By going through these CBSE Class 12 Accountancy Notes Chapter 6 Accounting for Share Capital, students can recall all the concepts quickly.

Accounting for Share Capital Notes Class 12 Accountancy Chapter 6

With the expansion in the scale of operations, non-corporate forms of organizations, for example, sole proprietorship, partnership firms found themselves unequal to the tasks of meeting all the capital requirements of the present-day large-scale business operations. Thus, a relatively new form of the business organization came into vogue and this is called a Company.

Company:

A Company may be defined as an artificial person created by law, having a corporate and legal personality distinct and separate from its members, perpetual succession, and a common seal.

The word Company implies a group of people who voluntarily agree to form a company.

In the eyes of law ‘Company’ is termed as ‘Company’ which is formed and registered under any of the previous laws before the Indian Company Act 1956 or under this act.

“Company is an artificial person created by law having a separate legal entity with a perpetual succession and a common seal.” -L.H. Haney

“A corporation is an artificial being, invisible, intangible and existing only in the contemplation of law.” -Justice Marshall

“it is an association of persons who contribute money or money’s worth to a common stock and employ it for some common purpose.” -Justice Lindley

Features of a Company:

- It is a voluntary association of persons for profit.

- It is a separate legal entity i.e. Its legal existence is different from that of its member.

- The members have limited liability.

- It has perpetual succession.

- It has a common seal which signifies the sign of company.

- The shares of a public limited company can be freely transferable.

- It can enter into contracts and can enforce contractual rights against others. Similarly, the company can be sued by others if there is a breach of contract by the company.

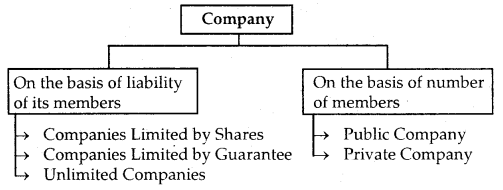

Kinds of a Company:

Companies Limited by Shares: In this case, the liability of the members is limited to the extent of the nominal value of shares held by them.

Companies Limited by Guarantee: In this case, the liability of its members is limited to the extent of the guarantee given by them in the event of the company being wound up.

Unlimited Companies: When there is no limit on the liability of its members, such Companies are called unlimited companies.

Public Company: A Public Company means a company that is not a Private Company.

Private Company: A Private Company is one which by its Articles of Association:

- Restricts the right to transfer its shares;

- Limits the number of its members to fifty;

- Prohibits any invitation to the public to subscribe for any shares in or debentures of the company.

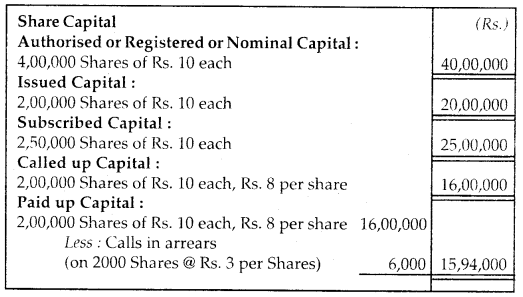

Share Capital of a Company:

Every company should have capital in order to finance its activities. The company raises this capital by issue of share because it does not have capital of its own being an artificial person. Thus, the total capital of the company is divided into shares, therefore, it is called share capital.

Categories of Share Capital:

1. Authorised Capital: An Authorised Capital refers to that amount that is stated in the Memorandum of Association as the share capital of the company. It is the maximum amount with which the company is registered and which it is authorized to raise from the public by the issue of shares. The amount is also called the registered or nominal capital.

2. Issued Capital: It is the portion of authorized capital that is offered to the public for subscription and the remaining portion not yet offered to the public for subscription is called the unissued capital.

3. Subscribed Capital: It is that part of the issued capital which has been actually subscribed by the public. When the shares offered for public subscription were subscribed fully by the public, in such a case the issued capital and subscribed capital would be the same.

4. Called-up Capital: It is that part of the subscribed share capital which the company actually demands from the share-holders. The company may decide to call the entire amount or part of the face value of the shares.

5. Paid-up Capital: It means the total amount paid up or credited as paid upon the subscribed capital. Some of the shareholders may fail to pay the amount due from them on account of a call which is termed as ”call-in-arrears” or “unpaid capital”.

6. Uncalled Capital: That portion of the subscribed capital that has not been called up is called uncalled capital. The company may collect this amount at any time when it needs further funds.

7. Reserve Capital: Sometimes a company, by means of a special resolution, decides that a certain portion of its uncalled capital shall not be called up during its existence and it would be available in the event of winding up of the company. Such a portion of uncalled capital is termed as ‘reserve capital’.

Share Capital in the Balance Sheet of Company:

According to Schedule VI of the Companies Act, 1956 the information regarding Share Capital is to be shown in the following manner

Sunrise Company Ltd.

Balance Sheet as at…………

Shares of a Company:

The capital of a company is divided into a number of equal units. Each unit is called a share. The Companies Act 1956, defines a share as “a share in the share capital of the company. The person who contributes money through shares is called Shareholders.”

The company issues a certificate to every shareholder stating the number of shares he holds. The certificate is called a Share Certificate.

Classes of Shares:

According to the Indian Companies Act, 1956 a company can issue two types of shares:

- Preference Share

- Equity Share (formerly known as ordinary share)

1. Preference Share: According to Section 85 of the Companies Act, 1956 a preference share is one, which fulfills the following conditions:

(a) That it carries a preferential right to the dividend to be paid either as a fixed amount or an amount calculated by a fixed rate which may be either free of or subject to income tax; and

(b) That with respect to the capital it carries or will carry, on .the winding-up of the company, the right to the repayment of capital before anything is paid to equity shareholders.

2. Equity Share: According to Section 85 of the Companies Act, 1956, an equity share is a share that is not a preference share.

This share does not carry any preferential right or in other words, equity share is one that is entitled to dividend and repayment of capital after the claims of preference share are satisfied.

According to Section 86 (a), equity share capital may be:

- With voting right or

- With differential rights as to voting, dividend, or otherwise in accordance with such rules and subject to such condition as may be prescribed.

Issue of Share:

The shares of a company can be issued in two ways:

- for cash

- for consideration other than cash.

Issue of Share for cash

Steps for the issue of share for cash:

1. Issue of Prospectus: The company first issues the prospectus to the public. It contains complete information about the company and the manner in which share capital is to be collected from the prospective investors.

2. Receipt of Application: When a prospectus is issued to the public, prospective investors intending to subscribe to the share capital of the company would make an application along with the application money and deposit the same with schedule bank as specified in the prospectus.

3. Receipt of Minimum Subscription: The company has to get a minimum subscription. It is to be noted that the minimum subscription of the capital cannot be less than 90% of the issued amount according to SEBI (Disclosure and Investor Protection) Guidelines, 2000 [6.3.8.1 and 6.3.8.2]. If this condition is not satisfied, the company shall forthwith refund the entire subscription amount received.

If a delay occurs beyond 8 days from the date of closure o! subscription list, the company shall be liable to pay the amount with interest at the rate of 15% [Section 73 (2)]. Within 120 days from the date of the issue of the prospectus, if the company fails to receive the same within the said period, the company cannot proceed with the allotment of shares, and the application may be returned within 130 days of the date of issue of prospectus.

Allotment of Shares:

When a minimum subscription has been received, the company may proceed with the allotment of shares. When allotment is made, it results in a valid contract between the company and the applicants who now became the shareholders of the company.

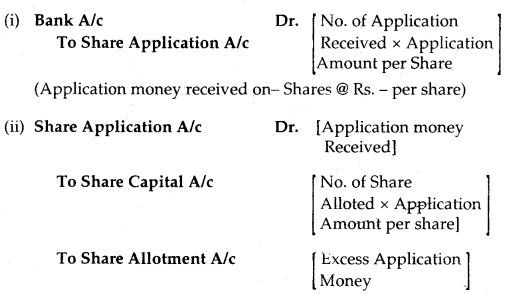

Accounting Treatment of Issue of Shares

Issue of Shares at Par:

When shares are issued for an amount equal to the face value of a share, they are said to be issued at par.

The issue price of a share may be payable either in lump sum along with the application or in installments.

The amount of application money is fixed by the directors but, according to legal provisions, it can in no case be less than 5% of the face value of shares.

Accounting Treatment:

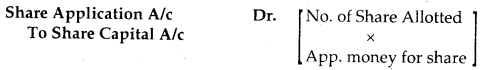

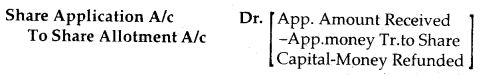

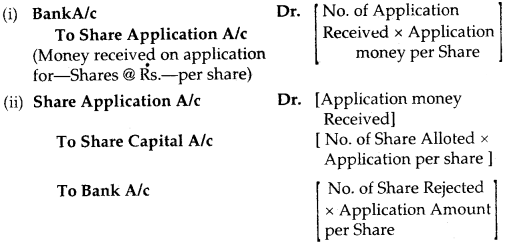

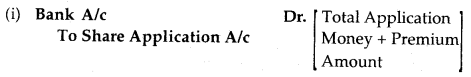

When Share Application money received along with the application:

BankA/c Dr.

To Share Application A/c [Total Amount received on, application]

(Amount received on the application for -Share Rs. -Per Share)

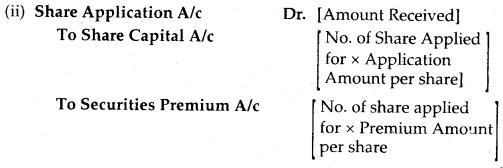

1. Transfer of Application money

[Application money on-Share allotted /transferred to Share Cap.]

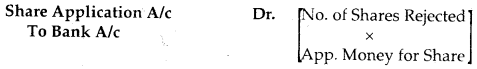

2. Money refunded on rejected application

(Application money returned on rejected applications for-share)

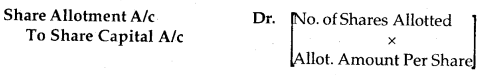

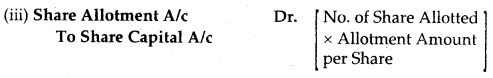

3. Amount Due on Allotment

4. Adjustment of Excess Application money

(Application Amount on -Shares @ Rs. -per shares adjusted to the amount due on allotment.)

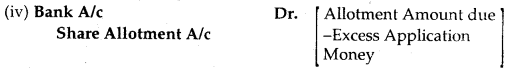

5.Receipt of Allotment Account

Bank A/c Dr.

To Share Allotment A/c

(Allotment money received on -Share @ Rs.-Per share)

Combined Account:

Sometimes a combined account for share application and share allotment is kept in the books of a company under the name Share Application and Allotment Account.

1. For Receipt of Application and Allotment

Bank A/c Dr.

To Share Application and Attotment A/c [Total Amount Received on Application]

(Money received on applications for shares @ Rs.-per share)

2. Transfer of Application money and Allotment Amount Due

Share App. and Allotment A/c Dr.

To Share Capital [No. of share Allotted × (Application money per share + Allotment Amount per share)]

(Transfer of application money to share capital for the amount due on allotment of shares @ Rs. – per share)

3. Money Refunded on Rejected Applications

Share App. and Allotment A/c Dr.

To Bank A/c [No. of share Rejected × App. money per share]

(Application money returned on the rejected application for….share)

4. Receipt of Balance Allotment money

Bank A/c Dr.

To Share Application and Allotment A/c

(Balance of Allotment money received)

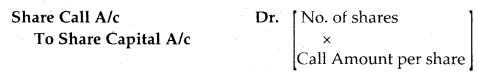

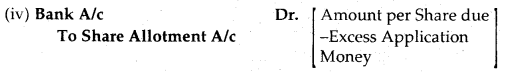

Calls on Share: Two points are important regarding the Calls on shares.

- The call amount should not exceed 25% of the face value of shares.

- There must be an internal dynamics of keeping at least some months between the making of two calls unless otherwise provided by the Articles of Association of the company.

Accounting Treatment:

1. Call Amount Due

(Call money due on – Shares @ Rs. – per share)

2. Receipt of Call Amount

Bank A/c Dr.

To Share Call A/c

(Call money received)

Note: The name of the call viz. First, the second and final call is added between the words ‘share’ and ‘call’ in the entry depending upon the identity of the call made.

Calls-in-Arrears: When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as ‘Calls- in-Arrears / Unpaid Calls’.

Call in Arrears amount shows the debit balance and the same is shown as a deduction from the paid-up capital on the liabilities side of the Balance sheet.

Accounting Treatment:

Calls-in-Arrears A/c Dr.

To Share Allotment A/c To Share Call/Calls A/c

(Calls in Arrears brought into account)

The Articles of Association of a company usually empower the directors to charge interest at a stipulated rate on calls in arrears. In case the Articles are silent in this regard, the rule contained in Table A shall be applicable, which states that the interest at a rate not exceeding 5% p.a. shall have to be paid on all unpaid amounts on shares for the period intervening between the day fixed for payment and the time of actual payment thereon. On receipt of the call amount together with interest.

Bank A/c Dr.

To Calls-in-Arrears A/c

To Interest A/c

Calls-in- Advance:

Sometimes some shareholders pay a part or whole of the amount on the calls not yet made. Such amount received in advance from the shareholders is known as “Calls in Advance”. It may also happen in the case of partial allotment of shares when the full amount of application money paid is not adjusted to the allotment. The amount received will be adjusted towards the payment of calls as and when it becomes due.

Accounting Treatment:

A separate call in advance A/c is opened for its accounting treatment and the following entry will pass:

Bank A/c Dr.

To Call-in-Advance A/c

(Amount received on Call-in-Advance)

When call becomes actually due requiring adjustment of

Call- in-Advance’A/c:

Calls-in-Advance A/c Dr.

To Particular Call A/c [Call Amount due]

(Calls-in-advance adjusted with the call money due)

The credit balance of Calls-in-Advance A/c is shown separately on the liabilities side of the balance sheet under the heading ‘Share Capital’ but is not added to the amount of Paid Up Capital.

As calls in advance are a liability to the company and it is under an obligation if provided by the Articles of Association, to pay interest on such amount. In case, the articles are silent then Table ‘A’ shall be applicable, according to which interest @ 6% p.a. may be paid.

1. Interest due

Interest on Calls-in-Advance A/c Dr.

To Sundry Shareholder’s A/c [Amount of Interest due for payment]

(Interest due on Calls-in-Advance)

2. Payment of Interest

Sundry Shareholder’s A/c Dr.

To Bank A/c [Amount of Interest paid]

(Interest paid on Calls-in-Advance)

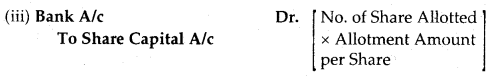

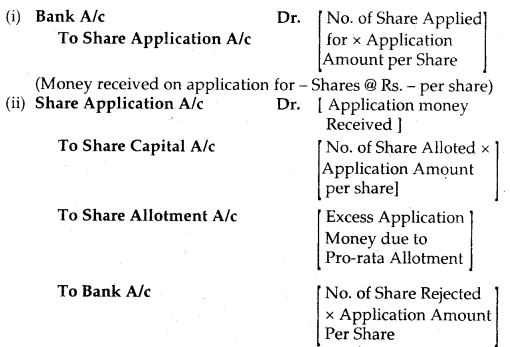

Oversubscription:

When Shares are issued to the public for subscription through the prospectus by well-managed and financially strong companies, it may happen that applications for more shares are received than the number of shares offered to the public, such a situation is said to be a case of oversubscription.

Alternative:

- They can accept some applications in full and totally reject the others.

- They can make a pro-rata distribution.

- They can adopt a combination of the above two alternatives.

Accounting Treatment:

1. If the excess applicants are totally refused for allotment, the application money received on these shares’s refunded.

(Transfer of money on the application for Share allotted and money refunded on the application for Share rejected)

2. If the applicants are made partial allotment (or pro-rata allotment):

The directors can as well opt to make a proportionate distribution of shares available for allotment among the applicants of shares. The proportion is determined by the ratio which the number of shares to be allotted to bear to the number of shares applied for. This is called ‘pro-rata allotment.

Generally, excess application money received on these shares is adjusted towards the amount due on allotment or call.

(Transfer of application money to share capital and excess application money credited to share allotment.)

(Amount due on the Attotment of – Share @ Rs. – Per Share)

(Allotment money received after adjusting the amount already received as excess application money)

3. This is a combination of two alternatives described above as thus:

(a) Application for some shares are rejected outright, and

(b) pro-rata allotment is made to the applicants of a remaining number of shares.

Thus, money on the rejected applications is refunded and excess application money due to pro-rata distribution is adjusted towards the amount due on the allotment of shares allotted.

(Transfer of application money to share capital, excess application amount credited to share allotment and money refunded on rejected application)

(Amount due on the Allotment of — Share @ Rs. — Per Share)

(Allotment money received after adjusting the amount already received as excess application money)

Under Subscription:

In case applications for a lesser number of Shares have been received than that for which they have been invited by the company, it is called Under Subscription of shares. When an issue of shares is undersubscribed, the company can proceed with the allotment of shares, provided a minimum subscription is raised.

Issue of Shares at a Premium [Sec 781 When shares are issued at an amount more than the face value of a share, they are said to be issued at a premium. The difference between the issue price and the face value of the Share is called the premium.

Note: According to the Companies (Amendment) Act, 1999, the term, ‘Securities Premium’ is required to be used in place of ‘Share Premium’.

Under Section 78 of the Companies Act 1956, the amount o share premium may be used only for the following purposes:

- In writing off the preliminary expenses of the company.

- For writing off the expenses, commission, or discount allowed on the issue of shares or debentures of the company.

- For issuing fully paid bonus shares to the shareholders of the company.

- For providing for the premium payable on redemption of redeemable preference shares or debenture of the company.

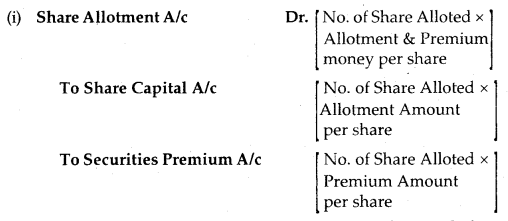

When Shares are issued at a premium, the journal entries are as follows:

(a) Premium Amount called with Application money

(Money received on the application for— Shares @ Rs. — per share including premium)

(Transfer of application money to share capital and premium accounts)

(b) Premium Amount called with Allotment money

(Amount due on allotment of shares @ Rs. – per share including premium)

(ii) Bank A/c Dr.

To Share Allotment A/c

(Allotment money received including premium)

Issue of Shares at a Discount:

When a share is issued at a price that is less than its face value, it is said that it has been issued at a discount.

Normally, a company cannot issue its share at a discount. Share can be issued at a discount only when the following conditions gives in Section 79 of the Companies Act, 1956 are satisfied.

1. At least one year must have elapsed since the company became entitled to commence business. It means that a new company cannot issue shares at a discount at the very beginning.

2. The company has already issued such types of the share;

3. An ordinary resolution to issue the shares at a discount has been passed by the company in the General Meeting of shareholders and sanction of the Company Law Board has been obtained.

4. The resolution must specify the maximum rate of discount at which the share is to be issued but the rate of discount must not exceed 10% of the face value of the share, for more than this limit sanction of the Company Law Board is necessary.

5. The issue must be made within two months from the date of receiving the sanction of the Company Law Board. Generally, the amount of discount is recorded at the time of allotment. Therefore the following entry should be passed on attornment.

Share Allotment A/c Dr.

Share Discount A/c Dr.

To Share Capital A/c

(For the amount due on the allotment, excluding discount)

‘Discount on the Issue of Shares Account’, showing a debit balance, denotes a loss to the company, which is in the nature of capital loss. Therefore, the account is presented on the assets side of the company’s balance sheet under ‘Miscellaneous Expenditure’. It is written off by being charged straight-way to the Securities Premium A/c if any, and in its absence, by being gradually charged to the Profit and Loss A/c over a period of years.

Issue of Shares for Consideration other than cash:

If a company purchases some assets from vendors, in exchange it can issue fully paid shares to them whereby the latter agrees to accepts it. Thus, no cash is received for the issue of shares. These shares can also be issued either at par, at a premium, or at a discount. The number of shares to be issued will depend on the price at which shares are issued and the amount payable to the vendor. To find out the number of shares to be issued to the vendor will be calculated as follows:

No. of Shares to be issued = \(\frac{\text { Amount Payable }}{\text { Issue Price }}\)

(a) On purchase of assets:

Assets A/c Dr.

To Vendor’s A/c

(Assets Purchased)

(b) Shares can be issued to vendors in any manner out of the following:

1. At Par:

Vendor’s A/c Dr.

To Share Capital A/c

2. At Premium:

Vendor’s A/c Dr.

To Share Capital A/c

To Securities Premium A/c

3. At discount:

Vendor’s A/c Share Discount A/c

To Share Capital A/c

Forfeiture of Shares:

If a shareholder fails to pay allotment money or call money on his share as called upon by the company, his shares may be forfeited by giving due notice and following the procedure specified in the Articles of Association in this behalf. This is known as forfeiture of shares.

To forfeit a share means to cancel the allotment to the defaulting shareholders and to treat the amount already received thereon as forfeited to the company.

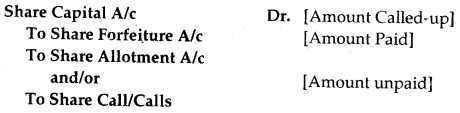

Accounting Treatment:

1. Forfeiture of Shares issued at par

Note: In case’Calls-in-Arrears’ A /c is maintained by a company, ‘Call-in-Arrears’ A/c would be credited in the above instead of ‘Share Allotment’ and/or ‘Share Call or Calls’ A/c.

The balance on the Share Forfeited A/c is shown in addition to the total paid capital of the company under the heading ‘Share Capital’ on the liabilities side of the Balance Sheet till the forfeited shares are reissued.

2. Forfeiture of Shares issued at a Premium:

(a) If Premium has not been paid by the Shareholders:

Share Capital A/c Dr. (Amount Called up Premium)

Securities Premium A/c Dr. (Premium amount)

To Share Allotment A/c (Amount unpaid)

To Share Call/Calls A/c (Amount unpaid)

To Share Forfeiture A/c (Amount paid)

(For Share forfeited)

(b) If Premium has been paid by the shareholder:

Share Capital A/c Dr. (Amount Called up Premium)

To Share Allotment A/c Dr. (Premium amount)

To Share Call/Calls A/c (Amount unpaid)

To Share Forfeiture A/c (Amount paid)

(For Share forfeited)

3. Forfeiture of Shares issued at a discount:

Share Capital A/c Dr. (Amount Calledup + Discount)

To Discount on Issue of Share A/c (Discount on forfeited share)

To Share Allotment A/c (Amount unpaid)

To Share Call/Calls A/c (Amount unpaid)

To Share Forfeiture A/c (Amount paid)

(Forfeiture of Shares and discount on issue adjusted)

Re-Tissue of Forfeited Share:

The director of a company has the authority to re-issue the shares once forfeited. These forfeited shares are reissued at par, at a premium, or at a discount, the amount of the discount does not exceed the amount paid on such shares by the original shareholder but in case of shares originally issued at discount, the maximum permissible discount will be the amount paid on such shares by the original shareholder plus the amount of original discount.

Accounting Treatment:

1. For Forfeited Shares reissued at Par:

Bank A/c Dr.

To Share Capital A/c

2. For Forfeited Shares reissued at Premium:

Bank A/c Dr.

To Share Capital A/c

To Securities Premium A/c

3. For Forfeited Shares reissued at Discount:

Bank A/c Dr.

Share Forfeiture A/c Dr. (Discount Allowed)

To Share Capital A/c

Transfer:

When all forfeited shares have been reissued, the credit balance left on the Share Forfeiture A/c is transferred ta> Capital Reserve A/c

Share Forfeiture A/c Dr.

To Capital Reserve A/c

Buy-Back of Shares:

A company may buy its own shares from the market. This is called ‘buyback of shares’. Section 77 A of the Companies Act, 1956 provides such a facility to the companies and can buy its own shares from either of the following:

- Existing equity shareholders on a proportionate basis

- Open Market

- Odd lot shareholders

- Employees of the company.

Buyback of its own shares may be made out of:

- Free reserve of the company e.g. general reserve, reserve fund, Cr. balance of Profit & Loss A/c.

- From the proceeds of all earlier issues.

- From Securities Premium A/c.

Section 77 A of the Companies Act has laid down the following procedures for buy-back of share:

- Its Articles of Association authorize it to do so.

- A special resolution must be passed in the companies annual general body meeting.

- The buyback should not exceed 25% of the total paid-up capital and free reserve of the company.

- The debt-equity ratio should not be more than a ratio of 2: 1 after the buy-back.

- All the company’s shares are fully paid up.

- The buy-back of the shares should be completed within 12 months from the date passing the special resolution.

- The company should file a solvency declaration with the Registrar and SEBI which must be signed by at least two directors of the company.