Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1B

These Solutions are part of Selina Concise Mathematics Class 10 ICSE Solutions. Here we have given Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1B.

Other Exercises

- Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1A

- Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1B

- Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1C

[In this exercise, all the prices are excluding tax/VAT unless specified].

Question 1.

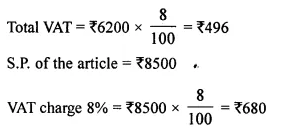

A shopkeeper purchases an article for ₹ 6,200 and sells it to a customer for ₹ 8,500. If the sale tax (under VAT) is 8%; find the VAT paid by the shopkeeper.

Solution:

C.P. of article = ₹ 6200

Rate of VAT = 8%

Amount of VAT paid by the shopkeeper = ₹ 680 – ₹ 496 = ₹ 184

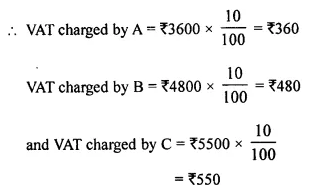

Question 2.

A purchases an article for ₹ 3,600 and sells it to B for ₹ 4,800. B, in turn, sells the article to C for ₹ 5,500. If the sale tax (under VAT) is 10%, find the VAT levied on A and B.

Solution:

C.P. of an article for A = ₹ 3600

C.P. of the article for B = ₹ 4800

and C.P. for C = ₹ 5500

Rate of VAT in each case = 10%

Now VAT levied on A = ₹ 480 – ₹ 360 = ₹ 120

and VAT levied on B = ₹ 550 – ₹ 480 = ₹ 70

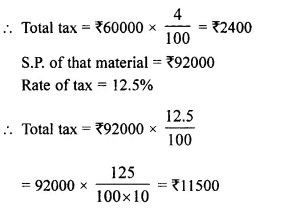

Question 3.

A manufacturer buys raw material for ₹ 60,000 and pays 4% tax. He sells the ready stock for ₹ 92,000 and charges 12.5% tax. Find the VAT paid by the manufacturer.

Solution:

C.P. of raw material = ₹ 60000

Rate of tax = 4%

VAT paid by the manufacturer = ₹ 11500 – ₹ 2400 = ₹ 9100

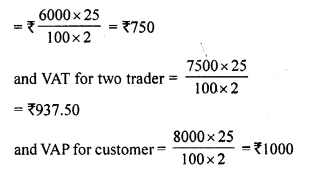

Question 4.

The cost of an article is ₹ 6,000 to a distributor. He sells it to a trader for ₹ 7,500 and the trader sells it to a customer for ₹ 8,000. If the VAT rate is 12.5% ; find the VAT paid by the :

(i) distributor

(ii) trader.

Solution:

Cost price of an article to a distributor = ₹ 6000

and selling price of distributor = ₹ 7500

and selling price of trader = ₹ 8000

Rate of VAT = 12.5% = \(\frac { 25 }{ 2 }\) %

Now, VAT for two distributor

(i) Now VAT paid by distributor = ₹ 937.50 – ₹ 750 = ₹ 187.50

(ii) and VAT paid by trader = ₹ 1000 – ₹ 937.50 = ₹ 62.50

Question 5.

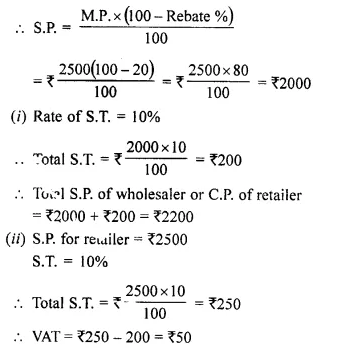

The printed price of an article is ₹ 2,500. A wholesaler sells it to a retailer at 20% discount and charges sales-tax at the rate of 10%. Now the retailer, in turn, sells the article to a customer at its list price and charges the sales-tax at the same rate. Find :

(i) the amount that retailer pays to the wholesaler.

(ii) the VAT paid by the retailer.

Solution:

M.P. of an article = ₹ 2500

Rebate = 20%

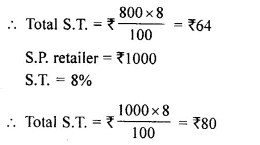

Question 6.

A retailer buys an article for ₹ 800 and pays the sales-tax at the rate of 8%. The retailer sells the same article to a customer for ₹ 1,000 and charges sales- tax at the same rate. Find :

(i) the price paid by a customer to buy this article.

(ii) the amount of VAT paid by the retailer.

Solution:

C.P. of an article for retailer = ₹ 800

Rate of S.T. = 8%

(i) Cost price of the customer = ₹ 1000 + ₹ 80 = ₹ 1080

(ii) VAT paid by the retailer = ₹ 80 – ₹ 64 = ₹ 16

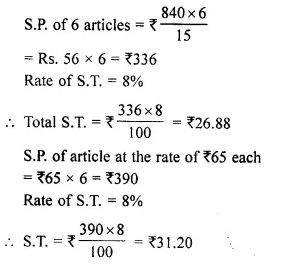

Question 7.

A shopkeeper buys 15 identical articles for ₹ 840 and pays sales-tax at the rate of 8%. He sells 6 of these articles at ₹ 65 each and charges sales-tax at the same rate. Calculate the VAT paid by the shopkeeper against the sale of these six articles.

Solution:

C.P. of 15 articles = ₹ 840

VAT paid by the retailer = ₹ 31.20 – ₹ 26.88 = ₹ 4.32

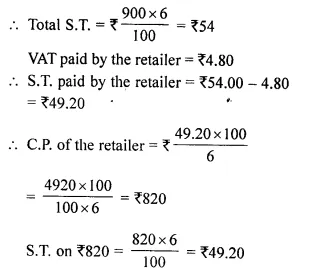

Question 8.

The marked price of an article is ₹ 900 and the rate of sales-tax on it is 6%. If on selling the article at its marked price, a retailer has to pay VAT = ₹ 4.80; find the money paid by him (including sales-tax) for purchasing this article.

Solution:

M.P. an article = ₹ 900

Rate of S.T. = 6%

Amount paid including S.T. = ₹ 820 + ₹ 49.20 = ₹ 869.20

Question 9.

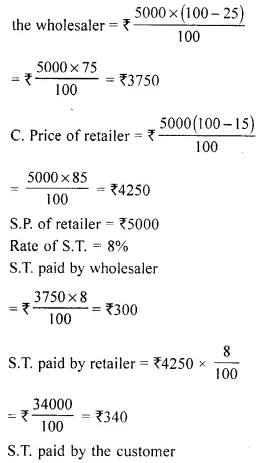

A manufacturer marks an article at ₹ 5,000. He sells this article to a wholesaler at a discount of 25% on the marked price and the wholesaler sells it to a retailer at a discount of 15% on its marked price. If the retailer sells the article without any discount and at each stage the sales-tax is 8%, calculate the amount of VAT paid by :

(i) the wholesaler.

(ii) the retailer.

Solution:

M.P. of an article = ₹ 5000

Rate of discount = 25%

S.R of the manufacturer or C.P of

Now VAT paid by

(i) The wholesaler = ₹ 340 – ₹ 300 = ₹ 40

(ii) Retailer = ₹ 400 – ₹ 340 = ₹ 60

Question 10.

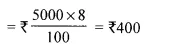

A shopkeeper buys an article at a discount of 30% and pays sales-tax at the rate of 8%. The shopkeeper, in turn, sells the article to a customer at the printed price and charges sales tax at the same rate. If the printed price of the article is ₹ 2,500; find :

(i) the price paid by the shopkeeper.

(ii) the price paid by the customer.

(iii) The VAT (Value Added Tax) paid by the shopkeeper.

Solution:

Printed price of an article = ₹ 2500

Discount = 30%

C.P of the article for shopkeeper

(i) Price paid by the shopkeeper = ₹ 1750 + ₹ 140 = ₹ 1890

(ii) Price paid by the customer = ₹ 2500 + ₹ 200 = ₹ 2700

(iii) VAT paid by the shopkeeper = ₹ 200 – ₹ 140 = ₹ 60

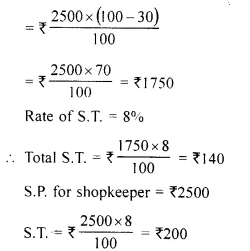

Question 11.

A shopkeeper sells an article at its list price (₹ 3,000) and charges sales-tax at the rate of 12%. If the VAT paid by the shopkeeper is ₹ 72, at what price did the shopkeeper buy the article inclusive of sales-tax ?

Solution:

S.P. or list price of an article = ₹ 3000

Rate of sales tax = 12%

C.P paid by the shopkeeper including S.T. = ₹ 2400 + ₹ 288 = ₹ 2688

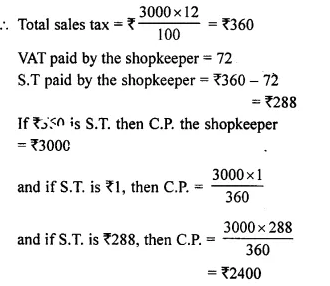

Question 12.

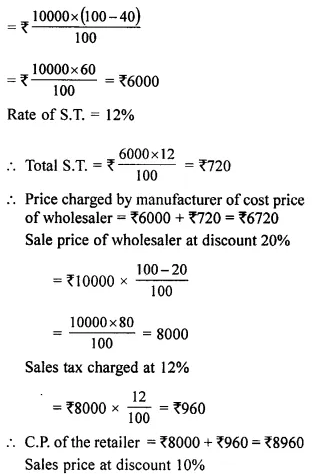

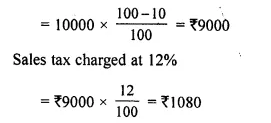

A manufacturer marks an article for ₹ 10,000. He sells it to a wholesaler at 40% discount. The wholesaler sells this article to a retailer at 20% discount on the marked price of the article. If retailer sells the article to a customer at 10% discount and the rate of sales-tax is 12% at each stage; find the amount of VAT paid by the :

(i) wholesaler

(ii) retailer

Solution:

Marked price of an article = ₹ 10000

Rate of discount = 40%

C.P of the wholesaler

Now

(i) Vat paid by wholesaler = ₹ 960 – ₹ 720 = ₹ 240

(ii) Vat paid by retailer = ₹ 1080 – ₹ 960 = ₹ 120

Hope given Selina Concise Mathematics Class 10 ICSE Solutions Chapter 1 Value Added Tax Ex 1B are helpful to complete your math homework.

If you have any doubts, please comment below. Learn Insta try to provide online math tutoring for you.