ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS

These Solutions are part of ML Aggarwal Class 10 Solutions for ICSE Maths. Here we have given ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS

More Exercises

- ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax EX 1

- ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS

- ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax Chapter Test

A retailer purchases a fan for ₹ 1200 from a wholesaler and sells it to a consumer at 15% profit. If the rate of sales tax (under VAT) at every stage is 8%, then choose the correct answer from the given four options for questions 1 to 5 :

Question 1.

The selling price of the fan by the retailer (excluding tax) is

(a) ₹ 1200

(b) ₹ 1380

(c) ₹ 1490.40

(d) ₹ 11296

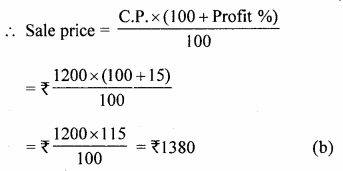

Solution:

Cost price of a fan = ₹ 1200

Profit = 15%

Question 2.

VAT paid by the wholesaler is

(a) ₹ 96

(b) ₹ 14.40

(c) ₹ 110.40

(d) ₹ 180

Solution:

Rate of VAT =8%

.’. VAT paid by wholesaler = ₹ 1200 x \(\\ \frac { 8 }{ 100 } \)

= ₹ 96 (a)

Question 3.

VAT paid by the retailer

(a) ₹ 180

(b) ₹ 110.40

(c) ₹ 96

(d) ₹ 14.40

Solution:

VAT deducted by the retailer = ₹ \(\\ \frac { 1380\times 8 }{ 100 } \)

VAT paid by wholesalers = ₹ 96 .

Net VAT paid by his = ₹ 110.40 – 96.00

= ₹14.40 (d)

Question 4.

VAT collected by the Government on the sale of fan is

(a) ₹14.40

(b) ₹96

(c) ₹110.40

(d) ₹180

Solution:

VAT collected by the govt, on the sale of fan

= ₹ \(\\ \frac { 11040 }{ 100 } \)

= ₹110.40 (c)

Question 5.

The cost of the fan to the consumer inclusive of tax is

(a) ₹1296

(b) ₹1380

(c) ₹1310.40

(d) ₹1490.40

Solution:

Cost of fan to the consumer inclusive tax

= ₹1380 + 110.40

= ₹ 1490.40 (d)

A shopkeeper bought a TVfrom a distributor at a discount of 25% of the listed price of ₹ 32000. The shopkeeper sells the TV to a consumer at the listed price. If the sales tax (under VAT) is 6% at every stage, then choose the correct answer from the given four options for questions 6 to 8 :

Question 6.

VAT paid by the distributor is

(a) ₹1920

(b) ₹1400

(c) ₹480

(d) ₹8000

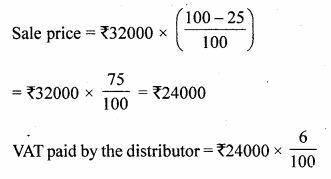

Solution:

List price of T.V. set = ₹32000

Discount = 25%

Rate of VAT = 6%

= ₹1440 (b)

Question 7.

VAT paid by the shopkeeper is

(a) ₹480

(b) ₹1440

(c) ₹1920

(d) ₹8000

Solution:

Total VAT charged by the shopkeeper

= ₹32000 x \(\\ \frac { 6 }{ 100 } \)

= ₹1920

VAT already paid by distributor = ₹ 1440

Net VAT paid by shopkeeper

= ₹1920 – ₹1440

= ₹480 (a)

Question 8.

The cost of the TV to the consumer inclusive of tax is

(a) ₹8000

(b) ₹32000

(c) ₹33920

(d) none of these

Solution:

Cost of T.V. to the consumer inclusive of VAT = ₹32000 + 1920

= ₹33920 (c)

A wholesaler buys a computer from a manufacturer for ₹ 40000. He marks the price of the computer 20% above his cost price and sells it to a retailer at a discount of 10% on the marked price. The retailer sells the computer to a consumer at the marked price. If the rate of sales tax (under VAT) is 10% at every stage, then choose the correct answer from the given four options for questions 9 to 15 :

Question 9.

The marked price of the computer is

(a) ₹40000

(b) ₹48000

(c) ₹50000

(d) none of these

Solution:

C.R of computer for manufacturer = ₹40000

After marking 20% above the C.R, the price

= ₹40000 x \(\\ \frac { 100+20 }{ 100 } \)

= ₹40000 x \(\\ \frac { 120 }{ 100 } \)

= ₹48000 (b)

Question 10.

Cost of the computer to the retailer (excluding tax) is

(a) ₹36000

(b) ₹40000

(c) ₹43200

(d) ₹47520

Solution:

Rate of discount = 10%

.’. Sales price after discount

= ₹48000 x \(\\ \frac { 100-10 }{ 100 } \)

= ₹48000 x \(\\ \frac { 90 }{ 100 } \)

= ₹43200 (c)

Question 11.

Cost of the computer to the retailer inclusive of tax is

(a) ₹47520

(b) 43200

(c) 44000

(d) none of these

Solution:

Rate of sales tax (VAT) = 10%

Sales tax charged = ₹43200 x \(\\ \frac { 10 }{ 100 } \)

= ₹4320

Cost price of T.V. including S.T.

= ₹43200 + ₹4320

= ₹47520 (a)

Question 12.

VAT paid by the manufacturer is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) none of these

Solution:

VAT paid by the manufacturer

= ₹40000 x \(\\ \frac { 10 }{ 100 } \)

= ₹4000 (a)

Question 13.

VAT paid by the wholesaler is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) ₹480

Solution:

VAT paid by the wholesaler = ₹43200 x \(\\ \frac { 10 }{ 100 } \)

= ₹4320

VAT already paid = ₹4000

Net VAT paid by = ₹4320 – ₹4000

= ₹320 (c)

Question 14.

VAT paid by the retailer is

(a) ₹4000

(b) ₹4320

(c) ₹320

(d) ₹480

Solution:

VAT paid by retailer = 48000 x \(\\ \frac { 10 }{ 100 } \) = ₹4800

VAT already paid = ₹4320

Net VAT to be paid = ₹4800 – 4320

= ₹480 (d)

Question 15.

Consumer’s cost price inclusive of VAT is

(a) ₹47520

(b) ₹48000

(c) ₹52800

(d) ₹44000

Solution:

Sol. Sale price to consumer = ₹4800

VAT paid by the consumer = ₹48000 x \(\\ \frac { 10 }{ 100 } \)

= ₹4800

Consumers cost price inclusive of VAT = ₹48000 + ₹4800

= ₹52800 (c)

Hope given ML Aggarwal Class 10 Solutions for ICSE Maths Chapter 1 Value Added Tax MCQS are helpful to complete your math homework.

If you have any doubts, please comment below. Learn Insta try to provide online math tutoring for you.