Here we are providing Online Education for Class 12 Accountancy Important Extra Questions and Answers Chapter 4 Reconstitution of Partnership Firm: Retirement/Death of a Partner. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Online Education for Class 12 Accountancy Chapter 4 Important Extra Questions Reconstitution of Partnership Firm: Retirement/Death of a Partner

Reconstitution of Partnership Firm: Retirement/Death of a Partner Important Extra Questions Very Short Answer Type

Question 1.

What is meant by ‘Gaining Ratio’ on retirement of a partner?

Or

P, Q and R were partners in a firm. On 31st March, 2018 R retired. The amount payable to R ₹ 2,17,000 was transferred to his loan account. R agreed to receive interest on this amount as per the provisions of Partnership Act, 1932. State the rate at which interest will be paid to R. (CBSE Delhi 2019)

Answer:

The ratio in which retiring Partner’s Share is distributed between remaining Partner is called gaining ratio.

Or

Rate of interest will be 6% p.a.

Question 2.

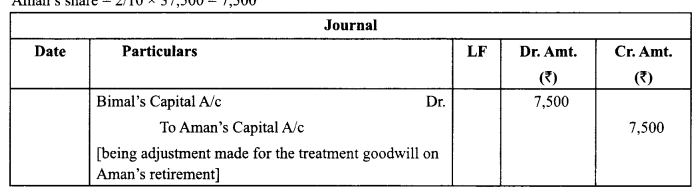

Aman, Bimal and Deepak are partners sharing profits in the ratio of 2 : 3 : 5. The goodwill of the firm has been valued at ₹ 37,500. Aman retired. Bimal and Deepak decided to share profits equally in future. Calculate gain/sacrifice of Bimal and Deepak on Aman’s retirement and also pass necessary journal entry for the treatment of goodwill. (CBSE Outside Delhi 2019)

Answer:

Old Ratio = 2:3:5

New Ratio =1:1 (on Aman’s Retirement)

Bimal’s Gain = 1/2 – 3/10 = 2/10

Deepak’s Gain = 1/2 – 5/10 = nil

Firm’s Goodwill = 37,500 .

A man’s share = 2/10 x 37,500 = 7,500

Question 3.

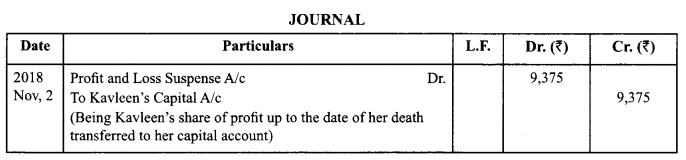

Riyansh, Garv and Kavleen were partners in a firm sharing profit and loss in the ratio of 8 : 7 : 5. On 2nd November 2018, Kavleen died. Kalveen’s share of profits till the date of her death was calculated at ₹ 9,375. Pass the necessary journal entry. (CBSE Sample Paper 2019-20)

Answer:

Question 4.

At the time of retirement how is the new profit sharing ratio among the remaining partners calculated₹ (CBSE Compt. 2019)

Answer:

The new share of each of the remaining partner is calculated as his/her own share in the firm plus the share acquired from the retiring partner.

Question 5.

In which ratio do the remaining partners acquire the share of profit of the retiring partner? (CBSE Compt. 2017)

Answer:

Gaining ratio.

Question 6.

At the time of retirement of a partner, state the condition when there is no need to compute gaining ratio. (CBSE 2013 Compartment OD)

Answer:

When the remaining partners share profits in old ratio.

Question 7.

On the retirement of a partner, how is the profit sharing ratio of the remaining partners decided?

Answer:

On the basis of old profit sharing ratio.

Question 8.

Why is gaining ratio of the remaining partners calculated at the time of retirement/death of a partner?

Answer:

Gaining ratio of the remaining partners is calculated to determine amount of goodwill payable by them to retired/deceased partner.

Question 9.

State the ratio in which share of goodwill of the retiring partner is debited to Capital Accounts of the remaining partners.

Answer:

In their gaining ratio.

Question 10.

Abha and Beena were partners sharing profits and losses in the ratio of 3 : 2 on April 1st 2013, they decided to admit Chanda for l/5th share in the profits. They had a reserve of ₹ 25,000 which they wanted to show in their new balance sheet. Chanda agreed and the necessary adjustments were made in the books. On October 1st 2013, Abha met with an accident and died. Beena and Chanda decided to admit Abha’s daughter Fiza in their partnership, who agreed to bring ₹ 2,00,000 as capital. Calculate Abha’s share in the reserve on the date of her death. (CBSE Sample Paper 2015)

Answer:

₹ 12,000

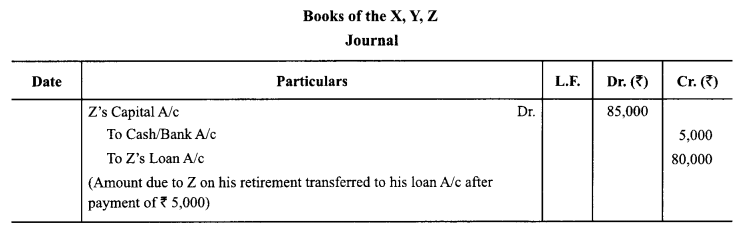

Question 11.

X, Y and Z were partners sharing profits and losses in the ratio of 3:2:2. Z retired and the amount due to him was ₹ 85,000. He was paid ₹ 5,000 immediately. The balance was payable in three equal annual instalments carrying interest @ 6% p.a. Pass necessary journal entry for recording the same on the date of Z’s retirement.

(Compt. Delhi 2017)

Answer:

Question 12.

Ram, Mohan and Sohan were partners in a firm sharing profits in the ratio of 4 : 3 : 1. Mohan retired. His share was taken over equally by Ram and Sohan. In which ratio will the profit and loss on revaluation of assets and liabilities on the retirement of Mohan be transferred to capital accounts of the partners?

(CBSE 2010 Compartment Delhi)

Answer:

In old profit sharing ratio.

Reconstitution of Partnership Firm: Retirement/Death of a Partner Important Extra Questions Short Answer Type

Question 1.

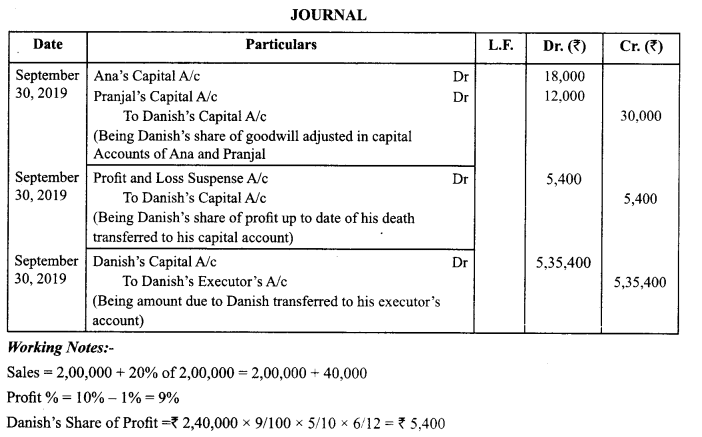

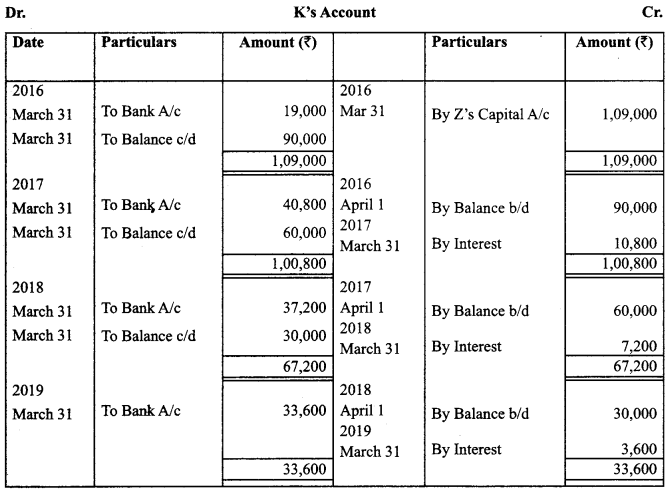

Danish, Ana and Pranjal are partners in a firm sharing profits and losses in the ratio of 5:3:2. Their books are closed on March 31 st every year.

Danish died on September 30th , 2019, The executors of Danish are entitled to: (CBSE Sample Paper 2019-20)

(i) His share of Capital i.e. ₹ 5,00,000 along-with his share of goodwill. The total goodwill of the firm was valued at ₹ 60,000.

(ii) His share of profit up to his date of death on the basis of sales till date of death. Sales for the year ended March 31, 2019 was ₹ 2,00,000 and profit for the same year was 10% on sales. Sales shows a growth trend of 20% and percentage of profit earning is reduced by 1%.

(iii) Amount payable to Danish was transferred to his executors.

Pass necessary Journal Entries and show the workings clearly.

Answer:

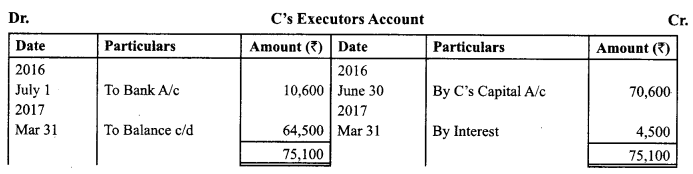

Question 2.

A, B and C were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. C dies on 30th June, 2016. After all the necessary adjustments, his capital account showed a credit balance of ₹ 70.600. C’s executor was paid ₹ 10,600 on 1st July, 2016 and the balance in three equal yearly instalments starting from 30th June, 2017 with interest @ 10% p.a. on the unpaid amount. The firm closes its books on 31st March every year.

Prepare C’s Executor’s Account till the amount is finally paid. (CBSE Compt. 2019)

Answer:

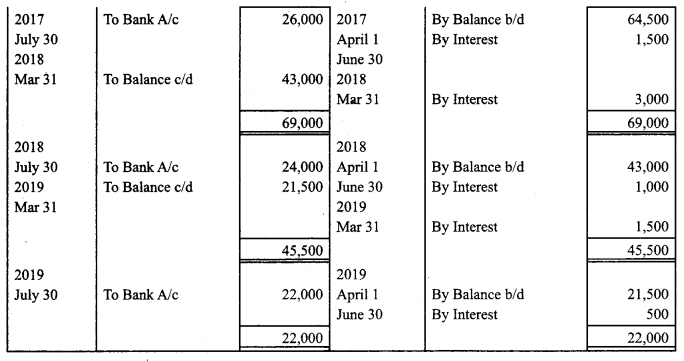

Question 3.

X, Y and Z were partners in a firm sharing profits in the ratio of 3 : 3 : 4. Z died on 31st March, 2016. The amount payable to Z’s executor K was ₹ 1,09,000. ₹ 19,000 were paid to K immediately and the balance was paid in three equal yearly instalments starting from 31st March, 2017 with interest @ 13% p.a. The firm ‘ closes its books on 31st March every year.

Prepare K’s account till he is finally paid.

Answer:

Question 4.

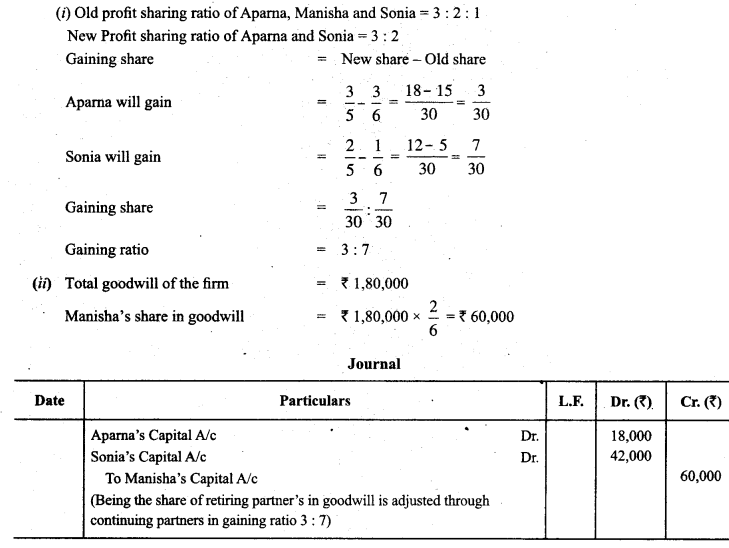

Apama, Manisha and Sonia are partners sharing profits in the ratio of 3 : 2 : 1. Manisha retires and goodwill of the firm is valued at ₹ 1,80,000. Apama and Sonia decided to share future in the ratio of 3:2. Pass necessary journal entries.

Answer:

(i) Old profit sharing ratio of Apama, Manisha and Sonia = 3 : 2 : 1

New Profit sharing ratio of Aparna and sonia = 3 : 2

Question 5.

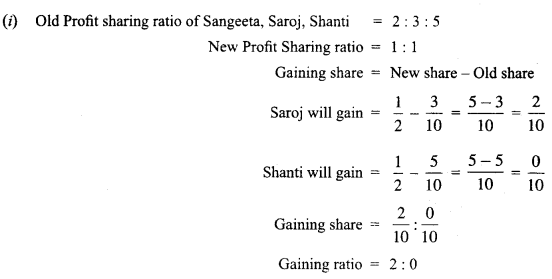

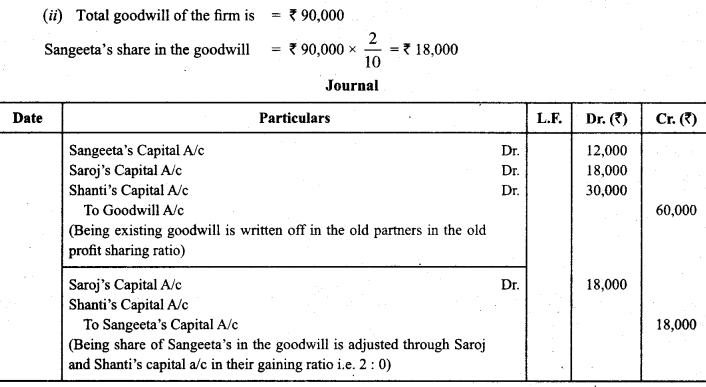

Sangeeta, Saroj and Shanti are partners sharing profits in the ratio of 2 : 3 : 5. Goodwill is appearing in the books at a value of ₹ 60,000. Sangeeta retires and goodwill is valued at ₹ 90,000. Saroj and Shanti decided to share future profits equally. Record necessary journal entries.

Answer:

Question 6.

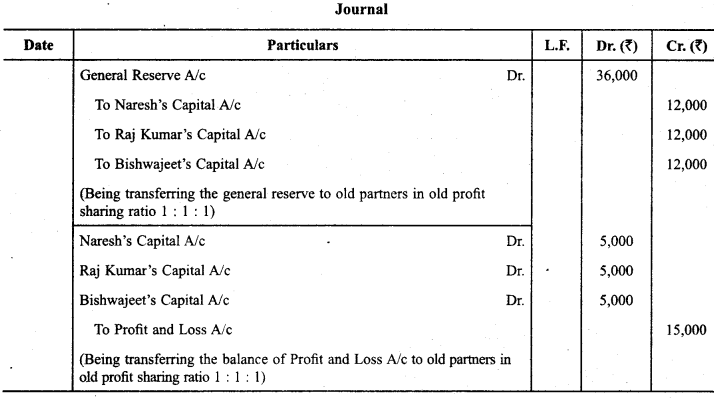

Naresh, Raj Kumar and Bishwajeet are equal partners. Raj Kumar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed the following : General Reserves ₹ 36,000 and Profit and Loss Account (Dr.) ₹ 15,000.

Pass the necessary journal entries to the above effect.

Answer:

Question 7.

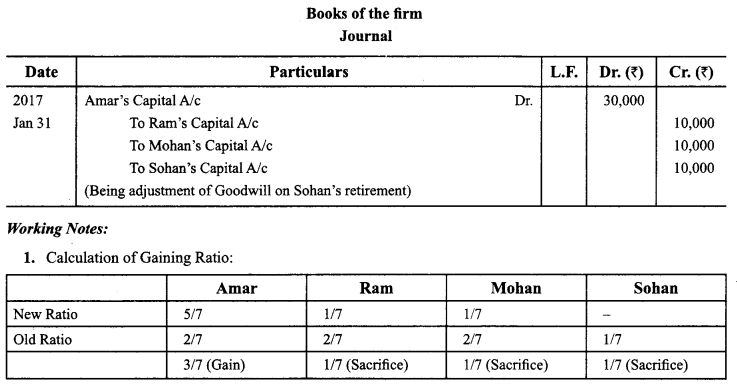

Amar, Ram, Mohan and Sohan were partners in a firm sharing profits in the ratio of 2 : 2 : 2 : 1. On 31st January, 2017 Sohan retired. On Sohan’s retirement the goodwill of the firm was valued at ₹ 70,000. The new profit sharing ratio between Amar, Ram and Mohan Was agreed as 5 : 1 : 1.

Showing your working notes clearly, pass necessary Journal Entry for the treatment of goodwill in the books of the firm on Sohan’s retirement. [CBSE Delhi 2017]

Answer:

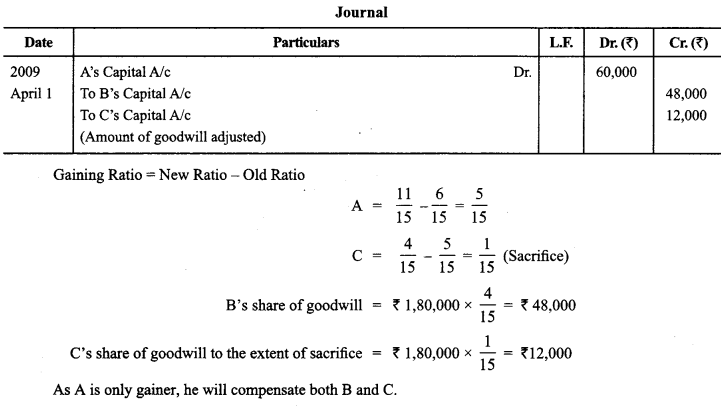

Question 8.

A, B and C were partners sharing profits in the ratio of 6:4:5. Their capitals were A₹ 1,00,000, B ₹ 80,000 and C ₹ 60,000. On 1 st April 2009, B retired from the firm and the new profit sharing ratio between A and C was decided as 11 : 4. On B’s retirement the goodwill of the firm was valued at ₹ 1,80,000. Showing your calculations clearly, pass necessary journal entry for the treatment of goodwill on B’s retirement.

Answer:

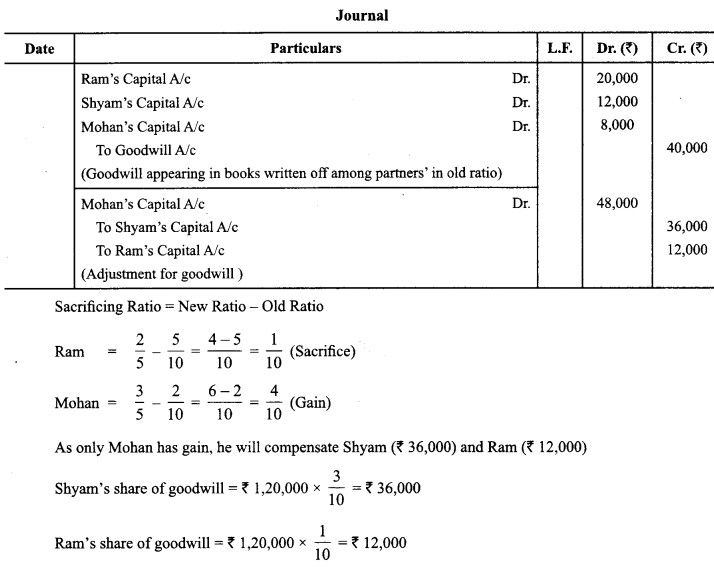

Question 9.

Ram, Shyam and Mohan are partners sharing profits in the ratio of 5 : 3 : 2. Shyam retired, and goodwill is valued at ₹ 1,20,000. Ram and Mohan decided to share future profits in the ratio of 2 : 3. Pass necessary journal entries for treatment of goodwill, if goodwill appears in the books at ₹ 40,000.

Answer:

Question 10.

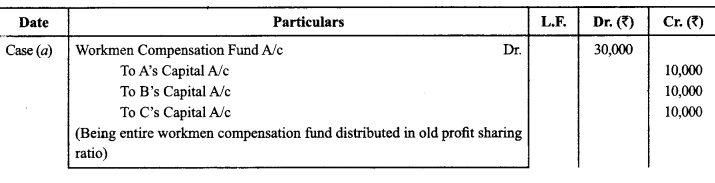

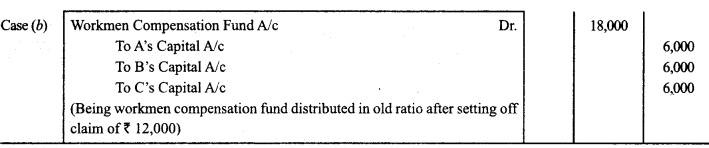

A firm of A, B and C has Workmen Compensation Fund of₹ 30,000. On retirement of a partner, how ₹ 20,000 will be treated in the following cases:

(a) There is no claim against Workmen Compensation fund.

(b) There is a claim of₹ 12,000 against Workmen Compensation Fund.

Journalise.

Answer:

Journal Entries

Question 11.

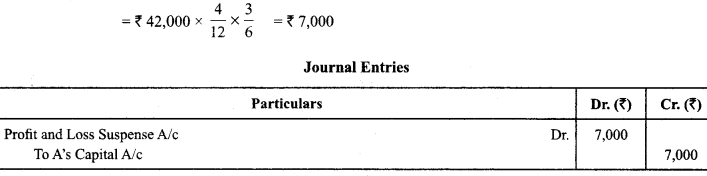

A, B and C are partners sharing profits in the ratio of 3 : 2 : l.A dies on 31st July 2011. The profits of the firm for the year ending 31st March 2011 were 42000. Calculate A’s Share for the period from 1st April to 31st July 2011 on the basis of last year’s profits. Pass necessary journal entry also.

Answer:

A’s profit = Preceding year’s profit x Proportionate Period x Share of A

Question 12.

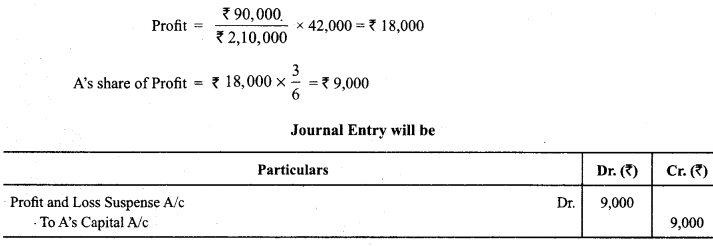

If in the example-1 given above, the sales for the last year are ₹ 2,10,000 and for the current year upto 31st July are say ₹ 90,000, what would be the Profits from 1st April to 31st July 2011.

Answer:

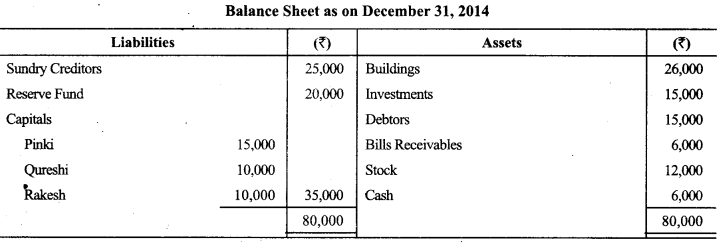

Question 13.

On December 31, 2014, the Balance Sheet of Pinki. Qureshi and Rakesh showed as under:

The partnership deed provides that the profit be shared in the ratio of 2 : 1 : 1 and that in the event of death of a partner, his executors be entitled to be paid out:

(a) The capital of his credit at the date of last Balance Sheet.

(b) His proportion of reserves at the date of last Balance Sheet.

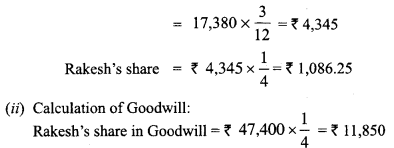

(c) His proportion of profits to the date of death based on the average profits of the last three completed years, plus 10%.

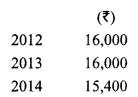

(d) By way of goodwill, his proportion of the total profits for the three preceding years. The net profit for the last three years were:

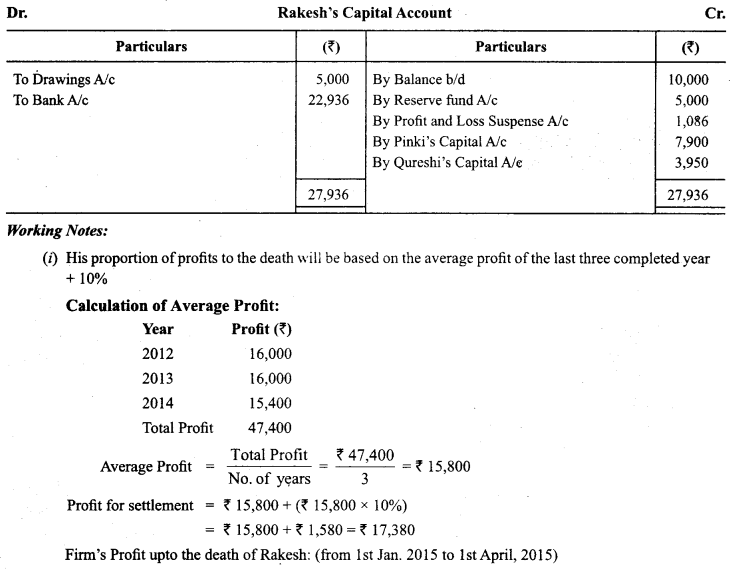

Rakesh died on April 1, 2015. He had withdrawn 5,000 to the date of his death. The investment were sold at par and R’s Executors were paid off. Prepare Rakesh’s Capital Account that of his executors.

Answer:

Note: Cash required to make payment is not enough even after selling the investment. Therefore, the payment has been made through bank.

Question 14.

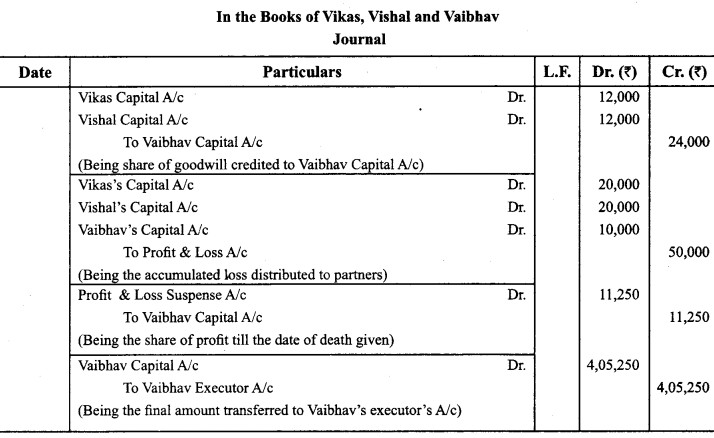

Vikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2 : 2 : 1 ..The firm closes its books on 31 st March every year. On 31.12.2015 Vaibhav died. On that date his Capital account showed a credit balance of ₹ 3,80,000 and Goodwill of the firm was valued at ₹ 1,20,000. There was a debit balance of ₹ 50,000 in the profit and loss account. Vaibhav’s share of profit in the year of his death was to be calculated on the basis of the average profit of last five year. The average profit of last five years was ₹ 75,000.

Pass necessary journal entries in the book of the firm on Vaibhav’s Death. (CBSE Outside Delhi 2016)

Answer:

Question 15.

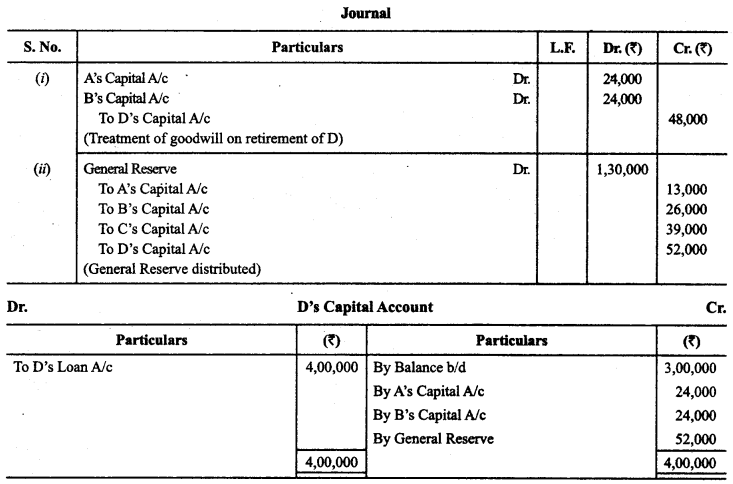

A, B, C and D were partners sharing profits in the ratio of 1 : 2 : 3 : 4. D retired and his share was acquired by A and B equally. Goodwill was valued at 3 year’s purchase of average profits of last 4 years, which were 40,000. General Reserve showed a balance of 1,30,000 and D’s Capital in the Balance Sheet was 3,00,000 at the time of D’s retirement. You are required to record necessary Journal entries in the books of the firm and prepare D’s capital account on his retirement.

Answer:

Question 16.

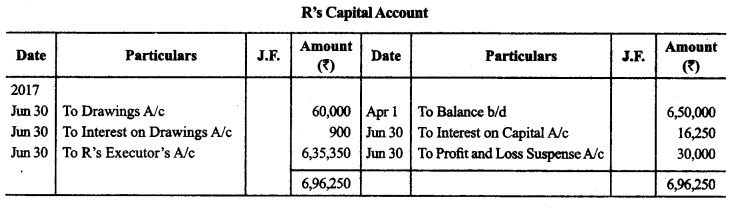

P, Q and R were partners sharing profits in the ratio of 2 :2 :1. The firm closes its books on March 31 every year. On June 30,2017, R died. The following information is provided on R’s death:

(i) Balance in his capital account in the beginning of the year was ₹ 6,50,000.

(ii) He withdrew ₹ 60,000 on May 15,2017 for his personal use.

On the date of death of a partner the partnership deed provided for the following:

(a) Interest on capital @ 10 % per annum.

(b) Interest on drawings @ 12 % per annum.

(c) His share in the profit of the firm till the date of death, to be calculated on the basis of the rate of Net Profit on Sales of the previous year, which was 25 %. The Sales of the firm till June 30, 2017 were ₹ 6,00,000.

Prepare R’s Capital Account on his death to be presented to his executors. (CBSE Sample Paper 2017-18)

Answer:

Reconstitution of Partnership Firm: Retirement/Death of a Partner Important Extra Questions Long Short Answer Type

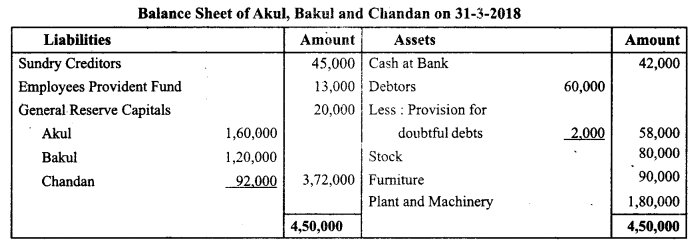

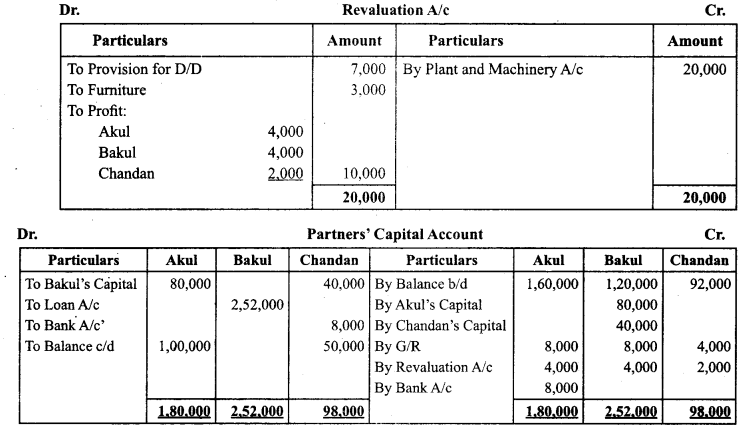

Question 1.

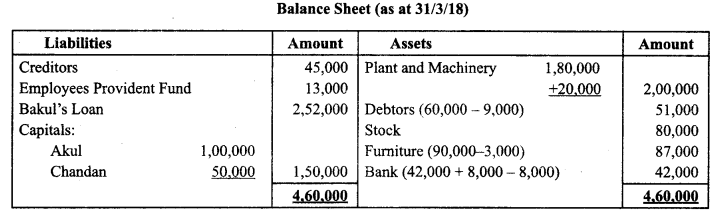

Akul, Bakul and Chan dan were partners in a firm sharing profits in the ratio of2:2: 1. On 31 st March, 2018 their Balance Sheet was as follows:

Bakul retired on the above date and it was agreed that:

(i) Plant and Machinery was undervalued by 10%.

(ii) Provision for doubtful debts was to be increased to 15% on debtors.

(iii) Furniture was to be decreased to ₹87,000.

(iv) Goodwill of the firm was valued at ₹3,00,000 and Bakul’s share was to be adjusted through the capital accounts of Akul and Chandan.

(v) Capital of the new firm was to be in the new profit sharing ratio of the continuing partners. Prepare Revaluation account, Partners’ Capital accounts and the Balance Sheet of the reconstituted firm. (CBSE Delhi 2019)

Answer:

Question 2.

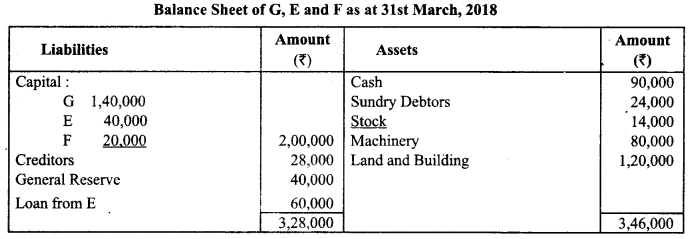

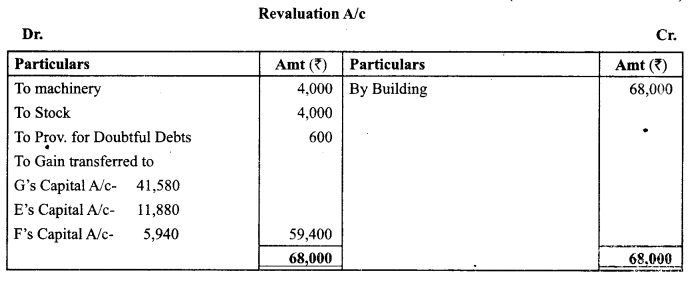

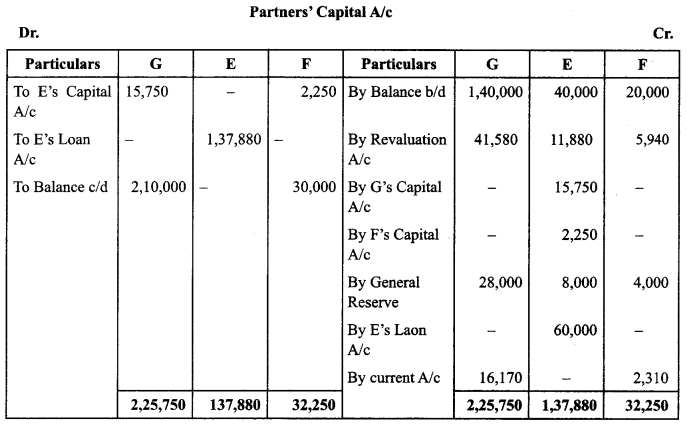

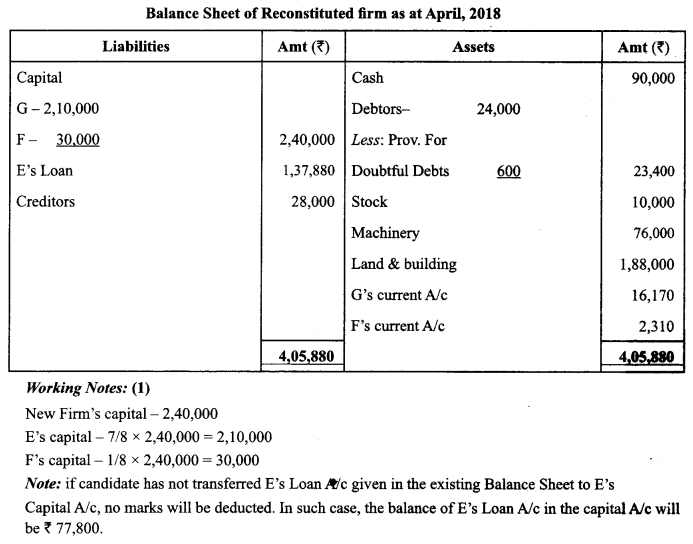

G, E and F were partners in a firm sharing profits in the ratio of 7 : 2 : 1. The Balance Sheet of the firm as at 31 st March, 2018, was as follows :

E.retired on the above date. On E’s retirement the following was agreed upon :

(i) Land and Building were revalued at ₹ 1,88,000, Machinery at ₹ 76,000 and Stock at ₹ 10,000 and goodwill of the firm was valued at X 90,000.

(ii) A provision of 2-5% was to be created on debtors for doubtful debts.

(iii) The net amount payable to E was transferred to his loan account to be paid later on.

(iv) Total capital of the new firm was fixed at ₹ 2,40,000 which will be adjusted according to their new profit sharing ratio by opening current accounts.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of reconstituted firm.

(CBSE Outside Delhi 2019)

Answer:

Question 3.

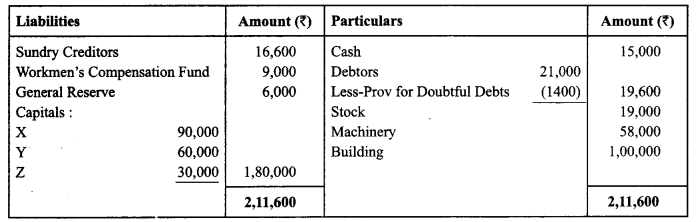

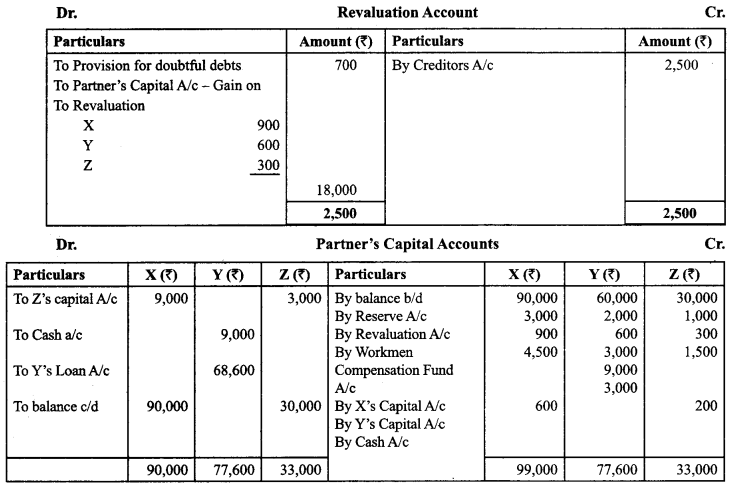

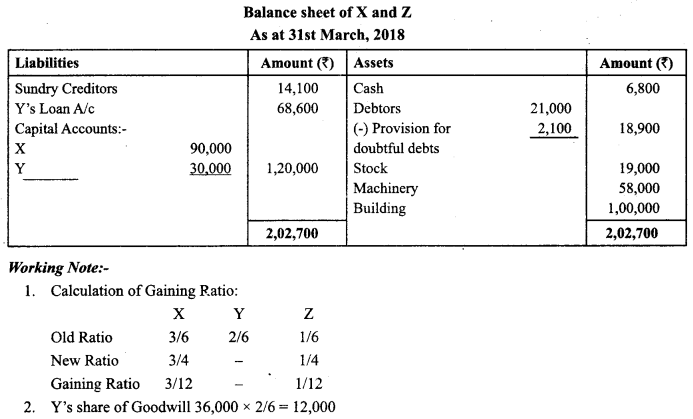

X,Y and Z were in partnership sharing profits in proportion to their capitals. Their Balance Sheet as on 31 st March, 2018 was as follows:

On the above date, Y retired owing to ill health. The following adjustments were agreed upon for calculation of amount due to Y.

(a) Provision for Doubtful Debts to be increased to 10% of Debtors.

(b) Goodwill of the firm be valued at ₹ 36,000 and be adjusted into the Capital Accounts of X and Z, who will share profits in future in the ratio of 3:1.

(c) Included in the value of Sundry Creditors was ₹ 2,500 for an outstanding legal claim, which will not arise.

(d) X and Z also decided that the total capital of the new firm will be ₹ 1,20,000 in their profit sharing ratio. Actual cash to be brought in or to be paid off as the case may be.

(e) Y to be paid ₹ 9,000 immediately and balance to be transferred to his Loan Account. Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm after Y’s retirement. (CBSE Sample Paper 2019-20)

Answer:

Question 4.

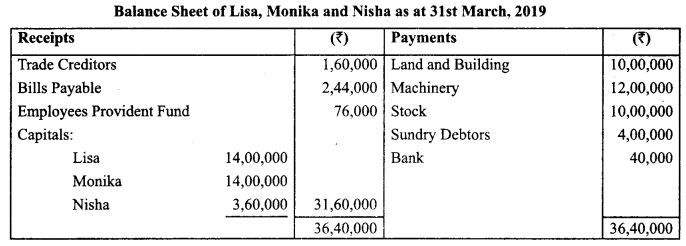

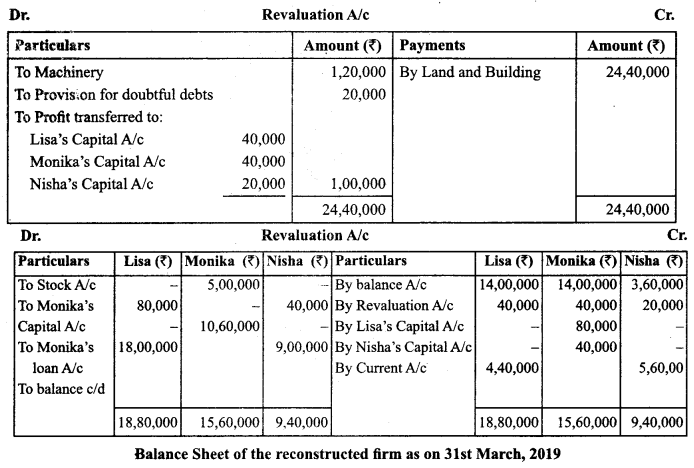

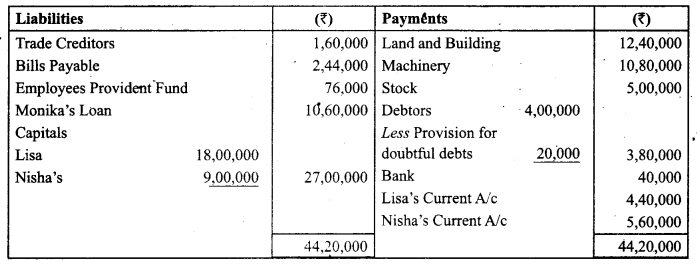

Lisa, Monika and Nisha were partners in a firm sharing profit and losses in the ratio of 2 : 2 : 1. On 31st March, 2019, their Balance Sheet was as follows :

On 31st March, 2019 Monika retired from the firm and the remaining partners decided to carry on the business. It was agreed that:

(i) Land and building be appreciated by ₹ 2,40,00 and machinery be depreciated by 10%.

(ii) 50% of the stock was taken over by the retiring partner at book value.

(iii) Provision for doubtful debts was to be made of 5% on debtors.

(iv) Goodwill of the firm be valued at ₹ 3,00,000 and Monika’s share of goodwill be adjusted in the accounts of Lisa and Nisha.

(v) The total capital of the new firm be fixed at ₹ 27,00,000 which will be in the proportion of the new profit sharing ratio of Lisa and Nisha. For this purpose, current accounts of the partners were to be opened.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance sheet of the reconstituted firm on Monika’s retirement. (CBSE Compt. 2019)

Answer:

Question 5.

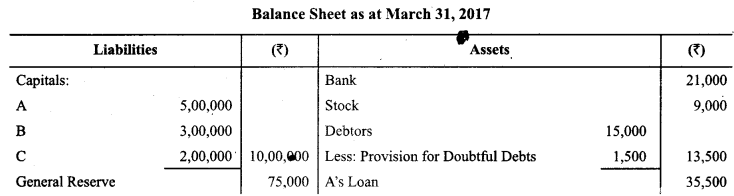

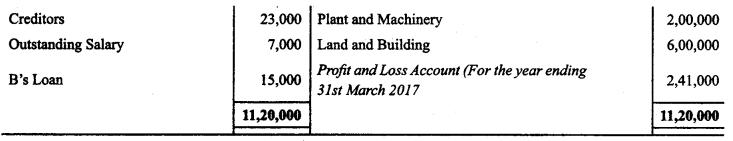

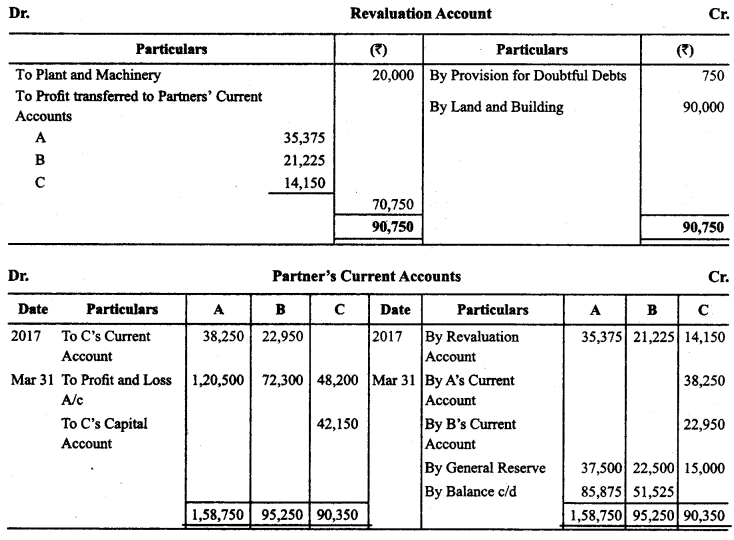

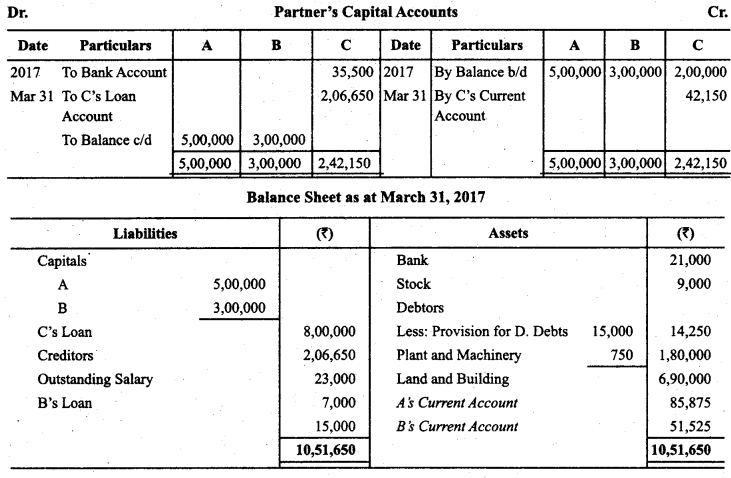

A, B & C were partners in a firm sharing profits & losses in proportion to their fixed capitals. Their Balance Sheet as at March 31, 2017 was as follows

On the date of above Balance Sheet, C retired from the firm on the following terms:

(i) Goodwill of the firm will be valued at two years purchase of the Average Profits of last three years. The Profits for the year ended March 31, 2015 & March 31, 2016 were ₹ 4,00,000 & ₹ 3,00,000 respectively.

(ii) Provision for Bad Debts will be maintained at 5% of the Debtors.

(iii) Land & Building will be appreciated by ₹ 90,000 and Plant & Machinery Will be reduced to ₹ 1,80,000.

(iv) A agreed to repay his Loan.

(v) The loan repaid by A was to be utilized to pay C. The balance of the amount payable to C was transferred to his Loan Account bearing interest @ 12% per annum.

Prepare Revaluation Account, Partners’ Capital Accounts, Partners’ Current Accounts and the Balance Sheet of the reconstituted firm. (CBSE Sample Paper 2017-18)

Answer:

Question 6.

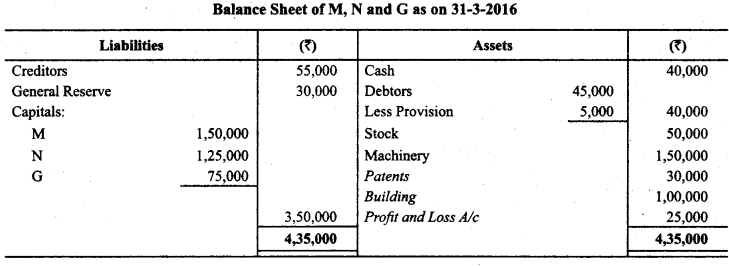

M, N and G were partners in a firm sharing profits and losses in the ratio of 5:3:2. On 31-3-2016 their Balance Sheet was as under:

M retired on the above date and it was agreed that:

(i) Debtors of ₹ 2,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ri) Patents will be completely written off and stock, machinery and building will be depreciated by 5%.

(iii) An unrecorded creditor of ₹ 10,000 will be taken into account.

(iv) N and G will share the future profits in the ratio of 2 : 3.

(v) Goodwill of the firm on M’s retirement was valued at ₹ 3,00,000.

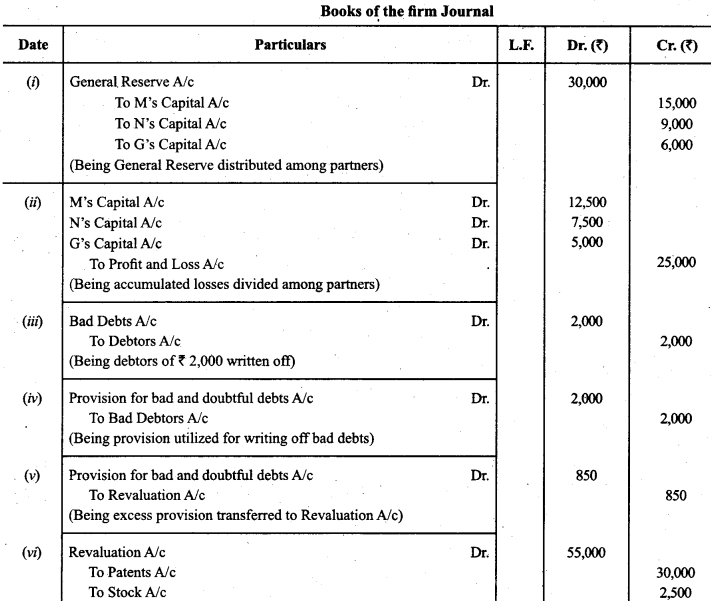

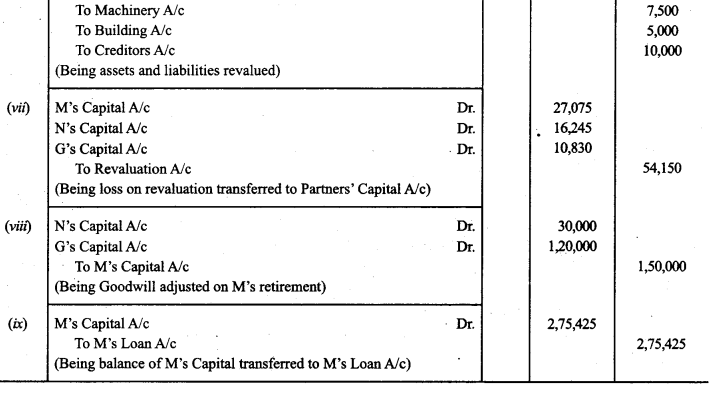

Pass necessary Journal Entries for the above transactions in the books of the firm on M’s retirement. [CBSE Delhi 2017]

Answer:

Question 7.

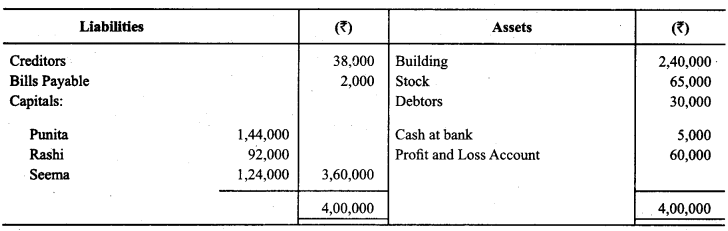

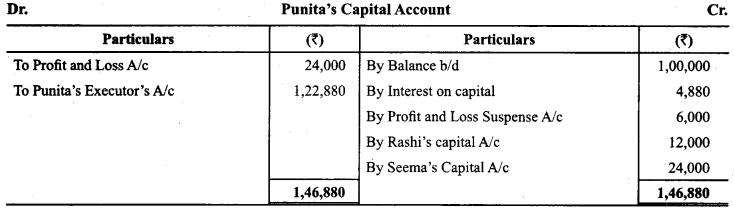

Following is the Balance Sheet of Punita, Rashi and Seema who are sharing profits in the ratio 2:1:2 as on 31st March 2013.

Punita died on 30th September 2013. She had withdrawn 44,000 from her capital on July 1, 2013. According to the partnership agreement, she was entitled to interest on capital @8% p.a. Her share of profit till the date of death was to be calculated on the basis of the average profits of the last three years. Goodwill was to be calculated on the basis of three times the average profits of the last four years. The profits for the years ended 2009-10, 2010-11 and 2011-12 were ₹ 30,000, ₹ 70,000 and₹ 80,000 respectively.

Prepare Punita’s account to be rendered to her executors.

Question 8.

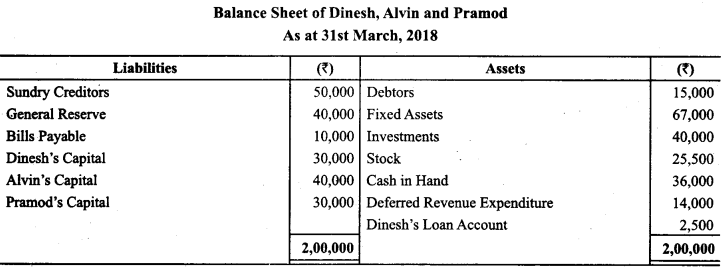

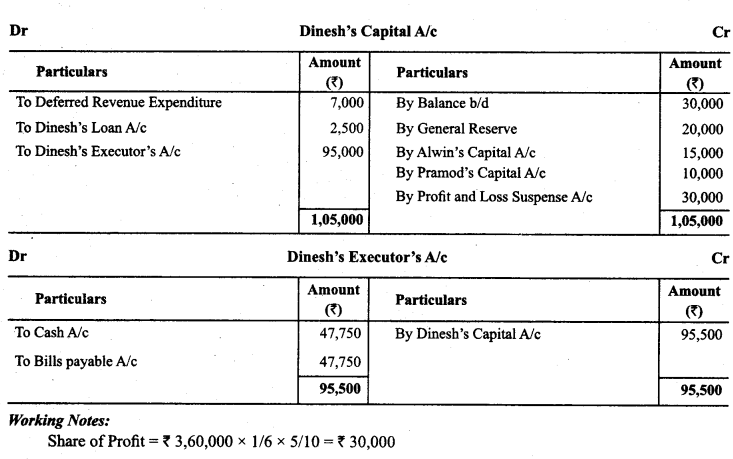

Dinesh, Alvin and Pramod are partners in a firm sharing profits and losses in the ratio of 5:3:2.Their Balance Sheet as at March 31,2018 was as follows:

Dinesh died on July 1,2018, The executors of Dinesh are entitled to:

(i) His share of goodwill. The total goodwill of the firm valued at ₹ 50,000.

(ii) His share of profit up to his date of death on the basis of actual sales till date of death. Sales for the year ended March 31, 2018 was ₹ 12, 00,000 and profit for the same year was ₹ 2,00,000. Sales shows a growth trend of 20% and percentage of profit earning remains the same.

(iii) Investments were sold at par. Half of the amount due to Dinesh was paid to his executors and for the balance, they accepted a Bills Payable.

Prepare Dinesh’s Capital account to be rendered to his executors.

Answer:

Question 9.

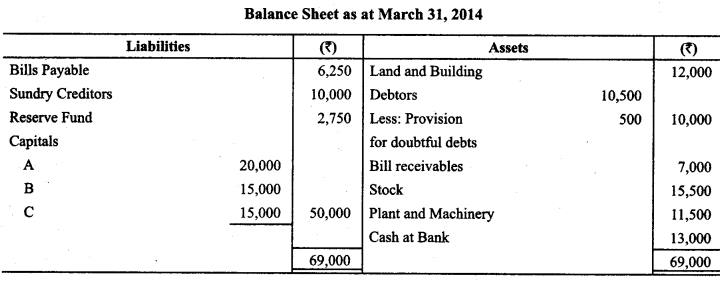

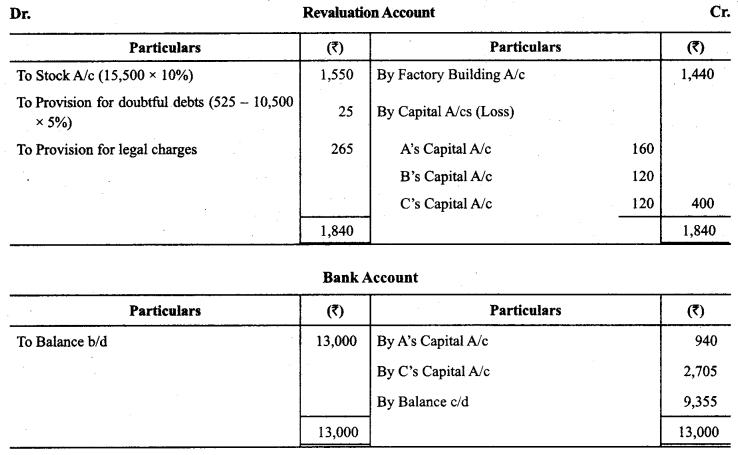

The Balance Sheet of A, B and C who were sharing the profits in proportion to their capitals stood as on March 31,2014,

B retired on the date of Balance Sheet and the following adjustments were to be made:

(a) Stock was depreciated by 10%.

(b) Factory building was appreciated by 12%.

(c) Provision for doubtful debts to be created up to 5%.

(d) Provision for legal charges to be made at X 265.

(e) The goodwill of the firm to be fixed at X 10,000.

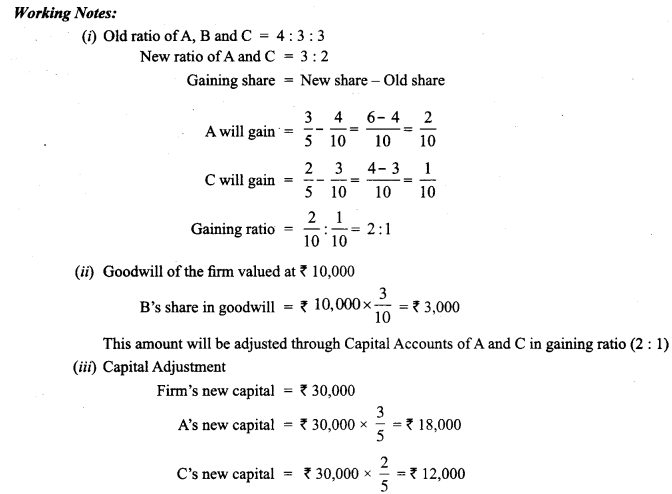

(f) The Capital of the new firm to be fixed at X 30,000. The continuing partners decided to keep their capitals in the new profit sharing ratio of 3 : 2.

Work out ‘he final balances in capital accounts of the firm, and the amounts to be brought in and/or withdrawn by A and C to make their capitals proportionate to their new profit sharing ratio.

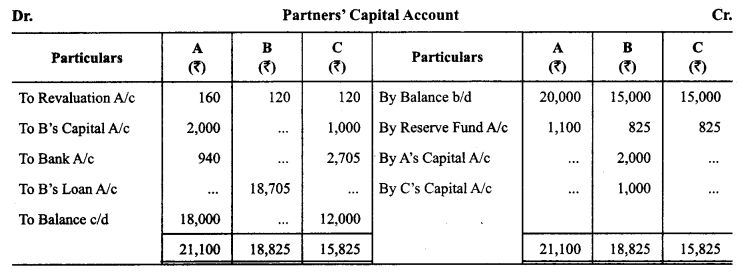

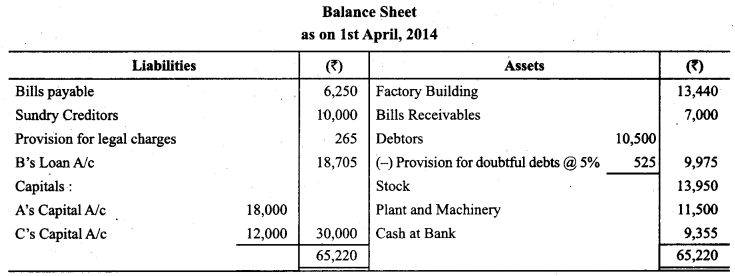

Answer:

Question 10.

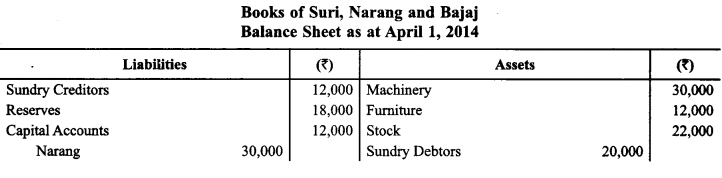

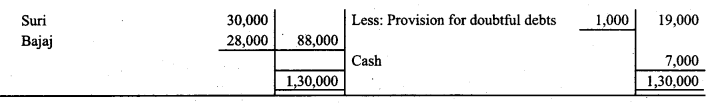

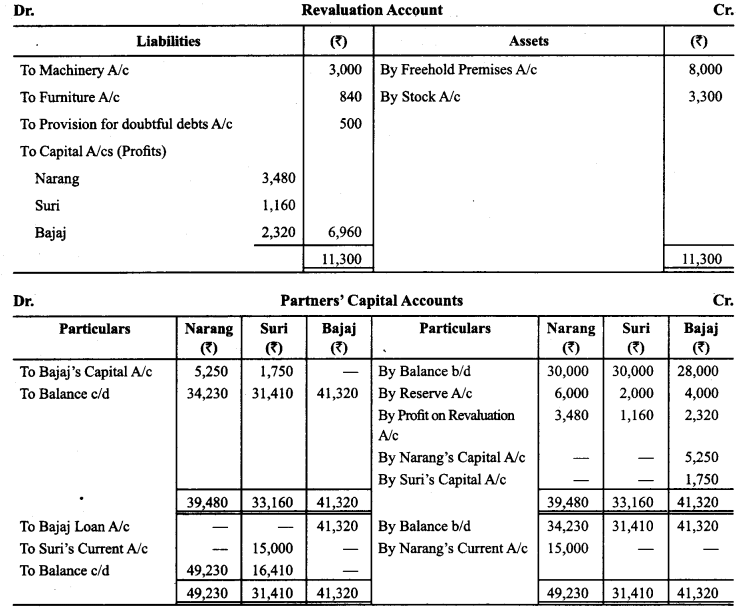

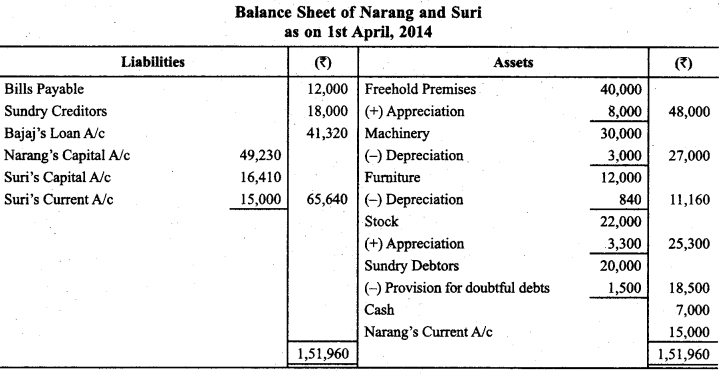

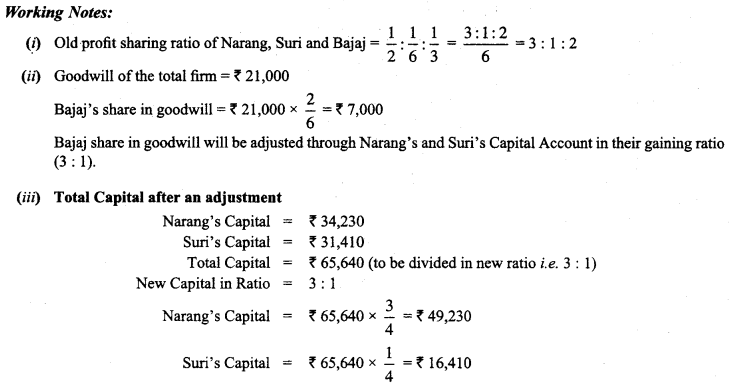

Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of 1/2, 1/6 and 1/3 respectively. The Balance Sheet on April 1, 2014 was as follows:

Bajaj retires from the business and the partners agree to the following:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

(c) Bad Debts reserve is to be increased to ₹ 1,500.

(d) Goodwill is valued at ₹ 21,000 on Bajaj’s retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Bajaj Surplus/deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

Answer:

Question 11.

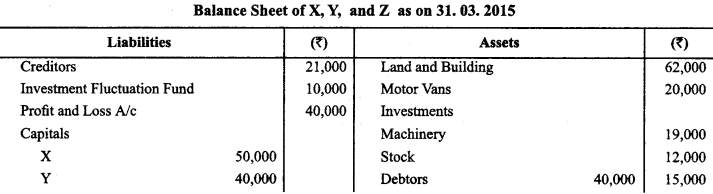

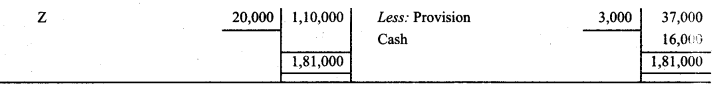

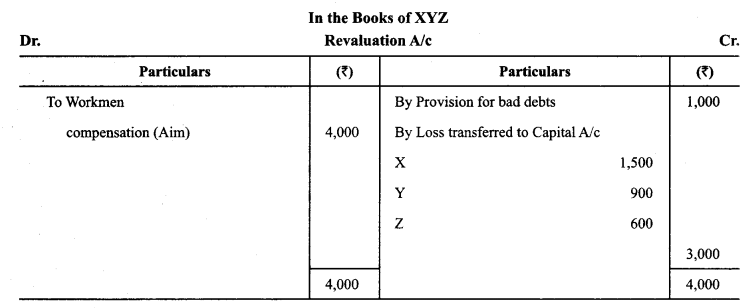

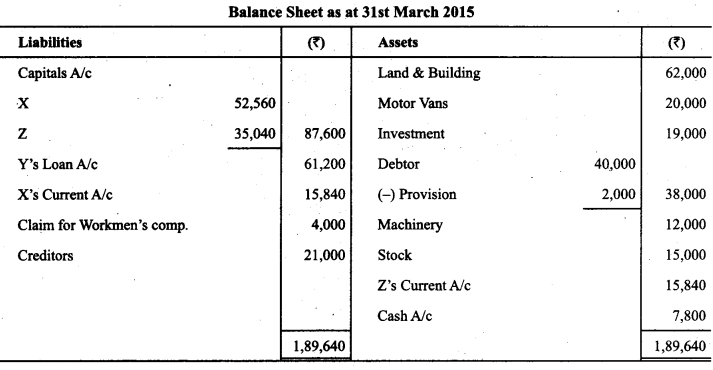

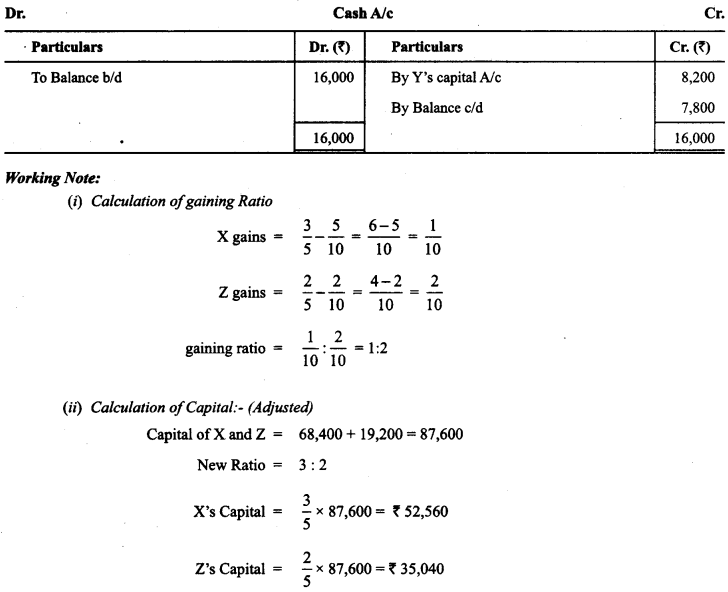

X, Y and Z were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31.3.2015 their Balance Sheet was as follows:

On the above date Y retired and X and Z agreed to continue the business on the following terms :

(i) Goodwill of the firm was valued at ₹ 51,000.

(ii) There was a claim of ₹ 4,000 for workmen’s compensation.

(iii) Provision for bad debts was to be reduced by ₹ 1,000.

(iv) Y will be paid ₹ 8,200 in cash and the balance will be transferred in his loan account which will be paid in four equal yearly instalments together with interest @ 10% p.a.

(v) The new profit sharing ratio between X and Z will be 3 : 2 and their capitals will be in their new profit sharing ratio. The capital adjustments will be done by opening current accounts.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted Firm. (CBSE Outside Delhi 2016)

Answer:

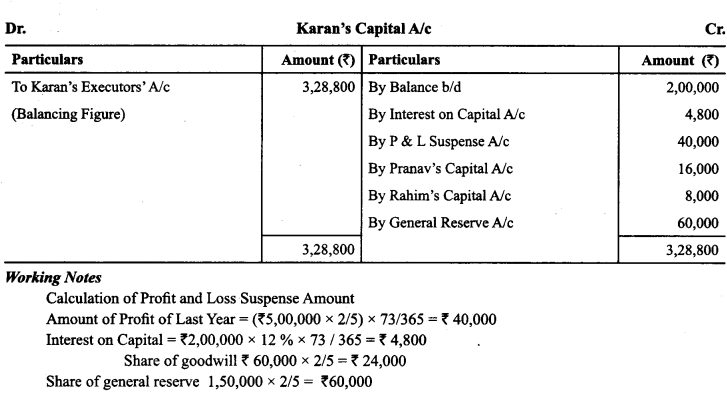

Question 12.

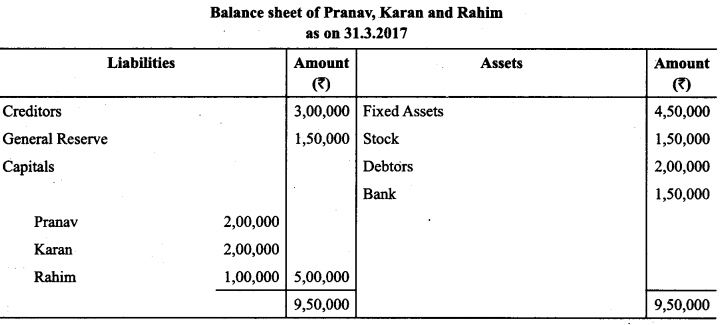

Pranav, Karan and Rahim were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31 st March, 2017 their Balance Sheet was as follows :

Karan died on 12.6.2017. According to the partnership deed, the legal representatives of the deceased partner were entitled to the following :

(i) Balance in his Capital Account.

(ii) Interest on Capital @ 12% p.a.

(iii) Share of goodwill. Goodwill of the firm on Karan’s death was valued at ₹ 60,000.

Share in the profits of the firm till the date of his death, calculated on the basis of last year’s profit. The profit of the firm for the year ended 31.3.2017 was ₹ 5,00,000. Prepare Karan’s Capital Account to be presented to his representatives. (CBSE 2018-19)

Answer: