Here we are providing Class 12 Accountancy Important Extra Questions and Answers Chapter 7 Issue and Redemption of Debentures. Accountancy Class 12 Important Questions and Answers are the best resource for students which helps in class 12 board exams.

Class 12 Accountancy Chapter 7 Important Extra Questions Issue and Redemption of Debentures

Issue and Redemption of Debentures Important Extra Questions Very Short Answer Type

Question 1.

What is meant by ‘Issue of Debentures as Collateral Security’ ? (CBSE Outside Delhi 2019)

Answer:

Debenture issued as secondary security/additional security over and above the primary security is known as Issue of Debentures as Collateral Security.

Question 2.

State the provision of the Companies Act, 2013 for the creation of Debenture Redemption Reserve. (CBSE Outside Delhi 2019)

Answer:

Where a company has issued Debentures, it shall create a DRR equivalent to at least 25% of the nominal value of debentures outstanding for the redemption of such debentures.

Question 3.

Profit arisen on account of buying an existing business at profit is transferred to which account?

Answer:

Capital Reserve.

Question 4.

Name the debentures which continue till the continuity of the company.

Answer:

Irredeemable.

Question 5.

Name the debenture which may be converted into equity shares at specified time.

Answer:

Convertible debentures.

Question 6.

Name the debentures which have charge on the company’s assets.

Answer:

Secured debentures (also known as mortgaged debentures).

Question 7.

When a debenture is issued at a price less than its face value or nominal value, what does such difference represent?

Answer:

Discount.

Question 8.

When debentures are redeemed more than the face value of debenture, What does the difference between face value of debenture and redeemed value of debenture is called?

Answer:

Premium on redemption of debentures.

Question 9.

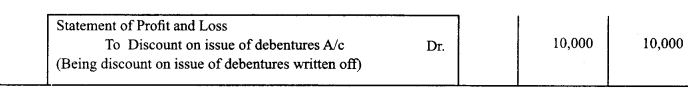

Name the head under which ‘discount on issue of debentures’ appears in the Balance Sheet of a company.

Answer:

Head ‘Current Assets’ and sub-head ‘Other Current Assets’.

Question 10.

What does the repayment or discharge of liability on account of debentures is called?

Answer:

Redemption of debentures.

Question 11.

Under which head is the ‘Debenture Redemption Reserve’ shown in the Balance Sheet?

Answer:

‘Reserve & Surplus’.

Question 12.

When the company issues debentures to the lenders as an additional/secondary security, in addition to other assets already pledged/ some primary security. What does such issue of debentures is called? (CBSE 2018)

Answer:

Issue of dedentures as collateral security.

Question 13.

It is a written instrument acknowledging a debt under the common seal of the company, name the term.

Answer:

Debenture.

Question 14.

State an exception to the creation of Debenture Redemption Reserve as per Companies (Share Capital and Debentures) Rules 18(7). (CBSE Sample Paper 2014 Modified)

Answer:

Banking Companies

Question 15.

Mention the type of debentures whose ownership passes on mere delivery of debenture certificates.

Answer:

Bearer debentures.

Question 16.

Can ‘Securities Premium’ be used as working capital?

Answer:

No.

Question 17.

A company purchased net assets of another company worth ₹ 20,00,000 and issued debentures worth ₹ 19,00,000. What type of profit has the buying company made?

Answer:

Capital Profit.

Question 18.

Vikas Infrastructure Ltd. has issued 50,000, 10% debentures of ₹ 100 each at par redeemable after the end of 7th year. Mention the amount by which the company should create Debenture Redemption Reserve as per Companies (Share Capital and Debentures) Rules 2014 before starting redemption of debenture. Answer with giving reason.

Answer:

₹ 12,50,000.

Question 19.

Axis Ltd. has issued 8,000, 10% debentures of₹ 100 at a premium of ₹ 5 per debenture redeemable at the end of 5 years. The company has created Debenture Redemption Reserve with ₹ 4,00,000. After 5 years, the company redeemed all the debentures ₹ Where should the company transfer the amount of Debenture Redemption Reserve?

Answer:

General Reserve.

Issue and Redemption of Debentures Important Extra Questions Short Answer Type

Question 1.

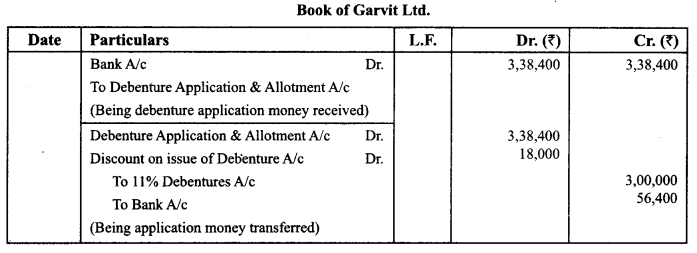

Garvit Ltd. invited applications for issuing 3,000, 11% Debentures of₹ 100 each at a discount of 6%. The full amount was payable on application. Applications were received for 3,600 debentures. Applications for 600 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants.

Pass the necessary journal entries for the above transactions in the books of Garvit Ltd. (CBSE Delhi 2019)

Answer:

Question 2.

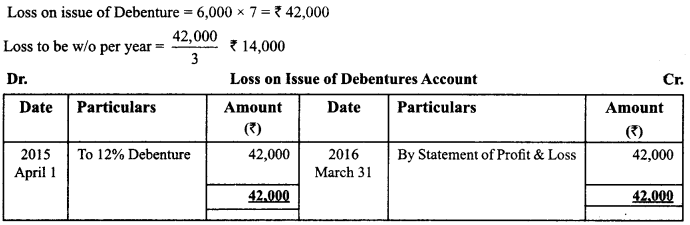

On 1st April 2015, P Ltd. Issued 6,000 12% Debentures of ₹ 100 each at par redeemable at a premium of 7%. The Debentures were to be redeemed at the end of third year. Prepare Loss on issue of 12% Debentures Account. (CBSE Delhi 2019)

Answer:

Question 3.

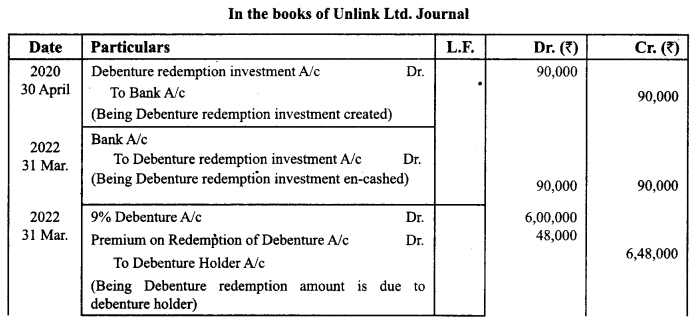

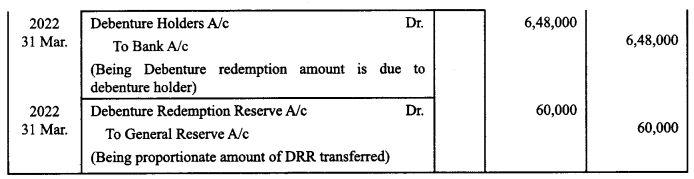

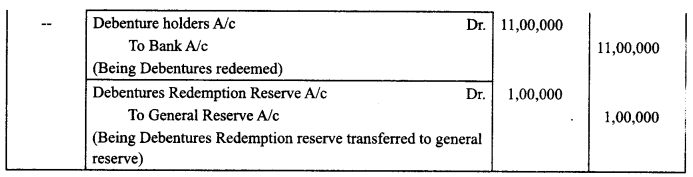

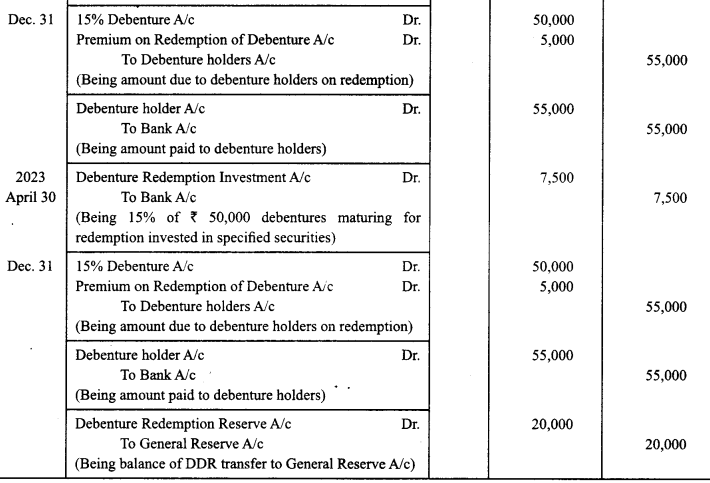

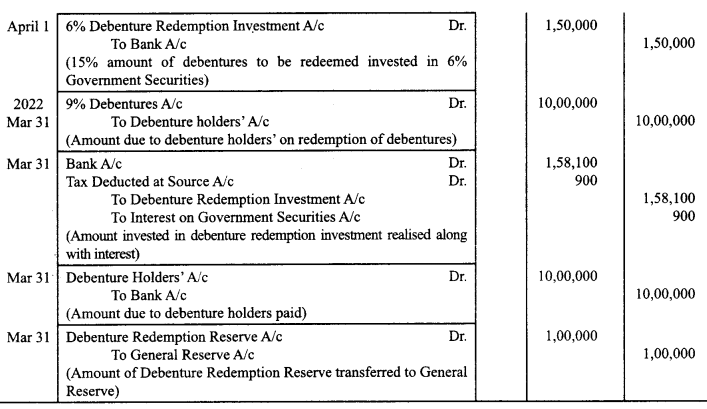

Unilink Ltd. (An unlisted company) had outstanding ₹ 12,00,000, 9% debentures on 1st April, 2020 redeemable at a premium of 8% in two equal annual instalments starting from 31st March, 2022. The company had a balance of₹ 1,20,000 in Debenture Redemption-Reserve on 31st March, 2020. Pass the necessary journal entries for redemption of debentures in the books of Unilink Ltd. for the year ended 31st March, 2022. . (CBSE Delhi 2019, Modified)

Answer:

Note: This question has been updated as per Companies (Share Capital and Debentures) Amendment Rules, 2019.

Question 4.

Krishna Ltd. (An unlisted company) had outstanding 20,000,9% debentures of₹ 100 each on 1st April, 2014. These debentures were redeemable at a premium of 10% in two equal instalments starting from 31 st March, 2021. The company had a balance of ₹2,00,000 in Debenture Redemption Reserve on 31 st March, 2020.

Pass necessary journal entries for redemption of debentures in the books of Krishna Ltd. for the year ended 31st March, 2018. (CBSE Delhi 2019, Modified)

Answer:

Note: This question has been updated as per Companies (Share Capital and Debentures) Amendment Rules, 2019.

Question 5.

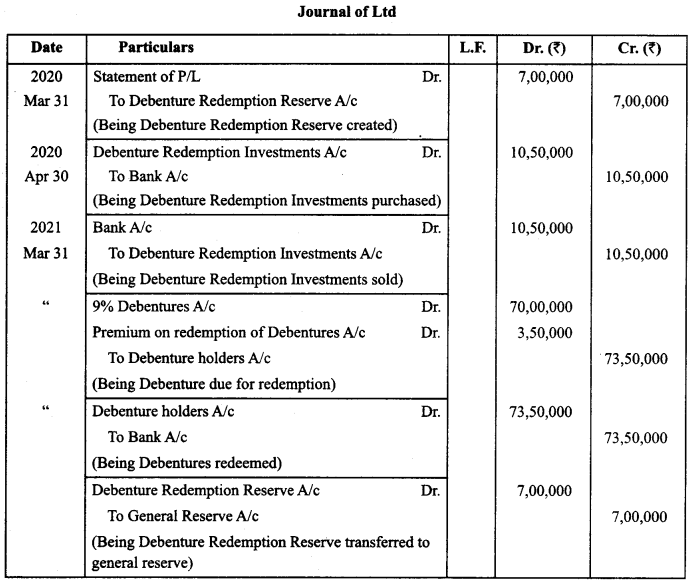

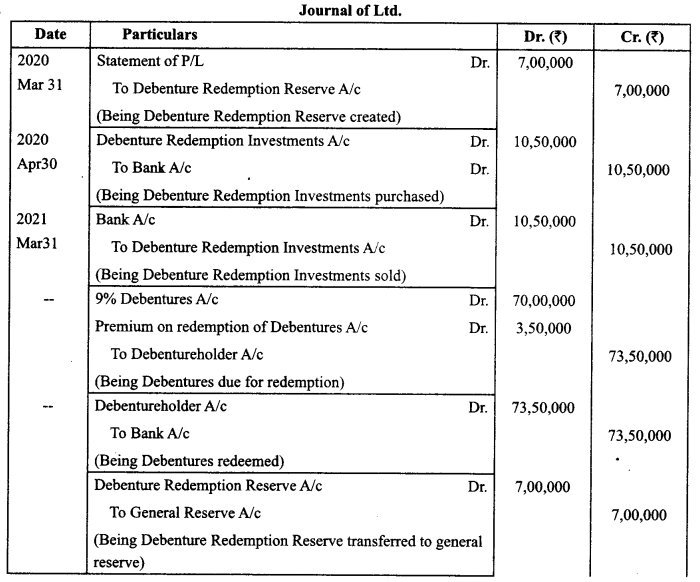

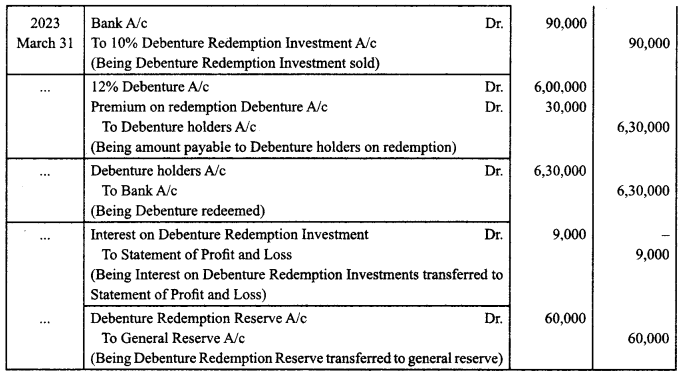

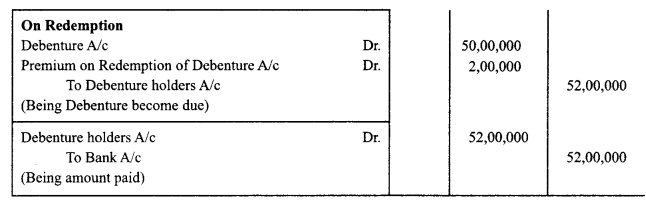

On 1st April, 2013 Anushka Ltd. (An unlisted companies) issued ₹70,00,000, 9% debentures of ₹ 100 each at par, redeemable at a premium of 5% on 31 st march, 2021. The company created the necessary, minimum amount of debenture redemption reserve and purchased debenture redemption reserve investments. The debentures were redeemed on 31 st March, 20121. Pass necessary journal entries for the redemption of debentures, in the books of the company.

(CBSE Delhi 2019, Modified)

Answer:

Note: This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

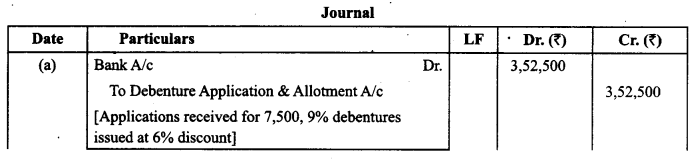

Question 6.

Pass necessary journal entries and prepare 9% Debentures Account for the issue of 7,500,9% Debentures of ₹ 50 each at a discount of 6%, redeemable at a premium of 10%. (CBSE Delhi 2019, Modified)

Answer:

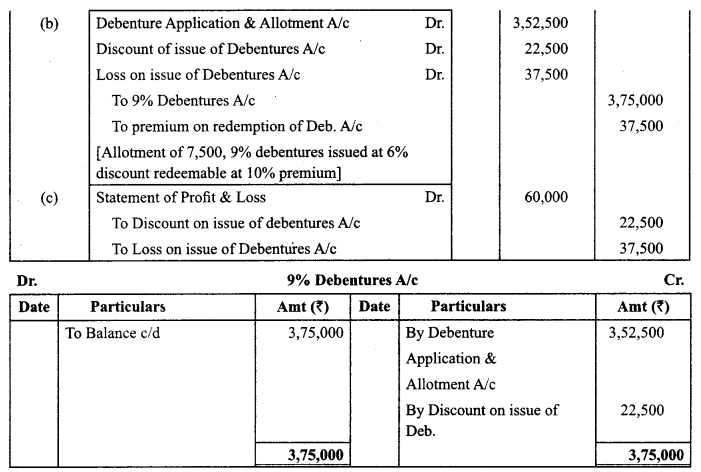

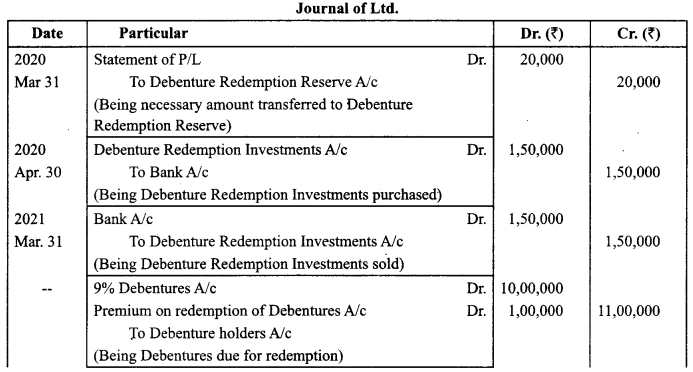

Question 7.

Krishna Ltd. had (an unlisted company) outstanding 20,000, 9% debentures of₹ 100 each on 1st April, 2014.. These debentures were redeemable at a premium of 10% in two equal instalments starting from 31st March, 2021.

The company had a balance of₹ 1,80,000 in Debenture Redemption Reserve on 31st March, 2020.

Pass necessary journal entries for redemption of debentures in the books of Krishna Ltd. for the year ended 31 st March, 2021. (CBSE Outside Delhi 2019, Modified)

Answer:

Note: This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

Question 8.

On 1 st April, 2013 Anushka Ltd. (unlisted company) issued ₹70,00,000, 9% debentures of ₹ 100 each at par, redeemable at a premium of 5% on 31 st march, 2021. The company created the necessary, minimum amount of debenture redemption reserve and purchased debenture redemption reserve investments. The debentures were redeemed on 31st March, 2021.

Pass necessary journal entries for the redemption of debentures, in the books of the company.

Answer:

Note: This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

Question 9.

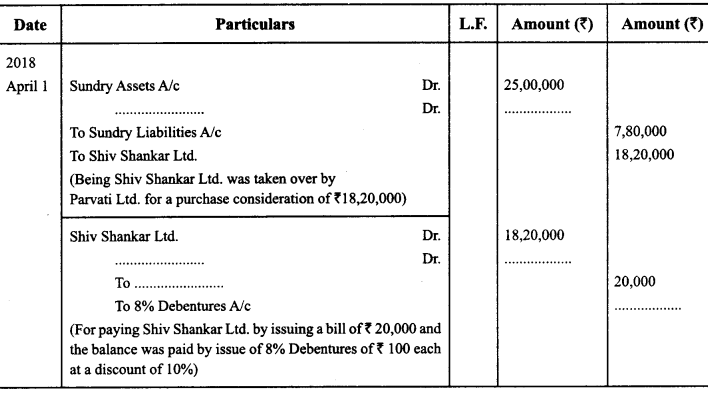

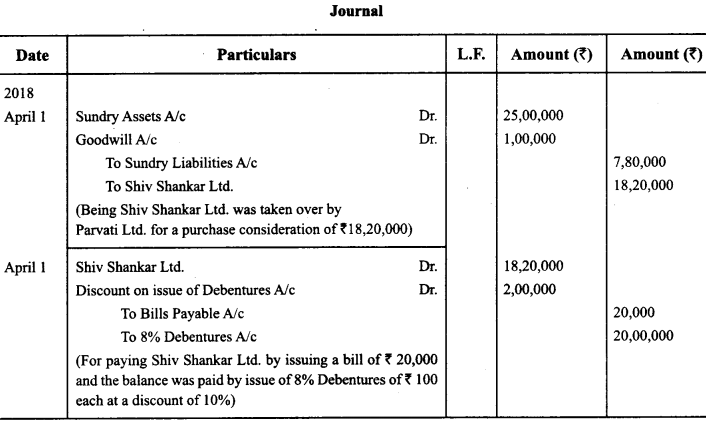

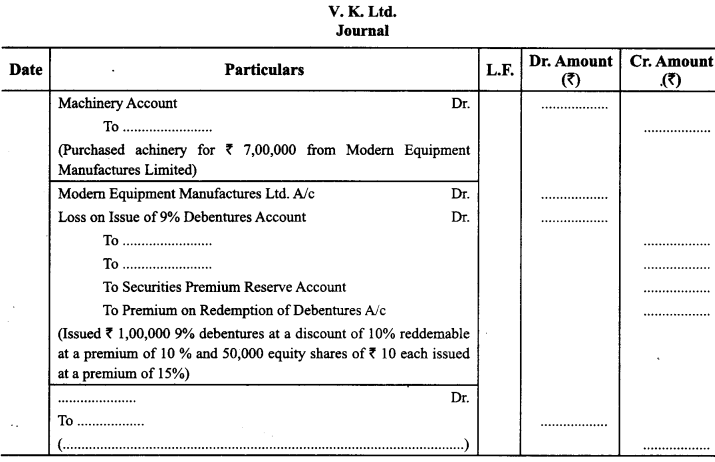

Complete the following Journal Entries

Answer:

Question 10.

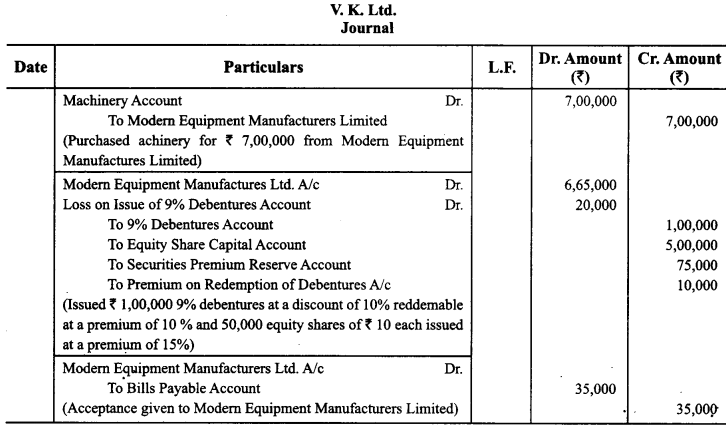

V K Limited purchased machinery from Modem Equipment Manufacturers Limited. The company paid the vendors by issue of some equity shares and debentures and the balance through an acceptance in then- favour payable after three months. The accountant of the company, while Journalising the above mentioned transactions, left some items blank. You are required to fill in the blanks.

Answer:

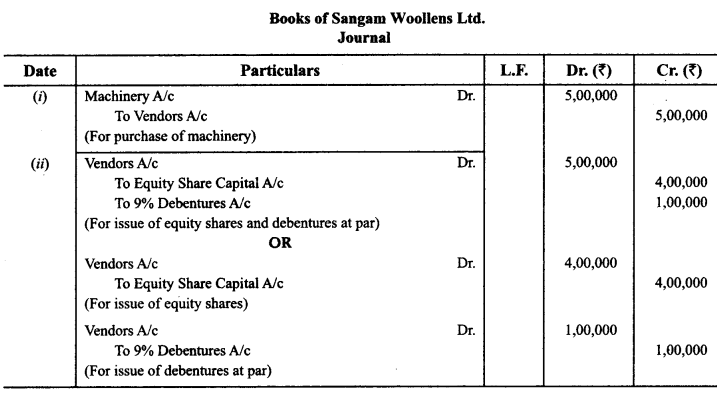

Question 11.

‘sangam Wooilens Ltd’, Ludhiana, are the and exporters of garments. The company decided to distribute free of cost oUes. garments to 10 villages of lahual and spiti district of Himachal Pradesh. The company also decided to employ 50 young persons from these villages in its newly established factory. The company issued 40,000 equity shares of’ 10 each and 1,000 9% debentures of’ 100 each to the vendors for the purchase of machinery of’ 5,00,000.

Pass necessary Journal Entries. (Dehli 2015, Modified)

Answer:

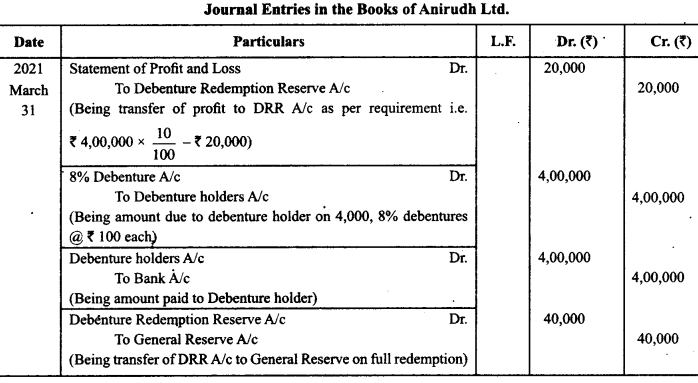

Question 12.

Anirudh Limited (Listed company) has 4,000, 8% debentures of₹ 100 each due for redemption on March 31, 2022. The company has a DRR of ₹ 20,000 on that date. Assuming that no interest is due. Record the necessary journal entries at the time of redemption of debentures.

Answer:

Note: This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

Question 13.

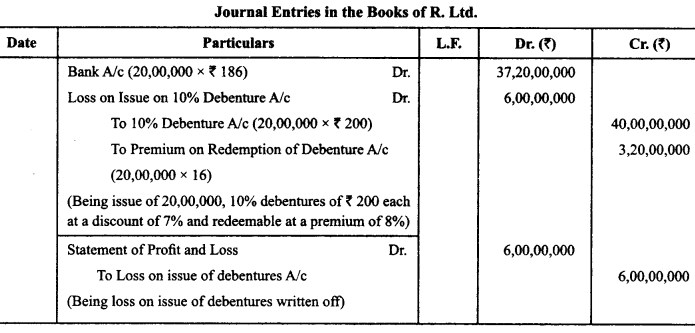

R. Ltd. offered 20,00,000,10% Debenture of₹ 200 each at a discount of redeemable at premium of 8% after 9 years. Record necessary entries in the book of R. Ltd.

Answer:

Question 14.

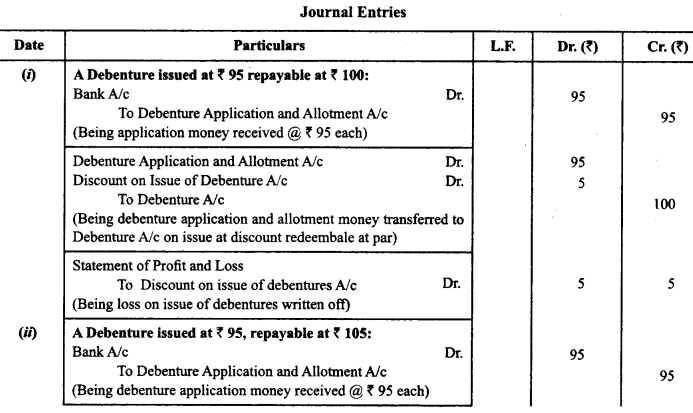

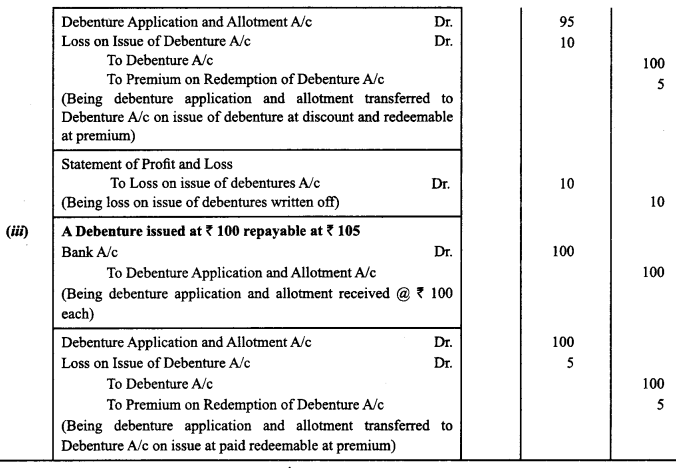

Journalise the following:

(i) A debenture issued at ₹ 95, repayable at ₹ 100;

(ii) A debenture issued at ₹ 95, repayable at ₹ 105; and

(iii) A debenture issued at ₹ 100 repayable at ₹ 105;

The face value of debenture in each of the above cases is ₹ 100.

Answer:

Question 15.

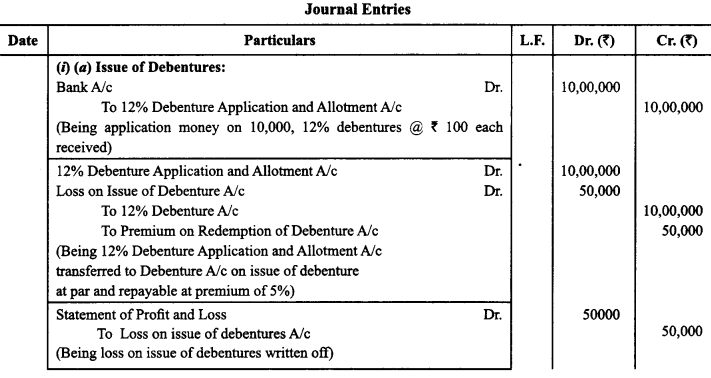

A Company issues the following debentures:

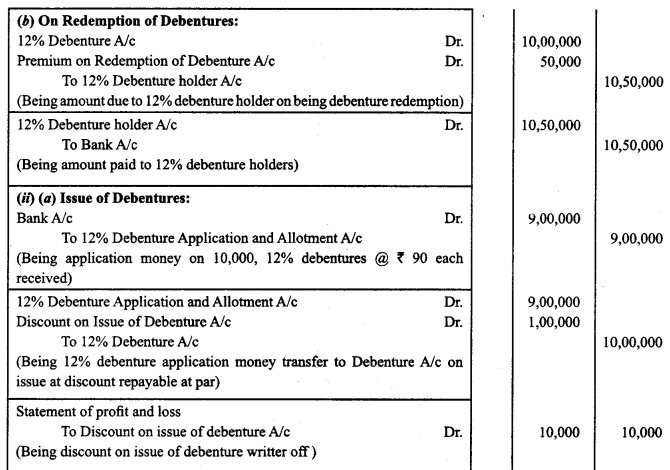

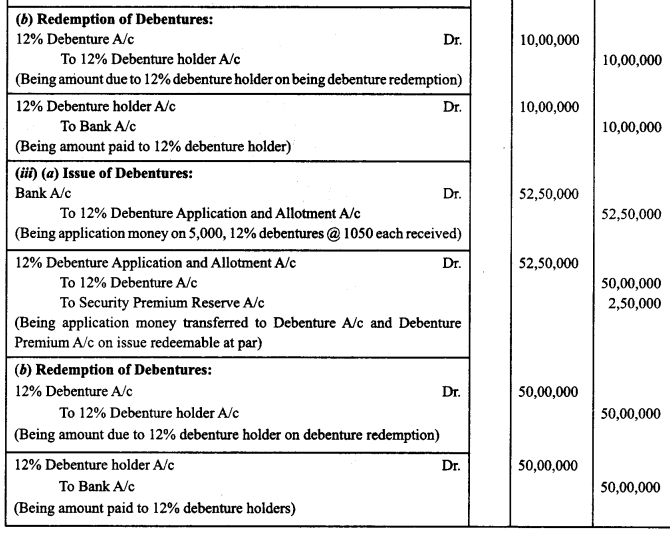

(i) 10,000,12% debentures of₹ 100 each at par but redeemable at premium of 5% after 5 years;

(ii) 10,000,12% debentures of₹ 100 each at a discount of 10% but redeemable at par after 5 years;

(iii) 5,000,12% debentures of₹ 1,000 each at a premium of 5% but redeemable at par after 5 years;

Answer:

Question 16.

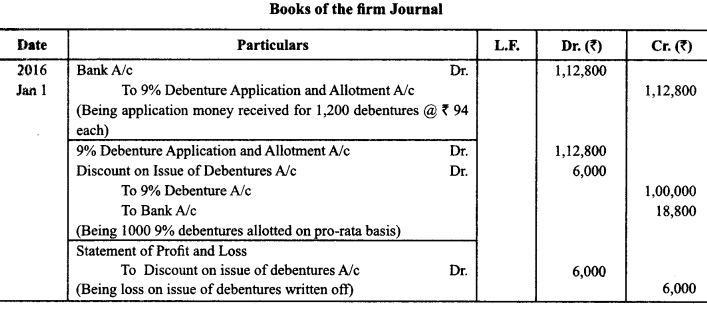

X Ltd. invited applications for issuing 1000,9% debentures of₹ 100 each at a discount of 6%. Applications for 1,200 debentures were received. Pro-rata allotment was made to all the applicants. Pass necessary Journal Entries for the issue of debentures assuming that the whole amount was payable with applications. [Delhi 2017]

Answer:

Question 17.

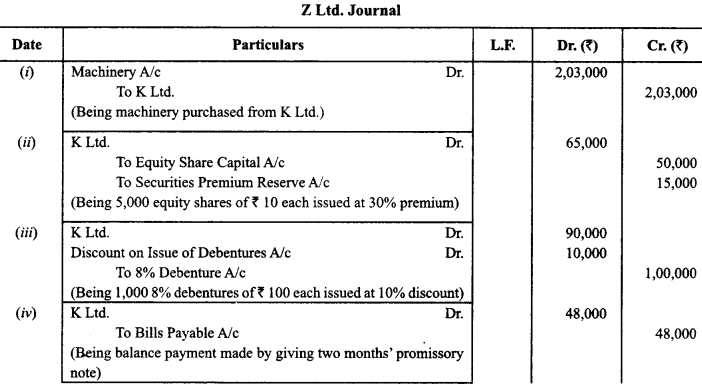

Z Ltd. purchased machinery from K Ltd. Z Ltd paid K Ltd as follows:

(i) By issuing 5,000 equity shares of ₹ 10 each at a premium of 30%.

(ii) By issuing 1000, 8% Debentures of₹ 100 each at a discount of 10%.

(iii) Balance by giving a promissory note of ₹ 48,000 payable after two months.

Pass necessary journal entries for the purchase of machinery and payment to K Ltd. in the books of Z Ltd. [Delhi 2017]

Answer:

Question 18.

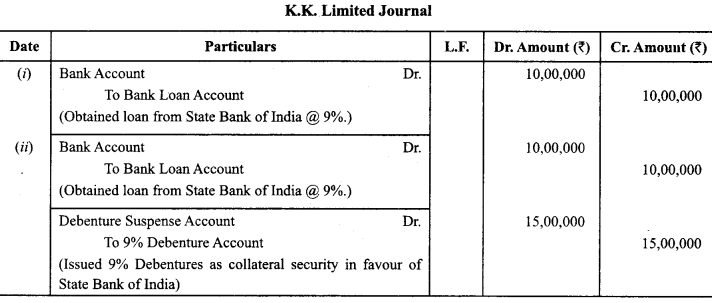

K K Limited obtained a loan of₹ 10,00,000 from State Bank of India @ 9 % interest. The company issued ₹ 15,00,000, 9 % debentures of₹ 100/- each, in favour of State Bank of India as collateral security. Pass necessary Journal entries for the above transactions:

(i) When company decided not to record the issue of 9 % Debentures as collateral security.

(ii) When company decided to record the issue of 9 % Debentures as collateral security. (CBSE Sample Paper 2018-19, 2017-18)

Answer:

Question 19.

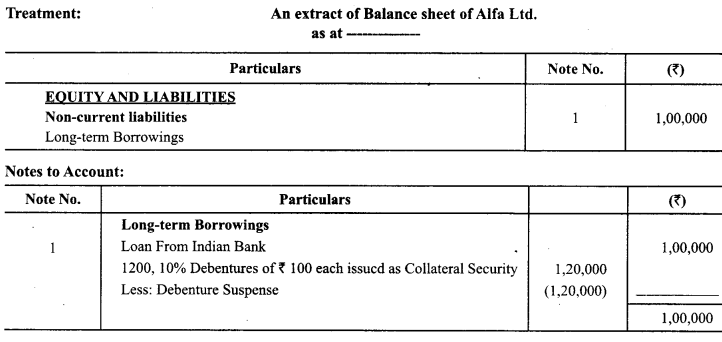

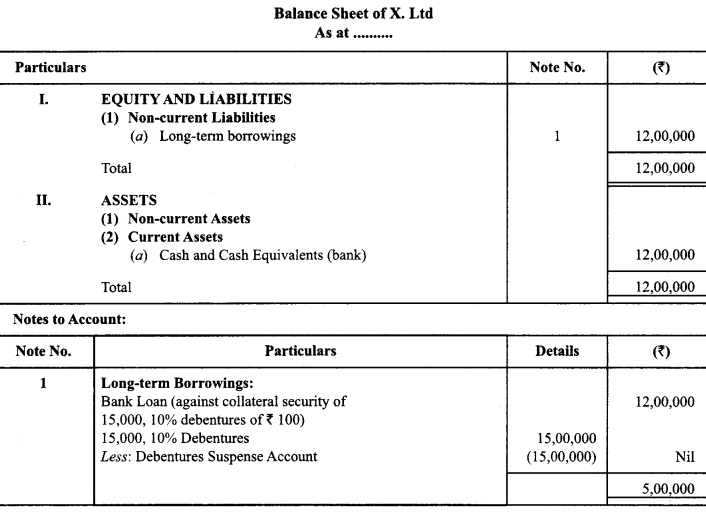

Explain with an imaginary example how issue of debenture as collateral security is shown in the balance sheet of a company when it is recorded in the books of accounts. (CBSE Sample Paper 2016, 2017)

Answer:

Alfa Ltd. obtained Loan of 1,00,000 from Indian Bank and issued 1200, 10% Debentures of 100 each as Collateral security.

Treatment: An extract of Balance sheet of Alfa Ltd.

Question 20.

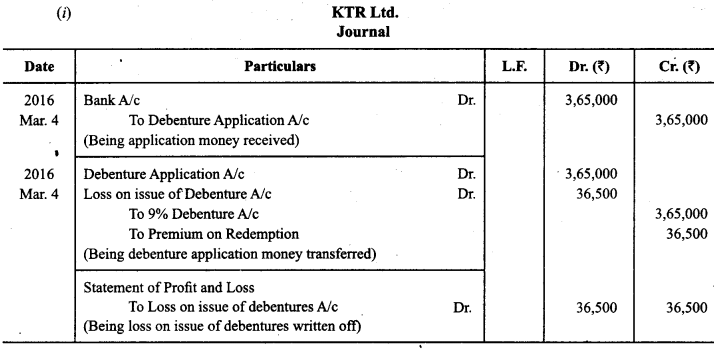

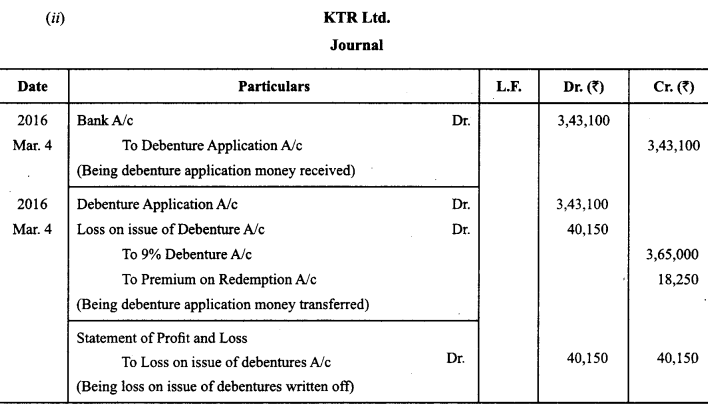

KTR Ltd., issued 365, 9% Debenture of 7’1,000 each on 4.3.2016. Pass necessary journal entries for the issue of debenture in the following situations : (CBSE Outside Delhi 2016)

(i) When debentures were issued at per redeemable at a premium of 10%.

(ii) When debentures were issued at 6% discount redemable at 5% premium.

Answer:

Question 21.

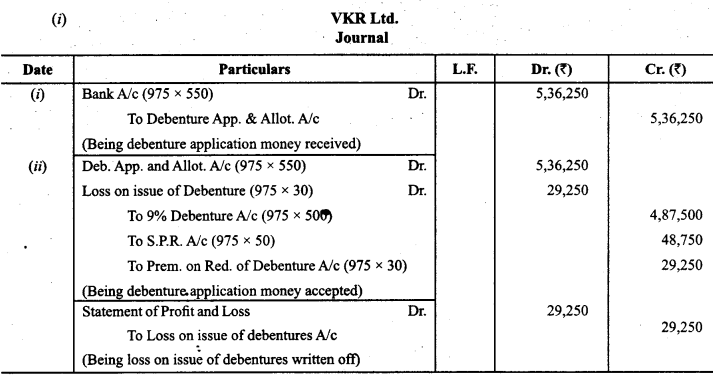

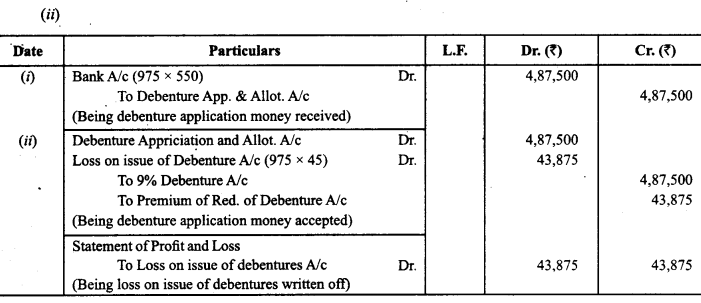

VKR Ltd. issued 975; 9% Debentures of 7 500 each on 4.3.2016. Pass necessary journal entries for the issue of debentures under the following situations:

(i) When debentures were issued at a premium of 10% redeemable at a premium of 6%.

(ii) When debentures were issued at a par redeemable at 9% premium. (CBSE Outside Delhi 2016)

Answer:

Question 22.

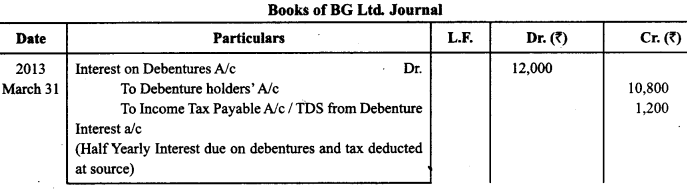

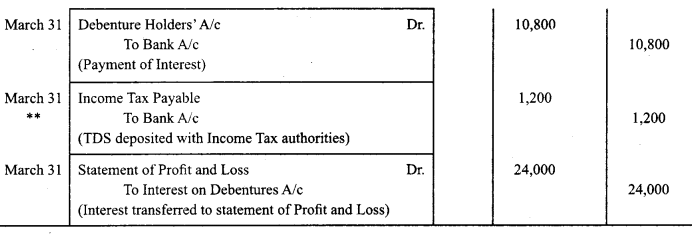

BG. Ltd. issued 2,000, 12% debentures of (100 each on 1st April 2012. The issue was fully subscribed. According to the terms of issue, interest on the debentures is payable half-yearly on 30s1 September and 31st March and the tax deducted at source is 10%. Pass necessary journal entries related to the debenture interest for the half-yearly ending 3151 March, 2013 and transfer of interest on debentures of the year to the Statement of Profit & Loss. . (CBSE Delhi 2014, Set I, II)

Answer:

Question 23.

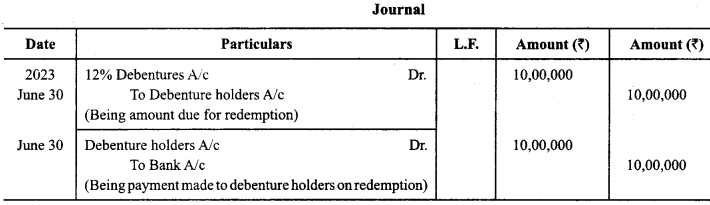

Jan Dhan Bank, an All India Financial Institution, had 10,000,12% debentures of₹ 100 each, outstanding as at 31st March, 2022. These debentures were due for redemption on 30th June, 2023. Pass necessary Journal Entries for redemption of debentures. Also, state the amount of Debenture Redemption Reserve to be created for the purpose of redemption. (CBSE Sample Paper 2018-19, Modified)

Answer:

Note:

According to Section 71(4) of the Companies Act, 2013 and Companies (Share Capital & Debentures) Amendment Rules, 2019, an All India Financial Institution is not required to create Debenture Redemption Reserve.

Question 24.

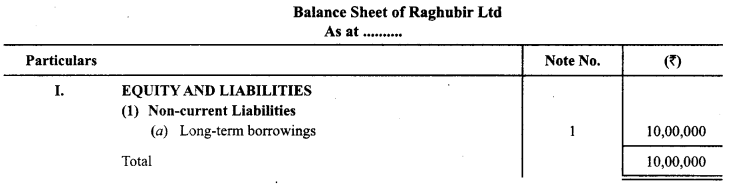

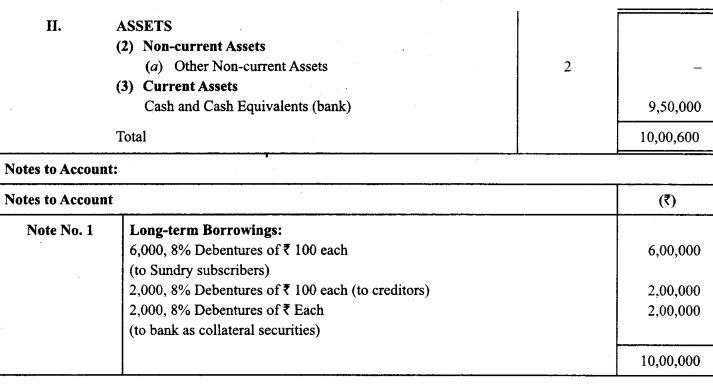

Raghuveer Limited created 10,00,000, 8% debentures stock which was issued as follows to:

1. Sundry subscribers for cash at 90%

2. Creditors for ₹ 2,00,000 capital expenditure in satisfaction of his claim

3. Bankers as collateral securities for a bank loan

worth ₹ 20,00,000 for which principal security is business premises worth

The issue (1) and (2) are redeemable at the end of 10 years at par. State how the debenture stock be dealt with while preparing the balance sheet of a company.

Answer:

Question 25.

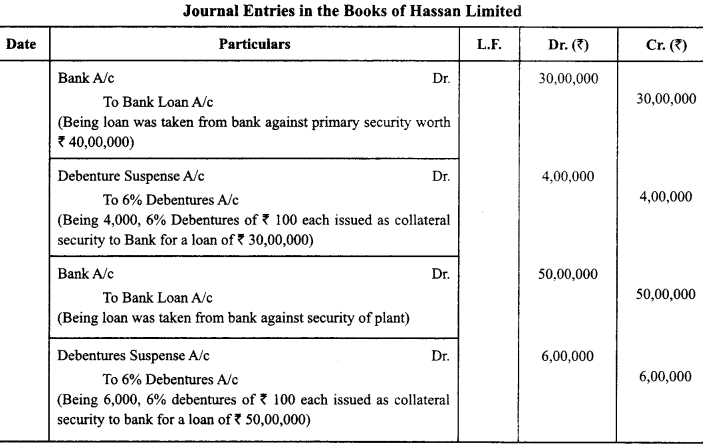

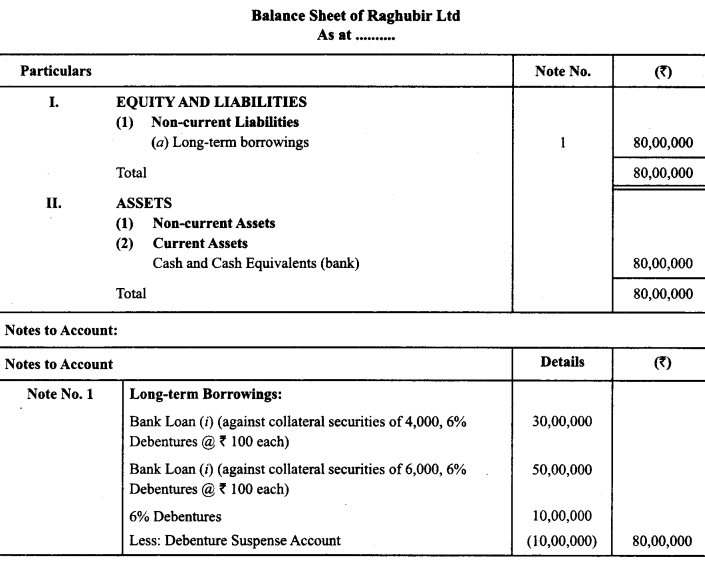

Hassan Limited took a loan of ₹ 30,00,000 from a bank against primary security worth ₹ 40,00,000 and . issued 4,000, 6% debentures of₹ 100 each as a collateral security. The company again after one year took a loan of ₹ 50,00,000 from bank against plant as primary security and deposited 6,000, 6% debentures of₹ 100 each as collateral security. Record necessary journal entries and prepare balance sheet of the company.

Answer:

Question 26.

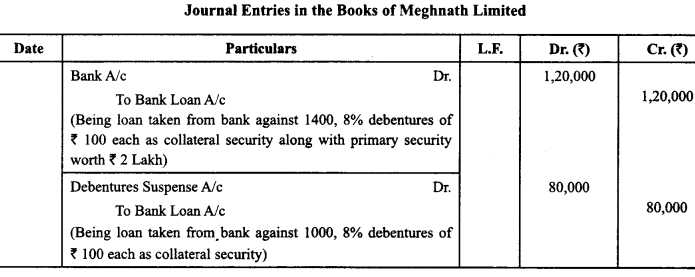

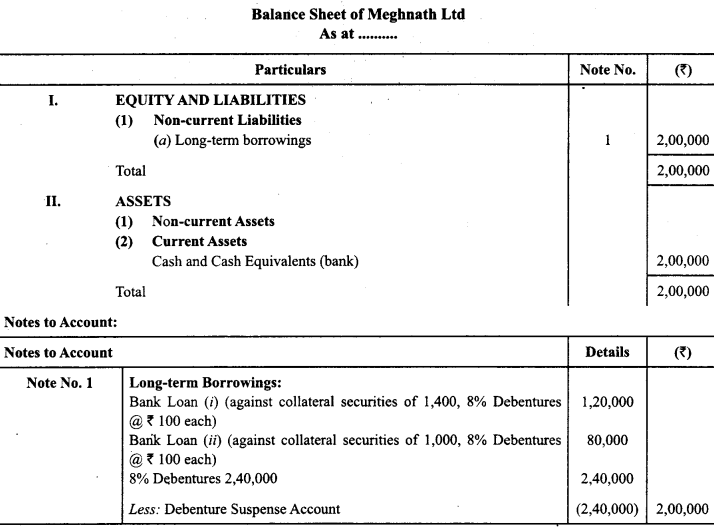

Meghnath Limited took a loan of ₹ 1,20,000 from a bank and deposited 1,400, 8% debentures of ₹ 100 each as collateral security along with primary security worth ₹ 2 Lakhs. Company again took a loan of ₹ 80,000 after two months from a bank and deposited 1,000, 8% debentures of ₹ 100 each as collateral security. Record necessary journal entries and prepare a balance sheet of a company.

Answer:

Question 27.

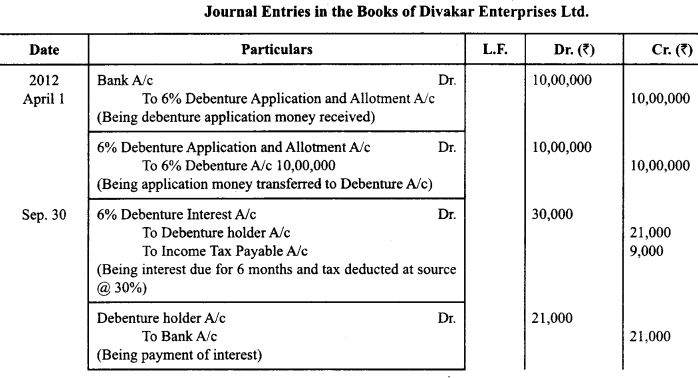

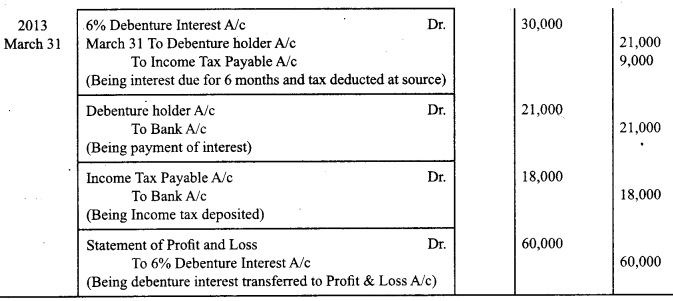

Diwakar Enterprises Ltd. issued 10,00,000, 6% debentures on April 1, 2008. Interest is paid on September 30, 2012 and March 31, 2013.

Record necessary journal entries assuming that income tax is deducted @ 30% of the amount of interest.

Answer:

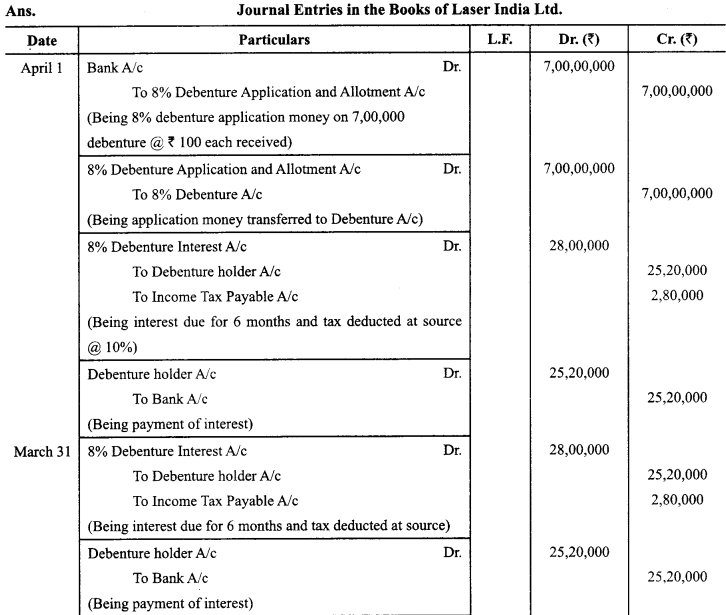

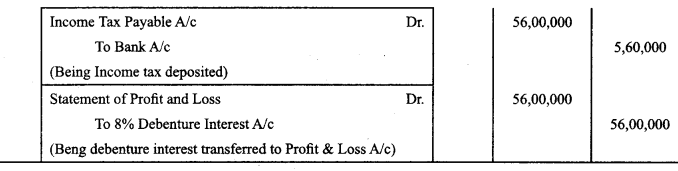

Question 28.

Laser India Ltd. issued 7,00,000, 8%. debentures of₹ 100 each at par. Company deducts income tax from the interest of these debentures at source. Interest is to be paid on these debentures half yearly on September 30 and March 31, every year. Amount of income tax deducted half yearly is ₹ 2,80,000.

Answer:

Question 29.

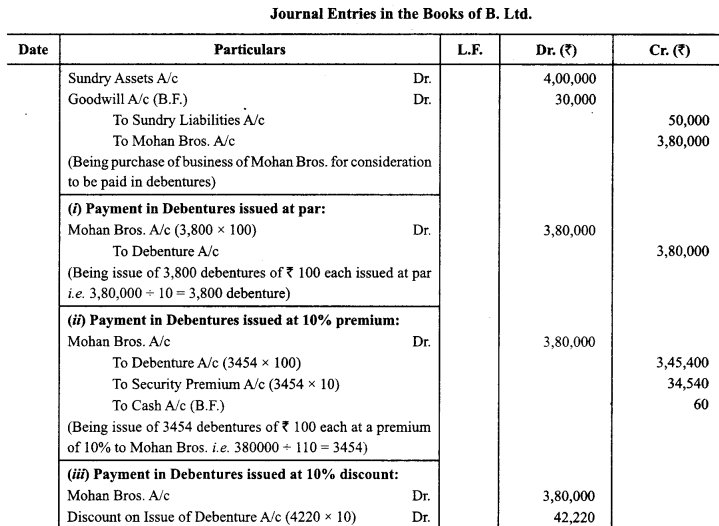

B. Ltd. purchased assets of the book value of ₹ 4,00,000 and took over the liability of ₹ 50,000 from Mohan Bros. It was agreed that the purchase consideration settled at ₹ 3,80,000 be paid by issuing debentures of₹ 100 each.

What journal entries will be made in the following three cases, if debentures are issued: (a) at par; (b) at a discount of 10%, (c) at a premium of 10%₹ It was agreed that a fraction of debentures be paid in cash.

Answer:

Question 30.

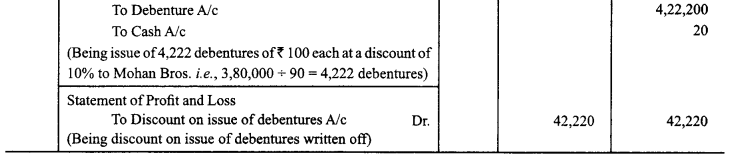

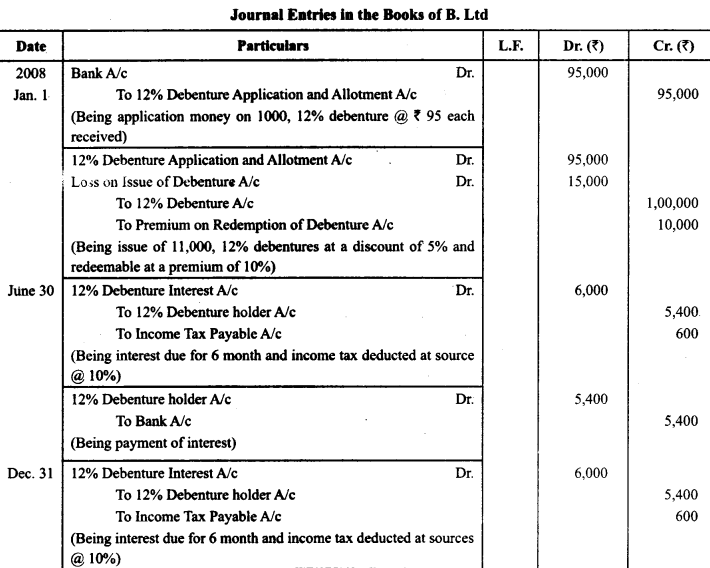

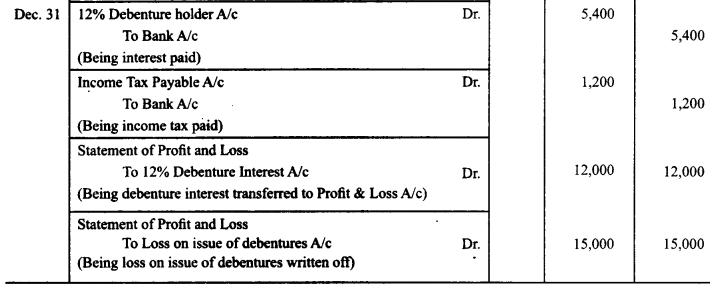

B. Ltd. issued 1,000,12% debentures of₹ 100 each on January 01,2008 at a discount of 5% redeemable at a premium of 10%.

Give journal entries relating to the issue of debentures and debentures interest for the period ending December 31,2008 assuming that interest is paid half yearly on June 30 and December 31 and tax deducted at sources is 10%. B. Ltd. follows calendar year as its accounting year.

Answer:

Issue and Redemption of Debentures Important Extra Questions Long Answer Type

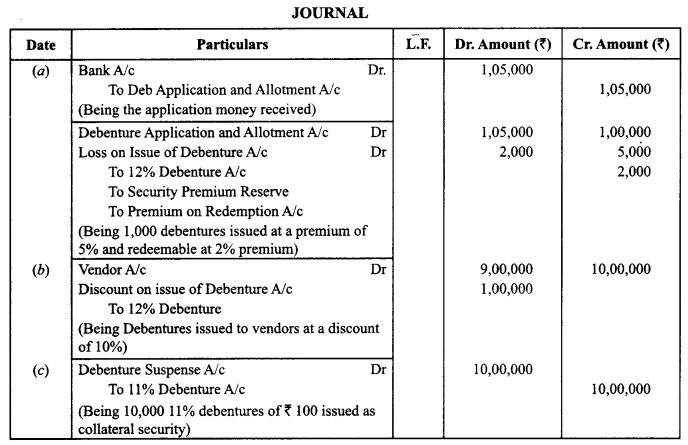

Question 1.

Journalise the following transactions

(a) Mehar Ltd. issued ₹ 1,00,000, 12% Debentures of ₹ 100 each at a premium of 5% redeemable at a premium of 2%

(b) 12% Debentures • were issued at a discount of 10% to a vendor of machinery for payment of ₹ 9,00,000

(c) Issue of 10,000 11% debentures of₹ 100 each as collateral in favour of State Bank of India. Company

opted to pass necessary entry for issue of debentures. (CBSE Sample Paper 2019-20)

Answer:

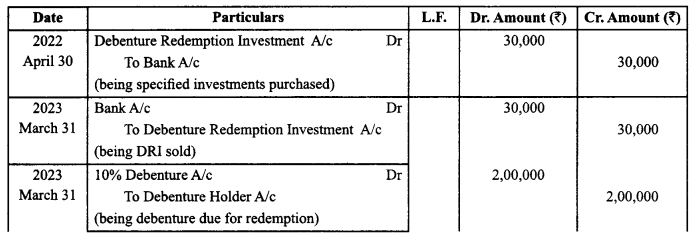

Question 2.

Faith and Belief Ltd has total redeemable debentures of₹ 5,00,000. It decides to redeem these debentures in two instalments of₹ 3,00,000 and ₹ 2,00,000 on December 31st 2021 and March 31st 2023 respectively. Assuming that the Company has sufficient funds in Debenture Redemption Reserve Account, pass necessary journal entries for the year ending March 31st 2020. (CBSE Sample Paper 2019-20, Modified)

Answer:

Note:

This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

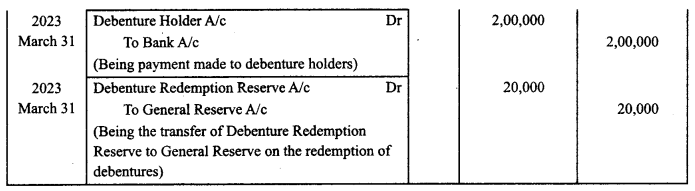

Question 3.

On 1st April, 2016, Ganesh Limited (An Unlisted Company) acquired assets of₹ 6,00,000 and took over liabilities of₹ 70,000 of Sohan Ltd. at an agreed value of₹ 6,60,000 Ganesh Ltd. issued 12% Debentures of ₹ 100 each at a premium of 10% in Ml satisfaction of purchase consideration. The debentures were redeemable after three years at a premium of 5%. The company decided to transfer the minimum required amount to Debenture Redemption Reserve of 31st March, 2022. It also made the required investment in Government securities earning interest @ 10% p.a. on IstApril, 2022. Tax was deducted on interest earned @ 10%.

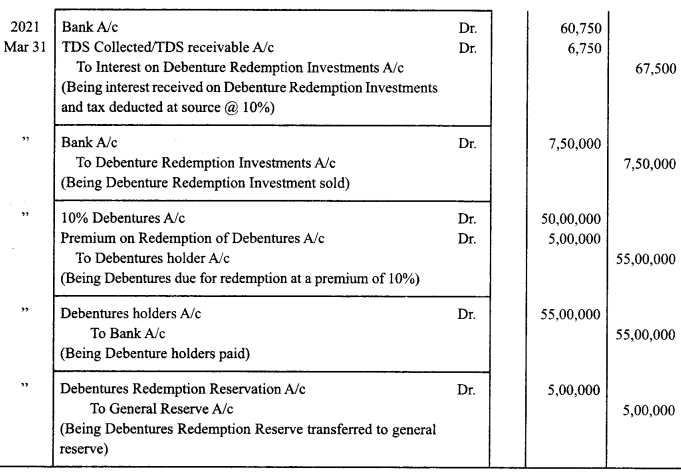

Ignoring entries relating to writing off loss on issue of debentures and interest paid on debentures, pass the necessary journal entries to record the issue and redemption of debentures. (CBSE Compt. 2019, Modified)

Answer:

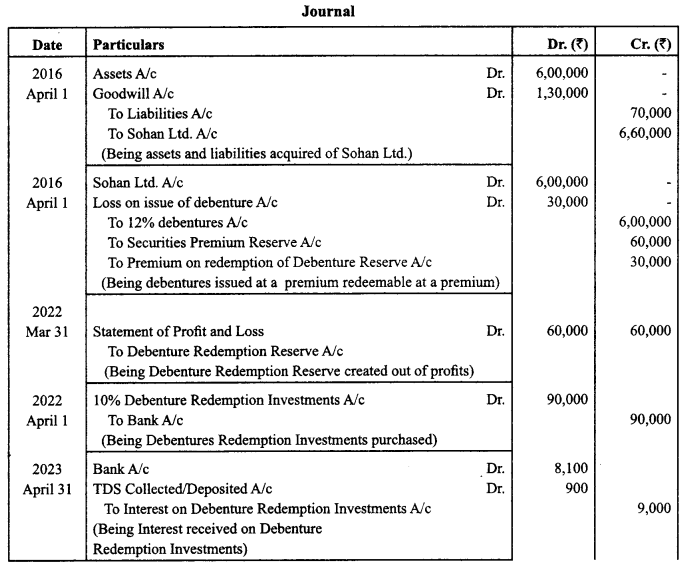

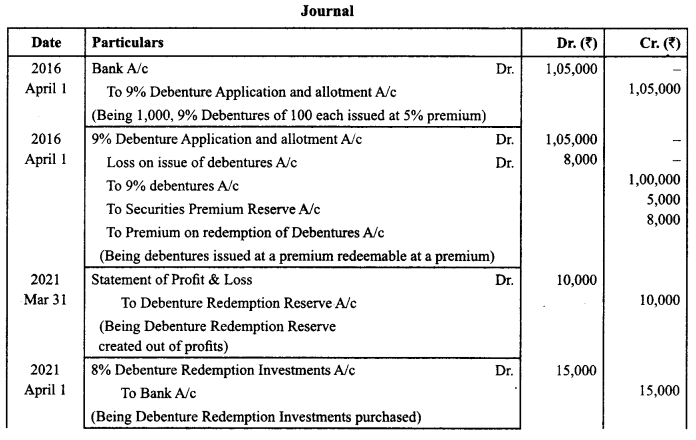

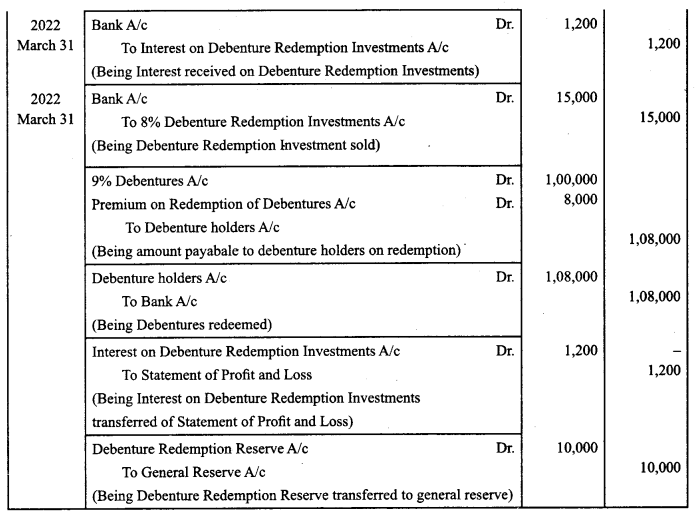

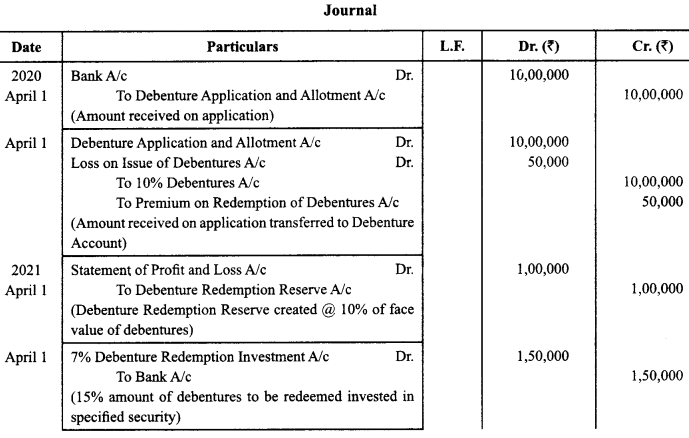

Question 4.

On 1st April, 2016 X Ltd. (An unlisted company) issued 1000; 9% debentures of₹ 100 each at a premium of ₹ 5 per debenture and redeemable on 31 st March, 2022 at a premium of ₹ 8 per debenture. The company created the minimum amount of debenture redemption reserve as per the amended provisions of the Companies Act, 2013 on 31 st March, 2021 and made investments in 8% p.a. fixed deposits in State Bank of India on 1 st April, 2021.

Excluding the entries for writing off loss on issue of debentures and interest on debentures, pass necessary journal entries for the above transactions in the books of X Ltd. (CBSE Compt. 2019, Modified)

Answer:

————-

Question 5.

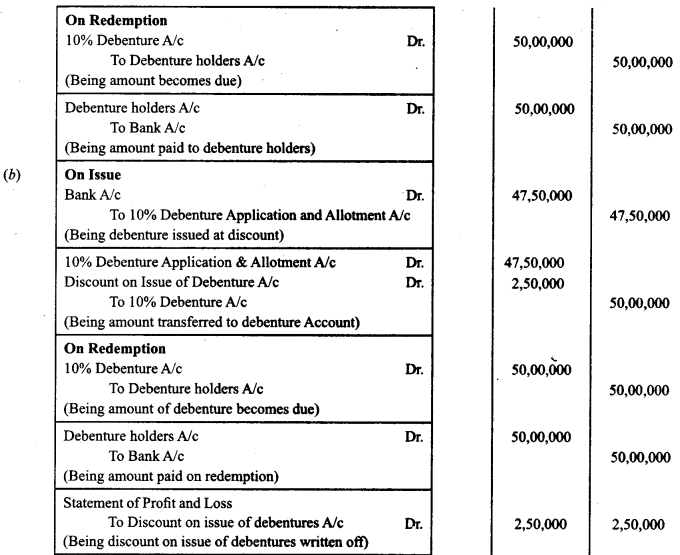

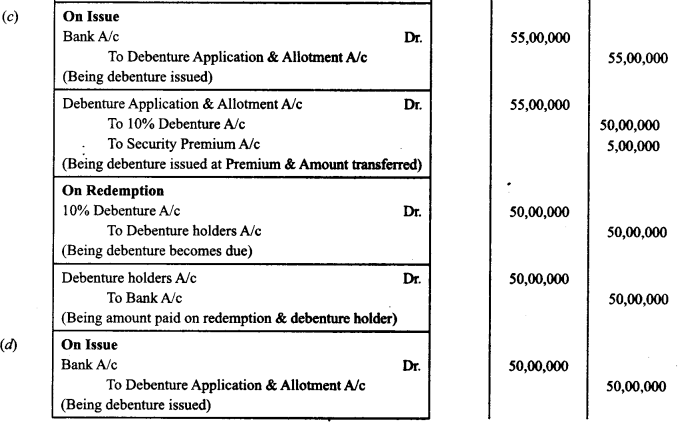

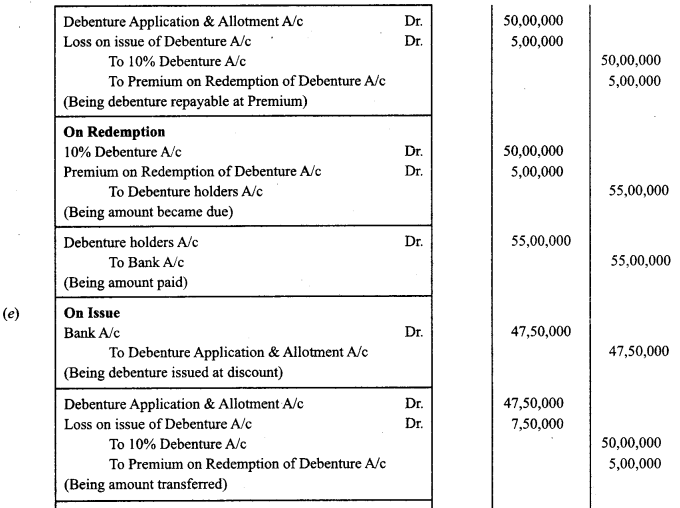

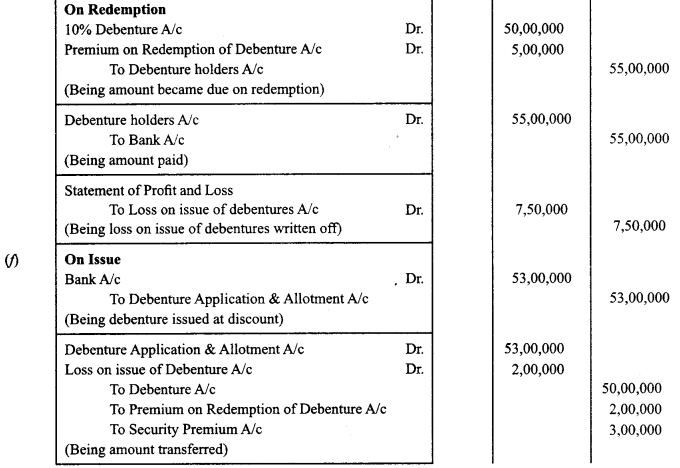

Nena Limited issued 50,000, 10% debentures of₹ 100 each on the basis of the following conditions:

(a) Debentures issued at par and redeemable at par.

(b) Debentures issued at discount @ 5% & redeemable at par.

(c) Debentures issued at a premium @ 10% & redeemable at par.

(d) Debentures issued at par & redeemable at premium @ 10%.

(e) Debentures issued at discount of 5% and redeemable at a premium of 10%.

(f) Debentures issued at premium of 6% and redeemable at a premium of 4%.

Record necessary journal entries in the above mentioned cases at the time of issue and redemption of debentures.

Answer:

Question 6.

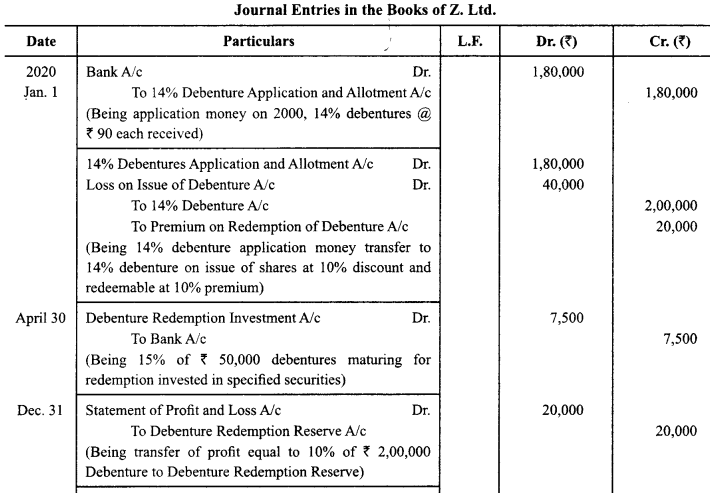

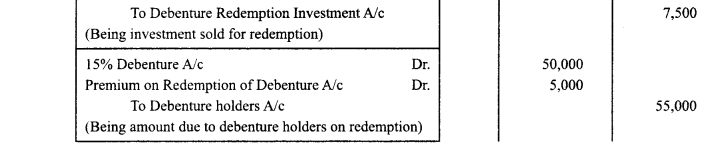

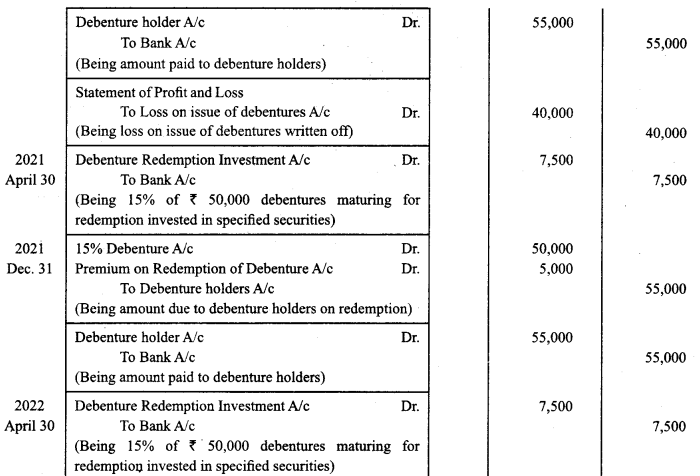

Z. Limited (An unlisted company) issued, 2,000, 14% debentures of₹ 100 each on January 01, 2020 at a discount of 10%, redeemable at a premium of 10% in equal annual Drawings in 4 years out of profits. Give journal entries both at the time of issue and redemption of debentures.

(Ignore the treatment of loss on issue of debentures and interest.)

Answer:

Question 7.

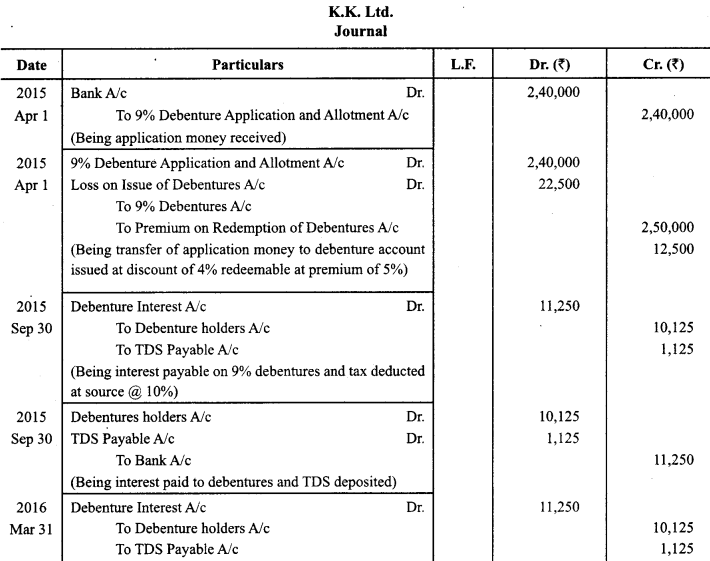

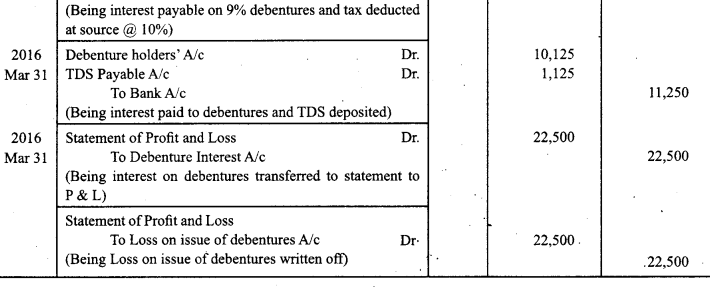

On 1-4-2015 K.K. Ltd. issued 500, 9% Debentures of ₹ 500 each at a discount of 4%, redeemable at a premium of 5% after three years.

Pass necessary Journal Entries for the issue of debentures and debenture interest for the year ended 31 -3-2016 assuming that interest is payable on 30th September and 31 st March and the rate of tax deducted at source is 10%. The company closes its books on 31st March every year. [Delhi 2017]

Answer:

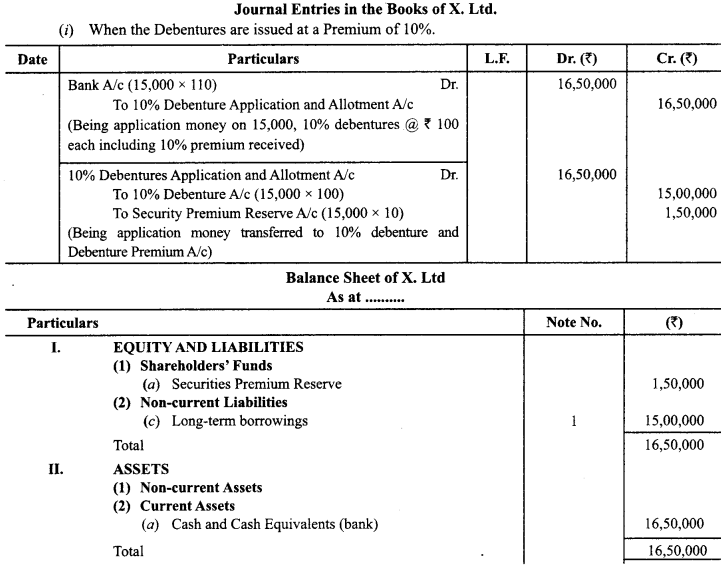

Question 8.

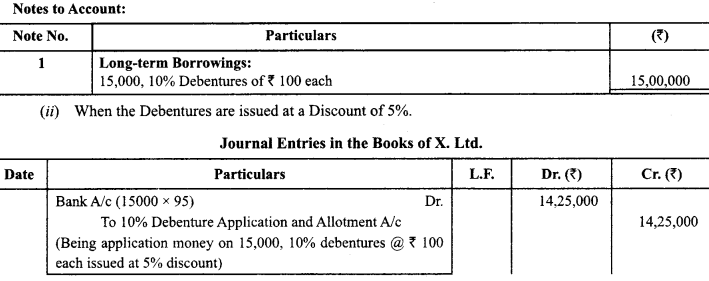

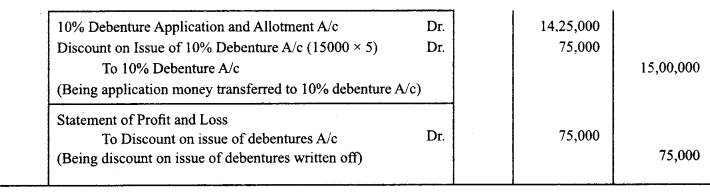

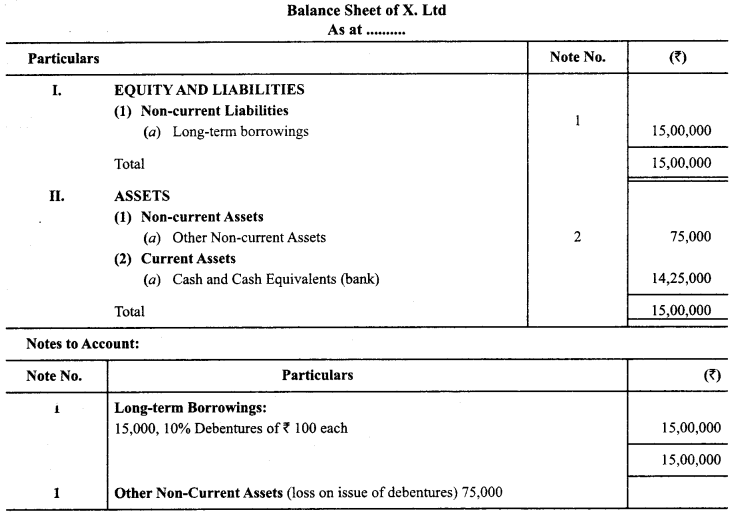

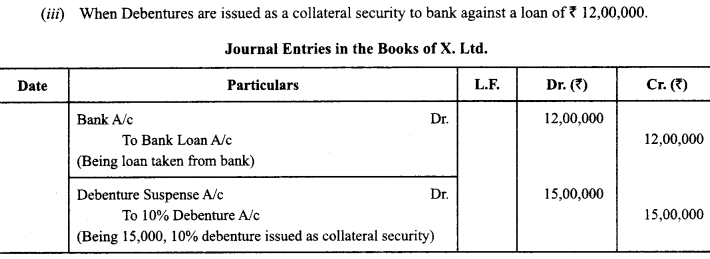

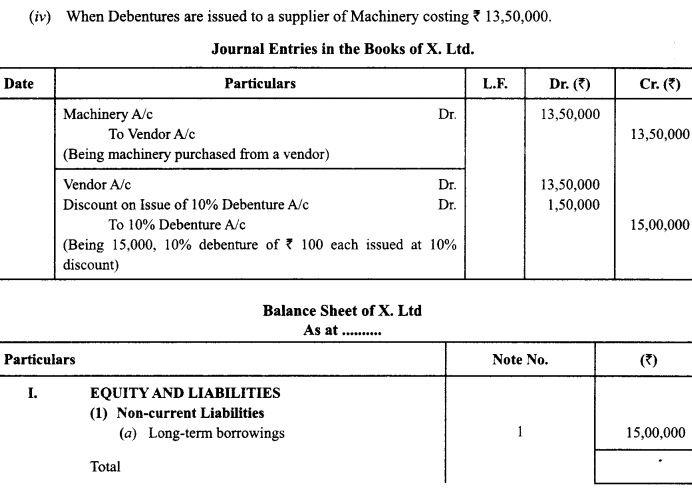

X. Ltd. issued 15,000, 10% debentures of₹ 100 each. Give journal entries and the Balance Sheet in each of the following cases:

(i) The debentures are issued at a premium of 10%.

(ii) The debentures are issued at a discount of 5%.

(iii) The debentures are issued as a collateral security to bank against a loan ₹ 12,00,000.

(iv) The debentures are issued to a supplier of machinery costing ₹ 13,50,000.

Answer:

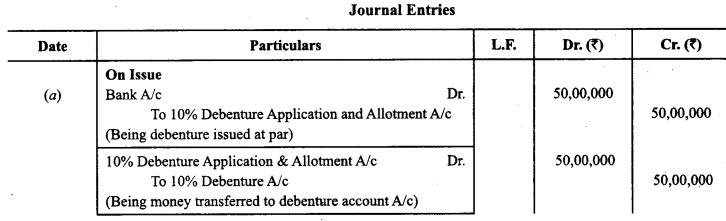

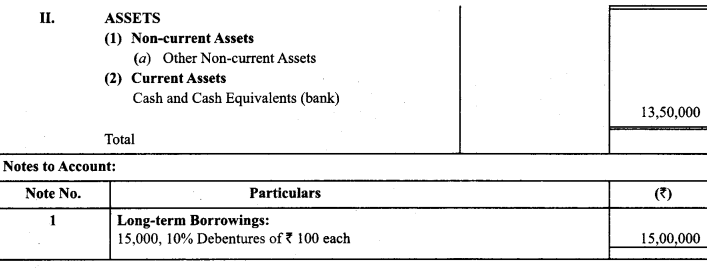

Question 9.

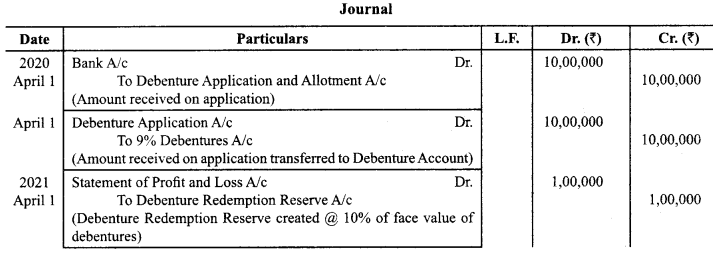

On 1st April, 2018, KK Ltd. (An unlisted company) invited applications for issuing 5,000 10% debentures of₹ 1,000 each at a discount of 6%. These debentures were payable at the end of 3rd year at a premium of 10%. Applications for 6,000 debentures were received and the debentures were allotted on pro-rata basis to all the applicants. Excess money received with applications was refunded. The directors decided to transfer the minimum amount to Debenture Redemption Reserve on 31.3.2020. On 1.4.2020, the company invested the necessary amount in 9% bank fixed deposit as per the amended provisions of the Companies Act, 2013. Tax was deducted at source by bank on interest @ 10% p.a. Pass the necessary journal entries for issue and redemption of debentures. Ignore entries relating to writing off loss on issue of debentures and interest paid on debentures. (CBSE 2018, Modified)

Answer:

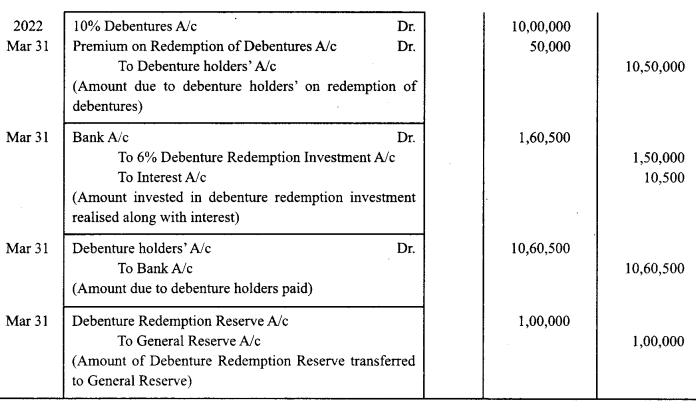

Question 10.

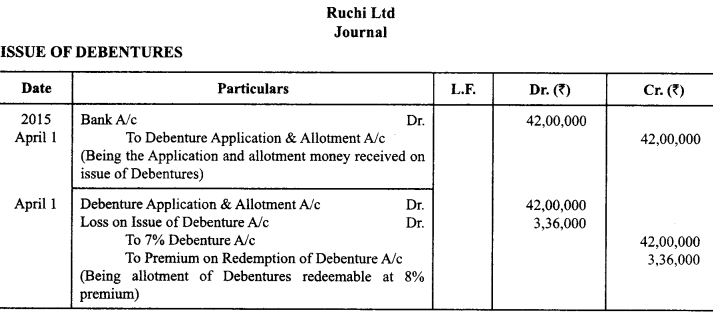

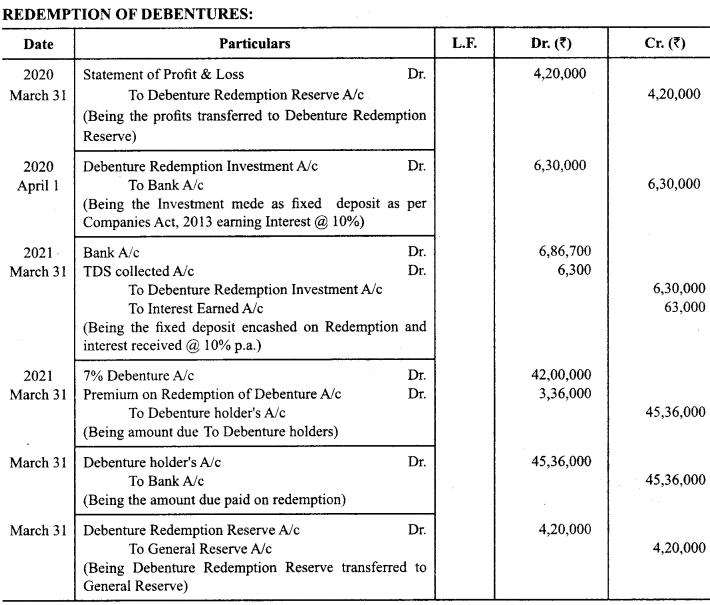

Ruchi Ltd (An unlisted company) issued 42,000,7% Debentures of 100 each on 1st April, 2015, redeemable at a premium of 8% on 31st March 2021. The Company decided to create required Debenture Redemption Reserve on 31st March 2020. The company invested the funds as required by law in a fixed deposit with State Bank of India on 1st April, 2021 earning interest @ 10% per annum. Tax was deducted at source by the bank on interest @ 10% per annum. Pass necessary Journal Entries regarding issue and redemption of debentures.

(CBSE Sample Paper 2016, 2017, Modified)

Answer:

Question 11.

(Lump-sum Method): Alibaba Ltd. (An unlisted company) issued 20,000, 9% debentures of ₹ 50 each on April 1, 2022 redeemable at par on March 31, 2022. All the debentures were subscribed and allotted. Investment of the required amount in securities is subject to deduction of 10% tax at source. Pass journal entries for issue and redemption of debentures assuming required investments were made in 6% specified securities.

Answer:

Question 12.

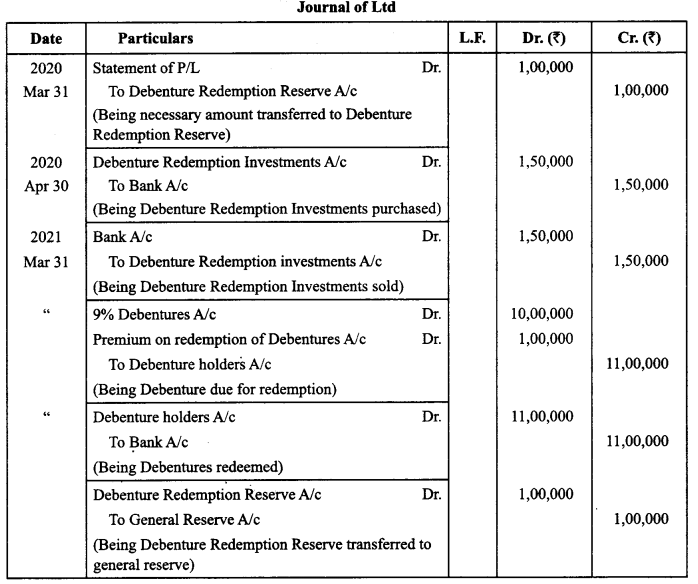

(Lump-sum Method): On April 1, 2020, Nelson and Tubro Ltd. (An unlisted company) issued 10,000, 10% debentures of₹ 100 each redeemable at 5% premium on March 31, 2022. Debentures were fully subscribed and allotted. Pass necessary journal entries for issue and redemption of debentures assuming necessary amount was invested in 7 % specified securities.

Answer:

Note: This question has been updated as per companies (Share capital and debentures) Amendment Rules, 2019.

Question 13.

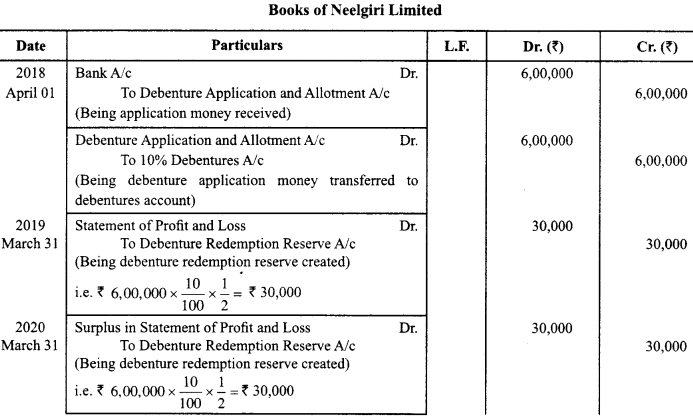

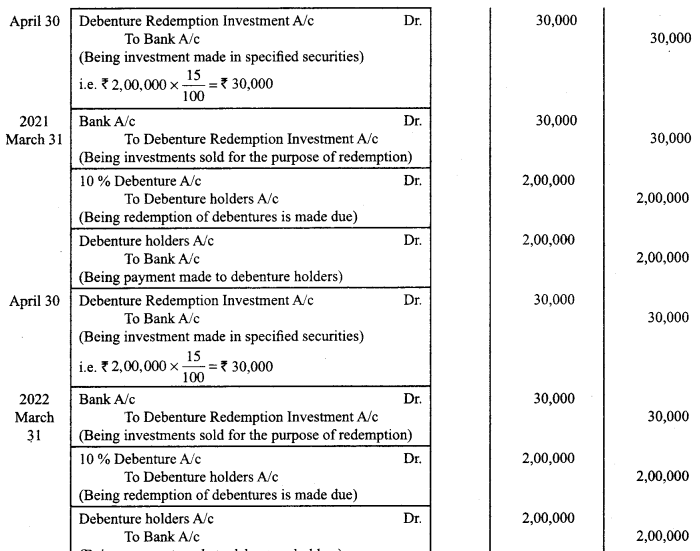

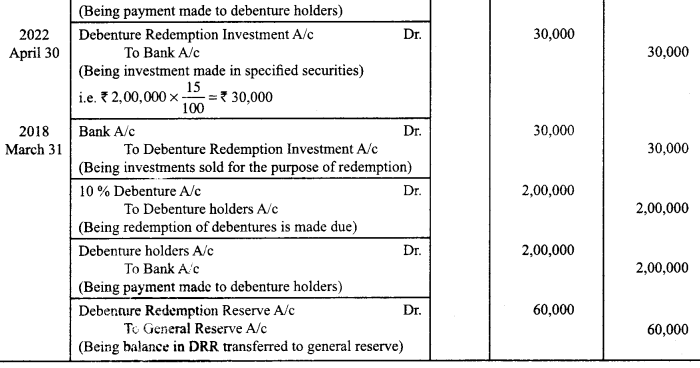

(Instalments or Draw a Lot Method): Neelgiri Limited issued 6,000, 10% debentures of ₹ 100 each on April 01, 2018 redeemable in 3 three equal instalments commeucing with March 31, 2021. The board of directors decided to transfer the required amount to Debenture Redemption Reserve in 2 equal instalments. Company also complied with Companies (Share Capital and Debentures) Amendment Rules, 2019.

Answer: