By going through these CBSE Class 12 Accountancy Notes Chapter 2 Accounting for Partnership: Basic Concepts, students can recall all the concepts quickly.

Accounting for Partnership: Basic Concepts Notes Class 12 Accountancy Chapter 2

Due to the limitation of sole-tradership regarding limited capital, limited managerial abilities, the low scale of business, involves more risk due to unlimited liability, tie need of partnership arises. A partnership is a relation of mutual trust and faith. There are certain peculiarities in ” the accounts of partnership firm than those are prepared in the sole tradership firm. The main peculiarities regarding the accounting of partnership firms are maintenance of the capital accounts of partners, distribution of profits to the partners, etc.

Meaning of Partnership:

The partnership is an agreement written/oral between two or more persons who have agreed to do some lawful business and to share profit ! or loss arising from the business.

According to the Indian Partnership Act, 1932, Section 4

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

In partnership, two or more persons join hands to set up a business and share its profit and losses.

Persons who have entered into a partnership with one another are called individually partners and collectively ‘a firm’, and the name under which their business is carried on is called the ‘firm name’. A partnership firm is not a separate legal entity apart from the partners constituting it.

There must be a minimum of two persons to form a partnership firm, according to the Indian Partnership Act, 1932, but it does not specify the maximum number of partners. In this issue Section 11 of the Companies Act, 1956 limits the number of partners to 10 for a partnership carrying on banking business and 20 for a partnership carrying on any other type of business.

Features of Partnership

1. Two or More Persons: There must be a minimum of two persons to form a partnership firm, according to the Indian Partnership Act, 1932, but it does not specify the maximum number of partners. In this issue Section 11 of the Indian Companies Act, 1956 limits the number of partners to 10 (ten) for a partnership carrying on banking business and 20 (twenty) for a partnership carrying on any other type of business.

2. Agreement: Partnership comes into existence on account of an agreement among the partners, and not from status or operations of law. The agreement becomes the basis of the relationship between the partners. It may be written or oral. It may be for a fixed period or for a particular venture or at will.

3. Business: A partnership can be formed for the purpose of carrying on some lawful business with the intention of earning profits. Mere co-ownership of a property does not amount to a partnership.

4. Mutual Agency: The partnership business may be carried on by all the partners or any of them acting for all. This statement means that every partner is entitled to participate in the conduct of the affairs of its business and there exists a relationship of mutual agency between all the partners.

Partners are agents as well as principals for all other partners. Each partner can bind other partners by his acts and also is bound by the acts of other partners with regard to the business of the firm. Relationship of the mutual agency is so important feature of partnership that one can say that there would be no partnership if this feature is absent,

5. Sharing of Profit: The agreement between the partners must be to share the profits (or losses). Though the definition of partnership, according to Partnership Act, describes the partnership as the relationship between people who agree to share the profits of a business, the sharing of loss is implied. If some persons join hands for the purpose of some charitable activity, it will not be termed as a partnership.

6. Liability of Partnership: The liability of partnership is unlimited. Each partner is liable jointly with all the other partners and also individually to the third party for all the acts of the firm done while he is a partner.

Partnership Deed:

A partnership is formed by an agreement, it is essential that there must be some terms and conditions agreed upon by all the partners. These terms and conditions or Agreements may be written or oral. Though the Partnership Act does not expressly require that there should be an agreement in writing. But in order to avoid all misunderstandings and disputes, it is always the best course to have a written agreement duly signed and registered under the Act.

A document in writing which contains the terms of agreement for the partnership is called ‘Partnership Deed’. This document contains the details about all the aspects affecting the relationship between the partners including the objectives of the business, the contribution of capital by each partner, ratio in which the profit and losses will be shared by the partners, and entitlement of partners to interest on capital, interest on the loan, etc. The clauses of the partnership deed can be altered with the consent of all the partners.

Contents of Partnership Deed:

- Names and Addresses of the firm and its main business.

- Names and Addresses of all partners.

- Amount of capital contributed or to be contributed by each partner.

- The accounting period of the firm.

- Date of commencement of partnership firm.

- Rules regarding operations of a bank account.

- Profit and loss sharing ratio.

- Duration of partnership, if any.

- Rate of interest on capital, loan, drawings, etc.

- Salaries, commissions, etc., if payable to any partner(s).

- The rights, duties, and liabilities of each partner.

- Mode of auditor’s appointment, if any.

- Rules to be followed in case of admission, retirement, death of a partner.

- Rules to be followed in case of insolvency of one or more partners.

- Settlement of accounts on the dissolution of the firm.

- Rules for the settlement of disputes among the partners.

- Safe custody of the books of accounts and other documents of the firm.

- Any other matter relating to the conduct of business.

Provisions Relevant for (Affecting) Accounting of Partnership:

Normally, the partnership deed covers all matters relating to the mutual relationship of partners amongst themselves. But if the partnership silent on certain matters, or in the absence of any deed, the provisions of the Indian Partnership Act, 1932 shall apply.

The important provisions affecting partnership accounts are:

- Profit-Sharing Ratio: In absence of deed or agreement, according to the act, the profit-sharing ratio is equal i.e. the profit and loss of the firm are to be shared equally by the partners, irrespective of their capital contribution in the firm.

- Interest on Capital: No interest on capital shall be allowed to the partners. In case the deed provides for payment of interest on capital but does not specify the rate, the interest will be paid at the rate of 6% p.a., only from the profits of the firm. It is not payable if the firm incurs losses during the period.

- Interest on Drawings: No interest is to be charged on drawings.

- Interest on Loan, Advances: If any partner, apart from his capital, provides a loan to the firm, he is entitled to get interested at the rate of 6% per annum. Such interest shall be paid even if there a losses to the firm.

- Remuneration to Partners: No partner is entitled to any salary or commission for participating in the business of the firm.

Apart from the above, the Indian Partnership Act specifies that subject to a contract between the partners:

- If a partner derives any profit for himself/herself from any transaction of the firm or from the use of the property or business connection of the firm or the firm name, he/ she shall account for the profit and pay it to the firm

- If a partner carries on any business of the same nature as and competing with that of the firm, he/she shall account for and pay to the firm, all profit made by him/her in that business.

Maintenance of Capital Accounts of Partners:

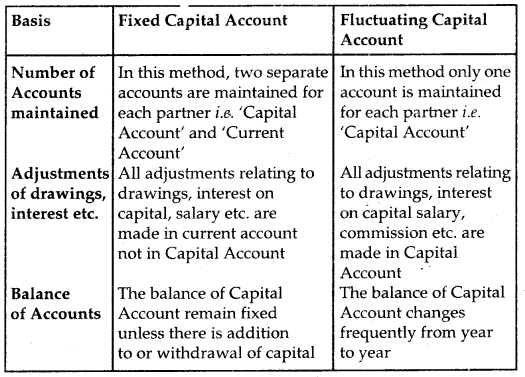

There are two methods by which the capital accounts of partners are maintained. They are the following:

(a) Fixed Capital Method

(b) Fluctuating Capital Method

(a) Fixed Capital Method: Under the fixed capital method, the capitals of the partner shall remain fixed or unaltered unless some additional capital is introduced or some amount of capital is withdrawn with the consent of all the partners.

In this method, two accounts for each partner are to be maintained:

- Capital Account

- Current Account.

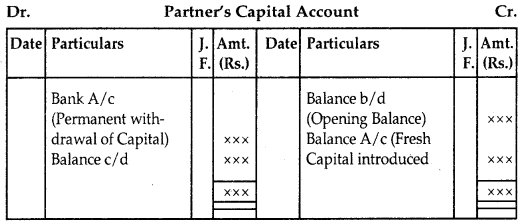

1. Capital Account: This account is credited with the amount of capital introduced by the partner. This account will continue to show the same balance from year to year unless some amount of capital is introduced or withdrawn. This account always appears on the liabilities side in the balance sheet.

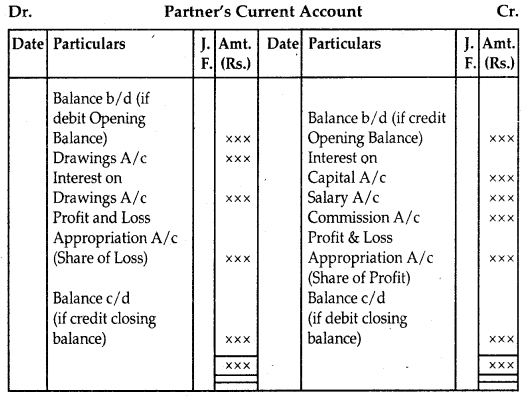

2. Current Account: All entries relating to drawings, interest on capital, interest on drawings, salary or commission, the share of profit or loss, etc. are made in this account. This account is debited with drawings, interest on drawings, the share of loss, etc. and credited with the interest on capital, salary, commission, the share of profit, etc. The balance of this account will fluctuate from year to year. If it has a credit balance then it will appear on the liabilities side of the Balance Sheet and if it has a debit balance then it will appear on the assets side of the Balance Sheet.

The format of the Capital Account and Current account are as follows:

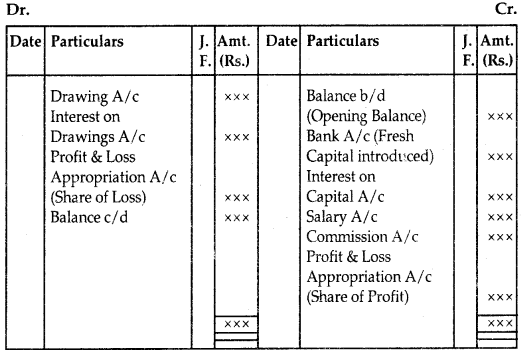

(b) Fluctuating Capital Method: Under this method, only one account i.e. Capital Account is maintained for each partner. All the entries relating to the interest on capital, salary, commission to partners, the share of profit and loss, drawings, interest on drawings, etc. are directly recorded in the capital accounts of the partners. The balance of this account fluctuates from year to year. The format of Fluctuating Capital Account is as follows:

Partner’s Capital Account

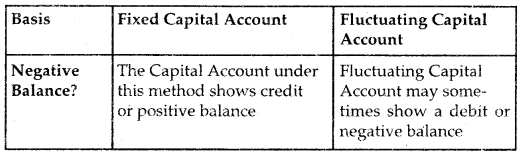

Difference between Fixed and Fluctuating Capital Accounts

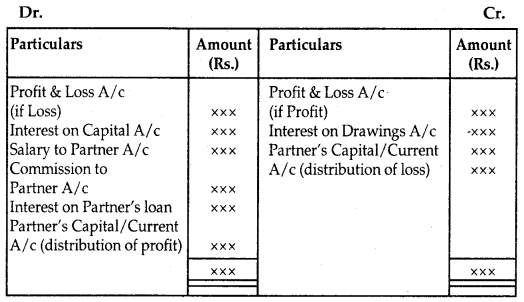

Profit and Loss Appropriation Account:

In partnership, net profit after adjustment of partner’s interest on capital, salary, and commission to partner’s, interest on drawings, etc. is distributed among the partners in the agreed profit sharing ratio. For this purpose, a separate account is prepared called Profit and Loss Appropriation Account.

It is merely an extension of the Profit and Loss Account. All adjustments in respect of partner’s commission and salary, interest on capital and on drawings, etc. are made through this account. It starts with the net profit/net loss as per the Profit and Loss Account is transferred to this account.

Journal Entries relating to Profit and Loss Appropriation Account:

1. Transfer of Net Profit/Net Loss as per Profit and Loss Account to Profit and Loss Appropriation Account:

(a) If Profit:

Profit and Loss A/c Dr.

To Profit and Loss App. A/c

(b) If Loss:

Profit and Loss App. A/c Dr.

To Profit and Loss A/c

2. Interest on Capital:

(a) For crediting interest on capital to partner’s Capital/Current

Account:

Interest on Capital A/c Dr.

To Partner’s Capital A/c or Current A/c (Individually)

(b) For transferring interest on Capital to Profit and Loss Appropriation A/c:

Profit and Loss App. A/c Dr

To Interest on Capital A/c OR

Only one entry may be passed in place of the above two entries:

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c (Individually)

3. Interest on Drawings:

(a) For charging interest on drawings to partner’s Capital/ Current A/c:

Partners Capital/Current A/c (Individually) Dr.

To Interest on Drawings A/c

(b) For transferring interest on drawings to Profit and Loss Appropriation Account:

Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c OR

Only one entry may be passed in place of the above two entries:

Partner’s Capital/Current A/c (Individually) Dr.

To Profit and Loss Appropriation A/c

4. Salary to Partner(s):

(a) For crediting partner’s salary’ to partner’s Capital/Current A/c:

Salary to Partner A/c Dr.

To Partner’s Capital /Current A/c (Individually)

(b) For transferring partner’s salary to Profit and Loss Appropriation A/c:

Profit and Loss Appropriation A/c Dr.

To Salary to Partner A/c OR

Only one entry may be passed in place of the above two entries:

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c (Individually)

5. Commission to Partner(s):

(a) For crediting partner’s commission to partner’s Capital/ Current A/c:

Commission to Partner A/c Dr.

To Partner’s Capital/Current A/c (Individually)

(b) For transferring partner’s commission to Profit and Loss Appropriation A/c:

Profit and Loss Appropriation A/c Dr.

To Commission to Partner A/c OR

Only one entry may be passed in place of the above two entries:

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c (Individually)

6. Share of Profit/Loss after adjustments:

(a) If Profit

Profit and Loss Appropriation A/c Dr.

To partner’s Capital/Current A/c (Individually)

OR

(b) If Loss:

Partner’s Capital/Current A/c (Individually) Dr. To Profit and Loss Appropriation A/c

Format of Profit and Loss Appropriation Account is given below:

Profit and Loss Appropriation Account

Interest on Capital:

Interest on Capital is generally provided for in two situations:

- When the partners contribute unequal amounts of capital but share profits equally.

- When the capital contribution is the same but profit sharing is unequal.

Interest on Capital = Amount of Capital × \(\frac{\text { Rate }}{100}\) × Time

When there are both addition and withdrawal of capital by the partners during the financial year, the interest on capital can be calculated as:

1. On the opening balance of Capital A/c, interest is calculated for the whole year.

If the closing balance of the Capital A/c is given then we have to find the opening balance of Capital A/c:

Closing Capital + Drawings during the year + Interest on Drawing – Share of Profits – Salary to Partner – Commission

to Partner – Additional Capital = Opening Capital

2. On the additional capital brought in by any partner during the year, interest is calculated from the date of introduction of additional capital to the last day of the financial year

3. On the amount of capital withdrawn (other than usual drawings) during the year interest for the period from the date of withdrawal to the last day of the financial year is calculated and deducted from the total of the interest calculated under points (1) and (2) above.

Or

Drawing has been made then the amount deducted from the capital and interest is calculated on the balance amount.

The interest on capital is allowed only when there is profit during the financial year. No interest will be allowed on capital if the firm has incurred a net loss during the year. If the profit of the firm is less than the amount due to the partners as interest on capital, the payment of interest will be restricted to the number of profits. In other words, profit will be distributed in the ratio of interest on capital of each partner.

Interest on Drawings:

Drawings is the amount withdrawn, in cash or in-kind, for personal use by the partner(s). Interest on drawings is calculated with reference to the date of withdrawal.

The calculation of interest on drawings under different situations is shown as under:

(a) When Fixed Amount is Withdrawn Every Month/Quarter:

If the equal amount is withdrawn at equal intervals of times, interest on the drawing can be calculated by Monthly/Quarterly Drawing Methods. While calculating the time period, attention must be paid to whether the fixed amount was withdrawn on the first day (beginning) of the month, at the last day (end) of the month, middle of the month, at the beginning of the Quarter or at the end of Quarter. Depending upon the time period the interest on drawings can be calculated as follows:

When drawings are made:

1. At the beginning of each month of the financial year:

Interest on Drawings = Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{6^{1 / 2}}{12}\)

Here, time period is 6\(\frac{1}{2}\) months.

2. At the middle of each month of the financial year

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{6}{12}\)

Here, time period is 6 months.

3. At the and of each month of the financial year:

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{5^{1 / 2}}{12}\)

Here, time period is 5\(\frac{1}{2}\) months.

4. At the beginning of the eaclr quarter of the financial year:

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{7^{1 / 2}}{12}\)

Here, time period is 7\(\frac{1}{2}\) months.

5. At the end of each quarter of the financial year:

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{4^{1 / 2}}{12}\)

Here, time period is 4\(\frac{1}{2}\) months.

(b) When Varying Amounts are Withdrawn at Different Intervals: When the partners withdraw different amounts of money at different time intervals, the interest is calculated using the production method. In this method, each amount of drawing is multiplied by the number of days/months (from the date of drawings to the last date of the financial year) to find out the product and then all the products are totaled. Here, the total product and interest for 1 month at the given rate are calculated.

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{1}{12}\)

or

\(\frac{1}{365}\)

(c) When Dates of Withdrawal are Not Specified: When the total amount withdrawn is given but the dates of withdrawals are not specified, then it is assumed that the amount was withdrawn evenly throughout the year. Here, the time period is taken 6 months.

Interest on Drawings = Total Drawings × \(\frac{\text { Rate }}{100} \times \frac{6}{12}\)

Guarantee of Profit to a Partner:

Sometimes a partner may be guaranteed a minimum amount of profit by one or some or by all the partners in the existing profit sharing ratio or some other agreed ratio. The minimum guaranteed amount shall be paid to a partner when his share of profit as per the profit-sharing ratio is less than the guaranteed amount.

The following steps may be followed in this case:

- Calculate the share of profit of the partner who has been guaranteed a minimum amount of profit as per profit sharing ratio. If this amount is more than or equal to the amount guaranteed, no adjustment is required.

- If the share of profit of that partner is less than the guaranteed amount, then we have to find out the difference between the guaranteed amount and the share of profit of that partner.

- Then, we add this difference to the share of the profit of the partner and deduct the difference from the share of profit of other partners or partner who has guaranteed the amount in the agreed ratio.

Past Adjustments:

Sometimes, after making of final accounts and the distribution of profits among the partners, a few omissions or errors in the recording of transactions or the preparation of summary statements are found. These errors or omissions need adjustments for correction of their impact.

This error or omissions may relate to:

- Interest on capital may have omitted or have been wrongly treated.

- Interest in drawings may have been omitted.

- Salary or commission payable has been omitted in the capital account of the partner.

- The profit-sharing ratio has been changed from the past.

- Interest in the partner’s loan has been omitted.

Instead of altering old accounts, necessary adjustments can be made either by:

(a) through ‘Profit and Loss Adjustment Account’

Or

(b) directly in the capital account of the concerned partners.

(a) Profit and Loss Adjustment Account:

1. For omission of Interest on Capital, Salaries to partner(s), Commission to partner, etc.

Profit and Loss Adjustment Account Dr.

To Partner’s Capital/Current A/c (Individually)

2. For omission of Interest on drawings etc

Partner’s Capital/Current A/c Dr.

To Profit and Loss Adjustment Account

3. Calculate the difference or balance of the Profit and Loss Adjustment Account and transfer it to the Capital/Current Accounts of partners in the profit-sharing ratio.

(a) If Profit (Credit balance):

Profit and Loss Adjustment A/c Dr.

To Partner’s Capital/Current A/c (Individually)

OR

(b) If Loss (Debit balance):

Partner’s Capital/Current A/c (Individually) Dr.

To Profit and Loss Adjustment A/c (b) Adjustment through a single entry or directly in the capital account of the concerned partner(s):

In this case, the following steps should be taken:

- Calculate amount which should have been credited to each partner’s Capital/Current Account by way of (Interest on Capital + Salaries to Partner(s) + Commission to Partner(s) – Interest on Drawings etc.)

- Distribute the amount calculated in step (1) in the current profit sharing ratio.

- Calculate the difference between the above two steps for each partner (1) – (2)

(-) Excess or (+) Short

Pass the following Journal entry:

Excess having Partner’s Capital A/c Dr.

To Short Partner’s Capital A/c