Here we are providing 1 Mark Questions for Accountancy Class 12 Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner are the best resource for students which helps in class 12 board exams.

One Mark Questions for Class 12 Accountancy Chapter 3 Reconstitution of Partnership Firm: Admission of a Partner

Question 1.

What is meant by Issued Capital ? (CBSE Delhi 2019)

Answer:

Issued capital means such capital as the company issues from time to time for subscription-section 2(50) of the companies Act 2013.

Question 2.

What is meant by ‘ Employees Stock Option Plan? (CBSE Delhi 2019)

Answer:

FSOP means an option granted by the company to its employees & employee directors to subscribe the share at a price that lower than the market price i.e., fair value. It is an option granted by the company but it is not an obligation on the employee to subscribe it.

Question 3.

A and B were partners in a firm sharing profits in the ratio of 3 : 2. C and D were admitted as new partners.

A sacrificed ith of his share in favour of C and B sacrificed 50% of his share in favour of D. Calculate the 4 new profit sharing ratio of A, B, C and D.(CBSE Outside Delhi 2019)

Answer:

Old ratio = 3:2

A’s Sacrifice (in favour of C) = 1/4 x 3/5 = 3/20

B’s Sacrifice (in favour of D) = 1/2 x 2/5 = 2/10

A’s New Share = 3/5 – 3/20 = 9/20

B’s New Share = 2/5 – 2/10 = 2/10

Question 4.

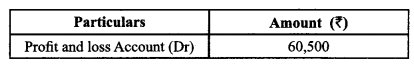

Ankit, Unnati and Aryan are partners sharing profits in the ratio of 5:3:2. They decided to share future profits in the ratio of 2:3:5 with effect from 1st April, 2018. They had the following balance in their balance sheet, passing necessary Journal Entry:

Answer:

Question 5.

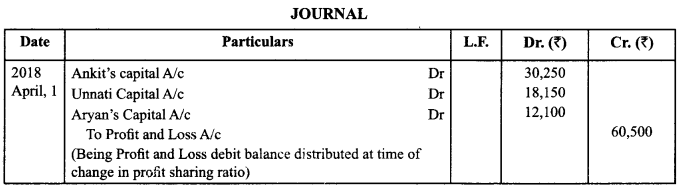

A and B are partners in a firm. They admit C as a partner with l/5th share in the profits of the firm. C brings ₹ 4,00,000 as his share of capital. Calculate the value of C’s share of Goodwill on the basis of his capital, given that the combined capital of A and B after all adjustments is ₹ 10,00,000. (CBSE Sample Paper 2019-20)

Answer:

Question 6.

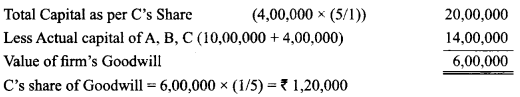

A and B are partners in a firm sharing profits and losses in the ratio of 3:2.On 1st April, 2019 they decided to admit C their new ratio is decided to be equal. Pass the necessary journal entry to distribute Investment Fluctuation Reserve of ₹ 60,000 at the time of C’s admission, when Investment appear in the books at ₹ 2,10,000 and its market value is ₹1,90,000.

Answer:

Question 7.

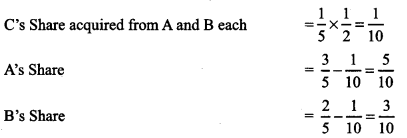

A and B are in partnership sharing profits and losses in the ratio of 3:2. They admit C into partnership with 1/5th share which he acquires equally from A and B. Accountant has calculated new profit sharing ratio as 5:3:2. Is accountant correct:

Answer:

New Profit Sharing ratio of A: B: C ¡s 5:3: 2

Yes, new profit sharing ratio is 5:3:2

Question 8.

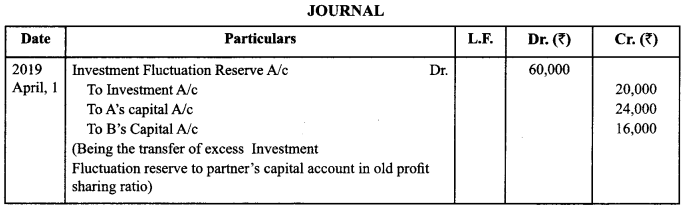

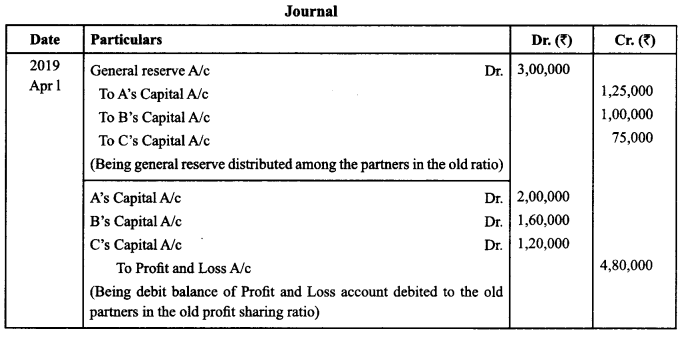

A, B and C were partners sharing profits in the ratio of 5 : 4 : 3. They decided to change their profit sharing ratio to 2:2:1 w.e.f. 1st April, 2019. On that date, there was a balance of ₹ 3,00,000 in General Reserve and a debit balance of ₹ 4,80,000 in the Profit and Loss Account.

Pass necessary journal entries for the above on account of change in the profit sharing ratio.

Answer:

Question 9.

At the time of admission of a partner, who decides the share of profit of the new partner out of the firm’s profit? (CBSE Compartment 2019)

Answer:

It is decided mutually among the old partners and the new partner.

Question 10.

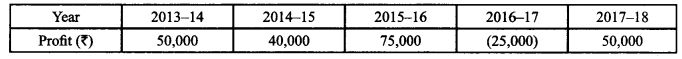

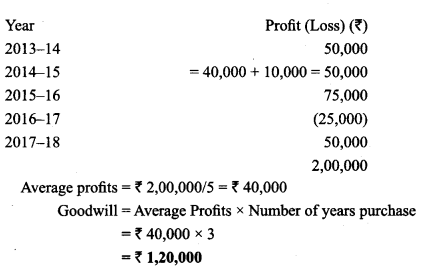

Hari and Krishan were partners sharing profits and losses in the ratio of 2 : 1. They admitted Shyam as a partner for 1/5th share in the profit. For this purpose the Goodwill of the firm was to be value on the basis of three years’s purchase of last five years average profits. The profits for the last five years were:

Calculate Goodwill of the firm after adjusting the following:

The profit of 2014-15 was calculated after charging ₹ 10,000 for abnormal loss of goods by fire.

Answer:

Question 11.

Amit and Beena were partners in a firm sharing profits and losses in the ratio of 3 : 1. Chaman was admitted as a new partner for 1/6th share in the profits. Chaman acquired 2/5th of his share from Amit. How much share did Chaman acquired from Beena? (CBSE 2018-19)

Answer:

Chaman acquired 1/6 – (1/6 x 2/5) = 3/30 from Beena.

Question 12.

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed equal amount and purchased a building for ₹2 crore. After 10 years they sold it for ₹3 crore and shared the profit equally. Are they doing the business in partnership.

Answer:

No.

Question 13.

Pawan and Jayshree are partners. Bindu is admitted for l/4th share. State the ratio in which Pawan and Jayshree will sacrifice their share in favour of Bindu? (CBSE Sample Paper 2014)

Answer:

Old ratio i.e. 1 : 1

Question 14.

X and Y are partners. Y wants to admit his son K into business. Can K become the partner of the firm?

Answer:

Yes, if X agrees to it otherwise not.

Question 15.

Name any one factor responsible which affect the value of goodwill.

Answer:

Location of a business.

Question 16.

Vishal & Co. is involved in developing computer software which is a high value added product and Tiny & Co. is involved in manufacturing sugar which is a low value item. If capital employed of both the firms is same, value of goodwill of which firm will be higher?

Answer:

Vishal & Co.

Question 17.

State a reason for the preparation of ‘Revaluation Account’ at time of admission of a partner.

Answer:

To record the effect of revaluation of assets and liabilities.

Question 18.

In which ratio is the profit or loss due to revaluation of assets and liabilities transferred to capital accounts?

Answer:

Old Ratio of existing partners.

Question 19.

Change in Profit Sharing Ratio amounts to dissolution of partnership or partnership firm?

Answer:

Dissolution of partnership.

Question 20.

State one occasion on which a firm can be reconstituted. (CBSE 2012, Delhi)

Answer:

Change of profit sharing ratio among the existing partners.

Question 21.

What is the formula of calculating sacrificing ratio? (CBSE 2011, Outside Delhi)

Answer:

Sacrificing Ratio = Old Ratio-New Ratio.

Question 22.

By which name the profit sharing ratio in which all partners, including the new partner, will share fixture profits?

Answer:

New profit sharing ratio.

Question 23.

If the new partner acquires his share in profits from all the old partners in their old profit sharing ratio, by which ratio will the old partners sacrifice their profit sharing ratio?

Answer:

Old profit sharing ratio.

Question 24.

Name the accounting standard, issued by the Institute of Chartered Accountants of India, which deals with treatment good will.

Answer:

AS 26.

Question 25.

When the new partner brings amount of premium for goodwill, by which ratio is this amount credited to old partners’ Capital Accounts?

Answer:

Sacrificing ratio.

Question 26.

What is the formula for calculating inferred goodwill?

Answer:

Net worth of business on the basis of new partner’s capital minus net worth of business in new firm.