By going through these CBSE Class 12 Accountancy Notes Chapter 8 Financial Statements of a Company, students can recall all the concepts quickly.

Financial Statements of a Company Notes Class 12 Accountancy Chapter 8

Financial Statements are the end products of the accounting process. They are prepared following the consistent accounting concept principles, procedures and also tire legal environment in which the business organization operates. These statements are the outcome of % the summarizing process of accounting and are, therefore the sources of information/on the basis of which conclusions are drawn about the profitability and the financial position of a business enterprise.

Meaning of Financial Statements: Financial Statements are the summarized statements of accounting data produced at the end of the accounting process by an enterprise through which it communicates accounting information to the external users as well as internal users.

These are the basic and formal means through which the corporate management communicates financial information to various users. External user includes investors, tax-authorities, government, employees, etc.

Financial information, which is the information relating to the financial position of any firm, when presented in a concise and capsule form, is known as the financial statement.

“Financial Statements are prepared for the purpose of presenting a periodical review or report on progress made by the management and deal with the status of investment in the business and the results achieved during the period under review.”

—American Institute of Certified Public Accountants (AICPA)

“The end product of financial accounting in a set of financial statements prepared by the accounts of a business enterprise that purport to reveal the financial position of the enterprise, the result of its recent activities and an analysis of what has been done with earnings.” -Smith and Assume

“The Finacial Statements provide a summary of accounts of a business enterprise, the balance sheet reflecting the assets, liabilities, and capital as on a. certain date and the income statement showing the results of operations during a certain period.”. -John N. Myer

“Financial Statement, essentially, are interim reports presented annually and reflect a division of the life of an enterprise into more or less arbitrary accounting period more frequently a year.” -Anthony

Thus, Financial Statements are the final product of accounting work done during the accounting period which shows the financial position and result of business activities for that accounting period. In other words, Financial Statements are the end products of the accounting process. It may be defined as the reports prepared for the purpose of presenting a periodical review of the performance and the financial position of a business enterprise. Financial statements are the indicators of profitability and financial soundness of a corporate sector.

Nature of Financial Statements:

Viewpoints of the Professional Bodies and Researchers about the nature of Financial Statements:

According to the American Institute of Certified Public Accountants

(AICPA), “Financial statements are prepared for the purpose of presenting a periodical review of the report on progress by the management and deal with the status of investment in the business and the results achieved during the period under review. They reflect a combination of recorded facts, accounting principles and personal judgments.”

In the words of the American Accounting Association, “Every corporate statement should be based on accounting principles, which are sufficiently uniform, objectives and well understood to justify opinion as to the condition and progress of the business enterprise. Its basic assumption was that the purpose of periodic financial statements of a corporation is to furnish information that is necessary for the formation of dependable judgments.”

According to John. N. Mayer, “The financial statements are composed of data which are the result of a combination of

- Recorded facts concerning the business transactions;

- Conventions adopted to facilitate the accounting technique;

- Postulates or assumptions made; and

- Personal judgments used in the application of the conventions and postulates.”

The following points explain the nature of financial statements:

1. Recorded Facts: The basis of recording transactions in financial statements is the original cost or historical cost. The assets purchased at different times and at different prices are put together and shown at cost price. The financial statements do not show current financial conditions, as they are based on original costs not on replacement costs.

2. Accounting Conventions: For preparing financial statements, certain accounting conventions are followed. For example, the convention of valuing inventory at cost or market price, whichever is lower, is followed. Small items like pencils, pens, postage, stamps, etc. although assets in nature but treated as expenditure in the year in which they are purchased. The Stationery is valued at cost. The use of accounting conventions makes financial statements comparable, simple and realistic.

3. Postulates: Financial Statements are prepared on certain basic \ assumptions known as postulates such as going concern postulates, money-measurement postulate, realization postulate, etc. Going concern postulates assumes that the enterprise is run for a long time. Money FC measurement postulate assumes that the value of money will remain the same in different periods.

4. Personal Judgements: Under more than one circumstance, facts and figures presented through financial statements are based on personal opinion, estimates, and judgment. For example, depreciation is calculated with a written-down method or at the original cost.

Provisions for doubtful debts are made on estimates and personal judgments. Personal opinion, judgments, and estimates are made while preparing the financial statements to avoid any possibility of overstatement of assets and liabilities, income, and expenditure, keeping in mind the, convention of conservation.

Thus, Financial Statements are the summarized reports of recorded facts and are prepared following the accounting concepts, conventions, and requirements of law.

Objectives of Financial Statements

1. To provide information about economic resources and obligations of a business: Financial Statements are prepared to provide adequate, accurate, reliable, and periodical information to investors and other external parties regarding economic resources and obligations of a business firm.

2. To provide information about the earning capacity of the business: Financial Statements are prepared to provide the information about the earning capacity of the business, which can be very useful and important for decision-making purposes for internal as well as external users. They provide very useful financial information, which can be utilized to predict, compare and evaluate the firm’s earning capacity.

3. To provide information about cash flows: Financial Statements can also provide vital information useful to investors and creditors for predicting, comparing and evaluating, potential cash flows in terms of amount, timing, and related uncertainties.

4. To judge the effectiveness of management: With the help of financial statements, we can judge the management’s ability to utilize the resources of a business effectively.

5. Information about activities of business affecting the society: They have to report the activities of the business organization affecting the society, which can be determined and described or measured and which are important in its social environment.

6. Meeting the informational needs of users: These statements have to disclose, to the extent possible, other information related to the financial statements that are relevant to the needs of users of these statements.

7. Disclosing accounting policies: These reports have to provide the significant policies, concepts followed in the process of accounting, and changes are taken up in them during the year to understand these statements in a better way.

8. To provide information about solvency: Solvency determined the ability of a business concern to meet its short-term debt such as creditors, bills payable and -bank overdraft, etc., and long-term debts such as debentures, bank loans, etc. The financial statements of the firm provide information regarding the solvency of the firm.

9. Helps in comparison: With the help of information provided by the financial statements, comparison between the different firms made easy.

Types of Financial Statements: Financial Statements generally includes:

- Income Statement (or Profit & Loss Account)

- Position Statement (or Balance Sheet)

The statement, which takes care of matching revenue receipts with revenue payments (of nominal nature) is known as Income Statement.

Items of capital nature that have potential uses and future obligations known as assets and liabilities. The statement which shown total assets and liabilities is known as the position statement (or Balance Sheet).

These two basic statements are required for external reporting and also for the internal needs of the management. These two basic statements are supported by a number of schedules, annexures, supplementing the data contained in the balance sheet and income statement.

1. Balance Sheet: It is a component of a financial statement that shows the balance of liabilities, equities, and assets of a business entity as on a particular date. The balance sheet is not an account. Balance of liabilities, equities, and assets are not closed by transferring to Balance Sheet, balance of those accounts are simply carried forward to the next accounting period.

The balance sheet displays the liabilities, equities, and assets position generally at the end of the accounting period. It is a sheet of the balance of ledger accounts that are still open after the transfer of all nominal accounts to the Income Statement. The balance of all the personal and real accounts are grouped as assets and liabilities. Liabilities are shown on the left side of the Balance Sheet and Assets on the right side.

According to the American Institute of Public Accountants, Balance\ Sheet is “A tabular statement of summary of balance (debits and credits) carried forward after an actual and constructive closing of books of accounts and kept according to principles of accounting.”

→ “A business form showing what is owed and what the proprietor is forth is called a Balance Sheet.” —Karlson exi

→ “The Balance Sheet is a statement prepared with a view to measure the ICT financial position of a business on a certain fixed date.”—J. R. Batliboi side

→ “The Balance Sheet is a statement at a particular date showing on one (he trader’s property and possession and on the other hand the liabilities.” -A. Palmer

It is the report about the properties owned by the enterprise and the claims of the creditors and owner against these properties. Thus, a Balance Sheet is a statement prepared with a view to measure the exact financial position of a business on a certain date.

2. Income Statement or Profit and Loss Account: It is the accounting report, which summarizes the revenues expenses, and incomes, and the difference between them for a specified accounting period. An income statement gives a mathematical interpretation of policies, expenses, knowledge, foresight, and aggressiveness of the management of a business from the point of view of income, expenses, gross profit, operating profit, and net profit or loss.

As per the accounting concept of income, profit or loss is the difference between the realized revenues of the period and the related expired costs. Income measurement is based on concepts like going concerned, accounting period, realization, matching, and objectives evidence, etc. Normally accrual basis of accounting is followed in income measurement.

Uses and Importance of Financial Statements

Financial Statements, which are prepared to depict true relevant, easily understandable, comparable, analytically represented, and promptly presented financial position, help the user in their economic decisions.

The main uses and importance of financial statements are following:

1. Provide Information to Shareholders: Financial statements provide information about the management performance to the shareholders. Shareholders are the suppliers of the basic capital to run the concern and as such, they are very much interested in the well-being of the business.

They are interested to know the profitability and prospects of future growth of the business. They come to know about the financial position and operating results of the business through these financial statements only.

2. Basis for Fiscal Policies of the Government: Financial Statement provides the basis for fiscal policies of the Government. Financial Statement provides useful information to various government departments like Income Tax, Sale Tax, Excise duty, etc to determine the tax liability of the concern. So, on the basis of financial statements, the government determines tax policy, import-export policy, industry policy, etc.

3. Basis for Dividend Policies: The dividend policies of the corporate sector are linked with the government regulation and financial performance of the undertaking. Hence, financial statements form the basis for dividend policies of companies.

4. Basis for Granting of Credit: Corporate undertaking has to borrow funds from banks and other financial institutions for different purposes. All financial institutions which provide loan to the corporate undertaking are interested to know the profit earning capacity of the business and its long term solvency. They make decisions based on the financial performance of the undertaking. Thus financial statements form the basis for granting credit.

5. Guide to the Value of the Investment Already Made: Shareholders of companies are interested in knowing the status, safety, and return on their investment. They may also need the information to make decisions about the continuation or discontinuation of their investment in the business. Financial statements provide information to the shareholder in taking such important decisions.

6. Basis for Prospective Investors: In addition to the existing investor there may be people who may be interested in investing money in the company. But before doing that they would be interested to know the long-term and short-term solvency as well as the profitability of the concern. Financial statements provide adequate information to such potential investors to enable them to take the necessary decisions.

7. Aids Government in Policy Framework: Financial statements help Government to assess the role of corporate undertaking in the economic development of the country. It also assesses the economic situation of the country from these statements in terms of industrial production, employment, etc. These statements enable the government to know whether a business is following various rules and regulations or not. These statements also form the basis for framing and amending various laws for the regulation of the business.

8. Aids Trade Associations in Helping their Members: Trade Associations can judge, on the basis of financial statements the profitability of the business enterprises. They can compute as to how much bonus and increase in their wages are possible from the profits of the business concern. Trade unions negotiate the wages and salaries with the company, the financial statements reveal the financial soundness of the company and thus provide the basis to the trade unions to go in for negotiations.

9. Helps Stock Exchanges: Financial Statements help the stock exchanges to understand the extent of transparency in reporting on financial performance and enable them to call for the required information to protect the interest of investors. The financial statements enable the stockbrokers to judge the financial position of different concerns and take decisions about the price to be quoted.

10. Helps Trade Creditors: Trade creditors and suppliers of goods are interested in knowing the short-term solvency of the business. They are interested to know whether the business firm will be making payment on time or not. Financial statements provide adequate information to them to take the necessary decisions.

Limitations of Financial Statements

Financial Statements suffer from the following limitations.

1. Do not reflect the current situation: Financial Statements are prepared on the basis of historical cost and do not throw light on the current and present position of the business. The purchasing power of money is changing, the value of assets and liabilities shown in the financial statement does not reflect the current market situation. It does not indicate the current position of the business.

2. Dividends out of Capital: Net profit is ascertained on the basis of historical cost. If profits are adjusted to changing price levels, it may lead to loss and consequently, dividends may be paid out of capital.

3. Incomplete Information: Financial statements do not include all of the relevant information necessary for evaluating the status, progress, and future prospects of a business enterprise. The Balance Sheet does not disclose information relating to the loss of markets and cessation of agreements that have a vital bearing on the enterprise.

4. Assets may not realize: Some of the assets may not realize the stated value if the liquidation is forced on the company. Assets shown in the balance sheet reflect the merely unexpired or unamortized cost.

5. Different accounting policies: Various concepts and conventions of accounting affect the value of assets and liabilities as shown in the Balance Sheet and profit as shown by the Profit and Loss Account. For example, different firms may adopt different methods of stock valuation.

6. No Qualitative Information: The financial statements do not reflect complete information about the firm. Only that information, which can be expressed in monetary terms, is given. Qualitative information is however ignored like industrial relations, industrial climate, labor relations, etc.

7. No free from Bias: Financial statements are prepared on the basis of certain established concepts and conventions yet they are greatly affected by personal bias and personal judgment of various factors.

8. Aggregate Information: Financial Statements show aggregate information but not specific information. Hence they may not satisfy the user in decision making unless modified suitably.

9. Interim reports: Financial Statements are merely interim reports, not final reports. Profit and Loss Account discloses only interim profits but not final profits. Final profits can be known only when an enterprise is liquidated, assets are sold and liabilities are paid off.

10. Affected by window-dressing: Some business firms have given too much attention to decorate their financial statements in such a way that they fulfilled all the legal requirements and show the sound financial position of the firm. In fact, these statements may be far from the truth.

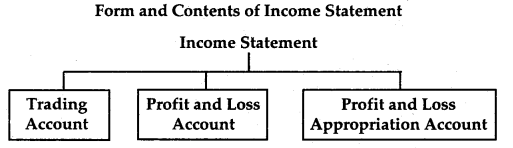

Income Statement may be divided into three components

- Trading Account → To show Gross Profit Earned or Gross Loss incurred.

- Profit and Loss Account → To show Net Profit earned or Net Loss incurred.

- Profit and Loss Appropriation Account → To show all appropriation from the current year and balance of profit or loss of last year and surplus or deficit at the end of the period.

Note: If the company is a manufacturing concern, apart from the above components manufacturing account is also required.

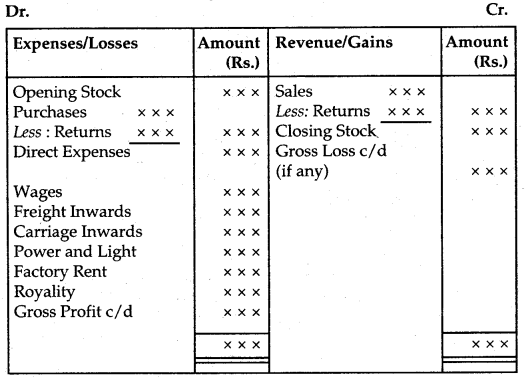

→ Trading Account: Trading Account is the first part of the financial statements. The trading account is designed to show the gross profit on the sale of goods. The trading account contains the transactions of the company relating to the commodities in which it deals, throughout the accounting period.

All expenses either related to purchasing of raw material or production are charged to the Trading A/c i.e. Debited to Trading A/c. It is prepared to find out Gross Profit or Gross Loss. If the sales are more than purchases and expenses the result is Gross Profit and vice versa. Its main components are sales, services rendered and cost of such sales or service rendered. A trading account provides the data for comparison, analysis, and planning for future growth.

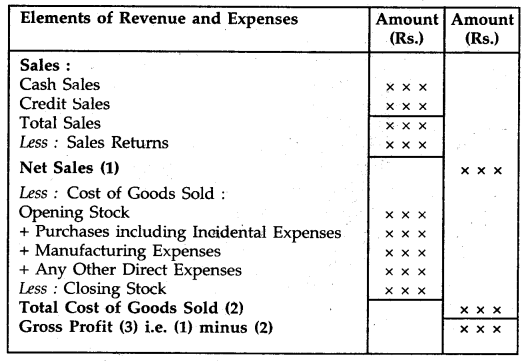

Form of Trading Account

Trading Account of…………………. Co. Ltd.

for the year ended……………………..

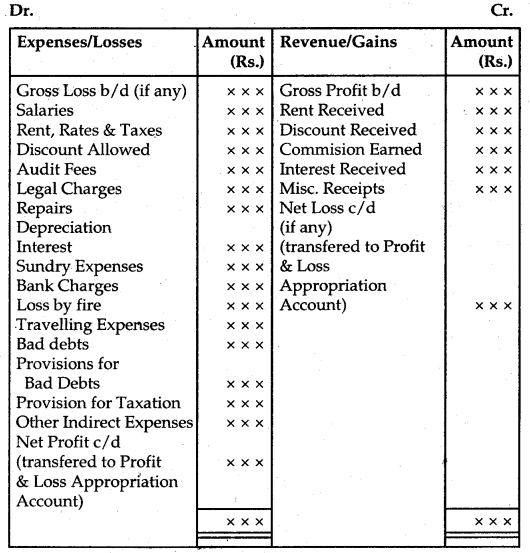

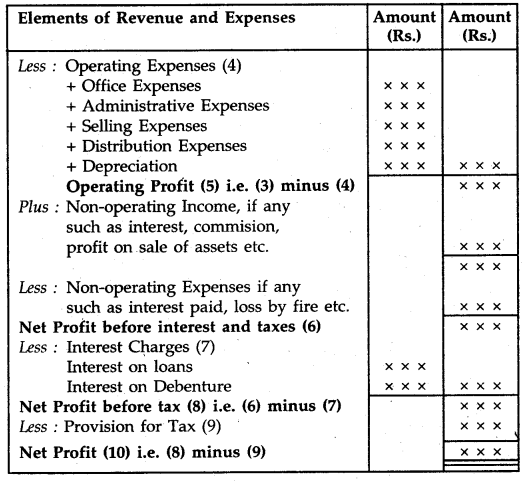

→ Profit and Loss Account: The profit and Loss Account is the second part of the financial statement. The company is more interested in knowing its net income or net profit, which increases its equity. Net profit represents the excess of gross profit plus other revenue income over indirect expenses.

The indirect expenses are not shown in Trading Account. On the debit side of the Profit and Loss Account, the indirect expenses are shown whereas on the credit side revenue incomes. If the debit side is less than of credit side, it would be net profit and if the credit side is less than of debit side it would be a net loss.

“A Profit and Loss account is an account into which all gains and losses are collected in order to ascertain the excess of gain over the losses or vice-versa.” -Prof. Carter

Form of Profit & Loss Account

Profit & Loss Account of………… Co. Ltd.

for the year ended…………………………..

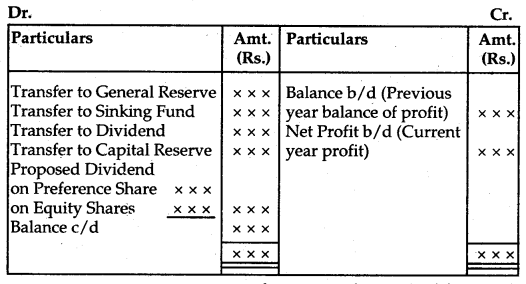

→ Profit and Loss Appropriation Account: The account which shows the disposition of profit is called the Profit and Loss Appropriation Account. The disposition of profit means the distribution of net profits by way of dividends, transfer of profits to various reserves, adjustment of arrears of depreciation, if any, bonus to shareholders, and so on.

Form of Profit and Loss Appropriation Account

Profit and Loss Appropriation Account of…………… Co. Ltd

for the year ending…………………………

Income statements may also be presented in vertical form with detailed data. Verticle form income statements are suitable for further analysis and providing suitable data for decision making.

Form of Vertical Income Statement

Income Statement of……………………. Co. Ltd.

for the year ending……………………..

Process for Preparation of Income Statement:

The following process is to be followed for the preparation of the income statement (in T form):

- Preparation of trial balance on the basis of balances of all the accounts available in the ledgers of the concern.

- Recording all the revenue receipts appearing on the credit side of tire trial balance on the credit side of income statement after making suitable adjustments for revenues received in advance or revenues realized but not received etc.

- Recording all the revenue expenditure items that appeared on the debit side of the trial balance on the debit side of the income statement after making adjustments for outstanding, prepaid expenses, depreciation, provisions for bad debts, taxes, etc.

- Recording non-operating incomes and gains on the credit side of the income statement.

- Recording non-operating losses on the debit side of the income statement.

- Finding the difference between totals of credit items and totals of debit items.

- If the credit items are more than the debit items, it is known as net profit and vice versa.

- In India, the accounting year for preparing financial statements for companies is 1st April to 31st March (same as that of the financial year of the Government).

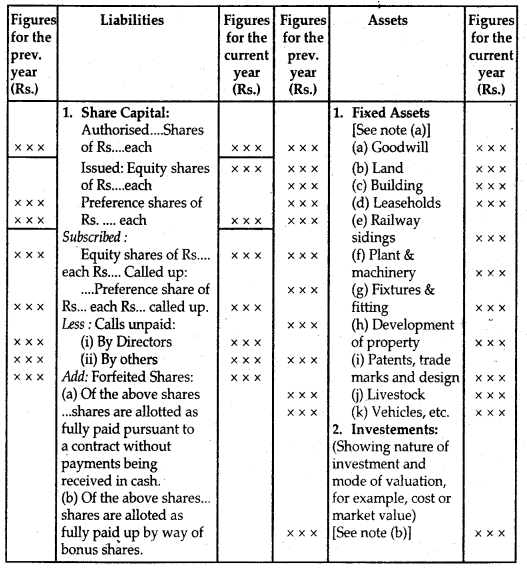

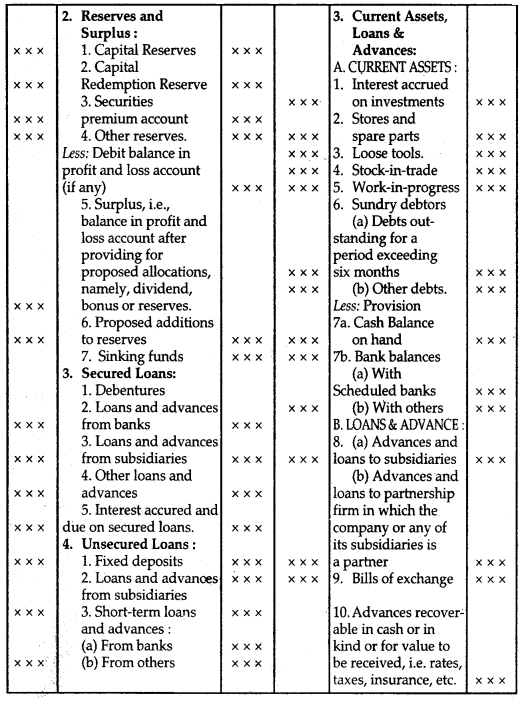

→ Form and Contents of Balance Sheet: A balance Sheet is a component of a financial statement that shows balances of liabilities, equities, and assets of a business entity as on a particular date. It is prepared with a view to measure the exact financial position of a business on a certain fixed date. It is usually prepared in horizontal T form. The assets are shown on the right-hand side and capital and liabilities are shown on the left-hand side. These can be arranged either on:

(a) Liquidity basis or on

(b) Permanency basis

(a) Liquidity Basis: According to this method an asset that is most easily convertible into cash such as cash in hand is written first and then will follow those assets which are comparatively less easily convertible so that the least liquid assets such as Goodwill are shown last.

In the same way, those liabilities which are to be paid at the earliest will be written first, in other words, current liabilities are written, first of all, then fixed or long-term liabilities, and lastly the equity of the owner.

(b) Permanency Basis: This method is just opposite to the first method. Assets that are most difficult to be converted into cash such as Goodwill are written first and the assets which are most liquid such as cash in hand are written last.

Those liabilities which are to be paid last will be written first. The owner equity is written, first of all, then long-term liabilities, and lastly the current liabilities.

The Companies Act adopted the permanency approach form in the preparation of the balance sheet. The registered companies are required to follow Part I of Schedule VI of the Companies Act, 1956 recording assets and liabilities in the tire balance sheet in a particular order. According to section 211 (i) of the Companies Act, the balance sheet shall be prepared in prescribed format from time to time, depict the true and fair view of financial position, and follow general instructions for the preparation of the balance sheet under the heading notes at the end of that part.

This format is not applicable to Banking and Insurance Companies. These companies follow the formats prescribed by their respective legislation.

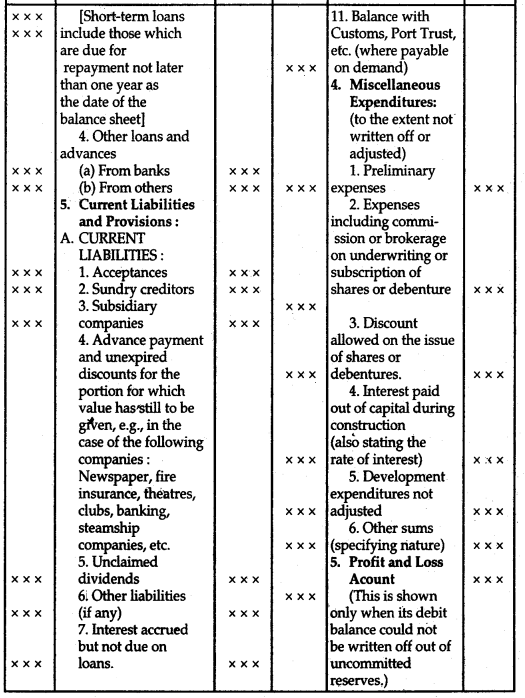

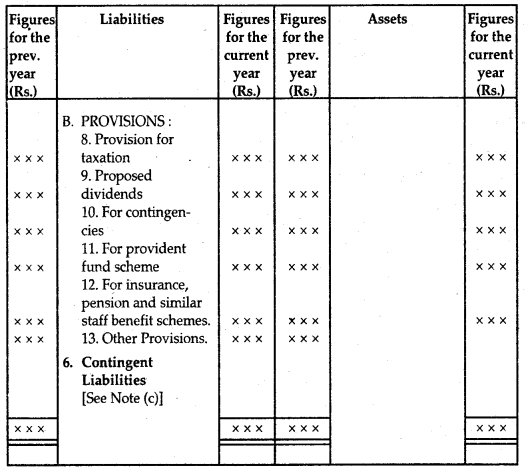

Horizontal Form Of Balance Sheet Schedule Vi, Part I (See Section 211)

A-Horizontal Form Of Balance Sheet Balance Sheet Of ……………………..

(Here enter the name of the company) as on (Here enter the date at which the balance sheet is made out)

Notes:

(a) Fixed assets are shown at original cost less total depreciation to date.

(b) Investments should be divided into two parts:

- Quoted, and

- unquoted. In the case of quoted investments market price must be disclosed.

(c) Contingent liabilities are not included in the total of the liability side. Following are the usual types of contingent liabilities:

- Claim against the company not acknowledged as debt.

- Uncalled liability on shares partly paid.

- Arrears of fixed cumulative dividends.

- The estimated amount of contracts remaining to be executed on capital account and not provided for, ‘

- Other money for which the company is contingently liable.

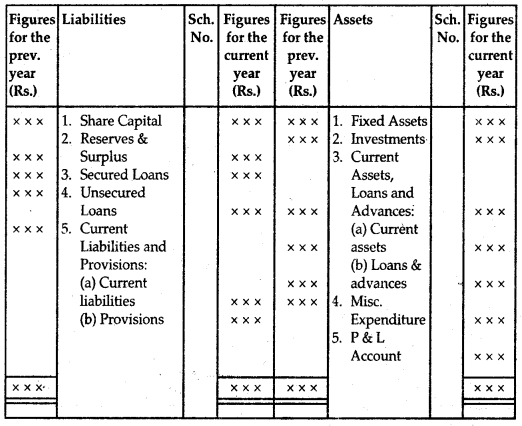

The Balance Sheet can be prepared in the abridged form also which is shown below:

Abridged Balance Sheet

Form of Balance Sheet (Horizontal Form),

Balance Sheet of ……………..Co. Ltd.

as on……………..

Note: A footnote to the Balance sheet may be added to show separately the contingent liabilities.

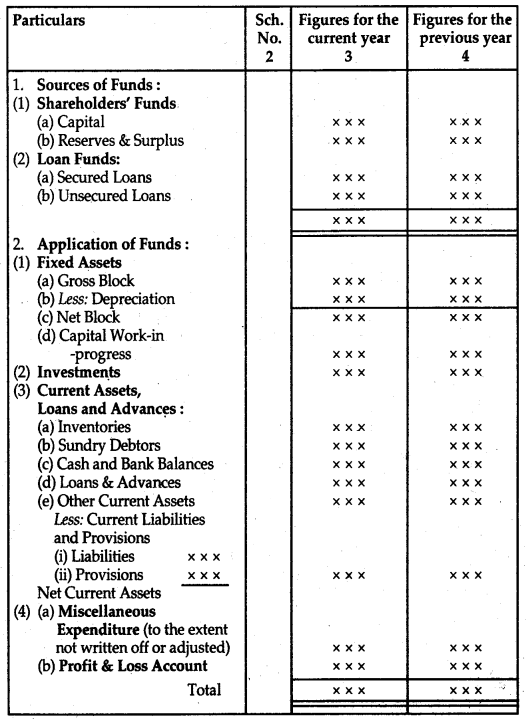

Vertical Form of Balance Sheet Form of Balance Sheet (Vertical Form)

Balance Sheet of………………….. CO. LTD.

as on…………………….

Note: Usually detail under each of the above items is given by way of a separate schedule. The number of the schedule incorporating the information is mentioned against the item in the column.

Explanation to Balance Sheet Items

Statutory Contents of Liabilities Side of Company’s Balance Sheet

1. Share Capital: It is the first item on the liabilities side of the balance sheet and shows details about the following:

- Authorized Capital

- Issued Capital

- Subscribed Capital.

- Called up Capital

- Paid-up Capital

In terms of the number of shares of each kind along with the nominal value. If forfeited shares are reissued then this amount is added to the paid-up capital.

2. Reserves and Surplus: As per Schedule VI to the Companies Act, 1956, ‘Reserves and Surplus’ includes the following items:

- Capital Reserves

- Capital Redemption Reserves

- Share Premium Account or Securities Premium

- Other reserves

- Surplus

- Proposed Addition to reserves

- Sinking fund

These reserves may be classified broadly as revenue and capital reserves.

3. Secured Loans: If any company given security for the loan by a mortgage or charge on all or any of its property, the loan will be called ‘Secured Loans’. It includes:

- Debentures

- Loans and Advances from Banks

- Loans and Advances from subsidiaries

- Other Loans and Advances if any

Information regarding the nature of security given for each secured loan should be given along with the respective loans.

4. Unsecured Loans: Loans and advances for which no security is given are shown under this heading. This include:

- Fixed deposits

- Loans and Advances from Subsidiary Companies

- Loans and Advances from other sources.

- Short-term loans from banks and others.

5. Current Liabilities and Provisions: Current Liabilities include:

- Acceptances (or Bills Payable)

- Sundry Creditors

- Advance Payments

- Un-expired Discounts

- Unclaimed dividends

- Accrued Interest but not paid

- Other liability (if any)

Provisions include:

- Provisions for taxation

- Proposed Dividend

- Provisions for Contingencies

- Provision for provident fund

- Provision for Pension

- Provision for Insurance

- Similar staff benefit schemes etc.

- Other provisions

Statutory Contents of Assets Side of Company’s Balance Sheet 1. Fixed Assets: These are those assets that are used for a long time in business to earn profit. They are acquired with an intention of using them in the main activity of the concern but not for resale.

It includes:

- Goodwill

- Land and Building

- Leaseholds

- Plant and Machinery

- Furniture

- Railway Lines

- Patents etc.

These assets are shown at cost less depreciation till the date.

2. Investments: It includes

- Investment in Government Securities

- Investment in Trust securities

- In shares, debentures, bonds, etc.

- Investment in immovable property etc.

3. Current Assets, Loans, and Advances: Current Assets includes:

- Inventories

- Sundry Debtors

- Cash and Bank Balances

- Loose Tools

- Accrued Interest

Loans and Advances include:

- Loans and Advances to Subsidiary Company

- Bills of Exchange

- Balance with customs, port trust, etc.

4. Miscellaneous Expenditure: Expenditure, which is not debited to Profit and Loss Account fully and deferred for some years, is shown under this heading.

It includes:

- Preliminary Expenses

- Advertisement Expenditure

- Discount on issue of shares and debenture etc.

5. Profit and Loss Account: If there is any debit balance in the Profit and Loss Account, it will be shown as the assets side of the Balance Sheet.