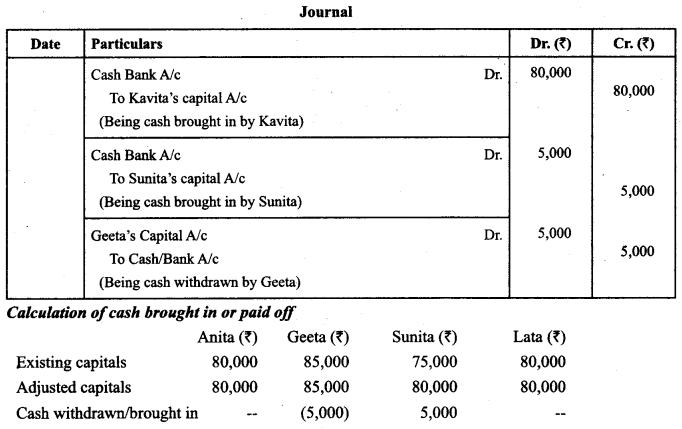

Question 13.

Anita, Geeta, Sunita and Lata were partners in a firm. They admitted Kavita as a new partner for 1/5th share in the profits. Kavita acquired her share equally from Anita, Geeta, Sunita and Lata. The total capital of the new firm was agreed at ₹ 4,00,000. Kavita brought cash equal to 1/5th of the total capital as her capital and the capital of Anita, Geeta, Sunita and Lata were to be adjusted according to the new profit sharing ratio. For this necessary cash was to be brought by or paid to Anita, Geeta, Sunita and Lata as the case may be. After doing necessary adjustments related to revaluation of assets and reassessment of liabilities the balances in the capital accounts of Anita, Geeta, Sunita and Lata were Anita ₹ 80,000; Geeta ₹ 85,000; Sunita ₹ 75,000 and Lata ₹ 80,000.

Calculate the new capitals of Anita, Geeta, Sunita and Lata and pass necessary journal entries for the above transactions in the books of the firm.

Answer:

Question 14.

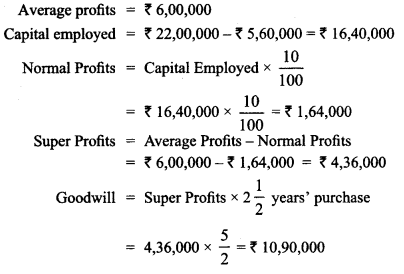

A business earned average profits of ₹ 6,00,000 during the last few years. The normal rate of profits in the similar type of business is 10%. The total value of assets and liabilities of the business were ₹ 22,00,000 and ₹ 5,60,000 respectively. Calculate the value of goodwill of the firm by super profit method if the good will is

valued at 2 1/2 years’ purchase of super profits. (CBSE Outside Delhi 2014)

Answer:

Question 15.

Geeta, Sunita and Anita were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1.1.2015 they admitted Yogita as a new partner for 1/10 th share in the profits. On Yogita’s admission, the Profit and Loss Account of the firm was showing a debit balance of ₹ 20,000 which was credited by the accountant of the firm to the capital accounts of Geeta, Sunita and Anita in their profit sharing ratio. Did the accountant give correct treatment₹ Give reason in support of your answer. (CBSE Outside Delhi 2015)

Answer:

No, the accountant didn’t give correct treatment as capital account of the partners are to be debited.

Question 16.

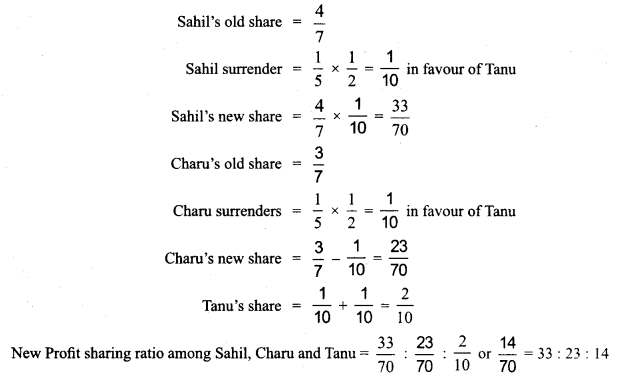

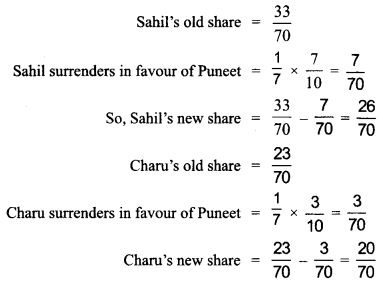

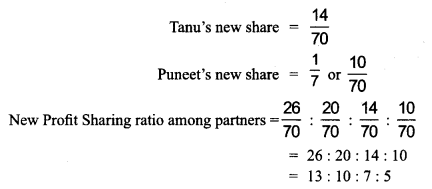

On 1-4-2010 Sahil and Charu entered into partnership for sharing profits in the ratio of 4 : 3. They admitted Tanu as a new partner on 1-4-2012 for 1/5 th share which she acquired equally from Sahil and Charu. Sahil,

Charu and Tanu earned profits at a higher rate than normal rate of return for the year ended 31-3-2013. Therefore, they decided to expand their business. To meet the requirements of additional capital they admitted Puneet as a new partner on 1-4-2013 for 1/7 th share in profits which he acquired from Sahil and Charu in 7 : 3 ratio.

Calculate:

(i) New profit sharing ratio of Sahil, Cham and Tanu for the year 2012-13.

(ii) New profit sharing ratio of Sahil, Cham, Tanu and Puneet on Puneet’s admission. (CBSE Delhi 2015)

Answer:

Question 17.

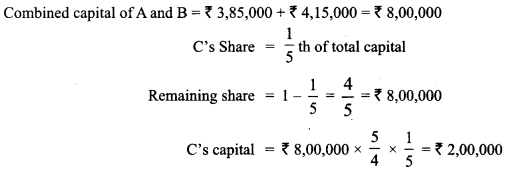

A and B were partners in a firm. They admitted C as anewpartnerfor20% share in theprofits. Afterall adjustments regarding general reserve, goodwill, gain or loss on revaluation, the balances in capital accounts of A and B were ₹ 3,85,000 and ₹ 4,15,000 respectively. C brought proportionate capital so as to give him 20% share in the profits. Calculate the amount of capital to be brought by C. (CBSE Sample paper 2016)

Answer:

Question 18.

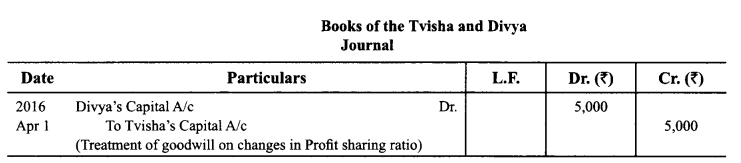

Tvisha and Divya were partners in a firm carrying on a tiffin service in Hyderabad. Divya noticed that a lot of food is left at the end of the day. To avoid wastage, she suggested that the same may be distributed among the needy. Tvisha wanted it to be mixed with the food to be served the next day.

Tvisha then gave a proposal that if her share in the profit is increased, she will not mind free distribution of left over food. Divya happily agreed. So, they decided to change their profit sharing ratio to 3 : 2 with immediate effect. On the date of change in the profit-sharing ratio, the goodwill of the firm was valued at ₹ 50,000. Pass the necessary adjustment entry for the treatment of goodwill. (Compt. Delhi 2017)

Answer:

Question 19.

A, B and C are the partners sharing profits and losses in the ratio of 5:3:2. C retired and his capital balance after adjustments regarding Reserves, Accumulated profits/losses and gain/loss on revaluation was 2,50,000. C was paid 3,00,000 in full settlement. Afterwards D was admitted for 1/4xshare. Calculate the amount of goodwill premium brought by D. (CBSE Sample Paper 2016-17)

Answer:

Goodwill share of C = 3,00,000 – 2,50,000 = 50,000 Firm’s Goodwill = 50,000 x 10/2 = 2,50,000 D’s share in Goodwill = 2,50,000 x 1/4 = 62,500

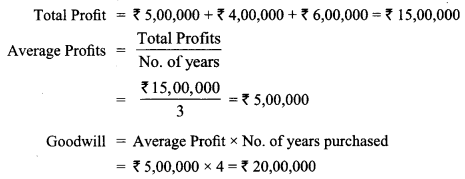

Question 20.

A firm’s profits for the last three years are ₹ 5,00,000, ₹ 4,00,000 and ₹ 6,00,000. Calculate value of firm’s goodwill on the basis of four years purchase of the average profits for the last three years.

Answer:

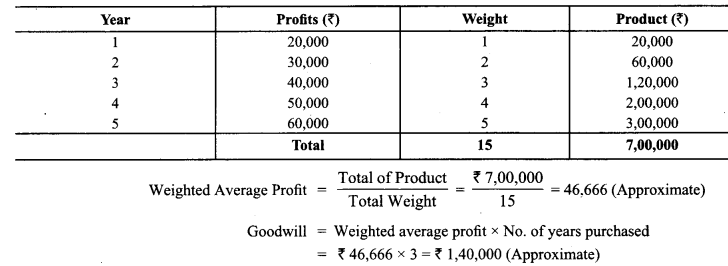

Question 21.

A firm’s profits for the last five years were ₹ 20,000, ₹ 30,000, ₹ 40,000, ₹ 50,000 and ₹ 60,000. Calculate the value of firm’s goodwill on the basis of three years’ purchase of weighted average profits after using weight of 1,2,3,4 and 5 respectively

Answer:

Question 22.

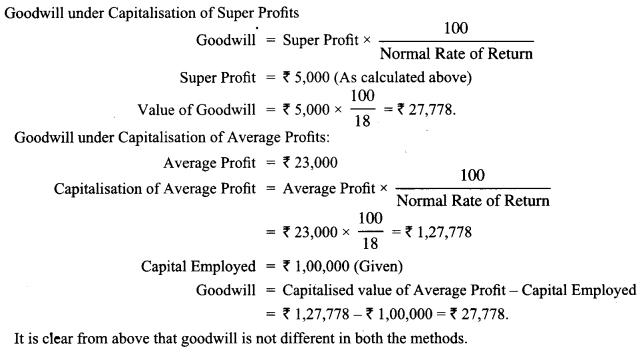

Based on the data given in the above question, calculate goodwill by capitalisation of super profits method. Will the amount of goodwill be different if it is computed by capitalisation of average profits₹ Confirm your answer by numerical verification.

Answer:

Question 23.

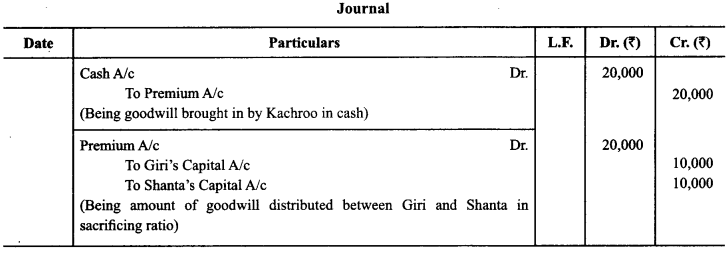

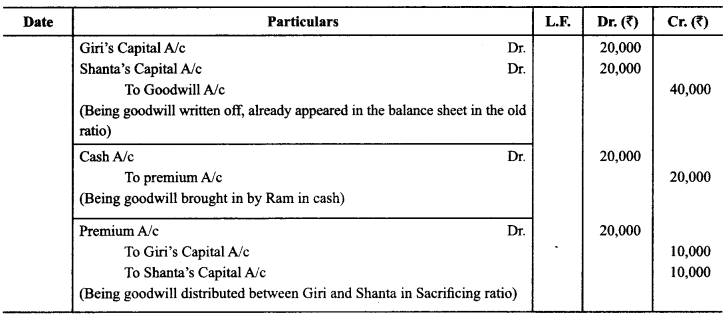

Giri and Shanta are partners in a firm sharing profits equally. They admit Ram into partnership who, in addition to capital, brings ₹ 20,000 as goodwill for 1/5 th share of profits in the firm. What shall be journal entries if

(a) no goodwill appears in the books of the firm.

(b) goodwill appears in the books of the firm at ₹ 40,000₹

Answer:

(a) No goodwill appears In the hooks of the tirm.

(b) Goodwill appears in the books of the firm at 40,000.

Question 24.

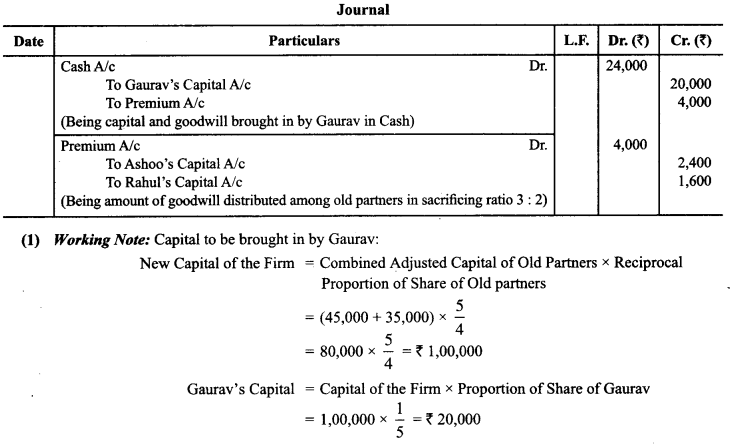

Ashoo and Rahul are partners sharing profits in the ratio of 5 : 3. Gaurav was admitted for 1/5 share and was asked to contribute proportionate capital and ₹ 4,000 for premium (goodwill). The capitals of Ashoo and Rahul, after all adjustments relating to revaluation, goodwill etc., worked out to be ₹ 45,000 and ₹ 35,000 respectively.

Calculate new profit sharing ratio, capital to be brought in by Gaurav and record necessary journal entries for the same.

Answer:

Question 25.

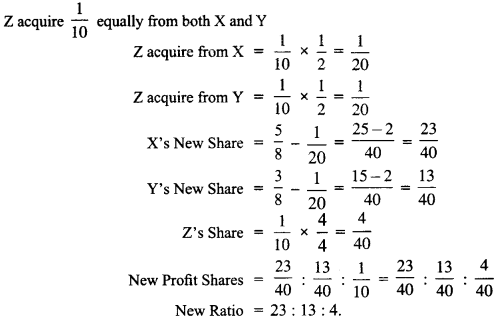

X and Y are partners sharing profits in the ratio of 5 : 3. They admitted Z for 1/10 share which he acquired equally for X and Y. Calculate new profit sharing ratio.

Answer:

Question 26.

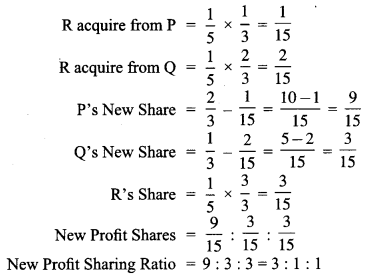

P and Q are partners sharing profits in 2 :1 ratio. They admitted R into partnership giving him 1/5 share which he acquired from P and Q in the ratio of 1 : 2. Calculate new profit sharing ratio.

Answer:

Old ratio of old partners of P and Q = 2 : 1

R acquire 1/5 from old partners (P and Q) in the ratio 1 : 2

Question 27.

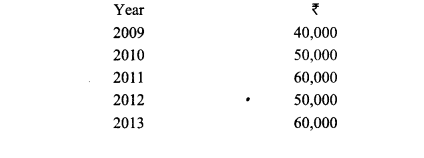

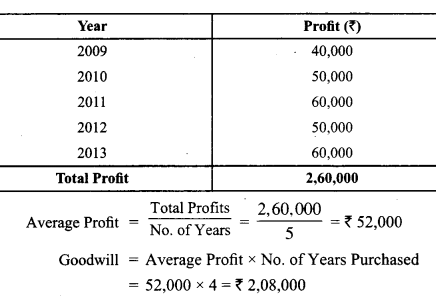

Compute the value of goodwill on the basis of four years’ purchase of the average profits based on the last five years. The profits for the last five years were as follows:

Answer:

Question 28.

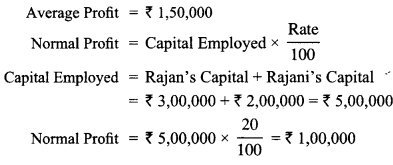

Rajan and Rajani are partners in a firm. Their capitals were Rajan ₹ 3,00,000; Rajani ₹ 2,00,000. During the year 2014 the firm earned a profit of₹ 1,50,000. Calculate the value of goodwill of the firm assuming that the normal rate of return is 20%.

Answer:

Question 29.

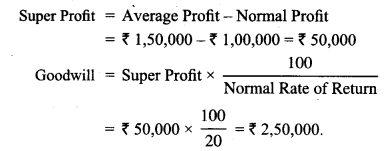

Amar and Samar were partners in a firm sharing profits and losses in 3 : 1 ratio. They admitted Kanwar for 1/4 share of profits. Kanwar could not bring his share of goodwill/premium in cash. The goodwill of the firm was valued at ₹ 80,000 on Kanwar’s admission. Record necessary journal entries for goodwill on Kanwar’s admission.

Answer:

Question 30.

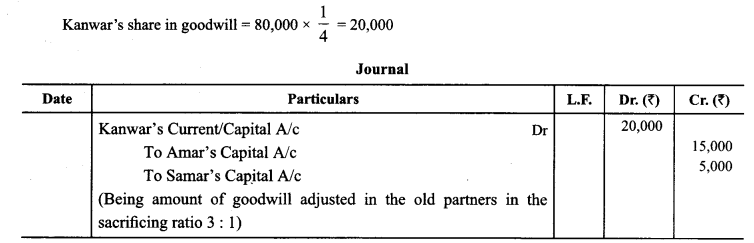

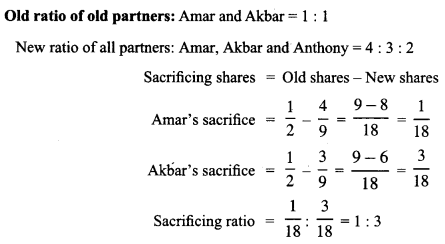

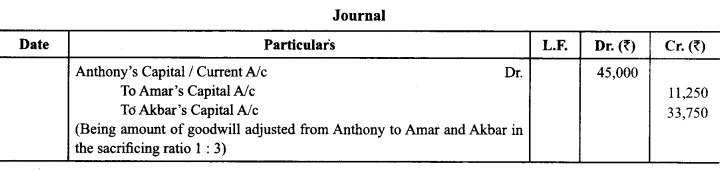

Amar and Akbar are equal partners in a firm. They admitted Anthony as a new partner and the new profit sharing ratio is 4 : 3 : 2. Anthony could not bring his share of goodwill ₹ 45,000 in cash. It is decided to do adjustment for goodwill without opening goodwill account. Pass the necessary journal entry for the treatment of goodwill.

Answer:

Old ratio of old partners: Amar and Akbar =1:1

New ratio of all partners: Amar, Akbar and Anthony = 4:3:2

Question 31.(a)

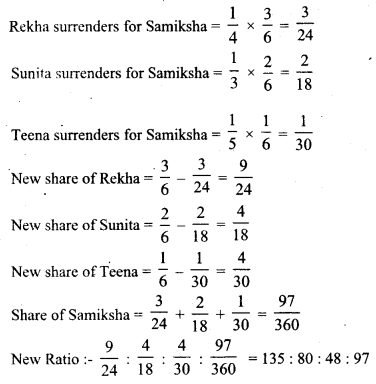

Rckha, Sunita and Teena are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Samiksha joins the firm. Rekha surrenders l/4th of her share; Sunita surrenders 1/3rd of her share and Teena 1/5th of her share in favour of Samiksha. Find the new Profit sharing ratio.

Answer:

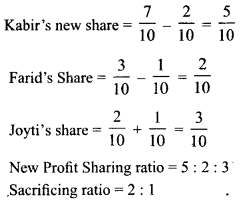

Question 31. (b)

Kabir and Fand are partners sharing profits and losses in the ratio of 7 : 3. Kabir surrenders 2/10th from his share and Farid surrenders 1/10th from his share in favour of Jyoti, a new partner. Calculate new profit sharing ratio and sacrificing ratio. (CBSE Sample Paper 2015)

Answer:

Question 32.

New Profit Sharing ratio = 5:2:3 .Sacrificing ratio = 2:1 .On April 1, 2018, a firm had assets of₹ 1,00,000 excluding stock of ₹ 20,000. The current liabilities were ₹ 10,000 and the balance constituted Partners’ Capital Accounts. If the normal rate of return is 8%, the Goodwill of the firm is valued at ₹ 60,000 at four years purchase of super profit, find the actual profits of the firm.

Answer:

Total Assets ₹ 1,20,000

Capital Employed Total Assets — Current Liabilities

= 1,20,000 – 10,000 =₹ 1,10,000

Normal Profits 8% of 1,10,000 ₹ 8,800

Goodwill = Super Profits x No. of Years Purchase

Super Profits = Actual Average Profits — Normal Profits

Given Goodwill = ₹ 60,000

60,000 4 (Average Actual Profits – Normal Profits)

15000 = Average Actual Profits — 8,800

Average Actual Profits = 15,000 + 8,800 = ₹ 23,800

Question 33.

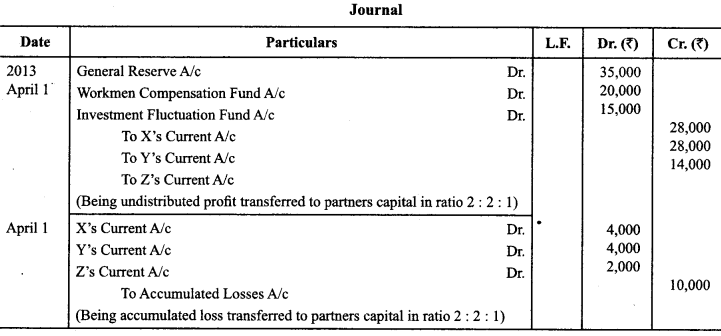

X, Y and Z are partners in a firm sharing profits and losses in 2 : 2 : 1 ratio. On April 1, 2013, they admitted A as a partner for 1/5th share in profits. On that date, the firm has general reserve of ₹ 35,000, Workmen Compensation Fund of ₹ 20,000, Investments Fluctuation Fund of ₹ 15,000 and accumulated losses of ₹ 10,000. The partners decided to transfer reserves and accumulated losses in their Current Accounts. Pass necessary adjustment entry.

Answer:

Question 34.

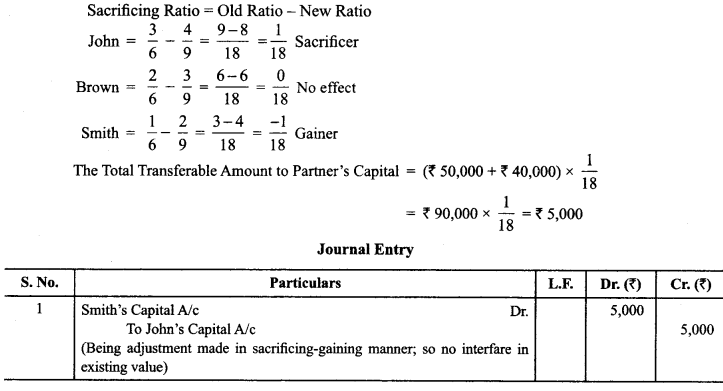

John, Brown and Smith are partners in a firm sharing profit and losses in 3 : 2 : 1 ratio. On April 1, 2013, they changed their profit sharing ratio as 4 : 3 : 2. On that date, the firm has general reserve of ₹ 50,000 and accumulated profits of ₹ 40,000. The partners decided to show reserves and accumulated profits in the existing manner. Pass necessary adjustment entry and show your working.

Answer:

Question 35.

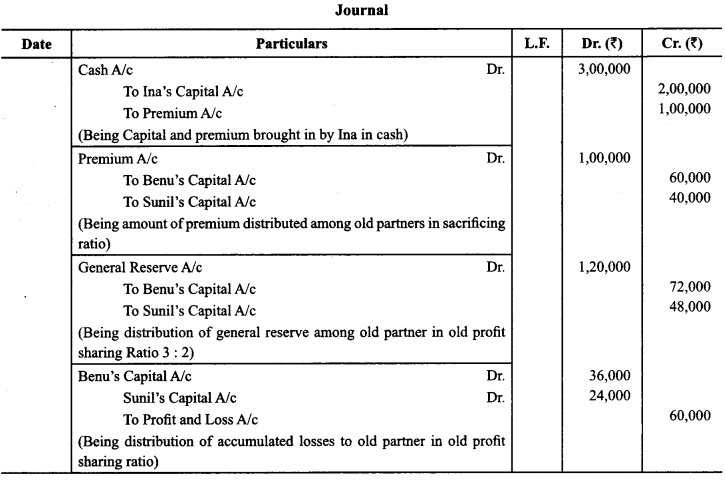

Benu and Sunil are partners sharing profits and losses in the ratio of 3 :2. On April 1,2013, Ina was admitted for 1/4 share who paid ₹ 2,00,000 as capital and ₹ 1,00,000 for premium in cash. At the time of admission, general reserve amounting to ₹ 1,20,000 and profit and loss account amounting to ₹ 60,000 appeared on the asset side of the balance sheet.Record necessary journal entries to record the above transactions.

Answer:

Question 36.

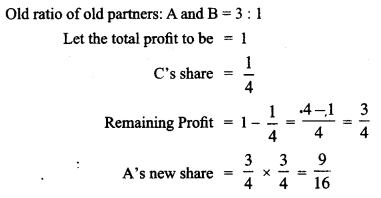

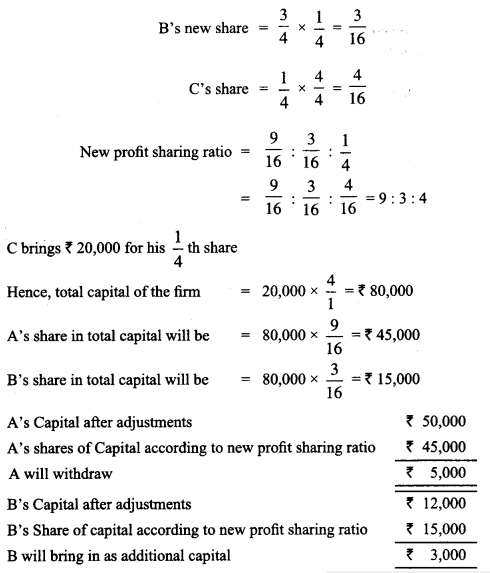

A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st Jan. 2014 they admitted C as a new partner for 1/4 share in the profits of the firm. C brings ₹ 20,000 as for his 1/4 share in the profits of the firm. The capitals of A and B after all adjustments in respect of goodwill, revaluation of assets and liabilities, etc. has been worked out at ₹ 50,000 for A and ₹ 12,000 for B. It is agreed that partner’s capitals will be according to new profit sharing ratio. Calculate the new capitals of A and B and pass the necessary journal entries assuming that A and B brought in or withdrew the necessary cash as the case may be for making their capitals in proportion to their profits sharing ratio.

Answer:

Question 37.

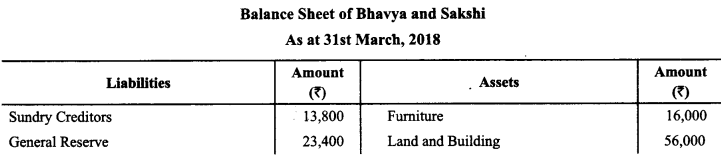

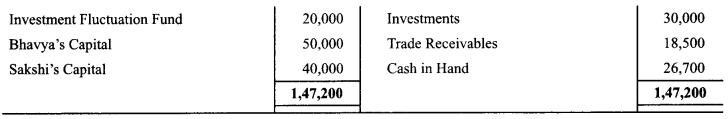

Bhavya and Sakshi are partners in a firm, sharing profits and losses in the ratio of 3 : 2. On 31 st March, 2018 their Balance Sheet was as under:

The partners have decided to change their profit sharing ratio to 1: 1 with immediate effect. For the purpose,

they decided that:

- Investments to be valued at 20.000

- Goodwill of the firm valued at 24,000

- General Reserve not to be distributed between the partners.

You are required to pass necessary journal entries in the books of the firm. Show workings.

(CBSE Sample Paper 2018-19)

Answer:

Question 38.

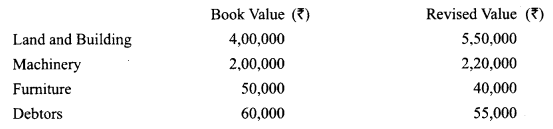

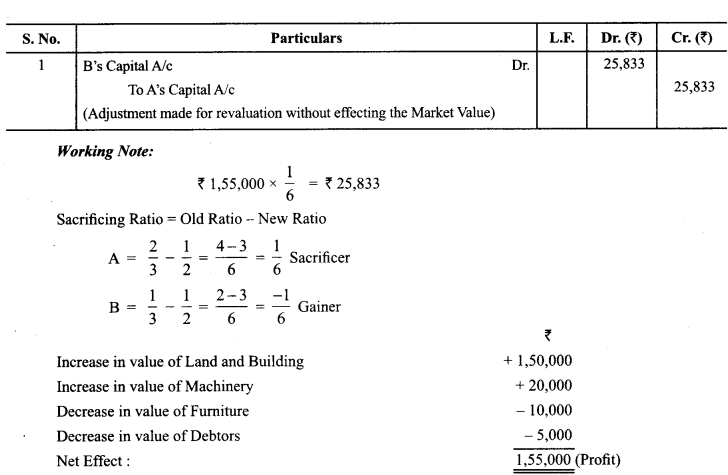

A and B are partners in a firm having 2 : 1 profit sharing ratio. OnApril 1, 2013, they agreed to share profits and losses equally. On this date, they decided to revalue assets as follows:

Partners also decided to record net effect of the revaluation of assets and reassessment of liabilities without affecting their book value by passing a single adjustment entry. Pass the adjustment entry.

Answer:

Reconstitution of Partnership Firm: Admission of a Partner Important Extra Questions Long Answer Type

Question 1.

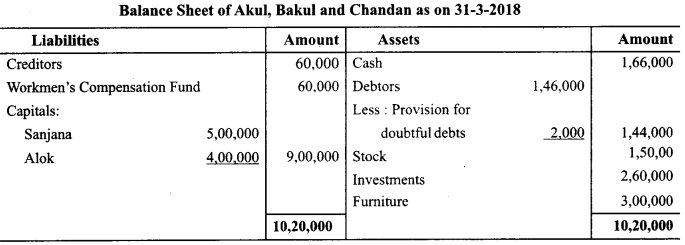

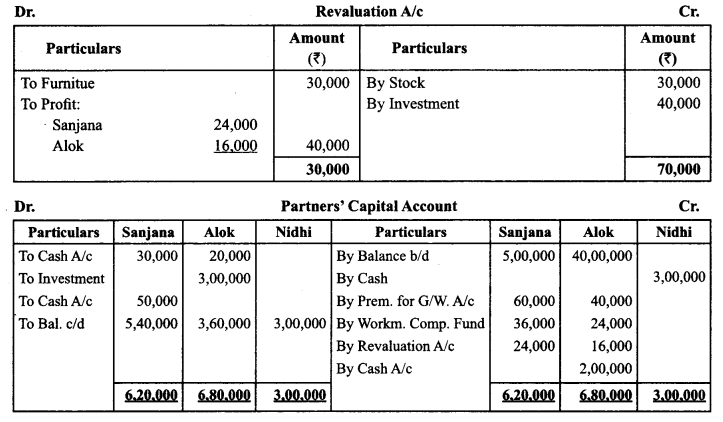

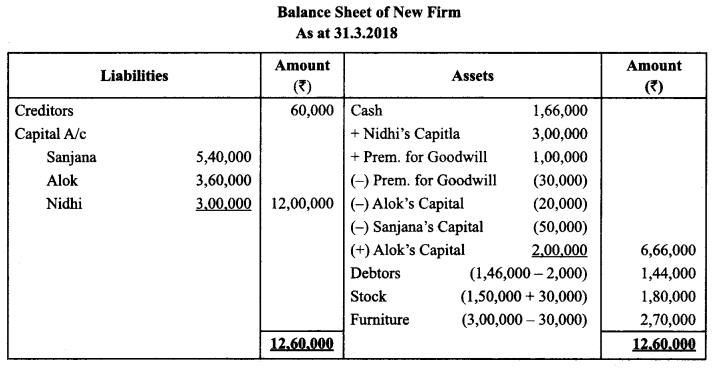

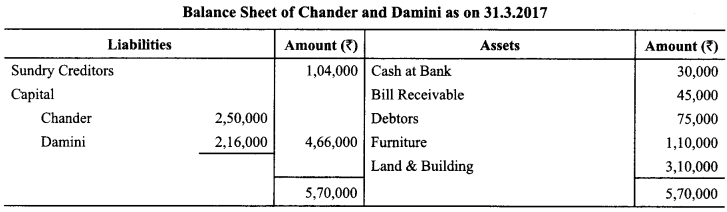

Sanjana and Alok were partners in a firm sharing profits and losses in the ratio 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

On 1st April, 2018, they admitted Nidhi as a new partner for l/4th share in the profits on the following terms:

(a) Goodwill of the firm was valued at ₹4,00,000 and Nidhi brought the necessary amount in cash for her share of goodwill premium, half of which was withdrawn by the old partners.

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at ₹3,00,000. Alok took over investments at this value.

Nidhi brought ₹3,00,000 as her capital and the capitals of Sanjana and Alok were adjusted in the new profit sharing ratio.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm on Nidhi’s admission. (CBSE Delhi 2019)

Question 2.

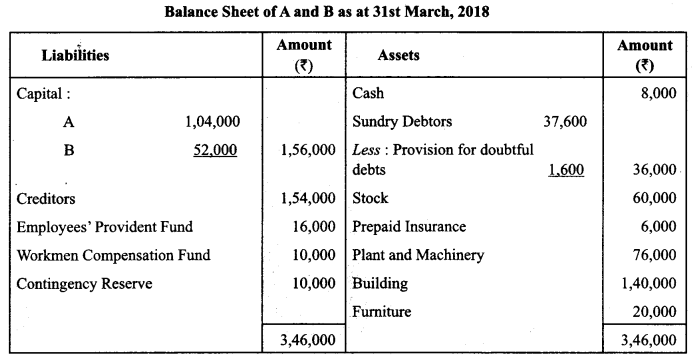

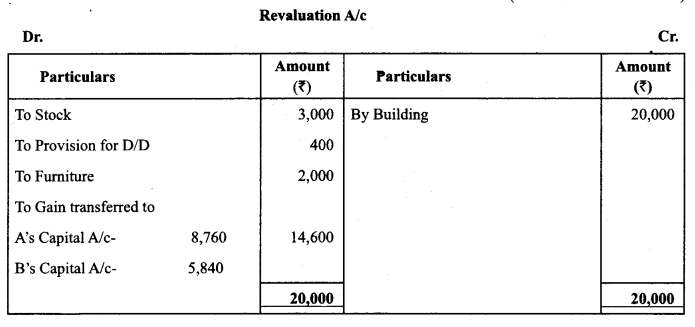

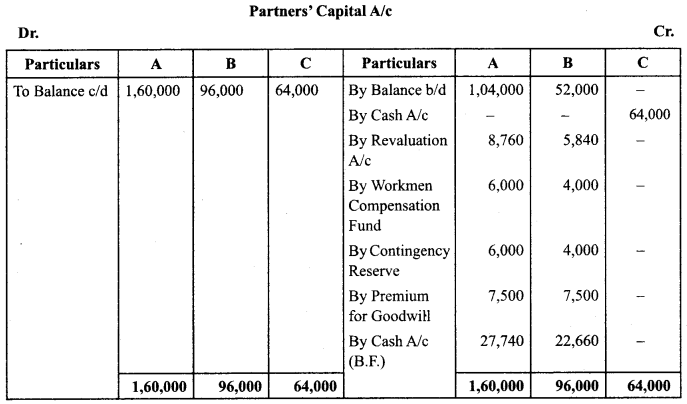

A and B were partners sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2018, was as follows :

C was admitted as a new partner and brought ₹ 64,000 as capital and ₹ 15,000 for his share of goodwill premium. The new profit sharing ratio was 5:3:2.

On C’s admission the following was agreed upon :

(i) Stock was to be depreciated by 5%.

(ii) Provision for doubtful debts was to be made at ₹ 2,000.

(iii) Furniture was to be depreciated by 10%.

(iv) Building was valued at ₹ 1,60,000.

(v) Capitals of A and B were to be adjusted on the basis of C’s capital by bringing or paying of cash as the case may be.

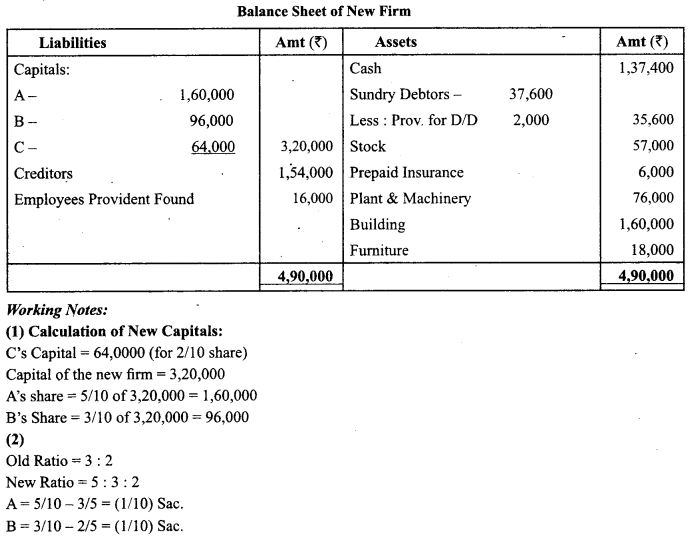

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of reconstituted firm. (CBSE Outside Delhi 2019)

Answer:

Question 3.

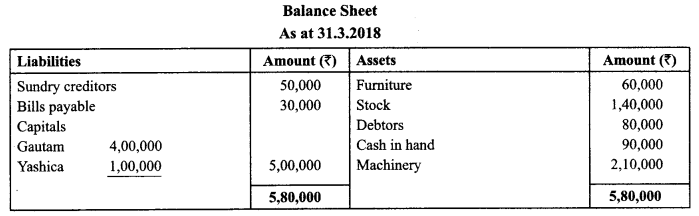

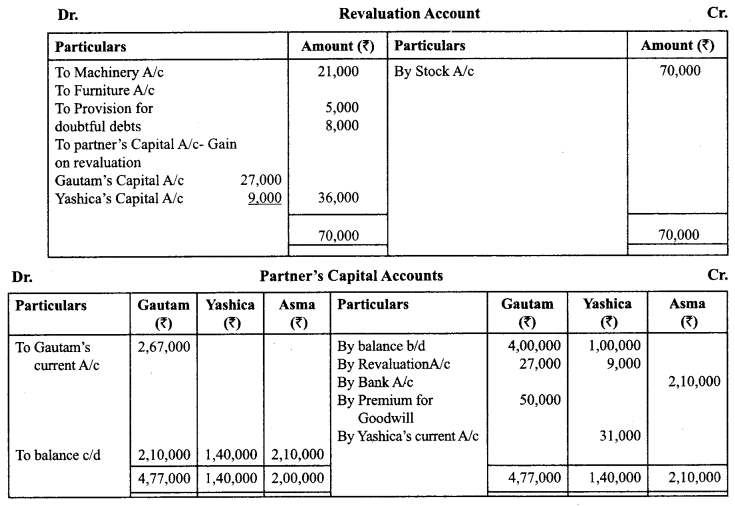

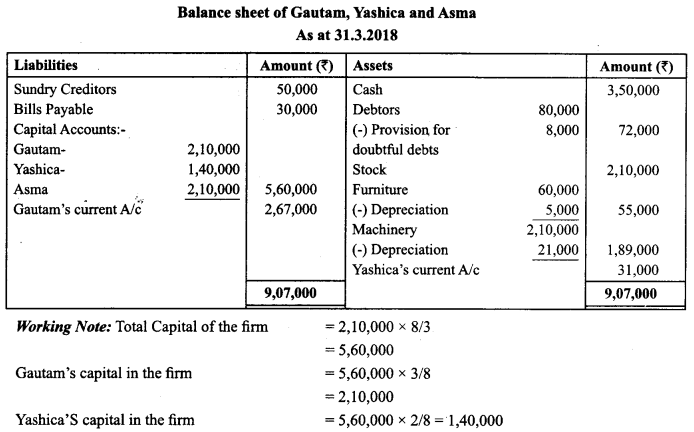

Gautam and Yashica are partners in a firm, sharing profits and losses in 3:1 respectively. The balance sheet of the firm as on 31st March 2018 was as follows:

Asma is admitted as a partner for 3/8th share in the profits with a capital of ₹2,10,000 and ₹50,000 for her share of goodwill. It was decided that:

- New profit sharing ratio will be 3:2:3

- Machinery will depreciated by 10% and Furniture by ₹5,000.

- Stock was re-valued at ₹ 2,10,000.

- Provision for doubtful debts is to be created at 10% of debtors.

- The capitals of all the partners were to be in the new profit sharing ratio on basis of capital of new partner any adjustment to be done through current accounts.

Prepare Revaluation Account, Partners Capital Account and the Balance Sheet of the new firm. (CBSE Sample Paper 2019-20)

Answer:

Question 4.

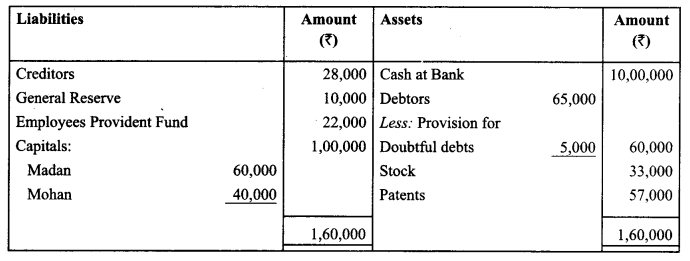

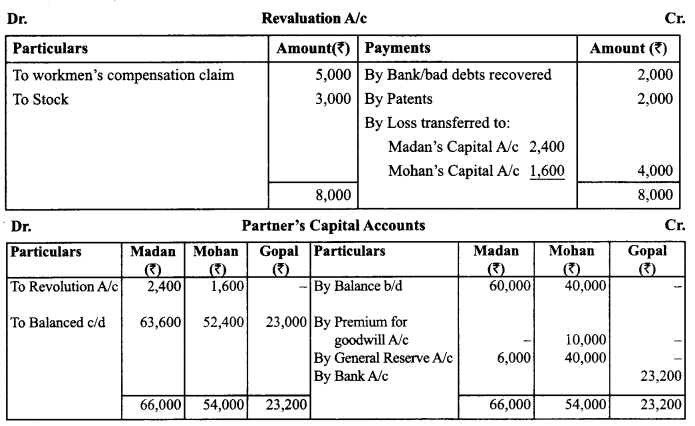

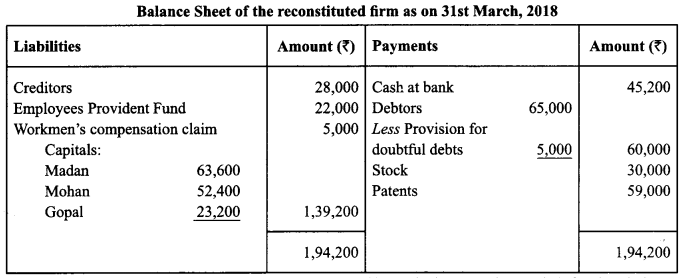

On 31st March, 2019 the Balance Sheet of Madan and Mohan who share profits and losses in the ratio of 3 : 2 was as follows:

They decided to admit Gopal on 1st April, 2019 for l/5th share which Gopal acquired wholly from Mohan on the following terms:

- Gopal shall bring ₹ 10,000 as his share of premium for Goodwill.

- A debtor whose dues of₹ 3,000 were written off as bad debt paid ₹ 2,000 in full settlement.

- A claim of₹ 5,000 on account of workmen’s compensation was to be provided for.

- Patents were undervalued by ₹ 2,000. Stock in the books was valued 10% more than its market value.

- Gopal was to bring in capital equal to 20% of the combined capitals of Madan and Mohan after all adjustments.

Prepare Revaluation Account, Capital Accounts ®f the Partners and the Balance Sheet of the new firm. (CBSE Compt. 2019)

Answer:

Question 5.

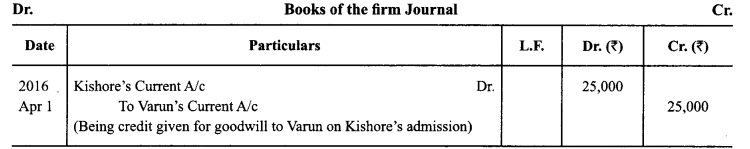

Karan and Varan were partners in a firm sharing profits and losses in the ratio of 1:2. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. On 1st April, 2016 Kishore was admitted as a new partner for 14th share in the profits. Kishore brought ₹ 2,00,000 for his capital which was to be kept fixed like the capitals of Karan and Varan. Kishore acquired his share of profit from Varan.

Calculate goodwill of the firm on Kishore’s admission and the new profit sharing ratio of Karan, Varan and Kishore. Also, pass necessary Journal Entry for the treatment of Goodwill on Kishore’s admission considering that Kishore did not bring his share of goodwill premium in Cash. [CBSE Delhi 2017]

Answer:

(a) Calculation of Hidden Goodwill:

Kishore’s share = 1/4 Kishore’s Capital = ₹2,00,000

(a) Total capital of the new firm = ₹2,00,000 x 4 = ₹8,00,000

(b) Existing total capital of Karan, Varan and Kishore = ₹2,00,000 + ₹ 3,00,000 + ₹ 2,00,000 = ₹ 7,00,000

(c) Goodwill of the firm = ₹8,00,000 – ₹7,00,000 = ₹ 1,00,000 Thus, Kishore’s share of goodwill = 1/4 x ₹ 1,00,000 = ₹25,000

(b) Calculation of New Profit Sharing ratio:

Karan’s new share = 1/3 i.e. 4/12, Varun’s new share = 2/3 – 1/4 = 5/12 Kishore’s share = 1/4 x 3/3 = 2/12 New Ratio = 4:5:3

(c)

Question 6.

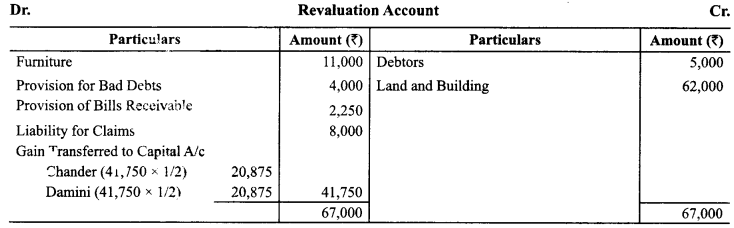

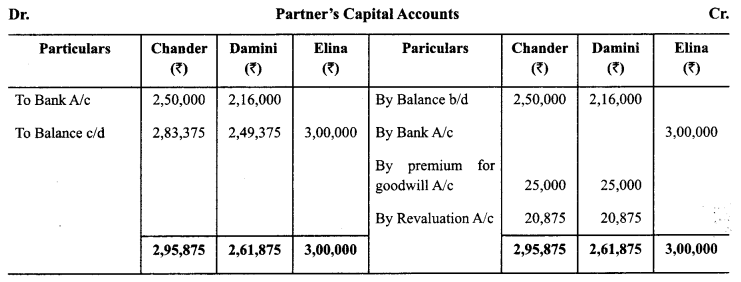

Chander and Damini were partners in a firm sharing profits and losses equally. On 31st March, 2017 their Balance Sheet was as follows:

On 1.4.2017, they admitted Elina as a new partner for l/3rd share in the profits on the following conditions :

(i) Elina will bring ₹3,00,000 as her capital and ₹ 50,000 as her share of goodwill premium, half of which will be withdrawn by Chander and Damini.

(ii) Debtors to the extent of ₹5,000 were unrecorded.

(iii) Furniture will be reduced by 10% and 5% provision for bad and doubtful debts will be created on bills receivables and debtors.

(iv) Value of land and building will be appreciated by 20%.

(v) There being a claim against the firm for damages, a liability to the extent of ₹8,000 will be created for the same. Prepare Revaluation Account and Partners’ Capital Accounts. (CBSE 2018-19)

Answer:

Question 7.

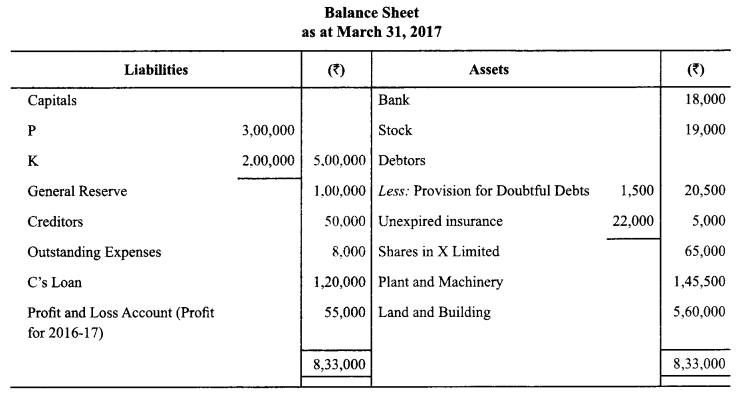

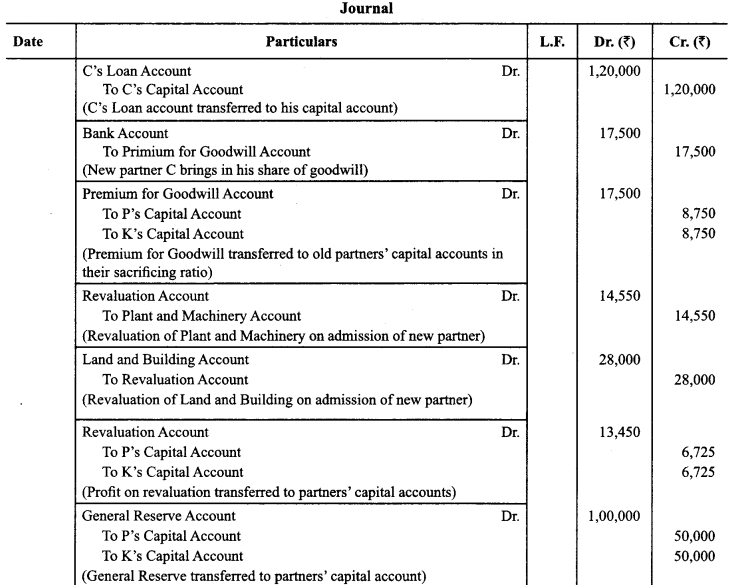

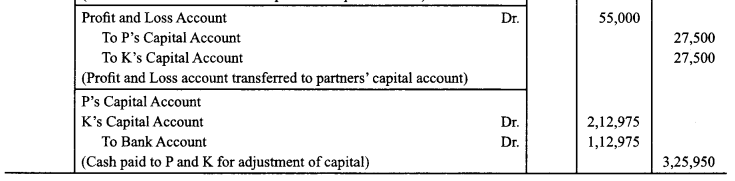

P & K were partners in a firm. On March 31, 2017 their Balance Sheet was as follows: Balance Sheet as at March 31, 2017.

On April 1,2017, they decided to admit C as a new partner for 1/4th share in profits on the following terms:

(i) C’s Loan will be converted into his capital.

(ii) C will bring his share of goodwill premium by cheque. Goodwill of the firm will be calculated on the basis of Average Profits of previous three years. Profits for the year ended March 31, 2015 and March 31, 2016 were ₹ 55,000 and ₹ 1,00,000 respectively.

(iii) 10% depreciation will be charged on Plant & Machinery and Land & Building will be appreciated by 5%.

(iv) Capitals of P & K will be adjusted on the basis C’s capital. Adjustments be done through bank and in case required overdraft facility be availed.

Pass necessary Journal entries on C’s admission. (CBSE Sample Paper 2017-18)

Answer:

Question 8.

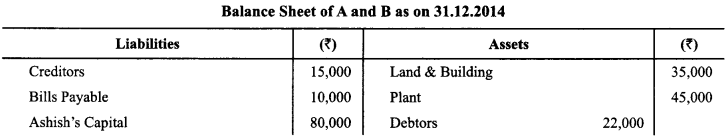

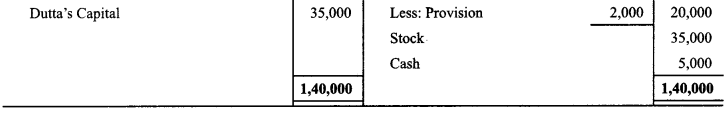

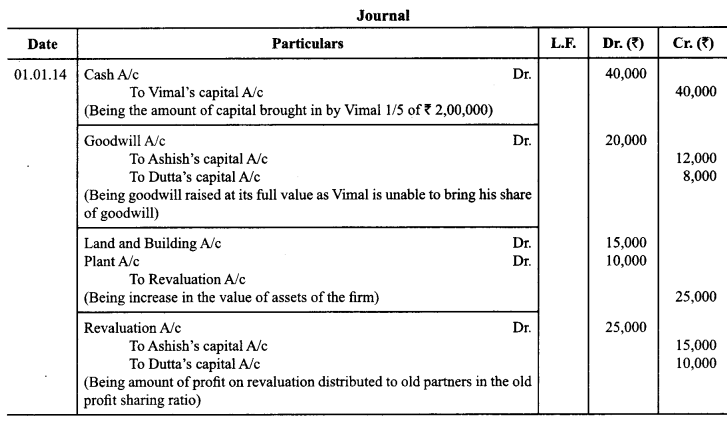

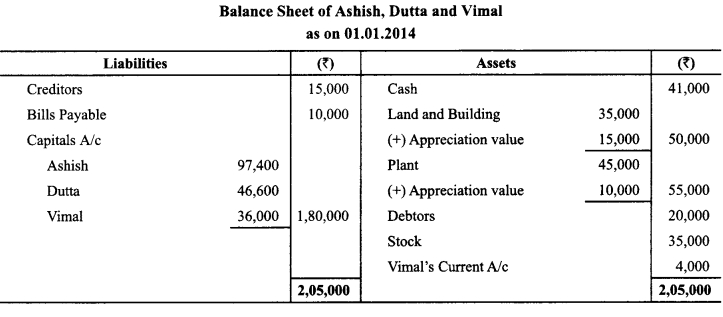

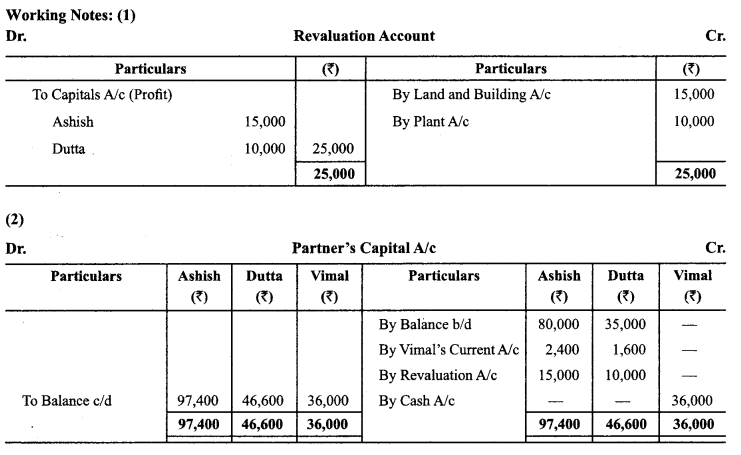

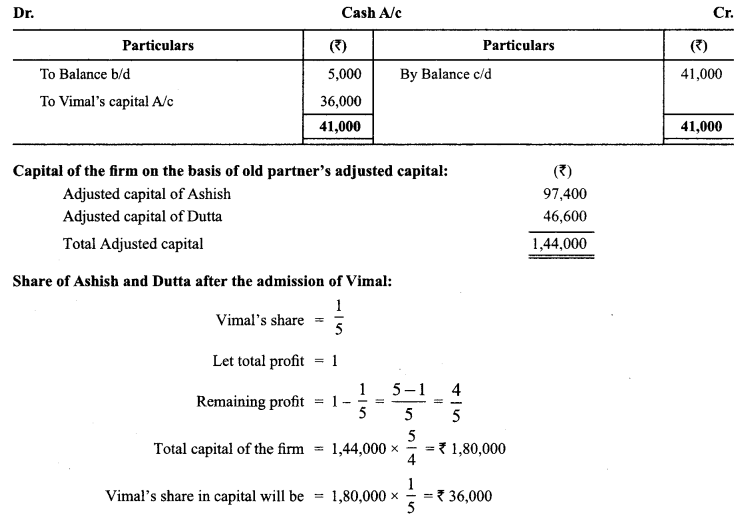

Ashish and Dutta were partners in a firm sharing profits in 3 : 2 ratio. On Jan. 01,2014 they admitted Vimal for 1/5 share in the profits. The Balance Sheet of Ashish and Dutta as on Dec. 31, 2013 was as follows:

It was agreed that:

(i) The value of Land and Building be increased by ₹ 15,000.

(ii) The value of plant be increased by ₹ 10,000.

(iii) Goodwill of the firm be valued at ₹ 20,000.

(iv) Vimal to bring in capital to the extent of l/5th of the total capital of the new firm. Record the necessary journal entries and prepare Balance Sheet after Vimal’s admission.

Answer:

Question 9.

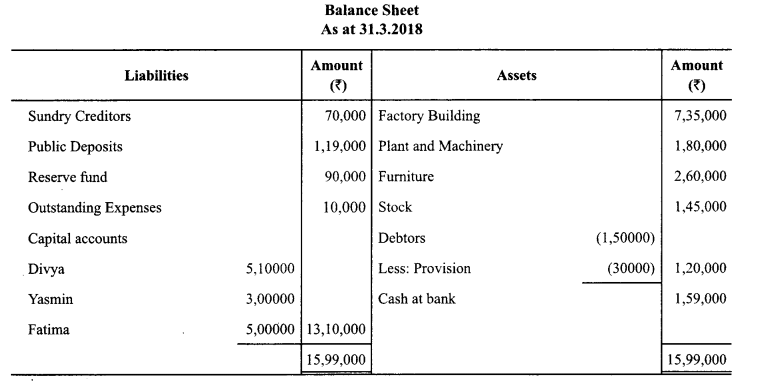

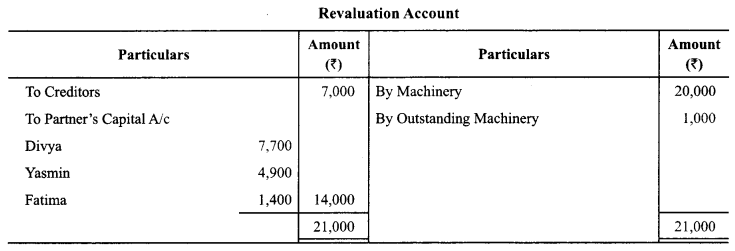

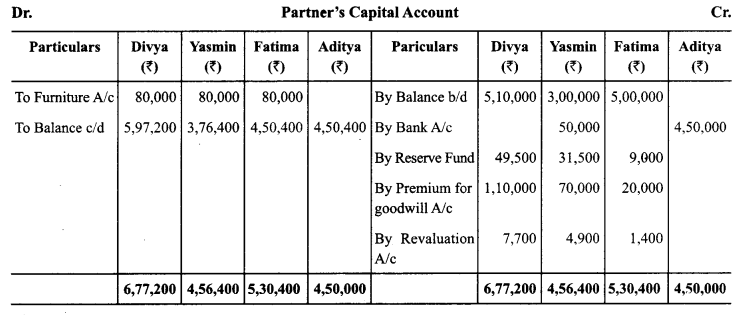

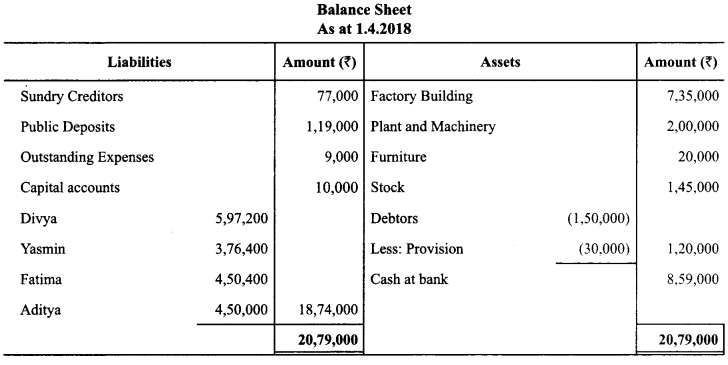

Divya, Yasmin and Fatima are partners in a firm, sharing profits and losses in 11 : 7 : 2 respectively. The balance sheet of the firm as on 31st March 2018 was as follows:

On 1.4.2018, Aditya is admitted as a partner for one-fifth share in the profits with a capital of ₹4,50,000 and necessary amount for his share of goodwill on the following terms:

(i) Furniture of ₹2,40,000 were to be taken over Divya, Yasmin and Fatima equally.

(ii) A creditor of ₹ 7,000 not recorded in books to be taken into account.

(iii) Goodwill of the firm is to be valued at 2.5 years purchase of average profits of last two years. The profit of the last three years were:

2015-16 ₹6,00,000; 2016-17 ₹2,00,000; 2017-18 ₹6,00,000

(iv) At time of Aditya’s admission Yasmin also brought in 50,000 as fresh capital

(v) Plant and Machinery is re-valued to ₹ 2,00,000 and expenses outstanding were brought down to ₹ 9,000. Prepare Revaluation Account, Partners Capital Account and the balance sheet of the reconstituted firm. (CBSE Sample Paper 2018-19)

Answer:

Question 10.

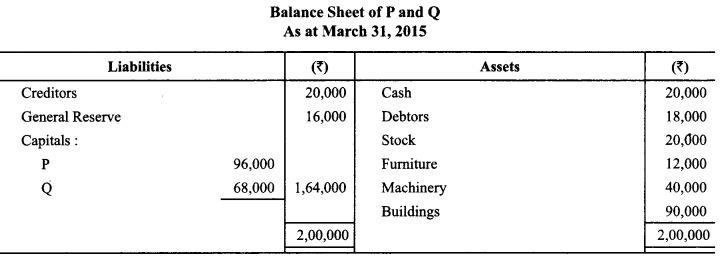

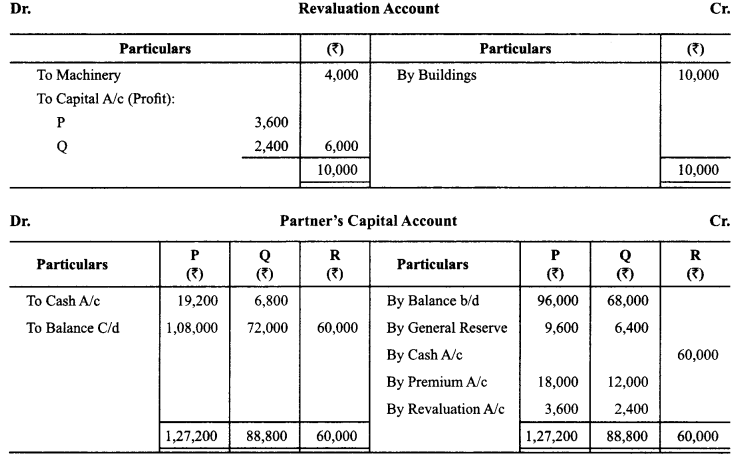

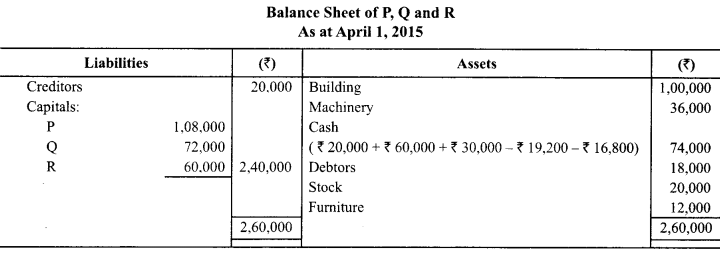

P and Q were partners in a firm sharing profits in 3 : 2 ratio. R was admitted as a new partner for 1/4x share in the profits on April 1, 2015. The Balance Sheet of the firm on March 31, 2015 was as follows:

The terms of agreement on R’s admission were as follows:

(a) R brought in cash 60,000 for his capital and 30,000 for his share of goodwill.

(b) Building was valued at 1,00,000 and Machinery at 36,000.

(c) The capital accounts of P and Q were to be adjusted in the new profit-sharing ratio. Necessary cash was to be brought in or paid off to them as the case may be.

Prepare Revaluation Account, Partner’s Capital Account and the Balance Sheet of P, Q and R. (CBSE Sample Paper 2016)

Answer:

Question 11.

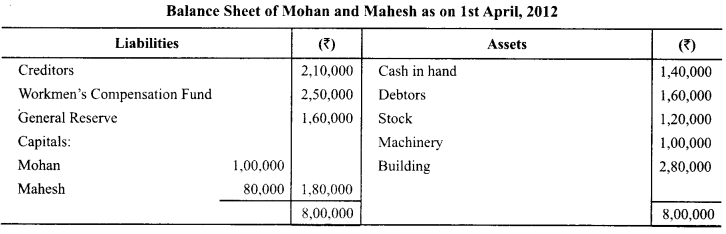

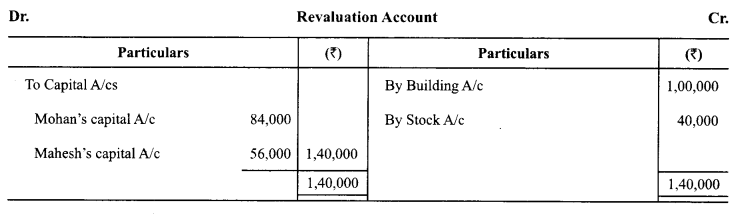

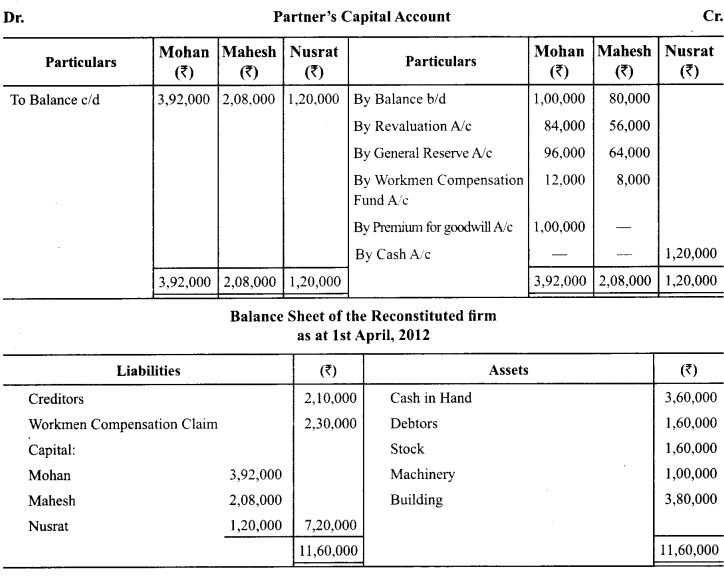

Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2012 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and Mahesh on that date was as under:

It was agreed that:

(i) The value of Building and Stock be appreciated to ₹ 3,80,000 and ₹ 1.60,000 respectively.

(ii) The liabilities of workmen’s compensation fund was determined at ₹ 2,30,000.

(iii) Nusrat brought in her share of goodwill ₹ 1,00,000 in cash.

(iv) Nusrat was to bring further cash as would make her capital equal to 20% of the combined capital of Mohan and Mahesh after above revaluation and adjustments are carried out.

(v) The future profit sharing ratio will be Mohan 2/5th. Mahesh 2 ‘5th. Nusrat 1/5th.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm. Also show clearly the calculation of Capital brought by Nusrat. (CBSE Delhi 2014, Set I, II)

Answer:

Working Notes: Capital Adjustment

Nusrat’s Capital (Mohan’s capital + Mahesh’s capital) 20/100

= ( ₹ 3,92,000 + ₹ 2,08,000) x ₹ 20/100

= ₹ 6,00,000 x 20/100 = ₹ 1,20.000

Question 12.

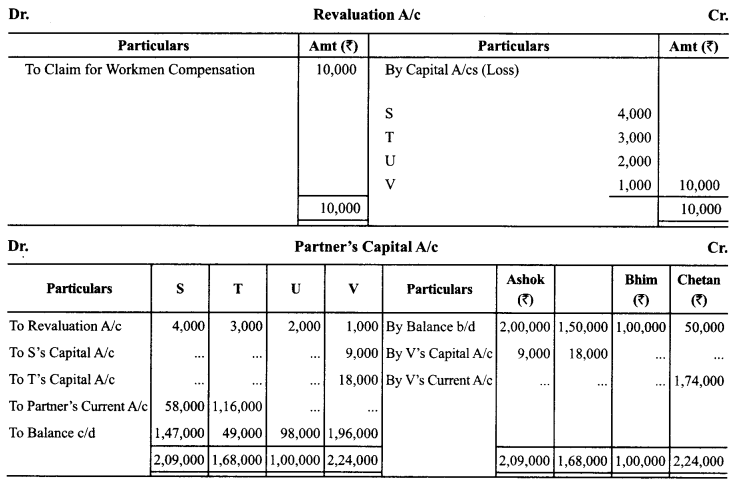

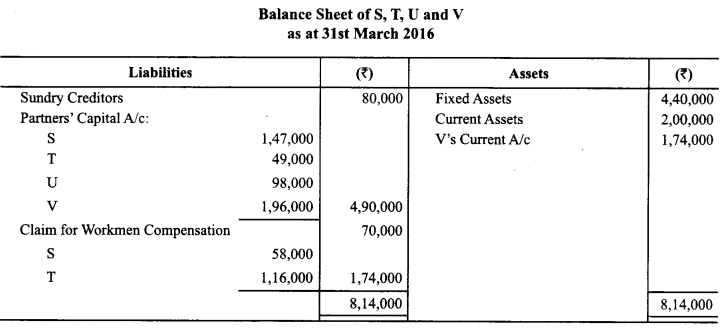

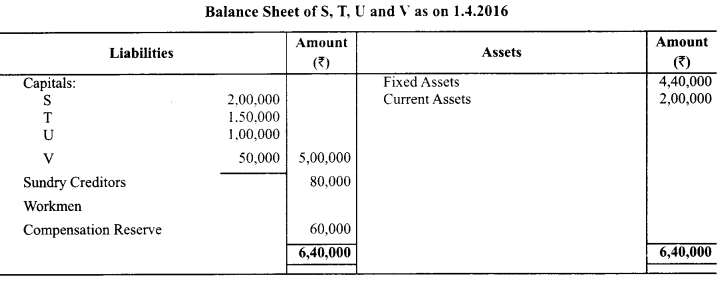

S, T, U and V were partners in a firm sharing profits in the ratio of 4: 3 : 2 : 1. On 1.04.2016 their Balance Sheet was as follows:

From the above date partners decided to share the future profits in 3 : 1 : 2 : 4 ratio. For this purpose the goodwill of the firm was valued at ₹ 90,000. The partners also agreed for the following:

(i) The claim for workmen compensation has been estimated at ₹ 70,000.

(ii) To adjust the capitals of the partners according to new profit sharing ratio by opening partners current accounts.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm. [Delhi 2017]

(CBSE Sample Paper 2017-18)

Answer: