Here we are providing Class 12 Economics Important Extra Questions and Answers Chapter 6 Rural Development. Economics Class 12 Important Questions are the best resource for students which helps in class 12 board exams.

Class 12 Economics Chapter 6 Important Extra Questions Rural Development

Rural Development Important Extra Questions Very Short Answer Type

Question 1.

Define rural development.

Answer:

Rural development refers to the action plan for the economic and social upliftment of rural areas.

Question 2.

Name the key initiatives required for infrastructural development in rural areas.

Answer:

Key initiatives required for rural development include:

- Expansion of rural credit

- Development of irrigation facilities

- Construction of roads

- Organised agricultural marketing

- Information dissemination

Question 3.

What has happened to the agriculture output during 2007-12?

Answer:

During 2007-12, agricultural output has grown at 3.2 percent.

Question 4.

Define credit.

Answer:

Credit is the amount of money available to be borrowed by an individual, which must be paid back to the lender at some point in the future.

Question 5.

What is the function of micro-credit programme?

Answer:

Micro-credit programme provides small loans to the needy for self-employment projects that generate income.

Question 6.

Classify rural credit.

Answer:

Rural credit can be classified into:

(i) Institutional Sources – commercial banks, regional rural bank, cooperatives, land development

(ii) Non-institutional Sources – moneylenders, traders, employers, relatives and friends

Question 7.

Why are moneylenders a popular source of rural credit?

Answer:

The moneylenders are a popular source of rural credit due to easy availability of credit.

Question 8.

When was NABARD set up?

Answer:

NABARD was set up in 1982.

Question 9.

What is agricultural marketing?

Answer:

Agricultural marketing is a process that involves the assembling, storage, processing, transportation, packaging, grading and distribution of different agricultural commodities across the country.

Question 10.

Name a few defects of agricultural marketing.

Answer:

Defects of agricultural marketing include:

(i) Sale at only village level

(ii) Inadequate transport facilities

(iii) Malpractices

(iv) Inadequate credit facilities

Question 11.

What is cooperative marketing?

Answer:

Cooperative marketing is a system through which a group of farmers join together to undertake some or all the processes involved in bringing goods to the consumer instead of individual sale.

Question 12.

What is agricultural diversification?

Answer:

Agricultural diversification refers to change in cropping pattern and/ or a shift of workforce from agriculture to other allied activities and non-agriculture sector.

Question 13.

Name the category that accounts for the largest share in livestock in India.

Answer:

Poultry accounts for the largest share in livestock in India with 58 per cent (in 2012).

Question 14.

What is operation flood?

Answer:

Operation flood is a system in which all the farmers pool their milk produced as per quality-based grading and process and market the same to urban centres through cooperatives.

Question 15.

What is the position of India in the production of fruit and vegetables?

Answer:

India is the second-largest producer of fruits and vegetables in the world.

Question 16.

What is the state of women in employment in fishery sector?

Answer:

Women are not involved in active fishing. However, they form about 60 per cent of the workforce in export marketing and 40 percent in internal marketing.

Question 17.

List some highly remunerative employment options for women in rural areas.

Answer:

Highly remunerative employment options for women in rural areas include:

(i) Flower harvesting

(ii) Nursery maintenance

(iii) Propagation of fruits and flowers

(iv) Food processing

(v) Hybrid seed production and tissue culture

Question 18.

What is sustainable development?

Answer:

Sustainable development is the process of development which fulfils the needs of the present generation without reducing the ability of the future generation to fulfil their own needs.

Question 19.

Define organic farming.

Answer:

Organic farming includes the entire system of farming that restores, maintains and enhances the ecological balance.

Question 20.

Why is the demand for organically grown food rising?

Answer:

The demand for organically grown food is rising in order to enhance food safety throughout the world.

Question 21.

List the major concerns related to promotion of organic farming.

Answer:

The major concerns related to promotion of organic farming are:

(i) Inadequate infrastructure

(ii) Problem of marketing the products

Rural Development Important Extra Questions Short Answer Type

Question 1.

Why is rural development important?

Answer:

The real progress of a country does not mean simply the growth and expansion of industrial urban centres. It is mainly the development of the villages, the rural sector. Development of rural sector is important because:

(i) agriculture is the major source of livelihood in the rural sector of India;

(ii) more than two-third of India’s population depends on agriculture; and

(iii) bulks of raw materials for industries come from agriculture and rural sector.

However, the level of agricultural productivity is so low that one-third of rural India still lives in abject poverty. Thus, it is important to develop rural India if our nation has to realise real economic and social progress.

Question 2.

What efforts has the government made for rural development?

Answer:

The government has made the following efforts for rural development:

(i) Prepared a road map for agricultural diversification with focus on horticulture, floriculture, animal husbandry and fisheries

(ii) Started Vishesh Krishi Upaj Yojana on I st April, 2004 as a special agricultural produce scheme with the objective of promoting exports of fruits, vegetables, flowers, minor forest produce, dairy and poultry ’

(iii) Focused on micro irrigation, finance, insurance and rural credit

(iv) Strengthened agricultural marketing infrastructure

Question 3.

Discuss the changes that have taken place in Indian agriculture and rural sector since initiation of reforms.

Answer:

After the initiation of reforms, the growth rate of agriculture sector decelerated to about 3 percent per annum during the 1991 -2012. Decline in public investment has been the major reason for this. The share of agriculture sector’s contribution to GDP has been declining while the population dependent on this sector has not shown any significant change.

There has been inadequate infrastructure, lack of alternate employment opportunities in the industry or service sector and increasing casualisation of employment, which further impedes rural development. During 2007-12, agriculture output has grown only at 3.2 percent.

Question 4.

What are the essentials of rural development?

Answer:

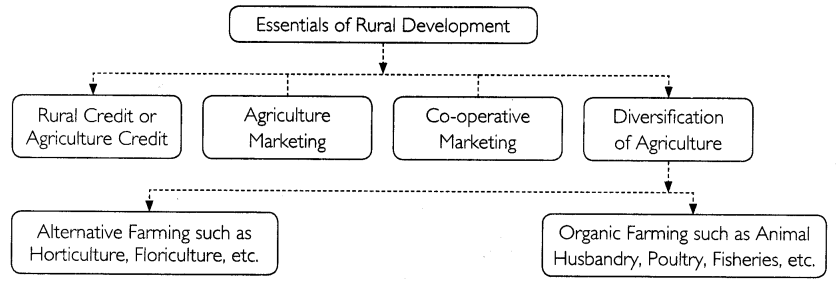

The essentials of rural development have been shown with the help of a diagram.

Question 5.

What are the limitations of non-institutional sources of credit?

Answer:

The following are the limitations of non-institutional sources of credit are:

(i) Moneylenders and traders exploit small farmers by charging very high rate of interest on loans.

(ii) They manipulate poor farmers’ credit accounts and keep them in debt trap.

(iii) They compel the farmers to sell their produce to him at low prices.

(iv) They do not issue any receipt after the payment is made by the farmer.

(v) They get the word cone by members of farmers family without any wages

Question 6.

What are significant features of moneylenders as a source of rural credit?

Answer:

The significant features of moneylenders as a source of rural credit are:

(i) Moneylender provides credit both for productive and unproductive purposes.

(ii) The money lending method is very simple. He provides loans for short-term, medium-term as well as long-term requirements of the farmer, without any legal formalities.

(iii) Moneylender provides loans with or without security.

(iv) If the farmer pays the interest on a regular basis, the moneylender does not compel the farmer to pay back the principal amount.

Question 7.

Discuss in brief the defects of agricultural credit.

Answer:

In India, the main defects in the agricultural credit system are as given under:

(i) Agriculturist needs to pay a very high rate of interest.

(ii) Moneylenders and traders are still the prominent source of agricultural finance.

(iii) There is a lack of coordination among the various agencies of rural credit.

(iv) Despite many institutions, adequate agricultural credit is not available. The institutional finance is only 50 percent of the total requirements of the farmer.

(v) The commercial banks hesitate to provide credit to agriculturist. Banks demand collateral as the risk involved is greater.

(vi) There is no systematic arrangement in New Agricultural Finance Corporations for agricultural credit.

Question 8.

Write a short note on the role and performance of SHGs as a source of credit. ;

Answer:

The formal credit delivery mechanism has not only proven inadequate but has also not been fully integrated into the overall rural social and community development. A vast proportion of poor rural households tend to remain out of the credit network as some kind of collateral is required to take loan from banks.

Self-Help Groups (SHGs) have emerged to fill the gap in the formal credit system. A typical SHG consists of 15-20 members. These members usually belong to one neighbourhood, who meet and save regularly. Saving per member depends on the ability of the people to save.

The SHG can extend these savings as small loans or micro credit to the needy members from the group I itself. Although the group charges interest on these loans, it is still less than what the moneylenders charge. Total SHG savings with banks increased from ₹ 23.9 billions as on 31st March, 2006 to around ₹ 70 billion as on 31 st March, 2011.

Question 9.

What should the rural banking sector do to improve the situation of rural credit in India?

Answer:

In order to improve the situation of rural credit in India, the rural banking sector should change their approach from being merely lenders to building up relationship banking with the borrowers. Developing the habit of savings and efficient utilisation of financial resources must be encouraged among the farmers.

Question 10.

What was the need for state intervention to regulate the activities of the private traders?

State intervention is required to regulate the activities of the private traders

Answer:

(i) to ensure adherence to standardised and open marketing procedures

(ii) to avoid collusion between brokers and traders that may cause disadvantage to the farmers

(iii) to ensure use of standardised weights and measures

(iv) to promote fair marketing fees; and

(v) to keep a check regarding unauthorised deductions from the purchase price payable to the framers.

Question 11.

Explain the policy instruments introduced by the government to safeguard the interests of farmers.

Answer:

Government has developed certain policy instruments to safeguard the interests of farmers. These instruments are:

(i) Fixation of Minimum Support Price (MSP): MSP is announced before the sowing season and assures agricultural producers against any sharp fall in farm prices. It provides long-term guarantee to the farmer.

(ii) Buffer Stock: The Food Corporation of India purchases wheat and rice from the farmers in states where there is surplus production and maintain it as buffer stock. Buffer stock is maintained by the government to stabilise prices. It helps in making the foodgrains available in the deficit areas and hence, resolves the problem of food shortage during adverse weather conditions or during the periods of calamity.

(iii) Public Distribution System (PDS): The PDS operates through fair price shops, also known as ration shops. The government offers essential commodities like wheat, rice, sugar, kerosene, edible oils, coal, cloth, etc. at a price below the market price to poor section of the society.

Question 12.

Write a short note on cooperative marketing societies.

Answer:

The cooperative marketing societies has been started in India in 1954 to assure reasonable prices to the farmers for their produce. The aim was to eliminate all the existing intermediaries from the market. It is a method of linking credit, farming and processing in order to help the farmers to get maximum advantage.

Cooperative marketing is responsible for collecting the produce from the members and disposing it off in the mandi (market) at a favourable time. The cooperative marketing societies, therefore, remove the defects of the present marketing system. The government sets up a cooperative credit society, commonly known as the Primary Agricultural Cooperative Societies (PACS), which can be initiated with 10 or more persons of the village. PACSs also provide loans to the farmers for productive purposes.

Question 13.

Discuss the objectives of cooperative marketing societies.

Answer:

The objectives of cooperative marketing societies are:

(i) To sell the products of its members at fair prices and distribute the sale proportionately among the members

(ii) To provide loans to members in need

(iii) To provide marketing information to the members

(iv) To provide seeds, fertilisers, pesticides and other inputs to the members

(v) To stabilise the prices of agricultural products

Question 14.

What is the need for agricultural diversification?

Answer:

Agricultural diversification is essential due to the following reasons:

(i) There is a greater risk associated with exclusive dependence on farming for livelihood.

(ii) Diversification provides productive sustainable livelihood options to rural people, thereby realising higher level of incomes for them.

Question 15.

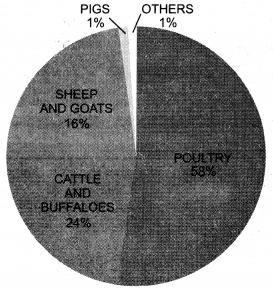

Show the distribution of poultry and livestock in India with the help of a diagram.

Answer:

Poultry accounts for the largest share with 58 per cent. Cattle and buffalo account for 24 per cent of India’s total livestock. India had about 300 million cattle, including 108 million buffaloes, in 2012. Other animals which include camels, asses, horses, ponies and mules are in the lowest rung. The diagram below shows the distribution of poultry and livestock in India in 2012.

Question 16.

What are the benefits of horticulture?

Answer:

The benefits of horticulture are given below:

(i) Horticultural crops play a vital role in providing food and nutrition.

(ii) India has emerged as a world leader in producing a variety of fruits like mangoes, bananas, coconuts, cashew nuts and a number of spices.

(iii) India is the second largest producer of fruits and vegetables in the world.

(iv) Economic condition of many farmers engaged in horticulture has improved.

(v) Horticulture has become a means of improving livelihood for many unprivileged classes.

(vi) It provides highly remunerative employment options for women in rural areas.

Question 17.

Why should organic farming be adopted?

Answer:

Modern farming methods make excessive use of chemical fertilisers and pesticides, which led to loss of soil fertility; soil, water and air pollution, and high chemical contents in foodgrains. Therefore, there is an urgent need to conserve the environment and eco-system and hence, promote sustainable development.

Organic farming is an eco-friendly and inexpensive farming technology,which can be easily purchased by small and marginal farmers. It restores, maintains and enhances the ecological balance. Moreover, organically grown food is considered more nutritious and healthier than chemically grown food.

Rural Development Important Extra Questions Long Answer Type

Question 1.

Discuss the key issues of action plan for rural development in India.

Answer:

The following are the key issues of action plan for rural development in India:

(i) Land Reforms: Land reforms are the measures to bring about changes in the ownership of land holdings to encourage equity. Land reforms providing a land system conducive for agricultural development should not only be enacted but also be faithfully implemented. The official land tenure system must aim at land to the tiller as self-cultivation can induce maximum improvement in farming.

(ii) Poverty Alleviation: Action plan for rural development includes high priority to poverty alleviation in the rural areas. For the overall development of each locality and in the rural areas special schemes like MNREGA should be launched.

(iii) Human Capital Formation: Human capital formation is still a major task in rural areas of the Indian economy. India has a huge pool of manpower resources but the available manpower lacks basic skill and training. Therefore, in order to make the -available resources strong and efficient, the action plan for rural development should consider the challenging issues like literacy, healthcare, education, on the job training, etc.

(iv) Development of Infrastructure: Development of infrastructure includes the following:

- Provision of credit facilities to the farmers in the rural areas

- Permanent water supply throughout the year in the areas receiving less or low rainfall

- Availability of agricultural research facilities to enhance the crop yield and productivity

- Development of efficient means of transport, communication and power resources.

Question 2.

Explain the various non-institutional sources of rural credit in India.

Answer:

The various non-institutional sources of rural credit in India are:

(i) Moneylenders: Moneylenders typically offer small personal loans to farmers at high rates of interest. They charge high interest rates due to the level of risk involved. They lend to people with limited access to banking activities.

(ii) Traders and Commission Agents: Traders and commission agents are also non-institutional source of agricultural finance. They advance loans to agriculturists for productive purposes against their crops without any legal agreement. They force them to sell their produce at low prices and charge heavy commission for themselves.

(iii) Landlords: Small and marginal farmers mostly depend on landlords for credit in order to satisfy their day-to-day requirements; However, with the abolition of zamindari system, this source has lost its importance to a large extent.

(iv) Relatives: Sometime the farmers have to borrow from their relatives and friends to meet their financial crisis. This type of loan does not carry interest.

Question 3.

What are the sources of institutional credit in India? Explain.

Answer:

The sources of institutional credit in India include the following:

(i) Government: The government provides loans to the farmer for his short-term as well as long

term needs. Normally, these loans are given at the time of natural calamities such as droughts, floods, etc. Long-term loans are given for making permanent improvements and a very low rate of interest is charged for the same.

(ii) Cooperative Credit: The cooperative credit societies meet the requirements of only short-term credit. However, to bring about permanent improvement on land and to introduce modern technology, long-term heavy investment is required. Land development banks are supposed to advance long-term loans for this purpose.

(iii) Commercial Banks: After the nationalisation of 14 big banks in 1969, the commercial banks have also started taking keen interest in farm financing. A number of schemes have been introduced to help the farmers so that they may introduce the modern,technology in agriculture. Most families covered by these banks are big landlords, who could give adequate security to the bank in the form of land mortgage.

(iv) Regional Rural Banks: A new rural credit agency has’ been set up to provide loan to the agriculturists. RRBs have been opened by the joint efforts of the central and state governments and commercial banks. These banks have been set up-in the rural areas where enough credit has not been available but there are substantial potentialities of agricultural development.

(v) National Bank for Agriculture and Rural Development: NABARD was set up on 12th July, 1982 as an apex body to look after the credit needs of the rural sector. It has got an authority to oversee the functioning of the cooperative sector through its agricultural credit department. It provides long-term loans by way of refinance of land development banks, cooperative banks, commercial banks and regional rural banks.

(vi) Kisan Credit Card (KCC) Scheme: This scheme was introduced in 1998-99 and it has made rapid progress, with the banking system issuing more than 556 lakh cards by November, 2005. This scheme has helped in augmenting the flow of short-term crop loans for seasonal agricultural operations to farmers. Besides the existing facilities, the KCC scheme has been enlarged to include long-term loans for agriculture and allied activities along with a component to meet the consumption needs.

Question 4.

Suggest some measures for the improvement of rural credit.

Answer:

The following measures should be adopted for the improvement of rural credit:

(i) Coordination: The different agencies of agricultural credit must be coordinated to facilitate efficient disbursal and utilisation of financial resources.

(ii) Deposit Insurance Scheme: The cooperative banks should start the Deposit Insurance Scheme to attract the maximum deposits from the public.

(iii) Cooperative Marketing Societies: The credit and cooperative marketing societies should be integrated. It will ensure the paying back of loans as the farmers sell their produce to cooperative markets.

(iv) Increase in Capital Resources: It is necessary to increase capital resources of the cooperative credit societies to meet the need of the farmers.

(v) Easy Availability of Loans: The loan process should be made simpler. The main reason for popularity of the moneylender is simple methods of lending the amount. The formalities should be minimised.

(vi) Efficient Management: The credit agencies should be efficiently managed. The managers should have complete knowledge about agriculture and they should be sympathetic towards

(vii) Promotion of Savings: To promote savings, the farmers should be given incentives. The government should use its mechanism to encourage farmers to save more and avoid unnecessary spending.

Question 5.

Explain the significance of agricultural marketing in rural development.

Answer:

An efficient marketing system is of great significance for the development of agricultural economy like that of India. Proper marketing of agricultural products is undoubtedly favourable to the farmers because it ensures fair price for their produce. The fair price encourages them to produce for the market. The needs of urban sector are better satisfied and the process of industrialisation gets a boost.

As a result, the income of the farmers rises, increasing their demand for industrial output. Thus, improvement in farm marketing helps the process of development. Naturally, an important problem of Indian agriculture concerns the marketing of its produce. In order to increase the income of the farmers and to promote economic growth of India, it is necessary that the problem of agricultural marketing be solved.

It is a fact that economic prosperity depends upon a sound system of marketing. In India, it becomes important because some states produce much more than their requirements and have to supply to other deficit parts of the country.

Question 6.

Discuss the conditions required for efficient agriculture marketing in India.

Answer:

Following are the conditions necessary for efficient marketing in India:

(i) Storage Facilities: Efficient marketing needs adequate storage facilities so that they should be able to wait for times when they could get better prices of their produce. Moreover, they do not have to dispose off their surplus produce immediately after harvesting.

(ii) Freedom from Moneylenders: In India, there is large number of moneylenders who compel farmers for distress sale. Thus, credit facilities should be extended to save them from the clutches of moneylenders.

(iii) Transportation Facilities: Farmers should have cheap and adequate transport facilities so that they may be able to take their surplus to the regulated markets instead of selling it away at the village level.

(iv) Reduced Intermediaries: The number of intermediaries should be minimised so that the profits of middlemen may be reduced. This in turn will increase the returns to the farmers.

(v) Adequate Information: Farmers should have adequate and clear information regarding the market conditions as well as about the prevailing prices otherwise they may be cheated. There should be organised and regulated markets where they can directly sell their produce.

Question 3.

Discuss the importance of cooperative marketing in India.

Answer:

The following are the advantages of cooperative marketing in India:

(i) End of Middle Man: The agricultural cooperative marketing has ended the presence of middle man in the process of sale and purchase of products. With the help of cooperative marketing, S agriculturists get fair price of their products.

(ii) Increased Bargaining Power of the Producers: With the help of cooperative marketing, farmers are less prone to exploitation and malpractices. Instead of marketing their produce individually, they market it together through one agency. This increases their bargaining’strength as merchants and intermediaries.

(iii) Direct Dealing with Final Buyers: The cooperatives can altogether skip the intermediaries and enter into direct dealing with the final buyers, which eliminates exploiters and ensure fair prices to both the producers and the consumers.

(iv) Standardisation and Gradation of Agricultural Produce: This task could be done more easily by a cooperative agency than by an individual farmer. Thus, each member can take advantages of standardisation and gradation of produce.

(v) Control Over the Supply of Produce: Prices of the produce fall down during cropping season

due to excess supply in the market. The cooperative marketing societies provide storage facilities. As a result, there remains a control over the supply of produce. The farmers can wait for better prices.

(vi) Credit Facilities: The cooperative marketing societies provide credit facilities to the farmers to save them from the necessity of selling their produce immediately after harvesting. This ensures better returns to the farmers.

(vii) Provide Training of Commercial Methods: The cooperative societies also provide training to the farmers for cooperative efforts and commercial methods in the marketing, which develops the cooperative tendencies in the rural areas.

(viii) Advertisement and Publicity: Through advertisements and publicity services, cooperative marketing increases the sale of farmer’s produce, which enlarges the size of the market.

Question 4.

Explain the advantages and limitations of organic farming.

Answer:

Advantages of Organic Farming

(i) Inexpensive Process: Organic agriculture substitutes costlier agricultural inputs with locally produced organic inputs, which are cheaper and hence, generate more return on investment.

(ii) Generates Higher Income: It generates higher income by means of international exports as the demand for organically grown products is rising.

(iii) Healthier Food: Organically grown food has more nutritional value than chemically grown food. It, therefore, provides us with healthier and tastier foods.

(iv) Creates Employment: Since organic farming organic farming requires is a labour-intensive process, it will solve the problem of unemployment.

(v) Eco-friendly: Organic goods are pesticide-free and produced in an environmentally sustainable way.

Limitations of Organic Farming

- Yields from organic farming are less compared to the yield from modern agriculture farming, at least in the initial years.

- Organic produce may also have more blemishes and a shorter shelf life than sprayed produce.

- Infrastructural facilities are inadequate to encourage small farmers to adapt organic farming

- There is a limited choice to produce off-season crops in organic farming.

Rural Development important Extra Questions HOTS

Question 1.

Explain the working of an SHG formed in Tamil Nadu.

Answer:

TANWA is a Tamil Nadu Women in Agriculture project,- which was initiated in Tamil Nadu to train women in the latest agricultural techniques. It induces women to actively participate in raising agricultural productivity and family income.

At a farm, women’s group in Thiruchhirapalli run by Anthoniammal, trained women successfully make and sell the vermicompost and earn money from this venture. With the accumulated savings, they promote small-scale household activities such as mushroom cultivation, soap manufacture, doll making or other income generating activities.