By going through these CBSE Class 12 Accountancy Notes Chapter 11 Cash Flow Statement, students can recall all the concepts quickly.

Cash Flow Statement Notes Class 12 Accountancy Chapter 11

The Income Statement and the Balance Sheet (Position Statement) are the two important and basic financial statements prepared by every business enterprise. Income Statement shows the profit or loss incurred by the enterprise for the accounting period and the Balance Sheet discloses the financial condition or position at a particular date. But many of those who study these statements are, for different reasons, also interested in knowing the inflow and outflow of cash.

Hence, many companies presented along with the final accounts, a statement called ‘Cash Flow Statement’ which shows inflows and outflows of the cash and cash equivalent. In June 1995, the Securities and Exchange Board of India, (SEBI) amended clause 32 of the Listing Agreement requiring every listed company to give along with its balance sheet and profit and loss account, a Cash Flow Statement prepared in the prescribed format showing separately cash flows from operating activities, investing activities and financing activities.

Meaning of Cash Flow Statement

A Cash Flow Statement is a statement that shows inflow (receipts) and outflow (payments) of cash and its equivalents in an enterprise during a specified period of time. Accounting Standard (AS-3) Revised issued by the Institute of Chartered Accountant of India on Cash Flow Statement in March 1997 has defined Cash Flow Statement as “a statement which shows inflows (receipts) and outflows (payment) of cash and its equivalents in an enterprise during a specified period of time.” According to the revised accounting standard 3, an enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented.

The terms, Cash, Cash Equivalents, and Cash Flows explained below:

Cash: It comprises cash in hand and demand deposits with banks.

Cash Equivalents: They are short term highly liquid investments that are readily convertible into cash and which are subject to an insignificant risk of change in value. An investment normally qualifies as a cash equivalent only when it has a short maturity, of say three months or less from the date of acquisition. Cash equivalent is held for the purpose of meeting short-term cash commitments rather than for investment or another purpose.

Cash Flows are inflows and outflows of cash and cash equivalents. An inflow increases the total cash and cash equivalents at the disposal of the enterprise whereas an outflow decreases them.

As per AS 3, Cash Flows exclude movements between items that constitute cash or cash equivalents because these components are part of the cash management of an enterprise rather than part of its operating, investing, or financing activities.

Objectives of Cash Flow Statement

The basic objective of the Cash Flow Statement is to highlight the change in the cash position including the sources from which cash was obtained by the enterprise and specific uses to which cash was applied.

The Cash Flow Statement serves a number of objectives which are following:

1. Depict Inflows and Outflows of Cash: The cash Flow Statement gives information about cash inflows and cash outflows of an enterprise during a particular period from operating activities, investing activities, and financing activities. It is an effective tool for managing cash.

2. Cash Flow information helps in Planning: Cash Flow Statements provide information for planning for short-range cash needs of the enterprise. It helps in the formulation of financial policies.

3. Helping in understanding the Liquidity of the Enterprise: Cash Flow Statement helps the enterprise to assess whether it would meet its current obligations or not. It also helps the lending institutions like banks etc to ascertain the liquidity of the enterprise.

4. Help in preparing Cash Budget: A cash Flow Statement helps the management of the firm in preparing a Cash Budget.

5. Analysis Management of Cash: CashFlow Statement reveals good and bad points relating to the management of Cash.

According to AS-3 (Revised) the objectives of the Cash How Statement are as follows: ” Information about the cash flow of an enterprise is useful in providing users of financial statements with a basis of assessing the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise to utilize these cash flows.

The economic decisions that are taken by users require an evaluation of the ability of an enterprise to generate cash and cash equivalents and the timing and certainty of their generation. The statement deals with the provision of information about the historical changes in cash and cash equivalent of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating, investing and financing activities.”

Advantages of Cash Flow Statement

A Cash Flow Statement is a useful financial statement and provides the following benefits:

(a) It enables the management to identify the magnitude and directions of changes in cash.

(b) It enables the users to evaluate the changes in the economic resources of an enterprise.

(c) It enables the users to evaluate the changes in financial structure. ‘

(d) It enables the users to evaluate the changes in net assets of enterprises.

(e) It enables the users to evaluate the enterprise’s ability to alter the amounts and timings of cash flows in order to adapt to changing circumstances and opportunities.

(f) It is useful in assessing the ability of the enterprise to generate Cash and Cash Equivalents and enables users to develop models to assess and compare the present value of the future cash flows of different enterprises.

(g) As a tool of planning, the Projected Cash Flow Statement enables the management to plan its future investments, operating, and financial activities such as repayment of long-term loans and interest thereon, modernization or expansion of the plant, payment of cash dividend, etc.

(h) It helps in efficient cash management. The management can know the adequacy or otherwise of cash and can plan for the effective use of surplus cash or can make the necessary arrangement in case of inadequacy of Cash.

(i) It also enhances the comparability of the reporting of operating performance by different enterprises because it eliminates the effects of using different accounting treatments for the same transactions and events.

Classification of Cash Flows

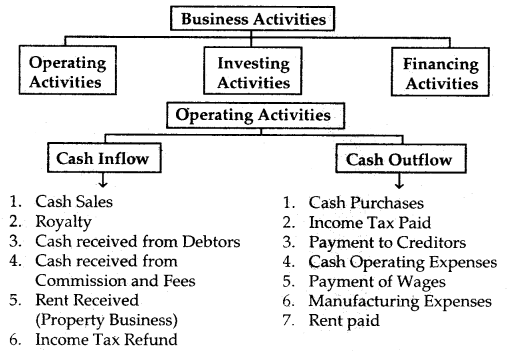

A Cash Flow Statement shows the inflow and outflow of cash and cash equivalents from various activities of a company during a specific period. As per AS-3, these activities can be classified into three categories which are following:

- Operating activities

- Investing activities

- Financing activities

1. Operating Activities: Operating activities are the principal revenue-producing activities of the enterprise and other activities that are not investing or financing activities. Cash flows from operating activities generally result from the transactions and other events that enter into the determination of net profit or loss.

The amount of cash flows arising from operating activities is a key indicator of the extent to which the operations of the enterprise have generated sufficient cash flows to maintain the operating capability of the enterprise to pay dividends, repay loans and make investments without resources to extent source of financing. Examples of Cash Flows from operating activities are:

Cash Inflows from Operating Activities:

- Cash receipts from the sale of goods and rendering of services.

- Cash receipts from royalties, fees, commissions, and other revenues.

- Cash receipts relating to future contracts, forward contracts, option contracts, and swap contracts when the contracts are held for dealing or trading purpose.

- Cash receipts as income tax refunds unless they can be specifically identified with financing and investing activities.

Cash Outflows from Operating Activities:

- Cash payments to suppliers of goods and services.

- Cash payments to and on behalf of employees for wages, salaries, etc.

- Cash payments of income tax unless they can be specified as financing or investing activities.

- Cash payments for future contracts, forward contracts, etc.

- Cash Payments for interest etc.

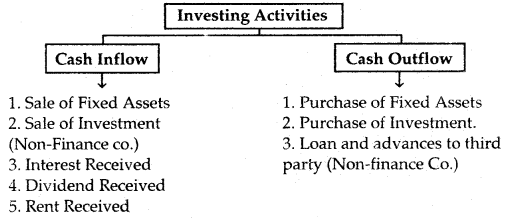

2. Investing Activities: As per AS-3 investing activities are the acquisition and disposal of long-term assets (such as land, building, plant, machinery, etc.) and other investment not included in cash equivalents. It is important to make a separate disclosure of cash flows arising from investing activities because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows.

Cash Inflows from Investing Activities:

- Cash receipts from disposal of fixed assets.

- Cash receipts from disposal of shares, warrants, or debt instruments of other enterprises and interest in joint ventures other than cash equivalents.

- Cash receipts from the repayment of advances and loans made to third, parties (other than advances and loans of the financial enterprise.)

- Interest received in cash from loans and advances.

- Dividend received from investment in other enterprises.

Cash Outflows from Investing Activities:

- Cash payments to acquire fixed assets.

- Cash payment, relating to capitalized research and development costs.

- Cash payment, to acquire shares, warrants, etc. other than cash equivalent.

- Cash advances and loans made to a third party (other than advances and loans made by a financial enterprise wherein it is operating activities.)

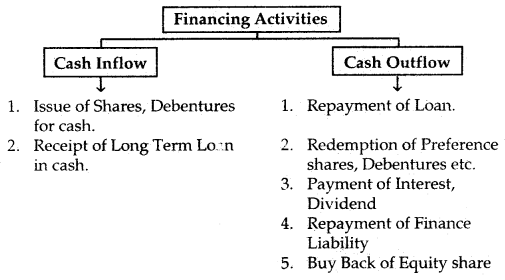

3. Financing Activities: As per AS-3, financing activities are activities that result in changes in the size and composition of the owner’s capital (including preference share capital in the case of a company) and borrowings of the enterprise. The separate disclosure of cash flows from financing activities is important because it is useful in predicting claims on future cash flows by providers of funds (both capital and borrowings) to the enterprise.

Cash Inflows from Financing Activities:

- Cash proceeds from issuing shares or other similar instruments.

- Cash proceeds from issuing debentures, loans, bonds, and other short or long-term borrowings.

Cash Outflows from Financing Activities:

- Cash repayments of the amounts borrowed.

- Payment of dividend, Interest, etc.

- Redemption of Preference Shares.

Classification of Business Activities as per AS-3, showing Inflow and Outflow of Cash.

Treatment of Important Items:

1. Extraordinary Items: Extraordinary items are not the regular phenomenon for example loss due to theft or fire or flood, winning of a lawsuit, or a lottery. They are non-recurring in nature and hence cash flow associated with extraordinary items is disclosed separately as arising from operating, investing, or financing activities in the cash flow statement, to enable users to understand their nature and effect on the present and future cash flows of the enterprise.

2. Interest and Dividend: Treatment of cash flows from interest and dividends can be described under two heads which are the followings:

1. In the case of a financial enterprise (whose main business is lending and borrowing), cash flows arising from interest paid and interest and dividend received are classified as cash flows from operating activities, while dividend paid is classified as a financing activity.

2. In the case of a non-financial enterprise, cash flows arising from interest and dividends paid should be classified as cash flows from financing activities while interest and dividend received should be classified as cash flows from investing activities.

3. Taxes on Income and Gains: Taxes may be income tax, capital gains tax, dividend tax, etc. As per AS-3, cash flows arising from taxes on income should be separately disclosed and should be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities.

This clearly implies that:

- Tax on Operating Profit i.e. Income Tax should be classified as operating cash flows.

- Dividend tax i.e. tax on the amount distributed as a dividend to shareholders should be classified as financing activity along with dividend paid.

- Capital Gains Tax i.e. tax on capital profits like tax paid on the sale of fixed assets should be classified under investing activities.

- Non-Cash Transactions: As per AS-3, investing and financing transactions which do not involve inflow or outflow of cash or cash; equivalent, are excluded from the cash flow statement. But significant such transactions should be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities.

Examples of the non-cash transaction are:

- Acquisition of fixed assets by the issue of share or on Credit.

- Redemption of debenture by conversion into equity share.

- Acquisition of an enterprise by means of an issue of share. s

Preparation of Cash Flow Statement: (Main Heads Only):

Cash Flows from Operating Activities:

Operating activities are the main source of revenue and expenditure in an enterprise. Therefore, the ascertainment of cash flows from operating activities is of prime importance.

As per AS-3, an enterprise should report cash flows from -N * operating activities using either by.

Direct Method

or

Indirect Method

In Direct Method, major classes of gross cash receipts and gross cash payments, are disclosed.

or

In the Indirect Method, net profit or loss is adjusted for the effects of

- Transactions of a non-cash nature.

- any deferrals or accruals of past/future operating cash receipts.

- Items of income or expenses associated with investing or financing cash flows.

Direct Method:

As we know that items are recorded on an accrual basis in profit and loss accounts therefore certain adjustments are made to convert them into cash bases.

These adjustments are discussed below:

1. Cash Inflow from Sales: Total Sales include Cash Sale and Credit Sale both. Cash sales is a cash inflow, but in the case of credit sales, cash receipts from Debtors are calculated as follows:

Cash receipts from Customers = Credit Sales + Opening Debtors and Bills Receivable: Closing Debtors and Bills Receivable – Bad Debts – Discount Allowed – Sales Returns.

2. Cash Outflow from Purchases: Total Purchases include both cash purchases and credit purchases. Cash purchases are cash outflow, but in the case of credit purchases, cash paid to the suppliers is calculated as follows:

Cash paid to Suppliers = Credit Purchases + Opening Creditors and Bills Payable – Closing Creditors and Bills Payable – Discount received – Purchases Returns.

Purchases = Cost of Goods Sold – Opening Stock + Closing Stock

3. Cash Outflow on Expenses Incurred: The figures of expenses given in the Profit and Loss Account have to be adjusted to find out cash outflow. The amount outstanding and the amount paid in advance have to be adjusted for this purpose.

Cash Paid for Expenses = Expenses as given in Profit & Loss A/c – Prepaid Expenses in the beginning and Outstanding Exp. at the end + Prepaid Expenses at the end and Outstanding Expenses in the beginning.

However, the following items are not to be considered:

1. All non-cash items are ignored as no cash is involved in them. Examples are:

(a) Depreciation

(b) Discount on issue of Shares written off

(c) Goodwill written off.

(d) Preliminary Expenses are written off

(e) Discount on issue of Debenture written off

(f) Patents and Copyright wrote off

(g) Underwriting commission written off.

2. Appropriations of transfer to different reserves and provisions like to General Reserve, Provision for Taxation, and Proposed Dividend should be ignored.

3. Items that are classified as investing or financing activities like profit or loss on sale of fixed assets, interest received, the dividend paid, etc. are also ignored.

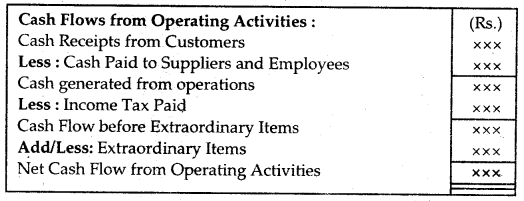

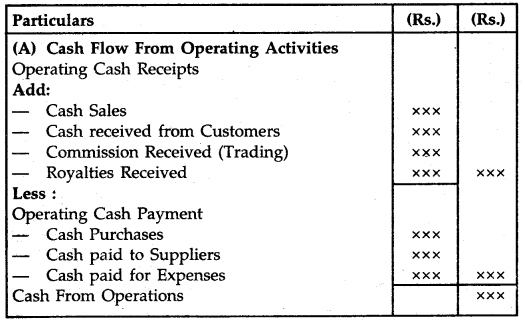

Cash Flows From Operating Activities (Direct Method)

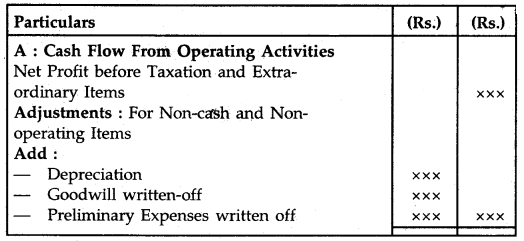

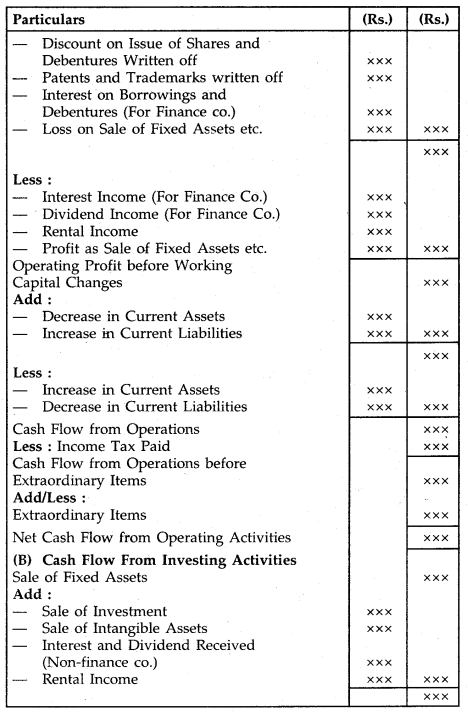

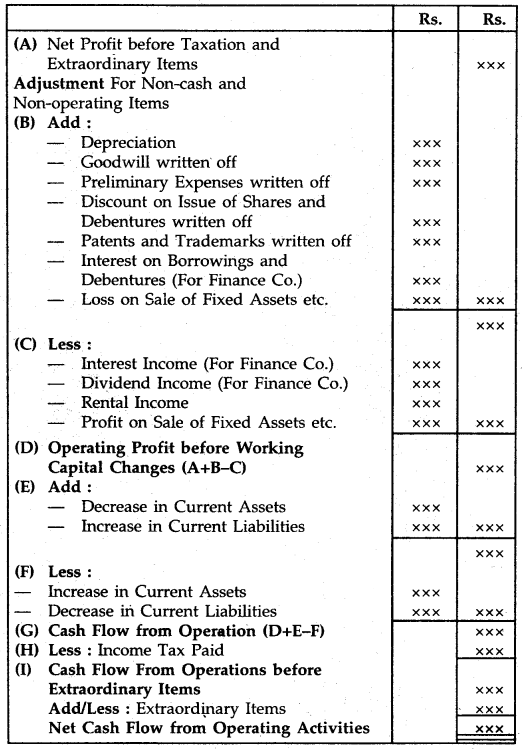

Indirect Method:

In this method, net profit or loss is adjusted for the effects of transactions of a non-cash nature flow. In other words, Net profit or loss is adjusted for items that affected net profit but did not affect cash.

As per AS-3, (Revised), under the indirect method, net cash flow from operating activities is determined by adjusting net profit or loss for the effects of:

1. Non-cash items are to be added back. Non-cash items like

(a) Depreciation

(b) Goodwill has written off

(c) Patents and Copyrights are written off

(d) Appropriation to General Reserve

(e) Interim dividend

(f) Deferred taxes etc.

2. All other items for which the cash effects are investing or financing cash flows. The treatment of such items depends upon their nature. All investing and financing incomes are to be deducted from the number of net profits while all such expenses are to be added back.

3. Changes in current assets and liabilities during the period. An increase in current assets and a decrease in current liabilities are to be deducted while the increase in current liabilities and a decrease in current assets are to be added up.

Cash Flows from Operating Activities (Indirect Method)

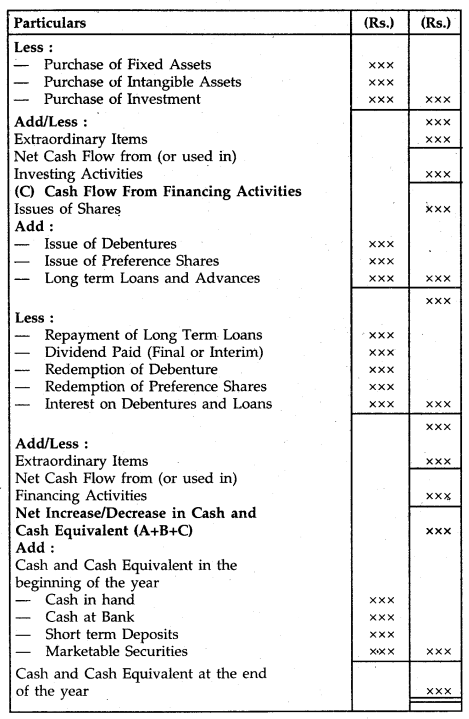

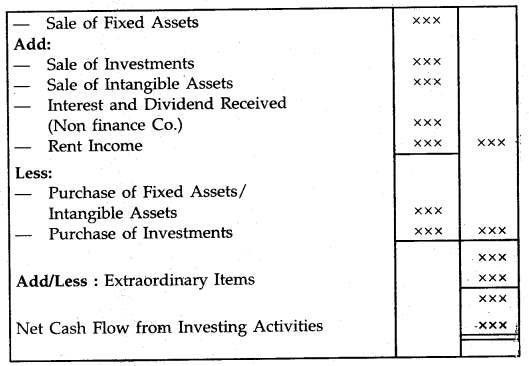

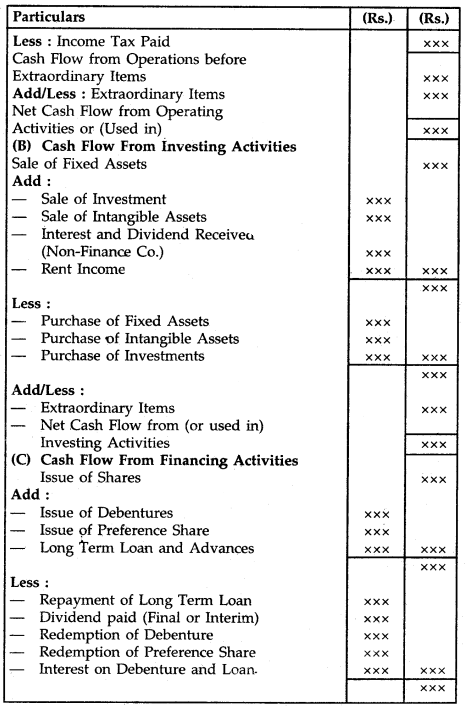

Cash Flow from Investing Activities:

Investing activities are the acquisition and disposal of long terms assets and other investments not included in cash equivalent. Accordingly, cash inflow and outflow relating to fixed assets, shares, and debentures of other enterprises, advances, and loans to third parties and their repayments are shown separately under Investing activities in the Cash Flow Statement.

It is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows.

Cash Flow from Investing Activities

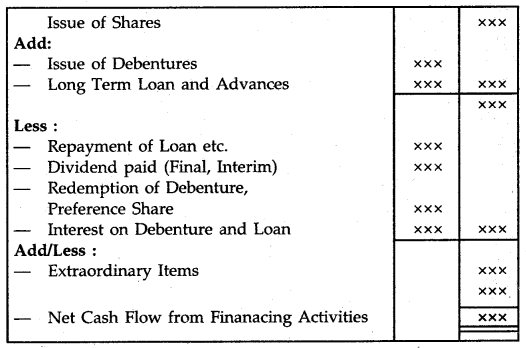

Cash Flows from Financing Activities:

The Financing Activities of an enterprise are those activities that result in a change in size and composition of owners capital and borrowing of the enterprise. It includes separate disclosure of proceeds from the issue of shares or other similar instruments, issue of debentures, loans, bonds, other short-term or long-term borrowings, and repayment of amounts borrowed. It is useful in predicting claims on future cash flows by providers of funds (both capital and borrowings to the enterprise.)

Cash Flow from Financing Activities

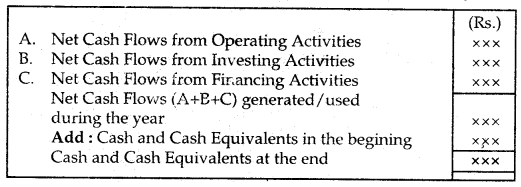

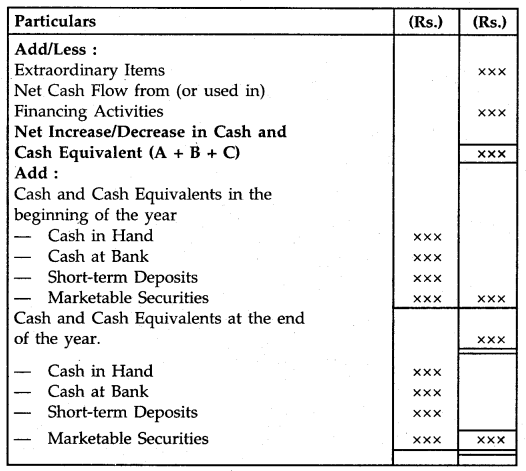

Format for Cash Flow Statement (As Per AS-3 (Revised))

1. Direct Method

Cash Flow Statement for the year ended………….

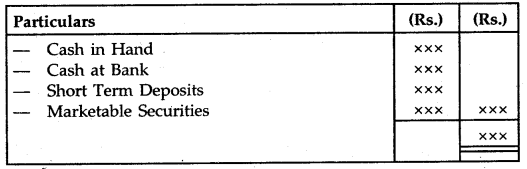

2. Indirect Method

Cash Flow Statement for the year ended…………