Here we are providing Class 12 Economics Important Extra Questions and Answers Chapter 2 National Income Accounting. Economics Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Class 12 Economics Chapter 2 Important Extra Questions National Income Accounting

National Income Accounting Important Extra Questions Very Short Answer Type

Question 1.

What is depreciation? (C.B.S.E. 2011), (2013 Comp.)

Answer:

Depreciation is the loss in the value of fixed capital due to normal wear and tear, foreseen obsolescence and normal rate of accidental damage. It is also known as consumption of fixed capital.

Question 2.

Define intermediate goods. (C.B.S.E. Outside Delhi 2011 Comp) (2013 Comp.))

Answer:

Intermediate goods are those goods, which are not meant for final consumption. These are raw materials used in the production of other goods, and services.

Question 3.

Define net exports.

Answer:

Net exports refer to the difference between the value of exports (X) and the value of imports (M) of a country during an accounting year.

Question 4.

What is saving?

Answer:

Saving is defined as that part of National Income, which is not spent on final consumption expenditure.

Question 5.

Give two examples of indirect taxes.

Answer:

Examples of indirect tax:

(i) Custom Duty

(ii) Excise Duty

(iii) Sales Tax

Question 6.

Define corporation tax.

Answer:

Corporation tax is a tax on the income of the corporations.

Question 7.

Define indirect tax.

Answer:

Indirect tax is a tax collected by an intermediary (seller) from the person who bears the ultimate economic burden of the tax (buyer). Its burden can be shifted by the tax payer on someone else.

Question 8.

How rate of saving is calculated?

Answer:

Rate of saving is calculated as:

\(\frac{\text { Net Domestic Saving }}{\text { Net Domestic Product }} \times 100\)

Question 9.

How rate of capital formation is estimated?

Answer:

Rate of capital formation is calculated as:

\(\frac{\text { Net Domestic Capital Formation }}{\text { Net Domestic Product }} \times 100\)

Question 10.

Give two examples of intermediate goods. (C.B.S.E. Outside Delhi 2013)

Answer:

Following are the two examples of intermediate goods:

(i) Cloth: Cloth is used as an intermediate good for manufacturing garments.

(ii) Steel: Steel is used as an intermediate good for manufacturing, say, bicycle.

Question 11.

Define a stock.

Answer:

Stock is an economic variable that is measured at a specific point of time. It is a static concept.

Question 12.

Define flow concept.

Answer:

Flow is an economic variable that is measured over a specific period of time. It is a dynamic concept.

Question 13.

Define a closed economy.

Answer:

A closed economy is the one, which does not undertake economic transactions with the rest of the world.

Question 14.

Define an open economy.

Answer:

An open economy is the one, which undertakes economic transactions with the rest of the world.

Question 15.

Is National Income a stock or flow variable?

Answer:

National Income is a flow variable because it is measured over a period of time.

Question 16.

What do you mean by money flow?

Answer:

Money flow refers to the flow of money value across different sectors in an economy.

Question 17.

State which of the following is a stock and which is a flow?

(i) Wealth

(ii) Cement Production

Answer:

(i) Wealth is a stock concept because it is measured at a point of time.

(ii) Cement production is a flow concept because it is measured over a period of time.

Question 18.

State whether the following is a stock or flow:

(i) Population of a country

(ii) Number of births

Answer:

(i) Population of a country is a stock concept because it is measured at a point of time.

(ii) Number of births is a flow concept because it is measured over a period of time.

Question 19.

Define flow variable. (C.B.S.E Outside Delhi 2012), (C.B.S.E 2011)

Answer:

Flow variables are the variables which are measured over a specific period of time.

Question 20.

What are stock variables? (C.B.S.E 2012), (C.B.S.E Outside Delhi 2011)

Answer:

Stock variables are those variables which are measured at a specific point of time.

Question 21.

What do you mean by circular flow?

Answer:

Circular flow is a pictorial illustration showing the flow of receipts of and payments for goods and . services, and factor of production across different sectors in an economy.

Question 22.

Give any two examples of flow concept. (C.B.S.E 2019)

Answer:

(i) National Income

(ii) Population growth

(iii) Investment .

Question 23.

What are leakages in circular flow?

Answer:

Leakages in the economy refer to the withdrawal of income from the process circular flow in the form of savings, taxes and imports from the foreign sector. For example: Savings.

Question 24.

What are injections into circular flow?

Answer:

Injections in the economy refer to the contribution of income into the process circular flow in the form of investment, government spending and exports to the foreign sector. For example: Investment.

Question 25.

Who supplies factor services in the circular flow?

Answer:

Household sector supplies factor services in the circular flow.

National Income Accounting Important Extra Questions Short Answer Type

Question 1.

Distinguish between goods and services.

Answer:

Goods are physical products, capable of being delivered to a purchaser. It involves the transfer of ownership from seller to buyer. For example: television, computers, car, etc. Services are all those economic activities essentially intangible that provide satisfaction of wants and are not necessarily linked to the sale of a product. For example: transportation, banking, insurance, etc.

Question 2.

What is the difference between final and intermediate good? (C.B.S.E Outside Delhi 2017), (C.B.S.E 2009,2017)

Answer:

Final goods are those goods which are ready for consumption or capital formation by final users. Intermediate goods, on the other hand, are those goods which not meant for final consumption. These are raw materials used in the production of other goods and services. For example: A chair is a final good, but wood, cane, foam, cloth, etc. used to produce chair are all intermediary goods.

Question 3.

Which among the following are final goods and which are intermediate goods? Give reasons. (C.B.S.E20I8)

(a) Milk purchased by a tea stall

(b) Bus purchased by a school

(c) Juice purchased by a student from the school canteen

Answer:

(a) Milk purchased by a tea stall is an intermediate good that will be used to produce the final good, that is, tea.

(b) Bus purchased by a school is a final product because it is used by the students and staff for final consumption. It is a kind of investment by the school as the school will use the bus for several years.

(c) Juice purchased by a student from the school canteen is a final product because it is ready for the final consumption.

Question 4.

Distinguish between consumer goods and capital goods. Which of these are final goods? (C.B.S.E 2010)

Answer:

Consumer goods are those goods which directly satisfy the wants of the consumer. These are used as final consumption goods. Consumer goods may be durable items, semi-durable items, non-durable and services. Capital goods, on the other hand, are those goods which are producer’s fixed assets, and are used in the production of other goods and services. Both, consumer goods and capital goods are final goods as these are meant for final use by the user.

Question 5.

Giving reasons, classify the following into intermediate and final goods:

(i) Machines purchased by a dealer of machines

(ii) A car purchased by a household

Answer:

(i) Machine purchased by a dealer of machines is a intermediate goods because this machine is used to produce other goods.

(ii) A car purchased by a household is a final good because this car is ready for the final consumption.

Question 6.

Giving reason identify whether the following are final expenditure or intermediate expenditure:

(i) Expenditures on maintenance of an office building

(ii) Expenditure on improvement of a machine in a factory

(iii) Computers installed in an office

(iv) Mobile sets purchased by a mobile dealer

(v) Furniture purchased by a school

(vi) Chalks, dusters etc. purchased by a school

Answer:

(i) Expenditure on maintenance of an office building is an intermediate expenditure as building will be used further for production activities.

(ii) Expenditure on improvement of a machine in a factory is a final expenditure as this machine is ready to be used by the labour who is the final user.

(iii) Computers installed in an office are final products as they are ready for final use and directly satisfy the users in the office.

(iv) Mobile sets purchased by a mobile dealer are intermediate products as they are purchased for resale.

(v) Furniture purchased by a school is a final product because it is used by the students and staff for final consumption. It is a kind of investment by the school as the school will use the furniture for several years.

(vi) Chalks, dusters, etc. purchased by a school are final products as they are used by the final users, that is, teachers.

Question 7.

Explain the circular flow of income. (C.B.S.E. 2013,2017)

Answer:

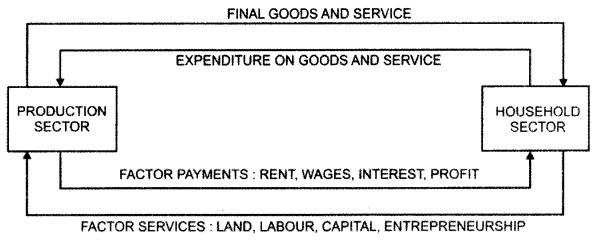

The circular flow with two-sector economy can be explained with the help of the following diagram:

The above diagram shows the two sectors in the economy-the household sector and the production sector. Household sector has the endowment of factors of production (land, labour, capital and entrepreneurship) and it sells them to the production sector which produces goods and services by using these factor inputs.

Production sector sells the goods and services it produces to the household sector. Thus, the output produced by the production sector is consumed by the household sector. It is called real flow, which involves flow of goods and services.

The production sector makes factor payment to the household sector in terms of wages for labour services, rent for land, interest for capital and profits to entrepreneurship. The household sector uses this income to incur expenditure on purchase of consumer goods and services produced by the production sector. This flow of money payments and expenditure is known as money flow.

Question 8.

What is real flow and money flow?

Answer:

Real flow refers to the flow of goods and services across different sectors in an economy. Households provide factors of production such as land, labour, capital and entrepreneur to the firms. The firms, in turn, provide the goods and services so produced to the households.

Money flow refers to the flow of money value across different sectors in an economy. Factor incomes such as rent, wages, interest and profit flow from production sector to household sector and the payment for consumption of final goods and services or consumption expenditure flow from household sector to production sector.

Question 9.

Giving reason, categorise the following into stock and flow:

(i) Capital

(ii) Saving

(iii) Gross Domestic Product

(iv) Wealth (C.B.S.E. 2013)

Answer:

(i) Capital is a stock concept because it is measured at a point of time.

(ii) Saving is a flow concept because it is measured over a period of time.

(iii) Gross Domestic Product (GDP) is a flow concept because GDP is measured over a period of time.

(iv) Wealth is a stock concept because it is measured at a point of time.

Question 10

Will the following be a part of domestic factor income of India? Give reasons for your answer.

(i) Old age pension given by the government

(ii) Factor income from abroad

(iii) Salaries of Indian residents working in Russian Embassy in India

(iv) Profits earned by a company in India, which is owned by a non-resident

Answer:

(i) Old age pension given by the government will not be a part of domestic factor income of India be-cause it is a transfer payment.

(ii) Factor income from abroad will not be a part of domestic factor income of India because it is a part of national factor income of India. Domestic factor income becomes national factor income by adding factor income from abroad to domestic income.

(iii) Salaries received by the Indian residents working in the Russian Embassy in India will be a part of the domestic factor income of India because these are the wages to Indian residents within the national territory of India.

(iv) Profits earned by a company in India, which is owned by a non-resident is not a part of domestic factor income of India because it is a retained earnings of resident company abroad. It is the part of factor income to abroad.

Question 11.

Explain the term ‘compensation of employees’ and its components. Giving reasons, state whether the following are treated as compensation of employees:

(i) Gifts by employers

(ii) Bonus

Answer:

Compensation of employees means the wages and salaries paid for mental and physical abilities of labourers in cash and kind. Following are the components of compensation of employees:

- Wages and salaries in cash

- Compensation in kind

- Employers’ contribution to social security schemes

- Pension on retirement

(i) Gifts by employers are treated as compensation of employees because it is a payment made in kind.

(ii) Bonus is the part of supplementary income and hence, treated as compensation of employees.

Question 12.

Give the meaning of factor income to abroad and factor income from abroad. Also give an example of each.

Answer:

Factor income from abroad is the sum total of factor incomes earned by normal residents of a country for abroad. For example, wages received by the Indian employees wonclng m American Embassy, Factor income to abroad means payments to foreigner for their goods and services. For example, wages to foreign technical export.

Question 13.

Why are exports included in the estimation of domestic product by the expenditure method? Can Gross Domestic Product be greater than Gross National Product?

Answer:

Expenditure method estimates expenditure on domestic products, that is, expenditure on final goods and services produced within the economic territory of the country. It includes expenditure by both residents and non-residents. Exports, though purchased by non-residents, are produced within the economic territory and therefore, a part of domestic product.

Gross Domestic Product can be greater than Gross National Product if factor income paid to the rest of the world is greater than the factor income received from the rest of the world, that is, when net factor income received from abroad is negative.

Question 14.

Define the problem of double counting in the computation of national income. State any two approaches to correct the problem of double counting. (C.B.S.E 2019)

Answer:

Double counting refers to counting of an output more than once while passing through various stages of production. The problem of double counting arises when the value of some goods and services are counted more than once while estimating national income. In measuring the national income, the value of only final goods and services is to be included. In other words, the problem of double counting arises when value of intermediate goods is also included along with the value of final goods.

Question 15.

How to Avoid Double Counting?

Answer:

There are two alternative ways of avoiding double counting

(a) Final Output Method: According to this method, the value of only final goods should be added to determine the national income.

(b) Value Added Method: Deduct intermediate consumption from value of output to arrive at value added.

Question 16.

Describe the precautions that should be taken while measuring National Income using income method. (C.B.S.E. Outside Delhi 2017)

Answer:

Following precautions should be taken while measuring the National Income using income method:

- The income from the illegal activities such as theft, smuggling and gambling should not be included in the National Income.

- Windfall gains such as lottery should not be included.

- Transfer payment such as unemployment allowance, old age pension, donation to the religious

places, etc. should not be included in the National Income. , - The value of the production kept for self-consumption should be included in the National Income.

- The imputed rent of the house in which landlord himself is living should also be included.

Question 17.

Describe the precautions that should be taken while measuring National Income using product method. (C.B.S.E. Outside Delhi 2017)

Answer:

Following precautions should be taken while measuring the National Income using product method or value added method:

- The value of self-consumption output should be included in the National Income.

- Imputed rent on the owner occupied house should be taken into consideration while measuring the National Income.

- Value of the sale and purchase of second hand goods and property should not be included in National Income.

- The imputed value of the government, corporate and household own-production of fixed capital should be included in the National Income.

Question 18.

Describe the precautions that should be taken while measuring national income using expenditure method. (C.B.S.E. Outside Delhi 2017)

Answer:

Following precautions should betaken while measuring the national income using expenditure method:

(i) While calculating the total expenditure, only the final-expenditure must be included and not the intermediate expenditure. If both of these are included, the problem of double counting arises.

(ii) Expenditure on second hand goods should not be included in final expenditure since the production of old goods took place in previous years and not in the current year.

(iii) The expenditure on old or new shares should not be included in final expenditure because it is only a transfer of wealth, which has not affected production at all.

(iv) Only gross investment should be included in total expenditure. Gross investment also includes expenditure on depreciation.

(v) Factor income (property income, labour income, interest, rent, wages) received by domestic residents from foreign countries should be included in exports, Similarly, factor income paid by domestic territory to foreign residents should be included in imports.

Question 19.

Given nominal income, how can we find real income? Explain. (C.B.S.E. 2018)

Answer:

Real income is the value of current income at base year prices. Nominal income, on the other hand, is the value of income or output at current year prices. Given nominal income, real income can be calculated by taking the ratio of nominal income to the price index and multiplying the result by 100.

That is \( \text { Real Income }=\frac{\text { Nominal Incóme }}{\text { Price Index }} \times 100\)

Question 20.

“Gross Domestic Product (GDP) does not give us a clear indication of economic welfare of a country.” Defend or refute the given statement with valid reason. (C.B.S.E. 2019)

Answer:

The given statement is defended as GDP may not take into account:

(a) Non-monetary Exchanges: The value of these activities in an economy are not evaluated in monetary terms. For example, sen/ices of a housewife such as cooking, gardening, etc. are not included in GDP due to non-availability of data. However, such activities do influence the economic welfare.

(b) Externalities: It refers to the benefits or harms of an activity caused by a firm or an individual for which they are not paid or penalised. Externalities can be positive or negative.

(c) Distribution of GDP: It is possible that with rise in GDP, inequalities in distribution of income may also increase. That is, the gap between the rich and poor increases. GDP does not take into account changes in inequalities in the distribution of income.

Question 21.

“Higher Gross Domestic Product (GDP) means greater per capita availability of goods in the economy.” Do you agree with the given statement? Give valid reason in support of your answer. (C.B.S.E 2019)

Answer:

The given statement is not true. Higher Gross Domestic Product (GDP) does not necessarily mean greater per capita availability of goods in the economy. The level of economic welfare may not rise if with an increase in the level of Gross Domestic Product (GDP), the distribution of GDP becomes more unequal.

Since only a few people benefit from the increase in the level of income, rich are becoming richer and poor are becoming poorer. If GDP growth increases the gap between rich and poor, then it cannot be treated as an index of welfare for a country. Moreover, if the population growth rate is more than the rate of growth of GDP, the per capita availability of goods and services will actually decline.

Or

Explain the meaning of Real Gross Domestic Product and Nominal Gross Domestic Product, using a numerical example. (C.B.S.E 2019)

Answer:

Real GDP is the value of current income at base year prices. Nominal GDP, on the other hand, is the value

of income or output at current year prices. Given nominal income, real income can be calculated as:

\(\text { Real GDP }=\frac{\text { Nominal GDP }}{\text { Price Index }} \times 100\)

Suppose in the year 2010, a country produced 100 units of bread and the price was ₹ 10 per bread. So, the GDP at current price or Nominal GDP was 100 x ₹ 10 = ₹ 1,000.

In 201 I, the same country produced 10 units at ₹ 15 per bread. Therefore, the nominal GDP in 201 I was 10 x ₹ 15 = ₹ 1,650. However, Real GDP in 2011 calculated at the base year price will be I 10 x ₹10 = ₹1, 100.

Question 22.

Distinguish between ‘real’ gross domestic product and ‘nominal’ gross domestic product. Which of these is a better index of welfare of the people and why? (C.B.S.E Outside Delhi 2013)

Answer:

Following are the points of distinction between real and nominal Gross Domestic Product (GDP):

| S.No. | Real GDP | Nominal GDP |

| 1. | Real GDP is the value of GDP at constant prices. | Nominal GDP is the value of GDP at current prices. |

| 2. | Real GDP measures the value of output economy, adjusted for price changes, | Nominal GDP is the market; or money value of all final goods and sen/ices produced in a country during a year. |

| 3. | Real GDP includes factor services provided by households, and, final goods and services provided by the firms, | Nominal GDP includes factor payments made by the firms for production resources and the payments made by the households for goods and services. |

Real GDP offers a better perspective than nominal GDP when tracking economic output over a period of time. Real GDP increases only when there is an increase in the production of goods and services.

As a result, change in income and employment can be estimated, However, since nominal GDP is valued at current price, it can increase even if there is no change in the production of goods and service. It neglects the impact of inflation on production.

Question 23.

Explain ‘non-morietary exchanges’ as a limitation of using GDP as an index of welfare of a country. (C.B.S.E. 2017)

Answer:

GDP does not take into account those tr^nsidtidfts that are not expressed in monetary terms. This is a major limitation of GDP as an index of welfare of a country as these are many transactions which although are non-monetary in nature but add To the growth and development of the nation. For example, work done by a social worker or a homemaker, Here, a-homemaker adds to the welfare of the family by keeping them healthy, which in turn-adds to the welfare of the country.

However as such transactions are non-monetary in nature, these are not included while calculating the domestic income. In LDCs, there are various non-monetary: exchanges, particularly in the rural areas and household sector. Consequently, such transactions remain outside the domain of GNP leading to underestimation of the value of GNP. Thus GNP cannot be regarded as an index of economic welfare, as it ignores the household and the volunteer sector

National Income Accounting Important Extra Questions Long Answer Type

Question 1.

Distinguish between domestic product and national product giving suitable examples in support of your answer.

Answer:

Domestic product is defined as the market value of all the final goods and services produced by the factors of production located in the country during a period of one year.

On the other hand, national product is the market value of all the final goods and services produced by the factors of production located in the country during a period of one year plus Net Factor income from Abroad (NFIA). NFIA is the difference between the incomes of residents for factor services to the rest of the world and payments to the factor services of non-residents in the domestic territory during a period of one year,

National Product = Domestic Product + NFIA

Example: If the domestic product is ₹ 5,000 and Net Factor Income from Abroad is ₹ 100, then theNational product will be:

National Product = ₹ 5000 +₹ 100 = ₹ 5100

Question 2.

Will the following be included in domestic factor income of India? Give reasons for your answer.

(i) Profits earned by a foreign bank from its branches in India

(ii) Scholarships given by Government of India

(iii) Profits earned by a resident of India from his company in Singapore

(iv) Salaries received by Indians working in American Embassy in India

Answer:

(i) Profits earned by a foreign bank from its branches in India will not be included in domestic factor income of India because it is the factor income of a foreign country or it is the income of non resident in India.

(ii) Scholarships given by the government of India will not be included in domestic factor income because it is a transfer payment and does not contribute to the flow of goods and services.

(iii) Profits earned by a resident of India from his company in Singapore will not be included in domestic factor income of India because it is the income of the resident earned abroad.

(iv) Salaries received by Indians working in American Embassy in India will be included in domestic factor income of India because it is the income of the normal residents of India, earned within the domestic territory of India.

Question 3.

Explain the expenditure method of estimating National Income. (C.B.S.E. 2007)

Answer:

Expenditure method of estimating National Income calculates the sum total of the expenditure by all the .final users: of goods and sendees plus addition to the stock with the producers and distributors. According to this method, expenditures on consumption and investment goods and government expenditures are aggregated as follows:

(i) Consumption Expenditure (C): Consumption expenditure includes expenditure on all goods and services produced and sold to the final consumer during the year.

(ii) Investment Expenditure (I): Investment is the use of today’s resources to expand tomorrow’s production or consumption. Investment expenditure is expenditure incurred on by business firms on:

(a) New plants;

(b) Adding to the stock of inventories; and

(c) Newly constructed houses

(iii) Government Expenditure (G): Government expenditure includes all government expenditure on currently produced goods and services but excludes transfer payments while computing national income.

(iv) Net Exports (X – M): Net exports are defined as total exports minus total imports.

Under expenditure method, National Income is calculated by summing up the final consumption expenditure, expenditure by business on plants, government spending and net exports.

National Income = C + I + G + (X-M)

Question 4.

What is the problem of double counting? How can this problem be avoided?

Answer:

Double counting means estimating the value of goods and services more than once. This problem takes place when the output of all the producers is added up without considering the fact that output of one producer may be the input for the other producer. The problem of double counting should be avoided because it overestimates the national income.

To get rid of the problem of double counting, the value added method is used. Value added method estimates the contribution of each individual firm at different stages of production. It is assumed that every individual firm adds to the value of the product which it purchases from some other firm as intermediary’ goods. When we sum the value added by each individual firm at different stages of production, we attain the National Income without double counting.

The estimation of value added by an individual firm can be explained with the help of an example. Suppose there are four types of firms: farmer, thread manufacturer, cloth manufacturer and readymade garment manufacturer. Their value of output, intermediate consumption and value added are displayed in the table below:

| (1) Stage of Production |

(2) Name of the Firm |

(3) Type of Output |

(4) Value of Intermediary Good (in ₹) |

(5) Value of Output (in ₹) |

(6) (5) – (4) Gross Value Added (in ₹) |

| 1 | Farmer | Cotton | ……. | 5,000 | 5,000 |

| II | Thread Manufacturer | Thread | 5,000 | 6,000 | 1,000 |

| III | Cloth Mill | Cloth | 6,000 | 6,800 | 800 |

| IV | Garment Manufacturer | Shirt. | 6,800 | 8,000 | 1,200 |

| Total | 17,800 | 25,800 | 8,000 |

Thus, the Gross Value Added by a Firm is the difference between the value of output and the value of intermediate consumption.

Question 5.

Giving reason explain how should the following be treated in estimating Gross Domestic Product at Market Price?

(i) Fees to a mechanic paid by a firm

(ii) Interest paid by an individual on a car loan taken from bank

(iii) Expenditure on purchasing a car for use by a firm (C.B.S.E 2014)

Answer:

(i) Fees to a mechanic by a firm will be included while estimating the GDPMP because the fee is being paid in return for the service provided by the mechanic.

(ii) Interest paid by an individual on a car loan taken from a bank will be included while estimating GDPMp because it is an income for the lending bank.

(iii) Expenditure on purchasing a car for use by a firm will be included while estimating GDPMp because the car is purchased by the firm for final use.

National Income Accounting Important Extra Questions HOTS

Question 1.

Are the following stocks or flows?

(i) Investment

(ii) Monetary expenditure

(iii) A hundred Rupee Note

(iv) A family’s consumption of salt

(iv) Services of a tutor

(vi) Production of cement

(vii) Machinery of a sugar mill.

Answer:

Flow is an economic variable that is measured over a specific period of time. Investment, monetary expenditure, a family’s consumption of salt, services of a tutor and production. Cement are flow concepts. Stock is an economic variable that is measured at a specific point of time. A hundred rupee note and machinery of a sugar mill are stock concepts.

Question 2.

Export receipts are not a part of net factor income from abroad. Why?

Answer:

Export receipts are not a part of net factor income from abroad because:

(i) Exports refer to the purchase of domestically produced goods by the rest of the world. Goods produced within the domestic territory of a country are to be treated as a part of GDP.

(ii) Export receipts refer to revenue of the firms from the sale of its output. These are not the receipts of factor incomes from abroad, which are to be in the form or rent, interest, profit and wages.