Here we are providing Class 12 Business Studies Important Extra Questions and Answers Chapter 10 Financial Markets. Business Studies Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Class 12 Business Studies Chapter 10 Important Extra Questions Financial Markets

Financial Markets Important Extra Questions Short Answer Type

Question 1.

Explain the concept of the Financial Market?

Answer:

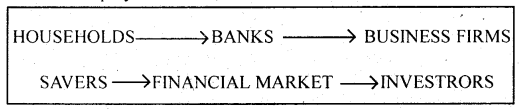

Concept of Financial Market: A business is a part of an economic system that consists of two main sectors – households that save funds and business firms which invest these funds. A financial Market helps to link the savers and the investors by mobilizing funds between them. In doing so it performs what is known as allocative functions. It allocates or directs funds available for investment into their most productive investment opportunity. When the allocative function is performed well, two consequences follow

- The rate of return offered to households would be higher.

- Scare resources are allocated to those firms which have the highest productivity for the economy;

There are two major alternative mechanisms through which allocation of funds can be done: via banks or via financial markets. Households can deposit their surplus funds with banks, who in turn could lend these funds to business firms. Alternately, households can buy the shares and debentures offered by a business using financial markets. The Process by which allocation of funds is done is called intermediation. Banks and Financial Markets are competing intermediaries in the financial system, and give households a choice of where they want to place their savings.

A financial market is a market for the creation and exchange of financial assets. Financial markets exist wherever a financial transaction occurs. Financial transactions could be in a fourth of creation of financial assets such as the initial issue of share and debenture by a firm or the purchase and sale of existing financial assets like equity share debenture and bonds.

Question 2.

Explain the term, Capital Market?

Answer:

Capital Market: The term Capital Market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested. It consists of a series of channels through which savings of the community are made available for industrial and commercial enterprises and for the public in general. It directs these saving into their most productive use leading to the growth and development of the economy. The capital market consists of development banks, commercial banks, and stock exchanges.

An ideal Capital Market is one where finance is available at a reasonable cost. The process of economic development is facilitated by the existence of a well functioning capital market. In, the fact the development of the financial system is seen as a necessary condition for economic growth. It is essential that financial institutions are sufficiently developed and that market operations are free, fair, competitive, and transparent. The capital market should also be efficient in respect of the information that it delivers, minimize transaction costs and allocate capital to most productivity.

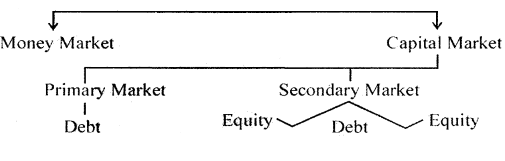

The Capital Market can be divided into two parts:

- Primary Market

- Secondary Market.

Question 3.

Mention, in brief, the classification of the financial market?

Answer:

Classification of financial market

Financial Market

Financial Markets are classified on the basis of the maturity of financial instruments traded ‘in them. Instruments with a maturity of less than one year are traded in the money market. Instruments with longer maturity are traded in the capital market.

Question 4.

Give the meaning of various terms used in the stock market in India?

Answer:

Various terms used in the stock market: The following terms in magazines or newspapers when you read about the stock market.

Bourses: Bourses is another word for the Stock Market.

Bulls and Bears: The term does not refer to animals but to the market sentiment of the investors. A bullish phase refers to a period of optimism and a bearish phase to a period of pessimism on the bourses.

Badla: This refers to a carry forward system of settlement, particularly at the BSE. It is a facility that allows the postponement of the delivery or payment of a transaction from one settlement period to another.

ODD lot Trending Trading in multiples of 100 stocks or less.

Penny Stocks These are securities that have no value on the stock exchange but whose trading contributes to speculation.

Question 5.

Explain the meaning of the stock-market Index?

Answer:

Stock Market Index: A stock market index is a barometer of market behavior. It measures overall sentiment through a set of stocks that are representative of the market. It reflects the market direction and indicates day-to-day fluctuations in stock prices. An ideal index must represent a change in the prices of securities and reflect price movements of typical share for better market representation. In the Indian markets, the BSE SENSEX and NSE NIFTY are important indices. Some important global stock market indices are:

- Dow Jones Industrial Average is among the oldest quoted stock market index in the US.

- NASDAQ composite index is the market capitalization weights of prices for a stock listed in the NASDAQ Stock Market.

- S and P 500 index is made up of the 500 biggest publicly traded companies in the US. The S and P 500 is often treated as a proxy for the US stock market.

- FISE 100 consists of the largest 100 companies by full market value listed on the London Stock Exchange. The FISE 100 is the benchmark index of the European market.

Question 6.

Explain the term Listing of securities and mention its advantage.

Answer:

Listing of Securities: A security is said to be ‘listed’ when its name is added to the list of securities in which trading on a particular exchange is permitted. The principal objectives of listing are

- to provide ready marketability and free negotiability to stocks and shares;

- to ensure proper supervision and control of dealings therein; and

- to protect the interests of shareholders and of the general investing public.

Advantages of Listing:

The advantage of listing may be viewed from two angles

- from the point of view of the management of companies; and

- from the point of view of the shareholders.

The advantages derived by the management as a result of listing are many. A part of the distinct advertising value, listing enables the management to broaden and diversify shareholding. It is the general, consensus of opinion that a company with broad-based share ownership is better suited for growth and stability than a company with shares concentrated in few hands. Ensuring thus a broadening of share ownership, listing not only brings a company’s shares to the attention of hundreds and thousands of new investors but also encourages institutional investors to be interested in them. It helps the company to gain national importance and widespread recognition.

There is a difference between a listed and non-listed security (particularly from the point of view of the psychological motivation of the investors in applying for subscription to shares) in as much as Section 73 of the Companies Act required that every company intending to offer shares or debentures to the public for subscription through the issue of a prospectus, must seek enlistment with one or more stock exchanges. If such listing is not granted or applied for then the company must return all money to the applicants.

This, in other words, implies that prospective listing prompts the investors to apply for the shares and failure to secure listing entitles the investors to claim a refund of the money. In fact, the listing has tremendous value to a company in regard to the raising of additional capital for expansion or other purposes.

Section 81 of the Companies Act provides that any further issue of the share unless waived by them in a general meeting, must in the first instance be offered to the existing shareholders, the company concerned will be in great difficulty, and will also have to incur great expense in selling them. But in the case of a listed company, there is neither this difficulty nor the additional expenses, for this right can be disposed of by the shareholders through the Stock Exchange.

Further, when a listed company makes such an offer of further shares to the shareholders, the shareholders in their turn get a better estimation of the value of the shares from the price at which the shares of the company are quoted on the stock exchange. Lasting, thus affords a great advantage to the management in ensuring a saving in the cost of raising new capital. This additional business or assets or mergers with the companies because listing enables it to offer its securities in exchange for those of a closely held or of an unlisted company.

The shareholders or investors derive manifold benefits if the shares held or owned by them are listed on the Stock Exchange. The main benefits are

1. It affords liquidity to their holding.

2. It affords them to obtain the best prices for the securities if they want to sell-off.

3. It helps them to avoid the botheration of canvassing from door to door to sell the securities and more telephonic or verbal orders to a stockbroker will help them to buy or sell listed security.

4. Transactions of the Stock Exchange are done by auction bids, so there is no hide or seek about the price at which the investor buys or sells the share.

5. The Stock Exchange quotation helps the investors to keep themselves abreast of the price changes of the securities owned or held by them.

6. The investors get maximum protection in regard to their holding, because the Stock Exchange rules and regulations have been formulated with the end in view.

7. Listing is also advantageous in the matter of income-tax, wealth-tax, estate, duty, and other taxes payable by shareholders in their capacity as assessees. However, from the foregoing discussion, it should not be concluded that the Stock Exchange vouches for the listed securities. In fact, Price determination and value judgments involve constant scrutiny and assessment of each company from business, financial, accounting, legal and technical points of view, and there are primarily the functions of the buyers and sellers in the market.

The Stock Exchange can not and does not stand sponsor for the listed securities or guarantee their investment value, but it does ensure continuing sponsorship and assistance in the establishment arid development of sound and progressively higher standards of corporate practice and procedure. For these reasons, listing carries the hallmark of prestige and confers on the listed company, its securities, and its shareholder a privileged position.

8. Listing gives an added collateral value to the securities held by investors, for the bank in making loans and advances prefer security quoted on the Stock Exchange.

Question 7.

Explain the role of the new issue market in the investment business.

Answer:

Role of the New Issue Market: The analysis of the role of the new issue market in financing

companies can be undertaken by the study of the statistics of the annual volume of the new issues. The data may be broken down in various ways, for example, according to the type of security issued, the kind of organization making the issue, the method of flotation of the issue, and so on.

The Reserve Bank of the organization making the issue, the method, for instance, has been following this method in its regular studies of capital issues in the private corporate sector. However, this approach is partial, and to that extent, an inadequate method of appraisal in that ‘ it does not explain the full significance of the role of the New Issue Market.

1. Its first shortcoming is that the technique to aggregate the amount of all prospectus and right issues, to arrive at the new issues made in a particular year does not reveal die true picture as the entire sum is not necessarily raised by the issuing companies from the investing public in the same year because they are collected through various calls which may be spread over five years. This, of course, is a minor point.

2. The method presents absolute figures, unrelated to the use to which these funds are put.

3. The method leads to the treatment of the New Issue Market in isolation from the rest of the capital market and consequently to a distorted view as to its real functions.

4. Further, it does not disclose as to what kind and size of firms are obtaining funds, nor at what cost they are doing so, and, therefore, gives no clue as to efficiency to explore such questions, obviously, a different approach in necessary.

Another approach that tries to remedy the weaknesses of the first, is the source-and-use-of-funds approach of analysis of company balance sheets. In this connection, two possibilities suggest themselves.

(a) A possible method is to make a direct comparison between new issues and industrial fixed capital formation, but this suffers from a serious limitation to the extent it is based on the simple assumption that long-term source of funds ought roughly to match long-term investment, for it is not virtually impossible for the analysts to relate the sums raised on the market to the uses that are made of those funds by the organization making those, issues, but it is also misleading to link specific sources of funds to a specific use.

True, investment intangible fixed assets in the most important long-term use of funds but is certainly not only important use to which funds are put when a group of companies is expanding output. The expenditure on fixed assets is, therefore not a good yardstick to measure the importance of capital issues. It is particularly misleading when studying different industries in which the relative importance of investment in stock and in fixed assets varies considerably.

What is needed is a much wider and more comprehensive approach in order to get the different sources and uses of funds into perspective. However, since it is not always possible to have the correct data forthcoming, we have to make use of that which is available.

Question 8.

Mention the Organizational Structure and Membership of Secondary Market.

Answer:

Organizational Structure of the Secondary Market: The stock exchanges are the exclusive centers for the trading of securities. At present, there are 23 operative stock exchanges in India. Most of the Stock Exchanges in the country are incorporated as ‘Association of Persons’ of Section 25 companies under the Companies Act. These are organized as ‘mutuals’ and are considered beneficial in terms of tax benefits and matters of compliance. The s trading members, who provide broking services also own, control, and manage the stock exchanges.

They elect their representatives to regulate the functioning of the exchange, including their own activities. Until recently the area of operation/ jurisdiction of exchange was specified at the time of its recognition, which in effect precluded competition among the exchanges. These are called regional exchanges.

In order to provide an opportunity to investors f to invest/trade in the securities of local companies, it is mandatory t for the companies, wishing to list their securities to list on the regional stock exchange nearest to their registered office. If they so wish, they can seek listing on other exchanges as well. The monopoly of the ’ exchanges within their allocated area, regional aspirations of the r people and mandatory listing on the regional stock exchange resulted ‘ in a multiplicity of exchanges. As a result, we have 24 exchanges (The Capital Stock Exchange, the list of the latest, is yet to commence trading) in the country recognized.

Over a period of time to enable investors across the length and – breadth of the country to access the market.

The three newly set up exchanges-over the couples exchange of r India (OTCEI), National Stock Exchange of India (NSE), and Inter-connected Stock Exchange of India (1CSE) were permitted since their inception to have nation-wide trading. Listing on these exchanges was considered adequate compliance with the requirement of listing on the regional exchange. SEBI recently allowed all exchanges to set up trading terminals anywhere in the country. Many of them have already expanded trading operations to different parts of the country.

Membership: The trading platform of a stock exchange is accessible only to brokers. The broker enters into trades in exchanges either on his own account or on behalf of clients. The clients may place their orders with them directly or through a sub-broker indirectly. A broker is admitted to membership of an exchange in terms of the provisions of the security contracts (Regulation) Act, 1956 (SCRA), the Securities and Exchange Board of India (SEBI) Act 1992, the rules, circulars, notifications, guidelines, etc. prescribed thereunder and the bye-laws, rules, and regulations of the concerned exchange.

No stockbroker or sub-broker is allowed to buy, sell or deal in securities unless he or she holds a certificate of registration granted by SEBI, A broker/sub-broker complies with the code of conduct prescribed by SEBI. The stock exchanges are free to stipulate stricter requirements for its membership are in excess of the minimum norms laid down by SEBI. The standards for admission of members laid down by NSE stress factors, such as corporate structure, capital adequacy, track record, education, experience, etc., and reflect a conscious endeavor to ensure quality broking services.

Financial Markets Important Extra Questions Long Answer Type

Question 1.

What is Stock Market? Mention its nature and functions.

Answer:

Stock Markets in India: Stock exchanges are intricately interwoven in the fabric of a nation’s economic life. Without a stock exchange the saving of the community – the sinews of economic progress and productive efficiency – would remain under-utilized. The tasks of mobilization and allocation of savings could be attempted in the old days as a much less specialized institution than the Stock Exchange.

But as business and industry expanded and the economy assured a more complex nature, the need t for “permanent finance”, arose. Entrepreneurs needed money for the long term whereas investors demanded liquidity – the facility to convert their investments into cash at any given time. The answer was a ready market for investments and this was how the Stock Exchange came to being.

Stock Exchange means any body of individuals, whether incorporated 1 or not, constituted for the purpose of regulating or controlling the 5 business of buying, selling, or dealing in securities. These securities include

- Shares, Scrips, Stock, bonds, debentures stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

- government securities; and

- rights or interest in Securities.

Nature and function of Stock Exchange: There is an extraordinary amount of ignorance and of prejudice born out of ignorance with regard to the nature and functions of the stock, exchange. As economic development proceeds, the scope for acquisition and ownership of capital by private individuals also groups.

Along with it, the opportunity for the Stock Exchange to render the service of stimulating private savings and channeling such savings into? productive investment exists on a vastly great scale. These are services which the stock exchange alone can render efficiently, it is no exaggeration to say that in a modern industrialist society, which t recognizes the rights of private ownership of capital, stock exchanges are not simply a convenience, they are essential, In fact, they are the markets which exist to facilitate purchase and sale of securities of companies and the securities or bonds issued by the govt, in the course of its borrowing operation.

As our country moves towards liberalization, this tendency is certain to be strengthened. The task % facing the stock exchanges is to devise the means to reach down to the masses, to draw the savings as the man in the street into productive investment, to create conditions in which many millions of little ‘ investors in cities, towns, and villages will find it possible to make use of the facilities, which have so far been limited to the privileged few. This calls for far-reaching changes, institutional as well as operational.

The Stock Exchanges in India, thus, have an important role to play in the building of a real shareholder’s democracy. The aim of the Stock Exchange authorities is to make it as nearly perfect in the social and ethical sense as it is in the economic. To protect the interests of the investing public, the authorities of the stock exchanges have been increasingly subjecting not only its members to a high degree of discipline but also those who use its facilities – joint-stock companies and other bodies in whose stocks and shares it deals.

There are stringent regulations to ensure that directors of joint Stock companies keep their shareholders fully informed of the affairs of the companies before their shares are listed are more rigorous and wholesome than the statutory provisions such as those contained in the Companies Act.

Apart from providing a market that mobilizes and distributes that nation’s savings, the Stock Exchange ensures that the flow of savings is utilized for the best purpose from the community’s point of view. ‘Free’ markets are not simply a matter of many buyers and sellers. If the prices at which stocks and shares change hands are to be ‘fair’ prices, many important conditions must be satisfied. It is the whole vast company of investors, competing with one another as buyers and sellers, this decides what the level of security prices shall be.

But the public is prone to sudden savings of hope and fear. If left entirely to itself, it could produce needlessly violent and-often quite irrational fluctuations. The professional dealers of the stock of these movements. These are valuable activities. So as to ensure that the investors reap the full benefiting them, they need to be regulated by a recognized code of conduct. Fair prices and free markets require, above all things, clean dealings both by professionals and by the investors – and dealings based upon up-to-date and reliable information, easily accessible to all.

Thus a free and active market in stock and shares has become a pre-requisite for the mobilization and distribution of the nation’s savings on the scale needed to support modem business. The Stock Exchange by a process of prolonged trial and error, which is by no means complete, has been continually streamlining its structure to meet these wide and ever-growing responsibilities to the public. The activities of the Stock Exchange to the public.

The activities of the Stock Exchange are governed by a recognized code of conduct apart from statutory regulations. Investors, both actual and potential, are provided, through the daily stock exchange price quotations, with an up-to-the-minute approval of the present worth of their holdings, in the light of all the influences that affect the position and prospectus of the companies in question. But the Stock Market does not determine the health of the company, it merely reflects it. It is a thermometer, not a fever.

The prices are sometimes distorted by excessive speculation but, by and large, they provide a continuous assessment of the current value of assets, not available to those who invest in houses or land or other assets, not traded on the Stock Exchange. In fact, whether our demand for a stock is motivated by income or profits, so long as it is related to a corporation, the prices of the securities markets will play ‘ a realistic part in determining the corporation’s ability to raise funds.

For those enterprises that must finance externally, the receptivity of the market to their offerings establishes both the volume and cost of capital raised. For those companies that finance the bulk of their requirements through reinvested earnings, the willingness of Stockholders to defer dividends in the expectation of a higher return through capital gains establishes both the volume and cost of the capital raised. If a company’s outlook is very promising and buyers bid up the security’s market value new financing becomes easier whether through? external or internal sources – the earnings prices ratio is reduced, and the cost of capital becomes correspondingly low.

However, the capacity, of a business to raise fresh capital for the approved purposes by selling shares to the public, and the cost of capital to the borrower, do not depend simply or even mainly upon the intrinsic merits of the business. They depend upon the public’s estimate of the investment merits of its share in comparison with those of other comparable securities. But these relative investment merits are measured very largely by the prices at which the new securities are offered and the comparable existing securities quoted in the market.

More precisely, they are determined by the relative’s yields, actual or prospective, that can be obtained in interest or dividends on the capital sum that these market prices represent. The cost of a company or raising new capital is not the price at which the new shares are sold to investors, but the effective rate of interest field that has to be offered in order to secure it. Other things being equal, investors will readily accept a lower interest yield for a progressive and promising company than they will demand from a slow-moving and inefficient one.

The tremendous important and socially useful service that the stock exchange renders to the industries is with regard to the shifting of the burden of financing from the mgt. to those of the investor. It will be realized more so from the fact that there is always a conflict of motives between the industries and the investors. Industries require long-term finance, with the end in view of looking it up in land, buildings, plants, etc. Investors, on the other hand, have liquidity preference, that is to say, they want to get back the money or and when they would need it.

In other words, while the industries require permanent finance, the investors can tend it only for a while because the money that they led to the industries comes from their savings which are made for future spending over contingencies. It is not merely the individual investors alone who suffer from the ‘liquidity’ preference complex institutional investors to have the same motive.

It is generally thought that a Stock Exchange serves only those who have money to invest and securities to sell. But a stock benefits the whole community in a variety of ways. By enabling producers to raise capital, it indirectly gives employment to millions of people and helps consumers to get the goods needed by them.

Again, all those who save, put their money either in banks or in life insurance, invest in buying shares and securities, are also help by stock exchanges, because the institutions with which they place their savings avail, themselves of the services of the exchange to invest the money collected by them.

It is efficient from the foregoing analysis that the ready liquidity and constant evaluation of assets, together with a range of available investments act as a powerful inducement to save and invest and draw the savings of the community into the channels which are expected to be most productive. It would be difficult to find a more effective method of doing this.

In addition, the overall trend of prices and volume of business on the stock exchange serve as an economic barometer which faithfully registers the changing events and opinion about the investment outlook. Even allowing for the aberrations of speculation, % this mirror of the investment scene is one that neither economists nor businessmen nor the govt, charged with the formulation of economic policy, can afford to ignore.

Question 2.

Explain the various risks attached to investment?

Answer:

There are many risks attached to the investment, which are as follows:

1. Business and Financial Risk: Business risk and financial risk are actually two separate types of risks, but since they are interrelated it would be wise to discuss them f together. Business risks, which is sometimes called operating risk, is ‘ the risk associated with the normal day-to-day operations of the firm.

Financial risk is created by the use of fixed cost securities. Looking at the two categories in sources and uses, Context, business risk represent the chance of loss and the variability of return created by a firm’s uses of funds. Financial risk is the chance of loss and the variability of the owner’s return created by a firm’s sources of funds.

To clarify this imp. distinction between business and financial risk, let us examine the income statement contained in the exhibit. Earnings before interest and taxes can be viewed as the operating profit of the firm, the profit of the firm before deducting financing charges and taxes.

Business risk is concerned with earnings before interest and taxes and financial risk is concerned with earnings available to equity holders. The two components of business risk signify the chance that the firm will fail because of the inability of the assets of the firm to generate a sufficient level of earnings before interest and the variability of such earnings.

The two components of financial risk reflect the chance that the firm will fail because of the inability, to meet interest and principal payments on debt, and the variability of earnings available to equity holders caused by fixed financing charge. Putting it in another way, this second component of financial risks is the extent to which earnings available to equity holders will vary at a greater rate than earnings before interest and taxes. In case the firm does not employ debt, there will be no financial risk.

An imp. aspect of financial risk is the interrelationship between financial risk and business risk. In effect, business risk is basic to the firm, but the firm’s risk can be affected by the amount of debt financing used by the firm. Whatever be the amount of business risk associated with the firm the firm’s risk will be increased by the use of debt financing.

As a result, it follows that the amount of debt financing used by, the firm should be determined by the amount of business without fear of default, or a market impact on the earnings available to the equity shareholders. Conversely, if the firm faces a lot of business risk, then the use of a lot of debt financing may jeopardize the firm’s future operations.

2. Purchasing power Risk: Whenever investors desire to preserve their economic position over time, they utilize investment outlets whose values vary with the price level. They select investments whose market values change with consumer prices which compensates them for the cost of living increase. If they do not, they will find that their total wealth has been diminished. Inflation is an economic crippler that destroys the economic power of investors over, goods and services.

In essence, investors have to be concerned with the command that their invested money has over goods and services on a continuing basis. In fact, we have been living with increasing consumer prices for many years.

3. Market Risks: This hazard arises from the fact that market prices and collateral values of securities and real property may vary substantially, even when their earning power does not change. The causes of these price uncertainties are varied. At times many markets are simply thin-that is, buyers and sellers, appear only intermittently. More commonly, investment prices vary because investors vacillate in their preference for different forms of investment, or simply because they sometimes have money to invest and sometimes do not have it. But once the equity has developed a particular price pattern, it does not change this pattern quickly. The causes of changes in market price are usually beyond the control of the corporation.

An unexpected war or the end of one, an election year, political activity, illness or death of a President, speculative activity in the market, the outflow of bullion – all are tremendous psychological factors in the market. The irrationality in the securities markets may cause by the general tenor of the market any called market risks.

The market risk in equity shares is much greater than it is in bonds. Equity share value and prices are related in some fashion to earning. Current and prospective dividends, which are made possible by earnings, theoretically, should be capitalized at a rate that will provide yields to compensate for the basic risks, on the other hand, bond prices are closely related to changes in interest rates on new debt. Equity prices are affected primarily by financial risk considerations which, in turn, affect earnings and dividends.

However, equity prices may be strongly influenced by mass psychology, by abrupt changes in financial sentiment, and by waves as optimism or presses. Whenever emotions run high, speculators and gamblers crave action. They cannot refrain from entering the market arena as their greed for profits becomes their overpowering motivation. They do not hesitate to analyze the market .environment. They do not base their judgment on an accurate evaluation of the underlying factors. Instead, do not base their judgments on an accurate evaluation of the semblance of value. Greed pushes-price up and fear drives them down.

In short, the crux of the market risk is the likelihood of incurring. Capital losses from price changes engendered by speculative psychology.

4. Interest Rate Risk: A major source of risk to the holders of high-quality bonds changes in interest rates, commonly referred to as interest rate risk. These high-quali|y bonds are not subjected to either substantial-business risk or financial risk. Consequently, they are referred to as high-quality bonds. But since they are high-quality bonds, their prices are determined mainly, by the prevailing level of interest rate in the market. As a result, if interest rates fall, the prices of these bonds will rise, and vice-versa.

Interest rate risk affects all investors in high-quality bonds regardless of whether the investors hold short-term or long term bonds. Changes in interest rate have the greatest impact on the market position of long-term bonds, Since the longer the period before the bond matures, the greater the effect of the change in interest rates. On the other hand, changes in interest rates will not have much of an impact on-the-market price of short-term bonds, but the interest income on a short-term bonds portfolio may fluctuate markedly from period to period, as interest rate changes. Consequently, changes in interest rates affect investors in long-term as well as short-term bonds.

5. Social or Regulatory Risk: The Social or regulatory risk arises where an otherwise profitable investment is impaired as a result of adverse legislation, harsh regulation climate, or in extreme instances nationalization by a socialistic govt. The profits of industrial companies may be reduced by price controls, and rent controls may largely destroy the value of the rental property, hold for income, or as a price-level hedge. The social risk is real political and thus unpredictable, but under a system of representative govt, based on increasing govt, intervention in business affairs, no industry can expect to remain exempt from it.

6. Other Risk: Other types of risk, particularly those associated with an investment in foreign securities, are the monetary value risk and the political environment risk. The investor who buys foreign govt, bonds, or securities of foreign corporations often in an attempt to gain a slightly.